Edited by Brian Birnbaum and an update of my GoPro deep dive.

1.0 The Turnaround is Getting Confusing

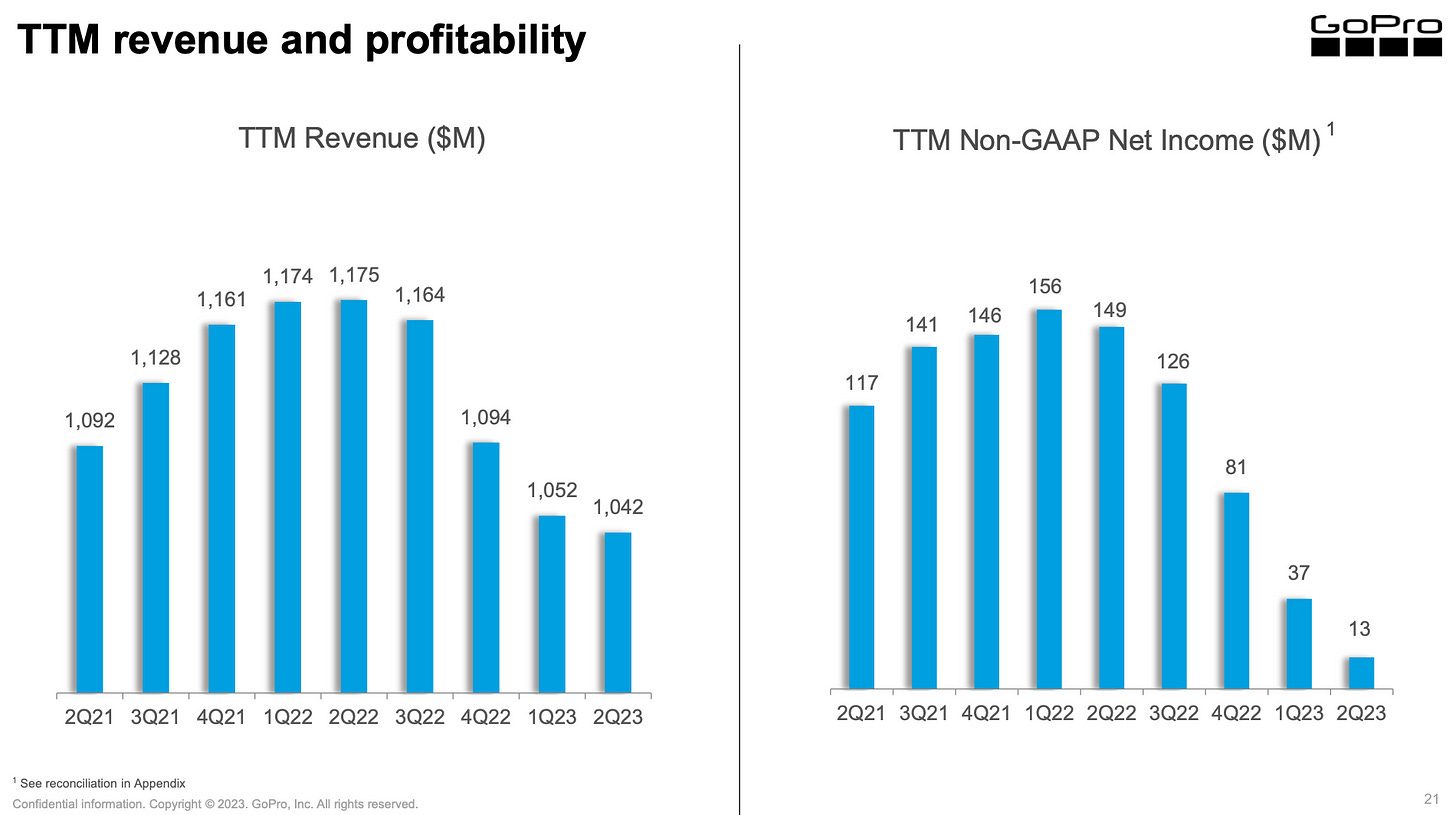

The original turnaround strategy led to some impressive results in FY2021, but management has been forced to pivot.

Until the inflationary pressures hit GoPro´s supply chains over the last year, the company had turned into a free cash flow machine as a result of what now might just be a temporary turnaround. Its strong balance sheet stands as a testimony, but things have now gotten a bit confusing with consumers pulling back and management pursuing a new strategy.

Before addressing the new strategy, I’ll outline how we got here.

The turnaround had three main drivers:

A subscription business (~80% gross margin), via which GoPro facilitates various digital services to its customers.

A focus on unique, premium hardware boasting higher margins than entry level hardware.

A focus on selling D2C via gopro.com, versus the traditional retail route.

The above three pillars enabled GoPro to print impressive financials in FY2021, with adjusted EPS (which excludes a one time $270M tax benefit) coming in at $0.9. Also, focusing on the premium segment strengthened GoPro´s moat by super-serving a customer segment to which knockoff cameras could not possibly cater.

The strategy offered management many tactical levers. For example, GoPro has been giving customers discounts when buying cameras online, so long as they opted into the subscription service. Yet the discount was for the same amount that retailers would be taking otherwise.

The above was ultimately an effective driver of value. First year renewal rates are between 60% to 65% and second year renewal are between 70% to 75%. With such great margins, funneling customers into the subscription business is a good way to elevate the company´s margin profile.

With consumers pausing their tech-related purchases over the last year and inflation eating away at the margins, the original strategy is now failing to:

Print cash.

Funnel customers into the subscription business at a rapid pace.

On a positive note, however, both the subscription business and the balance sheet continue to show strength, affording GoPro time to shift strategy, which I will be analyzing in the next section.

2.0 The New Strategy

If GoPro can scale up its hardware business without losing its perception of being cool (or its excellence in the premium segment), the new strategy can work.

In the last two quarterly calls, management sounded tired and analysts could not care less, with just one or two questions being asked in the respective Q&A sections. The stock price has also plummeted.

However, it helps to craft an ideal version of GoPro to cut through the emotional noise. This is what I want for the company once the turnaround is done:

Minimize the impact of ebbs and flows of the hardware business on overall profitability .

Have hardware drive subscriptions, through ups and downs of the former.

Deepen the subscription offering by driving retention and higher margins over time.

In aggregate, the above should have the company printing excellent financials, through good times and bad.

Essentially, the new strategy consists of reincorporating retail, selling entry level cameras again to drive volume, and thus drive the subscription business as fast as possible. I draw two fundamental lines here:

It can go terribly wrong if GoPro drains their moat by focusing on scaling the hardware business and wading too deep into the entry level domain.

GoPro can do alright if it manages to scale up hardware while staying relevant and cool. Kind of like Porsche moving a lot of Macans while maintaining the 911 as a status symbol. In fact, this very strategy has led to Porsche´s success.

Entry level hardware customers have a 20-30% attach rate to the subscription business, whereas flagship/premium customers have a 40% attach rate. The two cohorts are similarly engaged, according to management. If GoPro can scale hardware to drive software without draining the moat, all while maintaining the cultural relevance of its brand, there is no reason why subs from entry level hardware sales won’t be beneficial.

However, part of the new strategy is to jettison subscription discounts at gopro.com. This is crushing flagship sales because most gopro.com customers buy the flagship. GoPro is currently at a crossroad, such that:

Entry-level camera sales have exploded.

Flagship sales have declined.

The imbalance of entry-level sales has collapsed the overall margin profile. Flagship sales, which would be driving margins up, have declined more than expected due to the jettisoned discounts.

Margins were impacted by 190bps compared to guidance primarily due to higher than expected sales of our lower margin entry level cameras as sell-through of these cameras exceeded our projections by 50%.

- Bryan McGee, CFO during the Q2 2023 conference call.

Thus, GoPro investors are currently in a limbo: the old strategy is bringing down the new one, which is yet to prove itself. Yet I believe management is mirroring Porsche’s strategy and giving themselves a chance of success.

3.0 Deeper, Structural Concerns

Management is investing in the talent now, after tightening OPEX for some time.

As GoPro was printing excellent numbers in FY2021, my main concern was what seemed like an artificially lean OPEX. For short-term-oriented and self-serving managers, one of the best ways to deliver aesthetic results is to dry the company out by cutting costs. Although I believe McGee is a world class manager, Woodman´s reputation precedes him. He is the founder and CEO that burned investors after GoPro´s IPO.

However, the company is now investing in talent and innovation again. As long as they continue to do so, success is likely even as they (reasonably) continue to pivot strategies in pursuit of the ideal GoPro outlined in Section 2.0.

To be clear, I do not enjoy the fact that GoPro has had to pivot, but I would be more uncomfortable with a management that does not pivot when necessary.

So long as the talent is engaged, they will continue to make cameras that their customers love and bring incremental value to the subscription service. Over time, this should translate to better financials.

Q2 OPEX increased 8% year-over-year to $88 million, largely due to our continued investment in research and development to support our hardware and services roadmap as well as marketing. - Bryan McGee, CFO during the Q2 2023 conference call.

For FY2023, management is guiding for OPEX to be approximately $370 million in 2023, up nearly 12% from 2022, “largely driven by investments in research and development and increased marketing.” They expect increased OPEX to have an impact through Q4 and into 2024.

Management repurchased approximately $15 million of GoPro stock in Q2’23, or 3.6 million shares. So far, and as planned, they have only sufficed to offset SBC, but if the new strategy succeeds, and management remains committed to buying shares, they can compound the success of the turnaround.

Management is committed to continue share buybacks, with a range of $40 million and up to $70 million in share buybacks for the year.

4.0 Financials

While metrics in the income and cash flow statements are discouraging as outlined in Section 1.0, the balance sheet remains very strong. Second quarter total cash net of debt was $128 million, which, given the fact that we are entering GoPro´s seasonally lucrative quarters (Q3 and Q4), affords the company a fair bit of leeway.

Cash decreased $23 million sequentially, primarily from $15 million in share repurchases, and a net loss of $11 million, partially offset by improvements in working capital.

5.0 New Offerings

GoPro has demonstrated an ability to keep on iterating.

GoPro will launch two new offerings in H2 2023:

An entry level camera with an improved margins. McGee estimates that this new camera would have improved second quarter margin by nearly 300 basis points.

A premium subscription with higher margins that will allow consumers to import footage from any camera into the GoPro ecosystem.

The above will not alone fix GoPro, but these offerings reflect the company´s iterative capacity. If the company does execute this turnaround in the coming years, it will be thanks to an aggregation of strategies and tactics.

6.0 Conclusion

Management delivered via the original strategy in FY2021, when the market was discounting bankruptcy. They have now been forced to pivot, and although the overall scenario is emotionally challenging, I see no reason why they won’t deliver again–unless they get bogged down in the entry level segment.

Although the pivot is uncomfortable and adds additional uncertainty to the thesis, it is preferable to not pivoting when required.

GoPro´s products are still cool. They dominate the competitive environment, and an increasing number of content creators stand to benefit from their products. So long as GoPro maintains its moat and continues to enhance its iterative capacity, it stands a good chance of succeeding.

Over the coming quarters, I will keep an eye on the evolution of the new strategy. If it fails, I may be forced to cut my losses. Elsewise, I see plenty of upside ahead for the stock.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Disclosure

These are opinions only of the individual author. The contents of this piece do not contain investment advice and the information provided is for educational purposes only and no discussions constitute an offer to sell or the solicitation of an offer to buy any securities of any company. All content is purely subjective and you should do your own due diligence.

Antonio Linares makes no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness or reasonableness of the information contained in the piece. Any assumptions, opinions and estimates expressed in the piece constitute judgments of the author as of the date thereof and are subject to change without notice. Any projections contained in the Information are based on a number of assumptions as to market conditions and there can be no guarantee that any projected outcomes will be achieved. Antonio Linares does not accept any liability for any direct, consequential or other loss arising from reliance on the contents of this presentation. Antonio Linares is not acting as your financial, legal, accounting, tax or other adviser or in any fiduciary capacity.

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

I appreciate your analysis. Thanks for clearing up management's strategy. I do enjoy these quarterly reports. Thanks again!

Наблюдаю за компанией. Очень интересная.