Edited by Brian Birnbaum.

1.0 Satya’s Secret

Microsoft’s turnaround serves as a timeless blueprint for investors to spot world class companies and leaders in early stages.

In pursuit of an edge over the market, I strive to understand companies more deeply than most market participants are willing to. As you may know, this has led me to identify culture as one of the main precursors of organizational success. The Microsoft turnaround shows that getting culture right is a trillion-dollar game. As Satya Nadella wrote in his 2022 letter to shareholders:

“Our culture is the foundation on which our mission and strategy stand, and cultivating it is our greatest priority.”

Since Satya took over in February 2014, the company has gone from a market cap of ~$315B to that of ~$1.8T. Naturally picking the right strategy set the foundation for success. His letter ahead of FY2015 is prescient considering the technological reality that unfolded, which practically paralleled his predictions. However, vision can be worthless without the right vehicle for execution. In his letter, Satya demonstrates a fundamental understanding of what a company is and, thus, how to turn one around.

But first, some context.

Companies are optimization functions. To succeed, they must:

Minimize inputs.

Maximize outputs.

Continue as such in perpetuity.

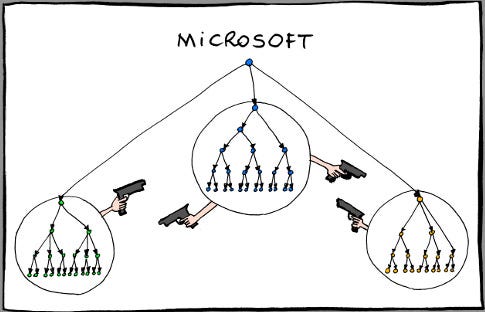

To do so, companies have to process information, allowing them to make the best decisions toward satisfying the above three constraints. Ergo, companies that process information best tend to outperform the rest. What Satya found in 2014 was a company failing to process information efficiently. Politics dominated the corporations. Individuals were scared to share ideas. The cartoon below featured in Business Insider perfectly summarizes the situation back in 2014.

In 2014, Microsoft had 128,000 employees. Given the complexity of the human condition, no formulaic, top-down “solution” could have suddenly erected an army of highly collaborative and innovative corporate careerists. As history has shown, only a combination of shared philosophy, creation myth, and mission story can do so. In his annual letter ahead of FY2015, Satya laid out the philosophical principles he felt would fix the situation. Along with Steve Jobs, he is the only CEO that I know of that has tapped into the power of individualism, as defined by Nietzsche:

A few months ago on a call with investors I quoted Nietzsche and said that we must have ‘courage in the face of reality’.

We have the right capabilities to reinvent productivity and platforms for the mobile-first and cloud-first world. Now, we must build the right culture to take advantage of our huge opportunity. And culture change starts with one individual at a time.

With the courage to transform individually, we will collectively transform this company and seize the great opportunity ahead.

Satya understood that the essence of a highly political environment is the suppression of individual courage. In such environments the reward of fitting in and climbing up the ranks is greater than that of sharing opinions, regardless of their concurrence with one another, in the pursuit of value creation. Thus, he promoted individual courage as the foundation for a more efficient and innovative Microsoft.

This requires fundamentally understanding that a company consists of a bunch of people working together toward a common goal. How they work together shapes a company´s fate. It also requires a deep understanding of the human psyche. In my research, I have found that not all CEOs understand this, and that the ones who do tend to outperform because they bring the best out in their people.

Concerning individual courage, Nadella laid out in the same letter the following core values:

Microsoft employees should now be learn-it-alls, not know-it-alls.

Microsoft employees could now move around the company freely to identify roles that best fit–but now with accountability staking performance.

A focus on personal growth and learning from failure.

Customer obsession.

Diversity.

Courage in isolation is not intrinsically valuable, but combined with the above values, it turns Microsoft employees into value-creation machines. Each employee becomes a node highly attuned to the information flowing within and outside of the network itself. Customer obsession enables the company to transcend its boundaries and diversity yields many vantage points from which to look at a problem. The focus on growth and learning made Microsoft´s potential growth boundless. Accountability provided the guardrails for that growth.

In his letter ahead of FY2015, Nadella also demonstrated an understanding of the importance of organizational structure and, thus, the flat structure. Individual potential can be frustrated by a constrictive structure that throttles the velocity of information flow. A hierarchical structure can also give way to a political environment despite the very best efforts to stop it, making an otherwise productive philosophy futile:

“Finally, every team across Microsoft must find ways to simplify and move faster, more efficiently. We will increase the fluidity of information and ideas by taking actions to flatten the organization and develop leaner business processes.”

He also laid out principles to improve every engineering group. From the start of his tenure, each group would be able to access data and applied sciences resources, helping them measure product outcomes. Software engineering processes would also have “fewer breakpoints between product or service gestation and delivery or drop dates”.

The above has enabled Microsoft to channel its philosophical upgrades into products and services that move the needle. In political organizations, feedback from the market tends to be distorted and muted. By measuring the outcomes of products at the engineering level, the company gets inevitably closer to truth.

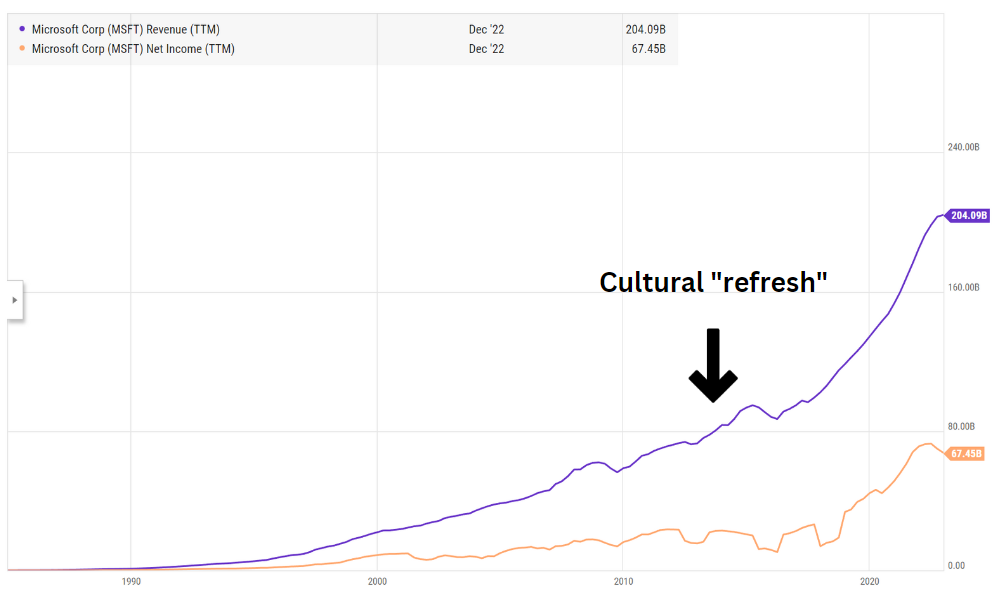

Satya´s turnaround of Microsoft is right up there for me with “Meditations” by Marcus Aurelius, in terms of the value of the lessons they teach. My long-time readers will have noticed that Microsoft now exhibits the fundamental properties that I originally outlined in my Electrons & Dollars thesis. It is a moment of intellectual satisfaction for me to see Microsoft´s financial results improve so rapidly after the cultural and structural reconditioning.

“Ultimately, we will only achieve our mission if we live our culture. It is at the root of every decision we make.” - 2020 letter to shareholders.

2.0 The Age of Leverage

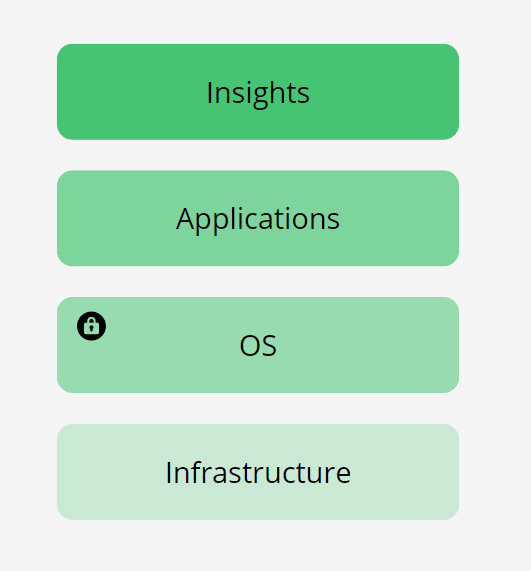

Microsoft is adding AI powered insights to its stack and this is likely to yield unprecedented leverage for all stakeholders. It has the potential to enhance the company´s profitability over the next decade.

Microsoft today is essentially a stack that goes from computing infrastructure, to the operating system and application levels. In aggregate, the objective of the stack is to provide a generous productivity surplus to users. The fundamental source of its moat is its dominance at the OS level, with its Windows operating system installed in 70%+ of the desktop computers worldwide. This gives it a distribution advantage from which a competitive cloud offering (infrastructure) and a range of presiding enterprise applications emerge.

“In sum, our platforms create broad surplus everywhere.” - Satya Nadella, 2018 letter to shareholders.

In an AI context, the applications serve as highly fertile training grounds. Users generate high signal data as they work on applications like Excel or Powerpoint. In turn, this data can be used to train AIs that can predict what any given user is trying to accomplish and thus automate the task. With this new platform, computers are evolving from bicycles for the mind to space ships for the mind.

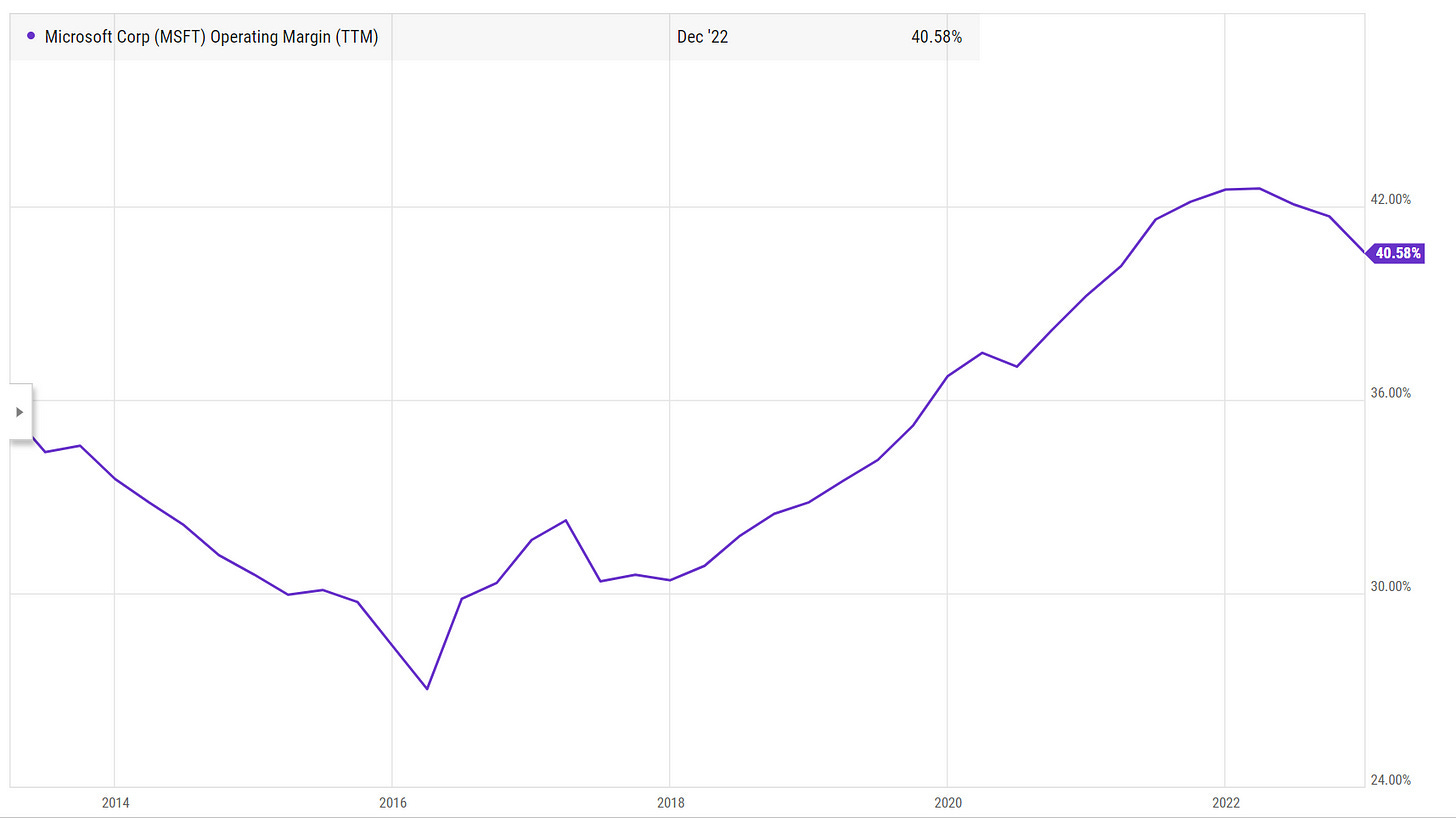

Financially, in the affirmative this is likely to translate into a much higher operating margin for Microsoft. It enables its users to accomplish much more, thus meaningfully expanding the productivity surplus that nourishes the business. It has the potential to fully remove repetitive and tedious tasks from the tertiary industry, enabling humans to focus on what really drives value creation.

Two fundamental concerns come to mind regarding the evolution of this novel part of the stack:

The user is now the product.

Computational intensity will rise exponentially.

AI models aggregate IP from individuals and so, user activity is an indispensable element of the value chain. Through time, much like has happened with Meta, users are bound to become gradually conscious of their place in the value creation process. In its many potential financial manifestations, this is likely to translate into lower margins than otherwise until the sum is larger than the whole of the parts. As the AI gets more and more intelligent, it should gradually offset this dynamic.

Further, training AIs and making inferences with them requires plenty of computational resources. It will dwarf those used to operate Microsoft´s traditional stack (OS + applications) and initially, it is hard to foresee how unit economics may evolve. As I covered in my AMD deep dive, this requires a new type of infrastructure that is able to accelerate computation across the board. Satya understands this, per his words in the Q2 2023 ER call:

“That's, in some sense, under the radar, if you will, for the last three and a half, four years, we've been working very, very hard to build both the training supercomputers and now, of course, the inference infrastructure because once you use AI inside of your applications, it goes from just being training-heavy to inference.

So, I think core Azure itself is being transformed for the core infrastructure business. It's being transformed. And so, you can see us with data beyond Azure OpenAI services even, think about what Synapse plus OpenAI APIs can do. We already have Power Platform incorporated capability.”

The vertical integration that Satya is hinting to is no doubt an appealing strategy. Naturally, the world is heading towards more computation for less, but making unit economics work along that journey is no easy feat. Having control over the different elements of the stack is beneficial and specially when one is pioneering the space. The direction that the semi conductor industry is heading towards will facilitate the transition towards AI across the board. This should make Microsoft´s life easier, which ultimately captures value at the application level.

The past few months have been all about ChatGPT, but I am far more impressed by Github´s Copilot which is currently being used my 1M+ developers. With it, you can simply describe what you would like to implement and Copilot makes code suggestions. If you like the code, you just have to hit tab and voila, you just saved yourself 10 minutes of coding. Copilot meaningfully improves the productivity of the subset of the population that generates an increasing portion of the world´s wealth.

“GitHub Copilot is the first at-scale AI product built for this era, fundamentally transforming developer productivity.” - Satya Nadella, Q3 2023 ER

What struck me most when learning about Copilot is the fractal nature of Microsoft´s ecosystems. Microsoft seems to be the machine that creates ecosystems, which create other ecosystems. This is clearly visible if you analyze the different parts of the operation, like Linkedin and Xbox. This fractality is a key source of leverage for Microsoft, since it multiplies the surface area on which it can productively deliver insights.

Going back through the company´s history, I was able to track this property back to Satya as well. He wrote a letter to Microsoft´s employees after the acquisition, in which he explained how merging the Office 365 and Linkedin ecosystems could compound. If you look carefully, you can see this particular fingerprint is all over Microsoft today underneath the surface.

Along with the new growth in our Office 365 commercial and Dynamics businesses this deal is key to our bold ambition to reinvent productivity and business processes.

Think about it: How people find jobs, build skills, sell, market and get work done and ultimately find success requires a connected professional world.

It requires a vibrant network that brings together a professional's information in LinkedIn's public network with the information in Office 365 and Dynamics.

3.0 The Search Fallacy

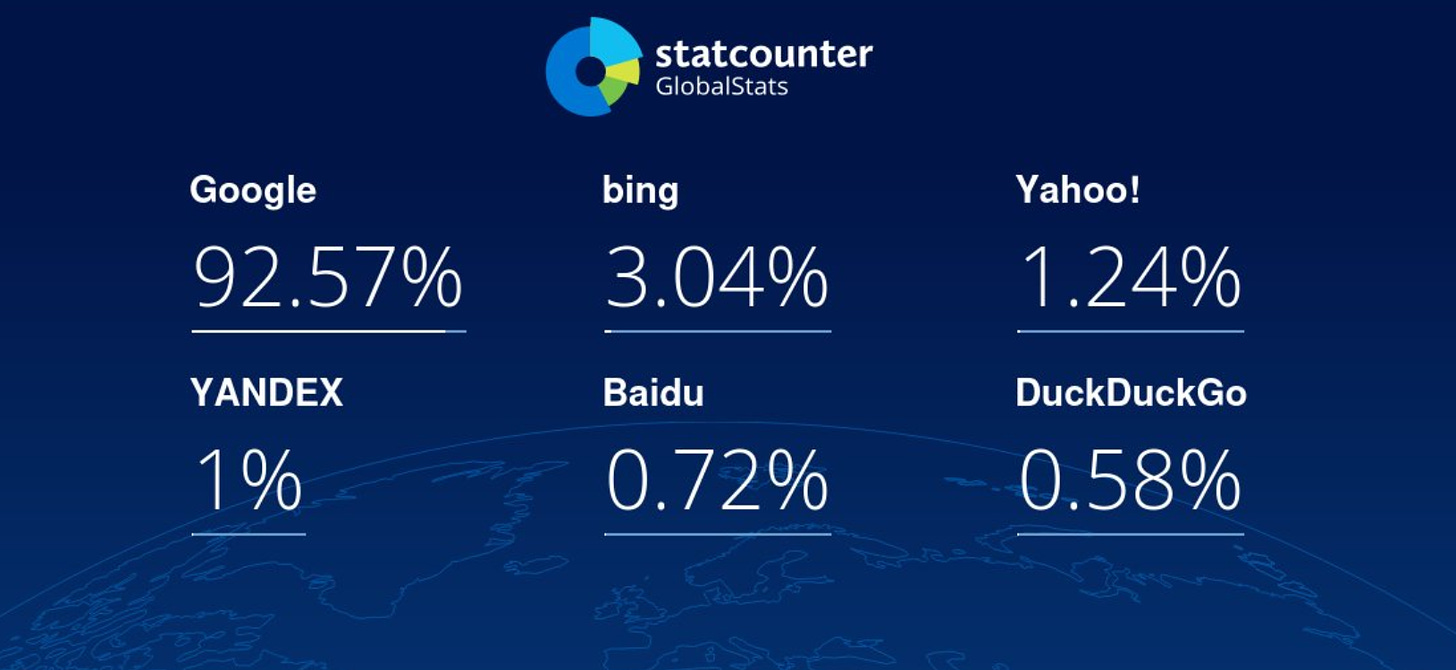

Bing has to be 10X better than Google to displace it.

In my fascination with psychology, I have read plenty about habits. Habit become physically ingrained in our psyche, in that the brain carves out specific pathways for them. That is why no matter how hard we may try, we often end up defaulting back to old habits. In my view, this is the source of Google´s moat and the same theory suggests that Microsoft will have a tough time with search.

As a recurrent user, to access Google you perform a series of actions that have been automated by your brain, in order to save you energy. Through time, you have evolved to use Google and every aspect of it with minimal energy input. When you type google.com, your finger tips move around the keyboard automatically. Your vocal cords even go through the motions to pronounce google.com as you type it, but you probably do not realize and more.

To change to a different search engine, you have to override all the circuitry that you have unknowingly developed. You need a very strong stimulus to do so and otherwise, you just end up defaulting back to the existing circuitry. Thus, the recent search narrative that Bing will displace Google ignores this science and underestimates the difficulty of the task.

With its distribution advantage, Microsoft can push Bing to its users, which keeps it in the search game. Whilst it is unlikely that Bing can overtake Google with the latter in good form, it can do if the changing landscape throws Google of its balance. Google is now coming up against a large challenge, which may require the company to reinvent itself.

Microsoft and Google are impacted by AI in different ways. For Microsoft, AI is purely a tailwind in that it can infuse AI into its stack, if anything improving its unit economics. With it, any of its apps become a gateway into the internet´s knowledge in situ. This is highly disruptive to Google, for two reasons:

Google´s business model relies on taking the user from point A to point B. If users can now access knowledge without moving from the app in question, this jeopardizes the operation.

Since Google makes most of its money by selling ads on its search engine, rising computation costs are likely to choke margins going forward, unless it radically increases the relevance of the adds.

Google has almost infinite options to confront the above two concerns, but it is likely that the company will have to cannibalize itself to varying degrees going forward. This requires strong leadership and a highly functional culture, that enables Google to pounce on potential businesses opportunities with lower gross margins. It is The Innovator´s Dilemma once more and yet again, culture will determine the outcome over the long run.

Further, when it comes to AI my mind is often not so much on the algorithms as on the data. No matter how great an algorithm you have, what ultimately determines an AI´s productivity is the quality and scope of the data that it is trained on. In that sense, Microsoft and Google both have extremely prominent data reservoirs in different domains:

Microsoft picks up data on enterprise.

Google picks up data on the world´s knowledge.

Although there is a degree of superposition, both companies are ideally positioned to birth highly valuable AIs within their domains of expertise. Google´s data infrastructure is perhaps the most prominent on Earth and it literally holds humanity´s knowledge. Thus, with the market beating up Google, perhaps there is an opportunity in searching for signals of a cultural refresh, similar to that outlined in section 1.0.

4.0 Quantitative Considerations

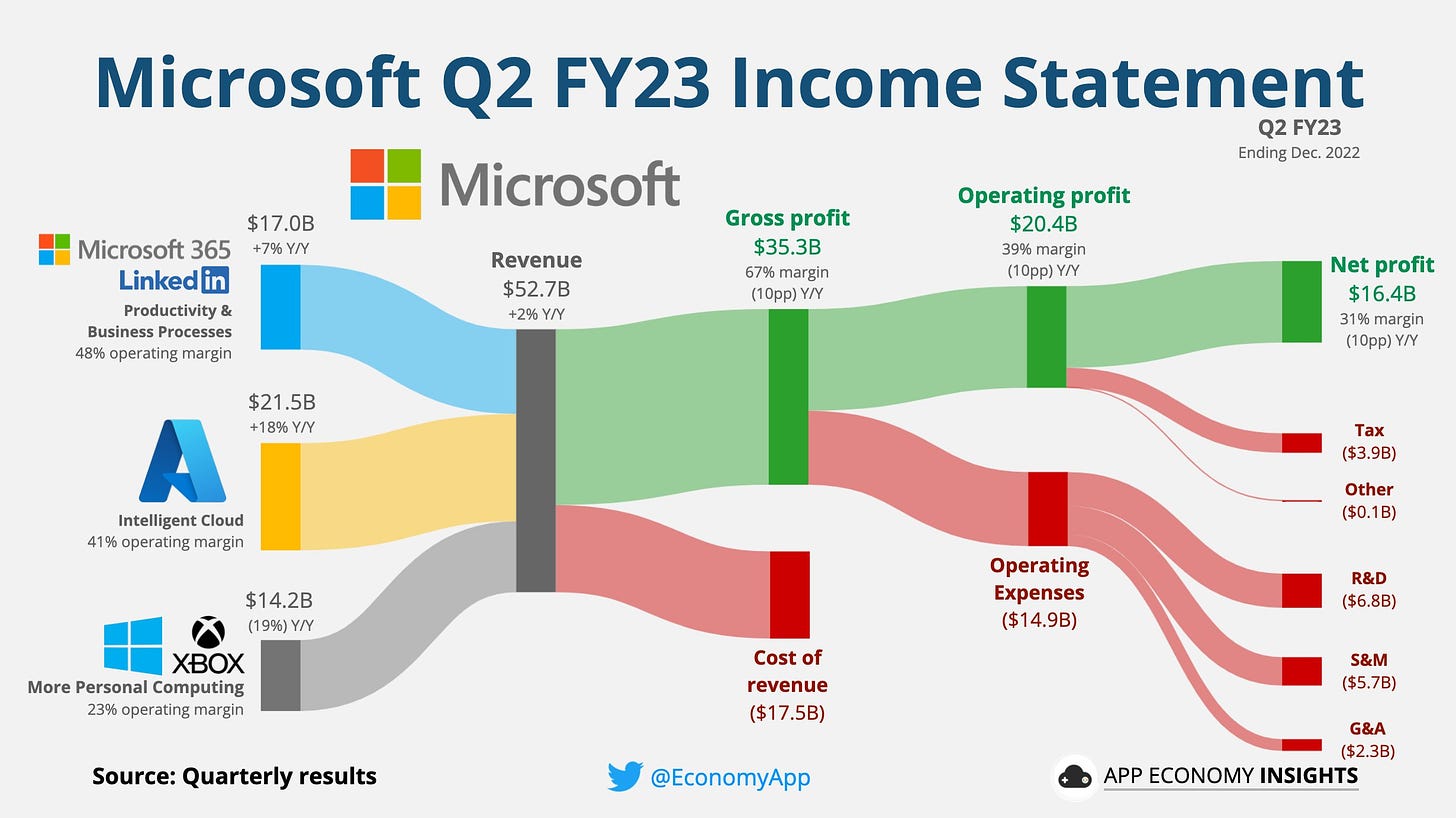

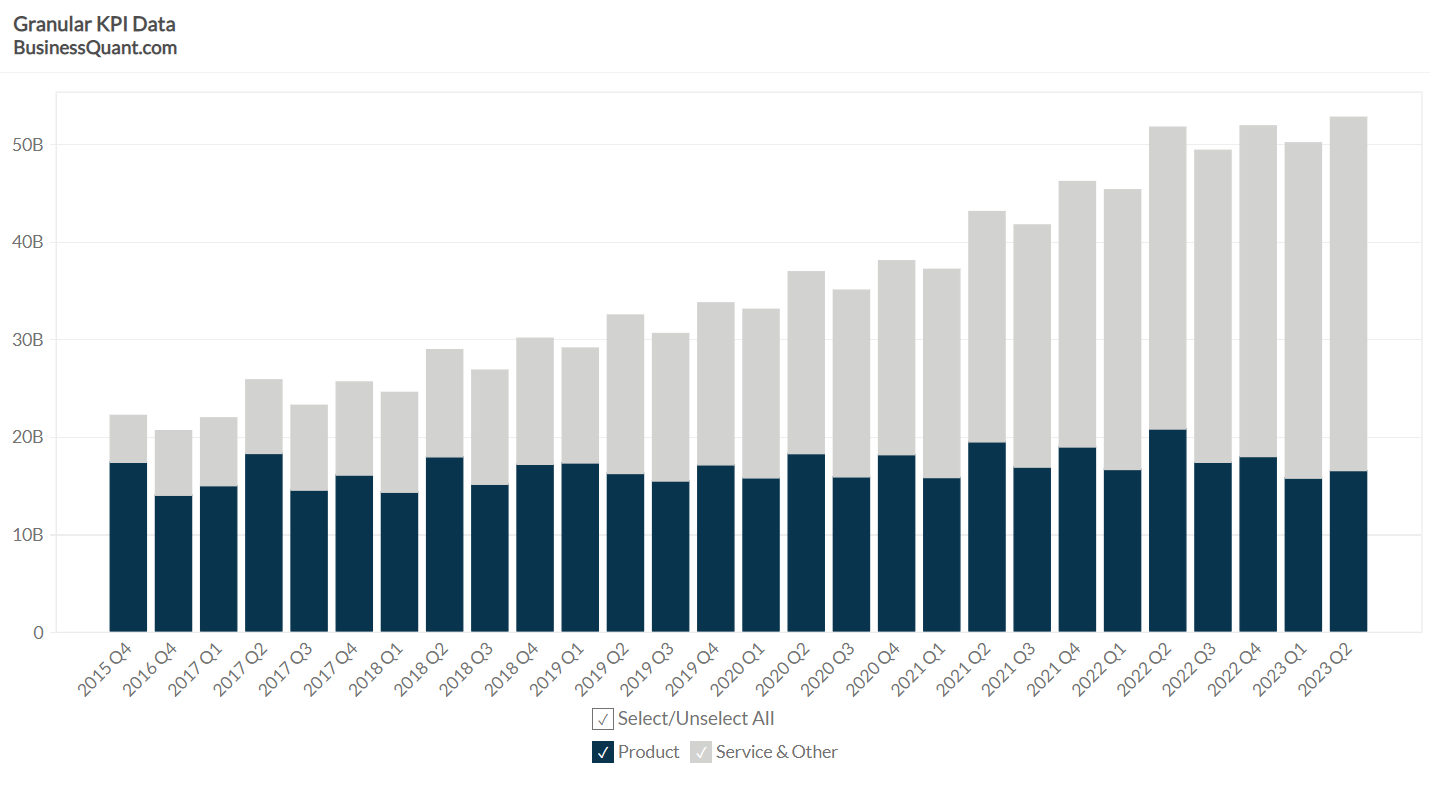

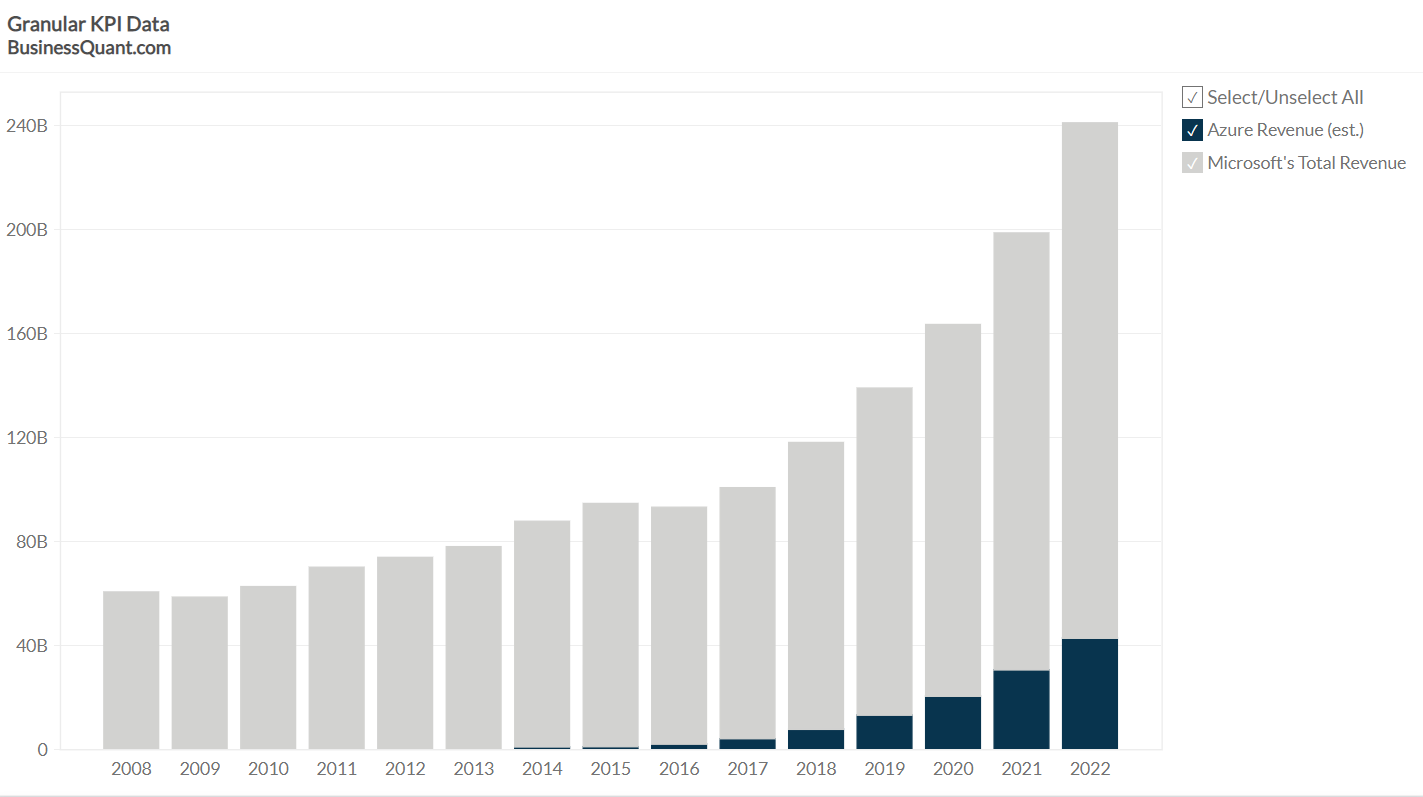

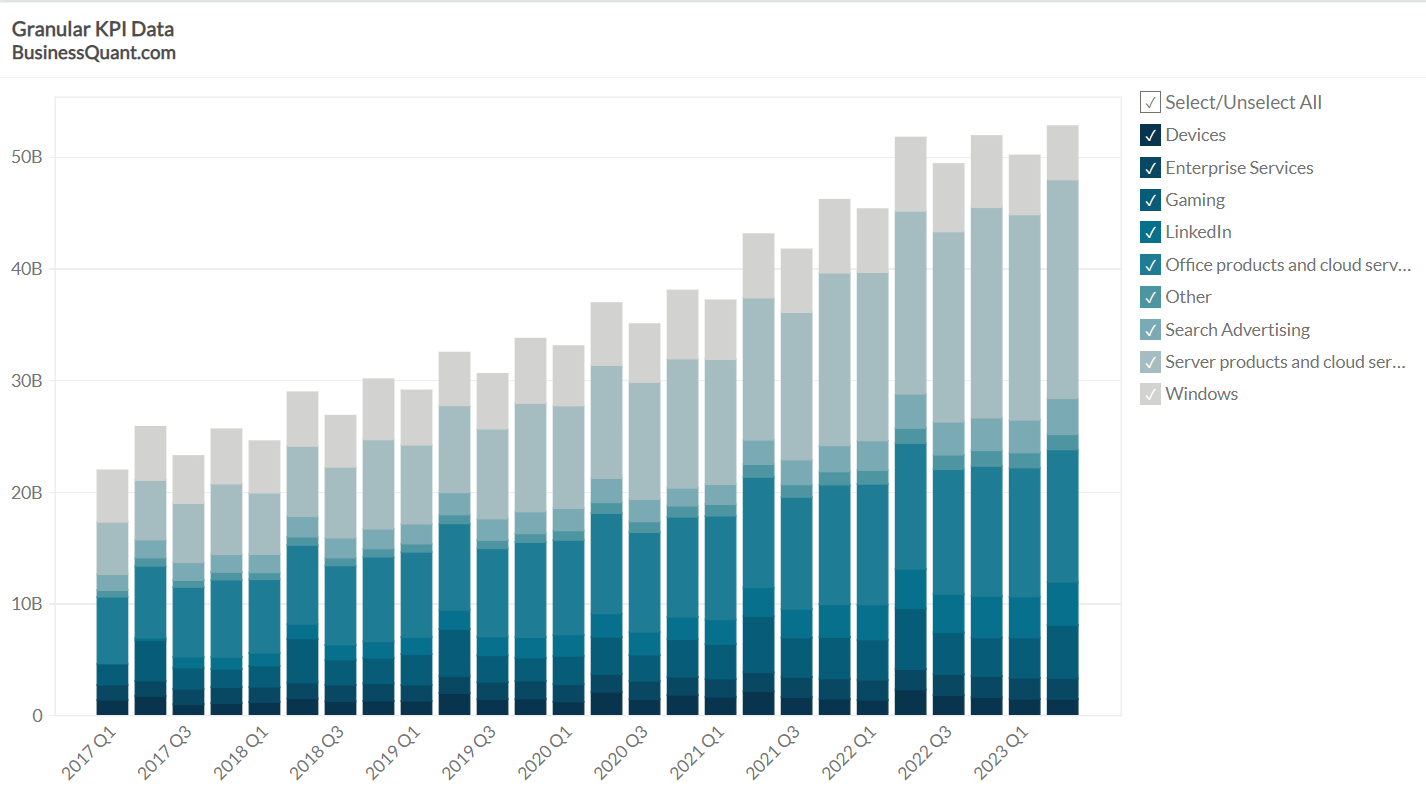

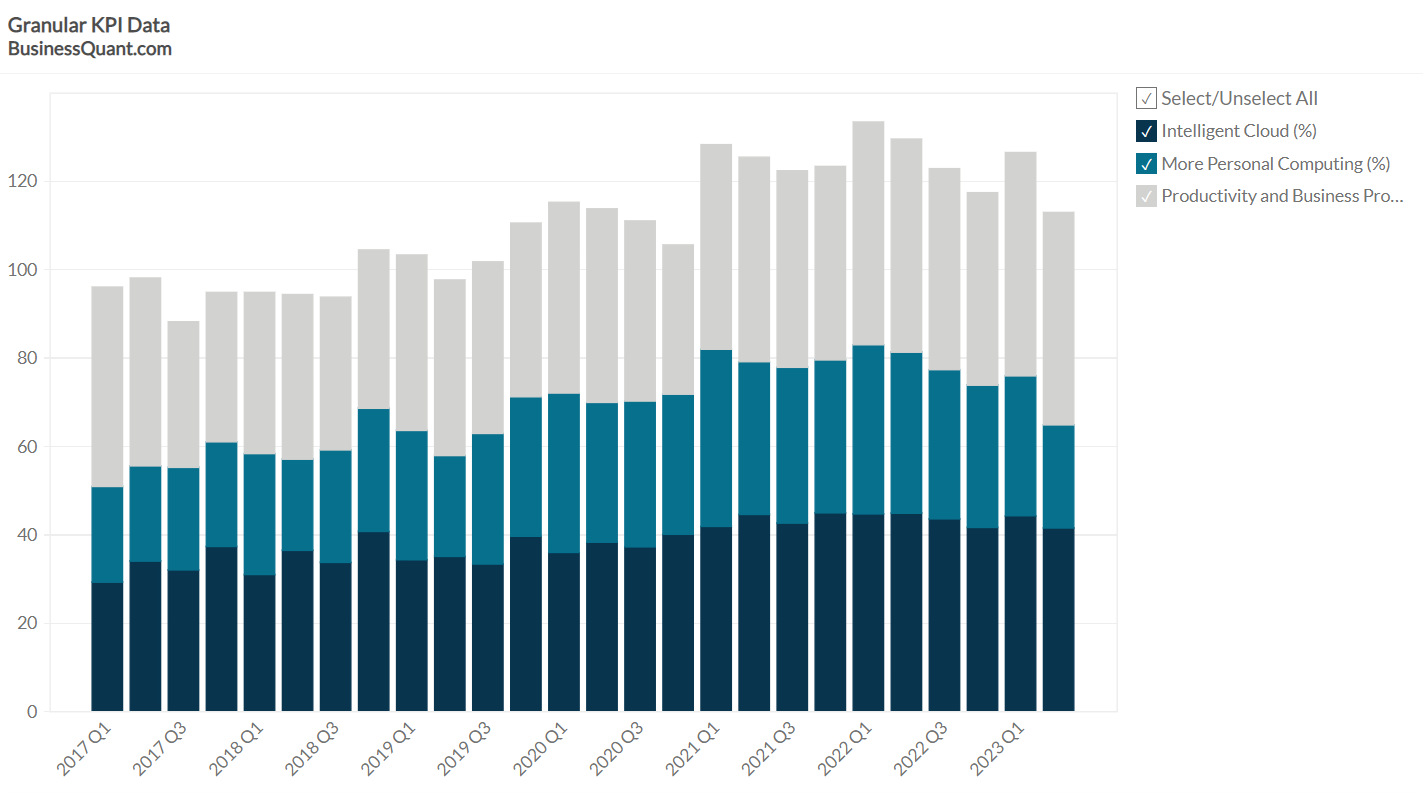

Microsoft’s operating margin has risen since 2014 as revenue from services has outgrown revenue from products. I would expect this trend to continue and to potentially be meaningfully enhanced per the dynamics outlined in section 2.0. This all stems from Microsoft’s ability to increasingly monetize its ecosystems via subscriptions and from the emergence of Azure.

Azure’s gross margin came in at 72% in Q2 2023, which is slightly above the company’s overall gross margin during the quarter, 66.85%. In turn, Azure’s revenue as a % of overall revenue is rising fast and so this is adding an element of buoyancy to the company’s financials. There are a number of key factors to consider regarding this aspect of the company:

The fact that cloud is a financially coherent business makes it more likely that Microsoft should add insights to its stack successfully over the next decade.

Its main competitor is Amazon´s AWS, which culturally has an obsession with continuously giving customers more for less. I believe this will stand as a deflationary pressure going forward. In their respective latest quarterly reports, Amazon mentions proactive price reductions in AWS many times and Microsoft only timidly mentions it once, when asked about customers pulling back.

“And there's real guidance that we ourselves in the product to say, here are the things that you do optimize your billing. And so that's sort of what is the fundamental thing.” - Satya Nadella, Q2 2023 ER

Per se, cloud consists in giving customers more for less, so the above should be read in a differential light. Although in fact Amazon and Microsoft have very similar cultures, the former´s focus on giving customers more for less seems far more pronounced than in Microsoft´s case. I believe this small observation will explain a lot of what we will see in the cloud space over the next decade.

Further, the thoughts outlined in section 2.0 would be void without actual quantitative evidence that Microsoft is able to operate multiple ecosystems at once. Indeed, once companies diversify too much, all sorts of trouble emerges. I have been positively surprised to see the core ecosystems grow quite well, despite being in some cases rather unrelated:

Windows has gone from being installed in 700M devices in 2018 to more than 1.4B by the end of FY2022.

Office 365 has grown from 70M seats in April 2016 to more than 320M at the end of FY2022.

Linkedin has grown from 575M users in 2018 to 900M+ at the end of Q2 2023.

Github has grown from 31M users in 2018 to 100M+ at the end of Q2 2023.

Xbox Live has grown from 57M users in 2018 to 120M+ by end of FY2022.

Xbox Game Pass has grown from 15M+ users in 2020 to 120M+ in Q2 2023.

The above are not all of Microsoft´s initiatives and they do not grow linearly either, but the overall picture looks rather cohesive. Cloud and office products continue to drive most of the revenue growth, but I see a company that can foster multiple business opportunities at once. Per the company´s quarterly comments, engagement seems to be on the rise across the board too. Thus, this presents meaningful optionality going forward if the dynamics outlined in section 2.0 play out.

The Linkedin case is particularly insightful, in that it sheds some light on the dynamic that is showing through the above numbers. In the letter Satya sent to employees after the acquisition, how outlines how he thinks about buying companies. My main takeaway is that he is highly focused on cultural match and transfer. As in, he thinks about buying companies that have similar cultures to Microsoft and that in turn, can accommodate additional cultural elements that it may lack at the time of acquisition.

“Given this is the biggest acquisition for Microsoft since I became CEO, I wanted to share with you how I think about acquisitions overall.

To start, I consider if an asset will expand our opportunity — specifically, does it expand our total addressable market?

Is this asset riding secular usage and technology trends?

And does this asset align with our core business and overall sense of purpose?

The answer to all of those questions with LinkedIn is squarely yes. We are in pursuit of a common mission centered on empowering people and organizations.”

The philosophical principles underlying Microsoft´s culture are boundless, in that they serve to advance any given mission. But it is this seeming ability to channel it into different missions simultaneously that is driving the company forward. I see a similar trend in Microsoft´s acquisition of various video game developers, for example. So long as this persists, I believe the graph will keep on pointing up and to the right.

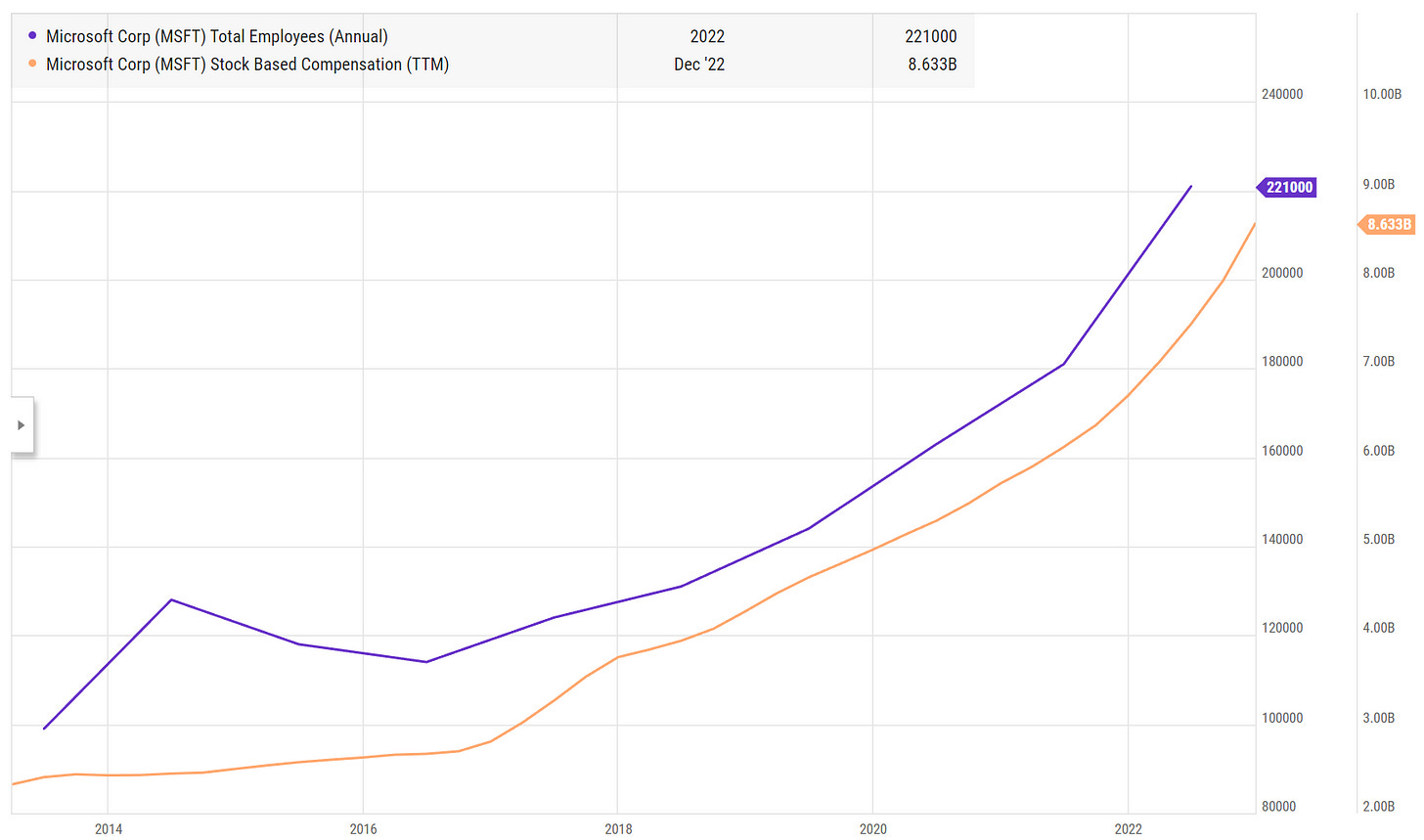

Additionally, Microsoft seems to be empowering its employees to be owners. This is something that Jeff Bezos discusses amply in his shareholder letters and that to me is a fundamental aspect of a business. Owners take better care of business than tenants. Since Satya took over, total headcount has risen fast but stock based compensation seems to be accompanying it. Without a high degree of ownership, I believe that over the long term the company´s initiatives would not be sustainable.

Further, Microsoft is a rather diversified business. With consumers pulling back across the board, the “More Personal Computing” segment is withering, but productivity and cloud continue to tow the business forward. Despite the macroeconomic ups and downs, we are still going to need much more computing in the future and Microsoft is exceptionally well positioned to deliver over the next decade.

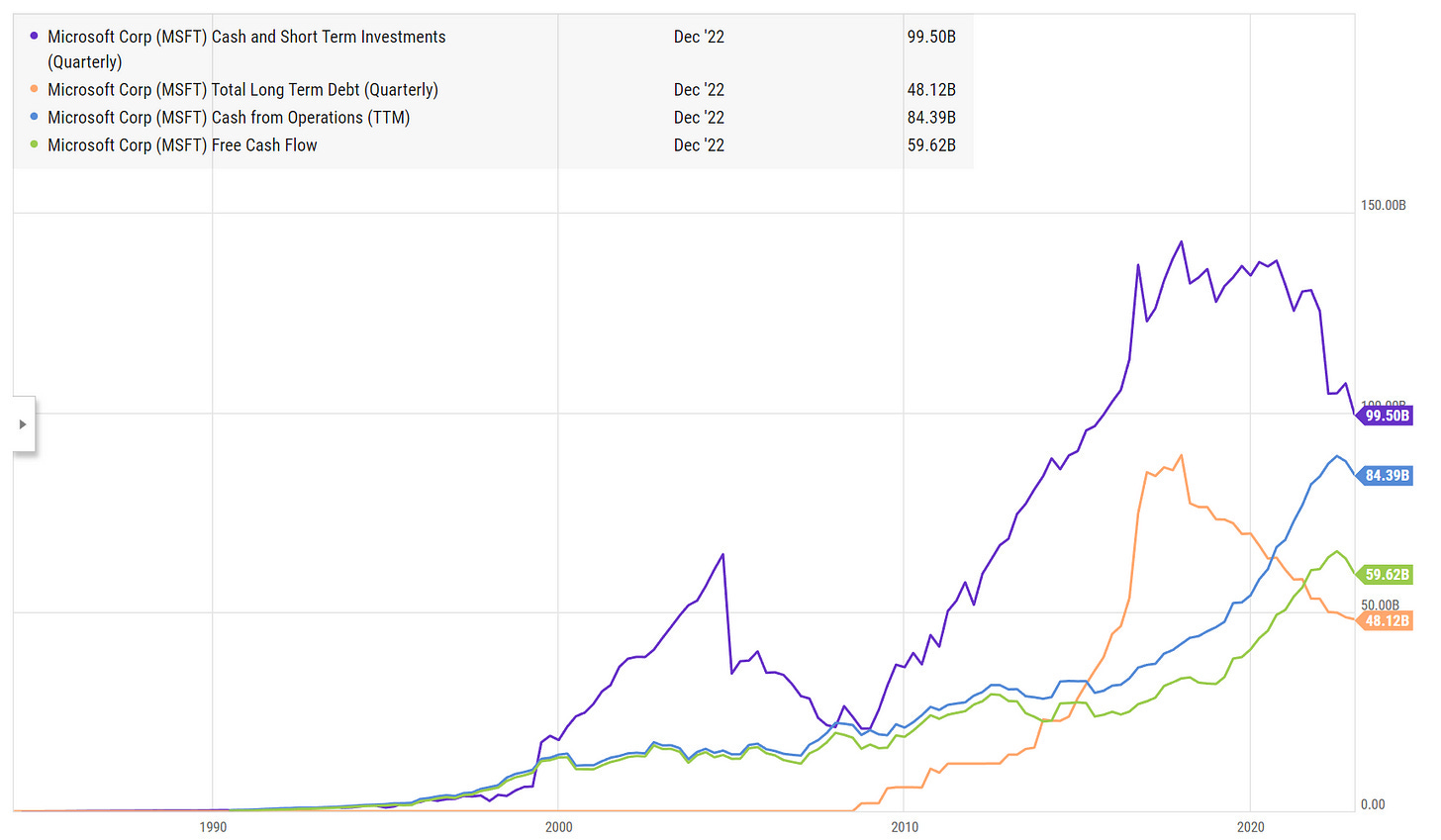

In FY2022, Microsoft paid a quarterly dividend of $0.62 per share. Further, Microsoft´s balance sheet and its ability to produce cash remain very healthy, although both have been materially impacted by the recent downturn. Going forward, as cloud grows to be a larger % of overall revenue I believe it will buffer the company from future downturns.

5.0 Conclusion

Microsoft is well set up for the next decade and is generously priced.

Microsoft´s turnaround serves as a source of incremental validation for my vision of what makes great companies. It is very intellectually satisfactory to learn that Satya Nadella believes culture will ultimately determine what Microsoft can achieve and that, it was the cornerstone of the company´s turnaround. I emerge from this deep dive with additional confidence on my ability to figure out what matters.

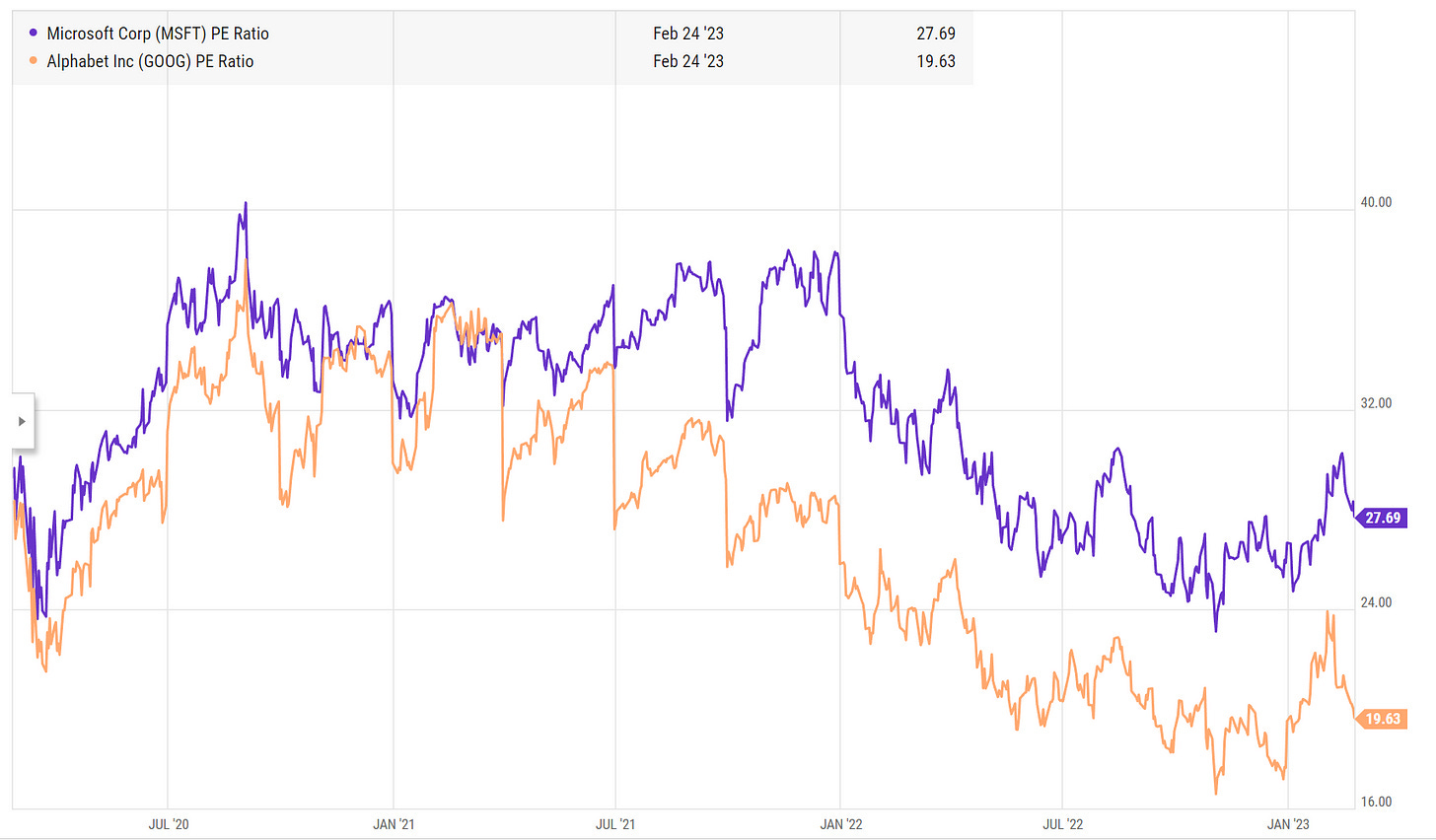

Over the last year, we have seen a divergence in the multiples that the market is assigning to Microsoft and Google. There is quite a bit of pessimism surrounding Google and Microsoft seems rather optimistically priced. Whilst Microsoft is a formidable company and will likely do well over the coming decade, I suspect there may be a more lucrative opportunity in buying Google.

As outlined in section 3.0, Google needs to evolve and to do so, it may benefit from a cultural refresh. Even without said refresh, the current pessimism may already yield an attractive opportunity by itself. However, philosophies as those outlined in section 1.0 could eventually lead to positive surprises.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

This is a PROPER deep dive, Antonio. I am so bored of people lecturing me about valuation without knowing more than me on the subject! You hardly talk about valuation and you go to the core of what you see as the issue. Same for Palantir, same for Tesla. It does not matter if I agree with you or not, I see the stocks for a different perspective, and I value your work highly as a result.

Great work Antonio. Interesting to see how MSFT has successfully managed seemingly disconnected businesses with cohesion, while many others fail at this endeavor. A lot of it seems owed to Culture, Organizational Structure and Satya's vision