Edited by Brian Birnbaum.

Below, you can find a summary of the deep dive and, further below it, the full deep dive.

One Pager

Section 1.0: Robinhood´s competitive advantage is its cultural affinity with younger generations, which manifests as its user interface and experience.

Section 2.0: Robinhood stands to benefit from becoming a financial one-stop shop for users, with Robinhood Gold positioned as the primary catalyst for future financial performance.

Section 3.0: Robinhood´s transaction-based revenues will come under pressure in the coming years, and the company risks losing higher-end customers to more senior platforms that are gradually coming to meet the expectations of young traders.

Section 4.0: Robinhood has exhibited commensurate signs of anti-fragility since 2021, which reflects management´s exclusive focus on value creation rather than pleasing the market.

Section 5.0: I conclude that Robinhood has great long term potential if it manages to convert short term traders into long term investors, while gradually cutting its reliance on trading revenues.

Full Deep Dive

1.0 Robinhood is Misunderstood

The point is not whether institutional investors use Robinhood, but whether Robinhood is and will continue to be the trading app of choice for retail investors of this generation. The structural drivers of more traditional brokerage companies are closer to the adequate prism through which to analyze Robinhood.

An in-depth study of Robinhood and its two most prominent direct competitors, Charles Schwab and Interactive Brokers, reveals that brokerages have traditionally monetized customers via transaction fees.

With the advent of Robinhood, which doesn’t charge transaction fees, the industry is on a slippery slope of deflation, charging less and less per transaction. Increasingly, these firms are relying on financial services beyond brokering, like financial advisory.

The business of brokering is now just the tip of a brokerage’s iceberg.

At a higher level of abstraction brokerages are not only money funnels, but also networks. In their increasingly–in the case of Robinhood, totally–digital form, brokerages are lattices that connect market participants. This blurs the competitive boundaries because, in effect, any other network containing said participants can in theory perform the role of broker.

The above has been and will continue to be the source of countless disruptions. It’s also an indispensable mental model for Robinhood.

Competing networks include Block (CashApp), Apple (iPhone), and SoFi, among others–none of which are a slouch. In effect, the world is full of networks with the ability to offer financial services. But, in my experience, just because a network can pivot does not mean that it will.

For example, Spotify has against all odds defeated Apple and Amazon by offering better customer experience–the result of faster iteration and exclusive focus in the realm of audio. The resources at the disposal of Apple and Amazon alluded to victory in the space. However, networks with superior qualities can succeed in the face of fierce competition.

Seeing a network fend off much larger competitors raises its investability. We have already seen Robinhood pierce the armor of brokerage industry giants.

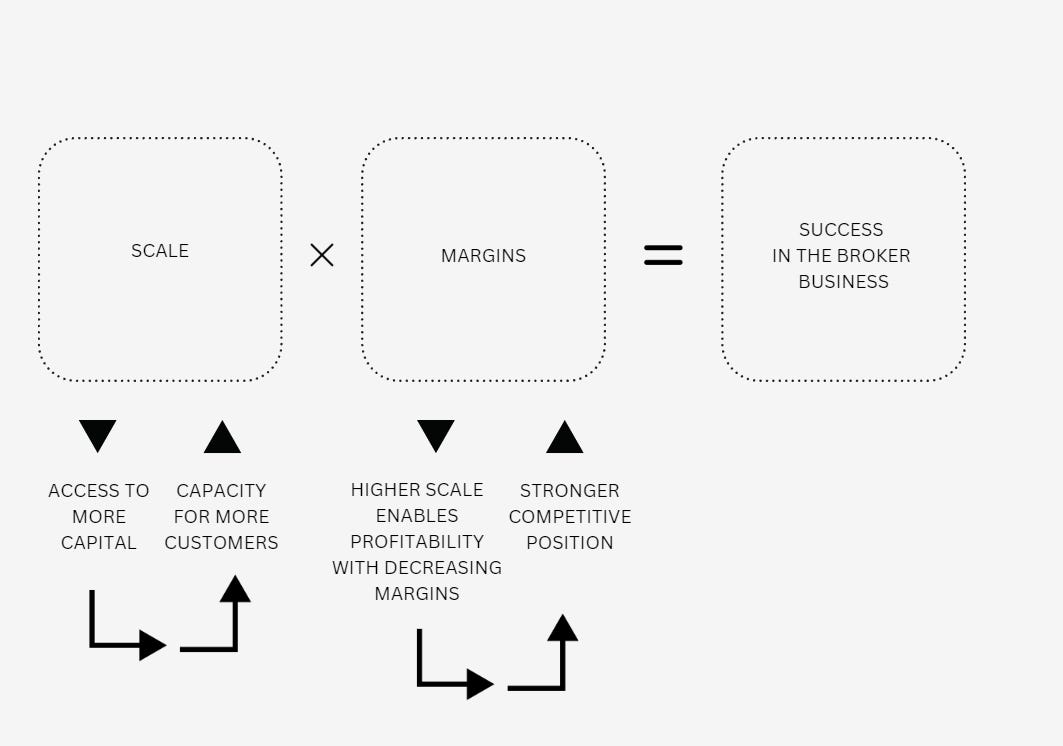

All considerations were and still are second to scale. The more customers a brokerage boasts, the more easily it can raise capital to post as collateral–thus enabling still higher rates of customer acquisition and scale, profitability despite lower (and expanding) margins, and a stronger competitive position.

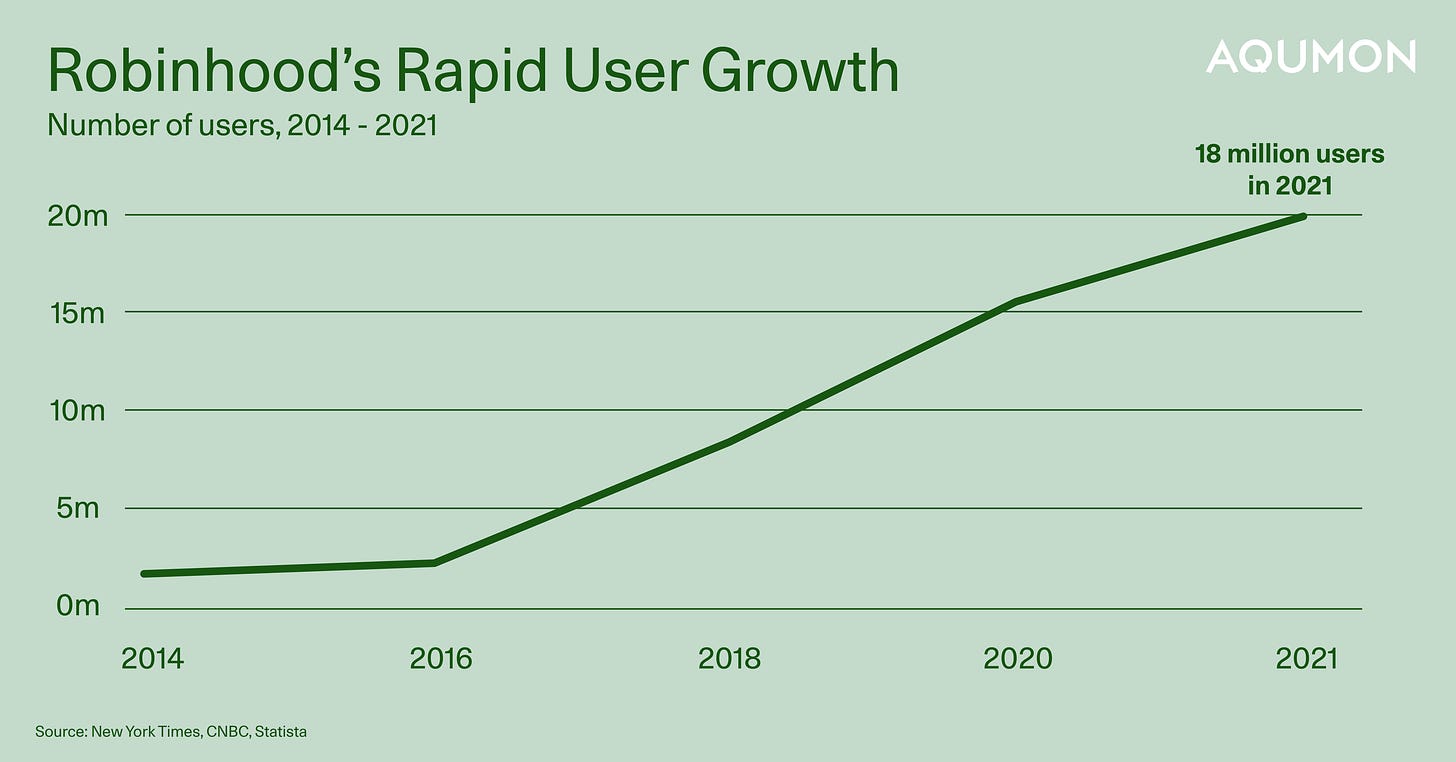

Acquiring the necessary scale to compete in the brokerage market would not have been possible if Robinhood had not struck a nerve with the younger generations.

When the world turned to the stock market for entertainment during the pandemic, Robinhood received the lion´s share of attention due to its connection with younger investors and traders. Their cultural affinity with millennials and Gen Z will be its most valuable asset when confronting Apple and other post-financial giants–to whatever extent Robinhood can retain this affinity despite the $GME incident.

Note: Apple has moved into credit cards and brokerages are ultimately funnels, to get people into credit, wealth advisory services etc. Apple's funnel is just the iPhone.

Cultural affinity can be expressed in many ways but, as refers to younger people, essentially comes down to delivering a user experience that satisfies all expectations. Contrary to the Baby Boomers, young people today expect services to be free, mobile and immediate. As I will explore in Section 2.0, staying ahead of the curve is how Robinhood remains relevant. Thus rapid iteration is fundamental to their growth.

The average Schwab, Interactive Brokers and Robinhood users are 50, 40, and 30, respectively. Each of these platforms is tailored to the taste and preference of each successive generation, each looking down on the next like a gaudy and even dangerous toy.

Charles Schwab seems the elder statesman next to Robinhood. Yet the truth is that the most active users of each platform engage in the age-old boondoggle of trying to get rich quickly. Rather comically, Schwab feels like a dinosaur to millennials and Robinhood feels like a casino to Baby Boomers, while platforms channel the timeless phenomenon that is human greed.

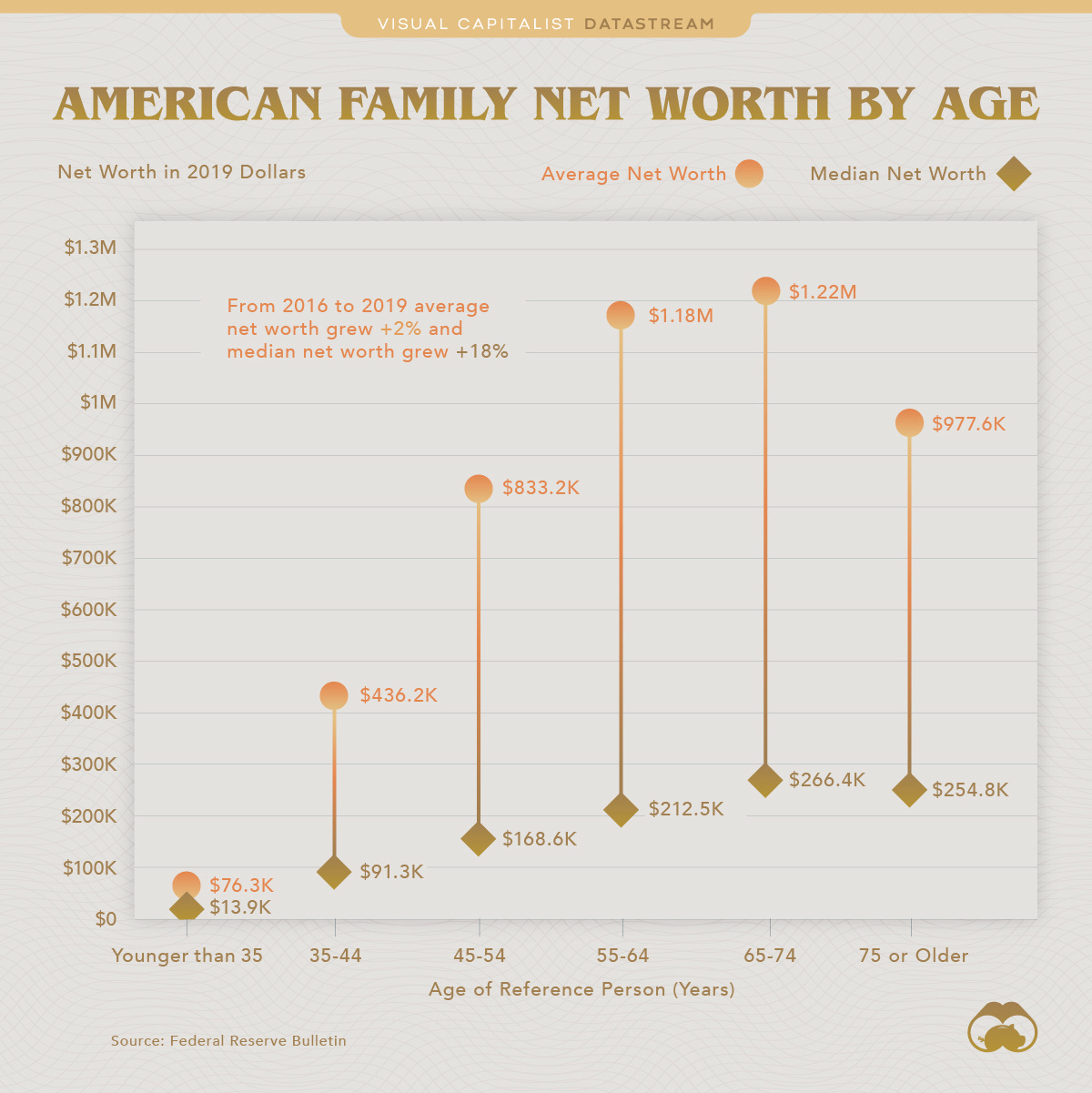

Although, I believe there to be a chance that Robinhood users “graduate” to platforms like Schwab and Interactive Brokers once they make serious money. For instance, the average account size in Interactive Brokers is $158K, while it is just $3.8K for Robinhood.

Per the chart below, account size delta is likely a function of Robinhood’s younger demographic. I believe this is a core component of the thesis going forward.

As a result, Schwab and Interactive Brokers have more experience with larger accounts. Assuming Robinhood learns twice as fast as these two companies (a wild assumption), it will still take the company decades to accumulate an equivalent volume of knowledge and trust from high-level traders. Nonetheless, it will likely do so as users age and grow wealthier.

If Robinhood´s edge is actually a cultural affinity with Millennials and Gen Z, then over time, like the current legacy platforms, it too will inevitably lose touch with younger generations of the future. It will be very interesting going forward to observe how legacy players navigate the prospect of cultural irrelevance. Their fate may portend that of Robinhood’s, which I discuss in depth later, in Section 3.0.

2.0 Operating Leverage is Set to Rise

The successful deployment of the Cash Sweep feature shows that Robinhood can smoothly implement additional financial services on its platform. Further execution may turn it into a one-stop shop for customers.

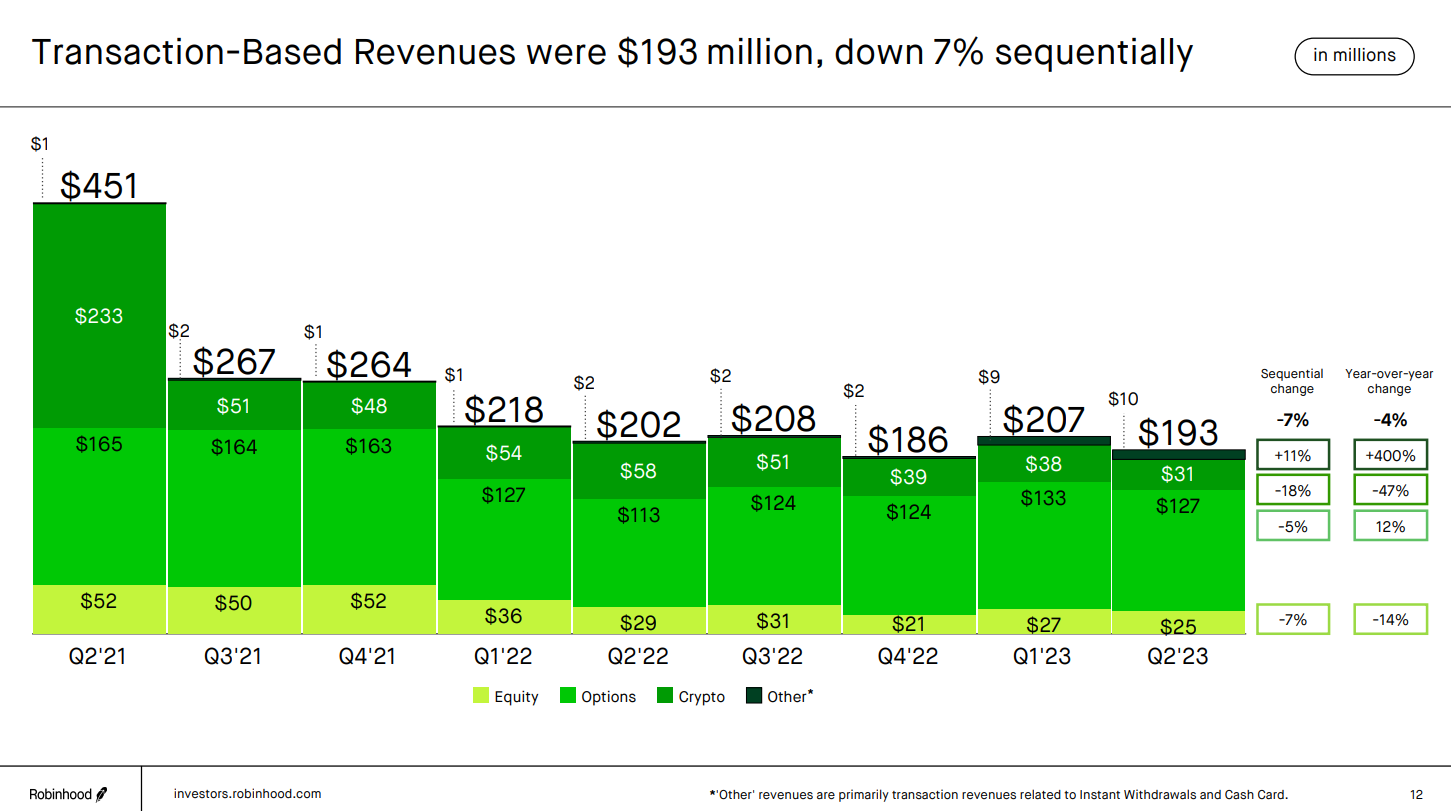

If indeed Robinhood is the trading app of choice for younger generations and has a meaningful chance of growing up with them, recent developments have not been priced in by the market. Transaction-based revenues (payment for order flow, or PFOF) have been declining throughout the industry due to the macro environment. However, Robinhood´s net interest revenues have risen 216% YoY, evidencing their successful diversification away from a brokerage-based monetization model.

Closer inspection reveals that increased net interest revenues stems from higher interest rates, via corporate cash (money from the company´s balance sheet) and segregated accounts (client money) in short duration instruments. This is perhaps not indicative of a fundamental evolution of the company, but the traction of the Cash Sweep feature is.

Note: Incidentally, a cash sweep allows clients to automatically put excess liquidity aside and reinvest it periodically, with brokers keeping the spread for themselves.

Cash Sweep points to Robinhood´s ability to deploy additional and differentiated financial services to its user base, because it is a feature rather than a function of capital allocation, such as corporate cash invested. Robinhood´s cash sweep is differentiated versus traditional ones as follows:

No minimum balance: There is no minimum balance requirement to participate in Robinhood's cash sweep program. This means that you can start earning interest on your uninvested cash even if you only have a small amount of money in your account.

Automatic enrollment: Robinhood customers are automatically enrolled in the cash sweep program, so they don't have to take any additional steps to start earning interest.

Laddered cash deposits: Let’s say you have a $260,000 cash balance that is eligible to be swept. You’ll have the first $248,000 swept into the first bank on the program bank list, and the next $12,000 will be swept into the second bank on the program bank list.

FDIC insurance: Uninvested cash in Robinhood's cash sweep program is eligible for FDIC insurance up to $2.25 million or $250,000 per program bank, inclusive of any other deposits you may already hold at the bank in the same ownership capacity. This means that your money is protected in the event that one of the program banks fails.

By successfully deploying more features of this sort, Robinhood can increase ARPU (average revenue per user) and, thus, operating leverage. This is a prime example of my Electrons and Dollars thesis, whereby a dominant platform with a high pace of iteration is able to deploy subsequent verticals, driving incremental revenue at marginal cost.

We must also contextualize Robinhood’s progress within the morphing interest rate environment. Surely, skyrocketing rates allows the company to more easily increase ARPU. But rates may come down. Therefore, failing to normalize Robinhood´s progress for rates is a mistake, which is why I place great emphasis on the company´s feature pipeline, which must be robust, regardless of interest rate fluctuations, for an investment to pay out meaningfully.

Robinhood may have started with trading and investing. But now, it’s moving towards spending, saving, and retirement products, with the ultimate goal–as mentioned above–of providing a one-stop shop for its customers. Apart from the assumption outlined in Section 1.0, that Robinhood is indeed the trading app of choice for younger generations , the thesis is particularly appealing if Robinhood indeed has the iterative capacity to bring adequate features/services to its pertinent demographic faster than its competitors.

We will not know whether this is the case until Robinhood develops a clear track record of defeating competitors. In the meantime, it remains particularly attuned to younger generations.

Since inception Robinhood has introduced innovations that have become industry standard: mobile trading, seamless digital onboarding, zero commissions, no-account minimums, and fractional shares. Just ahead of the Q2 call, Robinhood announced the launch of 24 Hour Market, which makes it the first US retail brokerage to offer 24-5 trading of single-name stocks.

Moving forward, there are two highly relevant initiatives the company is undertaking: retirement plans and Robinhood Gold.

In January, we saw the launch of Robinhood Retirement, the first IRA with a 1% match. As of Q2 2023, assets are now “close” to $1 billion. The evolution of this feature will be highly indicative of whether Robinhood users actually see themselves growing up with the platform.

The Robinhood user is highly dopaminergic at the outset. Most join to get rich quick by trading. Users managing their retirement via Robinhood better aligns them with a long term investment in the company.

Further, according to management, Robinhood Gold (launched in 2016) customers are depositing more money into their accounts. Robinhood Gold gives users access to premium features, which boil down to higher returns on their spare cash and cheaper money when they need to borrow, in exchange for a monthly $5 fee.

Robinhood Gold users can borrow at 8%, which is lower than the standard margin interest rate of 12% for non-Gold users. Gold users earn 4.9% on uninvested cash (cash sweeps), which is higher than the 1.5% rate for non-Gold users.

In Q2 2023, Robinhood introduced a 3% IRA match for Gold customers, three times the standard 1% match, seemingly in the pursuit of a faster flywheel. As Robinhood deploys new features, Gold supercharges the engagement of truly loyal users, which can exponentially increase the amount of business conducted with the average user.

As an illustration of this possibility, consider the evolution of cash held for non-Gold and Gold cash sweeps:

The brokerage operation risks entering a price spiral when competing with other platforms. Mediocre execution of Gold could lead to this. Gold simply pays users more. Thus, for the endeavor to be fruitful in the long run, Gold must disproportionately increase the volume of business per unit of economies of scale shared with each customer.

This will only be possible if indeed Robinhood’s cultural affinity holds up. As you will see in Section 3.0, the industry is very much gearing up for a continued price competition.

Moreover, Robinhood intends to offer customers a complete credit suite, outlining an “opportunity to go down market and help younger people build credit.” To this effect, Robinhood acquired credit card startup X1 for $95 million in cash in Q2 2023. At the time of acquisition X1 had 80,000 active card holders and, according to management, the startup has the “right values and DNA.” As many of you know, I believe that culture and cultural fit in the case of M&A are precursors of organizational success.

Upon integration and scale across the Robinhood user base, X1 will yield valuable insights. Management´s will be able to reach business lines far removed from their core brokering activity. This is not to say that I celebrate reckless adventure. Some of the biggest successes of our times have come from companies that can reinvent themselves via asymmetric bets, such as Amazon.

If Robinhood can encourage its users to save up for retirement and use credit responsibly, the sky’s the limit. But this brings me to an abstraction that is central to Robinhood´s successful deployment of financial services: its customer acquisition method involves rapid hits of dopamine, yet its success going forward seems to rest largely on their ability to convert its users into responsible financiers.

Per this 20VC Podcast episode (minute 24), it would seem that the above represents CEO and founder Vlad Tenev´s long term vision. But how Robinhood can continue selling cheap dopamine while encouraging long-term planning and investing is unclear to me at this point. I very much look forward to seeing how it plays out. Nonetheless, its competitor Charles Schwab seems to have managed to do this fairly well, as I will discuss in Section 3.0.

[…] the things we've been focused on as a company and on the product side over the past year, they haven't naturally flown into MAUs because, even retirement itself, it's sort of a passive long term investing product, and not typically a product that you associate with sort of like active trading or engagement. - Vlad Tenev, CEO, during the Q2 2023 conference call.

Regarding crypto, in Q1 Robinhood rolled out a non-custodial Robinhood wallet, which has thus far been downloaded in 130 countries worldwide so far. It gives customers total control of their crypto and NFTs and it also enables no gas fees for coin swaps on the Polygon chain. As many of you know, my view is that crypto in its current form is ill-fated, but I do not write off the possibility that the space morphs into a more sustainable version of itself over time.

Thus, while I do not have any intention of buying crypto assets, I do not mind that a portion of Robinhood´s transaction revenues stems from this space. With continued macroeconomic uncertainty, crypto transaction revenues have naturally declined, together with the entire segment.

Pending regulatory approval, Robinhood “hopes” to launch futures trading around the end of this year and is “focused” on launching brokerage operations in the UK around the end of year.

3.0 Problems Ahead for Transaction-Based Revenues

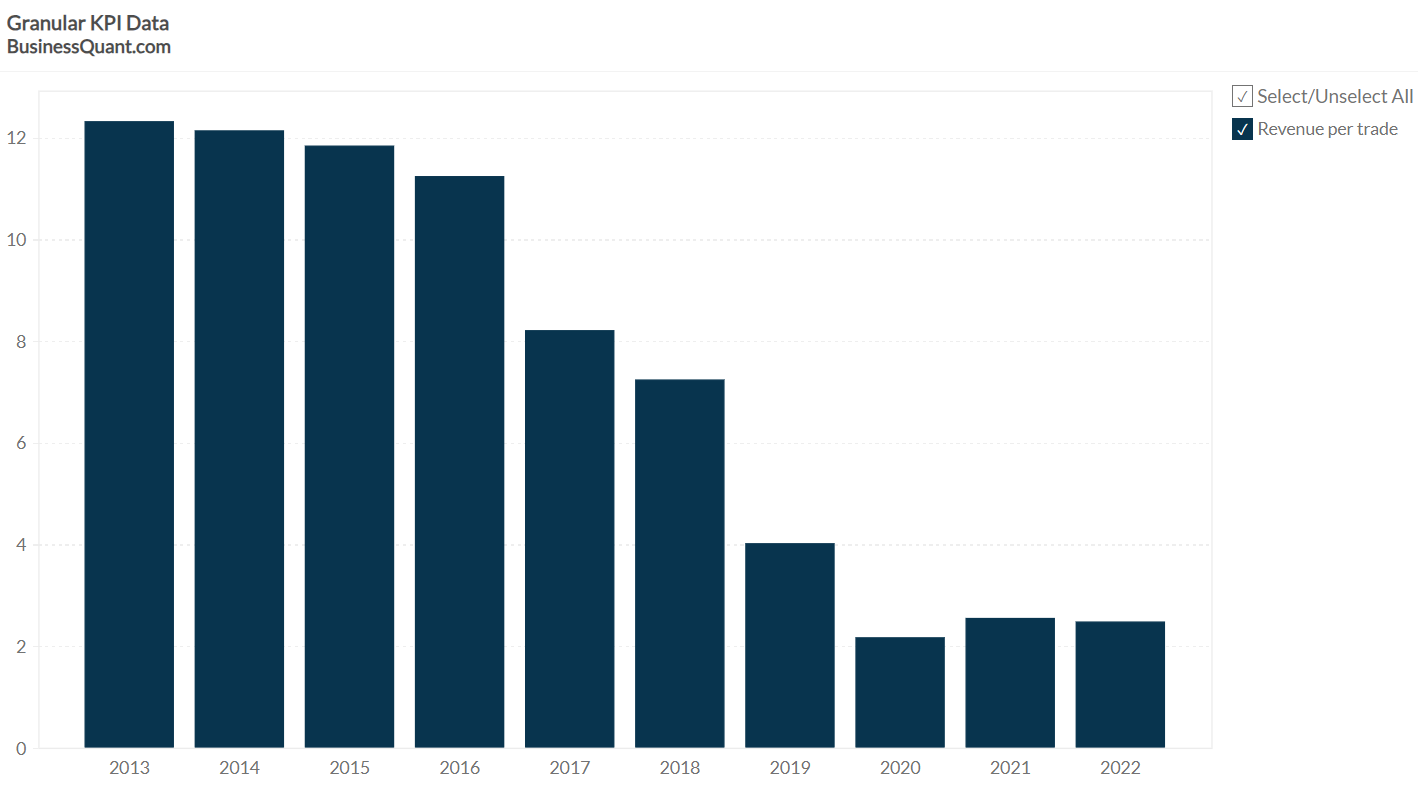

Charles Schwab is far better equipped than Robinhood to thrive amidst the deflationary under-current that has afflicted the broker business over the last decade. Further, the Ameritrade acquisition has given Schwab a meaningful scale advantage.

As you can see in the transaction-revenues graph, which I include again for your convenience, most of the segment´s revenue comes from options, which, as I will soon outline, are subject to disruption. Transactions accounted for 39.7% of total revenues. A disruption of the options business would deliver a meaningful financial hit to Robinhood.

In 2019, as a response to Robinhood´s stellar rise, Charles Schwab eliminated equity commissions. Schwab management could have remained in denial. Instead, they chose to disrupt their own business, in effect piercing through the Innovator´s Dilemma.

Schwab has seen its revenue per trade decline notably over the past decade as a result of the industry’s deflationary slope outlined in Section 1.0. Given the way the company has been managing this dynamic and its current revenue breakdown per category (graph below), nothing is stopping Schwab from offering free options trading. In Q2 2023, trading revenue sank to $701M, compared to $841M in asset management fees and $1.7B from net interest.

In turn, option contract notional volume has risen steadily since May 2022, while equity has moved sideways and crypto has slid down. It would seem that options trading is a key source of its anti-fragility that I explore in Section 4.0 and, overall, a key signal, since traders seem to resort to it when the market is going down:

Schwab has far more dry powder than Robinhood because it is far ahead of the latter in terms of funneling brokerage clients into long-duration financial services. Further, the Ameritrade acquisition that Schwab completed in 2020 has set up an unprecedented level of scale; as of June 2022, Schwab had 34.5M accounts and Ameritrade had 11m accounts, which upon complete integration would yield a total of 45.5M accounts, almost twice that of Robinhood.

It is also worth noting that Schwab has only recently begun to absorb Ameritrade customers.

Over Memorial Day weekend, we completed the largest brokerage conversion in the industry, moving more than five million client accounts from Ameritrade to Schwab.

- Walt Bettinger, Schwab CEO during the Summer Business Update conference call.

On paper, Schwab’s scale confers a meaningful distribution advantage, which, combined with a full on deflationary strategy could hamper Robinhood. I say “on paper” because, of course, Robinhood´s cultural affinity–the result of its rapid feature deployment and iteration tailored specifically for young generations–could in practice prove to be a strong moat.

With the acquisition, Schwab is now in a position to make further strides into the retail space. Ameritrade’s proprietary trading platform, Thinkorswim, is considered the retail industry’s “premier” product. These moves should be a cause of concern for Robinhood shareholders.

Thinkorswim is one of the crown jewels of Ameritrade. And all retail clients will have this at our competitive pricing representing our true no trade-offs approach.

- Rick Wurster, Charles Schwab President during the Summer Business Update conference call.

As I discussed in Section 1.0, the broker business is essentially a function of scale because more scale enables cheaper capital. This abstraction yields a dynamic worth further exploration.

If Schwab is able to scale the retail market through Thinkorswim, which is fairly likely, there’s a chance it manages to lure the upscale segment of the retail trader/investor space as well. This could limit Robinhood to the–statistically speaking–more dopaminergic crowd, who are less sophisticated and well-off.

In such a scenario, Schwab´s funnel would attain marginally higher loan quality, which at scale and over time would translate into a non-linear delta in capital efficiency. Schwab would slowly–and then quickly–accrete more capital, scale, and, ultimately, competitive position, slowly–then quickly–eroding Robinhood´s market share.

As noted earlier, Robinhood’s current cash cow is PFOF: the compensation a brokerage firm receives for directing orders for trade execution to a particular market maker or exchange. (The MMs use this data to better understand market flows, which increases their ability to profit from their various methods of arbitrage.) However, larger trades decrease PFOF’s appeal. If you open a $200K options position, you do not want to give critical information to those at the other end of the trade.

This is why, structurally speaking, Robinhood is not well positioned to capture higher-end retail. Beyond their credit aspirations, this issue threatens any long-duration financial service into which Robinhood plans to funnel its brokerage clients.

Naturally, there’s the question of whether Robinhood can deliver shareholder returns by focusing on low-end retail traders. Yet I don’t find this dichotomy productive. I firmly believe that Robinhood has emerged stronger from the recent downturn, exhibiting compelling signs of resilience.

4.0 Financials: Robinhood´s Anti-fragility

From the recent MAU and market downturn, Robinhood has emerged stronger, which can be traced back to management´s exclusive focus on value creation.

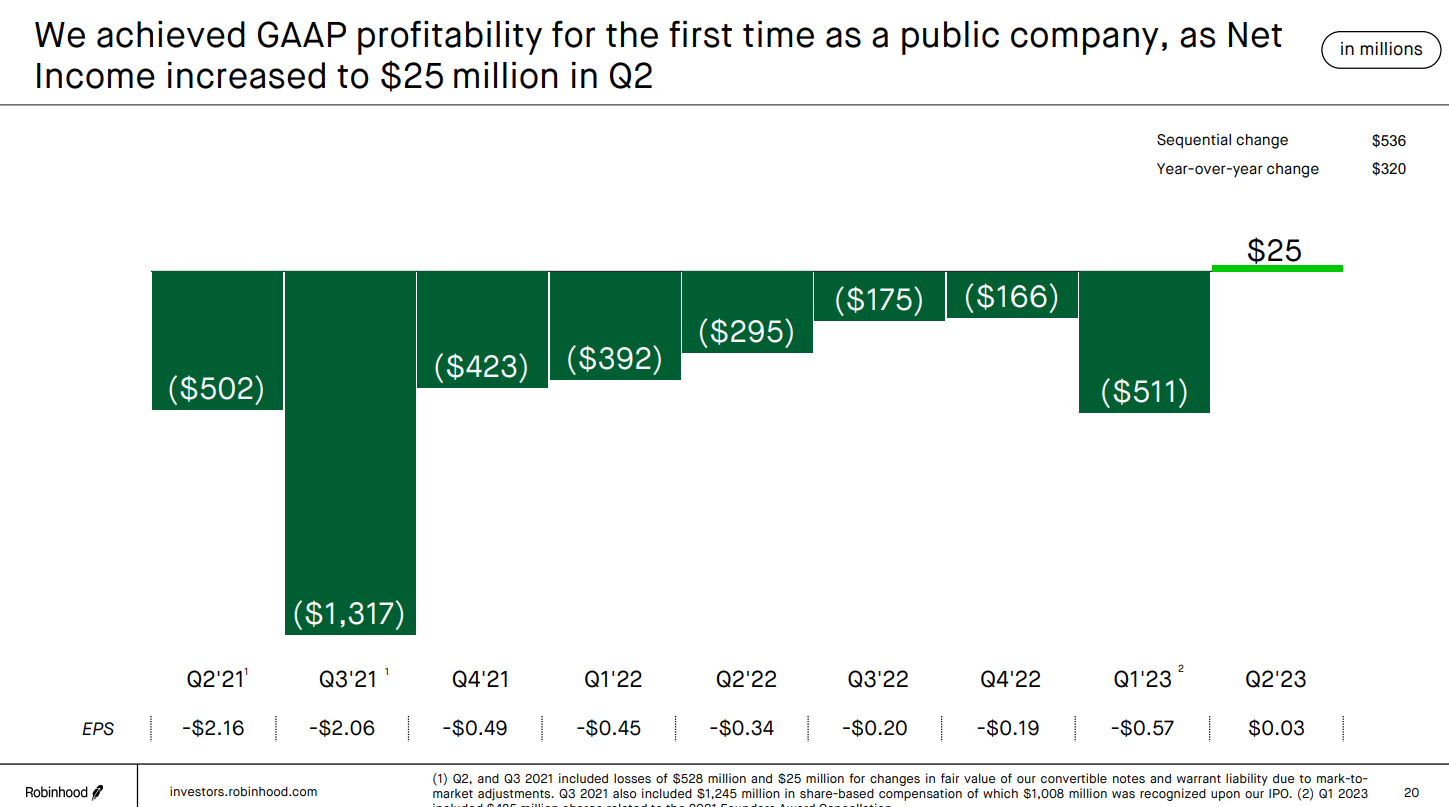

While net funded accounts are up, as displayed in the previous section, MAUs (monthly active users) have been declining rather briskly since mid 2021. The downturn has been long and painful–and yet, as we begin to see light at the end of this tunnel, Robinhood has emerged GAAP profitable. As discussed previously, rising rates have no doubt helped. However, qualitatively, I am perhaps most impressed with management's attitude during this period.

I reread the quarterly conference call transcripts to date, starting from Q2 2021 and found management´s response consistently intent on iteration–i.e. launching new features to delight customers. I believe its current profitability is fundamentally attributed to this dedication to iteration. Robinhood is resilient because management focuses on delivering more value to customers rather than pleasing the Street.

Per the company´s demonstrated ability to deploy cash-rich features (cash sweep, for now) while simultaneously paring costs–new features do not seem to be driving incremental costs–the drivers outlined in Section 2.0 are set to be highly accretive to Robinhood´s bottom line. OPEX sans SBC (stock-based compensation) is down from $500M in Q2 2021 to $357M in Q2 2023, representing a reduction of 28.6%.

A prevailing concern, echoed in Section 3.0, is that, given the platform’s dopaminergic nature, many users are likely to decrease if not altogether cease all activity during bear or boring markets. On the contrary, I believe Robinhood’s financials reflect a less extreme scenario.

As referenced earlier, the perception of Schwab the elder statesman and Robinhood as the gambling addict is false. Both platforms exhibit the signs and symptoms of a casino. The real difference lies less in user behavior than the generation for which each platform is tailored. Obviously, with the advent of social media, younger generations are accustomed to a far more dopaminergic user experience. But this doesn’t mean Millenials and Gen Z’ers will quit the stock market when it gets boring.

Per the recent slide in MAUs, many will. But enough stick around for the platform to continue evolving, proven by the relatively stable levels of AUC (assets under custody).

I also welcome Robinhood’s declining SBC. Although rife with nuance, SBC’s rapid decline shows mature management of its employee base.

Altogether, these developments illustrate a company that has what it takes to elevate not only shareholders but employees as well. But the jury’s not out. We need to see how culture and overall employee satisfaction evolve over the coming year or two–this might be an artificial constriction of compensation.

As in, they can be tightening compensation temporarily just to please the market, when in reality it might be squeezing employees too much.

Meanwhile, the balance sheet holds strong with $6B in cash and no debt. Of course, as a result, rather than paying interest on debt, we are diluted through SBC.

5.0 Conclusion

If indeed Robinhood is the app of choice for traders of this generation–and it’s well-equipped to fend off Schwab´s push into the retail space, along with other large institutions with the dry powder and firepower to add financial service arms to their core business lines–then the market is missing a potential rocket.

Further, I believe that, over time, most of the upside will come from converting short-term traders into long-term investors. The broker business is moving toward no fees and, in turn, relies increasingly on funneling customers into long-duration financial services. As explained in Section 3.0, Robinhood is likely to experience turbulence in this domain, which for now shrouds its long-term prospects.

Although the business is attractive in many ways, I do not like that a lot of the revenue comes from reinvesting cash in financial assets that I cannot examine in depth. This is not specific to Robinhood, but applies to the industry at large and thus is a great source of uncertainty and anxiety.

The company has great long-term potential if it:

succeeds in fending off Schwab (and other brokerages) and retaining its user base, including the higher-end users.

demonstrates that it can then defeat larger indirect competitors like Apple, Block, and any other company with the resources and clout to muscle into the industry.

can convert short-term traders into long-term investors while gradually cutting its reliance on trading revenues.

I believe these three goals are within reach, and that is why I will continue to watch Robinhood going forward.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Disclosure

These are opinions only of the individual author. The contents of this piece do not contain investment advice and the information provided is for educational purposes only and no discussions constitute an offer to sell or the solicitation of an offer to buy any securities of any company. All content is purely subjective and you should do your own due diligence.

Antonio Linares makes no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness or reasonableness of the information contained in the piece. Any assumptions, opinions and estimates expressed in the piece constitute judgments of the author as of the date thereof and are subject to change without notice. Any projections contained in the Information are based on a number of assumptions as to market conditions and there can be no guarantee that any projected outcomes will be achieved. Antonio Linares does not accept any liability for any direct, consequential or other loss arising from reliance on the contents of this presentation. Antonio Linares is not acting as your financial, legal, accounting, tax or other adviser or in any fiduciary capacity.

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

I'm wondering how the company will fare with falling rates. It might reignite interest in margin trading, but they'd lose out on a ton of interest income, no? Q2 GAAP profit was great, but if we assume rates to drop by half in the midterm, then the 23m net income becomes a 100m loss. (not comparing q3 because it was a very bad macro quarter)

Thank you! unexpected discovery for me!

Now there is something to think about)