Note: this is an update to my original Gingko Bioworks deep dive.

1.0 The Foundry Business

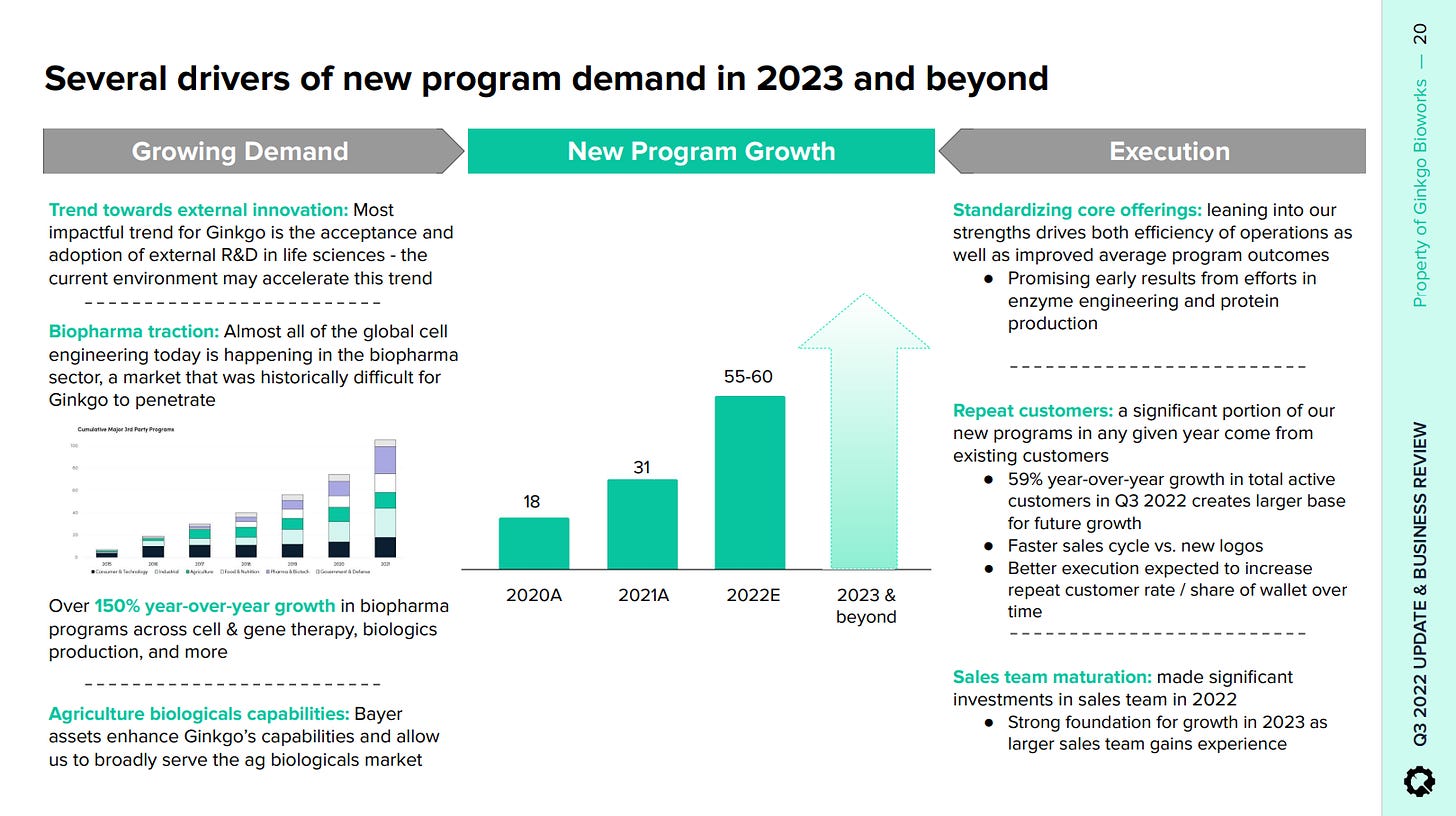

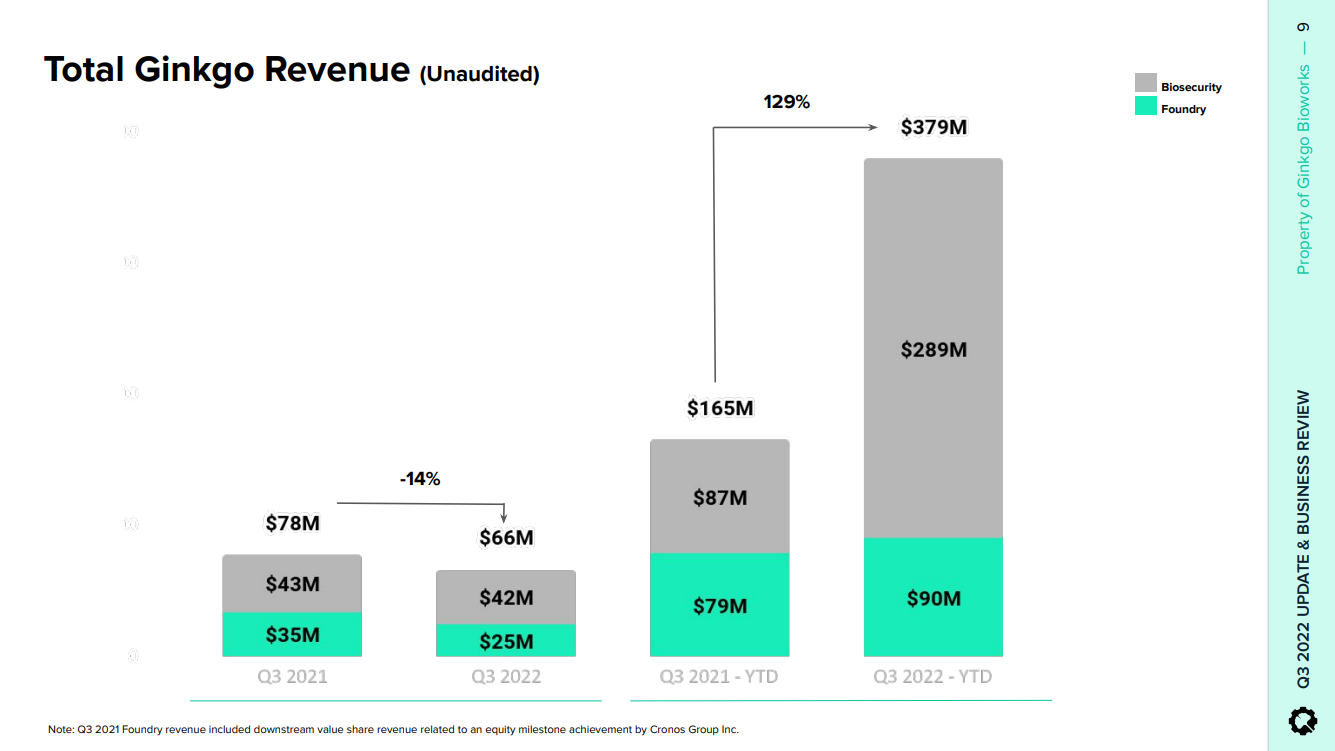

Ginkgo aims to be like a sort of AWS in the synthetic biology space (which consists in using biology/cells to make useful things). Indeed, as it works with more customers, it gets smarter and making stuff through biology and this can turn into something incredibly powerful. However, Gingko does not actually make the end products themselves: it facilitates the strains (modified cells) that customers can then use to make whatever they want to make. In Q3 2022, all the metrics are pointing in the right direction, with the number of customers and programs trending up into the right, but the question remains, how do Gingko customers actually make things with the strains the company provides them with?

And mind you, there have been some positive developments during the quarter in this sense.

Gingko makes money in two ways:

Foundry services: delivering engineered strains to customers.

Biosecurity: testing people for Covid, essentially.

Revenue is shooting up, but the problem is if you look through their 10Q, the customers that they disclose are either partially or totally owned by Gingko and also funded by Gingko investors. Examples like the following are abundant:

“In 2016 and 2018, we entered into separate preferred stock purchase agreements in which we offered cash and R&D services to Genomatica in exchange for its preferred shares.”

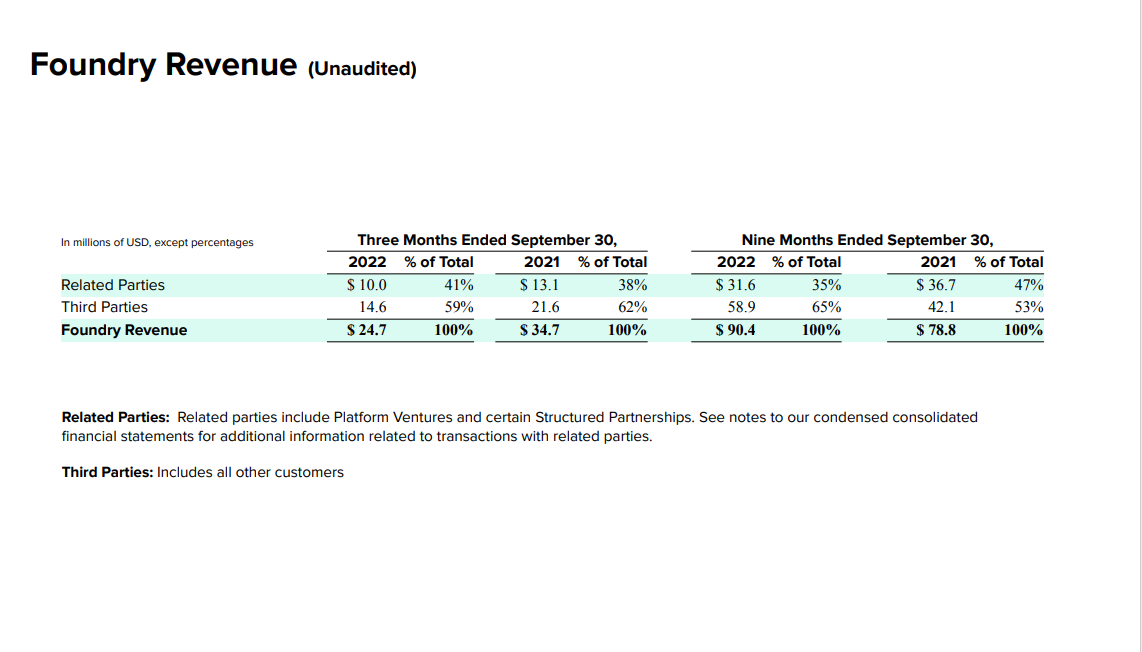

So Foundry revenue is growing nicely, but it seems to be at least partially purchased by Gingko. In many cases, Gingko does not disclose what percentage of its customers equity it owns or how much cash it paid for it, so it is hard to discern just how much of the revenue is purchased, although the percentage of revenue from related parties seems to be going down versus 2021. In turn, much of the foundry´s revenue comes from R&D fees, whilst the actual long term value creation depends on their end customers scaling up the production of their end products. There is not a single mention of how customers are doing in this regard and Kelly brushes over this aspect of the business, somewhat assuming that it will be fine and that Gingko will participate in such fineness:

“While the majority of Foundry revenue today is made up of Foundry usage fees, as we increase Cumulative Programs and to the extent our customers successfully commercialize products built on our platform, downstream value share is expected to comprise a larger proportion of Foundry revenue.” - 10Q Q3 2022

“So, we get asked all the time, you know, why doesn't Ginkgo vertically integrate into final products, you know, the TAM for end products and biotechs is huge, and we would [keep more] [ph] of the economics, obviously for sharing them with our partners. And our view is that we do still get a piece of that downstream exposure by sharing in this value with our customers while diversifying away from individual product risk. Okay?” - Jason Kelly, CEO @ Q3 2022 ER

The positive development on the Foundry side is that Gingko closed a deal with Merck, to help them manufacture “up to four enzymes as bio-catalysts”. Enzymes essentially speed up chemical reactions that enable a molecule to undergo some form a of a transformation, so that it can serve a specific function. During the Q3 call, Kelly said that Gingko is very early in the penetration of the pharma industry and per the press release that announced the deal, it seems that Merck itself will be synthesizing the enzymes with strains facilitated by Gingko. Perhaps Gingko has a long runway ahead working with big pharma players that can scale up precision fermentation manufacturing? I will be watching this closely going forward.

"Ginkgo's platform model enables us to identify improved enzymes and develop powerful fungal strains and fermentation processes for enzyme manufacturing, empowering downstream API production for our customers." - Jason Kelly, CEO, press release

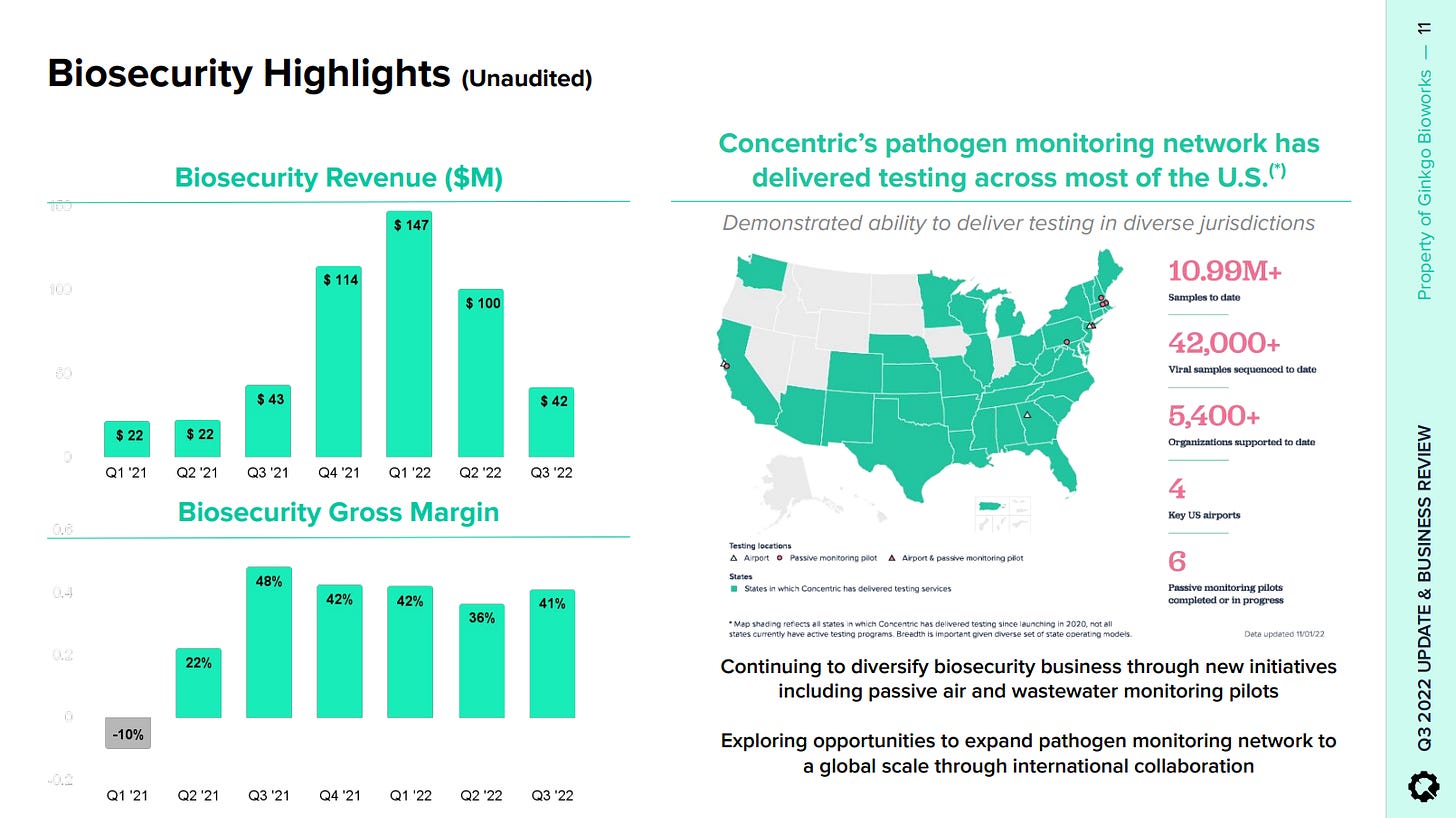

2.0 The Biosecurity Business

About biosecurity, the business itself does not have much to do with Gingko´s core capabilities just yet. Gingko has effectively deployed some sort of a testing distribution network, whereby it sells testing kits to end customers and then sends the kits to local labs, to the return the results to its customers via a web portal. In effect, it is a totally separate business, but the revenue growth is impressive and this points to some excellent business development capabilities inside the firm.

Looking out into the long term, however, it actually makes sense. The more I deepen in syn bio the more I understand that the world is pending on a genomic string. Nowadays, pretty much anyone can edit the genome of a given virus or bacteria and wreak havoc. The implications of this become specially apparent when you study how bacteria evolve to be resistant against antibiotics. Different antibiotics target different parts of a bacteria´s (prokaryotic) cell, so once you modify the underlying genomic code which then expresses each of these different parts, a bacteria becomes resistant to the antibiotic in question.

What happens if some enemy of the West releases a modified bacteria that resists all commonly available antibiotics? All hell breaks lose. The infrastructure Gingko is building, once deployed at scale, actually links with its Foundry capabilities in a series of ways, which Kelly illustrates well during the Q3 call:

“… the goal of the program [IARPA] is to detect if a sequence of DNA was genetically engineered.

So, in the program, we were given challenged samples of either engineered non-engineered organisms. […] and our technology had to make a call on which it was. And I'm happy to report that we were one of the top performers and we're seeing a lot of interest in this, sort of technology in both the U.S. and internationally.

… they [IARPA] have had robust demand for all of the platforms from partners, not just in the United States, but in the usual partner countries that the U.S. intelligence community works with.” - - Jason Kelly, CEO @ Q3 2022 ER

If their biosecurity infrastructure continues to compound through time, there will be eventually many ways in which they add incremental value to participants of the network at a marginal cost, thanks to their Foundry and this may translate into quite favorable unit economics. Currently, governments across the world are leaning towards the interventionist / collectivist side of things and until this changes, I believe that a future market by biological surveillance is unfortunately very much on the table. As evidenced over the last few years, it is fairly easy to convince the population that it is good.

Conversely, the policy driven nature of this part of the business could deflate it any time. If you track the pandemic back through time, people were mostly concerned about the virus when told to be concerned and viceversa, regardless of what was actually happening. Notably, along 2021, we went from maximum panic to normalcy without the epidemiological situation changing - just the way governments were communicating and this is quite unpredictable.

In the Q3 call, Kelly talked about durability in the biosecurity business as “as schools reopened and resumed testing in late Q3 and other entities such as the CDC are extending contracts”. What if the bureaucrat in question decides that testing in schools, given the highly contagious nature of the virus, is a completely futile task? The point being, unless being subject to psychological operation or forced to in some way, people are much less likely to go and get tested and this is very much policy driven.

For this reason and despite the attractive numbers, I believe the biosecurity business to be a call option. Ideally, it would sit on top of another business segment with a more capped downside, but Foundry´s revenue is hard to understand clearly, given the highly complex network of relations between Gingko and its customers - which by the way, such accounting tangles are ideal and typical breeding conditions of deleterious management. Having said that, if Foundry gains traction on the pharma side, I think that would be noteworthy and could perhaps change the current situation of the business.

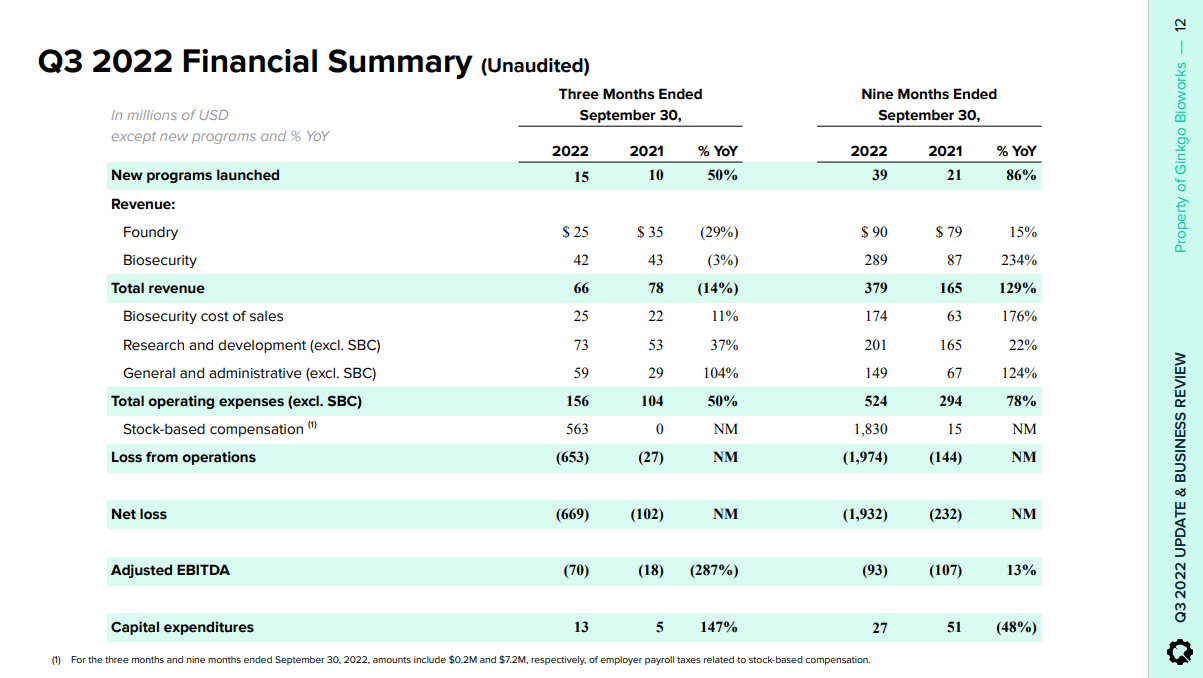

3.0 Financials

Much like other companies in the space, Gingko´s income statement is immature and pending sustainable value creation. If someone were to come along and totally commoditize synthetic biology manufacturing or at least do so for certain verticals, then Gingko´s situation would change quickly, because then it really could just focus on Foundry and be great at that. This has not happened yet and unless I am mistaken, it is not likely to happen soon.

Gingko closed four acquisition transactions during Q3, which impacted OPEX for the quarter. The increases consists fundamentally in Foundry spend:

Bayer Biologics Group: “which [opex] we expect would be largely offset by the revenue from our new collaboration with Bayer.”

Zymergen: “which is largely just a [pull-forward of spend]. We would have incurred organically in 2023 and 2024 to build these capabilities.”

The Zymergen acquisition came in with $100m in net cash, after all the transaction related expenses, which seems like a fantastic move. The goal of the acquisition seems to be to integrate Zymergen´s horizontal platform.

“But underneath, we’re really both building strong horizontal technology platforms. [The integration] can happen very quickly because there is a ton of cultural overlap between the teams.” - Jason Kelly, CEO @ Q3 2022 ER

During the call, management also announced the intention to standardize sales process, in order to accelerate pipeline development. This will be interesting to watch going forward:

“Second, we are continuing to evolve how we sell our services. So, as an example, one of the things we're hoping to do is to have a segment of our offerings be increasingly standardized from the customer perspective. In other words, more standard milestones and cost structures, standard IP terms, and time lines. And the hope is this can start to speed our sales cycle.”

Finally, the one thing that really stands out for Gingko is its balance sheet, with over $1.3B in cash and no debt. It is probably the best capitalized company in the synthetic biology space, so the cost of shareholder dilution is currently more than warranted. Per its cash from operations, -$147.5M (higher than otherwise due to the acquisitions), the current war chest gives it a reasonable runway. This could prove to be very valuable if Gingko was able to acquire Amyris like it acquired Zymergen (distressed, on the cheap) - which I hope does not happen.

4.0 Conclusion

The company still faces the issue how their clients are going to scale manufacturing, but I like the following:

Related parties account for a smaller % of Foundry revenue in the 9 months ending in Sept 2022 vs Sept 2021.

Gingko seems to be tractioning in the pharma space, in which big players can perhaps scale up manufacturing.

The balance sheet is healthier than other players in the space, like Amyris.

Lastly, I notice that Gingko´s platform is pointing to a series of domains that Amyris´ is not, such as CAR-T therapies and so it would be great for me to add some diversification in that sense to my portfolio. I continue to watch the company going forward, but perhaps the revenue from related parties and the manufacturing hurdle may prove to be too troublesome going forward. In terms of the end goal of the syn bio value chain, which is making things, Gingko is still around a decade behind Amyris despite its far healthier balance sheet.

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Nice piece. Might want to spellcheck "Ginkgo" as I see a few different variations :)