Note: to better understand this post, I suggest you check out this other post in which I explain the key tech advancements in the synthetic biology space, if you have not already.

Summary:

DNA 0.00%↑ is developing a potentially world class moat in the synthetic biology space, which I believe will be very relevant in the future.

Today´s financials and business dynamics (an unclear customer acquisition strategy, notably) make the current valuation seem stretched.

Despite the valuation posing some considerable downside in the short term, today´s valuation may look very cheap in 10 years time.

Introduction: a genomic knowledge compounding machine in its early phases.

Below, I am going to walk you through why I believe Gingko Bioworks ($DNA) is likely to be a world changing company. I may be wrong, however, but the least you and I will gain from this deep dive is an improved and early understanding of a new technological landscape that is likely to permeate and revolutionize our economy, much like digital technologies have done so. Going forward, the key principle that will increasingly rule our world is that we can now program biology, the same way we can program computers. In the last decades, we have gained the ability to read, edit and write genetic code, which is the code from which our entire biological reality emerges. As such, we are now increasingly able to harness biology in our favor, enabling us to go from being subjects of biology to co-creators. In $DNA´s words, “programming biology is to the physical world what programming computers is to the information economy”.

Up until recently, biotech was predominantly about companies working on developing a single product, which would then vertically integrate if succesful. From an investment point of view, this kind of set up presents much risk, because it is hard to predict what products will be succesful. Advances in synthetic biology and data analysis, however, have yielded a scenario in which we can now build democratized platforms to innovate on at decreasing marginal costs. $DNA is effectively a horizontal platform, that enables anyone with little knowledge of the domain to synthesize a protein of choice. In other words, this platform enables anyone to operate in the synthetic biology space, much like AWS enables anyone to deploy world class apps, independent of technological advances and disruptions in the different enabling verticals. AWS clients do not worry about advancements in semiconductors. AWS abstracts that away, the same way $DNA abstracts advances in gene editing away, for instance. For this reason, $DNA presents an unusual risk profile in the biotech space.

Everytime $DNA serves a client, it stores information on how to best synthesize a given protein. As such, it builds a library of renewable genetic parts, which is likely to compound over time and eventually capture a significant portion of the world´s synthetic biology knowledge. The best analogy for this is perhaps $GOOG, which gets smarter every time a user searches for something and clicks on a result. 10 to 15 years down the line, $DNA´s moat could be as unassailable as $GOOG´s, because it would be very hard to catch up with them.

To understand the value of this moat, consider Stephan Bancel somewhat involuntarily and partially owning the markets as of late, because he effectively is the spearhead of mRNA technologies today. Yesterday he (is quoted to have) said the new COVID variant is likely to decrease vaccine efficacy and so markets have scrambled. This is just the beginning, as we continue to make our way into the genomic layer of reality. Money and power will accrue to those that know their way around the genome best and $DNA is a genomic knowledge compounding machine in its early phases. Let me take you through the details now.

Understanding Gingko Bioworks

As mentioned, at its core $DNA offers clients the ability to synthesize proteins. Ultimately, clients choose to synthesize proteins through $DNA because said proteins are cheaper and/or offer functional benefits over existing alternatives. For instance, Motif Foodworks is able to offer new meat, dairy and plant-based proteins via Gingko Bioworks. For every client, including Motif Foodworks, $DNA goes through the following process, in very broad terms:

It synthesizes a series of genomic sequences, that are estimated to code for the protein the client wishes to obtain.

It inserts each genomic sequence into a series of cells (most typically different yeast strains).

The cells, with the genetic information embedded, then produce proteins.

It then analyses the results obtained and repeats until the desired protein is obtained. It also performs the analysis at the metagenomic level, meaning that it is able to catch details that would otherwise be missed.

If the client chooses so, $DNA can take care of protein manufacture at scale.

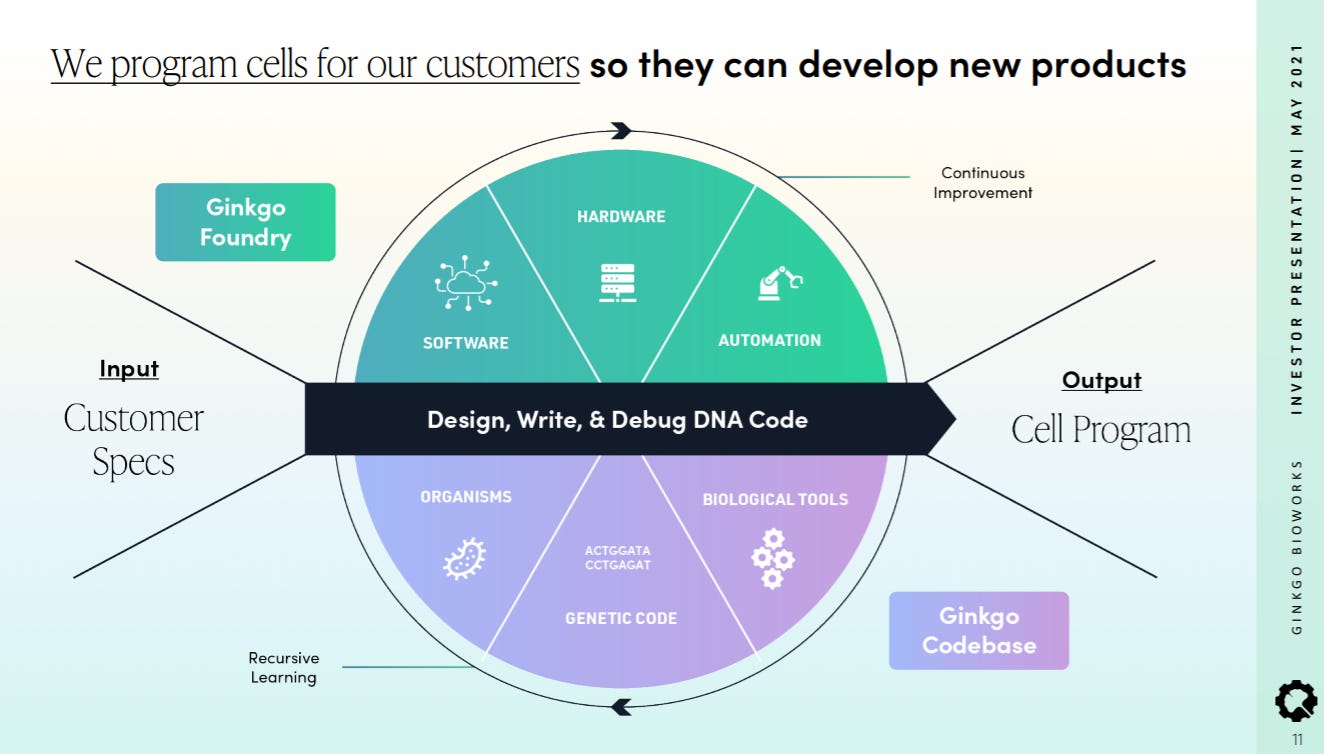

$DNA´s value stems from its ability to do the above at a decreasing cost, ultimately attracting more clients and getting smarter as a result. This drives a flywheel of decreasing costs and increasing efficiencies, which if well executed, I expect to translate into a very strong moat in the future. The above is facilitated by two core assets:

Foundry: a system made of proprietary software and hardware, that allows $DNA to maximize the throughput of steps 1-5 outlined above. You can basically think of it as a factory that strives to perform steps 1-5 as quickly as possible, in the highest volume possible. $DNA acquired Gen9 in 2017, enabling it to synthesize its own genetic code> key for its supply chain independence.

Codebase: the library of reusable genetic parts, which maps genomic sequences to functional data (i.e. how the resulting protein actually behaves). Codebase is data analysis at its finest, to assist in figuring out the best way (cheapest, fastest) to synthesize useful proteins. $DNA acquired Warp Drive Bio in 2019, to onboard its genome mining platform.

The faster Foundry gets, the smarter Codebase gets. The smarter Codebase gets, the more efficient Foundry gets, since it can use cheaper and faster metabolic pathways (different ways to obtain a protein in question).

Although $DNA was founded in 2009, we do not have a large body of data to illustrate the above. We do have the following datapoints, however:

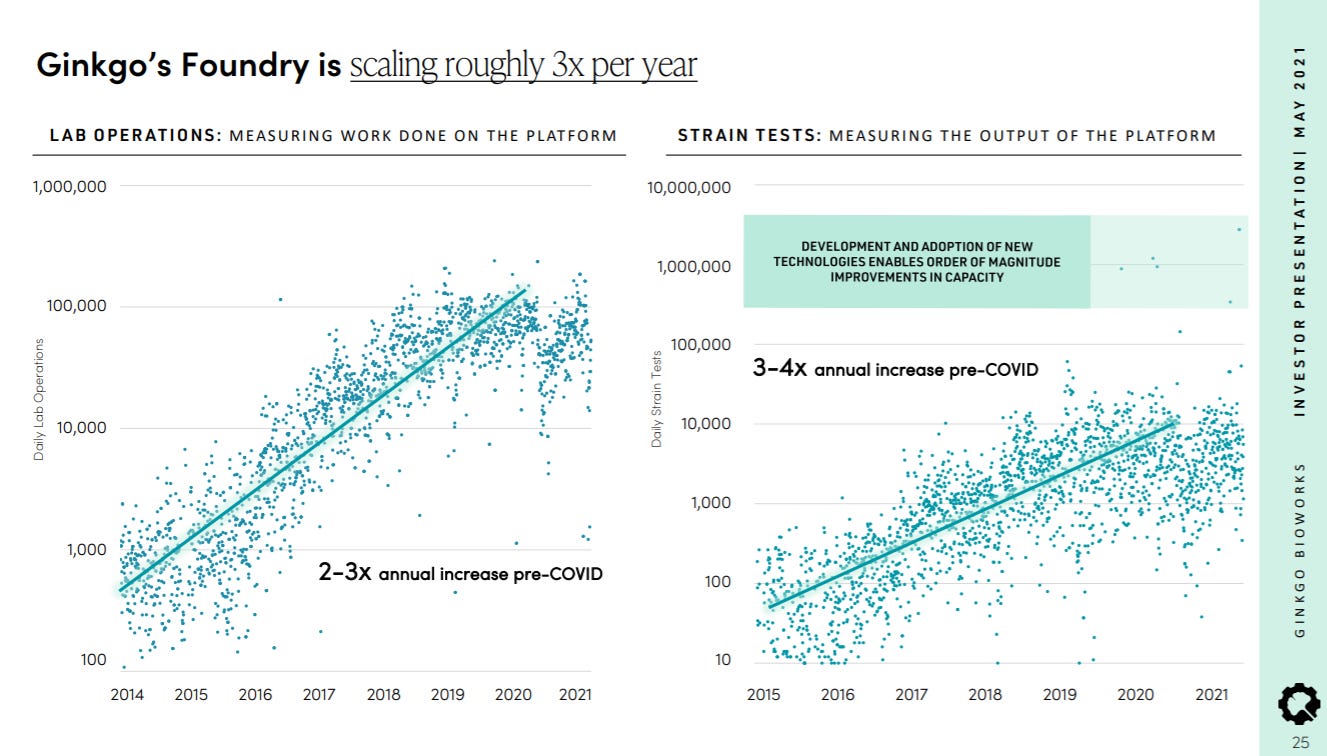

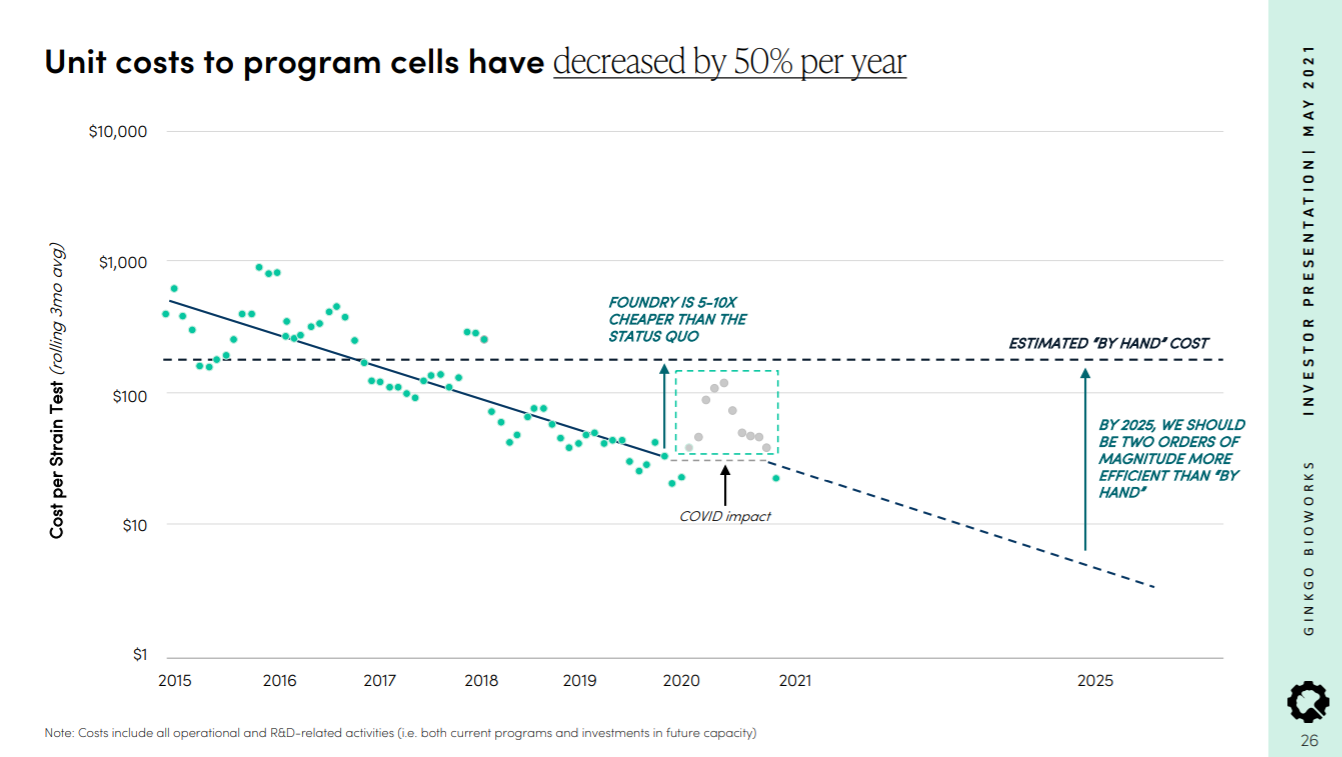

$DNA has 3Xed the output of Foundry yearly since 2015, the time at which they started measuring it.

Since then, the average cost per unit of operation has fallen by approximately 50% every year.

The two dynamics above are essentially coming together to produce the genomic knowledge compounding machine I was describing earlier on in this post, so long as new clients keep coming in.

A very interesting idea here is that because the platform is designed to make biological information useful and because its enabling components are biological in nature, the platform can eventually be pointed at itself and it could eventually figure out better ways to do things like edit, write and read genes, for instance.

The question is, however, where is this all heading? What could be a mature expression of this flywheel a decade or two on? If you think about yourself, for instance, you are entirely an expression of your underlying genetic code, including your brain, which is perhaps the greatest mystery in the known universe. This being the case, there is no theoretical limit to what we can produce through synthetic biology and how many industries can be revolutionized. Our industry is incapable of producing something as complex as the brain, so surely biology presents a quantum leap in this sense. For instance, McKinsey estimates we can synthesize 60% of the physical inputs to the global economy. Synbio presents a fundamental paradigm shift in terms of how we produce abundance. Our current systems are extractive and pollutant, whilst synbio is renewable and cooperative with nature by default.

Business Dynamics

Whilst the above is indeed an exceptional moat in the making, current business dynamics are foggy, although they are worth tracking them through time. How $DNA intends to accelerate the acquisition of new clients is unclear to me, as has been the case with $PLTR until they have launched Foundry for builders (not to confuse $PLTR´s foundry with $DNA´s). Once customer acquisition becomes clearer, I believe $DNA´s business dynamics will take on a good shape.

Revenue Breakdown

$DNA now has 2 distinct business lines:

Foundry: figuring out how to synthesize / actually synthesizing proteins for clients.

Bio-security: selling COVID19 end-to-end diagnostic tests. Started in Q2 2020.

For #1 $DNA makes money by charging fees and/or capturing downstream value in the client´s business, via equity stakes or royalties, for instance. For #2, $DNA charges per diagnostic test it serves. It seems that #2 has outpaced #1 in a short amount of time. It must also be noted that $DNA expects to capture much of the value from #1 through its equity stakes, which would accrue straight to the bottom line in the future, although this also remains highly uncertain.

Key Metrics

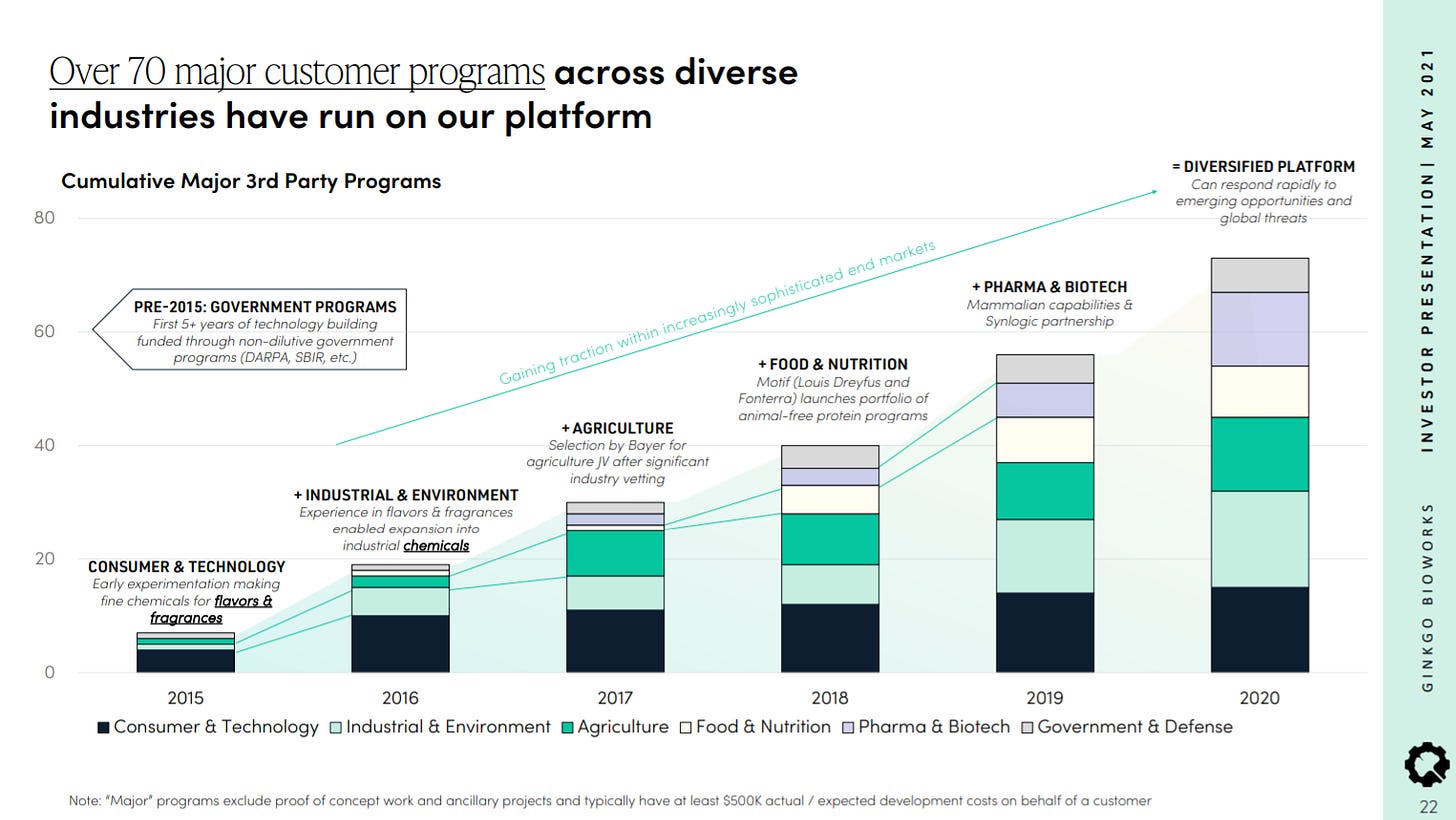

Regarding cell programming (foundry), $DNA seems to be experiencing growth. Most new customers are little known brands, which makes one wonder whether these little brands will keep popping up in the future. I have heard the CEO Jason Kelly say numerous times that he expects Foundry growth to be driven by startups. I read “the Code Breaker” by Walter Isaacson earlier this year and in one of the chapters he paints the idea of a possible future in which bio hacking becomes as mainstream as the hacker culture is today, in the digital space. I see this happening, but I would not be taking an investment decision based on that alone today.

What does seem likely to take off is bio-defense. The world is now subject to disturbances caused by genomes, since:

We have a pandemic going on.

It is relatively easy to synthesize another virus and simply release it into the world.

Whilst it has been largely taboo to discuss potential non natural origins of COVID19, the truth is that given today´s genomic technologies it would be all to easy for such a virus to have emerged artificially. We need bio-defense urgently and naturally, $DNA´s Foundry + Codebase combo is a very valuable asset in this space. Still, unless there is a clear demand stream for cell programming, $DNA is going to struggle.

What is also true is that $DNA has seen clients from a growing diversity of industries since 2015 and this points to the underlying reality that indeed programming biology is a key advancement in the physical world. Again, this is nice to see but still does not shed any light on how the company is going to be accelerating customer acquisition.

Use Cases

There are many ways that $DNA can help its customers and for this reason, I believe that in time they will fix customer acquisition. One such use case is enabling a given crop to pull nitrogen directly from the air, reducing its need to fertilizer, which not only increases crop yield but also decreases greenhouse emissions. At scale, this would imply a 5% of greenhouse emissions and savings for farmers. $DNA aims to do this by employing specific genes in the microbes that surround soybeans and then inserting them into microbes that naturally surround a crop in question.

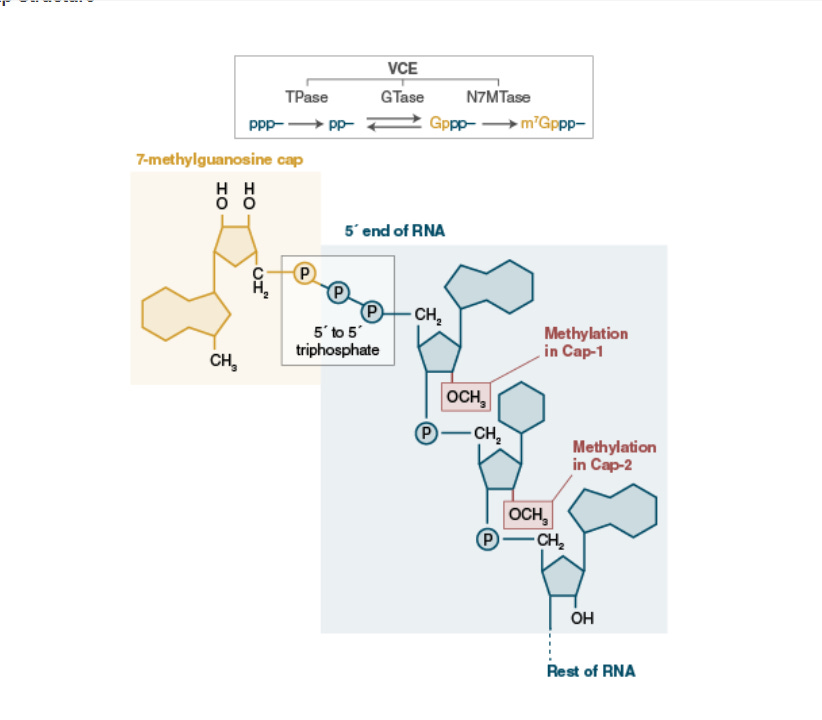

Another interesting one is that $DNA´s collaboration with Aldevron produced a manufacturing breakthrough (10 times more efficient that previous methods) for vaccinia capping enzyme, which basically enables the RNA code of COVID vaccines to work inside the body. Without it (the component in yellow below), vaccines do not work. Clearly, $DNA has the ability to tackle many of today´s big problems.

Competitive Advantages

$DNA is the result of the confluence of automation, data science, genomics and arguably, mass spectrometry (a way of analyzing molecules). Putting this tech stack together is very complicated and for the entire stack to be competitive in the marketplace, you need to run it for some time in order for it to get smart enough to decrease costs and ultimately, attract new customers. This requires a considerable investment and so this puts up a high barrier to entry for $DNA´s business.

The company claims that the current competitive landscape is slim, with the main competitor being their customers´own labs. $DNA could really capitalize on this by accelerating (again) customer acquisition. However, by the time they have figured it out and / or the market is ready, more competition may have emerged. Although it is complicated to replicate $DNA, I would not say it is impossible and even less so given the size of the potential price down the line.

Framing a Potential Investment

I consider $DNA to be forming a very strong moat in a space that is going to define the history of our species. Synthetic biology is going to be a very relevant space and the combination between Foundry and Codebase is very promising. I see a mini synbio AWS / Google search engine in the making.

However, I have a slight issue with the current valuation and there is not too much data to look at yet, including a balance sheet it seems. The company is currently valued at 17.6b$ as I am writing this post and in the TTM it has only grossed in 76.6m$. This means it is currently trading at a P/S ratio of 229. Now, this arguably is not the best metric to look at the stock, because the value of the platform that it is building could be much larger in the future and it is at the very early stages, but I believe the stock per se could be a little pop away from trading lower to more reasonable valuations.

I have realized that it usually takes me a while to really lean into a stock (or not), after I have done the first deep dive on it. The way I am going to approach $DNA is to continue learning about it and possibly average into it slowly over the next 6-12 months, if I do see a path to accelerated customer acquisition.

I guess what I am looking for in $DNA is a $SPOT-like situation, in which I see a customer acquisition machine with steady growth, that is very good at transforming each new customer into incremental value for its platform, with the market not fully understanding or pricing it in for whatever reason. I will be following the company closely and will be posting new updates on what I find in the hope that at some point business dynamics will clear up and Mr. Market will find a way to get sad about it.

In summary, I believe that today´s 17.6b$ market cap presents meaningful downside in the short term, but in turn, if management executes well, is likely to seem like peanuts in 10 years time or less. $DNA is likely to be an AWS / $GOOG in the future, but in the synbio space.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

D0 you consider AMRS to be a competitor? They have a similar foundry approach and have produced useful molecules at scale - for example, squalane (sharks liver oil) used in cosmetics, and a sugar substitute that I have actually tried - dissolves in cold brew coffee rapidly, which is a nice feature for me.