Companies that excel at electron management will grow their respective earning powers and thus stock prices exponentially. Today, many are under appreciated and share the same fundamental and qualitative properties.

By fundamentally understanding humanity´s core wealth generation process, we can effectively infer how wealth will be generated in the future. This allows one to take advantage of assets that are under priced in the market today and that are actually quite likely to excel going forward. This is the mental framework that underpins most (if not all) of my investments and I am thrilled to share it with you today.

What is this core wealth generation process? Ever since its beginnings, humanity has been doing the same thing to create wealth: unlock novel ways to arrange atoms, that deliver some kind of incremental benefit. Regardless of how exotic or confusing the future may turn out to be, wealth will continue to ferment on this first principle for millennia, just as other fundamental laws persist through time.

Everything around you, including yourself, is made of atoms arranged according to a particular blueprint, that either humanity, biology or the physical rules of our universe have designed. Throughout history, any advancement that has enabled us to collectively process information faster and more efficiently has translated directly into an increased ability to unlock new atom configurations and thus generate wealth at an accelerated pace. Books are one notable example.

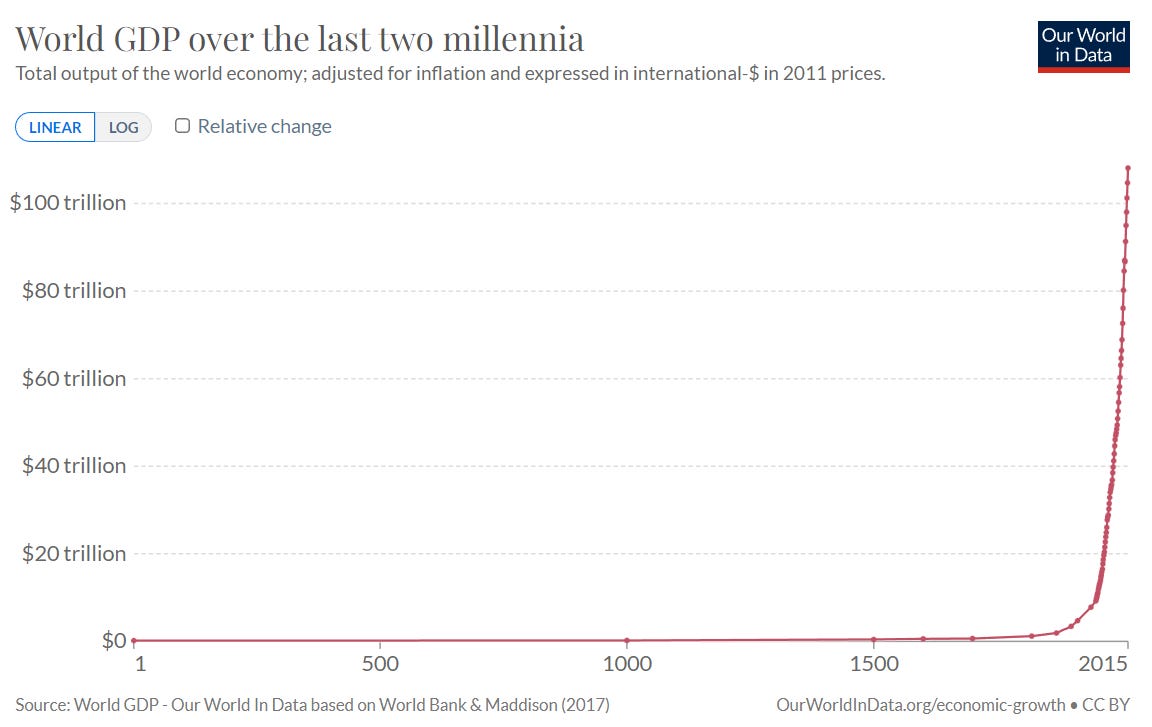

In the past couple hundred years, our ability to handle information has increased exponentially and so has the world´s wealth. This new found ability to deal with information no doubt rests in many societal and energetic advancements which this framework obviates, but is fundamentally enabled by our ability to manage electrons. Electrons, via computing, enable us to process, store and share information at rates that our biological brains never could. We therefore unlock insights much faster than otherwise, that then have a real impact in our world.

Whilst many consider that the internet is “done”, if we reason by the first principles I am exposing, it becomes apparent that the electron will continue to permeate and define more and more areas of our civilization. Current incoming examples include software defined cars or even synthetic biology, that uses computation to figure out what genetic code to insert into what cell in order to produce a certain output. It follows that, broadly, the companies that get very good at electron management will excel in the future.

A company can get good at managing electrons along two dimensions:

Facilitating the infrastructure for electron management: this includes semi conductor designers like AMD 0.00%↑.

Providing the software to generate the network effects that make the management of electrons desirable and profitable in the first place: digital twins in the case of PLTR 0.00%↑ , synthetic biology in the case of AMRS 0.00%↑ , audio in the case of SPOT 0.00%↑ and connected cars in the case of BB 0.00%↑ and TSLA 0.00%↑.

Particularly so in the case of the companies travelling along the second dimension, but also in the case of the first, these companies face a highly iterative challenge. Before explaining why, let us consider the following: what, in essence, is a company? A company is an optimization function in which we want to minimize the inputs and maximize the outputs. To do so, companies process information to allocate capital as efficiently as possible. The best companies in the world are simply the most efficient at processing and acting on information.

These novel companies are obliged to process information much more effectively than traditional ones, because to to preserve and ideally strengthen their moats they must always be fortifying their respective network effects at the margin, which necessarily stems from incessant iterations. They are intangible-capital weaving machines and the moment they stop improving their capacity to process information, what may seem like an exponential advantage relative to competitors can suddenly be compressed - because their competitors inhabit a non-linear plane too.

These optimization machines, as I refer to them, have a set of properties that enable them to embrace uncertainty and find a successful way forward in what is an increasingly unpredictable world, in which the definition of value is constantly morphing at the surface. They are the following:

A highly transparent information flow - specially regarding bad news.

A focus on optimization, with a generalized ability and proclivity to iterate fast and tolerate failure.

Employee autonomy and empowerment. The top talent wants to work there.

A flat hierarchy, in which anyone can have a conversation with decision makers.

A sense of mission, that unites people in the organization.

Excellent, centralized capital allocation.

Ideally, we are able to spot these companies before the market is able to appraise the likely financial manifestation of the above. Often, before these business bloom and become apparent to the general public, they also exhibit the following properties:

A dominant competitive position, which is not evident to casual observers.

A strong balance sheet.

Ideally positive and at worst, non-hemorrhaging cash flows.

Overall financial homeostasis, with an income statement that is not stellar but not poor and looks relatively uninteresting.

The overall financial meekness of these companies is generally due to the base layer of their electron management platform exhibiting modest unit economics. However, if they do indeed have a dominant competitive position and the rest of the pieces outlined above come into place, these companies will gradually be able to deploy theoretically infinite further layers or “verticals” of electron management with better unit economics and at a marginal cost - because they will not require for the whole infrastructure to be built out again, but only a relatively small amount of software deployment.

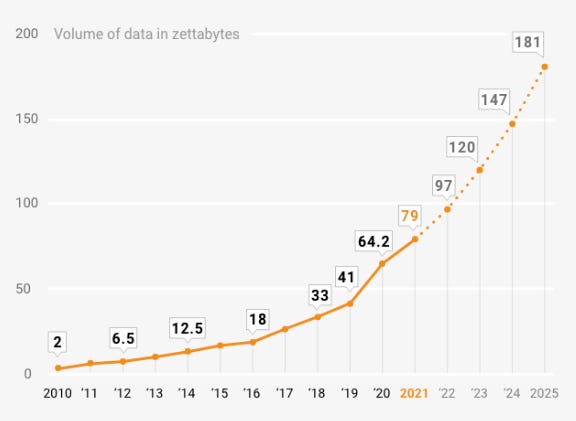

At maturity, these platforms will graduate to become insight machines in their respective domains. They will generate and process inordinate amounts of data, which will unlock new atom configurations at an ever decreasing cost. The insights generated by these platforms will transcend the virtual domain and will have a very real impact in our physical and biological words, via the emergence of robotics and synthetic biology. 20 years out from now, they will likely redefine our economies and what it means to “work”.

If managed well and in a shareholder friendly manner, this hypothetical ability to commoditize insights via world class electron management should translate, over the long run, into exponentially higher earnings per share and thus stock prices.

Electrons and dollars will go hand in hand.

Below, a list of my top convictions for the next 5-10 years, in no particular order:

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Cool post Antonio! Simple and valuable way to think about the world and investments.

Antonio, I know that you saw asymmetric investing opportunity in $AMD especially when it was significantly undervalued years ago and was rewarded accordingly. One may argue valuation has caught up to $AMD since then, although recently whole semiconductor space has taken a beating. Given current climate with semiconductor business (China geopolitical tensions/ US Chip Act/ cyclical nature/ competitions such as $NVDA, $INTL), do you still feel that $AMD specifically is still the company with asymmetric investment upside? As opposed to $NVDA, $TSM, $ASML, etc.

Also, I know that $DNA was significantly overvalued when you reviewed them last year, but since then their valuation has significantly decreased, and they are still in a promising field with great financials ($2 billion cash run way, which is more comforting in current economic crisis), although not vertically integrated like $AMRS. Do you see any asymmetric upside in $DNA now?