Ad: I’m selling 10 units of my 2 Hour Deep Diver course for just $150 (instead of $199).

By completing the course, you will emerge as a self-sufficient analyst with a distinct ability to do more research in less time, know when to buy or sell a stock and more easily spot undervalued companies, among other valuable skills that will help you compound wealth over your life, slowly.

More than 60 students have succesfully made it through the course to date.

No time to read the the update? Watch/listen for free:

Edited by Brian Birnbaum.

1.0 Uncovering Deeper Fundamentals

The contribution margin has accelerated meaningfully QoQ, implying exponential financial growth over the coming year.

Palantir is rapidly productizing its offerings, best evidenced by a rising contribution margin. Contribution margin is defined as “revenue less cost of revenue and sales and marketing expenses, excluding stock-based compensation, divided by revenue.”

Increasing contribution margin signals lower cost of deployment and therefore improved unit economics. As a leading indicator of profitability, all margins follow suit. Contribution margin is therefore the Palantir thesis’s most signal-rich metric: if it rises quickly, so too will cash flow production.

The above graph displays a trend reversal. In 2021, Palantir began onboarding smaller commercial clients, dragging down contribution margin. Palantir was yet to acquire the appropriate deployment mechanisms. With subsequent productization, however, the metric is now trending up again.

Per my original thesis, aggregate contribution margin has risen from 54% in FY2022 to 56% in FY2023. More impressively, the metric has risen from 55% in Q1 2023 to 60% in Q1 2024, implying a meaningful acceleration in the rate of productization. This matches management’s comments during the latest earnings call:

So, in one to five days with a bootcamp, we're able to do what used to take three months. And we're seeing customers shortly after bootcamp sign seven-figure deals.

-Ryan Taylor, Palantir CLO during the Q1 2024 earnings call.

As the bootcamps themselves are productized–thus enabling Palantir to conduct more bootcamps per unit of time–I believe contribution margin will accelerate further. I also believe we can already see this dynamic in this quarter’s acceleration. In Q1 2024 Palantir launched Build with AIP, which promises to assist in the productization of the bootcamps:

And we have started rolling out Build with AIP, a series of developer and builder-oriented tutorials and reference implementations that enable builders to ramp quickly on the primitives and power of AIP in practical examples that unlock every employee at every customer.

-Shyam Sankar, Palantir CTO during the Q1 2024 earnings call.

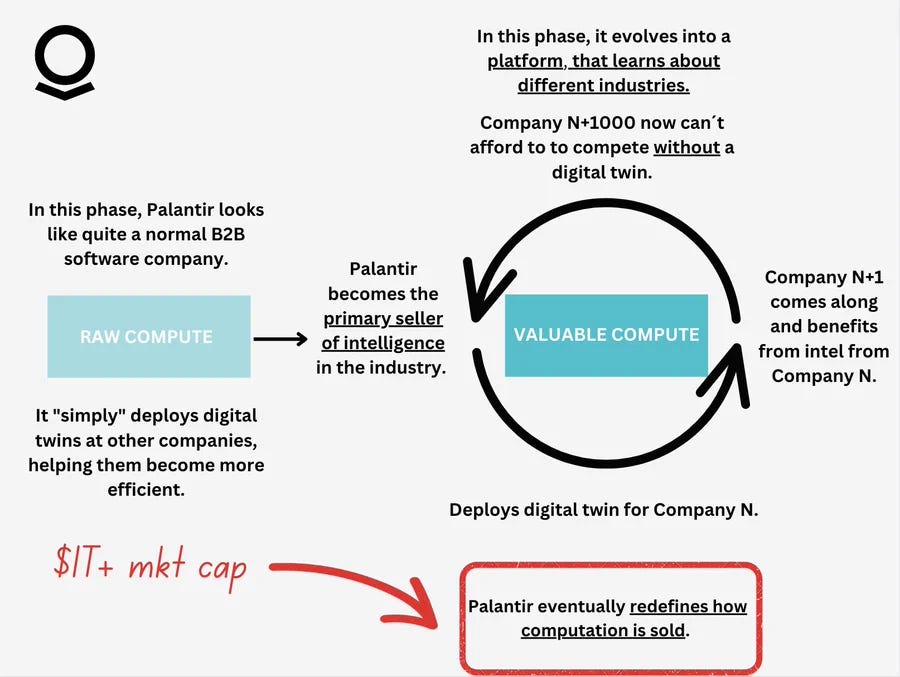

At the current rate of acceleration, the contribution margin will rise above 90% in the coming years and this will fundamentally change Palantir moving forward.

At 90%, seamless deployment will allow Palantir to drastically increase the number of customers per vertical, enabling a blueprint for scaling infrastructure that becomes accessible to companies N+1 and beyond.

This approach frees each subsequent company from purchasing raw compute and allows them to acquire computation tailored precisely to their operational objectives. Drawing a parallel to gasoline, this shift is akin to providing wildcatters with industrial drilling equipment.

This changes how computation is sold in the market and places Palantir at the top of the cloud compute funnel–in the fortunate position of being able to redirect prospective customers to the cloud hyperscalers. In time, this should proliferate Palantir’s operating capability and, thus, free cash flow levels per share.

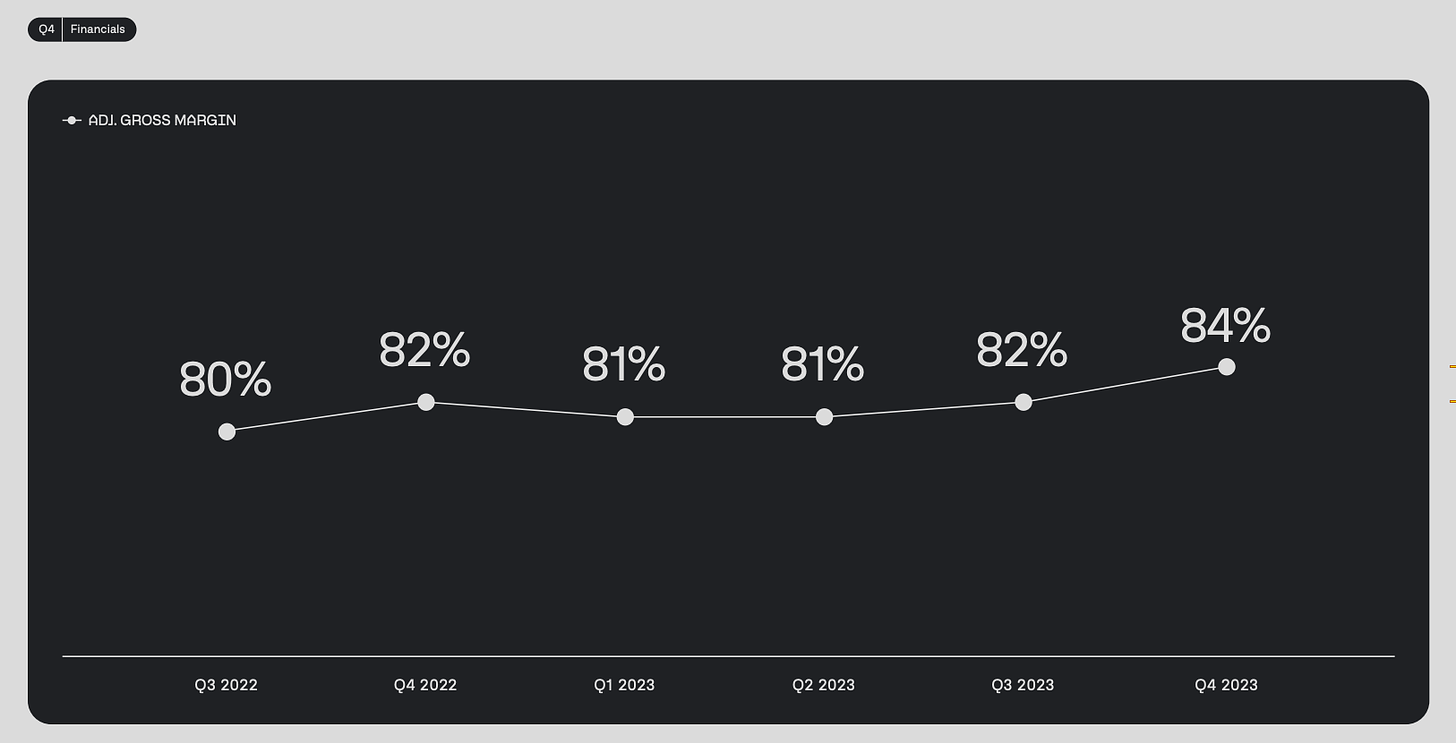

Led by contribution, the above explains why Palantir’s margins are now expanding across the board.

The graph below depicts adjusted operating margin up from 24% in Q1 2023 to 36% in Q1 2024. The next graph illustrates meaningful YoY gross margin expansion, from 81% to 84% from Q1 2023 to Q4 2023–although it is certainly disappointing that Palantir did not include this graph in Q1 2024, which would have shown a decline to 83%.

You don’t want to see management cherry-picking data. As with Warren Buffett, you want to hear them simply tell you what’s going on with the business and where it’s going.

Though certainly not a dealbreaker, I find that Palantir’s reporting falls short of its operational capability.

As further evidence of productization, US commercial customer count continues to grow, with total customer count up 19% QoQ, coming in at 262 clients. The fact that contribution margin trended down in 2021 demonstrates that onboarding new (and smaller) customers was taxing for Palantir. The trend reversal together with the rising customer count proves Palantir is meaningfully accelerating its deployment capabilities.

This evolution is also well depicted by the Rule of 40, which simply combines growth and profitability to provide a simple, single measure. The rule states that a SaaS (software-as-a-service) company's combined growth rate and profit margin should be at least 40%. The trend since Q2 2023 is remarkable.

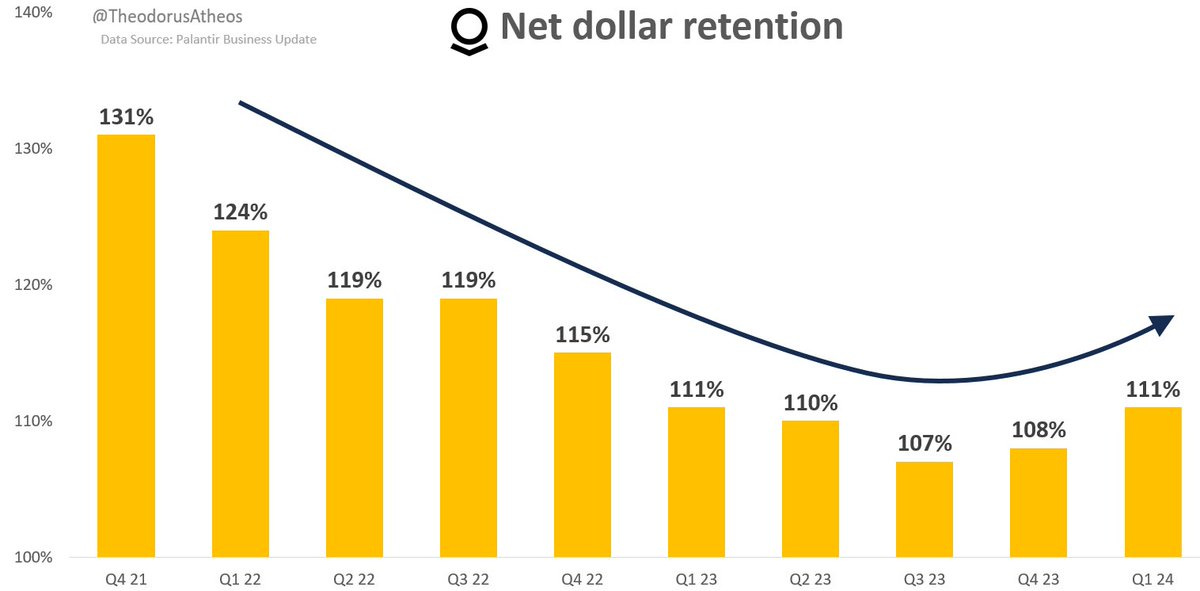

NDR (net dollar retention) came in at 111%, continuing the trend reversal which started in Q4 2023. This metric is laggy, however, because it doesn’t account for customers acquired over the last 12 months. Q1 2023 NDR therefore accounted for customers acquired in Q4 2021, which according to management drove most of the NDR expansion:

Net dollar retention was 111%, an increase of 300 basis points from last quarter.

The increase was driven both by expansions at existing customers and new customers acquired in Q1 of last year.

As net dollar retention does not include revenue from new customers that were acquired in the past 12 months, it does not yet fully capture the acceleration in velocity in our US commercial business over the past year.

-Dave Glazer, Palantir CFO during the Q1 2024 earnings call.

According to management, AIP Bootcamps are driving expansions with existing customers too. We should see NDR continue trending up as productization continues. Qualitatively, as deployments become easier, existing customers are more likely to increase engagement with the platform.

2.0 Conclusion

Deeper KPIs (key performance indicators) are always worth paying attention to.

Business is multi-dimensional chess. The most important moves can often seem the most benign. For Palantir, contribution margin is the leading indicator of all other metrics of financial performance. The acceleration in the contribution margin indicates that Palantir’s financials will improve rapidly over the rest of FY2024.

At the top of my watch-list is the productization of bootcamps. Continued productization will pave the way for non-linear increases in contribution margin and the ultimate goal of becoming a platform–and, therefore, a trillion dollar company.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Beautiful Analysis!!