Edited by Brian Birnbaum and an update of my original Tesla deep dive.

1.0 Price Cuts and Operating Margins

2.0 AI and The Changing Auto Business

3.0 4680 Ramp Up

1.0 Price Cuts and Operating Margins

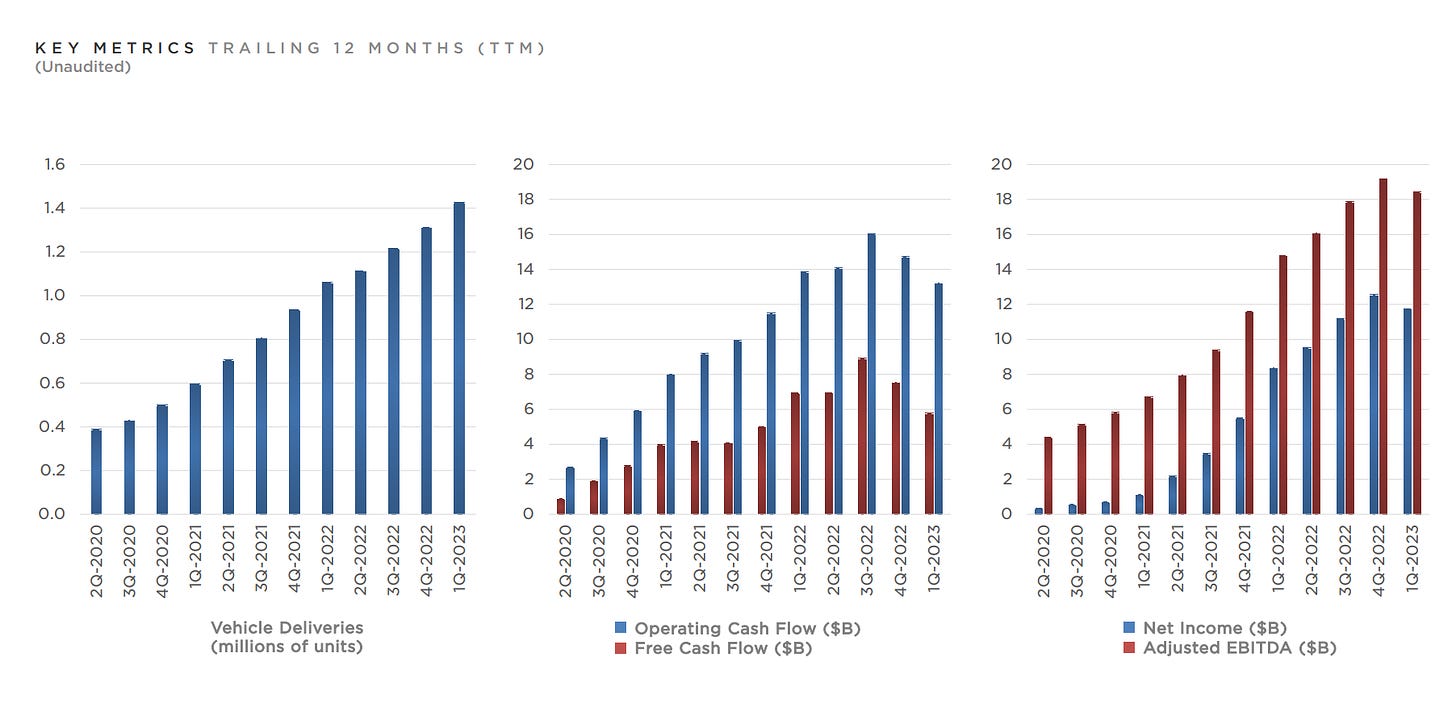

Price cuts can be interpreted in a number of ways, but for a company that thrives off volume they seem like a reasonable procedure when faced with rate hikes, which lessen the purchasing power of consumers worldwide. It could be that Tesla cars are no longer as desirable as they were, but I would take my time in asserting this. Quite notably, these price reductions (and FX headwinds of $0.8B) have brought down operating margin from 16.0% to 11.4% QoQ, above Toyota’s operating margin of of 7.33% in the TTM.

Toyota has long been recognized as the automotive industry leader in manufacturing and production and here comes Tesla, which on average has a ~50% higher operating margin. What we can infer from this is that Tesla is quite adept at manufacturing and that whilst it is currently focused on making cars, it could focus on making anything that resembles a car and at some point achieve cost leadership. The fundamental enabler of this competitive advantage is Tesla’s ability to continuously learn and innovate.

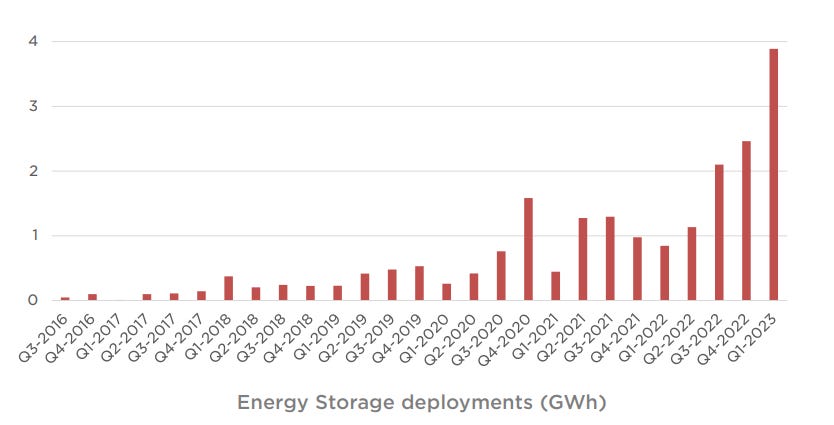

From its ability to scale operations and continuously innovate, emerge two other exponential curves: FSD and energy storage. The more cars on the road Tesla has, the more data it picks up which then increases the odds of it creating an AI that is able to drive cars around autonomously. The better it gets at battery technology for its cars, the more storage capacity it can deploy across the board. The manufacturing, software and energy curves eventually merge enabling Tesla to produce intelligent things that can do stuff for us whilst we rest or participate in more productive activities.

2.0 AI and The Changing Auto Business

Until now, the auto business consisted in selling cars at a low margin and then spare parts at a high margin. Software has now been added, with high-margin digital products and services like performance/security OTA updates, predictive maintenance and payments.

Whatever device Tesla puts out into the world with Hardware 3 becomes a node within a growing network that gathers and distributes information, which in aggregate equates to intelligence. The intelligence in turn can translate into full autonomy or into anything that currently requires human brain power. As in, we currently imagine autonomy to be the pinnacle of the auto industry, but what happens when we have full self driving cars that are also doctors, for example?

This may sound like a bad science fiction novel, but let’s review an excerpt from my original Tesla deep dive:

Quite likely, the value of software defined cars will rise exponentially over the coming decades and the auto business will transform from the sale of pricey spare parts to selling intelligence. Thus and in line with my observations in the first section, every basis point sacrificed for scale will ultimately pay off. Ideally, Tesla´s manufacturing prowess should translate into superior margins on end products sold and the software will likely be accretive. Having said that, the real gains will rest on the side of software.

3.0 4680 Ramp Up

According to management, the new Texas 4680 factory will require only 30% of the “capex per gigawatt hour than typical cell factories when fully ramped”. In turn, the 4680 battery is expected to provide up to 5X the energy, enable 16% more range for their vehicles, and deliver 6X the power of previous cell formats. This is a notable efficiency delta, which is nonetheless quite typical of the company and illustrates the fundamental property that I point to in the first section.

Other than FSD, the 4680 battery is the latest manifestation of Tesla´s ability to pursue exponential curves. Porsche, for example, has been around for 92 years now because it has continuously made its cars cooler and funner to drive and Tesla likely has a similar runway ahead, so long as it does the same. By incessantly pursuing advancements on the manufacturing, software and energy sides, it is structurally positioned to keep on making cars that people love.

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc