As we move from 2D to 3D content, $U has an exponential growth curve ahead - top and bottom line.

U 0.00%↑ is still expensive at 27 time sales and is likely to get hammered as rate hikes come into play. It is a worthwhile radar addition.

3D Content Will Lead to a Wealth Explosion

As you may know, I am long $GPRO (deep dive) because I believe that content is directly equivalent to cash and any company that facilitates top content creation will do very well. $U falls in this category in a way that is not obvious, but once you see it, you will not be able to unsee it.

Today most content is in 2D, meaning that our potential interactions with the content are quite limited. As computing gets better and cheaper, we are increasingly able to make 3D content, which exponentiates the ways we can interact with it. $U has the world´s leading 3D content engine.

Content in 2D is already generating immense economic value. As it moves to 3D, the increase in economic value will be exponential, in line with the increase in interactivity. Content will become ontological, with each piece of content presenting a sort of immersible reality.

Consider a tennis match. Today, we watch whatever the cameras are pointing at. In a 3D format, all kinds of sensors would collect data from the match and in real time, create a 3D representation of the game that users can experience in many ways. New streams of monetization will naturally emerge.

To really understand the power of 3D content, however, you have to take a step back and comprehend content at its core. Content is not just videos, words and songs, but our default way to engage with information.

Content is how we store, edit and share information, which in turn are the 3 core actions that have propelled humanity forward, right since we started writing to track crops in the Agricultural Revolution, thousands of years ago.

The blueprint for a new factory can be content, for instance. Augmenting the blueprint from 2D to 3D, we get a digital model of the factory that together with machine learning, can enable us to effectively build the factory in the digital space first and then “download” it to physical reality once we know it works. You may have heard $NVDA´s CEO talk about this.

To further illustrate this, what would happen if I could deploy a hyper realistic 3D avatar of me and have it read the words in this post? I would become a YouTuber at a marginal cost of 0, as well as a writer.

The bottom line is 3D content shortens the distance between information and value, by making it easier to engage with content and $U is ideally positioned to capture this shift.

Understanding Unity and its Financials

$U´s offerings are very sticky and its Operate Solutions present meaningful upside in the future, due to their scalability and leveraged nature.

Unity has two core offerings:

Create Solutions:

“offers developers, artists, designers, engineers and architects the tools that they need to create immersive and interactive experiences”.

$U charges a yearly fee per developer.

Operate Solutions:

“ offers customers the ability to grow and engage their user bases, and to run and monetize their content”.

$U charges a % of the money clients make.

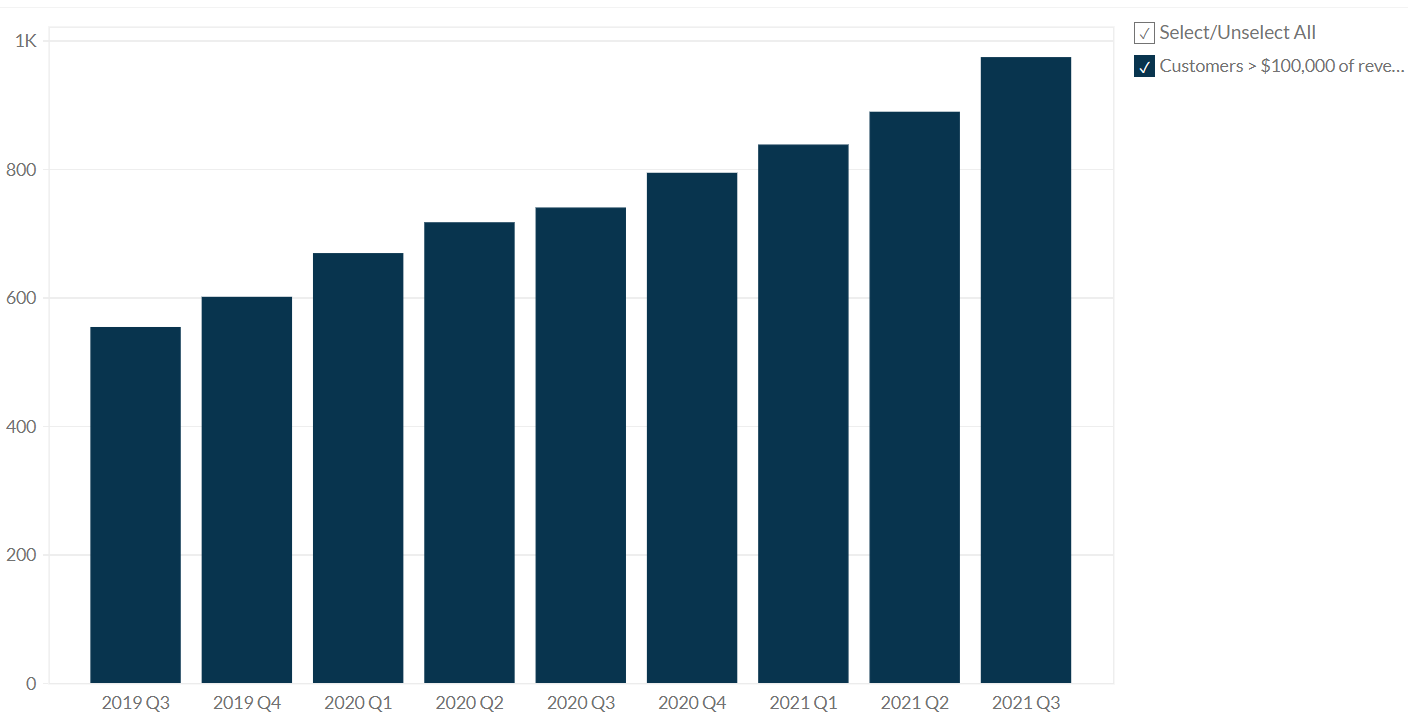

$U and 3D content are still in their early days. Most of $U´s clients are in the gaming sector, but there are already signs of the superiority of its 3D engine. From their 2020 annual letter:

“We estimate that in the fourth quarter of 2020, 71% of the top 1,000 mobile games were made with Unity.”

“Ninety-four of the top 100 game development studios by global revenue in 2020 were Unity customers.

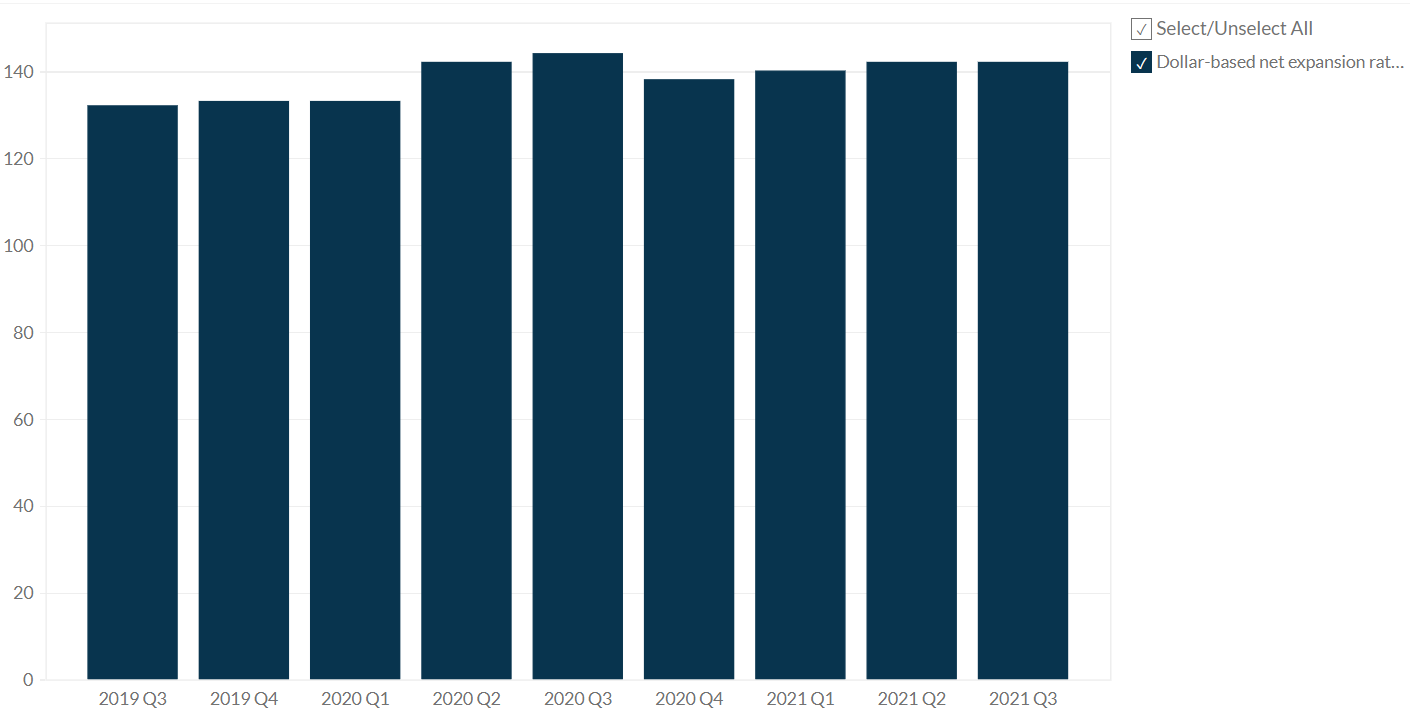

On top of this, $U’s offerings are looking quite sticky, which makes sense because once you deploy your 3D content (game, most often) it is probably not a good idea to swap the underlying engine. Dollar-based net expansion rate is quite high at around 140%. This means $U would be growing revenue at 40% without acquiring new customers.

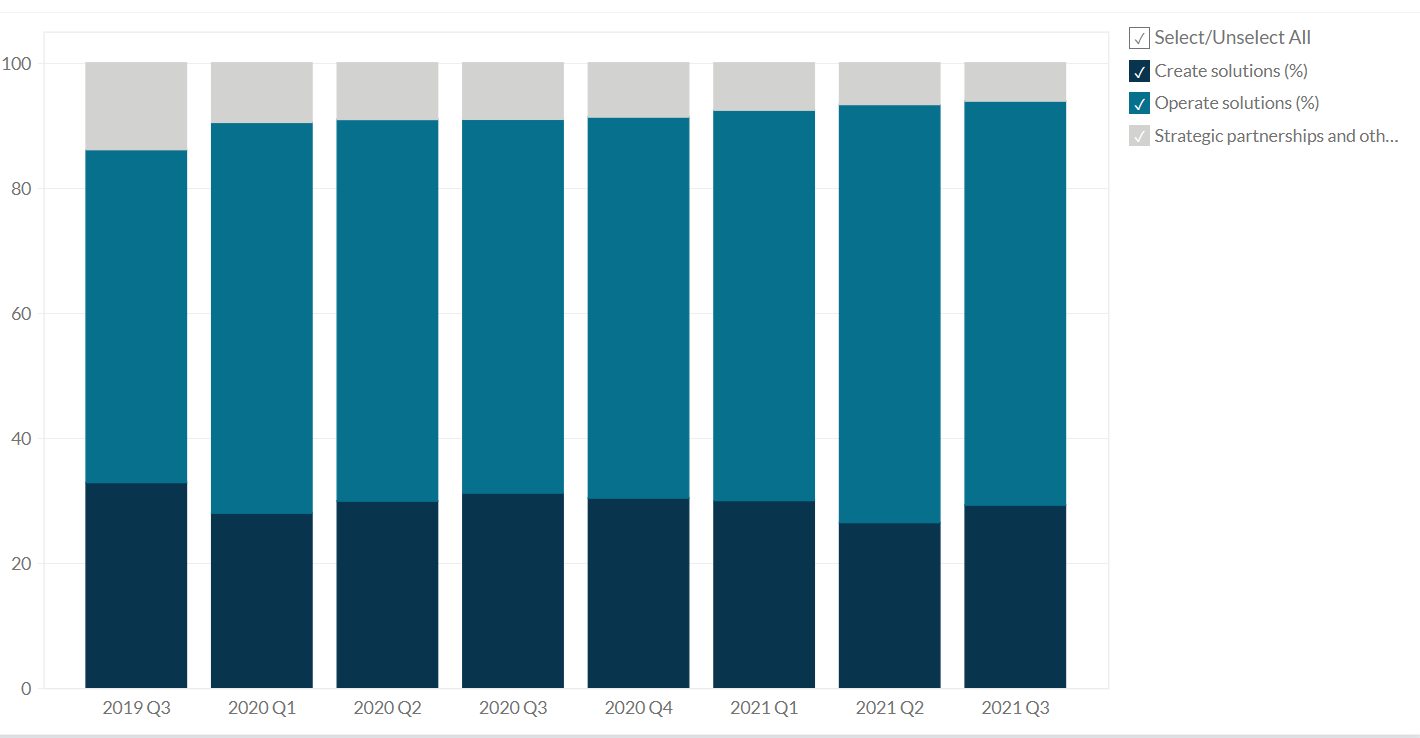

On top of this stickiness, the most promising aspect of $U´s business is helping their clients monetize the 3D infrastructure they create, versus enabling them to create it. There is no limit to how much creators can monetize their 3D content and this is where $U is positioned best to capture the upside of its engine.

If I am not mistaken, the company is not disclosing the gross profit per revenue segment. However, margins are naturally higher in business operations that leverage existing infrastructure, much like is the case with $SPOT and podcasts. By default, this is the case of Operate Solutions.

We can already see this part of the business account for a growing share of revenue, quarter after quarter. As it continues to grow, I believe we will see $U post healthier financials.

$U´s financials are messy, with revenue growing fast nonetheless. Gross profit is good, at 77.65% in the TTM. However, operating expenses put the company´s bottom line well into the red.

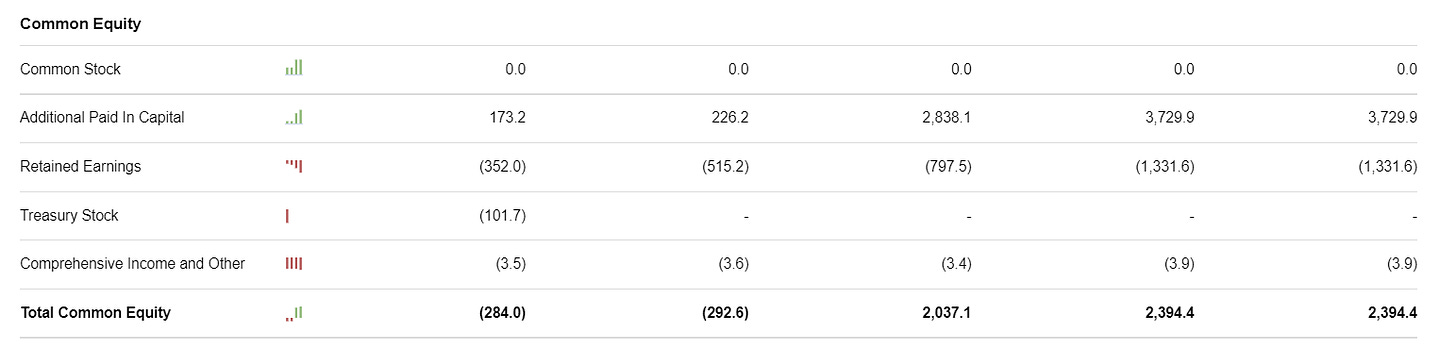

$U has $1,055.8m in cash and $1,703.0m in LT-debt. With FCF of $106.5m in the TTM, the balance sheet looks ok, although it is not radiating health. Additionally, there has been quite a lot of dilutive action going on in the last few years:

Of course, all of this financial observations are excusable because the company is in the growth phase and it is indeed growing very fast. However, $U is trading at 27 times sales even after the recent sell off and given its current financials I think the company is in for some pain going into this new and fresh rate cycle.

As 2022 goes on, I think this company is worth keeping on your radar. The long term potential of Unity is vast and its ability to win over the minds and hearts of game developers can spill over to other types of content, as we continue to make our way from 2D to 3D content.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc