This month I am delighted to bring you my deep dive on AMZN 0.00%↑ . I hope that you learn as much as I have from studying it.

Also, this deep dive was edited by Brian Birnbaum, who from now on will be working with me to maximize the quality of these write ups. He runs an interpreting services company and I am thrilled to have him onboard.

1.0 The Capex Ghost

Amazon´s free cash-flow will likely explode from here and, with it, the stock price. In this section, I dissect the mental model which leads me to this conclusion.

Ghosts do exist and they show up periodically, across all domains of human endeavor. Very notable examples include stock market bubbles and communism–they just keep coming back no matter how sophisticated we get and are essentially different manifestations of collective amnesia. Amazon has a rather unique approach to the creation of value and, as such, has a history of being recurringly misunderstood. The company is in effect a brilliant case study of the cyclical lapse of financial memory.

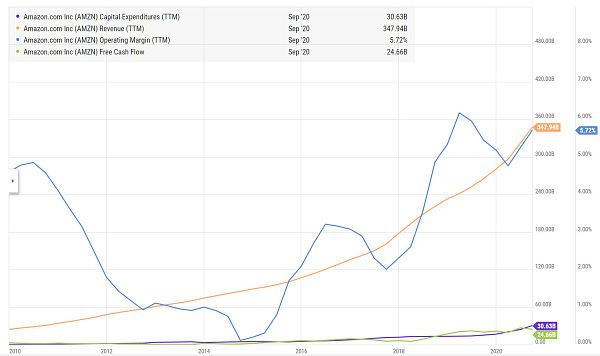

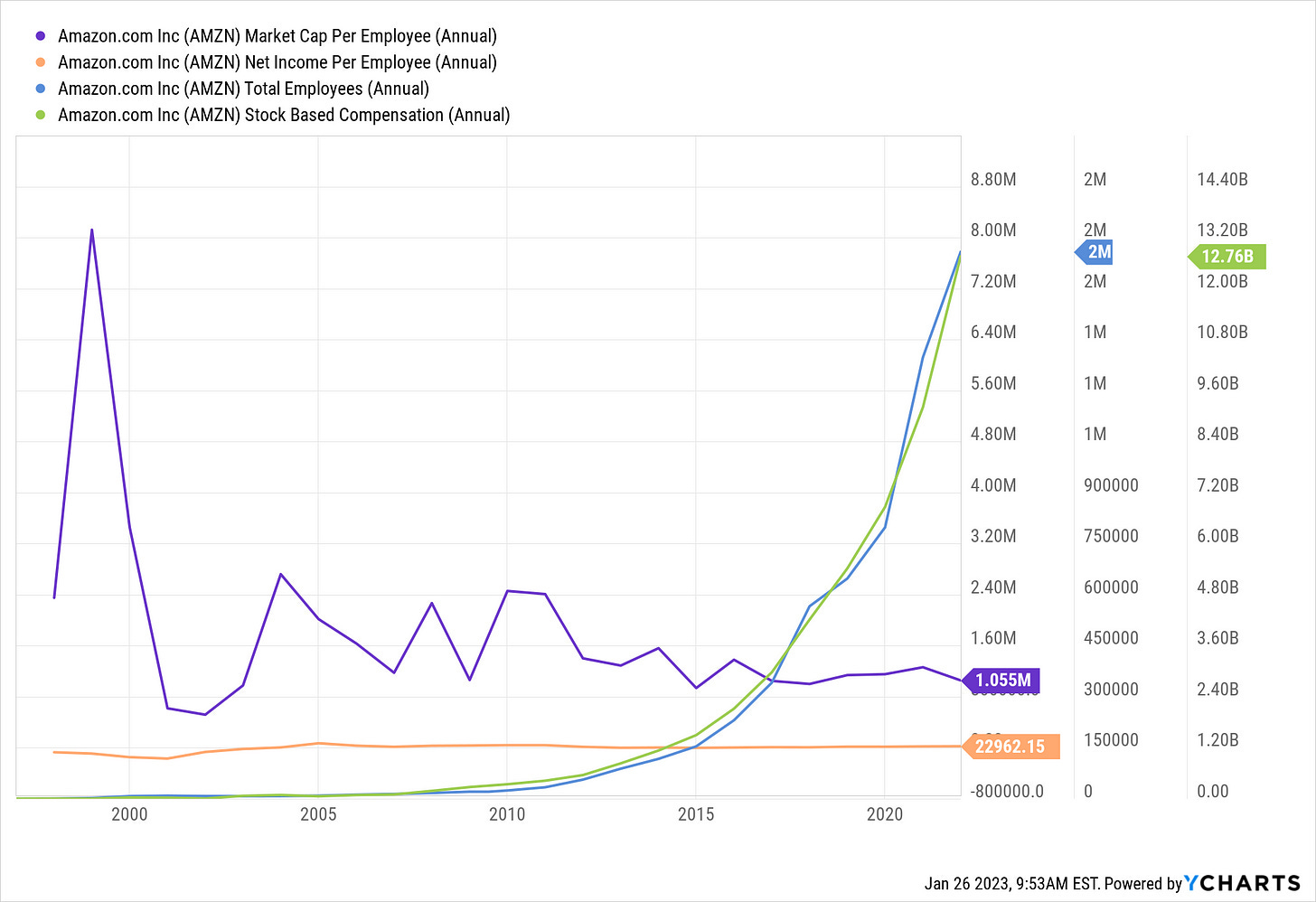

Throughout its history, Amazon has stepped up its capex intermittently, with every increment serving as a new operational baseline intended to serve more customers and to serve them better. During these periods, until the demand catches up (typically as a result of the operational improvements) and the new facilities are fully operational, the company has to drag the new capacity along with its added costs. As such, its operating margin and free cash-flow production languish accordingly for some time, to varying degrees.

Sometimes, analysts are very understanding and simply nod their way through conference calls. Other times, when there is enough pessimism in the air, both the analysts and the market forget that Amazon got to where it is today by reinvesting profits to improve customer experience. However, every single time and often against consensus, the company comes out proportionally stronger on the other side, both in terms of its operational leverage and free cash-flow production (per share). The company's capex cycles have overlapped in the past, but the dynamic depicted in the graph above reflects each cycle´s tendency.

The above is what I term “The Capex Ghost” and I believe that it is one of the more powerful mental models for long-term Amazon investors. This has occurred many times and, in the last decade alone, I have spotted instances during the following years (inclusive):

2010 => 2012

2014

2016 => 2017

2019

2020 => 2022

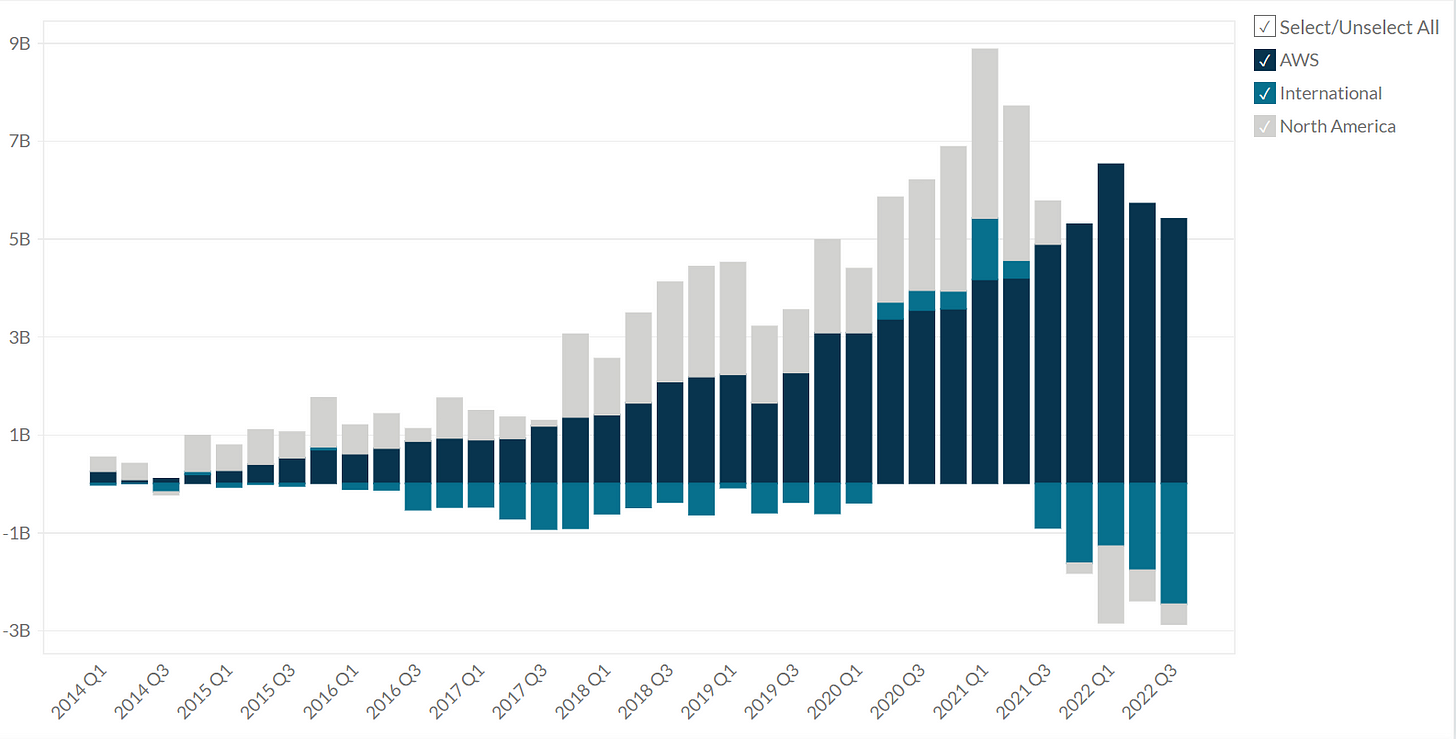

Two things stand out about the instance from 2020 to date, that are best visualized in the graph below:

The fulfillment network has doubled in size, which is by far the largest capacity expansion in Amazon’s history.

The company has seen a reversal of its working capital situation, due to labor shortages and supply chain dysfunctions.

This time around, while operating margins have not fallen much more in relative terms than in previous instances, free cash-flow has plummeted. I believe this is due to the magnitude of the expansion. Perhaps even more so–and in accordance with its principles–it’s due to Amazon having to over-stock and over-pay to ensure supplies and fully buffer the customers. In essence, prior to the pandemic Amazon could pay suppliers after the customer purchased a product, but this situation seems to have been reversed as a result of supply chain dysfunction.

Reading Jeff´s letters, however, the improvement of its three customer pillars (price, convenience, selection) together with continuous cost and price reductions have been the main precursor to free cash-flow per share increases. I would say that the three pillars have improved substantially since 2020. In effect, with every capex cycle the company is returning economies of scale to its customers, which then usually translates into more and better business down the line. There seems to be nothing different going on this time despite the breathtaking numbers. Much like stock declines, past shocks always seem much smaller than the latest one and sometimes even trivial.

“We realized the equivalent of three years’ forecasted growth in about 15 months.” - Andy Jassy, CEO, in his 2021 letter to shareholders.

“So what the issue there is that we generally have a favorable working capital impact from accounts payable that is more days than our inventory. That's been flipping the last year, and we expect that to normalize as we move into 2023.” - Q3 2022 ER

Further, when ecommerce took off in 2020, management had the choice to stick to the company´s core values and buffer the customer by meaningfully expanding capacity, thus knowingly dampening its financials in the short/medium term. The alternative was to simply let the consumer take on the global catastrophe with the existing capacity. It chose the former and, as a prospective long term investor, that is what I like to see. So long as it continues to stick to its principles–which means focusing on the three pillars–Amazon is likely to emerge much stronger from this current capex cycle, as it has in the past. If it had chosen the latter option, the financials would look wonderful and the market would likely be joyous, but I would not be as impressed.

Reading Jassy´s 2021 letter, it seems to me that he perfectly understands this:

“We’re divinely discontented with customer experiences, whether they’re our own or not. We believe these customer experiences can always be better, and we strive to make customers’ lives better and easier every day. The beauty of this mission is that you never run out of runway; customers always want better, and our job is both to listen to their feedback and to imagine what else is possible and invent on their behalf.

[…]

One of the lesser known facts about innovative companies like Amazon is that they are relentlessly debating, re-defining, tinkering, iterating, and experimenting to take the seed of a big idea and make it into something that resonates with customers and meaningfully changes their customer experience over a long period of time.”

The core drivers of this phenomenon are qualitative; what enables Amazon to efficiently deploy and operate additional layers of capacity and “bounce back” from these capex cycles is a series of organizational properties that cannot quite be conveyed via numbers. They ultimately culminate in the company delighting more and more customers in an increasingly efficient manner. These properties also enable the company to successfully branch out into other businesses, as evidenced by the rise of AWS, for instance, which is now the company's profit engine. While organizational excellence can indeed fade, as I’ll illustrate in section 4.0, I do not believe this is the case for Amazon just yet.

I have been studying these rather elusive properties for years now and Amazon strikes me as one of the world´s best manifestations of such, as evidenced by its multi-decade string of achievements. Amazon is a self-sustaining improvement factory, making it seem like a guaranteed asymmetric bet, constantly trying out new ideas with potentially large payoffs both in existing and new lines of business. In essence, the company mimics evolution and is able to sustain a pace of innovation that on average equates to more value for less, for all stakeholders.

Jeff says the company is “the best place on Earth to fail” and this gives everyone in the company permission to experiment, fail, and learn, greatly accelerating progress. If this comes across as a cliche, consider the healthcare industry, which is perhaps on the other end of the spectrum. Every year, the number of deaths caused by medical errors in the US equal that of a Jumbo jet falling from the sky–on a daily basis. This is because in healthcare, not making mistakes is glorified and making them is demonized, so the errors just get brushed under the rug. Marginal differences in terms of how well failure is accepted and processed make for exponential differences in outcomes.

The company's customer-centricity is genuine and its operational history full of examples of the company getting out of its own way to satisfy its customers–even at the expense of its own disruption. Perhaps the most notable example is the latest capacity expansion. The unrelenting customer-centricity pulls innovation forward by forcing the company to proactively acquire new capabilities . This, in combination with a culture that doesn’t trivialize smaller projects, enables Amazon to transcend The Innovator's Dilemma, whereby companies eventually disappear because they fail to jump into new businesses that look small and meaningless at the outset.

The internal culture holds high standards as its holy grail and thus repels many and attracts only some. In his letters, Jeff discussed the importance of eliminating muda (which means waste in Japanese) via a culture of relentless iteration (kaizen).Combined with the above properties and decentralized operations (as always), Amazon’s culture has created the behemoth that we see today. Especially during these times of skepticism, the above are merely overused and buzzy terms. Yet my fundamental understanding of how companies work–and of Amazon in particular–enables me to see that the company's operational supremacy is something that I can bet on, and it is still very much alive (despite the stock´s decline–or perhaps as proof of it).

There is however one factor beyond the company's control that can meaningfully hinder operations: the recently rising cost of capital. For the last two decades, Amazon has been riding a declining rates curve which has no doubt facilitated its expansion. However, 3-5% rates didn’t stop the company from expanding after the 2001 crash; and, indeed, the sub-1% rate we so rapidly got used to during the pandemic is far from the average over the last decade, during which the company has also fared well.

Further, the company's shift towards services also sets it up well for a world with a higher cost of capital, since services offer a more favorable margin structure. This is particularly relevant should we avoid reverting to what previously seemed like uncontrollable deflation. I will explore this in depth in the next section.

2.0 Services are Amazon's Future

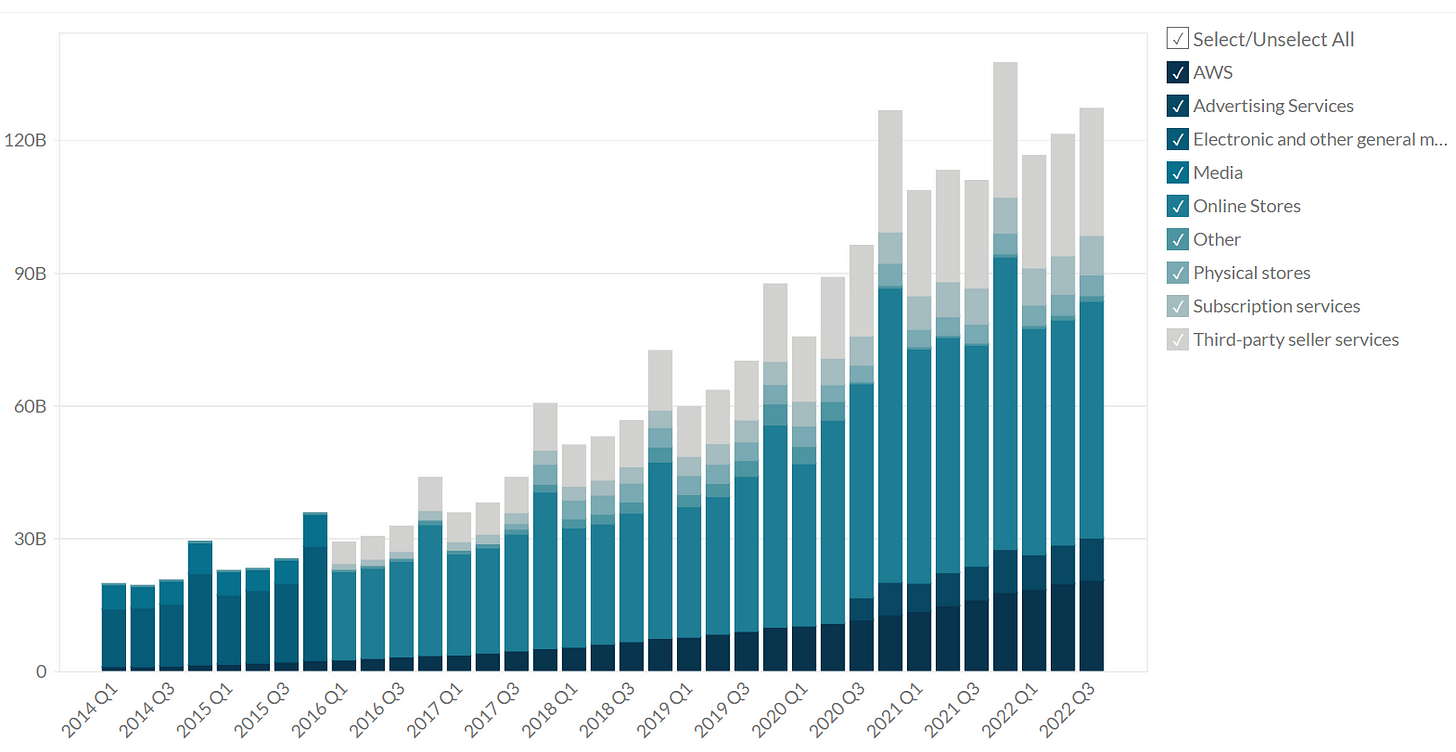

Amazon is now a launchpad for high margin digital services. Going forward, this should add an element of buoyancy to its capex cycles and its income statement.

Amazon´s ecommerce business is inherently deflationary and categorized by many as charitable, yet it is a goodwill compounding machine. With every capex cycle, Amazon is able to create/capture more goodwill at a marginally decreasing cost. Every day, more and more consumers trust Amazon to deliver the best deal possible and get into the habit of defaulting to its website when looking to purchase a product. This has profound implications.

Consumption accounts for ~70% of US GDP and this is roughly representative of the world's economy. This means that consumers are the most valuable component of the economy, together with supply. Amazon's ecommerce may not yield profits, but it excels at capturing the mind-share of consumers, thus creating a platform from which Amazon can solve all sorts of problems for them. At this point, Amazon is essentially a launch pad for high margin digital services and they still have a lot of shoppers worldwide to enchant.

One can perfectly envision a future in which Amazon keeps making things cheaper on the ecommerce front, accepting perennial break-even on their 10-K report.. They currently are and likely will remain in a position to extract profits at will (and always at the expense of mindshare). That being said, I believe the more important trend has been unfolding in front of our eyes for quite some time now; for the first time in the company's history, the revenues from services have exceeded those obtained from products and it looks to me like this is just the beginning.

There is no better testament to the company's culture than how novel business lines have evolved parallel to the ecommerce business despite their disparate respective functions. A company's culture tends to broadly determine its fate. If a company operates many divisions with different cultures under the same roof, the operation risks dilution. In Amazon´s case, the gradual and successful shift towards services is the result of applying the following philosophical principles across the organization:

obsessing over the customer and iterating nonstop

making bold bets

making many experiments and tolerating failures

combining the pursuit of efficiency with the power of experimentation

not looking down upon small businesses within the company and instead nurturing them.

The market wants to break down the evolution of Amazon's income statement to some quantifiable measure,=. But it can only be broken down to the durable code of human behavior within the organization and its correct implementation throughout. By gaining visibility on this code, the company's future prospects become more legible and, to an extent, the company´s coherence regarding these values becomes the top KPI. So long as harmony is preserved in the company's DNA, the shift towards services is likely to continue prospering.

Further, Amazon´s platform has expanded in scope over the last decade such to the extent that these achievements may very well be dwarfed by those of the next ten years. Amazon has branched out, creating three new platforms that essentially enable the company to compound goodwill simultaneously across three core components of the global economy: demand, supply, and developers. Of course, Amazon was already compounding goodwill on the demand and supply sides via its marketplace. What we are seeing here is a meaningful acceleration. The company is now taking on the foundations of the economy itself.

Over the last decade, Amazon has branched out to compound goodwill across the most relevant domains of the economy.

The Amazon we know today is the result of compounding goodwill on the demand side and then deploying the proceeding capital to further compound goodwill and foster the other two domains. What I think will happen over the next decade is an exponentiation of this process, with the company now compounding goodwill in all three areas simultaneously and then redeploying capital to other productive and still unknown domains. Per the strategic relevance of the new components, I believe this will take the company a long way.

The next ten years will also see compounding exclusively within the digital domain, with its corresponding nonlinear tendencies. To be clear, I still expect Amazon to be a very physical and three-dimensional company going forward. But the avenues that I explore below are moving the company into purely digital realms with vast levels of optionality.

Platforms include:

Echo/Alexa: enables Amazon to occupy a more meaningful place in the life of its ecommerce customers, helping it strengthen its grip on the demand side of the economy.

3rd-party sellers service: enables Amazon to further integrate its merchants´operations below the top of the funnel, helping it penetrate deeper into the supply side of the economy.

AWS: enables Amazon to become a key part in the lives of developers, which by definition are the enablers of productive computing. Developers’ output is increasingly becoming the medium via which supply and demand are matched throughout the global economy.

In the coming subsection, I will dissect the relevance of each platform. Note that I do not believe that all three components will play out to perfection. I do believe that the combination of these three initiatives, to whatever extent they come to fruition, is likely to yield outsized returns at some point in the future. Indeed, the margins from the AWS division are already durably driving Amazon's operating profitability–and this is just the first-order derivative of the mental model that I am exposing in this section.

Echo/Alexa and AI

After the recent layoffs, there has been speculation as to whether the company is terminating the project or not. I believe they miss the point. The company has been iterating on mobile consumer devices ever since it launched the Kindle in 2007 and, notably, when failing to gain traction with a proprietary smartphone some years later. During this time, however, it has been accumulating talent and knowledge in the field. The more it experiments, the more likely that something does end up working out.

If it works, Echo will likely facilitate the deployment of a long string of high-margin digital services that solve problems for customers in their daily lives. As Amazon builds a presence amid important parts of its consumers’ lives–like entertainment (Amazon Music, Video [NFL, other sports etc]), food (via the acquisition of Whole Foods, among other moves) and healthcare (which it has been dabbling in for some time)–it further increases the odds of some kind of mobile device serving as a gateway. Via incessant iteration and experimentation, the odds that the company will find a solution are quite high.

Further, perhaps the company will fail to gain traction with a device but not the underlying intelligence that it is currently boot-loading. In effect, Amazon has one of the more prominent data reservoirs on the planet and knows best who likes to buy what, when, and how. This knowledge only continues to compound as time goes by and the company branches out, successfully or not. I believe we overestimate what AI can do in a couple of years while we underestimate what it can do in a decade or two. Amazon´s data infrastructure is positioned to unleash plenty of value, with or without a proprietary consumer device.

3rd-party sellers

The 3rd party sellers segment enables any merchant to leverage Amazon's fulfillment network, helping the company gain mindshare within the other essential component of the economy: supply. In my research, I have come across a case that I think is particularly indicative of Amazon´s relentless innovation as it refers to merchants. Based on this finding, I can somewhat trace an invisible line into the future whereby the company keeps making improvements and digs deeper into merchant operations.

In preparation for this deep dive I reviewed Shopify. Having talked to quite a few merchants that run their business on it, I have realized that the company does excel at enabling creators to do their best work. However, it is also clear to me that it is and has been struggling with distribution for some time. In fact, it is somewhat confusing to track management´s comments when cross-referencing what they plan to do with what was then actually done. This dubiety has greatly impacted my perception of the company, which otherwise has some phenomenal traits.

On the other hand, Amazon has recently promoted Buy with Prime. As a merchant, all you have to do is connect to the API and Amazon will fulfill the orders for you while you keep the commercial relationship with your customers. This strikes me as phenomenally disruptive to Shopify and although I do not see Amazon accumulating their level of goodwill with brands anytime soon, it can take a very meaningful bite out of Shopify’s cake.

According to Amazon, this has increased conversion shopping in trials by an average of 25%, and why would it not? As a consumer, you know you can trust blindly with your money. You find a “Buy with Prime” button on your favorite creator´s store. The urge to buy suddenly becomes stronger, and I bet you even felt it just reading the last phrase.

AWS

On the other hand, AWS serves to amplify goodwill on the developer side. As we move into the Information Economy, a smaller percentage of the population generates a growing share of the wealth. A lot of these people happen to be developers. Amazon channels its customer-centricity towards them via AWS, effectively capturing the mindshare of a subset of the population that is going to make it rain for the foreseeable future. This will be increasingly present in value creation and capture processes.

The history of AWS is full of instances of constant:

feature- and product-level innovation

price reductions

The division got to where it is by understanding that it had to iterate faster than anyone else. That fundamental principle seems to be very much alive across Amazon and within the division per Jassy´s latest comments. For this reason, while there is speculation that perhaps Google and/or Microsoft may disrupt AWS, three things stand out to me:

On its current path, the odds that AWS will be much bigger in the future are high.

The above is likely the case regardless of competition, because we are likely just at the beginning of the shift to the cloud and, in turn, just getting started with computing as a civilization.

These three companies have the most prominent data harvesting infrastructures in their respective domains, which are in turn of existential relevance to humanity. Meanwhile, they are all investing heavily in AI which makes it likely that one or more of them will at some point yield an intelligence of great economic value. So why not own all three? Incidentally, here is my deep dive on Alphabet.

“We iterate continuously, and when a feature or enhancement is ready, we push it out and make it instantly available to all. This approach is fast, customer-centric, and efficient – it’s allowed us to reduce prices more than 40 times in the past 8 years – and the teams have no plans to slow down.” - Jeff Bezos, 2013 letter to shareholders.

The platform´s overall evolution is appealing to me as a prospective investor and perhaps even more so given the market's reaction to its latest investment cycle. However, I think that Amazon will have to deal with a higher level of competition on the consumer side than it’s been accustomed to over the last decade. I will explore this in depth in the next section.

3.0 Walmartzon

Walmart and Amazon are now set to collide over the coming decade. It is likely to evolve into Amazon´s most formidable opponent.

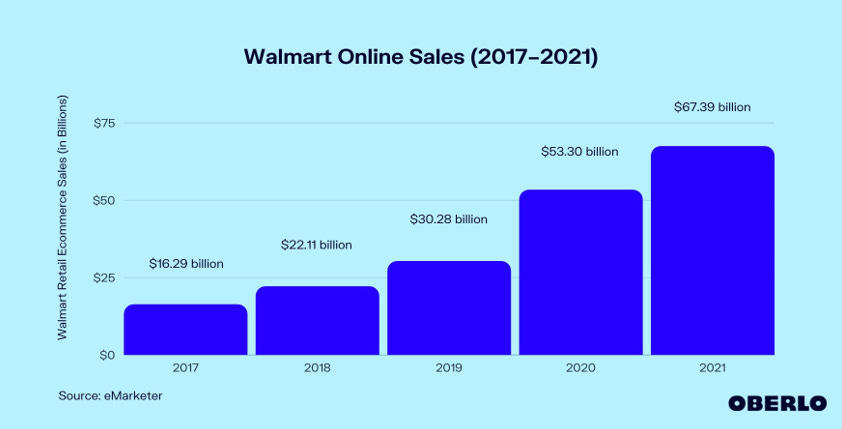

Jeff´s organizational ideas can be traced back to books like “Built to Last,” “The Innovator's Dilemma,” and “Lean Thinking.” But they can also be tracked back to Sam Walton, the founder of Walmart. Having reviewed Walmart, it strikes me as an Amazon of the 20th century and vice versa - they have nearly identical DNAs. Walmart is also constantly focusing on the customer, doing all it can to guarantee the possible deals and compounding goodwill. Most notably, its ecommerce capital allocation and revenue has taken off recently with Amazon beginning to branch out in the opposite direction, aiming to revolutionize physical commerce via AmazonGo, its cashier-less store. The two companies are now set to collide.

$WMT Capital Expenditures Allocation, $

Walmart is centering its digital efforts around Walmart Marketplace - an app that connects buyers and sellers. This digital real estate has allowed the company to thus far deploy the following services:

Advertising–Q3 2022 saw the “highest ad spend for all years of sponsored search.”

Fulfillment for third parties.

As is the case with Amazon, these are higher margin businesses than the retail operation. Through this new avenue, Walmart is positioned to see higher margins in the medium/long term, even if the digital operation were to fully cannibalize the physical one. This is because the digital space enables for much higher dimensionality of interaction with customers/suppliers and, accordingly, for the deployment of additional high margin services at a marginal cost.

Walmart´s vision is to “run compelling stores and clubs, scale [of] first- and third-party e-commerce business, and connect them together in an omnichannel fashion that saves customers and members money and time.” Although Walmart is less versed in the digital world than Amazon, it carries a whole lot of goodwill from its customer base and does have the operational culture to iterate its way to success. My intuition is also that this aperture into optionality for Walmart is currently not priced into the stock.

Amazon has encountered noteworthy adversaries throughout its journey. It tried to take on Square (now Block) and develop a merchant point of sale system, but failed. It has also been greatly surpassed by Spotify on the music streaming operation. This is because these two companies, to varying extents (and I am actually not very fond of the former), are also optimization machines that focus on the customer and iterate at a relentless pace. While this is not a widely known fact, I do observe that when Amazon runs against companies of similar organizational excellence it tends to have a hard time.

As the two companies move towards each other, Amazon is set to encounter its most formidable opponent to date and I believe that this dynamic will dominate the scene for the next decade or so. It will likely take a few years to pop up on the mainstream radar. Today Amazon stands as the uncontested consumer goodwill compounding machine on the internet–but I think its blue ocean days are likely coming to an end.

4.0 Lessons from the Fall of General Electric

Amazon´s Darwinism is its greatest asset, but also its Achilles’ heel.

General Electric was not too long ago the largest company by market capitalization worldwide. It was perceived to be as unassailable as Amazon, Google and Microsoft are today. The stock went 57X+ from 1983 to 2000 and, ever since, it has been on a two decade slide. Having studied the fall of this giant in depth, I believe there are some valuable lessons that can be extracted from the story as it refers to analyzing Amazon. It sheds some light on how a company of Amazonian proportions can fall and you may not be surprised to read that it boils down to qualitatives.

During Jack Welch´s tenure,, the company posted one earnings beat after another. GE´s financial performance was staggering. It dominated many different business lines, with numerous business units flourishing throughout the company. Each unit had a leader that was trained to act as an owner. In turn, managers had goals that they had to meet and, after a certain number of breaches, were systematically ousted from the company. For many years, this yielded a cutthroat, high performance environment that pleased investors.

Yet, the perks of climbing up the corporate ladder overcame the feeling of ownership for most managers. Meeting the short term profit goals became the top priority. Together with the organizational complexity, the company became a breeding ground for relatively fraudulent activities. Often, if managers needed to up the top line to surpass objectives, demand was artificially created from sub-divisions. All sorts of dubious practices emerged, including indiscriminate acquisitions, which for quite some time allowed managers to hide behind accounting complexity.

Eventually, the numbers ceased to make sense and the operation collapsed, with the stock price plummeting accordingly. Essentially, what led to the demise of the company was the following:

The culture became too short-term and promotion-focused. No one wanted to miss short term objectives and the reward of getting promoted outranked the reward of creating value.

As a result of the above, communication became opaque and especially so for bad news. This led to the company going further astray from the appropriate value creation mechanisms.

The firm´s excessive diversification led to sufficient complexity that malicious practices could be concealed relatively easily. As such, given the adequate incentives, these practices flourished.

Eventually, undoing these practices required dampening the financials in the short term, but no one was up to the task. As such, the company failed.

Now, Amazon seems to be very far away from such a scenario, but I do read plenty of remarks on Glassdoor about how Darwinian the environment is inside the company. Per the reviews, there seems to be a breed of Amazonian that has figured out how to pull the right political levers to rise above the rest. Judging by the company's progress over the last few years, I would not say that this has become an endemic problem, but it definitely seems to be there.

This stands in juxtaposition with what seems like a culture that attracts hard working, ambitious people that like to create new things. I do get the sense that this sort of person likes to work at Amazon and, in turn, it tends to repel people that are not excellent across a whole range of qualities. However, in a cut-throat environment with growing complexity and segmentation, the GE spirit can rear its head quickly.

I would say that, while it is possible for Amazon to be disrupted by some other company, this is unlikely–at least until we see a fundamental shift towards a more decentralized internet, which remains to be seen. What is far more likely, as was the case with GE, is that its own virtue turns against itself. As a prospective investor and indeed perhaps an actual investor at some point, this is what I would spend most of time looking at going forward.

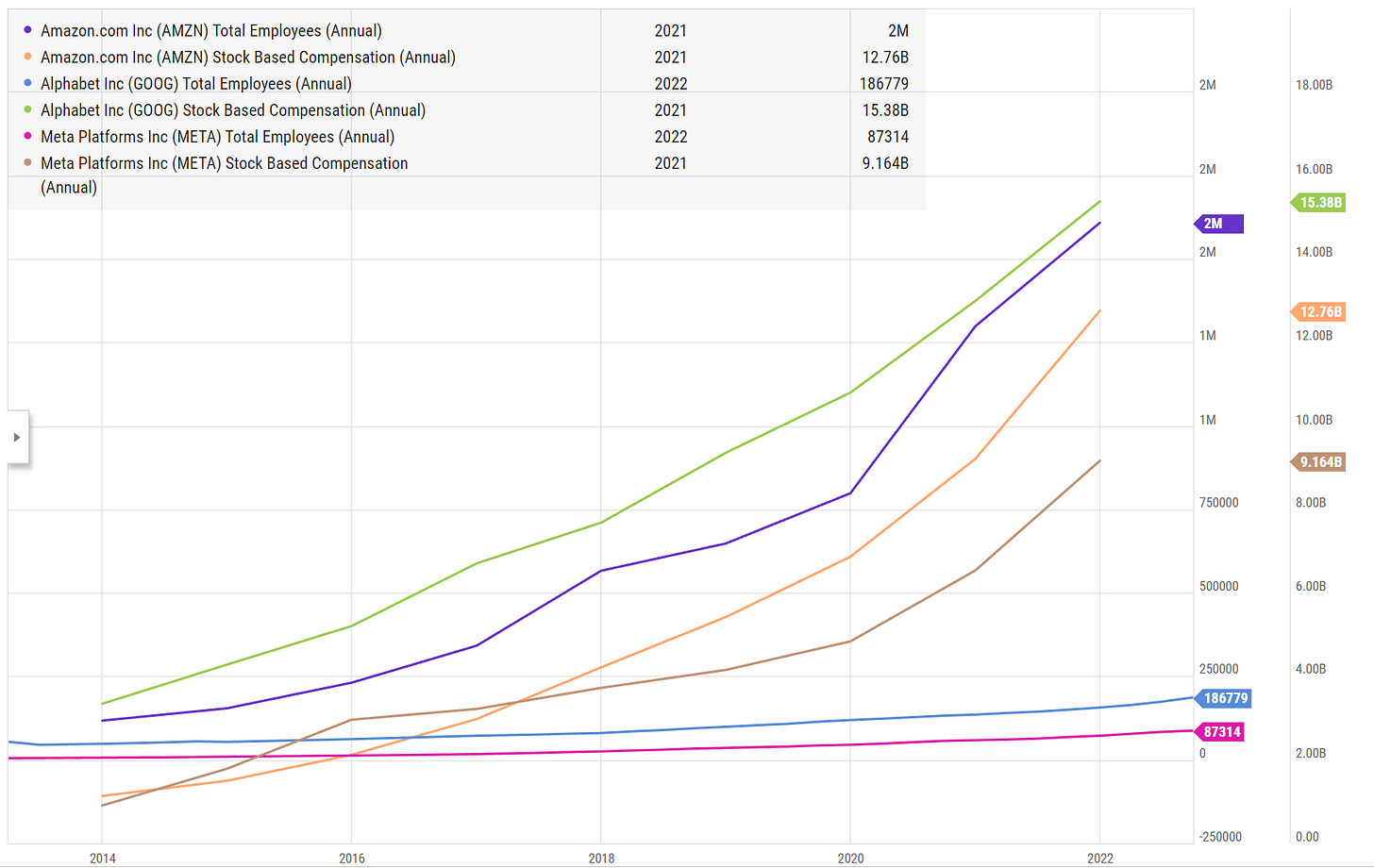

In the graph below, you will see that the pie per employee has not gotten much bigger over the company's public life. There will of course be different employee tranches, and likely the ones that create most value do not operate in a zero sum environment But the big picture is food for thought. You know what zero-sum games do to humans, and this data seems to match the reviews on Glassdoor.

In his 2003 letter, Jeff set the standard of empowering employees to be owners and not tenants. Compared to Alphabet and Meta, the company is perhaps not fully living up to the call. Stock options per employee are far lower for Amazon than the other two companies. As I said above, I suspect this has to do with Amazon running vast physical operations in which the value created per employee is lower than at higher realms of abstraction and creativity. Still, I don’t like this trend. Perhaps someone with experience working at the company can comment on this matter.

“Owners are different from tenants. I know of a couple who rented out their house, and the family who moved in nailed their Christmas tree to the hardwood floors instead of using a tree stand. Expedient, I suppose, and admittedly these were particularly bad tenants, but no owner would be so short-sighted. Similarly, many investors are effectively short-term tenants, turning their portfolios so quickly they are really just renting the stocks that they temporarily “own.”

[…]

Here’s to not being a tenant!”

5.0 Financials

Income Statement

Both the ecommerce and AWS businesses tend to expand during recessions. The company is also dealing with inflation in wages and energy.

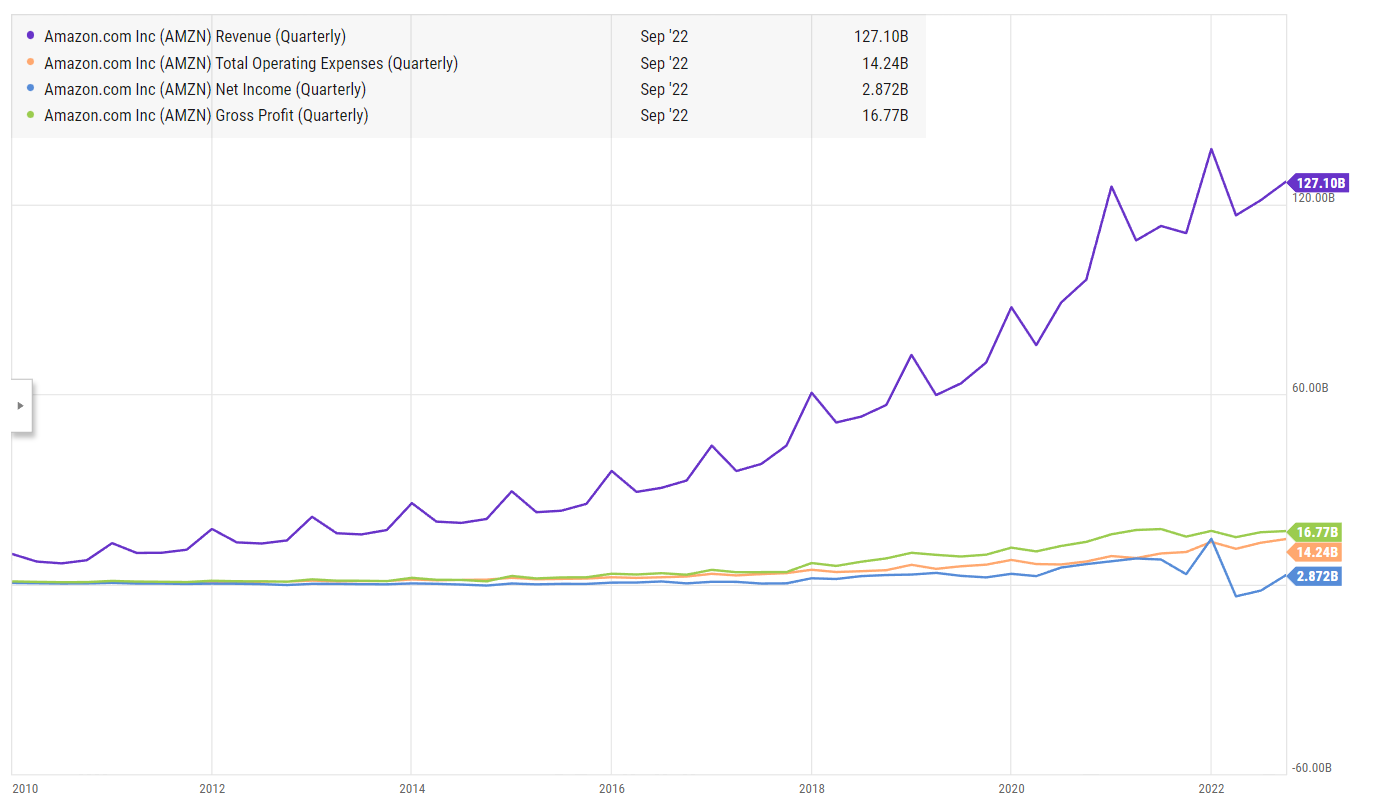

The cumulative effect of the sequential capex cycles is easily visualized in the graph below. Revenue rises non-linearly with respect to OPEX , which hugs the X axis in relative terms. As explained in Section 2.0, the continuing shift towards services should accentuate this dynamic going forward. Indeed, while it is not guaranteed, the odds are high so long as the company does not undergo some form of cultural mishap. In turn this should elevate the bottom line too.

Regarding the quality of the top line, it did not surprise me to see Walmart gaining market share in its respective domain during Q3 2022. In the conference call, management explained that the company tends to grow when consumers go looking for better deals. I believe that Amazon's ecommerce will mirror this dynamic. Further, Amazon management said in Q3 2022 that they are actively working with AWS customers to reduce the prices they pay and, as such, I believe this division will also do well during a recessionary period.

“With the ongoing macroeconomic uncertainties, we've seen an uptick in AWS customers focused on controlling costs. And we're proactively working to help customers cost-optimize, just as we've done throughout AWS' history, especially in periods of economic uncertainty.” - Brian Olavsky, CFO during the Q3 2022 ER.

So long as ecommerce and AWS continue to chug along, the company will have resources and time to continue iterating its way forward. The top KPI here is whether the company continues to deliver more value for less to customers going forward, which for now seems to be the case. Management also says that it is seeing considerable inflation on wages and is actively working to reduce it in other areas of the supply chain. Much of the wage inflation seems to have been concentrated on AWS employees in the Czech Republic.

On the OPEX side, the company is seeing “materially higher energy costs” than before the pandemic. Whilst I believe that we cannot forecast just how quickly inflation itself will dissipate or in what areas of the business it will have a lasting impact or not, I think that the more Amazon detaches itself from business lines with physical operations, the less disrupted it will be by inflation.

However, computing requires plenty of energy. The company will have to get very creative to deal with higher prices. Its proprietary chip, Graviton, continues to improve, with gen 3 delivering “40% better price performance than comparable x86-based instances.” Perhaps over the next decade Amazon surprises the market with a higher degree of energetic self-sufficiency than otherwise brought about by cumulative efficiency increases of Graviton. On the consumer side, I would not be surprised to see it spinning off into energy at some point too.

Finally, it is also interesting to see that net income (blue) seems to be bouncing back from its rather turbulent decline throughout 2022, driven by moderating demand together with the weight of the larger capacity. It is worth noting, however, that net income from Q3 2022 includes a “pre-tax valuation gain of $1.1B,” so the trend is perhaps not as favorable as it would initially seem.

Cash-Flow Statement

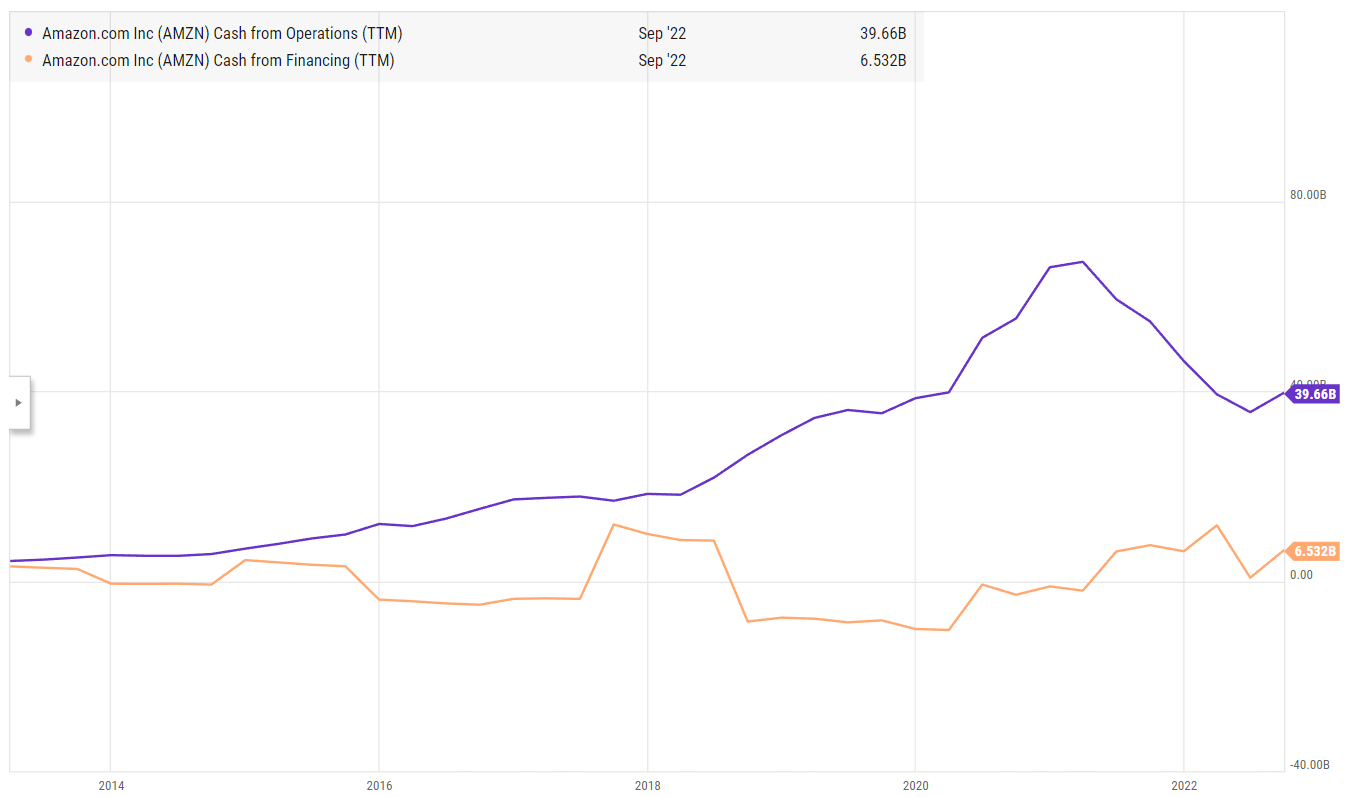

The evolution of the cashflow profile is coherent with the elements explored in the thesis.

Cash from Operations in the TTM has declined as the recent capex cycle has hindered the operational leverage of the company. I believe the decline likely does not reflect anything having broken at the fundamental level. Further, I learned reading the Q3 2016 ER transcript that new facilities (during one of the company's capex cycles) are “inherently less efficient than more established and mature ” ones–but also that they get more productive each year after their deployment.

I believe this sheds some light on the inner-workings of the capex cycles, which in turn carry over into the cash-flow profile. Indeed, the company has doubled the size of its network in a very short period of time, with inflationary headwinds, supply chain disruptions, and, ultimately, moderating demand. Amazon´s cash-flow profile has taken a large hit, but for good reasons I believe. Also, it is worth noting that cash from operations is pointing back up.

Balance Sheet

The balance sheet is at a crossroad.

The extraordinary dimensions of the last capex cycle have reduced an otherwise very healthy balance sheet to a less privileged situation. In Q3 2022 Amazon management said they have “tightened” capex up and feel good about the current “arc of demand versus supply that we have in our fulfillment and transportation area.” Going back to the income statement, I believe that unless the company initiates another investment cycle, it is positioned to start generating cash again soon and increase the size of its war chest again.

6.0 Conclusion

In all, this seems like a very solid business that, while previously subject to much enthusiasm, is now suffering from superfluous negative sentiment. Fundamentally, Amazon continues to progress well, and I believe its best days are ahead of it. In addition to everything covered here, another potential driver is the fact that the company still does most of its business in the US. In my research, I have found that the vast majority of the planet is further behind the US in terms of digitization than one would initially suspect. For a generational mega-cap like this, the opportunity to expand simply by growing internationally is very large. Plenty of alpha.

Further, capex cycles are not free of risk, and there is no guarantee that the company will succeed here once again. Yet the track record is remarkable, and I believe that Jeff has chosen what seems like a worthy successor. The odds are very much on. Indeed, I have no way of telling what is on Jassy´s mind, but this is the man that built the company's current operating profit engine and, in his letter, he lays out a train of thought which I think is correct. The way AWS got to be Amazon's cash printer is precisely by running the code that the latter needs to continue dominating this decade. I certainly sense an air of coherence in the succession.

What concerns me the most about the company is the seeming proliferation of political individuals that can optimize their way up the ranks. To illustrate, Tesla is another optimization machine that has thus far been able to branch out into many different areas (all with one particular focus, however), but its organizational structure is fundamentally flat, so that the incentive to get ahead by climbing the corporate ladder is relatively nonexistent. This is not the case in Amazon and as complexity increases, the incentive formula can potentially skew the wrong way.

Long term, I do see clearly that the company will benefit meaningfully from shifting towards predominantly digital services. The same principles that have so richly rewarded shareholders over the last two decades are likely to yield even better results as the company moves further into the digital realm, in which dynamics unfold non-linearly.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Excellent article Antonio!!

Fantastic read. I have very high hopes for Amazon. My thesis is, that it will take 2023 for all the capex overinvestment to unravel and for margins to come back up. From that point on, AMZN will have a healthy Ecommerce business with the third largest advertising network in the world and the largest cloud business. There is simply no other large cap company, expect maybe for Tesla, that has such a large growth opportunity. For Amazon it all comes down to where the margins will end up.