No time to read the update? Listen to it for free on Spotify:

Welcome to all the 500 new subscribers that joined the newsletter this week! It’s great to see that many of you have enjoyed my Palantir, AMD, Amazon and Crowdstrike deep dives among others.

On top of the free monthly deep dive that I send out, I also write free quarterly updates on a list of stocks, which includes Palantir.

Also, here are some of my latest deep dives that you can read for free:

Edited by Brian Birnbaum.

1.0 Palantir’s Missing Link (Distribution)

Palantir has figured out a way to grow the commercial business fast. The financials also seem to be going through an inflection point.

In my original Palantir deep dive I essentially explain that, once the company figures out distribution, it can grow exponentially.

Since 2021, my long term Palantir thesis has been that once the company can seamlessly deploy its offerings, it eventually becomes a platform on which folks can build their companies first.

I believe digital twins (Palantir’s core offerings) will be essential for business in the future. When creating a company, people will create their digital twin before they do anything else, just like they create their Gmail account today.

As Palantir gets better at distributing/deploying, contribution margin rises exponentially, reaching a maximum once the cost of deployment is marginal. At that point, Palantir becomes a network that reduces OpEx as a % of revenue for all participating enterprises, just like electricity.

Although Palantir has not filled its 10K form for FY2023, we can see that contribution margin has been trending up recently. From Q4 2020 to Q3 2022, the metric trended down as Palantir added smaller clients.

Now, although Palantir continues to add small clients, it has made great progress in distribution.

When I first invested in Palantir, I could not quite foresee how the company would go about fixing distribution. But the mental models that I use to analyze companies enabled me to understand that Palantir’s odds of figuring it out were high.

Incidentally, if you want to learn these mental models and how to analyze companies in depth like I do, check out my 2 Hour Deep Diver course. I am discounting the price from $199 to $150 for 72 hours only, so now is a great time to buy.

Palantir has been dabbling in its AIP Bootcamps since this fall. In Q4 it seems that these bootcamps drove much more efficient distribution.

For context, Palantir conducted 100 pilots in the whole of 2022. Since introducing AIP last year in October, the company has performed more than 500 bootcamps. The resulting acceleration in the US commercial business is tangible.

Going forward, I believe Palantir will productize their bootcamps, gradually decreasing the marginal cost of each one over time. As they get cheaper to operate and Palantir can increase the number of bootcamps operated per day, the commercial business will grow faster and faster.

Currently, the bootcamps require customers to travel to the location in question and engage with Palantir employees for days. Eventually, I believe customers will be able to do these bootcamps anywhere on a laptop. At that point, distribution will be far similar to how Gmail does it.

We have a latent nascent sales force that has put its tiny toe in the water and has noticed that it can move around.

We have to build that into a strong, aggressive machine.

-Alex Karp, Palantir CEO during the Q4 2023 earnings call.

I understand why many claim that we are in an “AI bubble,” but I believe such doomsayers have not studied the technology deeply enough. AI bequeaths computers with an entirely new skill set of transcendental importance.

AI is not going to do everything for us. But it allows us to use computers as prediction machines, when previously we could only use them to store and share information.

The economy essentially consists of eight billion people processing information to optimize their operations. This is why the internet has created trillions of dollars in value–it’s allowed us to share information far more quickly.

But AI is now tapping into our core wealth creation mechanism (making decisions), which is going to exponentiate the economic impact of computers. We can’t offload all judgment to AI, but we will certainly hand over a growing share.

In turn, generative AI enables us to evolve from retrieval methods to generative methods. We no longer have to spend hours clicking and typing–we can just ask computers questions in natural language.

The combination of commoditized predictions and generative methods will equate to readily available automated intelligence in any connected device.

This sounds distant, but it is actually what AIP Bootcamp attendants are already experiencing:

At a recent two-day bootcamp with [a] construction, engineering, and architecture company, our customer developed a production-ready use case that provided $10 million of savings.

They used AIP to build an AI-powered disruption manager application that processes production disruption notifications through AIP Logic to determine what the best new production plan would be.

AIP, wielding a linear optimizer as a tool, and using LLMs to parameterize and contextualize the disruption, translates the notification to a clear understanding of impact on the optimized schedule. AIP Logic and AIP Automate then rerun the optimizer to generate opportunities to respond to disruption.

-Shyam Sankar, Palantir CTO during the Q4 2023 earnings call.

AIP certainly isn’t making the final decision in the above example, but it does seem to be doing work that a bunch of analysts would otherwise be doing.

In the same manner, Palantir’s software seems to be making NHS hospitals much more efficient. The results don’t seem like hype to me.

Over the past few years, an increasing number of NHS trusts have used the software to reduce the care backlog.

For example, at Chelsea and Westminster NHS Foundation Trust, it helped bring down the in-patient waiting list by 28%, and operations canceled on the day due to missed preoperative assessments subsequently fell by half.

-Ryan Taylor, Palantir CLO during the Q4 2023 earnings call.

2.0 Platformizing the Government Business

The government business is becoming a platform too.

Palantir’s government business has always been a blindspot for me and I ultimately invested in the company in spite of it. Over time, however, I’ve gained an appreciation for Palantir’s ability to execute in the public sector.

Although I think the vast majority of the upside going forward will come from the commercial operations, I now think the government business is on the doorstep of operating leverage expansion.

Palantir is making its Gotham, Gaia, and MetaConstellation offerings available via a platform that allows other companies to build on top of these solutions. This enables defense companies to focus on driving innovation rather than the plumbing.

This is a fundamentally different approach to selling the solutions directly to governments, which allows Palantir to position itself as an infrastructure provider in the defense industry.

I believe that, over time, this will smooth out the sales cycle. During times in which governments are not buying, Palantir can still sell to players in the defense industry.

This distribution format also increases optionality. Some of the solutions built on its platform may succeed disproportionately over time, benefiting Palantir.

In my Q3 2023 digest I argued that Palantir’s rapid growth in the healthcare sector, together with the rapid progress on AIP, was indicative of commensurate distribution advancements.

This pivot in the government business seems to be a continuation of this progress, pointing to an organizational focus on distribution.

In my UiPath deep dive, written in July 2023, I expressed concerns about Palantir’s sluggish progress on distribution. Now, my concerns have been squelched, since I see the organization evolving into a platform very rapidly.

We continue to focus on accelerating the rate of bootcamps with current and prospective customers.

-Shyam Sankar, Palantir CTO during the Q4 2023 earnings call.

3.0 Financials

Palantir’s unit economics are improving, which strengthening the company’s cash flow profile and balance sheet.

Income and Cash Flow Statement

Palantir’s distribution leap parallels the evolution of its gross margin and the key financial metrics from which it emerges. In the last few quarters, Palantir’s cash flow seems to have been enhanced.

See the uptick in blue and purple below.

Revenue came in at $608.4M, up 8.9% QoQ from $558.2M. During the same period, gross margin jumped from 80.66% to 82.16%, and OpEx as a percentage of revenue has decreased by 2.17% to 71.33%.

The increased cash flow production has certainly been aided by tightening costs, but per the increased gross margin, Palantir’s unit economics have improved. The above convergence is thus also the result of a lower cost of doing business.

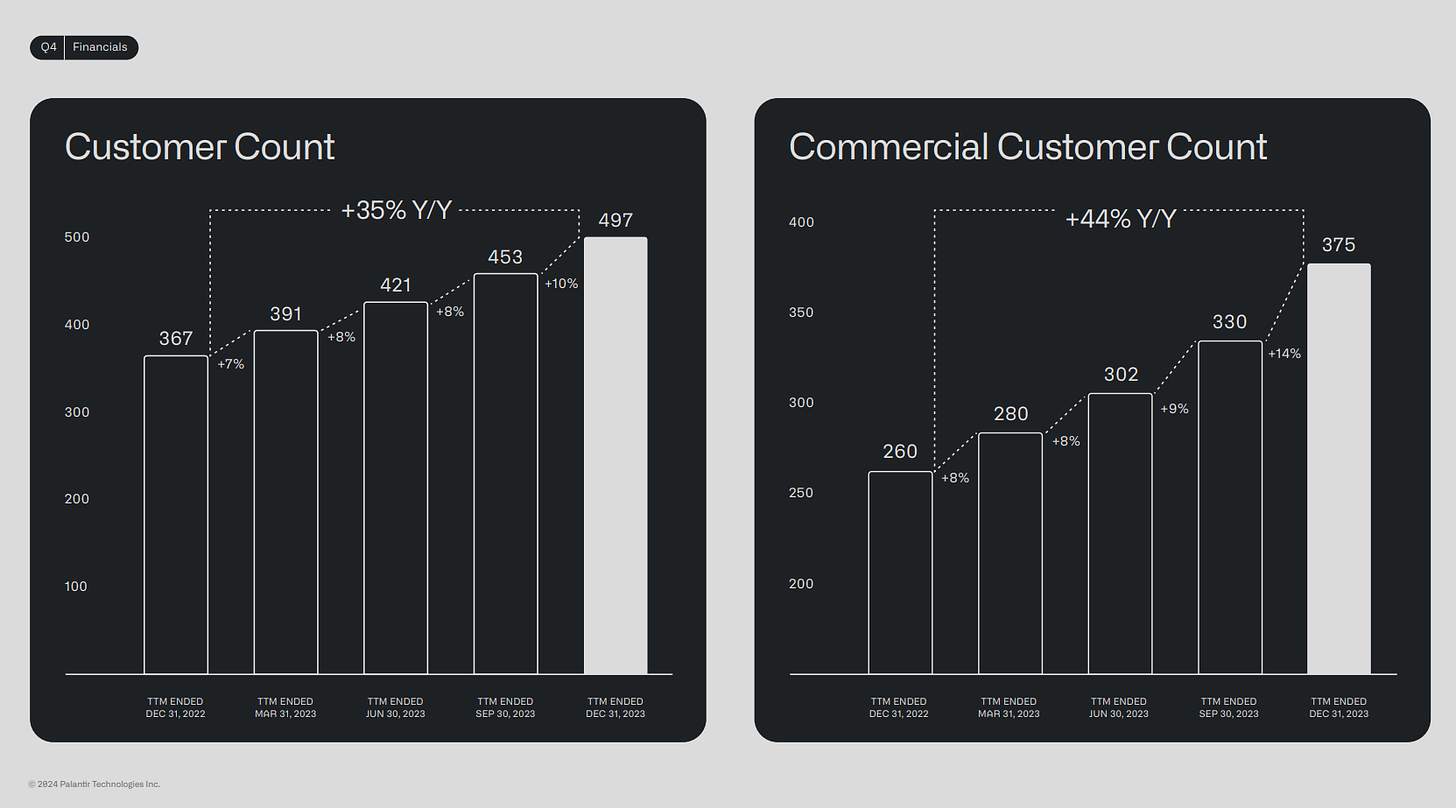

The improved unit economics also coincide with an acceleration in customer acquisition. Overall customer count is up 10% QoQ, which is a meaningful acceleration versus the prior four quarters.

The evidence for improved distribution is substantial. Once Palantir’s 10K is live, I would not be surprised to see contribution margin continuing to tick up for Q4 2023.

Meanwhile, Palantir’s GAAP profitability continues its positive trend, with the company renaming eligible to join the SP500.

Balance Sheet

A picture is worth one thousand words. Palantir’s balance sheet is strong.

4.0 Conclusion

In the past I have been critical of management’s upbeat tone paired with seemingly no progress on the distribution side. However, AIP Bootcamp anecdotes and favorably evolving metrics suggest that they had a reason to be excited.

I believe that, from here, Palantir’s customer-centricity and pace of iteration will soon help transform the company into a distribution machine. Meanwhile, they’ll continue to improve the underlying offerings.

Financials should improve in tandem. With just five hundred customers in total, Palantir has a very long runway ahead. In the coming year or so, as distribution efficiency continues to rise, I also believe we will see Palantir kickstart its valuable compute flywheel.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Very insightful and smart as usual. I like how you can think both really big picture about the vast potential of AI and also get into the details of the company and its model.. Long PLTR and PATH. I look forward to your take on PATH after they report.

Great insights! Further solidifies my investment in this company!