Edited by Brian Birnbaum and an update of my Blackberry Q2 FY2024 Digest and deep dive.

1.0 IoT Remains the Core Value

While Blackberry’s moat in the IoT space continues to grow stronger, the CEO transition has revealed comprehensive mediocrity throughout the organization.

Blackberry is increasingly looking like a mistake.

While Blackberry’s real time operating system (QNX) occupies a privileged position in the IoT space, it’s slowly becoming more apparent that the company lacks the excellent organizational and cultural properties of my historical winners.

I’ve always known this to some extent, but I began to truly understand the implications last month. Previously, some degree of wishful thinking in me didn’t assign the correct weight to this matter.

In December, I sat down to condense my investment framework into a two hour online course, called 2 Hour Deep-Diver (by the way, the price goes up to $199 next week on 01/14, so now is a great time to buy the course). In doing so, I gained exceptional clarity myself on what makes a winner and what makes a loser, based on my experience.

In essence, we cannot predict the future. But, we can bet on systems that are very likely to do well over time.

Companies are very much like species in Darwin’s world. Those with a superior ability to adapt end up thriving over time, evolving in ways that are unpredictable and often surprising.

On the other hand, companies in a perpetual state of inertia, put in motion only by external forces, end up failing.

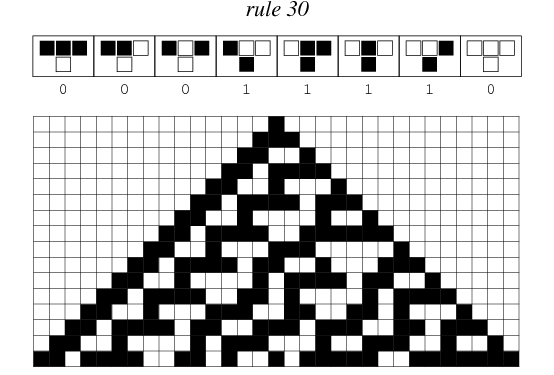

This abstraction is best depicted by Wolfram’s Rule 30, which specifies the next color in a cell, depending on its color and the color of its immediate neighbors.

The first few iterations form very simple patterns, but after many iterations, the rule produces some marvelous complexity.

This is just how the universe works: the building blocks are simple. But when they’re correctly aligned, the results are beautiful and mind-boggling–e.g. the planet Earth and humankind.

Conversely, the smallest deviation ends up producing catastrophic effects down the line.

What is interesting is that both positive and negative outcomes are hard to reverse engineer. We study history to figure out what we did wrong or right, but, as the common saying goes, it doesn’t repeat, it rhymes.

Although we can’t parse every causal chain, we sense rhythms that emerge from various layers of reality, all the way from the atomic to anthropological and celestial levels.

Wars, pandemics, and economic booms and crashes are recurrent because our psyches and biology go through repeating sequences, of sorts.

It is no coincidence that the sine graph elegantly captures oscillatory motions all the way from our heart beats to economic cycles to the movement of planets.

This is relevant because companies are subject to the same laws of nature. Culture plays a large role in the fate of a company, as personality in that of an individual.

Last month I was listening to Charlie Munger’s last interview on the Acquired podcast. I was fascinated by his reply when asked what he saw in Costco early on.

He said that Cotsco parking spots were “wider,” and that they just got a “whole lot of things right.” To many that may sound like a vague response, but Charlie was actually pointing to Costco’s culture.

Early on, he sensed that Costco had a superior culture to competitors and, thus, a higher chance of adapting and thriving over time.

It’s worked out for him.

The top performing stocks of the last two decades, like Amazon, Microsoft and Meta excel in this sense too. Sure, they experience cultural turbulence–those sine waves–but over the long term the general trend points up and to the right. Their respective financial inflection points can be traced back to specific cultural fluctuations.

Of course, I do not believe that an excellent culture is a sufficient condition, but rather a necessary one. Companies without quality culture require excessive analysis only to, usually disappoint in the end.

Companies with strong moats and excellent cultures, on the other hand, tend to do well.

Over the past few years, Blackberry’s cybersecurity division has proved incapable of going beyond its government business.

The company still cannot clearly explain what is wrong with the cybersecurity business, and the new CEO has seemingly no vision for the company outside cutting costs.

The IoT division is doing well. Future prospects remain bright. But the CEO transition has revealed just to what extent the broader organization remains mired in mediocrity.

Despite its privileged position in the IoT space, Blackberry has thus far failed to deliver because the corporate culture is such that the company cannot take advantage of its key assets–at present, at least.

2.0 Paths Forward

I am going to be monitoring the situation for a few more quarters.

I am contemplating exiting my position and reallocating to higher conviction opportunities. However, I still believe that the IoT business, which I explore in depth in the next section, has plenty of potential.

In this sense, the thesis remains intact. Further, I suspect that IoT’s continued prosperity in the face of abject mediocrity is indicative of a good culture within the division and overall ability to execute.

I therefore believe that the path forward for the company is now:

Selling the cybersecurity division.

Getting rid of the seemingly political stand-alone organization that currently holds the IoT and cybersecurity divisions together.

Ultimately right-sizing Blackberry down to the IoT division and getting everything out of the way so that the business can grow.

I believe I will hang around for a few quarters more to see if Blackberry moves in this direction. If during this period of time the company remains set in its ways, I will exit.

But it seems unlikely that the political organization will eliminate itself.

Further, the company has now confirmed that it will not IPO the IoT division, but that it will fully separate the IoT and cybersecurity divisions.

3.0 The IoT Business

IoT continues to do well and revenue is in fact set to reach all time highs.

IoT revenue continues to grow just fine. It came in at $55M this quarter, up 15% sequentially and 8% YoY, with gross margin coming in at 84%. Management expects revenue to come in at $62-$66M next quarter, which would be the highest level ever.

Regardless of the guidance, the business seems to be doing well, with the usual design wins coming in. Apparently, one of the “largest” automakers in the world will now be using QNX as its operating system.

Blackberry is also on track to release QNX 8.0 soon, which allegedly will come with great scalability enhancements.

What we don’t see is upsells to IVY of the installed QNX base, however. If Blackberry cannot manage to funnel QNX customers into IVY, then the IoT thesis is invalid.

As a reminder, I believe that Blackberry will yield good returns to shareholders if it manages to convert its large QNX installed base (the operating system powers 235M cars on the road today) to its “app store for cars”, called Blackberry IVY.

The question naturally remains whether the IoT division has superior organizational properties as compared to the rest of the company. If not, Blackberry will not be able to extract further value from the QNX network.

According to the new CEO, John Gianmatteo, the company is making “progress in what is a long sales cycle business,” with concept trials progressing well and good feedback from customers.

No matter how depressing the last conference call was, something is telling me to wait around and see how the IoT division evolves.

If we do see QNX customers signing up to IVY at some point, then I see no particular reason why the business can’t do well over time.

IoT has evidenced its ability to accrue new customers. Now, it just needs to figure out how to increase ARPU (average revenue per user–i.e. customer).

Additionally, it might be a buyer that figures out how to increase ARPU.

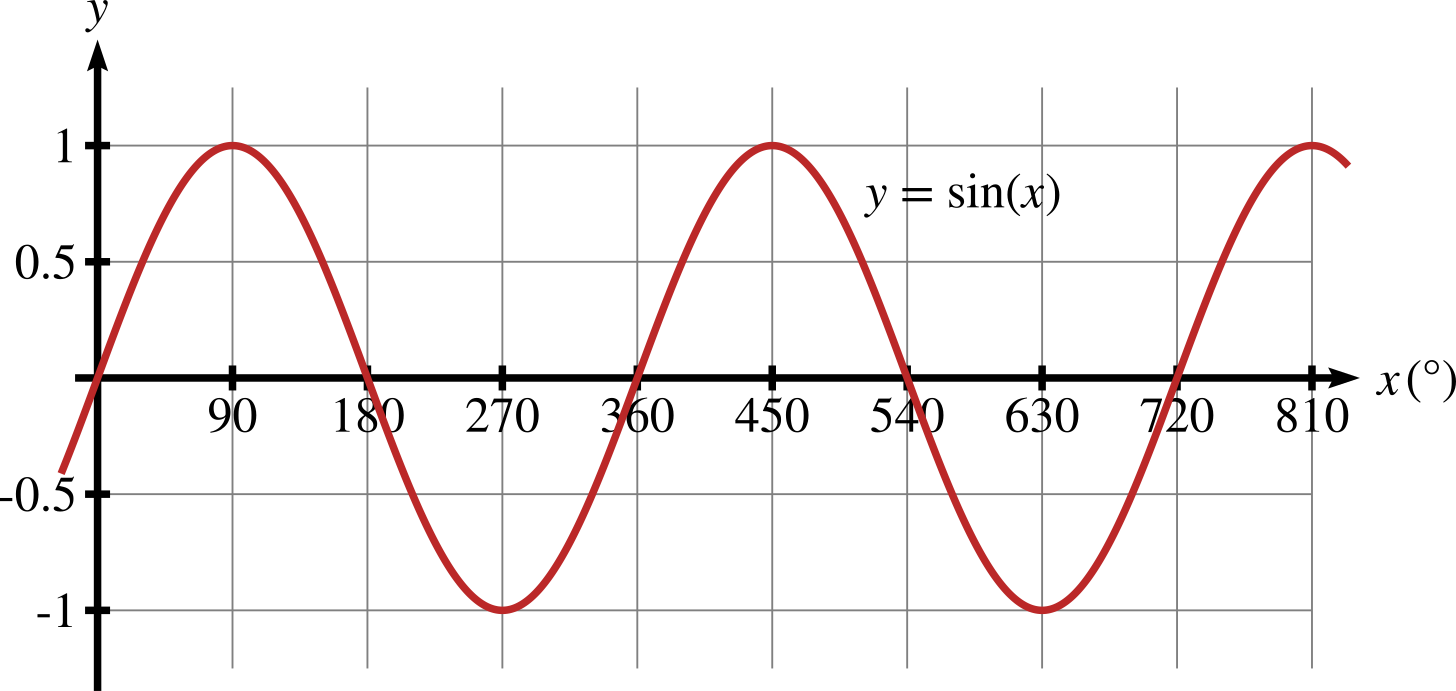

4.0 The Cybersecurity Business

Although cybersecurity is mired in mediocrity, financials seem to be converging.

Chen guided a year ago for cybersecurity ARR (annual recurring revenue) to resume growth by now. In the last call, the current CEO and former VP of cybersecurity (Gianmatteo) brushed off questions about the revenue guidance, attributing the failure to “churn.”

Gianmatteo offered no clarity in terms of what the business’s strategy is to take market share and grow revenue going forward. All he talked about was cutting costs.

He was previously leading the cybersecurity division, so the above has damaged my confidence in his managerial abilities and negatively affected my overall view of Blackberry.

Gianmatteo seems to lack rigor as a leader and, by extension, I believe other caretakers of the organization do as well.

I thus no longer expect cybersecurity to go anywhere from here. The XDR market is incredibly competitive. I see no clear path for Blackberry to go beyond the government space.

Having said that, the graphs below show the division’s financials somewhat stabilizing from the extended decline that began in Q3 FY2022. However, the stabilization is a projection, not yet a reality. Additionally, as you’ll see below, though management projects stabilized revenue, ARR remains in a downtrend, showing that they are accruing on the top line at the expense of returns to the bottom line.

Further, this quarter we saw the Malaysian government hiring the full range of Blackberry’s cybersecurity products in a multi year deal. The deal includes the Cylance, UEM, AtHoc, and Secusmart offerings.

Blackberry also closed a seven-year AtHoc contract with the US Department of Homeland Security.

I see this as further evidence of Blackberry’s strength in government, which, in the context of a healthily growing IoT division, is not to be fully disregarded.

First, the division can be sold. Blackberry’s cybersecurity offerings are no doubt valuable to many important governments across the world. A hypothetical sale can thus yield plenty of cash.

Secondly, via cost cuts, the division may soon become cash flow positive. A sale won’t imbue deeper levels of innovation, but it might stop the cyber business from being a drag on IoT.

I think this might be worth waiting out.

5.0 Financials

Blackberry currently has three quarters to get its affairs in order.

As I contemplate the possibility of exiting the business, my main focus is avoiding a permanent loss of capital.

In that sense, I welcome Gianmatteo’s focus on cutting costs, so long as it doesn’t spoil IoT’s growth. This is the second big risk worth watching.

Cash from operations came in marginally negative at $(31)M this quarter.

Having paid off $365M of the 2020 debentures and issued $150M on short term convertible debentures during the quarter, Blackberry now has $271M in cash and equivalents and just $150M in debt.

The short-term debentures, at a rate of 1.75%, are held by Fairfax, which in turn is a large Blackberry shareholder. The debentures are due quite soon–February 15, 2024–though the contract has an option for the date to be extended until May 15 2024.

Factoring out the money from the new debentures, therefore, Blackberry has a net cash position of roughly $120M. At the current rate the company has a three-quarter runway.

This doesn’t factor in the money from the new debentures, because by the end of that runway, the debentures will be due anyway.

Thus, Blackberry has two quarters at most to aggressively cut costs and achieve positive cash from operations. As explained, these cost cuts must also not kill whatever innovative spirit the company has left, otherwise demise–or, at best, perpetual mediocrity–is certain.

On the call, Gianmatteo said he sees plenty of cost-cutting opportunities in the back office–far removed from any nests of innovation.

6.0 Conclusion

While the call was terribly depressing, the truth is IoT continues to do just fine. However, until we see IVY upsells, the thesis is in peril.

The risk is now that the broader organization takes the IoT division to the grave with it. With just three quarters of runway, this risk is material.

That being said, I believe the focus on cost cuts is the right approach at present. It caps the cybersecurity division’s prospects of succeeding in the broader market, but it helps secure Blackberry QNX’s future.

With a leaner Blackberry, the next move should be to bring in a new CEO that can reshape the company’s culture.

The fact that I find myself saying that the company “should” do something, is indicative of the poor organizational qualities of the company in itself.

I am going to give this investment a few more quarters, but right now the thesis is hanging from a string.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Great and honest analysis Antonio. I appreciate the assessment, and I agree with what you say. Keep up the good work.

Disappointed with the lack of understanding as to what BlackBerry actually offers with QNX and IVY. IVY is nothing close to an app store, IVY is the plumbing that allows the data from all the separate subsystems that make up a modern car to be aggregated and used at the Edge or sent to the cloud without the manufactures and OEM's having to maintain all the interfaces.

QNX 8.0 is a dramatic shift from QNX 7 allowing the power of modern chips to truly be realised for the first time - this is huge.

Lumping all of Cybersecurity together is another mistake. All products other than Cylance are doing great - AtHoc is winning left right and center.

Cylance has value - it has more AI Patents than its 15 closest competitors combined. These patents also predate those of the competitors. Cylance works on embedded systems, its competitors do not. The use of embedded systems if growing dramatically (automotive, Medical, defense) etc. and the other Cyber Security vendors could value Cylance as an extremely attractive acquisition.