Edited by Brian Birnbaum and an update of my original Amyris deep dive.

1.0 Introduction 2.0 Nearing the Inflection Point

3.0 Bankruptcy 4.0 Conclusion

Summary: Amyris continues to inch towards an inflection point, despite its hideous balance sheet.

1.0 Introduction

For those of you that are new to this thesis, Amyris is my venture capital play in the synthetic biology space, to which I have allocated a small percentage of my portfolio. It trades on the Nasdaq, yet it is actually a start up. It has tremendous long term potential, but it is going through a rough period and is currently flirting with bankruptcy. I made my first purchase at $4 and doubled my position in terms of shares held when it hit $1.

Amyris reprograms cells to make useful stuff, for cheaper and more sustainably than otherwise. With the world´s consumers moving towards sustainability, Amyris is positioned to fill a large gap: making things at scale by engineering cells is very complex and Amyris is currently the only company on planet Earth that can do so. Amyris is ten years ahead of the competition, but:

It has a horrible balance sheet.

Its management seems to be recklessly burning cash and seems to have lost the market´s trust.

Nonetheless, the above graph summarizes how I view the company´s situation. Growth has been rising exponentially and Amyris is also taking steps to bring its costs under control. Despite the pessimism surrounding the company, I believe that if it stays alive long enough, revenues will eventually far exceed costs. To get there, Amyris essentially has to vertically integrate its operations, while organically growing its consumer brands. This is a monumentally complex challenge.

2.0 Nearing the Inflection Point

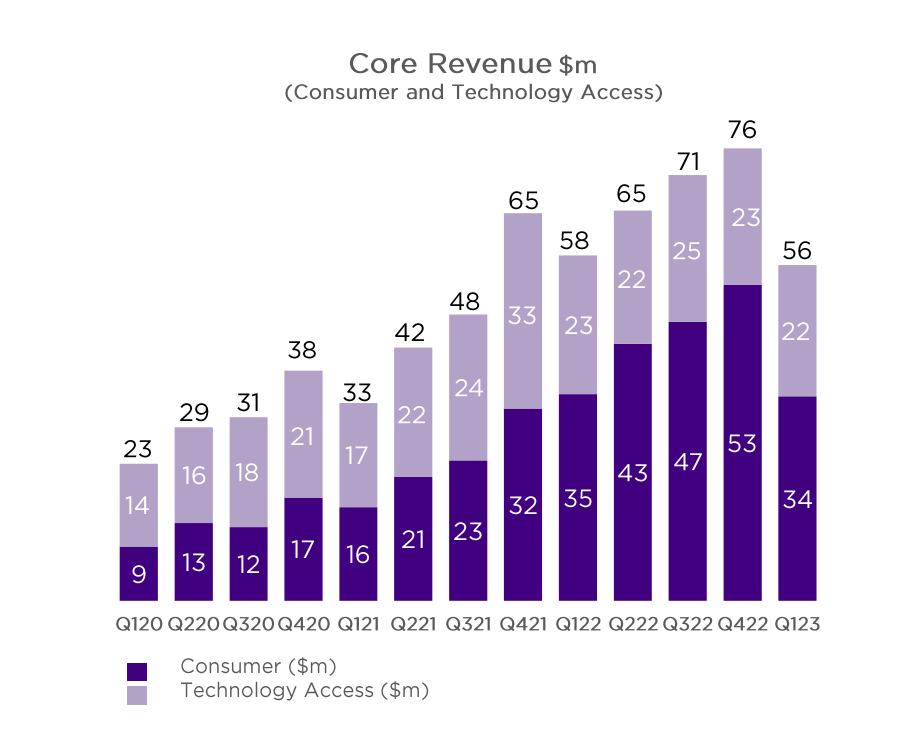

Amyris continues to make meaningful quarterly progress on both the revenue and cost fronts:

Revenue: this quarter, the consumer brands have exhibited clear organic demand for the first time since I have been covering the company. The market value of Amyris´sustainable molecules is also going up, per the latest strategic transaction with Givaudan.

Marketing spend in Q1 2023 was 25% of marketing spend in Q1 2022.

Despite this reduction in marketing spend, Q1 2023 consumer revenue came in at $34M, just $1M below Q1 2022 consumer revenue of $35M.

However, following an extended period of exponential growth, consumer revenue has stalled after Amyris has reduced marketing spend. It remains to be seen whether the company can continue growing exponentially going forward, with lower levels of marketing spend.

During H1 2022, Amyris was obtaining less than $1 of revenue per every $1 invested in marketing. In Q4 2022 it was up to $2 of revenue per dollar invested. This quarter it came in at $10 (due to the marketing reduction), but the point is that it is trending upwards.

During Q1, Amyris closed the strategic transaction with Givaudan and received $200M in upfront proceeds. This revenue will be recognized in the second quarter. Since 2020, Amyris has generated $800M+ of upfront cash and earnout payments from molecule deals.

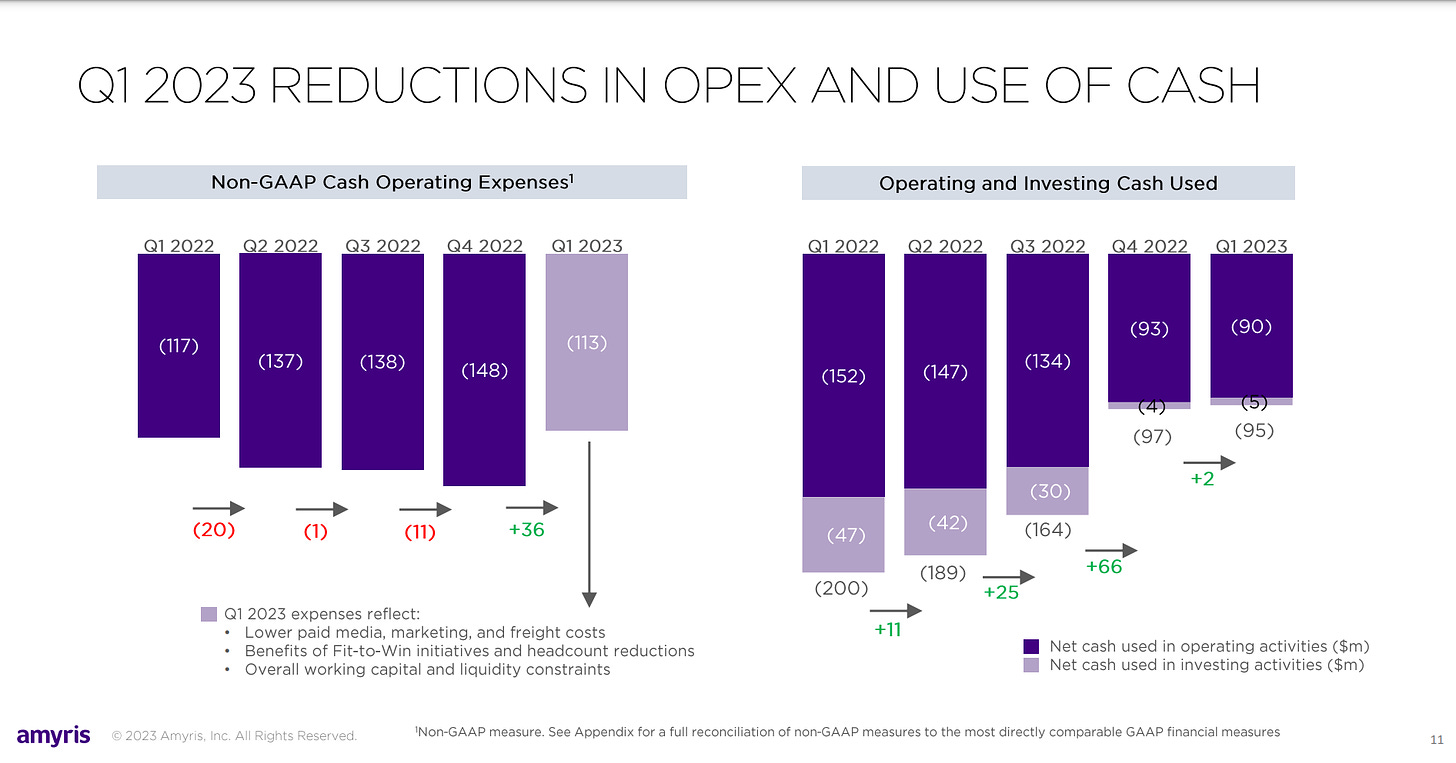

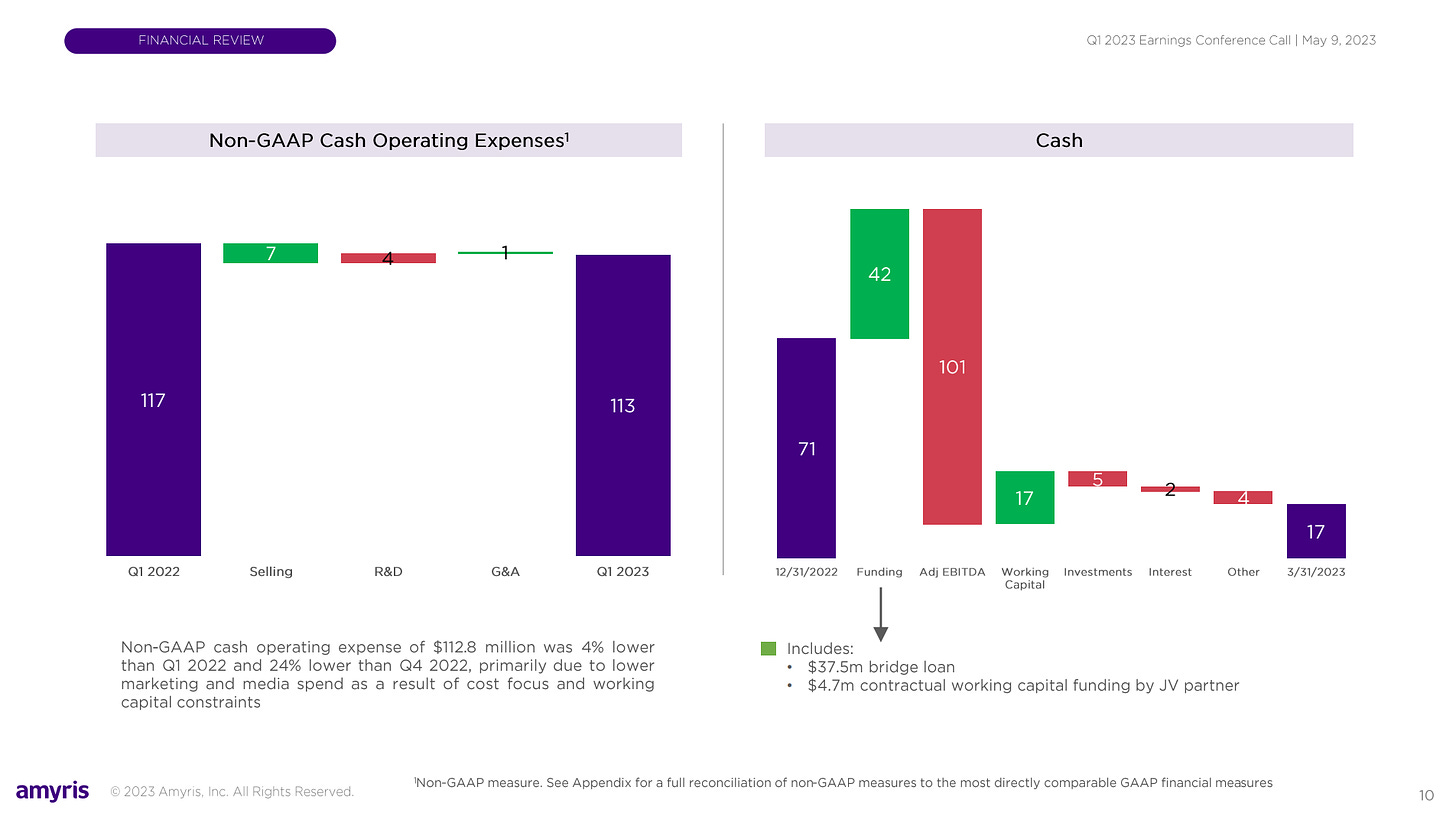

Costs: Amyris delivered on a 24% improvement in operating expenses versus Q4 2022: this was due primarily to a lower marketing spend. However, the company seems to be getting leaner across the board.

Inbound freight expense was reduced to $2.4 million from $8.5 million in Q1 2022, although the sales volume was almost the same as during Q1 2023.

Cash use is trending down rapidly, following the deployment of Barra Bonita. Without Barra Bonita, Amyris has 0 chance of vertically integrating.

If you review the Q4 2022 ER (my digest here), Amyris has been achieving some very notable reductions in COGS as it has been deploying Barra Bonita (50% for Biossance as of Q4 2022). This quarter, management disclosed that only 3/5 lines are up and running at the factory and that 90% of the production has been moved to Barra Bonita already, from 3rd party factories. It looks like there is still plenty of spare capacity.

Amyris is now exiting its under performing brands, looking to end up with a portfolio of 5-6 brands. During Q1 it exited the EcoFabulous brand (booking an asset impairment of $95.4M), which it only just acquired in February 2022. Not looking too prudent, perhaps.

If Amyris continues this quarterly progress, it is a matter of time before the graph in section 1.0 becomes a reality, but the balance sheet is abysmal.

3.0 Bankruptcy

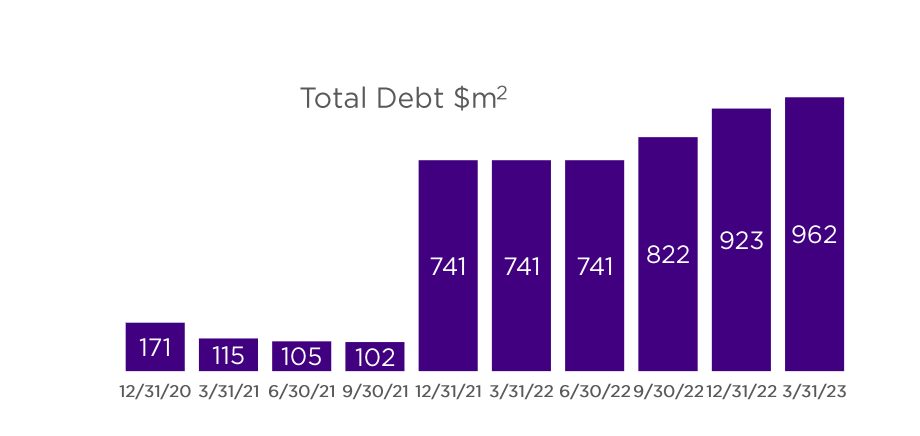

Amyris has an awful balance sheet, with $962M in debt and as of the end of this quarter, just $17M in cash. The strategic transaction with Givaudan, which as mentioned will be recognized next quarter, gives the company a further $200M in cash. The last two quarters Amyris has been using close to $100m in cash per quarter, so the extra liquidity gives the company oxygen for a few more quarters.

Furthermore, in Q1 Amyris reached a forbearance agreement related to the maturity of an aggregate $92.5 million of debt principal with Foris Ventures, LLC, Perrara Ventures, LLC and DSM Finance B.V. These lenders have agreed to forbear from exercising any rights and remedies with respect to certain payment defaults until June 23, 2023. Going forward, whether Amyris goes into bankruptcy or not largely depends on the attitude of these lenders.

It can be tempting to speculate about whether these organizations, especially Foris Ventures LLC, would be inclined to take Amyris into bankruptcy and fully take over its key strategic assets. However, these assets are ultimately the result of the motivation of Amyris employees and nothing would be worse for them than bankruptcy. The level of uncertainty that spreads through an organization in such scenarios ends up scaring away talent, often making sophisticated assets unusable.

If Amyris continues to bring costs under control, while growing its top line, I believe that over the coming years it will be able to pay off its debt via the sale of molecules. It is important to note that in such transactions, Amyris retains the rights to commercialize the molecule in question for all markets outside the specific license. If the world does indeed continue moving to sustainability, all the consumer brands making impossible sustainability promises to their end customers only have one option: Amyris.

“This represents an average of nearly $90 million of licensing value per molecule. The Givaudan transaction is the most valuable molecule deal we have completed.” - John Melo, CEO @ Q1 2023 ER.

Further, while management has a track record of burning cash it also has one of being scrappy. They are now planning the following:

Completing more strategic transactions, like the Givaudan one, across Amyris´s portfolio of 30 molecules.

As I am writing this, Amyris has announced another deal with the British firm Croda International Plc to manufacture and supply squalene in exchange for $4m upfront and a share of profits generated from the sale of products based on the squalene.

Croda has a revenue of $2.5B in the TTM and it plans to use squalene as a vaccine adjuvant “globally across its customer base”. In 2021, its healthcare division brought in approximately $200m in sales, mostly from “principal vaccine customers”, so the deal is not looking huge, but quite interesting nonetheless.

The sale of non-core assets (consumer brands), which are expected to generate $100M in proceeds.

Establishing a “biomanufacturing JV that would provide Amyris an estimated $50 million to $100 million in proceeds and support the working capital needs of ingredient manufacturing as well as provide the necessary CapEx” to build its next fermentation plant.

This deal allows the counterpart of the JV to use Barra Bonita, in exchange for it funding the next factory.

This enables Amyris to transition to an capital-lite model, whereby it no longer has to spend large amounts of cash to progress on its vertical integration efforts.

Over time, this model makes it far more likely that revenues will eventually far exceed costs.

Advancing the proceeds of up to $350 million of performance based earn-outs from previously closed strategic transactions. When Amyris closes a strategic transaction, sometimes that involves payments from customers down the line when certain conditions are met, so the $350M essentially consist in getting that money ahead of time.

4.0 Conclusion

With the company flirting with bankruptcy, this is no doubt a war-time scenario. Still, I find the company´s technology and manufacturing prowess to be one of the world´s most interesting and promising assets. I am also not quite sure what to make of management just yet, although I do have an appreciation for the complexity of the task they are carrying out.

I cannot predict what will happen over the coming quarters, but the situation remains essentially the same as when I first wrote about the company. The risk of bankruptcy is very real, yet the potential upside is monumental. If Amyris survives and successfully transitions to a capital-lite model, in which only they have the power to bring sustainable molecules to the world, the payoff could be very large.

Meanwhile, since I have allocated my capital prudently, I am happy to see how the situation plays out. My life philosophy is to make asymmetric bets when I spot them, while managing the downside so that I do not get taken out permanently. All the above most likely makes zero sense if we are talking about a large allocation as a percentage of your overall portfolio.

Lastly, I realize that many of you regularly ask me about how I size positions. Would a deep dive on this topic be of your interest?

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Monsieur- cut your losses on this one. The amount of energy spent analyzing and writing about this company can be better spent elsewhere. You want an asymmetric bet- try $ENVX (Enovix). Bon chance 🍀 ✌🏽

This story Remember me of tesla at the beginning.it was saved by Musk marketing Genius,Will this CEO be similar?