This is an update to my original GoPro deep dive. Below, you can find the format of this post and as always, feel free to skip to any section of your interest.

1.0 Long Thesis Recap

2.0 Things I Didn´t Like

3.0 The Innovation Continues

4.0 TAM Expansion

5.0 Organizational Culture

6.0 Financials

1.0 Long Thesis Recap

Content is king and so content creation tools are in the money.

Hundreds of you have joined Investment Ideas just in the past month or two and so I thought that rehashing my long thesis on GoPro would be appropriate. GoPro is perhaps the most hated stock in the US market and is synonymous with just about every undesirable attribute of a stock / company. “Peloton is the next GoPro”. “This is GoPro 2.0”. Yet, the company is turning around brilliantly.

The combination of one of the stickier narratives in stock market history with a very unlikely turnaround has yielded the sort of investment opportunity that Benjamin Graham use to preach about in his day. A company selling far below its fair value, requiring no complex model of any kind to assert so. A value trap, you may be wondering?

Today, content is king and directly equivalent to cash. If you want to sell anything (online), you need to create engaging content to captivate potential buyers. Being a content creator is now a real job and if well done, a highly paid one. We all have a smartphone with an excellent camera, but content creators need specialized devices and they are willing to pay hefty amounts for the best ones, which GoPro happens to provide.

For instance, we all wear shoes day to day that are good for most things, but football, tennis and golf players need specialized types of shoes. Sure, you can go on a 10km run with some nice Italian leather loafers, but you will probably want some running shoes for your next run. The same happens with GoPro cams -smartphones are good enough for most of us, but the growing number of content creators much prefer GoPros. As a brief exercise, go on Twitch to see how many creators use GoPro cams.

In its transformation, GoPro has gone from only selling hardware, to selling hardware and digital services bundle via a subscription service. It has gone from being a hardware provider, to increasingly providing a content creation ecosystem, that makes life easier for content creators. This has put the company into great financial health with lots more to come, as content continues to gain importance in the world.

If you spend just 5 minutes looking at the company´s financials, you will see that the stock price has to 3X just to trade as if it were not dead. Most investors think the company is bankrupt and/or are scared away by the narrative, so the opportunity is sitting in plain sight.

For more details, I recommend you read my deep dive on $GPRO. Now, onto the earnings report.

2.0 Things I Didn´t Like

I picked up a small amount of potential misalignment between Nick and Bryan.

In the Q&A section, Nick and Bryan started speaking at the same time when answering a couple of questions. This concerned me, because the turnaround is largely based on two individuals being highly aligned and splitting their work as follows:

Nick sticking to developing the vision and maintaining the overall gravitas of GoPro (which is the company´s moat).

Bryan sticking to execution and financials.

It is not like I perceived a great deal of misalignment, but rather a very small sparkle of it at that particular moment. It seems that the execution continues to be excellent, so I am not very concerned at this time. Nonetheless, I will be monitoring this closely.

On a similar note, Nick went on a small rant about how GoPro did not discard selling different products in the future (not cameras) to the same customers it is catering to today. On the one hand, I think this spirit is the reason GoPro is innovating again, but on the other hand, the speech sounds a bit like the old GoPro:

I think that the above snipped triggered some panic amongst all the longs, but if you look at it dispassionately, every innovation that GoPro has released in the past years (subscription service and everything it involves, the new cameras etc) seems to be on point. In my deep dive, I noted how $GPRO was achieving its best metrics to date with its lowest R&D spend, signaling that something has really changed inside the company. I only see continued signs of this, despite Nick´s soliloquy.

3.0 The Innovation Continues

The cameras continue to show signs of superiority and the subscription business continues to grow.

GoPro´s turnaround has been facilitated by two key aspects of the business:

A focus on driving premium hardware renewal.

Its subscription business.

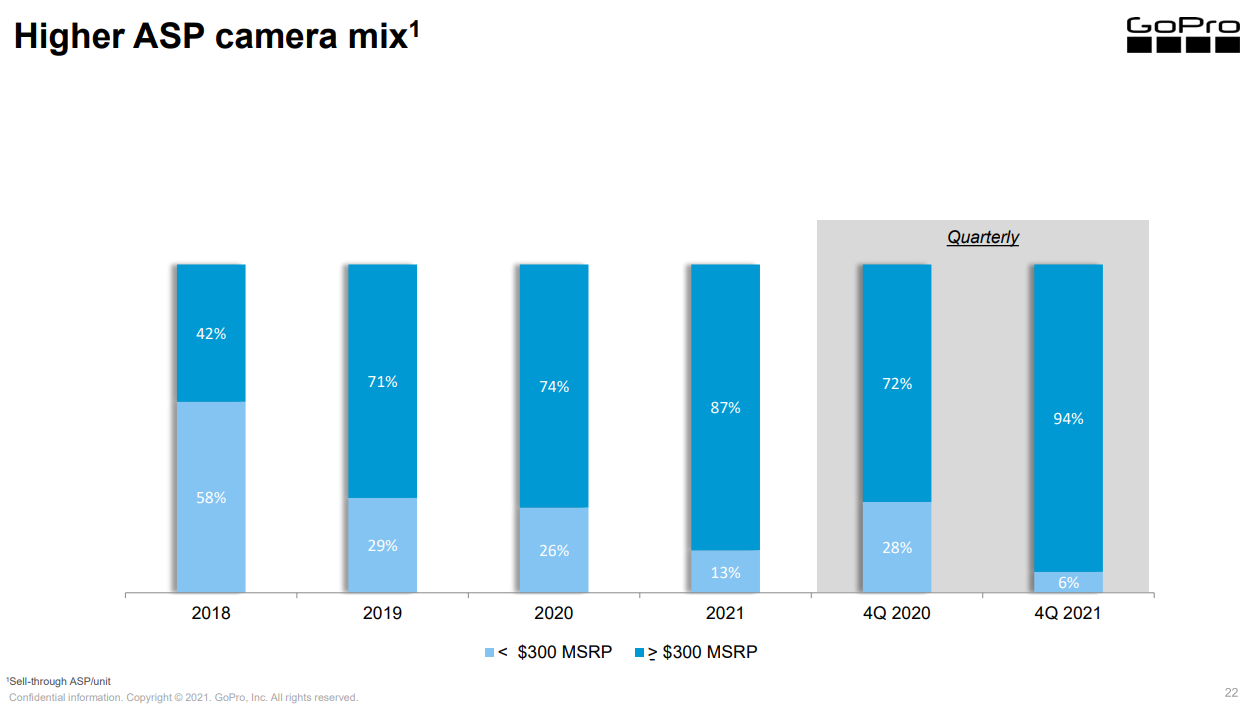

About #1, there is no question that the company is succeeding, with average selling prices consistently rising and the more premium cameras consistently taking on a larger share of the units shipped.

This quarter, we have seem the company launch its Hero 10 Creator Edition and the new Hero 10 Bones, which I will comment on in more depth on section 4.0. In Q1 2021:

Cameras with retail prices at or above $400 represented 92% of Q1 2022 camera revenue, up from 79% in Q1 2021.

Street ASP was $414, up 13% year-over-year.

Regarding pricing, management said that they have “already moved up the price curve. And if we try to move prices up, I think that's going to have a deteriorating effect on demand”. The forecast for Q2 and beyond factors in the price increases of inputs already and overall, I think the company is well set up to navigate the inflationary environment, specially considering the buoyancy of its subscription business, which is my next point.

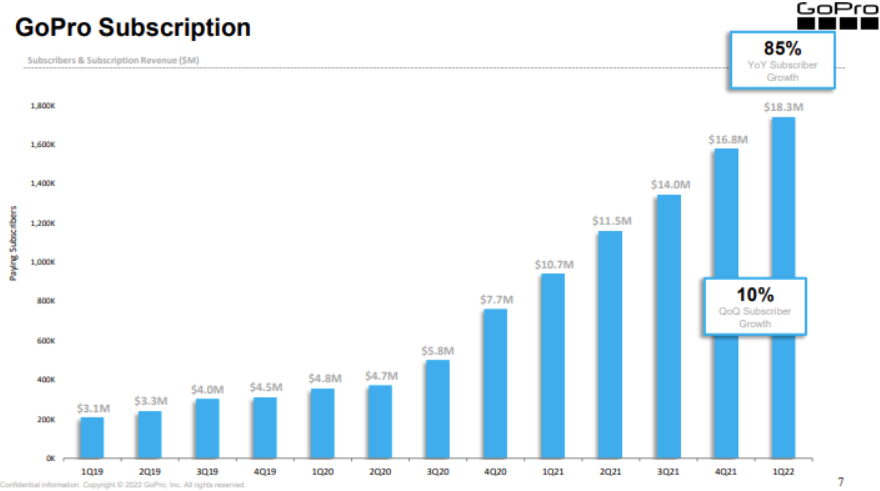

During the call management referred to its subscription business as the “financial engine of GoPro”. For 2022, management estimates that the company will do $80m in subscription and service revenue, at a 70-80% margin. As you can see below, subscribers are up 85% YoY to 1.74m subs.

GoPro funnels customers into its subscription service by offering a discount to buyers at gopro.com (D2C). The discount is the % of the sale that retailers would be taking if the product were not sold D2C. In this way, $GPRO is betting that customers will then choose to renew the subscription when it expires (it is set on auto-renew by default). Is this a fake subscription business?

At this point, management still does not disclose churn data, although they have said a number of times that the figures are quite good. Still, the best way to look at it is by qualitatively understanding the value proposition of the service. To me it seems like a no-brainer to creators. For $49.99/yr, you get:

Unlimited cloud backup + storage.

50% off in purchases at gopro.com.

No questions asked camera replacement.

Having talked to plenty of content creators, I understand that the deal is worth it on #1 alone. Others will say the same of #2 and/or #3. Either way, it does not seem far fetched to say that the above is worth it for $50 per year. During the call, management disclosed that 72% of users are uploading footage to the cloud. Check.

What is perhaps most interesting from this quarter regarding the subscription, is how they seem to have improved a lot at funneling customers into the subscription. Retail subscription attach rate (% of people that buy at retail and then get the subscription) is at 39% for Q1 2022, versus 18% at Q1 2021.

This is a phenomenal improvement, driven by “just getting the subscription and its benefits infront of people… into the Quik app, which is our GoPro app, and getting those benefits in front of users that have bought their GoPro at retail”. Management expects that this is “going to be dramatically improved later this year”.

GoPro has millions of followers on social media and content creation is becoming a very big industry. 1.74M subscribers is a little blip, when put into context. I like to see that the company continues to optimize its subscription funnel, because the runway ahead is long and it seems to me that content creation is going nowhere but up and to the right.

Another highlight in this part of this business is the launch of GoPro Player + ReelSteady desktop app, a powerful, yet easy-to-use desktop app with professional-level stabilization and 360 content tools for creators. Here we see the company continuing to provide top level tools for content creators, continuing its transition towards becoming a content creation ecosystem, versus merely a hardware provider.

4.0 TAM Expansion

As international travel returns and as the company continues to launch derivative cameras, we will see the top line rise.

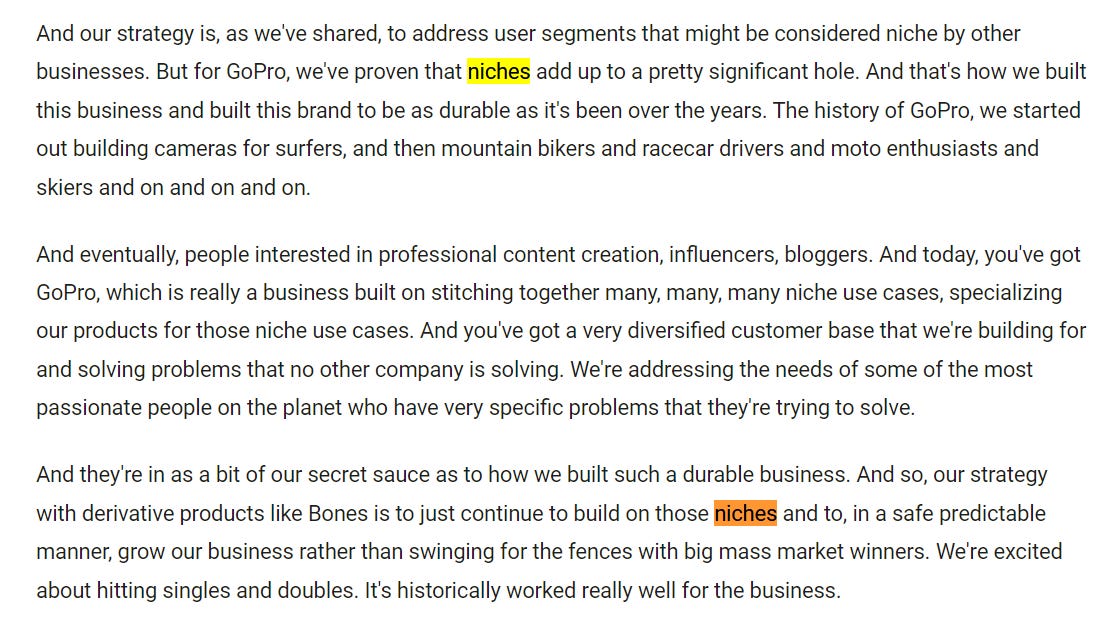

If you look at GoPro´s I/S, over the last couple years the turnaround story has been driven by cost optimization and the new subscription cashflow. Still, the market likes to see top line growth and now the company is onto it. During the call, I found interesting what Nick said about GoPro being a company that stitches up a wide range of niches.

The company´s strategy to expand its TAM is to super serve those niches and what we have seen with the new Hero 10 Bones cam seems to validate that. It turns out that the FPV (first person view) drone community has been buying Hero 10s, stripping them of pretty much everything but the components strictly related to imaging and mounting it on drones.

These people were buying fully equipped Hero 10s, with all these unnecessary components and here comes GoPro with a camera that specifically meets their needs at $399.99 (with subscription), which is around the same price as the Hero 10, but obviously with a much lower cost of production.

This is likely to not only expand the TAM, but also the gross margin of the camera business. It truly is a derivative camera, one that leverages GoPro´s existing platform to obtain more dollars at a marginal cost. This is quite a genius move by management and seems to be a continuation of what I have seen in the company in the recent years - very clear thinking and excellent execution. Gives me some perspective on the things I picked up on the call that I didn´t like.

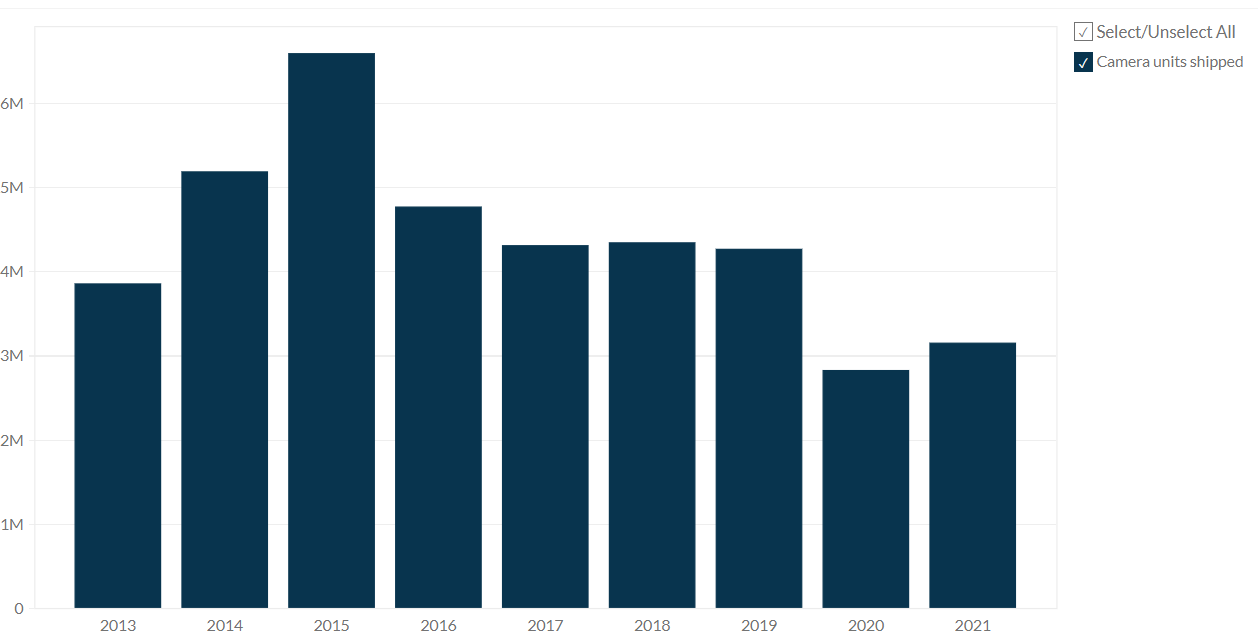

2014-2015 is the time that the market thought GoPro cameras were going to be ubiquitous, when smartphones did come in with good enough cameras for most applications. Since, however, units shipped have remained stabled until the pandemic hit. GoPro´s current financials are the result of international travel having been shut down, which is how they make a large part of their sales.

According to management, international travel returning has not been included in their forecasts.

“Yes. If -- we haven't factored in travel. Travel is up domestically in the U.S., but international travel has not picked up. So we don't have that market right now. That's been eviscerated once COVID hit. And so, as that comes back, travel represented historically, as we were running 4 million units, about 10% of what we sold. So it's a sizable tailwind, once that comes back.”

Management also said that we will see 3 new derivative cameras be launched this year. Bryan said in last quarter´s call that these cameras do not require much capex, so I view them as asymmetric bets to grow the company´s TAM. Either way, we have international travel returning at some point and these bets in the pipeline, so I believe we will see GoPro get back above 4M units shipped and continue to grow from there.

“ And so, our strategy with derivative products like Bones is to just continue to build on those niches and to, in a safe predictable manner, grow our business rather than swinging for the fences with big mass market winners. We're excited about hitting singles and doubles.”- Nick

Management is guiding for 3.3M units shipped this year. The increase is expected to be driven by the sales of new cameras:

“New products will drive most of the growth. On the new products, we'd expect the flagship and then there's one other which we have very good historical analytics on for driving demand. So that's why we're pretty comfortable with what the demand outlook would be between Q3 and Q4. Obviously, the older cameras still play a role 10, 9, and a bit of 8 and MAX, which has continued to do really well.

So the new products are more mass appeal versus more initially like the Bones.”

It also seems that the new derivatives will not be as niche as the Bones.

5.0 Organizational Culture

Employee retention is high and that makes the turnaround sustainable.

There is very little information on how people work inside GoPro, but one thing you can tell is that what they do is totally aligned with why and how they do it. I have written about this a number of times, but this creates gravitas, which has all sorts of benefits.

Fundamentally, gravitas makes customers and employees more loyal. It yields an air of coherence which people tend to feel very attracted to. If you look at its marketing and its products, it probably is the best company at evangelizing people in general after Apple.

During the call, Bryan made some remarks about employee churn which I liked.

“It's worth noting that we were named the number one large employer by Outside Magazine. Part of the reason for that -- well, there's lots of reasons, but you mentioned merit. We actually did a pretty sizable merit increase to our employee base. This year, it was, I think, double what we've typically done.

That's factored into our guidance of $340 million to $345 million of opex in the year as well as any inflationary aspects to the business -- contained in there. I'd also point out that it kind of goes with the number one large employer, retention rate with employees globally has been exceptional. And that's been great, great teamwork, great continuity. And we're really, really pleased with retention rate.”

Outside Magazine has around 3.4M active readers and they are all the GoPro / Patagonia / Rivian type. People of this sort like to work at GoPro because it is fun and it is totally aligned with the lifestyle it sells. GoPro is a place I would happily work at, because I love being outdoors. Do you see where I am going?

At this stage of the turnaround, OPEX has been under quite a bit of pressure and that would tend to upset people at the company. Your friend gets fired. Your mountain biking buddy gets fired etc. Still, the reviews in Glassdoor are going up and not that they are a definitive signal, but the little bread crumbs tend to point to GoPro being a good place to work. This is also indicative of excellent management.

This makes all the difference because if financials are excellent but the human capital is under pressure, then the turnaround is unsustainable. GoPro needs to take care of its talent so that innovations continue to flourish and it seems like they are doing so. The innovations it is pouring out can only come from people that love what they do, that understand the customers really well. I like what I see.

6.0 Financials and Guidance

Doing just fine.

Gross margin came through at 41.76% for the quarter, up from 41.18% last quarter. Gross margin has been ticking up very nicely since back in 2019 (212.68% at Q3 2019, for example). The income statement is healthier every time I look at it.

The company also paid down a $125m convert, leaving it with $305.3m cash and just $140.3m in debt. The balance sheet looks rock solid. On the other hand, free cashflow has come in at $(75.9)m. Q1 is a weak quarter for GoPro historically in terms of units shipped, because people do not buy many cameras during that time. I think we will continue to see healthy FCF generation during the remainder of the year.

“Ironically, we made over $150 million of cash flow in the last year and that enabled us to tidy that up and pay it off. We do expect cash to end the year between $450 million and $480 million. And we'll exit this year -- or exit Q2 at about $330 million. So as a typical, in the second half, we generate most of our free cash flow.”

Today, $GPRO trades at $1.125b, so by year end the company will have nearly 50% of its market cap in cash. If we see it trade lower in the coming months, the arbitrage will be all that more pronounced.

About guidance, management is guiding for a 17% sequential increase in units shipped (675,000), which seems to be a decline on a YoY basis. I do not see a concerning dynamic here and further, Bryan pointed out that channel inventory (cameras on shelves) will also be down next quarter. This is important, because a lower channel inventory translates into a non-linearly higher inventory acquisition by retailers - they want to be stocked.

The key thing is, going forward, that GoPro continues to output innovations that customers actually want in a cost effective manner. So far, there are no signs of the company doing otherwise and for this reason, I consider the bull thesis to remain unchanged.

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Hi Antonio, thanks for putting out this deep dive! I like GoPro both as product and company. I'm not a content creator and also not super outdoorsy, my wife and I usually just use GoPro (Hero7 and Hero10) to record fun moments that's it. I found the $49.99 subscription really good deal and like you said, even just the "Unlimited cloud backup + storage" worth the price. It's really smart that the management decided to give huge discount if you purchase with subscription. GoPro videos usually have super large size, auto-upload to the cloud during charging is really convenient and won't crash my computer storage during file transfer. With more photo/video upload to GoPro+ I don't see myself cancel subscription anytime soon. I would bet the churn being very low going forward.