AMD: Disrupting Nvidia.

(1 minute read)

AMD is set up to take a lot of market share from NVDA for 2 reasons:

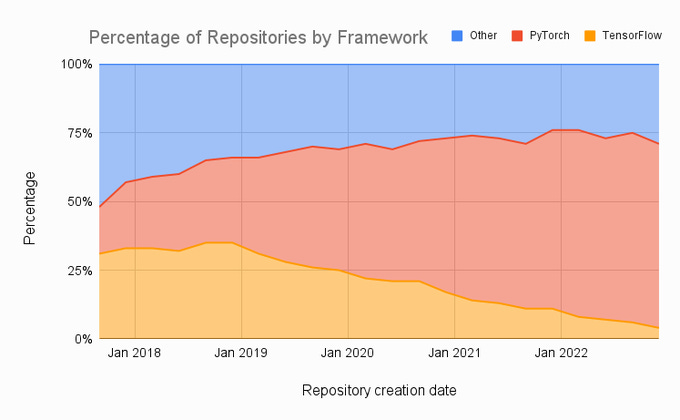

1.Much of of Nvidia’s moat stems from CUDA, which enables developers to interact with $NVDA GPUs seamlessly when coding.

However, Pytorch has become the dominant framework for deep learning (AI) and now, AMD GPUs work out of the box on Pytorch.

This opens the veil for AMD to disrupt Nvidia’s software moat and levels the playing field.

2. Nvidia’s chips are monolithic, while AMD’s chips are chiplet based. Chiplets have enabled AMD to disrupt INTC by yielding high performing but cheap chips.

This is because when you make a chip out of chiplets, if one of the components goes wrong you don’t have to throw the entire thing away. Hence, yields are much higher than in monolithic architectures.

I believe the same is going to happen on the GPU side.

Chiplets have lower margins and so pivoting to this would hurt Nvidia’s financials: a clear case of the Innovator´s Dilemma. Nvidia has a fantastic business and will hardly find the incentives to disrupt itself moving towards chiplets.

In combination, a democratization of deep learning development tools with $AMD coming into the GPU space with its chiplet capabilities bodes well for $AMD to grow its market share.

To learn more about AMD, Nvidia and other tech companies, subscribe for free to my newsletter, in which I send out one monthly deep dive for free.

You can also read my AMD deep dive for free:

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc