Edited by Brian Birnbaum and an update of my original Blackberry deep dive.

In Section 1.0, I go through my Blackberry thesis.

In Section 2.0, I analyze Blackberry´s IoT division.

In Section 3.0, I analyze Blackberry´s cybersecurity division.

In Section 4.0 I analyze the company´s financials.

In Section 5.0, I conclude the write up.

1.0 Thesis Re-Cap

Blackberry QNX is the most undervalued tech platform on Earth.

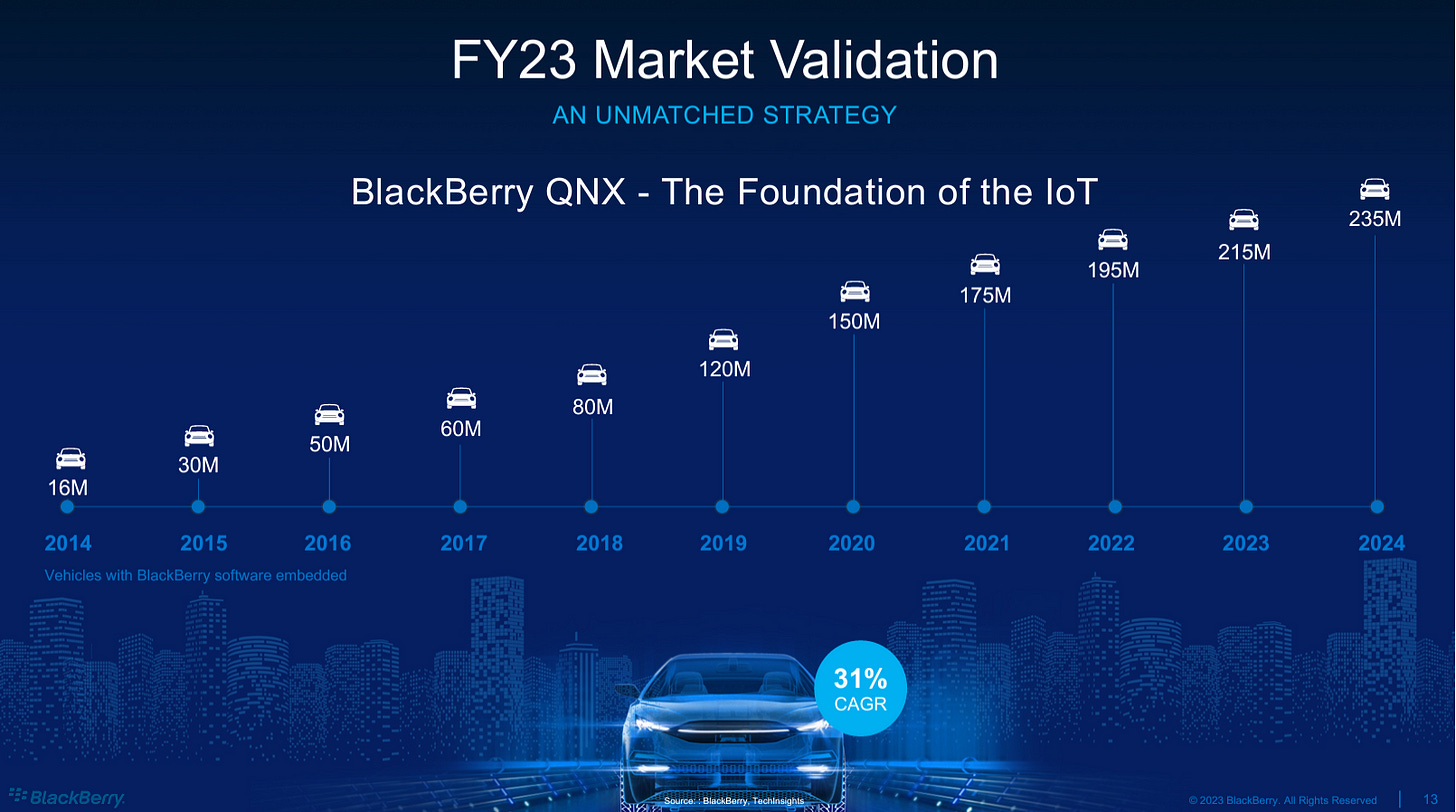

Blackberry´s real-time operating system, QNX, is installed in 235m+ cars on the road today, with all major OEMs (including the new EV OEMs) except for Tesla onboard. Blackberry currently monetizes QNX via a one-time fee per car, thus the business exhibits little operating leverage. However, with cars becoming more and more defined by software, QNX stands as the gateway to an emerging multi-billion-dollar data value chain.

Cars generate inordinate amounts of data. Capturing and processing it can unlock valuable insights for all stakeholders along the auto value chain. Blackberry IVY (which became generally available in May) is a platform designed to do just that. Ivy is, at its core, an app store for cars that abstracts away the complexity of managing the data value chain for OEMs.

By enabling a higher level of monetization per unit of QNX, IVY has the potential to meaningfully increase operating leverage for Blackberry.

Blackberry also fields a cybersecurity division, Blackberry Cylance, an XDR solution. Cylance scarcely seems competitive compared to Crowdstrike and Sentinel One. However, by extending the reach of its RT-OS (real time operating system) QNX, Blackberry has created distribution infrastructure it can use to preferentially deploy its cybersecurity offerings.

As with so much AI-driven software, XDR aims to deliver higher quality, leading security by aggregating the most and best data. Blackberry's QNX installed base is effectively a proprietary distribution channel, via which the company gets access to data that no one else has access to. Thus, the IoT business is positioned to give Blackberry an advantage on the XDR side over time.

By merging the IoT and cybersecurity businesses, Blackberry has the potential to meaningfully increase its operating leverage.

It is also worth noting that, while Blackberry´s forte is the auto space, the company is also taking strides toward other IoT verticals such as medical and aerospace. QNX´s moat is trust–it is very hard to get folks across industries to trust your operating system because:

The operating system cannot fail under any circumstance.

In case of failure, the OEM stands to lose a tremendous amount.

This is why Blackberry’s potential can be found in any of Blackberry’s IoT verticals. Blackberry has currently monopolized the auto space and, given enough time, will likely monopolize others. In turn, as time goes by, more and more things will be connected to the internet, which increases the number of potential verticals to saturate.

From its acquisition of QNX, it has taken Blackberry 15 years to hit 235m cars. Thus, although a quarterly evaluation of progress is very much in order, the thesis requires a long time horizon. It will take perhaps another decade for Blackberry to permeate medical and aerospace, for example. Yet, the wait will be worthwhile so long as Blackberry is able to:

Effectively grow the QNX installed base.

Convert it into networks per vertical (like IVY).

Blackberry’s financials may be mediocre, but if the company stays alive and meets the above two conditions, the payoff down the line should be worthy. In the interim, evaluating the company exclusively per its financials misses the point.

Blackberry recently announced that it will finally split the IoT and cybersecurity divisions into two separate entities. The company is targeting an IPO for the IoT business in H2 of next fiscal year. I believe this is a great move. lt gives the QNX moat more transparency.

The long term success of QNX is far from guaranteed of course. Given its extraordinary reach, one would expect it to be more well known. In fact, I believe its relative obscurity is due to branding. When the layperson hears “Blackberry,” they seldom express any excitement regarding the aforementioned verticals or any desire to research their potential.

The IoT spinoff can make the QNX moat rather evident to the world and especially if it involves a thorough rebranding of the division. I welcome the move and continue to be impressed by Chen´s management.

2.0 The IoT Business

The QNX installed base continues to grow well, but IVY up-sells are thus far scarce and have little pedigree.

The precursor of financial health in the IoT business is new design wins. Once secured, these wins take time to translate into actual revenue.. As with all quarters over the past few years, Blackberry secured a healthy number of design wins:

In the quarter, QNX secured 20 new design wins in auto and seven in general embedded market verticals. The largest of these was an eight-figure estimated lifetime revenue ADAS win with one of the top five global automakers to deploy our QNX OS for safety. - John Chen, Blackberry CEO during the Q2 2024 conference call.

QNX also seems to continue making strides in the medical space (although I lament that the company is not offering aggregate numbers quite yet, as it does with auto):

As well as our strong footprint in auto, QNX is well diversified in other verticals, particularly medical and industrial. Building on our position in surgical robotics, this quarter we secure a design win for our QNX Medical OS for safety to be deployed in the robotic arms for dentistry. - John Chen, Blackberry CEO during the Q2 2024 conference call.

Blackberry´s track record in terms of growing the QNX installed base is clear. What is not clear to me yet is the company´s ability to convert said base into a network, which would allow Blackberry to upsell higher levels of software abstraction–like IVY–thus increasing revenue per unit of QNX, perhaps exponentially. This ability or lack thereof is what will make or break the thesis.

This quarter, we saw (the automotive branch of) Mitsubishi Electric sign up to IVY to power its FlexConnect.X in-cabin systems. It is unclear whether FlexConnect has any customers at all or whether the actual Mitsubishi Motors that sells cars will use this technology for its own cars. There seems to be no relationship between Mitsubishi Electric and Mitsubishi Motors, as their similar names would imply. Thus, while the deal is encouraging, it is not a tangible sign of traction.

During the quarter, the Foxconn-initiated group known as MIH (Mobility In Harmony) selected both Blackberry QNX and IVY for its “next generation vehicle platform.” Foxconn's MIH consortium includes a range of suppliers and automakers such as India's Tata Motors and South Korean battery maker LG Energy Solution that have come together to design and produce electric vehicles.

The MIH electric vehicle platform is projected to be showcased in late 2023. It will be exciting to see when it comes out.

Other than the above two deals, thus far two integrators have signed up for IVY: Bosch and Pateo. The latter has a large presence in China and has already led to DongFeng (one of China´s largest automakers) signing up to have IVY power its Pateo Digital Cockpit for its all-electric VOYAH H97 model. Meanwhile, Bosch has not yet funneled any of its customer OEMs to IVY.

IVY seems to be gaining traction–but we’ve yet to see any of the top OEMs convert to IVY. On the other hand, a month ago BMW announced that it would be using Amazon´s cloud technology to build out its semi-autonomous driver assistance systems. Since IVY is effectively a 50:50 joint venture between Amazon and Blackberry, I expected the latter to have something to do with the deal–but no such announcement has been made.

On the other hand, Chen continues to express optimism regarding the proofs of concept with OEMs, and, given his track record in securing design wins, I give his remarks some weight in the analysis:

The strong level of interest for IVY POC clearly confirms our strategy. On the product front, this month we released an updated version with significant enhancement to cloud features and increased hardware and software support.

IVY's development [has] moved from the early heavy lifting phase and the focus is now on refinements, enhancing stability, expanding sensor supports, and improving the developer experience.

Further, an update of QNX (8.0) is scheduled to be launched in December. According to Chen, the update will yield notable improvements in “scalability and functionality,” which will enable OEMs to run mission critical processes securely “alongside a GenAI stack on the same chip.”

Financially speaking the division is doing fine, with revenue for the quarter increasing 9% sequentially to $49 million and gross margin increasing by 400 basis points to 84%. In the conference call I also learned that apparently a number of big OEM clients are restructuring to improve production of software-defined cars. Chen believes that the reorganizations are near completion and is optimistic about the IoT division´s revenue in Q4:

Toyota has announced re-org. VW has announced re-org.

[…] but it's kind of like a one year move, four quarter move. And frankly speaking, we are in the third of the four quarter already. So this is one of the reason[s] why the team has some really strong pipeline[s] that they believe in for Q4. And as I want to repeat this, we expect Q4 to be the best quarter in revenue for QNX ever.

In the Q&A section, Chen reiterated the 20% YoY growth guidance.

3.0 The Cybersecurity Business

Blackberry has thus far failed to implement a successful strategy in cybersecurity. While the success of the IoT division is essential to the long thesis, that of the cybersecurity is not.

Cybersecurity revenue has declined for 6 quarters in a row now. Revenue declined from $93m to $79m, quarter over quarter, allegedly due to a few large and “mainly perpetual” deals with the government slipping to “later quarters” as a result of “elongated sales cycle.” Chen expects these deals to close this fiscal year. While this could be the case, I am generally quite disappointed with the way the cyber business has been managed.

Its edge within government and finance remains, but Blackberry has simply not been able to expand.

Over the last year or so the company has not disclosed a clear growth strategy. Chen has been emphasizing the importance of gaining traction in the SMB space and has at times celebrated Blackberry making strides therein. During their recent call, however, there was no mention of security. In fact, Chen only talked about it when asked during Q&A:

Q: How is Cylance trending in the market?

A (Chen): The numbers are obviously smaller than the competitors, but we do reasonably well in the win rates on SMB. We actually [had] a pretty good [quarter] in new logos. And it will continue, you know, I said it many times, you know, our products are now up to class, took us a while. We are working very hard with channel partners to swing them our way. And so once we have more achievement there we'll have more leverage, but clearly the product could win and Guard is a good solution.

The dollar-based net retention rate came in at a “stable” 81%, which is awful compared to companies like Crowdstrike and Sentinel One. Blackberry acquired Cylance nearly four years ago and has had ample time to grow the division. Thus far, they have failed.

On the other hand, during the call Chen reiterated the guidance seen below. As mentioned in the IoT section, I find that Chen has a tendency to underpromise and overdeliver. This is why I am willing to give the cybersecurity division some more time, although I am not sure of how Chen is planning to obtain the extra revenue.

Further, for the thesis to pan out, growing the QNX base and upselling to IVY or equivalents will be essential, while the success of cyber is not. If the IoT division succeeds, Blackberry has endless optionality to monetize by lining up bids for access to their IoT distribution channel.

The above would not be as profitable as deploying their own proprietary XDR, but the investment would still be a success. On the contrary, a failed IoT division with a relatively successful cybersecurity would yield little for shareholders over the long term, as the latter would have a tough time acquiring and retaining clients in a standalone format.

4.0 Financials

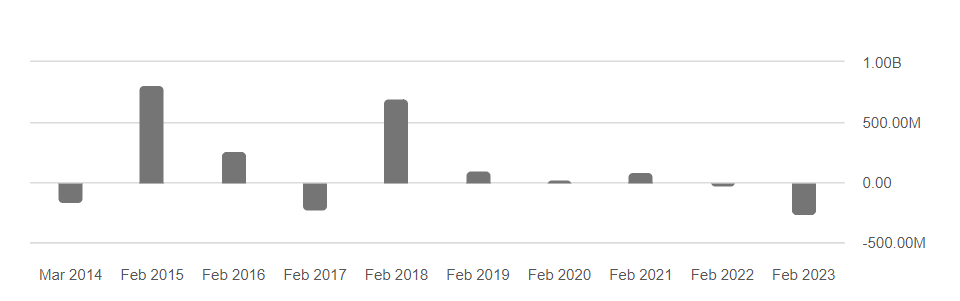

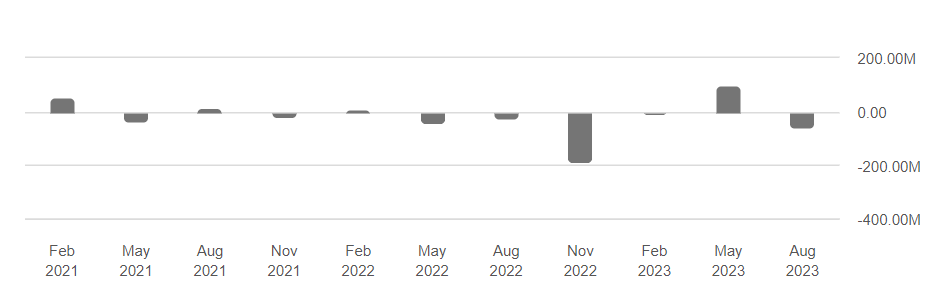

The balance sheet remains in good health, but the repayment of the debentures due in November will greatly reduce the company´s cash position.

First and foremost, the balance sheet is still healthy. Total cash, cash equivalents, and investments came in at $519M, decreasing $59M QoQ. Debt (debentures) came in at $383M, which Blackberry intends to fully repay in November. This would leave the company with $136M in cash.

For the most part, since 2019, Blackberry has been at financial equilibrium–barely using up or generating too much cash. However, the remaining cash balance after paying the debentures would only afford the company a few quarters of runway. If indeed Blackberry´s IoT and cybersecurity divisions evolve as management expects them to, the additional business should be fairly cash flow accretive.

Otherwise, the company will have to refinance by issuing new debt or via the hypothetical IoT division IPO:

BlackBerry remains laser focused on maximizing efficiency and expanding margins, and we remain on course for both positive operating cash flow and non-GAAP EPS in the fourth quarter and for the fiscal year as a whole. - Steve Rai, Blackberry CFO during the Q2 FY2024 call.

The current debentures mature in November and we intend to fully repay them. With respect to raising any new debt, the outcome of Project Imperium will obviously have a significant bearing on future needs.

5.0 Conclusion

H2 FY2024 is a critical period to evaluate the management team. If Blackberry fails to deliver on the guidance, the balance sheet will come under pressure and the company will need to refinance.

The earnings report is a mixed bag. The IoT division is doing well, although I am not yet seeing clear traction in IVY. The cybersecurity business has simply not been able to stand up to best of breed players such as Crowdstrike and Sentinel One. The balance sheet is adequate but may come under pressure in the coming few quarters.

The IoT division has to thrive for investors to profit; IoT’s success would, in turn, enable the cybersecurity division to acquire new customers at a marginal cost, which, in turn, would spark off the first few spins of the XDR flywheel. An inverse scenario–in which the IoT division goes stale and cyber does well–would all but crush investor hopes. Long term, it is very hard for Cylance to succeed without an edge in distribution.

As a result, despite the disappointing performance of the cybersecurity division, I remain long Blackberry. Further, Chen´s track record of (notably) underpromising and overdelivering encourages me to wait and see whether the guidance the company has issued materializes.

If it does, the relatively weak cash position after paying the debentures will not be too much of a problem. Else, the company will have to refinance and this will likely end up in shareholder dilution.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Thank you, Antonio. Very thorough and balanced