Summary:

Businesses that share economies of scale have a higher expected corporate lifespan and therefore, a longer runway to compound capital.

Everything in nature follows the Power Law. In business, a minority of businesses accrue the majority of the earning power. This is why paying premiums for truly good businesses turns out to be a wise thing.

The two concepts above are the essence of what in retrospect have been / are fantastic capital compounding machines, like $AMZN, $COST and $WMT.

Shared Economies of Scale and Capital Compounding

This week, I was reading “Richer, Wiser, Happier” by William Green and came across what Nick Sleep refers to as shared economies of scale. When a company generates economies of scale, it may opt to share the benefits with different stakeholders and thus enhance the quality of its business relationships. For instance, a given company that is achieving economies of scale may well afford to keep its gross margin at a comfortable spot. It may, however, choose to durably lower the prices of products to share with customers part of the economic value it generates. In doing so, it would be sharing economies of scale with its customers, ultimately sweetening its relationship with them in the long run.

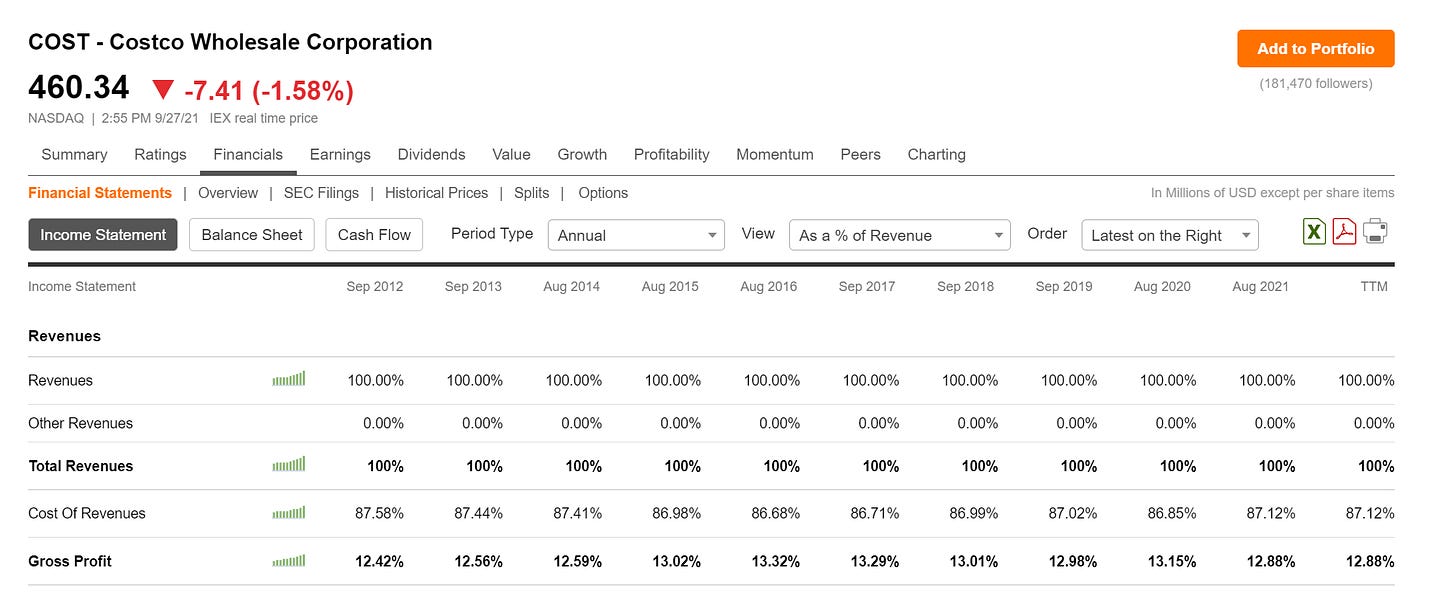

In many occasions, this ends up generating a brand loyalty that yields an economic value far superior to the one that may have been captured by defending margins in the first place. It also seems to enhance the longevity of the corporation, allowing for a longer time frame to compound capital. Examples of this are companies such as $AMZN, $COST and $WMT. For a long time, these companies have charged lower prices than they could afford to, sacrificing margins, simultaneously earning a top spot in their customer´s minds and hearts. Consider $COST´s gross profit, versus an average gross profit of around 50% in retail.

Anywhere you see a Costco, you know you are going to be treated fairly and this makes all the difference. Needless to say, this is also the case with $AMZN and $WMT. I find the evolution of their respective stock prices to be the equivalent of a lullaby in the investing world.

Good Businesses are Scarce and Worth Paying For

Last year I became quite interested in learning about the nature of reality, in terms of what rules define and govern it. I came across the idea of self organized criticality, which is a property by which a system ends up producing events of different magnitudes with inversely proportional frequencies, regardless of whatever changes may be made to the system. For instance, no matter how much we play with the configuration of sand in sand dunes, we still get exponentially more little sand slides than large sand slides. We get mini sand slides pretty much every second and really big ones maybe once a month.

It turns out self organized criticality describes most if not all natural processes in our universe, such as earthquakes, fractal shapes in plants and even the stock market. It seems that the same occurs in the world of business. We get many small businesses with perhaps non-optimal properties and every once in a while, we get businesses with optimal properties that grow to be generational wealth creation vehicles and to account for most of the earning power in their respective markets. As such, SOC combined with the second law of thermodynamics has helped me understand that paying premiums for good businesses is often wise, since there are not so many of them and by definition, only strong businesses can counter entropy in the long term. Of course, if you are going to pay a premium, you´ve got to really make sure the business is exceptional.

SOC + Corporate Longevity

Putting the two ideas together produces a new long term investing mental model for me - not that I do investing in any other time horizon. Finding a truly good business is hard to do, firstly because it is hard to identify and secondly because they do not show up that often. Even less frequently, we find a good business that is sharing economies of scale for the long run. When we do, we know we are very likely to have a capital compounding machine in front of us.

You can also reach me at:

Twitter: @alc2022

Feel free to leave me any comment.