Summary:

BB 0.00%↑ ‘ s current business is ok priced and has a very cheap implicit call option on what is likely to be one of the biggest tech platforms 5-10 years down the line.

$BB has a relatively stable financial situation, increasingly competitive products and is now focusing on sales. All the above makes this an asymmetric investment opportunity.

The toughest thing about investing is knowing when you are tricking yourself into believing something that may not be real. Over the past 6 years, listening closely to my intuition has payed off well in terms of investments. However, over the last week or so, I have been mentally wrestling with the position I initiated (mostly out of intuition) in $BB last winter. Today, I bring you my updated conclusions. In essence, seen with a linear mindset $BB may look like a relatively boring and even fairly valued IT business. Seeing the forest for the trees, however, it looks to me like deep value and like what is likely to be the cheapest tech platform on earth today, with the properties of an asymmetric investment.

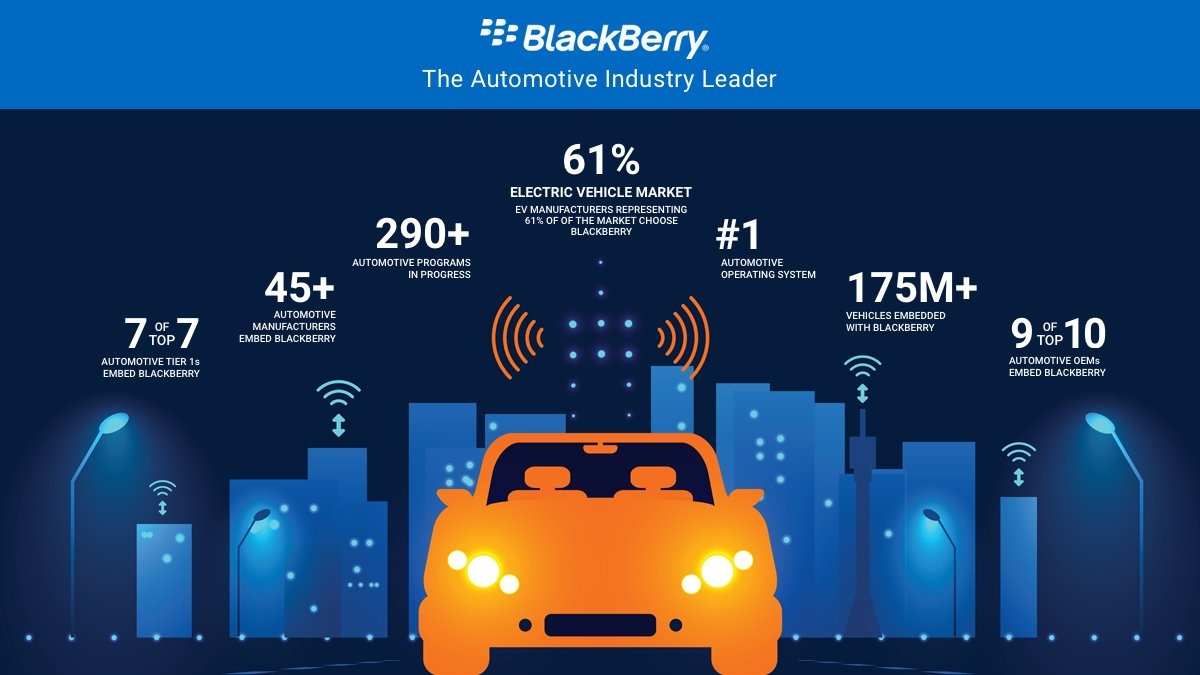

To cut a long story short, $BB´s QNX real-time OS is installed in 195M cars today, out of 1.4B cars in total on the road worldwide. QNX enables many different software pieces to run in a car, so acts as a kind of central control unit. QNX is becoming the predominant OS for connected cars, since it´s installed in so many cars. Whilst today $BB licenses QNX to OEMs on a per-unit royalty basis, QNX is effectively set up (through Blackberry Ivy, in partnership with $AMZN) to be the foundation of the data value chain for the auto industry, which McKinsey estimates will be quite big, specially for a company ($BB) with a market cap of 5B$ today. I think this will extend to other verticals over the next decade.

Blackberry IVY is going to enable vehicle data to be translated into vehicle applications that drive value for OEMs, drivers and other stakeholders like insurance companies. It´s most likely going to capture value through fees.

Let´s dive into further detail.

First Semis, then Endpoints

Back in 2012 or so, it was hard to imagine a world so permeated by semiconductors. Today, computing is increasingly ubiquitous, semis are in everything and in fact we have a shortage of them. Semiconductor equities have done well over the last decade, because semis enable the rest of the economy to compute more for less. In this post, I argue that wealth stems from finding new ways to arrange atoms, that yield some kind of new benefit for us. From this definition, it is evident that semis have been / will be generating plenty of wealth and are going to stick around, because they allow us to find new beneficial atom arrangements at lower marginal costs. As we continue to add computing power to things, we are going to need to focus on security, otherwise the computing power we deploy can work against us in many crazy ways. For this reason, I believe over the next decade or two we are going to add a security layer on top of the computing layer. I also believe related equities will tend to do well as a group.

As computing continues to spread and things become smart, we are going to have to trust networks a whole lot more. Today, if a network gets compromised we can suffer considerable losses. For instance, our social media accounts or valuable enterprise information can get hacked. However, once objects around us get connected to the internet, things get much more serious. For instance, consider what could happen if all 2.56M cars in London, once connected to the internet, got hacked. Or what would happen if the 1.4B fridges around the world got hacked - immediate food shortage worldwide? The consequences would be quite dire for a long series of scenarios. Why would we connect things to the internet in the first place, you may ask? Because they get smarter and as a consequence, we get wealthier (not just economically).

Blackberry happens to have spent the past 8 years positioning itself for this future. In summary, $BB is quite good at securing endpoints (things that are connected to the internet). Firstly, with its real-time operating system (QNX), $BB helps ensure the correct functioning of devices we cannot afford to have malfunction. For instance, your car actually runs software from many providers and this can be tricky to manage, specially when your life depends on it. The software that runs the rear view mirror adjustments is usually made by a different provider than the software that tightens your seat belt when you get too close to another car, for example. QNX makes sure it can all run on the car safely. Secondly, $BB´s cybersecurity solutions make attacking an endpoint hard, by catching threats before they happen with the use of AI.

The combination enables $BB clients to safely add computational power and connectivity (intelligence) to things. QNX + Unified Endpoint Security / Management is about much more than cars. It is about generally being able to connect devices to the internet and being able to trust them. In the abstract, AI and blockchain are going to evolve the internet from being a network in which we send information around to a network which takes intelligent decisions on its own and in which we are going to gradually transact most of the world´s value. Devices that get connected to the internet are going to inherit these two properties and in turn enhance the network back, so providing the infrastructure to do so safely is going to be a good business.

The above intertwines with the digital twins thesis that I discuss in this post about $PLTR. What $PLTR is actually doing is enabling client companies to generate digital twins, so that AI and blockchain can be run on top. By generating digital twins, $PLTR enables a value generation that would not be possible with the analogue counterparts. To generate these twins, you need plenty of connected endpoints constantly picking up data and sending it to servers. This is the industrial reality we are headed towards.

From Phones to Security

Since 2012, CEO John Chen has pivoted $BB from being a phone company to being a cyber/security company. The pivot may be summarized as follows:

The stock is well off its former highs and, as some of you may know, it has been caught up in the Wallstreetbets trading frenzy (which in retrospect might look smarter). With the particular addition of the Wallstreetbets movement, this company has all the properties of a turnaround worth taking a look at. Firstly, most analysts do not see $BB favorably, with a rating consensus of sell. The financials on their own, which I will dive into below, do not merit any praise, but is this ever the case in a turnaround before the turnaround has happened? Analysts are on the safe side with $BB and this makes the potential upside worth the investment risk.

Secondly, the CEO John Chen is a turnaround veteran, his last victim being Sybase. I do not really care about Sybase as much as I care about Chen´s vibe, which is that of a man with the stoicism to focus on long term strategy versus appealing to the short term demands of the street. In Spain, bullfighting is a popular sport. Some are against it (“anti-taurinos”) and some are for it (“taurinos”), but both groups need each other to give their lives meaning, as they continue to make a fuss about things. In successful turnarounds, I have observed that CEOs and Wall street are the same in terms of the way friction evolves, at least in the first half of the turnaround. Good turnaround CEOs focus on long term execution, which irritates analysts and so the cycle goes on. Bad turnaround CEOs give in to short term demands and the set up looks different. Chen is perhaps on the very extreme of stoicism, but he seems to me like a good horse to bet on.

Thirdly, Chen (or Prem Watsa, rather) has set up a sort of asymmetrical situation for those of us that dare to peek open minded, which is the sort of turnaround scenario that I like. If it goes well, I make a lot and if it does not, then I don´t lose much. The company is currently pointing at a vast business opportunity, but seems to have its ass covered today. Let´s dissect the asymmetry of this play.

Asymmetric Play

A reasonable business today, with a cheap implicit option

The bird´s eye view of the situation of the company is that it is reaching homeostasis (having shed its legacy business), is backed by Fairfax and is pointing at a very large business opportunity. In essence, it looks like today´s $BB business is valued alright, whilst they have plenty of runway to push the products they have today, which are simultaneously yielding a very valuable real estate which the market is largely ignoring, as QNX continues to be installed in a growing number of devices. So, buying $BB today, I believe I am buying the business at a reasonable price, with an option to absolutely kill it down the line.

I am often eager to see quarterly results myself, but I am not seeing the IoT space take off yet, so I don´t think leaning too hard on quarterly earnings is a good idea in the short term. The further I look into this investment thesis, the more it looks like the semi play in terms of dynamics. I am not seeing traffic lights talk to cars or fridges to supermarket supply chains today, so patience is key here- the future I am discussing is years out. What I am seeing is $BB´s offerings showing plenty of signs of competitiveness whilst the company seems to be making increased efforts to sell more.

Signs of product competitiveness:

QNX is installed in 195m cars. No other OS comes close (a RT-OS is not to be confused with Apple CarPlay and Android Auto, those sit on top of the RT-OS, kind of like apps).

$BB protects 18 of the G20 governments.

$BB UEM now offered on Microsoft 365 (as of Q2).

95% net dollar retention rate on cybersecurity products (Q2 conference call).

From Gartner's Unified Endpoint Management report 08/2021:

From the ratings in Gartner´s website, $BB looks well into the game, although it only acquired Cylance (AI cybersecurity) in late 2018:

Signs of increased efforts to sell more:

$BB has rearranged its lines of business to: IoT, Cybersecurity and Patents. This suggests a more sales focused mentality. The previous arrangement was complicated even to analyze, let alone to sell products. Shows a clear understanding that although IoT benefits from cybersecurity, they each go their own way. A lot of clients today want protection from ransomware and they are not necessarily thinking about connected cars meanwhile.

New top directives are salesmen. Mattias Eriksson, new head of the IoT department, is capable of speaking for 30 minutes without saying anything. I cannot infer much about his managerial skills or vision from this interview, but I can infer that he knows how to sell. I assume that is what Chen wants of him. On the other hand, John Gianmatteo, former Chief Revenue Officer of McAffee, is now the new head of the cybersecurity department.

The new deal with $MSFT suggests $BB is beginning to push sales.

It is also noteworthy that $BB is somewhat coming out of nowhere. The company is now successfully competing with other firms that have been in the business for decades, so I believe this speaks highly of the management and their efforts. I would not necessarily assume that this catch up journey stops here for $BB. Judging by its recent history of acquisitions (2012 onward), $BB is just getting started.

Fair and cushioned financials

Note: financials include data up to and including Q1 2022. Will examine Q2 2022 results below.

The thing that strikes me the most perhaps is that the company seems to be propped up by Fairfax, which incidentally owns 8% of the equity in $BB.

Initially, it seemed that the net debt position for $BB was a bit too tight, but then further research revealed that $BB´s debt is convertible and entirely owned by Fairfax. In the case of default, Fairfax becomes a bigger shareholder diluting the rest of us, but at least the company does not go under. Since Fairfax owns a large chunk of equity, there is a big alignment in interests. In my opinion this sheds off a lot of the risk of permanent loss of capital for shareholders.

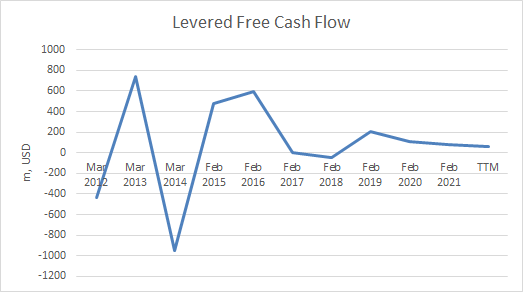

The above is further compounded by $BB´s ability to produce some free cash flow. If the debt was not held by the largest shareholder and entirely convertible, I think I would like to see bigger numbers here, but being the situation what it is, I think the FCF numbers are quite favourable:

My feeling of the company reaching homeostasis comes from the above relatively healthy picture plus a sense that revenues are stabilizing around a product line that has a long runway ahead of it.

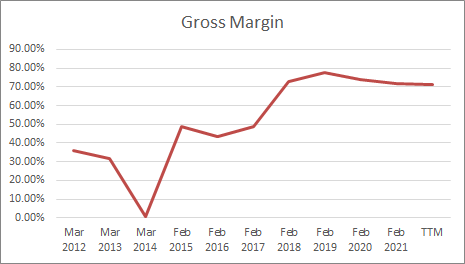

As the company has been shedding its legacy business, revenue and gross profit seem asymptotically have reached around 1b USD yearly. Over the last year or two, the company has faced considerable headwinds with COVID and the shortage of semi conductors and as a result, the revenue has dropped a bit. Much of the market believes this drop in revenue is due to the business dying, but I do not believe this to be the case. I think the company is stabilizing and getting ready to move into growth phase.

Indicative of $BB´s transformation is the growing gross margin aswell, which has seen a slight decline since COVID hit.

The operating margin looks typical of a software company that needs to get sales going. The way forward now is growing the top line, whilst $BB is already showing signs of focusing on that.

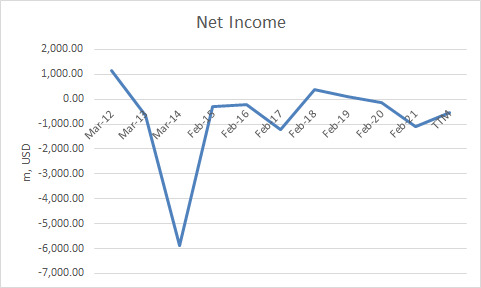

Meanwhile, net income is in the red. However, I find that most of the negative values in the bottom line are due to unusual items, which the company discloses are related to the unwinding of the legacy business. Once this process is finished, I expect to see much less gravity for $BB´s bottom line.

$BB needs to get sales going, but meanwhile its financial picture does not seem overly dangerous.

Valuation

There´s a number of ways to look at $BB´s valuation. One, as compared to peers. Two, as compared to other large tech platforms that have successfully flourished. In fact, I believe that a succesful valuation assessment looks at these two possibilities, because they inevitably compound on each other.

Firstly, comparing $BB to $CRWD yields some interesting insights.

$BB is barely reaching homeostasis whilst $CRWD is in growth mode and arguably, has the best products in the market today. The thing is that the difference in multiples is quite large and probably not too reflective of the underlying reality. I do not believe $CRWD to be so far ahead or $BB so far behind. At 7X forward sales, $BB is currently not a gift, but considering that it is only getting started with growth, it may look cheap in a few months. Multiples-wise, it has a long way to go to catch up with $CRWD, which I think it will do as it gets going with its expansion. With $CRWD´s multiples $BB´s market cap would be 5 times today´s market cap.

On the other hand, as $BB continues to inch along, it is building a very valuable tech platform. The comparison may sound futile, but $NFLX has around 210m subscribers and it has a market cap of 261b USD, whilst QNX is in 195m cars and $BB has a market cap of 5b USD. NFLX turns electrons into entertainment, whilst QNX / IVY are going to turn electrons into safety, convenience and cost savings for players in the auto industry and drivers. QNX is not at that stage yet, but it is creating the moat that is going to allow $BB to get there and give everyone else a tough time trying to take their place.

IVY is a 50:50 collaboration with $AMZN, in which $BB keeps the commercial relationship with OEMs. What $AMZN is on boarding with this deal is the trust of OEMs, which it would have a tough time getting without $BB´s help. Sure, $AAPL and $GOOGL are definitely going to give the connected car a shot, but on top of all the above, $BB is now under $AMZN´s wing at a market cap of just 5b USD. Risks are plenty, but the bet looks asymmetric to me. For the price of a cybersecurity company that hasn´t convinced the market yet, we get cybersecurity company that is catching up with leaders and that is silently working towards a far bigger future, that few of us see clearly today.

Q2 2022 Update

Whilst it is true that $BB beat expectations last night, there is not much to get excited about in my opinion. The company continues to navigate through headwinds brought about by COVID and semiconductor shortages, but I believe they are short term hiccups. I remain focused on the bigger picture and I am happy to patiently wait for $BB to pick up its sales and advance further with IVY. Chen incidentally disclosed yesterday that we would be seeing a beta of IVY this October, so looking forward to that.

As for the rest of metrics, nothing much has changed. Regarding the patent sale, it looks like we might be close to hearing some good news on that. My long thesis doesn´t depend much on it, but the above case would definitely be facilitated by a good 1-1.5bn $ of fresh cash.

If you enjoyed this article, remember to subscribe to my newsletter for more!

You can also reach me at:

Twitter: @alc2022

Feel free to leave me any comment.

I enjoyed reading your write up on BB. It was very detailed and accurate. Do you get into the same depth and detail on each company? May I ask how long yo have been doing this and what is your backgroung. Do you work on your own or do you have any assistants, if so how many? Do you take any positions in the companies you cover? Thanks, Ed

Feels way to fluffy.

This could happen, but the idea of betting on this is a little bit sickening to me. They have a bit of an edge, but the firm has yet to show signs of winning that fight.

Not worth it in my eyes.