This is an update to my original Tesla deep dive. In short, I believe this company is on its way to redefining the economy and generating unprecedented levels of abundance, by fostering the joint development of next generation manufacturing (auto business), AI and renewable energy. On a quarterly basis, I look for compelling evidence that the company is advancing well on these 3 fronts, together with financial health.

In essence, the way Tesla works is what sets up the company for prolonged success. Time and time again, it manages to pull a seemingly impossible feat off. The market fails to understand that this is due to its unique organizational and cultural properties, which lure in and retain the best talent. In many ways, learning about Tesla’s inner workings is not only pertinent as it refers to investing it, but to learn how to spot future emerging world class companies - so be sure to check out the deep dive if you have not.

On to the quarterly results now. Today´s structure:

1.0 Manufacturing and Auto

2.0 AI

3.0 Energy

4.0 Talent

5.0 Financials

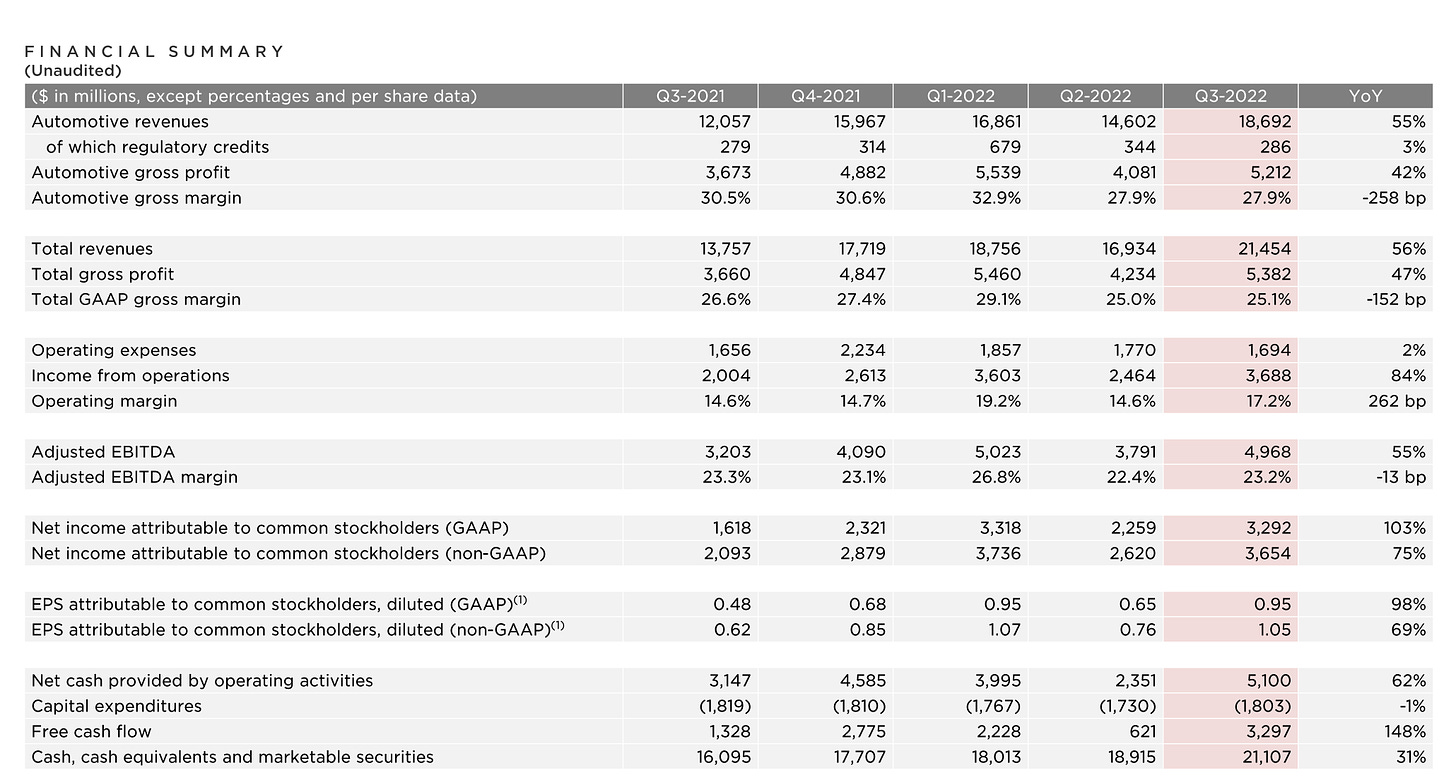

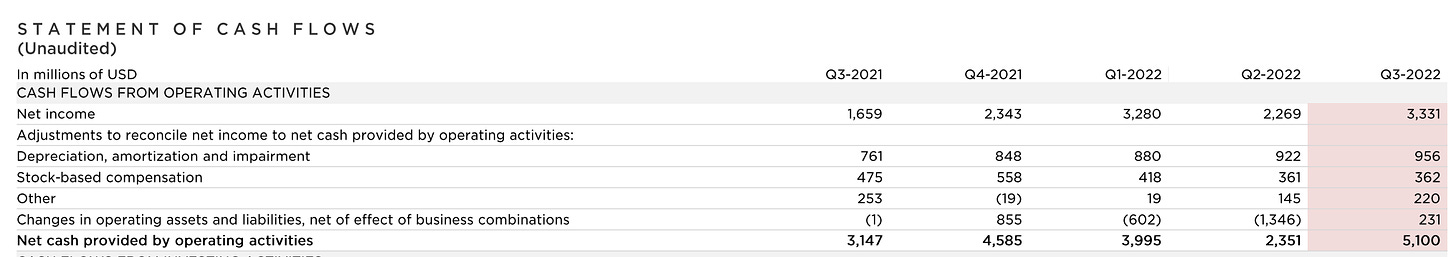

The graphs below are taken from Tesla´s Q3 2022 shareholder deck.

1.0 Manufacturing and Auto

If Tesla continues to compound its manufacturing efficiency, the sky is the limit.

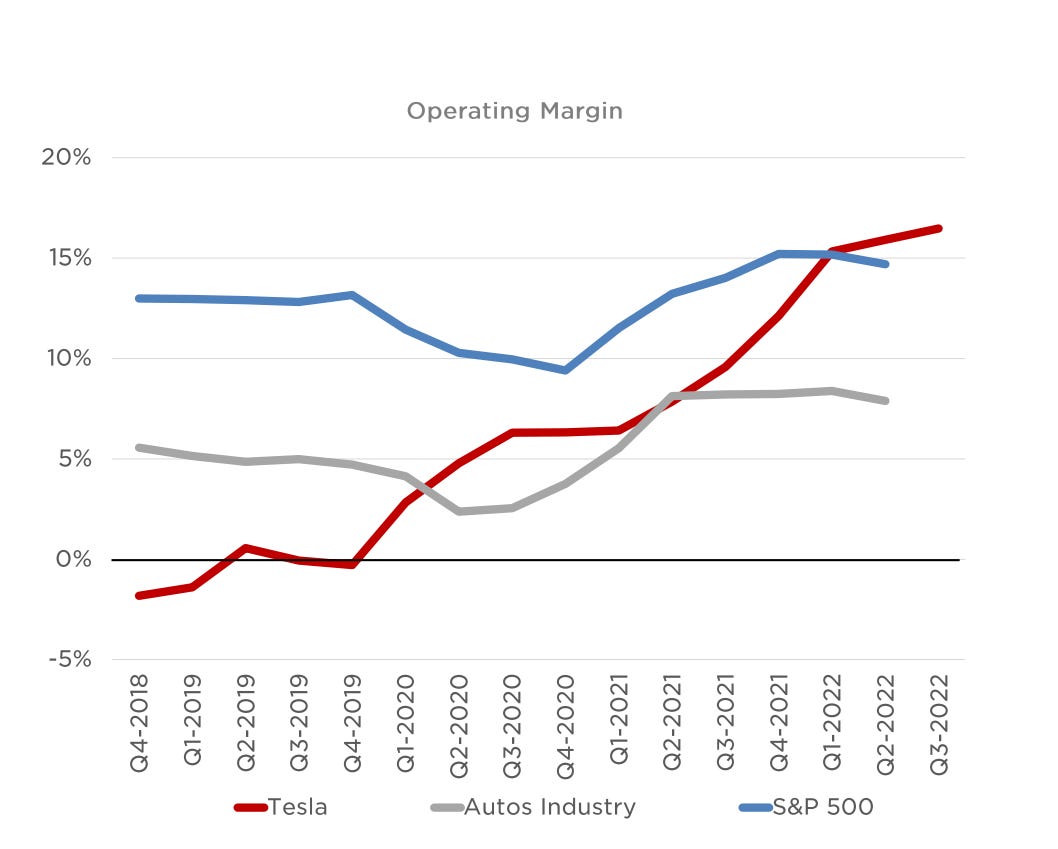

Tesla took a manufacturing efficiency quantum leap to bring the Model 3 to the world, evidence by its growing operating margin. If you review its financials, you will see that they look particularly attractive from that point onward - specially FCF. For this reason, I would argue that together with demand, this is the key metric to watch for the health of the company.

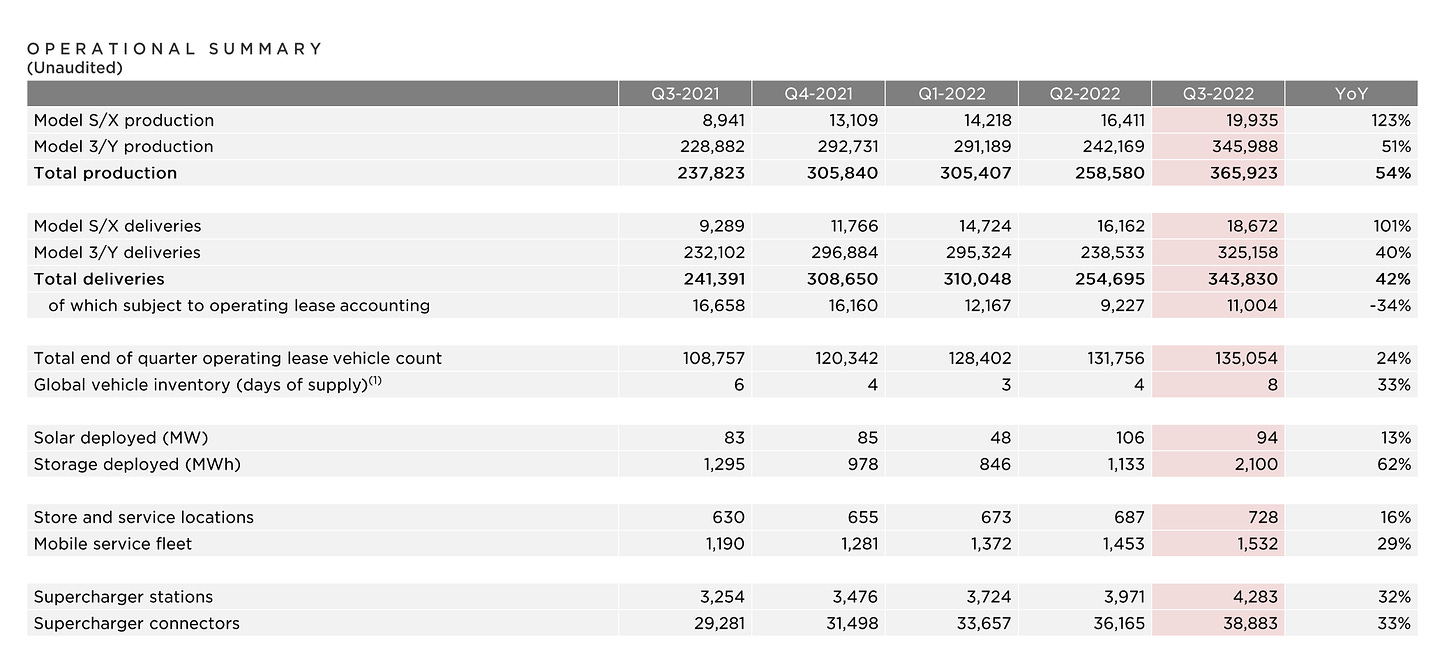

This quarter, Tesla hit a record 17% operating margin (goes higher as does the manufacturing efficiency), with over 365,000 vehicles produced and over 343,000 delivered, which is a considerable ramp up from last quarter:

In the abstract, so long as Tesla continues to compound its manufacturing efficiency, it will eventually be able to competitively make:

Exponentially more cars.

Anything it wishes to (except that which implies biology: see Amyris for that), at very large scale.

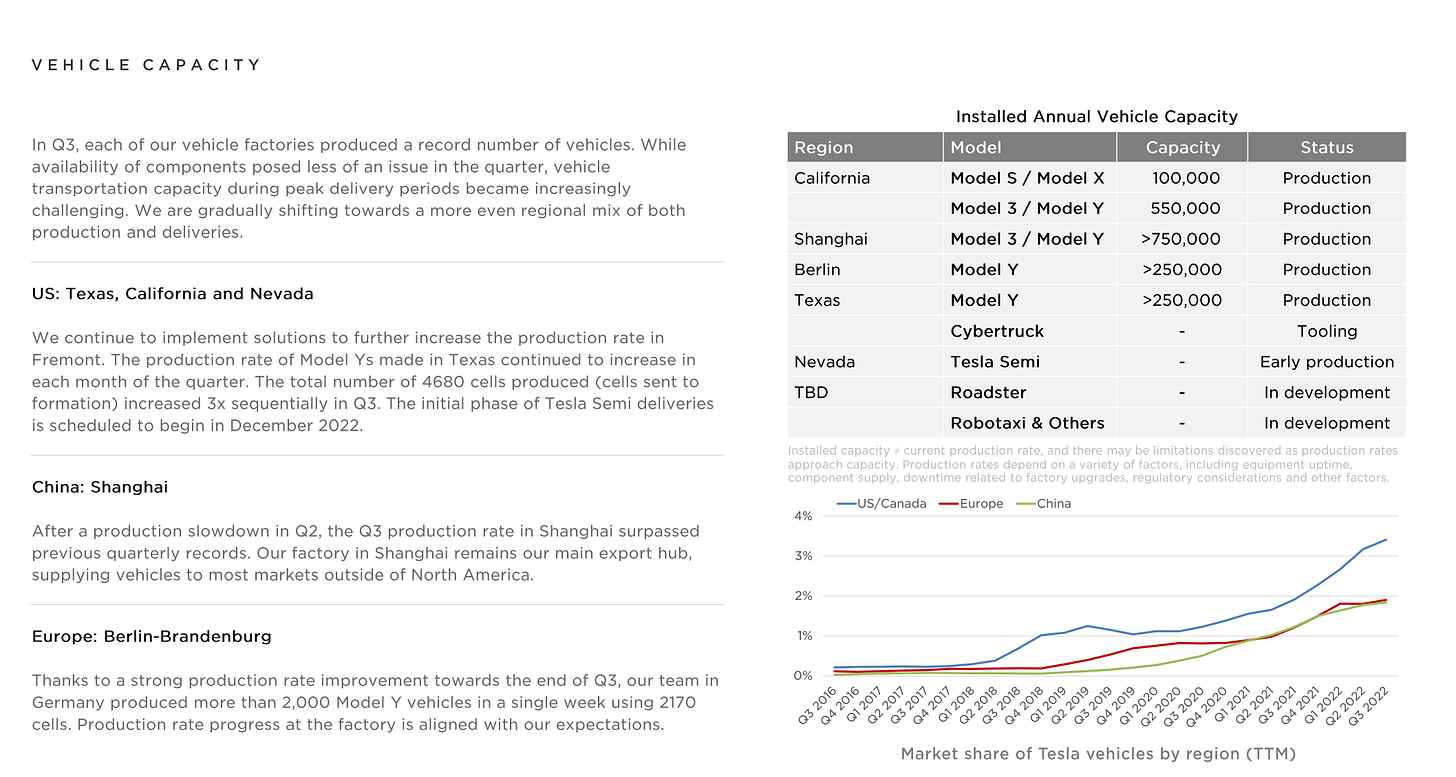

Today, less than 1% of the cars on the road are electric and the world is moving in this direction. I believe that all output will be gobbled up and so sales growth, specially given Tesla´s gravitas, is a function of output and hence manufacturing prowess / efficiency. As Tesla deploys more factories and gets better at making cars, the output will increase beyond what linear models can portray.

Of course, not any kind of manufacturing efficiency gain going forward will suffice:

Analyst: “Which is the progression from Tesla's first platform with SMX to the second platform with 3 and Y led to a 50% reduction in cost of goods sold. When do you see Tesla's third platform being released?”

Musk: So, it's obviously against what we're working on, which is the next-generation vehicle, which will be probably about the cost of 3 and Y platform. It will be smaller, to be clear […]

[It will] certainly exceed the production of all our other vehicles combined.

So we're trying to get to that 50% number again. […] how are we making two cars for the amount of effort that we currently take to make one Model 3? […] Half the loss, half the past, half the factory floor space.

If the Model 3 manufacturing advances essentially led to the company´s current notoriety, what will doubling them result in? Likely non-linearly more free cashflow, among other things.

Some further datapoints regarding the manufacturing advances:

“Giga Berlin achieved another milestone of 2,000 cars made in a week with very good quality and is ramping rapidly. Giga Austin or Giga Texas should reach this milestone very soon. And in fact, just yesterday, we extrapolated yesterday's hold rate, it would be 2,000.”

2.0 AI

Don´t get distracted by the robot - Tesla´s AI is coming anyway.

The Optimus robot presented in the AI day looked a bit underwhelming, but with Tesla´s incessant iteration and innovation, it will soon be able to do many things that humans today are paid to do. In effect, human jobs below the creative domain consist in processing relatively simple stimuli and performing a corresponding action - neural nets can be trained for this. As Musk said in the presentation:

the economy = capita x [production / capita]

If you can produce billions of robots that perform said tasks, then the “capita” component of the equation tends to infinity, radically changing our economy - pushing humans way out into the creative domain. Note that of course, the mechanics outlined in the previous section are what makes envisioning this possible in the first place and in fact, quite a likely reality a decade or two into the future.

Perhaps this endeavor fails for some unexpected reason, because it is so far fetched: Tesla is still making meaningful progress today is in training an AI in the first place. This, beyond its software prowess, is fundamentally because Tesla has gone down the route of putting many GPU chips together instead of creating one big one, NVDA 0.00%↑ style, which for reasons that Moore exposed in his original paper, is so much more efficient if done adequately (more about this in my upcoming AMD 0.00%↑ deep dive).

Musk: “So, the jury is out on Dojo. Dojo team thinks they can outperform NVIDIA for neural training. Dojo is out.”

Meanwhile, the FSD program has gone from 2,000 customers to 160,000 customers in 2022. This, put together with the above, is very much in line with what I discussed in my deep dive - Tesla is not only building and selling a lot more cars, it is deploying a network of them that picks up information and essentially compresses the act of driving into an electron management game:

“Cars are increasingly becoming smartphones with wheels and anyway, all we do to drive them is process visual stimuli and take appropriate decisions to steer, accelerate or hit the brakes. The point is, when humans drive a car, transportation is an analogue problem that befalls on individual judgement. But when cars are connected, it becomes a networking problem.

Say you have 1M connected cars, that are picking up data (sound, video, other sensor even) as they drive. The data gets sent back to a centralized server, where it is processed and turned into insights. The insights then get sent back each car, which get an updated knowledge set on how to best drive. Eventually, the fleet knows how to drive even better than humans and from the on, transportation is exclusively a function of how you move electrons back and forth.”

The point is that, without Optimus or not, this is not only a unique selling point for Tesla vehicles, but can also be turned into a SaaS with Google-proportion implications: in fact, perhaps many times Google. The software and the underlying hardware can then be repurposed to other tasks, that are equal in nature. The cranky robot is not the point.

3.0 Energy

The energy business continues to reach new highs.

Zachary Kirkhorn: “we achieved our strongest gross profit yet for this business, driven primarily by record volumes of our Megapack and Powerwall products.”

According to this report by Rethink X, we can generate energetic abundance by going full on with renewable energy, kind of like we have done with information and the internet. The key is storage/batteries, where we see Tesla making meaningful progress The 4680 battery in this context is what the Model 3 implied for manufacturing efficiency, which is in itself, also a key enabler for the production of batteries.

Some key 4680 datapoints:

“Our production of 4680 cells has tripled in Q3 compared to the previous quarter.[…] production of 4680 ramp is growing exponentially.”

“[…] our goal is to strive toward 1,000 gigawatt hours a year of annualized production in United States alone by Tesla.”

“[…] to transition to sustainable energy, our calculation for both stationary and vehicles is 300,000 to 400,000 gigawatt hours or 300 to 400 terawatt hours.”

As manufacturing and battery efficiency continue to ramp up, Tesla is uniquely positioned to unlock energetic abundance, in the transportation sector to start with. Down the line, this enables the company to bring its AI into the physical world too.

Drew Baglino : “It's the attention to detail on how to bring costs out of the manufacturing process -- or remove processing steps.”

Musk: “all the way down from the mine to the cell. And I think, once we are fully integrated, I think we still do see a path to hold roughly $70 kilowatt hour cell -- $70 per kilowatt hour cell before any incentive.”

4.0 Talent

I found it noteworthy in this call when management was asked about R&D spend and Musk replied the following, perfectly summarizing the intangible qualities of the company:

Musk: “What matters is where are the most brilliant people working. And Tesla remains the -- Tesla and SpaceX are two companies where the smartest engineers want to work.

I think one nickel Tesla is frankly worth an infinite number of dollars. You could have like a -- almost same the number of credit shares and they would not be able to do work one nickel of Tesla we can do. You can't make it up in volume. ”

A very brief section, but actually the most important.

5.0 Financials

Financials remain exceptional.

I/S and C/F

The income and cashflow statement are thus far going nowhere but up:

When asked about a potential recession, Musk replied:

“Well, to be frank, we're very pedal to the metal come rain or shine.”

If you are a long term thinker, you may appreciate as do I that the company is producing enough cash and is riding a deep enough demand trend that a recession would likely only be a little bump in the road - so long as the manufacturing prowess remains and is accentuated through time. Positive cash from operations and a big cash position help too.

Management claims to be seeing deflation across the board as well:

Musk: “there´s more deflation than inflation”

Kirkhorn: “There is a small amount of production that we're seeing going into our Q4 cost structure from steel and aluminum primarily, but it's less than 10% of the total increases we've seen so far. So, we're optimistic here based upon what we're seeing on the indexes for some of our cost structure.”

B/S

The company ends the quarter with $21.1B in cash, adding $2.2B versus last quarter “driven mainly by free cashflow of $3.3B”, having paid down $0.9B in debt. Only $63m in debt remain, which is formidable. One of the better balance sheets in the market.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc