Summary:

Stock prices follow earnings. Short term fears cloud our judgement.

By confronting our own impermanence, we can collapse short term fears and increase our odds of obtaining better returns.

We can also prime our physical state to make #2 easier.

Updating our Emotional Software

Investing is a probabilistic game and as such, it lends itself to playing tricks on investors. Discerning the truth amidst the infinite number of mirages that we encounter every day is intellectually hard, but arguably even more so at an emotional level. We are wired for a world that we left behind a long time ago, in which we had to run away from predators for our lives and things of the sort, so as investors we find ourselves facing a series of infinite unknowns daily with an outdated emotional software, that is constantly working to throw us around to edges of the emotional spectrum that serve no purpose. Seeing this with clarity, I have made it a priority of mine to get better every day at transcending my emotions and most notably, the emotion of fear. Below, I share some thoughts on the matter with you, that hopefully will help you improve your emotional software and become a better investor.

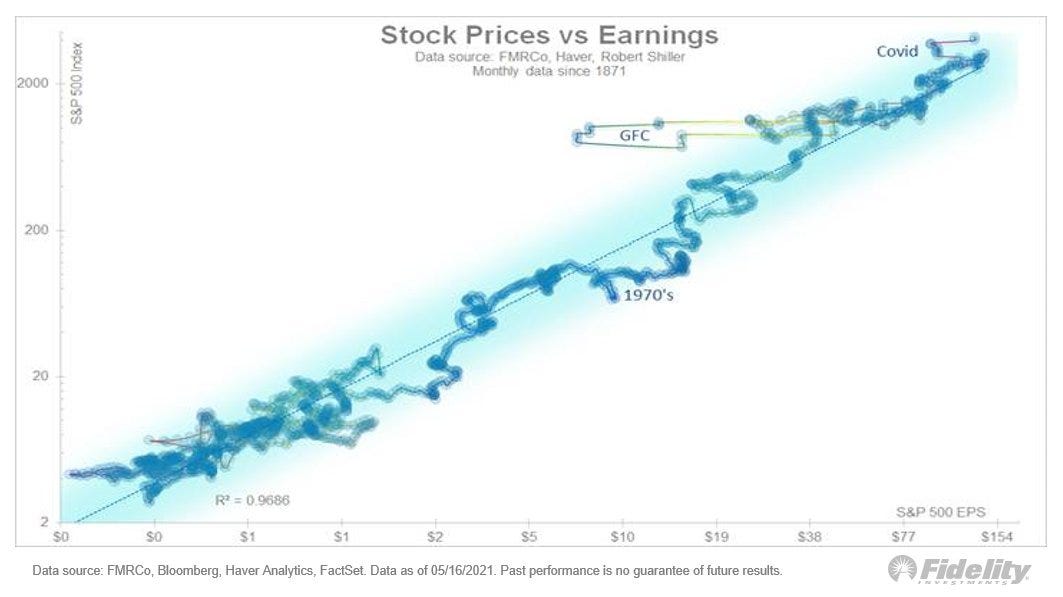

Stock Prices Follow Earnings

To start with, I have based on all my investment related emotional work on one very simple premise, which is that stock prices tend to follow earnings. As such, if I am able to identify a company that is likely to improve its earning power, then in the long term I know that the stock is very likely to follow suit. If I identify such a company and buy its underlying stock at a good price, which occurs rarely, then the remainder of the work consists in:

Following fundamentals, to ensure the long thesis remains viable through time.

Making sure my emotions do not work against me during whatever time I hold the stock.

Accepting Impermanence, Confronting the Fear of Death

I have found that #2 is perhaps the hardest part and in summary, I attribute much of this difficulty to the fear of death. In reading plenty of psychology, I have learnt that it turns out that most of our fears stem from our fear of dying and by confronting it, we can gradually and more easily collapse the rest of the fears that emerge from it and that we encounter in our lives. At a more superficial level, I believe that seeing a stock price goes down taps into our fear of scarcity, which is the result of our species having lived in a considerable level of scarcity for hundreds of thousands of years up until very recently. I find the solution to the above to be in accepting impermanence, a concept I have borrowed from Buddhism and Stoicism alike. By accepting that we are here for a short time, we can weigh our fears and concerns more proportionately.

Everything in the universe we live in is subject to the second law of thermodynamics and has an expiry date. Accepting this is hard and in fact, I have found that there are deepening levels that one can accept this at. Per every level of acceptance that I have dropped into, I have found the emotional and spiritual work to get harder but the fruits to be increasingly worthwhile. Along this journey, I have seen my primary impulses get considerably weakened, with my intellect / consciousness gaining an upper hand over them. This has enabled me to place a sharper focus on long term fundamentals, whilst remaining present and increasingly undisturbed by superficial and short term fluctuations, such as daily price action in the markets.

When stocks go up, I get excited and when stocks go down, I get scared - the emotions are still there. However, the relative detachment from worldly outcomes that I have gained from confronting my own transience, enables me to see these emotions in 3rd person perspective and manage them from a dashboard kind of set up, which enables me to see what is going on inside me at an emotional level. Quite often, the emotions get a grip of me, but in being conscious about them and actively watching them, I end up bringing myself to a neutral space. At first, the above seems almost impossible, but with time and perseverance, anyone can get there.

Body, Mind and Soul

I have also found it helpful to work on other parts of myself to advance in the direction of detachment and emotional intelligence. When we experience negative emotions, we release a number of hormones into our body that stick around for longer than the emotion in question, such as cortisol. A build up of cortisol in the body makes us more prone to feeling negative emotions, which in turn increases levels of cortisol in the body and so we get a negative flywheel. As such, I have designed routines to lower levels of cortisol in my body and increase levels of other more desirable hormones, such as serotonin. I do the following:

Work out 6 times a week.

Sauna and cold plunge 3-4 times a week.

Immerse myself in nature for more than 2 hours once a week.

Meditate 20 minutes / sleep 8 hours / drink 2.5L of water every day.

The above gives me a strong foundation from which to keep working on the above mental framework. I find that the weeks that I am not able to do any of the 3 things listed above, it gets considerably harder to transcend daily occurrences that are perhaps not so relevant to my long term goals, since my physical state may work against me. Feel free to drop me any comment you want below. I am more than happy to answer any question you may have!

If you enjoyed this article, remember to subscribe to my newsletter for more!

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Feel free to leave me any comment.

It's impressive that you've managed to build such habits.

Congratulations.