Edited by Brian Birnbaum and an update of my original Tesla deep dive.

1.0 Tesla is Entering Its Next Inflection Point

Tesla is exhibiting newly gained operating leverage, and the energy and AI businesses have seen a clear uptick in the last quarter. In combination, the result is likely to be its next inflection point.

Tesla is, primarily, a unit economics optimization machine. It is fascinating to see how, despite the auto price reductions over the last year (which have yielded a series of silly narratives), Tesla´s free and operating cash flow production is ticking up again, on a notably thinner margin structure; operating margin, for instance, is down from 14.6% to 9.6% YoY.

Despite Tesla’ squeezed margins (which are still head and shoulders above that of other players in the auto industry), key metrics are looking far better in Q2 FY2023 than during the same period in FY2021 and FY2022.

Per the number of vehicles delivered, it may also be fair to infer that Teslas are just as desirable as ever–this despite recent noise made to the contrary.

Thus the company has once again emerged on the other side of trouble with a higher operating leverage. The last time the market questioned their capacity, they managed to proliferate their manufacturing efficiency to bring the Model 3 to life at scale. The chart below expresses how much free cash flow the company can produce per $ invested in the company. The higher, the more efficient (at manufacturing).

Operating cash-flow to CapEx declined post 2019, as Tesla set out to deploy additional factories, but the 2017-2019 period is when Tesla evidenced, perhaps for the first time, to what extent it can pursue and collapse cost curves. In my original deep dive, I pointed out that this is Tesla´s core source of value, as enabled by a series of unique organizational properties.

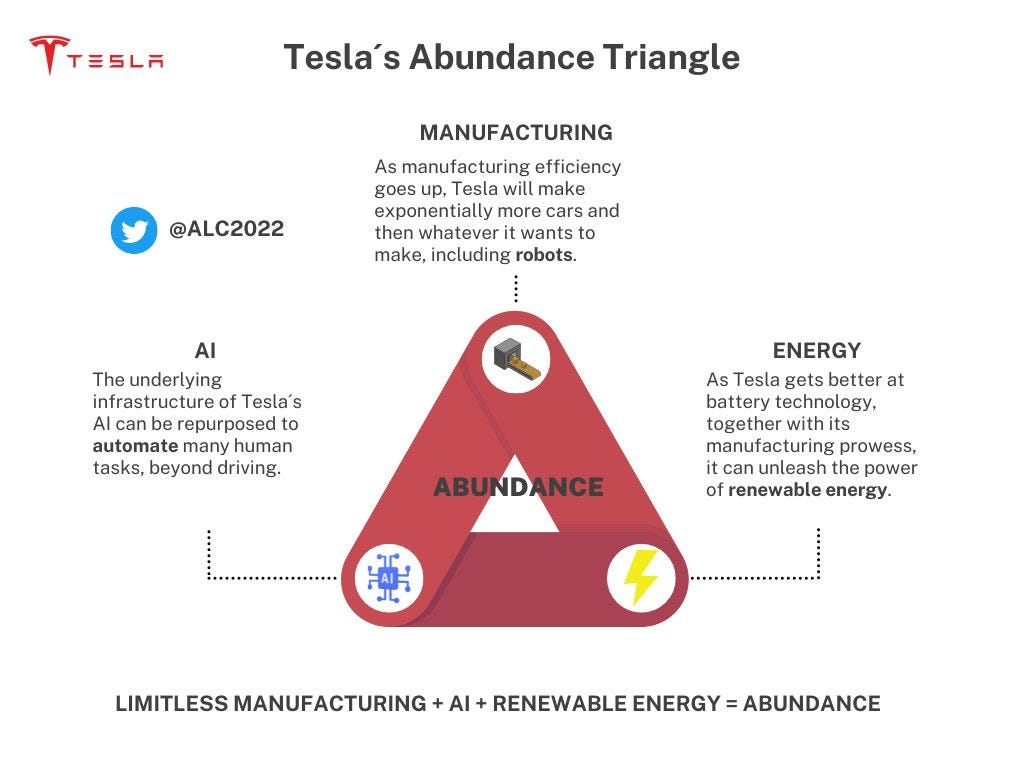

In the deep dive I also outlined that this trait was going to bleed deeper than auto and into the domains of AI and energy (which includes manufacturing), eventually forming a triangle of abundance. This is the first quarter that I see the company accelerating in this direction, with both the AI and energy businesses exhibiting what seems like an inflection point.

The graph refers to what initially is likely to be a localized form of abundance from which only Tesla customers will benefit. As Tesla continues collapsing the manufacturing, AI, and energy cost curves it will eventually be able to put out inordinate numbers of robots and other tools that can continuously gather data and learn, powered by its own sources of energy.

Now, a look at the mentioned inflection points.

Energy

Revenue from the energy business is up $74M YoY. While solar deployment is down 38% YoY (allegedly due to consumers postponing purchases because of interest rates), storage deployed is up 222% YoY. The graph below depicts the ramp up of Tesla´s first “dedicated” Megapack factory in Lathrop, CA. You may thus appreciate how the manufacturing prowess bleeds into the energy business.

As Tesla deploys more factories dedicated to energy storage, the total GWh installed will likely follow an exponential curve going forward. Naturally, this is also likely to apply to solar panels, which complete the energy loop: energy generation <> energy storage.

On a similar note, Tesla managed to decrease the cost of goods sold for the 4680 cell by 25% during the quarter. It also increased the production of the cell by 80% with respect to Q1, producing more than 10 million cells in Texas. These advancements point to the energy business riding an exponential curve.

AI

Simultaneously, cumulative miles driven with FSD has also seen a clear uptick since March of FY2023. This due to the fact that:

They can and have produced more cars.

The software is getting better, as more cars participate in the network and, ultimately, generate more data that the AI models can learn from.

During the ER conference call, Elon offered an eloquent qualitative breakdown of larger data volumes equate to non-linearly increase performance of the AI models:

[…] the more training data you have, the better the results.

Basically it’s sort of at 1 million training examples, it barely works; at 2 million, it slightly works; at 3 million, it’s like wow, okay, we’re seeing something, but then you get like 10 million training examples, it’s like -- it becomes incredible.”

In my original deep dive I pointed out this dynamic, when I explained how Tesla is in fact turning transportation into a networking problem. It is happening and, with the recent increase in operating leverage, the process is accelerating as they are able to put more cars out on the road at a lower cost. Below, an excerpt from the deep dive with my original observations:

2.0 OEMs are Converging Towards Tesla

OEMs have defaulted to Tesla´s charging network and this is likely just the beginning. Software is the new frontier in the auto space, and now Tesla and Blackberry are set to compete.

Tesla has printed a further inflection point, with the gross margin of “services and other” pivoting to positive over the last two years, with the trend seemingly consolidating. OEMs like Ford, GM, Mercedes, Nissan, Polestar, Rivian (the next deep dive), Volvo and Electrify America have announced the adoption of the NACS (North American Charging Standard) - a charging standard developed by Tesla over a decade ago.

They are all now charging their EVs at Tesla stations.

Note that this has no doubt aided the uptick in FCF too.

In essence, the other OEMs have not been able to collapse the respective cost curves fast enough (or at all) and have been forced to default to Tesla´s charging network. It is likely that the same will happen with FSD. In the conference call, Elon said the following about licensing it out:

[…] we are very open to licensing our full self-driving software and hardware to other car companies.

For FSD to work, a car needs to run Hardware 3 (Tesla´s inference computer) and Tesla´s Linux-based real time operating system, or equivalents. OEMs (and especially the legacy ones), have long design to production cycles that can sometimes span for more than half a decade.

Thus, getting the entire stack out to other OEMs will take time, but the NACS case proves that Tesla definitely has the patience to make it happen. Legacy OEMs do not have the required vertical hardware/software stack and the talent required to develop and operate FSD. Tesla has a huge lead and OEMs may eventually just have to default to the former´s offerings.

As some of you know, however, most top OEMs in the world (including the new EV companies, like Rivian for example and legacy OEMs like Mercedes, GM, VW, BMW and more) run on Blackberry QNX: a real-time operating system. Blackberry now powers more than 230M cars on the road.

QNX is deeply embedded in the auto industry, because it has gained the full trust of OEMs–a much stronger moat than many believe. (Incidentally, QNX is also prospering in the medical, aviation, and industrial sectors).

Together with Amazon (50:50 joint venture), Blackberry just launched Blackberry IVY, which is intended to be like an app store for cars. IVY could become a network installed on tens/hundreds of millions of cars, all collecting data that can then be used to train AI models for a range of purposes–including self driving.

And obviously, Tesla has more vehicles on the road that are collecting this data than all of the companies combined by, I think, maybe even an order of magnitude. So, I think we might have 90% of all -- or a very big number. - Elon Musk, CEO, during the Q2 FY2023 call.

If fully instantiated today, IVY would be a much bigger network than Tesla´s fleet. However, the IVY network is far from being fully instantiated, OEMs are not collecting data yet, and the talent to make something of the data is not yet on the radar. However, if OEMs chose to fully commit to IVY, together they could yield some sort of an Android in the auto space.

Blackberry is a neutral player to the OEMs, while Tesla is a direct competitor. Over the coming decade, most OEMs will have to choose between participating in the Tesla network or in the Blackberry one: but there is also a chance for cross-pollination between the two.

FSD is effectively an app and there is no reason for which it could not be deployed on IVY, powered by some third party inference engine (provided by AMD or Nvidia, for example), with QNX at the lower level. Once FSD is fully functional, OEMs are going to find it hard to resist.

At the limit, Tesla is faced with two potential approaches:

Selling a vertical stack, all the way from the hardware to the apps. This will yield:

More control.

But more friction.

Selling only the apps. This will yield:

Less control.

But way less friction.

And thus, will enable Tesla to gather more data than with the above approach.

The competitive landscape in the software defined vehicle space will be shaped by Tesla´s final approach to licensing out FSD.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Hi Antonio, thanks for your write-up, good to hear your thoughts.

I think short-term investors might have been disappointed, but for longterm investors, this earnings call showed the huge growth potential for energy at good margins and the tone regarding FSD is extremely confident.

I think the next two years will be extremely excited and the whole auto industry will look quite different in 2025.

I think of QNX as more of an OS, lower level infrastructure. What about MBLY? They have OEM solutions and FSD is on the roadmap. That could be an alternative to Tesla.