Edited by Brian Birnbaum and an update of my original Tesla deep dive.

In Section 1.0 I explain how a cyclical analysis of Tesla falsely implies that the company is in trouble, and how, in the past, Tesla has overcome even larger challenges.

In Section 2.0 I dissect the energy and AI businesses.

In Section 3.0 I analyze the financials and explain how they reveal that, despite Tesla facing problems in a cyclical context, the company is actually much stronger than it was just two years ago.

In Section 4.0 I conclude the write up.

1.0 A Diagnosis of the Tesla Machine

Tesla cyclically makes efficiency gains and then passes them on to consumers. This time around, it has been forced to pass on the efficiency increases faster than otherwise, which is putting the company under pressure.

In turn, the dwindling growth rate of EV demand is likely to push Tesla further ahead of legacy players.

If Tesla continues compounding its AI, renewable energy, and manufacturing prowess, it can eventually yield a platform that brings a new level of material abundance to the world. The moment the company can create robots with generalized, human level intelligence, it will effectively abstract most forms of (manual) work away, and there is no telling how valuable this can be.

But, in order to get there, Tesla has to continue selling cars profitably to generate free cash flow that can then be reinvested into the above initiatives.

Further, for investors to obtain outsized returns going forward, Tesla does not need to hit all three endeavors out of the park. A combination of manufacturing + AI or manufacturing + energy will produce outsized returns.

The only combination that won’t produce such gains is AI + energy; manufacturing is the fulcrum upon which rests Tesla’s ability to produce AI and energy at levels that attain economies of scale.

High-functioning AI requires many devices picking up data that can then be used to train models. High-functioning energy production requires the production of solar panels and batteries at scale for the unit economics to make sense.

Naturally, as rates rise, the cost of money–i.e. debt and borrowing–rises in tandem. As a result, investors can certainly expect Tesla to sell less cars than otherwise as fewer customers are able to afford the cost of borrowing. But, so long as Tesla´s manufacturing increases efficiency, lowering prices won’t hit free cash flow enough to hamper the pace of reinvesting back into the business.

Tesla´s progress in this sense exhibits a cyclical pattern. When they make efficiency gains, they pass them on to consumers by dropping prices. Then they move on to pursue further scale and efficiency, to then pass it on to consumers again.

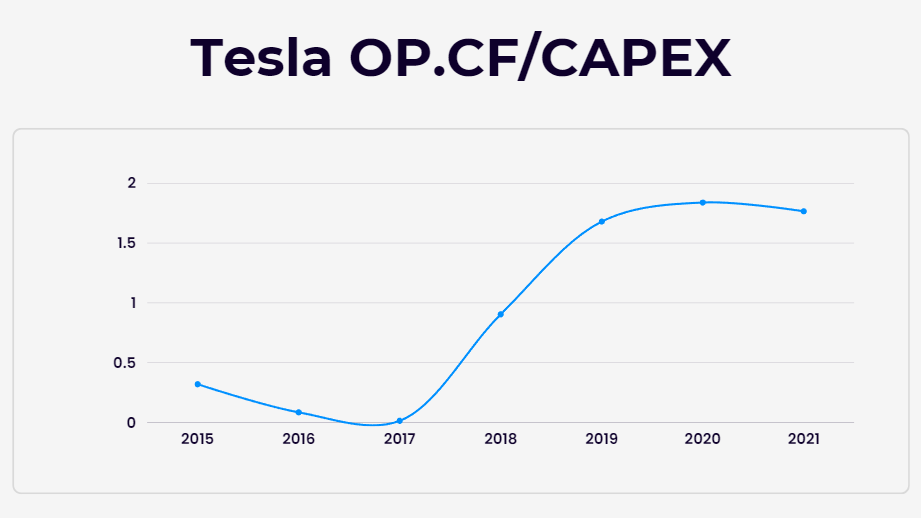

This can be tracked via the following two metrics:

Operating cash flow / CapEx: an increase in this metric could denote an increase in automation; holding all else equal, higher rates of return per invested dollar would indicate more efficient operational processes.

Free cash flow / Operating margin: indicates how much free cash flow Tesla is able to produce per percentage point of operating margin.Increased FCF/Op. Margin indicates that Tesla can produce more free cash flow with lower margins, meaning more efficient manufacturing (and operational) processes.

What we can tell from the graphs above is that this time around Tesla has been forced to drop prices before the completion of their current cycle and that, therefore, the company is under more stress than usual:

I’m worried about the high interest rate environment that we’re in. I just can’t emphasize this enough that the vast majority of people buying a car is about the monthly payment. - Elon Musk, during the Q3 2023 conference call.

Tesla can break under this pressure, or it can emerge strengthened. However, to do so it must bring prices down fast enough to outpace increasing rates and decreasing affordability. If accomplished, Tesla may be able to emerge from this gauntlet in a much stronger position if and when the macro environment returns to normal.

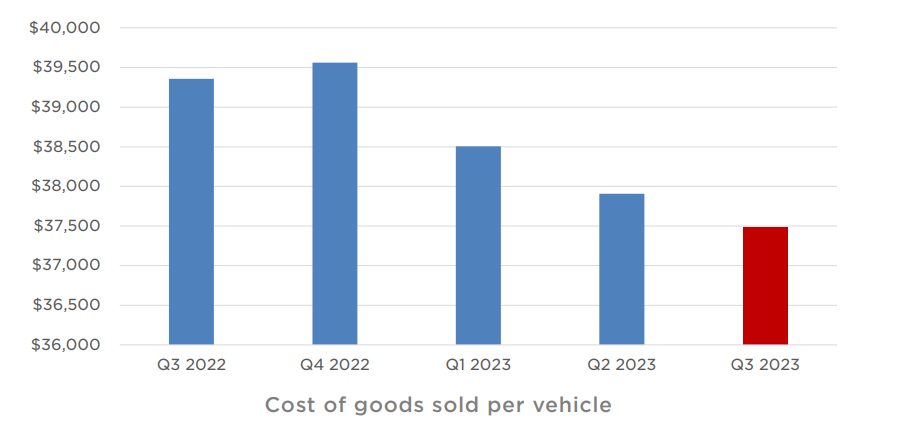

Despite planned factory shutdowns during Q3, cost of goods sold has decreased (seen below).

In its history, the company has gone through two particular instances of having to proliferate manufacturing efficiency, the latest being producing the Model 3 at scale–termed “production hell” by Musk. This was a monumental challenge, but as you can see below, the end result was spectacular.

Tesla “the free cash flow machine” was born after this cycle. So long as its extraordinary organizational properties remain front and center, odds are high that the company will do just fine despite continued pressure.

I think that there’s very significant price elasticity. I mean, to be totally frank, if our car costs the same as a RAV4, nobody would buy a RAV4 or at least they’re very unlikely to. - Elon Musk, during the Q3 2023 conference call.

Lastly, investing in Tesla as an “EV play” is dangerous. The idea that EVs are better for the environment is a temporary phenomenon. The truth is, the batteries are highly pollutive’ and therefore the practical reality is that people will continue buying EVs only if they become generally better and cheaper than the alternatives.

Reducing the cost of our vehicles is our top priority. - Vaibhav Taneja, Tesla CFO during the Q3 2023 conference call.

Over time, Tesla´s continuous iteration is more likely than not to yield such a value proposition. As the company works on its next generation platform, it now expects Cybertruck deliveries to begin later this year.

Due to its complexity, management expects Cybertruck to be a drag manufacturing efficiency for some time, until its various production problems are resolved. I believe the market is exaggerating this issue, unable to see beyond current challenges and into the future. Tesla continues innovating, while legacy automakers like Volkswagen are tip-toeing around their shareholders’ conflicting operational opinions.

Due to weaker EV demand, VW announced on the 23rd of September that it will suspend production of the ID.3 and Cupra Born electric cars at its Zwickau and Dresden plants in Germany. This is actually because VW has not yet found a way to efficiently make EVs that people want.

If the above is representative of the attitude legacy players are adopting across the board, the current downturn is likely to extend Tesla´s lead. By the time the macro clouds dissipate, Tesla will be much stronger, while the question of whether legacy players like VW figure out that they require lower rates to present a semblance of operational efficiency may linger unresolved.

2.0 The Energy and AI Businesses

Tesla´s businesses beyond auto are now beginning to stand on their own.

According to management, energy is becoming Tesla’s highest margin business, driven, apparently, by Megapack deployments. Energy and service now contribute over $0.5 billion to quarterly profit. Not long ago they were a drag on financials. Moving forward, energy’s profitability should act as a tailwind for Tesla´s mission to reduce the cost of goods sold.

Energy storage deployments are up 90% YoY in Q3, 4.0 GWh being its highest quarterly deployment yet. This growth has been enabled by the Lathrop factory, which will advance to full capacity (40 GWh) during phase two expansion.

Further, 4680 cell production in Texas increased 40% QoQ, with scrap down 40% QoQ, seemingly a deceleration from to Q2, in which they managed to increase 4680 cell production by 80%. This is perhaps natural as the factory reaches its full capacity.

With the Lathrop factory running at full speed, it will be interesting to see Tesla continue building out new factories and cyclically sharing efficiency gains with customers. Once that pattern emerges, the “abundance” thesis will find more solid footing.

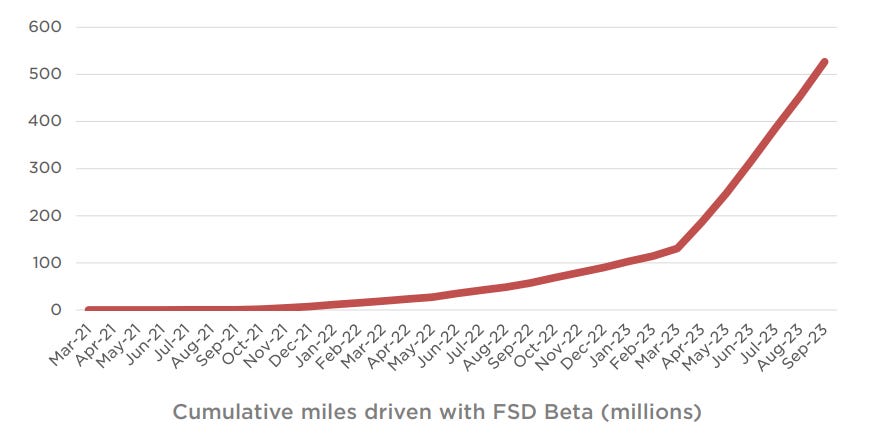

Simultaneously, following an inflection point last spring, cumulative miles driven with FSD Beta continues moving in the right direction. In August, Tesla dropped the price of FSD from $15,000 to $12,000, presumably with the same thinking that drove auto prices lower.

[…] our vehicles are now driven over 0.5 billion miles with FSD beta, full self-driving beta, and that number is growing rapidly.

- Elon Musk, during the Q3 2023 conference call.

As cumulative miles driven continue rising, AI model(s) grow smarter. Certainly, FSD may never become a reality, but a commercial breakthrough promises to proliferate Tesla´s earning power. Bringing FSD to life requires a pharaonic organization: vertical integration of multifarious operations and business lives. As of today, no other company is close.

With unparalleled manufacturing efficiency paving the way for an exploding energy business, Tesla’s AI business presents an extremely appealing degree of asymmetry.

3.0 Financials

Tesla’s numbers remain where they were in 2021, during a macroeconomic bonanza. An economic re-acceleration could kick Tesla into overdrive.

Income / Cash Flow Statement

Year to date, Tesla has generated operating cash flows of approximately $8.9 billion and free cash flows of approximately $2.3 billion. This represents an average of $2.96B in operating cash flow per quarter. Its current rate ($2,460 in Q3) seems sufficient to fund capital expenditures going forward.

Management expects to increase CapEx going forward, which they can always recalibrate to match the operating leverage growth rate:

On the operating expenses front, R&D expenses continued to rise due to Cybertruck prototype builds and pilot production testing combined with spend on AI technologies like full self-driving, Optimus and Dojo. We have and will continue to make investments in these areas, and hence our capital expenditure and R&D will continue to grow in the near term.

- Vaibhav Taneja, Tesla CFO during the Q3 2023 conference call.

In the first section, the numbers reveal a downcycle, which the Street interpreted as a source of concern. However, the numbers outlined above reveal that, in absolute terms, Tesla´s operating cash flow increased from Q3 2021 to Q3 2023. This, despite the fact that, back in 2021, markets, economies, and therefore consumers were in a state of euphoria, purchasing Tesla cars at meaningfully higher prices.

From Q3 2021 to Q3 2023, vehicle deliveries increased almost twofold, from 241,391 to 435,059. Net income is up 18%, from $1.6B to $1.9B–not too shabby considering where we are in the cycle.

Taken as a whole, it is more than evident that Tesla´s efficiency gains since 2021 have made the company much stronger as it becomes a low-cost provider.

Perhaps not as impressive, free cash flow during the same period has decreased, falling from $1,328M to $848M. However, this delta of -$480M is relatively close to that of CapEx, which came in at $641M. Certainly, for Tesla to continue increasing CapEx in the current environment, it must embark on a Model 3-esque quest for added efficiency.

Free cash flow (FCF) is the money a company has left over after paying its operating expenses (OpEx) and capital expenditures (CapEx). - Investopedia

In layman’s terms, FCF is the actual cash coming in (or out) the door. That’s why, on the Statement of Cash Flows, non-cash expenses are added to Net Income–e.g.stock-based compensation (SBC), depreciation, and amortization. Additionally, other cash gains and losses are added (or subtracted)–e.g. sales of assets, changes in net working capital, CapEx, and other cash changes that aren’t on the Income Statement. (Remember, the Income Statement includes only their revenues and costs of selling that aren’t amortized.)

Thus, analysis of Tesla’s income statement suggests that reinvesting cash into the business will inevitably make it a much stronger company in the years to come. As manufacturing, energy, and AI operations continue to evolve, Tesla’s asymmetrical prospects, fundamentally speaking, remain intact.

Balance Sheet

Accounts payable decreased $1,336M QoQ, coming in at $13,937. Meanwhile, debt, net of the current portion, came in at $2,426M, up from $872M QoQ.

In turn, cash and equivalents increased $3.0B, with total cash and short-term investments coming in at a very healthy $26.1B.

Robust cash flows and a strong balance sheet provide Tesla with plenty of gunpowder to carry on with the battle.

4.0 Conclusion

As an investor since 2016, following the acquisition of my SolarCity shares by Tesla, I am very happy to wait and see whether Tesla evolves into more than a car company. Certainly, I think that the market is yet to understand that the company is capable of collapsing cost curves like no other company on the planet and, as such, achieving economies of scale across all verticals.

It’s no coincidence that, beyond auto, Tesla has chosen to channel this ability into AI and energy. Leveraging its manufacturing, Tesla can create a platform, akin to the internet, that abstracts manual work away so that humans can focus on higher-value tasks.

Over the next couple of quarters, I am looking for the two metrics discussed in Section 1.0–(Operating cash flow / CapEx) & (Free cash flow / Operating margin)–to trend up. Once they do, Tesla will burst out of the woods and accelerate into the open field.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc