New! There are only a few seats left for the pre-launch cohort of my 2 Hour Deep Diver course, in which I teach you how to analyze companies in depth on your own. The first 20 students will receive personalized attention from me at no added cost, to guarantee success.

The course sells for just $150 and enables you to acquire a life changing skill, that will help you compound your wealth over your life, slowly.

Edited by Brian Birnbaum and an update of my original GoPro deep dive and my Q2 update.

1.0 The Structural Advances Persist

Following the soft results in Q2, GoPro revealed tactical levers that will buoy the company through macroeconomic storms.

When the turnaround is complete, I still believe GoPro will be worth over $30 per share.

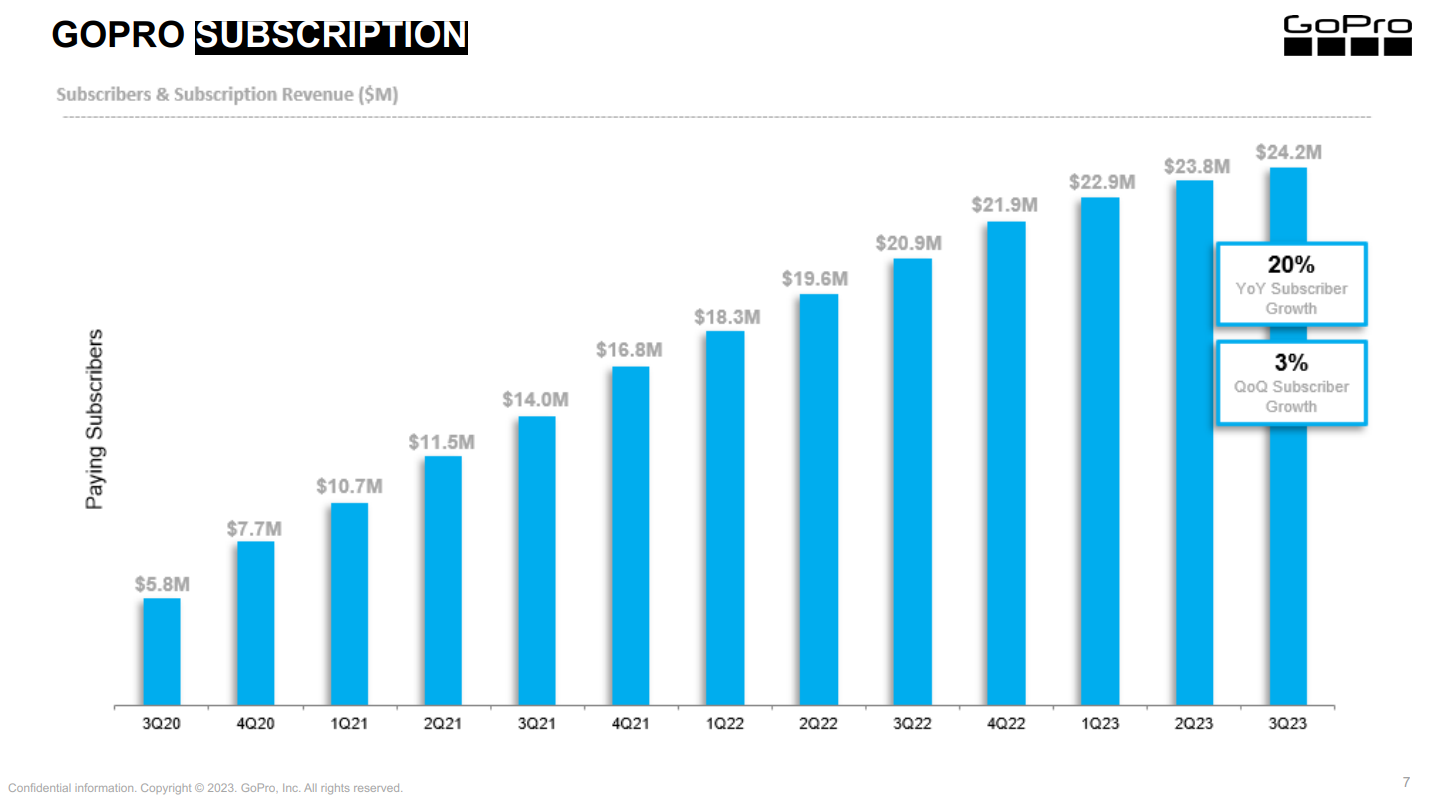

GoPro has been transforming its business by leveraging a new subscription business model, into which it funnels a growing number of customers from its traditional hardware business. Over the last few years, this has seen GoPro produce impressive levels of free cash flow.

The CEO has stepped back to a more visionary role. CFO Bryan McGee is now operating the company, with great success. GoPro is to action cameras what Apple is to smartphones, dominating its niche and strengthening its base from which to orchestrate its turnaround.

GoPro´s moat is far stronger than the market believes.

GoPro has figured out new ways to serve its customers at marginal cost, delivering highly accretive ARPU (average revenue per user) increases. A no-brainer for GoPro´s customers due to the value-add, the subscription business model has an 80%+ gross margin.

In turn, GoPro is experimenting with camera derivatives produced through design and manufacturing processes traditionally used to produce the cameras themselves. These derivative cameras help expand the TAM and drive more volume in the subscription business.

Until Q2 2023, GoPro was:

Cutting retail presence and driving customers to gopro.com.

Focusing on the premium level hardware (flagship cameras).

Giving customers on gopro.com a subscription discount equivalent to the retailer´s cut.

The focus on premium hardware expanded margins. In turn, the incentive to subscribe led to the impressive revenue growth noted in the graph above.

However, inflation drove production costs up sharply and chipped away performance at margin. A general pullback in consumer electronics (tracking the broad PC pullback) hurt sales of premium cameras, stiffening the operational levers.

Nonetheless, in my Q2 update, I argued that the company´s structural advances would persist, giving management the opportunity to add new levers. Since Q2 2023, the company has pivoted to:

back to retail, with increased marketing.

back to entry-level hardware, dropping prices to pre-pandemic levels.

The above strategy was designed to drive expansion through subscriptions. In the Q2 update I explain the validity of this thesis. Yet I also posit that GoPro incurs a major risk: selling entry-level cameras may erode its image and, by virtue of such, its moat.

In Q3, total revenue of $294M exceeded expectations of $281M. Both the sales of premium and entry-level cameras outperformed. We have seen great brands like Apple and Porsche run this playbook without diluting their appeal to customers. So far, it looks like GoPro is pulling it off.

Total units sold is up 31% sequentially and 16% YoY; the new approach is driving volume, which will in turn convert into subscriptions.

GoPro has added the four following levers:

Lowering the cost of entry-level cameras.

Increasing the attach rate.

Driving up retention.

Deploying new, premium subscription tiers to increase ARPU.

In the next section, I will describe each of these levers in depth.

2.0 Key Levers Going Forward

Three of four GoPro’s new levers are well-oiled. The company has failed to exhibit progress with attach rates for entry-level customers.

1) Reducing the cost of entry-level cameras

Increased volume of entry-level cameras sold is shrinking margins. The company´s success relies on the volume of said cameras to continue increasing over time and, thus, must take meaningful action to increase margins in this domain.

McGee expects gross margin to improve from 32% in FY2023 to 37% in FY2024, driven by:

Approximately 230 basis points from introducing a new, lower-cost entry-level product in Q2 2024, which will be redesigned to deliver higher margins.

150 basis points from the elimination of the discount in gopro.com.

Approximately 80 basis points from identified product component cost savings.

Approximately 70 basis points from subscription growth and other improvements.

2) Increasing Attach Rate

In the Q2 update I explain that entry-level hardware customers have a 20-30% attach rate, whereas flagship customers have a 40% attach rate.

In the Q3 update, management issues no update on the attach rate of entry-level cameras, other than saying that “subscriber attach and retention rates remain strong.” The volume of entry-level cameras sold has increased dramatically, but we see no equivalent spike in new subscribers.

Without a tantamount increase in attach rates, the GoPro´s turnaround loses a great deal of strength. I will therefore be watching this metric closely going forward.

On their website, GoPro now offers prospective subscribers a 50% discount for the first year. This may be an effort to increase the attach rate of entry-level customers.

3) Driving retention

In the Q2 conference call McGee explains that first-year retention rates have risen from 50% to 60-65%. Year-two retention is holding at the 70-75% range, which is very healthy for what was previously a highly incentivized membership. GoPro was essentially give customers a discount on hardware purchases if they opted into the subscription.

Since I initiated my position in GoPro, the company has become more vocal about its research efforts. At the start, improvements in R&D were only evident in declining OPEX as a % of revenue and the simultaneously rising ASPs (average street prices). The combination of these two metrics proved that GoPro could produce better cameras with less R&D spend, pointing to higher efficiency in this sense.

This quarter, GoPro announced a new Mac desktop app to be released later this month– a benefit exclusive to subscribers–with the Windows version expected in Q2 2024. The app will:

will bring the simplicity and convenience of automatic edits to desktop users, along with manual editing and media management tools, synced editing between mobile and desktop apps, plus the ability to import footage from any camera.

-Nick Woodman, GoPro CEO during the Q3 2023 conference call.

For the first time, to my memory, McGee has been explicit about GoPro´s research endeavors’ leading to the desktop app’s release. So long as GoPro continues along these lines, I believe retention rates will continue increasing:

We've done a lot of work on consumer insights. That's why for people who subscribe to GoPro, they'll have access to desktop app.

That's been a very positive response rate from a consumer insight perspective. So hopefully that drives not only attach, but increased retention rates over time. And we'll add other kind of services and applications to the service [as the subscription offering] dis-enhances it over time. And that's really [what continues] to drive attach [rates], and retain the subscribers we have.

-Bryan McGee, GoPro CFO during the Q3 2023 conference call.

4) New premium subscription tiers

The app launch coincides with the introduction of a premium $99/year subscription tier, which is $49.01 more expensive than the standard tier. It includes:

An advanced desktop based HyperSmooth Pro video stabilization feature,

Increased cloud storage for footage captured with any camera.

3.0 Financials

Income Statement

The numbers in Q3 are driven by a re-accelerating top line and a tightened cost base. The bottom line is back in shape, following a sharp decline in profitability over the last two quarters. Q1 and Q2 2023 witnessed the failure of the former strategy. In Q3, we see the company’s new levers driving increased volume of units shipped.

The bottom line’s buoyancy is largely due to GoPro tightening Opex. Q3 revenue growth came in relatively flat compared to the same period in FY2022 and FY2021, meaning margin expansion explains much of the increased profitability.

Operating expenses as a % of revenue ballooned up to 52.83% in Q1 and 40.77% in Q2, driven by higher R&D spend, and in Q3 came in at 33.30%. (R&D in Q3 came in at 14.17%, down from 17.39% in Q2 and 21.85% in Q1.)

Q1 and Q2 saw steady R&D spend in absolute terms, but OPEX as a % of revenue rose briskly due to a contracting top line (brought about the pullback in consumer electronics).

However, the new approach on volume and the entry-level cameras cost refactoring is expected by Q2 2024. In the meantime, GoPro is adjusting its cost base to the new strategy.

Cashflow Statement

The cash-flow statement tells the same story as the income statement. The old strategy succeeded triumphantly in 2021 before withering during FY2022. The decline was most evident in Q2 2023´s negative cash from operations. Cash from operations came in at a meager $(1.6)M in Q3, which points to GoPro beginning to reign in the hardware business.

Balance Sheet

GoPro ended Q3 with $220.9M in cash and $141.7M in LT debt, which affords the company a fairly long runway to get its affairs in order. If GoPro manages to raise the attach rate of entry-level customers (Section 2.0, part 2), the balance sheet will grow healthier over time.

You can see nonetheless how total cash and short term investments have trended down since peak operating cash flow production in Q4 FY2021. The timing of the new strategy is elegant and operationally excellent given the recent decline.

McGee said on the call that GoPro expects to end 2023 with $300M in cash–not far-fetched given the bulk of GoPro’s sales come in Q4. Further, he expects to buy back $10M in shares during Q4 and finish FY2023 with a total of $40M in share repurchases.

For the moment–and as management has guided–share repurchases are barely offsetting stock based compensation, which has trended slightly higher in the twelve trailing months. I welcome this initiative, because retaining talent is key to the company´s turnaround. Something GoPro does well is appeal to and satisfy the needs of a given niche of content creators. They can only do so because their employees are passionate about their work.

4.0 Conclusion

Despite the depressing price action, the thesis remains intact. I like to see management actively navigating their way through tough conditions and I believe GoPro is set up to succeed in 2024.

Ultimately, the subscription business has to grow enough for GoPro to make money despite hardware downturns. Although high end content creators seem to be a resilient bunch, GoPro was evidently hit by the consumer electronics pullback over the last year.

A focus on scale to maximize the subscription business growth, together with an additional focus on increasing subscriber ARPU is the way forward for the company. As outlined previously, for scale on the hardware business to translate into additional scale on the subscription, GoPro has to get the attach rate for entry level customers right.

Meanwhile, there are more content creators every day, and GoPros remain very valuable tools for the high end subset of creators. If the company can get to consistent profitability regardless of pullbacks in the hardware business, the upside is large.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc