Important SQ 0.00%↑ has been added to the the list of Active Deep Dive Updates. I will be writing updates on Block biannually.

New! To gain exclusive access to my updates for free, you can refer other readers to my publication. One referral gets you one free month and, 10 referrals gets you 3 free months. This program applies both for free and paid subscribers.

Edited by Brian Birnbaum and an update of my Block deep dive.

In Section 1.0 I review the thesis.

In Section 2.0 I discuss why I do not like the management team.

In Section 3.0 I analyze the platform´s impressive growth YoY.

In Section 4.0 I analyze the financials.

In Section 5.0, I conclude the update.

1.0 Thesis Recap

Block has the potential to become one of the world’s largest financial institutions over the coming decade(s). But, despite my positive impression of the organization, my view of management has deteriorated.

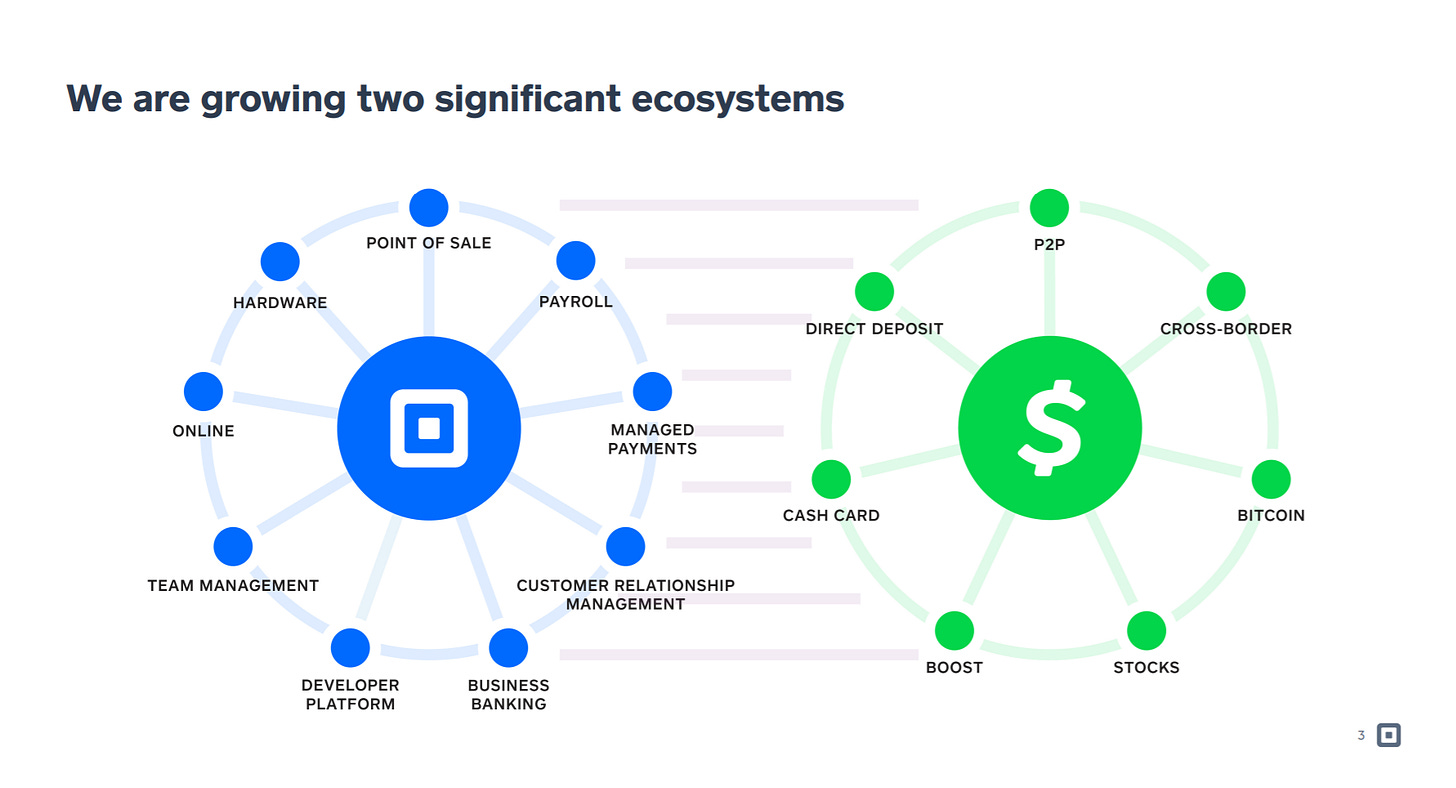

In my previous Block deep dive I noted how Square was becoming a hyper-growth fintech distribution machine by connecting its two primary ecosystems

Sellers (Square)

Individuals (CashApp)

I also explained how the successful combination of these ecosystems has the potential to enable Block to distribute any consumer-focused financial product at a marginal cost. In commercial finance, as in most spaces, distribution is 90% of the game.

To connect the two ecosystems, Block bought the buy now, pay later (BNPL) company Afterpay for $29B in stock last year. By enabling consumers to buy now and pay later, Afterpay in theory would lure consumers in the CashApp environment to purchase from Square merchants. Almost a year after writing the deep dive, a fundamental issue remains: if Block manages to connect its two ecosystems via Afterpay, it can result in a giant toxic debt-generation machine.

This wouldn’t happen under proper management. Yet, despite my initial positive impression, since I wrote my deep dive I have developed serious concerns about the quality of Blocks´s management. Q2 2023’s earning results have only magnified my concerns.

New! To gain exclusive access to my updates for free, you can refer other readers to my publication. One referral gets you one free month and, 10 referrals gets you 3 free months. This program applies both for free and paid subscribers.

2.0 Red Flags from the Earnings Call

Thus far, Square has been unable to either come up with a clear strategy to connect its two ecosystems or communicate such a strategy to shareholders. Further, the Q2 call discusses increases in operating leverage only in reference to gross profits, leaving out any reference to margins, making it harder for investors to assess any alleged progress.

An open minded management is paramount to a platform of this sort. No one knows exactly how the platform will ultimately succeed. Thus, the path forward typically embraces an iterative approach, which solves problems for stakeholders over time.

I am thus tolerant of open-ended answers to questions regarding how they actually plan to connect the two ecosystems–specifically as it refers to Block. When asked on the call, the first half of Dorsey´s reply seemed to be building towards something meaningful:

[...] we do believe our power and especially resilience in our business [comes from] the fact we have multiple different ecosystems serving different audiences, and I've been spending a lot of my time and focus on looking for opportunities with the teams to connect them.

Some of the ones we mentioned earlier [in] the remarks are mostly between Square and Cash App, so Payroll and Cash App Taxes was a big one.

But then, he finished off saying this:

Cash App and Square through Afterpay is the biggest part of my focus right now and I'm really excited about the strategy.

[…]

And we're constantly looking for other ones, there's a lot around Cash App Pay and Square, especially around local offers and local merchants and we continue to find more and more connections and that doesn't speak to the future ones, which would be titled in looking at opportunities for Square, especially musicians looking forward to sell[ing] merchandise for ticketing, and TBD, we believe with its protocol will enable both Cash App and Square and even entitled to move much faster and move much faster globally. So we're excited about that.

I inferred from Dorsey’s above comments that, one year after the acquisition of Afterpay, Block has no concrete strategy as of yet to connect the two ecosystems. It may be that Block has indeed submitted to the iterative approach that I discuss above, but the company should at least be able to explain this to shareholders.

On the other hand, Block seems to have made some progress in Q2 linking Square and CashApp with the following features:

In June, Block initiated Cash App Pay: a payment method for Square invoices that gives customers the ability to pay outstanding invoices directly from their Cash App balance.

Block has launched Cash App Pay with several “well-known” Afterpay sellers. It also recently launched strategic partnerships with payment providers Stripe, Adyen, and PayNearMe, an important step-in reaching a wider range of merchants.

Block started enabling Square Payroll employees to file taxes for free by using automated import, directly in Cash App Taxes.

On another note, in the most recent call, management talks about increased operating leverage. However, they discuss gross profit with no mention of gross margin. Block´s gross margin has risen from 26.71% in FY2014 to 34.95% in the TTM, which is impressive, but there is no way for investors to evaluate an alleged increase in operating leverage this quarter if management does not break down deltas in relative terms.

In the second quarter, we had strong growth at scale with gross profit of $1.87 billion, up 27% year-over-year. Our strong profitability this quarter is a demonstration of our ability to drive leverage and operating efficiency in our business. - Amrita Ahuja, Block CFO during the Q2 2023 call.

Throughout the call–and shareholder newsletter–there isn’t a single mention of gross margin. As with the two ecosystems, this may be an issue of communication, but either way, my impression is that management either does not care or does not want to address it. Further, whatever the degree of the operating leverage gains, they seem to stem mostly from cost cuts.

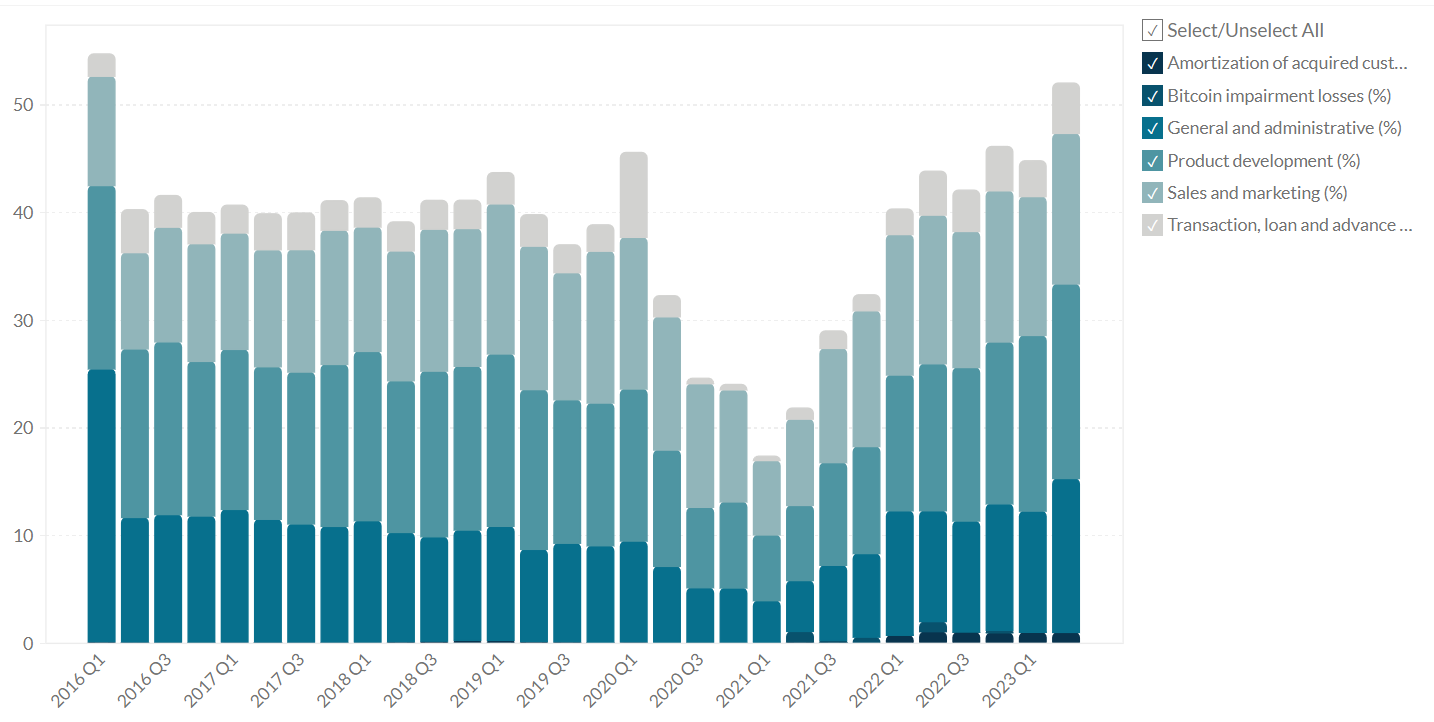

The cost cuts are of course welcome given the macro environment. Still, Ahuja’s comments implies that increased leverage stems further upstream along the income statement. Operating expenses as a percentage of revenue seem to have moderated with respect to Q3 and Q4 2022, in which they came in at 35.99% and 41.45% respectively. However, they have ramped up considerably since 2020: they came in at 24.01% of revenue in Q4 2020 and 36.43% in the last quarter.

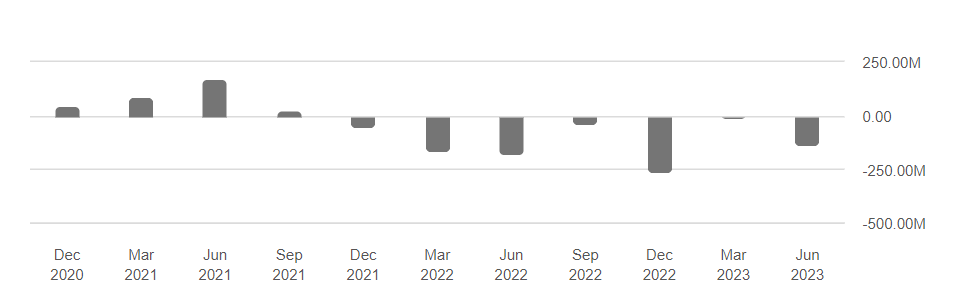

While management is rather elusive per operating leverage, quarterly operating income has been red since 2020. The following figure shows things trending in the wrong direction.

In her prepared remarks, Ahuja said:

With sales and marketing, we've pulled back on lower ROI channels to increase our efficiency, while Cash App's variable sales and marketing expenses, namely peer-to-peer and Cash App Card issuance costs, were up year-over-year, overall company customer acquisition spend was down year-over-year, driving leverage across Square and Cash App.

And then in the Q&A, she only added:

Namely three [sources of operating leverage] that I'd call out to you [are] the three biggest areas in our expense base of leverage: first, sales and marketing; second, around hiring and headcount; and third, around our corporate overhead.

Beyond this, I’m concerned about what happens to the BNPL business once it fully connects the two ecosystems. In such a scenario, given the size of CashApp and Square, BNPL would produce inordinate amounts of debt. The nominal quality of the debt may be adequate, but a combination of scale and mismanagement can end in tears.

Again, I was hoping management would share some insights and clarity pertaining to potential losses in the BNPL business. Instead, we only heard:

[...] whether you look at GMV [gross merchandise volume] or gross profit with consistent loss rates and we've maintained a really disciplined approach here to risk loss and continue to see stable trends in consumer health and repayment behavior with stability as you noted on losses on consumer receivables from the year-over-year perspective in the second quarter. - Amrita Ahuja, Block CFO during the Q2 2023 call.

Management is not doing anything tangibly wrong. Nonetheless, for the reasons I explain above, I believe that the company lacks:

Clarity and focus

A general regard for shareholders

3.0 The Good News

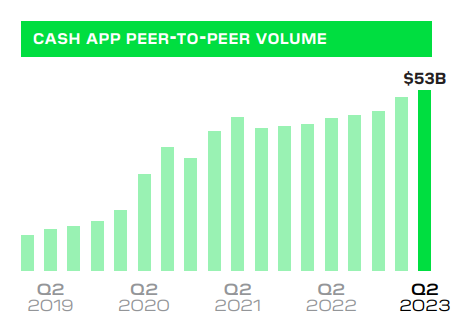

The platform continues to grow, with CashApp processing a record $53B in peer-to-peer payments during the quarter. The continued and rather impressive growth affords the company time to get its affairs in order and makes it worthy of continued study.

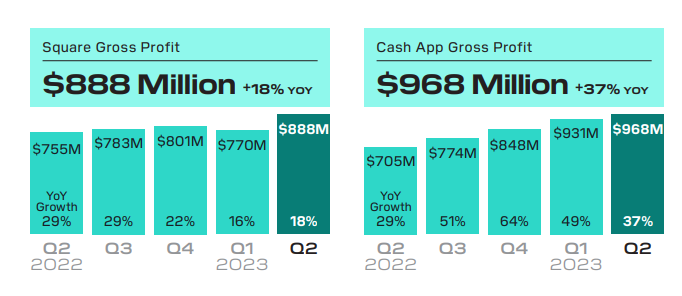

The overall Block platform continues to grow: in Q2 Square generated $888m in gross profit, up 18% year-over-year; and Cash App generated $968m in gross profit, an increase of 37% year-over-year. So long as the platform continues to grow, the company has time to yield from its connected ecosystems a vast fintech distribution channel with applications beyond a mass toxic debt machine.

As such, despite suboptimal management, Block remains worthy of our attention.

The relevant details of Square´s progress include:

Gross profit from vertical point-of-sale products up 37% year-over-year, with restaurants, retail, and appointments products each delivering over $100 million in annualized gross profit.

Square GPV (gross payment volume) up 12% year-over-year, with growth driven by acquisition and churn remaining relatively stable.

Strength in Square banking products, with gross profit up 24% year-over-year, and accounting for 19% of Square gross profit excluding PPP (payment protection program).

Mid-market gross profit up 20% year-over-year, reflecting the company's focus on growing up-market.

Regarding Cash App, peer-to-peer transactions per actives reached an all-time quarterly high, which drove a whopping $53 billion in peer-to-peer volume across Cash App during the second quarter, representing an increase of 18% year-over-year. Inflows per Transacting Active averaged $1,134 in the second quarter, up 8% year-over-year and stable compared to the first quarter, which typically has a seasonal benefit from tax refunds.

In turn, according to management, the adoption of financial service products has been steady, with both Cash App Card and direct deposit allegedly experiencing strong growth in actives and volumes. The monetization rate of Cash App is up 16 basis points year-over-year, but it has been driven primarily by price changes over the last year.

Still, it’s a shame management refuses to provide hard numbers. We do not have concrete information to discern whether CashApp is making progress with product distribution.

The BNPL platform contributed $84 million of gross profit to each of Square and Cash App in the second quarter, with GMV coming in at $6.4 billion in the second quarter, an increase of 22% year-over-year. Losses on consumer receivables were 1.01% of GMV, relatively consistent with the prior year.

4.0 Financials

The numbers point to a very competent but shareholder-unfriendly management team.

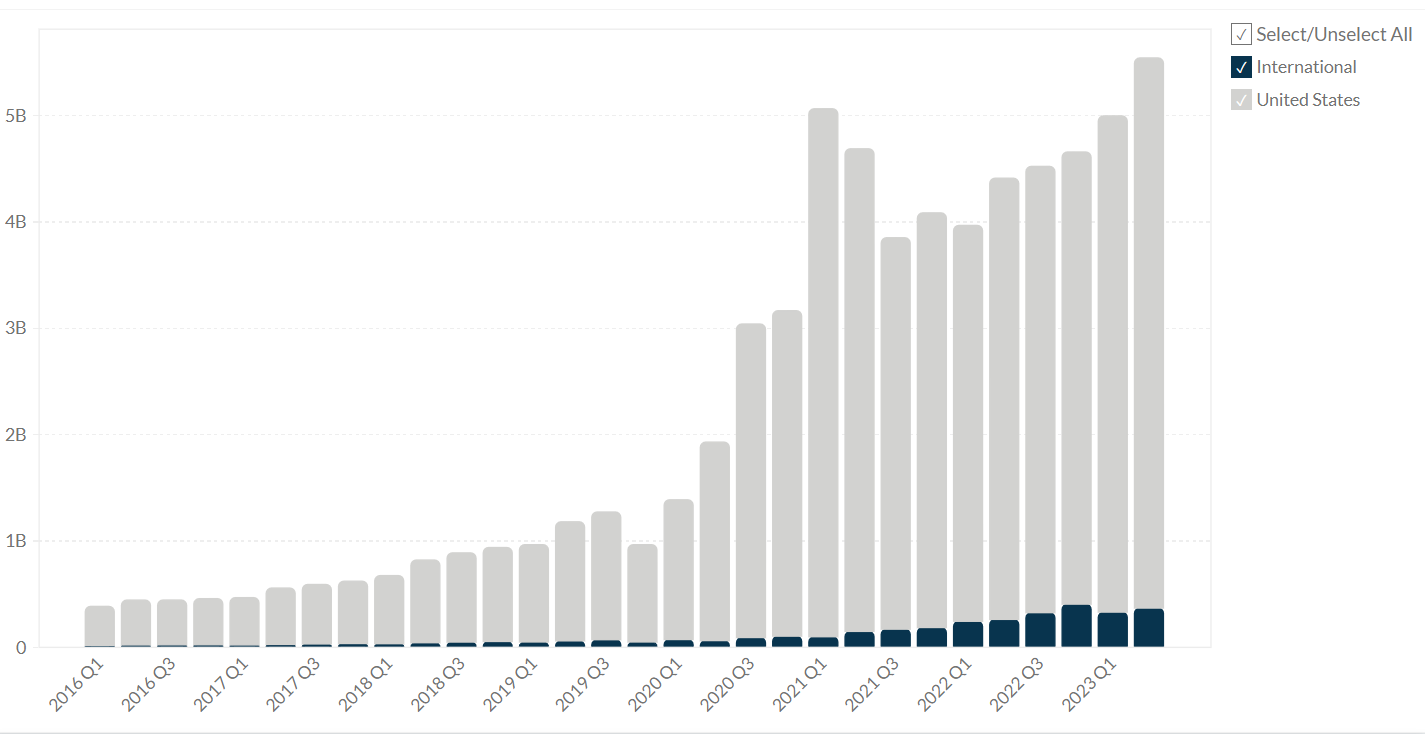

With the world´s economy driven by consumption, I see Dorsey´s efforts to connect the company´s two ecosystems via a mechanism that enables delayed payment as strategically fascinating. Despite its large size, most of Block´s revenue derives from the US, which means that the company actually has a long runway in the decades to come by expanding internationally.

Certainly, leveraging BNPL as a hinge for the Square and CashApp flywheel can be very dangerous–especially so with what seems like an unfocused management team. However, with continued growth, the overall platform’s optionality remains vast, further compounded by international opportunity.

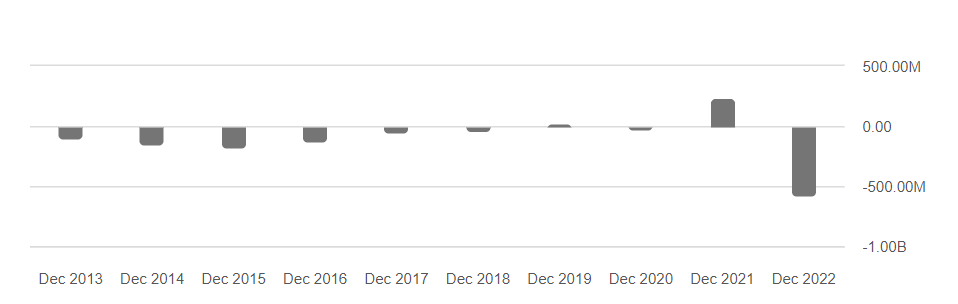

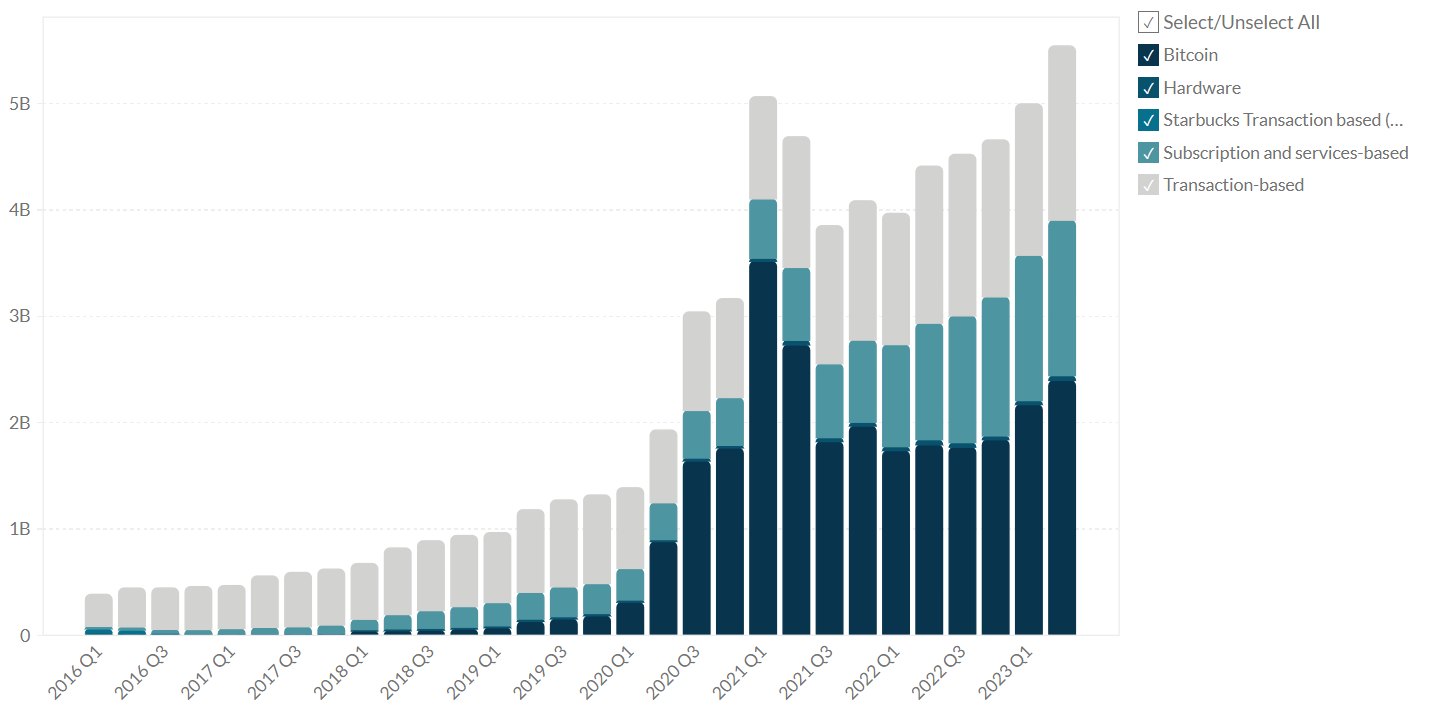

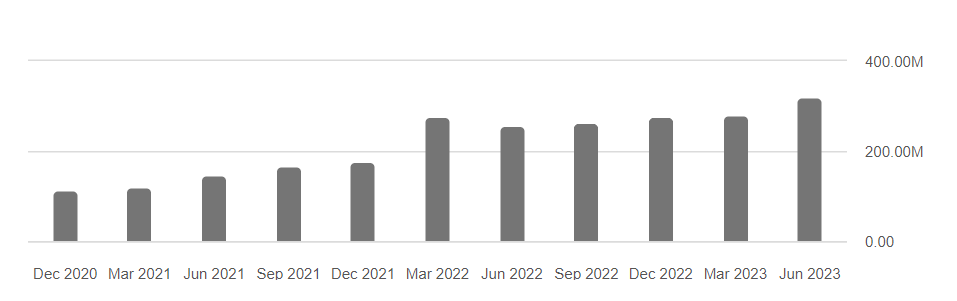

The platform´s growth this quarter is not an anomaly by any means, with overall revenue growing exponentially since 2016 as you can see below. This phenomenal track record suggests the red flags pointed out in Section 1.0 are not a result of incompetency, but rather of shareholder disregard.

As outlined in the deep dive, Bitcoin revenue is far larger than gross profit. This is because Block counts all Bitcoin purchased via CashApp as revenue, keeping only a small percentage, which trickles down to gross profit. The dependence on Bitcoin is therefore much smaller than it seems at first glance.

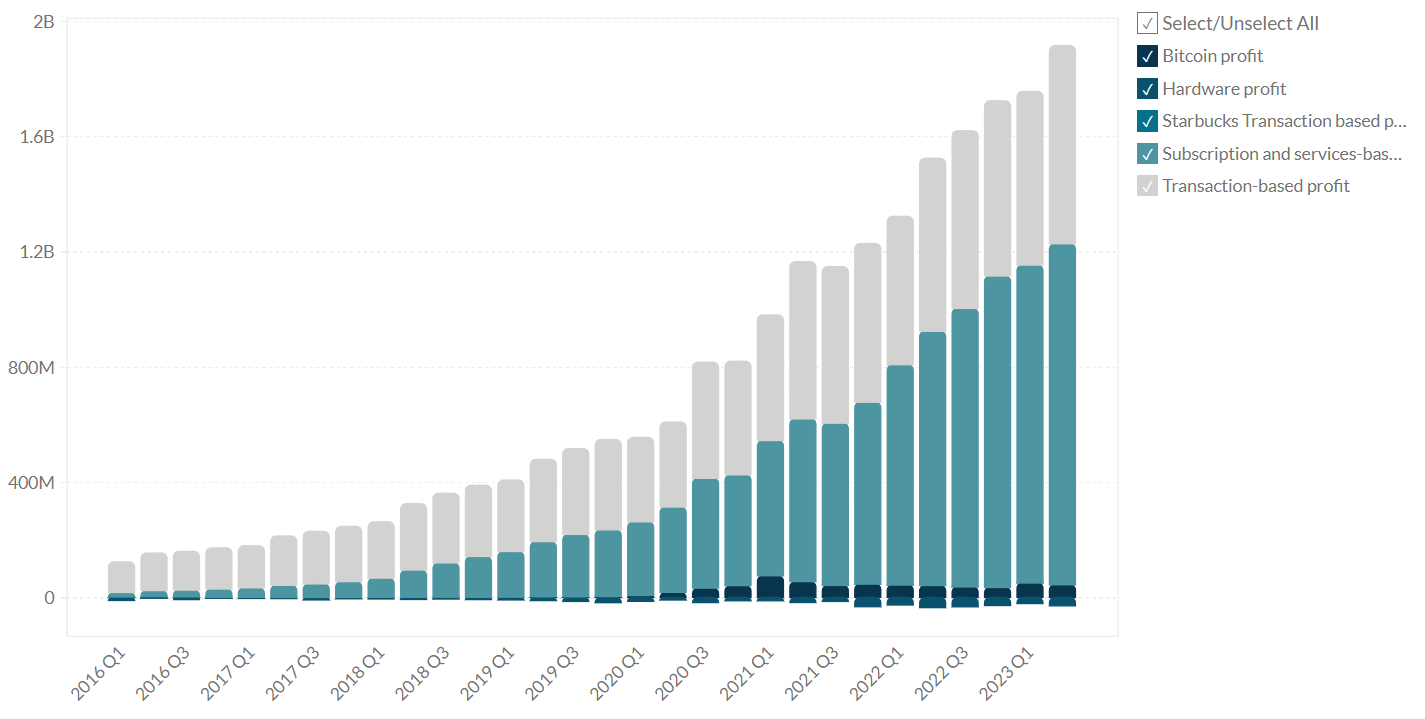

Although management speaks of increased operating leverage in the Q2 conference call brought about by cost cuts, the graph below would suggest that management has no sense of direction in this aspect of the business. Since Q1 2021, OPEX as a % of revenue has been trending back up. This further accentuates the red flag outlined in Section 1.0, regarding there not being a single mention of the term gross margin in the conference call - management´s reluctance to speak in relative terms is very concerning.

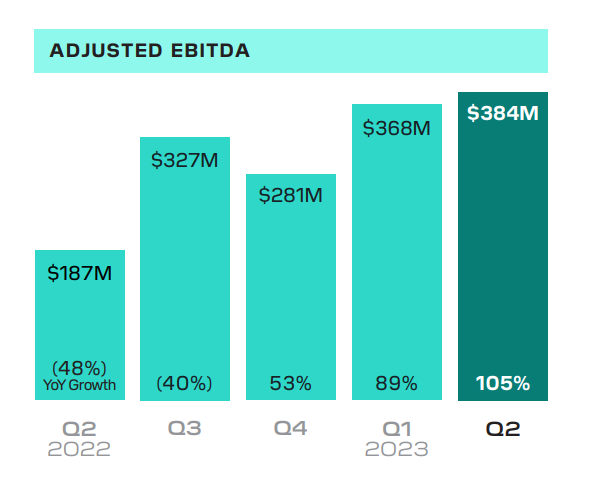

As evidence of increased operating leverage, management discussed during the call a rising adjusted EBITDA. While this metric has increased meaningfully, a true increase in leverage would be visible at the operating cash-flow level, which in fact, as you can see at the end of this section, shows no meaningful inflection point.

In Q2, SBC (stock based compensation) came in at $319.3m, accounting for 5.7% of revenue. This implies an acceleration from the previous quarter, in which SBC came in at 5.6%. But it represents a deceleration from FY2022, in which SBC was 6.1%. However, the current rate of SBC issuance is up considerably from FY2022 and FY2021, in which SBC came in as 4.1% and 3.4% of revenue respectively.

I have written many times about how this metric is hard to analyze on its own because retaining talent in the tech space is quite difficult. Coupled with qualitative datapoints, such as those outlined in Section 1.0, SBC may signal trouble. In this case, I see the relative increase in SBC as further disregard of shareholders:

“As Jack mentioned, share-based compensation remains an area on which we are focused and expect to drive greater leverage over time.”- Amrita Ahuja, Block CFO during the Q2 2023 call.

At the end of the quarter, Block had $5.8B in cash and equivalents and $4.114B in debt, affording the company a net cash position of $1.751B. With positive cash from operations, the company can safely manage its obligations going forward:

5.0 Conclusion

Block is impressive in many ways. The platform becomes more valuable each day, with a long list of potential (and sustainable) applications in the commercial finance space. The company is financially healthy, with a strong balance sheet and sufficiently buoyant cash flow.

However, the management team has an air of indifference towards shareholders that may turn out to be costly in the long run. Further, the company lacks clarity and focus. It seems to have no particular sense of direction in terms of actually increasing its operating leverage.

However, it is very hard to justify any notion that management is incompetent–Block´s track record is littered with spectacular achievements. Considering the platform´s continued growth and increasing optionality, I continue to watch the company going forward.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc