Edited by Brian Birnbaum.

This is an update of my original Blackberry deep dive. And here is the last quarterly update.

Blackberry continues to be uniquely positioned for the inevitable convergence of IoT and cybersecurity. For whatever it is worth, McKinsey estimates a $750B TAM and, as many of you know, I think it will dwarf chips over time. The distribution moat on the IoT side continues to get stronger, and on the cybersecurity side, Blackberry seems to be fixing the issues that were previously impeding growth. If Blackberry continues to advance in this manner, success is only a matter of time.

In my Crowdstrike deep dive I outlined how cybersecurity is now a function of getting more data than anyone else and then training an AI to keep the bad guys away. Blackberry´s dominance on the IoT side is in effect a highly moated data pool that, down the line, will likely enable them to train the best cybersecurity AI models in the space: unless you breach the moat, you cannot train the AI. In general, it also turns them into the gatekeepers of emerging data value chains across multiple sectors, like auto and medical.

1.0 IoT

The IoT division continues to get stronger every day.

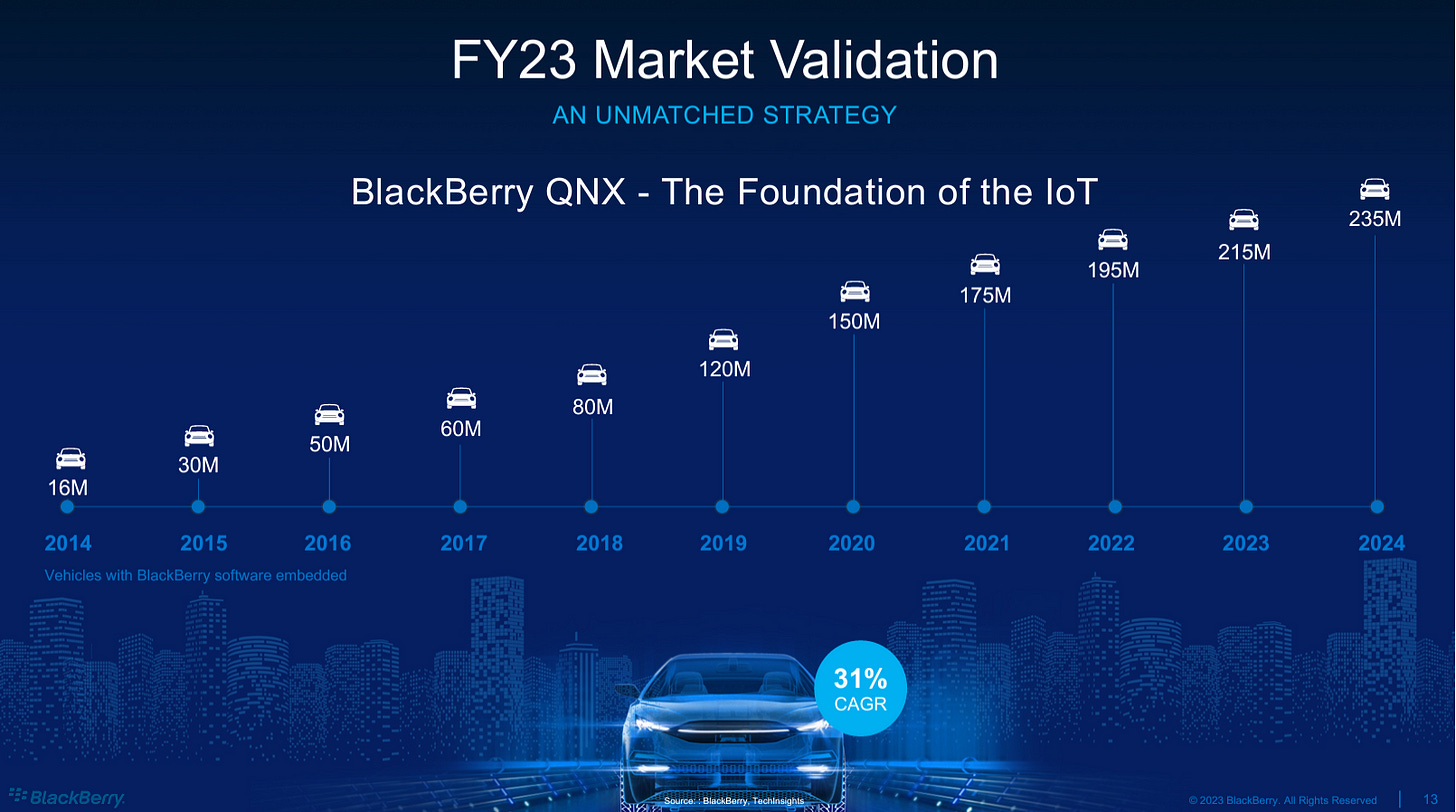

QNX continues to grow favorably, with 235M cars on the road running the operating system (note: Q1 2024 is the latest ER call). In this domain, Blackberry experiences ebbs and flows–and yet the market only seemingly extrapolates the ebbs. In the meantime QNX just keeps on growing over time. This quarter, we saw revenue come in lower than expected with OEMs allegedly revising and delaying their development plans as they “step up their software-defined efforts.” I continue to focus on seeing the forest through the trees.

During the quarter, Blackberry extended its lead in design, scoring two wins in particular that rank among “the Top 5 global automakers”:

“The first win includes our real-time operating systems, as well as our Hypervisor and acoustic middleware.”

“The second win would deploy two instances of QNX supporting the digital cockpit and main body domain, both running on high-performance compute engines.”

Further, I have never seen John Chen underspeak. When he increases the confidence in his tone, it tends to have a near 1:1 correlation to the improvement in fundamentals. IVY became generally available this quarter and on the matter, Chen said:

“ […] IVY is quite unique right now in the market. The competition that we run into is the customer themselves.

Some of them already decided that they are coming with us, so that's to the extent that I could comment on.” - John Chen, CEO during Q1 2024 ER.

2.0 Cybersecurity

The division is now growing with key issues well on their way to resolution.

The cybersecurity division is beginning to display clear signs of traction:

Revenue for the quarter was $93 million, representing 6% sequential growth.

Total Contract Value (TCV billings) grew for the fourth consecutive quarter with 14% sequentially and 37% year-on-year growth.

Previously, Blackberry was experiencing two major issues which impeded growth:

They were seeing churn on the SMB side for unified endpoint management (UEM), which “allows IT to manage, secure, and deploy corporate resources and applications on any device from a single console.” It basically allows companies to not get hacked via a smartphone within the network, for example. This has now been “stabilized”.

They were also having trouble on the go-to-market front with Cylance. Apparently, this has now been fixed.

“[…] the Cylance product line, as you know, we were having trouble integrating it and we did integrate it and then we caught up on the EDRs' technology.

We're now winning bake-offs.

So, we are comfortable with that and the customer is seeing that. So, our renewal rates are now trending up nicely and [we are] winning new logos by replacing, kind of, the legacy folks in the SMB market and that's why I also commented on the channel.” - John Chen, CEO during Q1 2024 ER.

The pieces of the puzzle seem to now be in place to deliver ARR growth going forward, which Chen reiterated will occur in H2 FY2024.

3.0 Licensing

Blackberry can now focus on IoT and cybersecurity exclusively, with plenty of additional dry powder.

Chen has once again proved that he is a superb manager with the recently closed patent sale deal. It took some time, but it is a much better deal than the previously lined up one with Catapult:

The deal includes an initial $170 million cash payment, which has been received.

The deal value could total as much as $900 million over time.

The deal allows Blackberry to retain revenue from any pre-existing licensing agreement, which is phenomenal. This quarter, revenue was $17M and for the remainder of the fiscal year, management expects it to be $5M per quarter.

4.0 Financials

The cash from the deal greatly derisks the Blackberry thesis.

Income Statement

SG&A expenses came in at $98M, levels not seen since August 2021 and R&D expenses came in at $54M, up from $48M last quarter. It seems that OPEX is going up as Blackberry pursues IVY.

Cash-Flow Statement

The patents added considerable buoyancy to the cash-flow statement, with cash from operations coming in at $99M. The remainder of the cash from the deal is likely to act as a tailwind going forward.

Balance Sheet

Cash and short term investments came in at $516M total, with $389M in debentures (average maturity 11/2023. The latter are accounted for as current liabilities, which Blackberry is now equipped to pay off comfortably.

5.0 Conclusion

My confidence in Chen´s leadership has been renewed with the closing of the patent deal and I continue to see both the IoT and cybersecurity divisions advance well. I believe that the world vastly underestimates the implications of merging IoT with cybersecurity and I very much look forward to seeing Blackberry capitalize on it.

Going forward, I remain focused on evaluating IVY´s progress. Blackberry needs to now demonstrate that it can yield operating leverage over its IoT base. Once an organizational ability emerges on that front, the sky's the limit.

I believe we are at the end of the beginning and that Blackberry is gearing up to take off.

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Hi Antonio,

I’m confused about your tweet today on Tesla FSD and competing with bb...I.e busting the thesis.

Why does blackberry care if FSD is bought from Tesla or Nvidia Drive or Apollo etc...

If Tesla sells its FSD to the market, I understand it to be above the foundational RTOS lower stack stack where qnx lies and doesn’t affect IVY either since this is and edge compute platform for a number of different apps unrelated to FSD. What am I missing? Really appreciate your writing, cheers.