Hello! In this post I bring you my take on yesterday´s Spotify Investor Day. SPOT 0.00%↑ is a very contrarian/high conviction pick of mine and in turn, a large % of my portfolio. I doubled my position at $97 per share.

Previous posts: Q1 2022 Digest, Deep Dive. I recommend reading them so this post makes sense.

Below, the format for this post. As always, feel free to skip to any section of your interest.

1. Ek´s $100b Goal

2. The Music Industry is Better Off with Spotify

3. Lifetime Value: the Secret Sauce

4. The Spotify Machine

5. Not the Netflix of Audio

6. The Audio Arbitrage

7. Some Key Metrics and Guidance

1. Ek´s $100b Goal

"[It´s] hard to put in a financial model, because this type of company has never existed before".

It is an understatement to say that the market does not understand Spotify and where it is headed. Some very interesting datapoints were disclosed during the presentation, but what caught my eye most is how disconnected Ek´s closing remarks are from the “reality” the market has agreed upon, which is nonetheless distant from the truth. In the eyes of many, he is coming out of nowhere with a seemingly outlandish goal. For 2030, he expects Spotify to:

Generate $100B in revenue

Achieve a 40% gross margin and 20% operating margin.

My point is that the attainment of these goals is just a matter of Spotify continuing its trajectory, towards 1B users and 50M creators. As Spotify continues to grow its user base and broaden the audio formats it works with, the potential ways to bring in extra dollars at a marginal cost are pretty much infinite and highly implementable, namely across two categories: facilitating interactions between listeners and creators and through ads. Even today, the platform is incredibly under-monetized.

This is the business playbook of our time. First build a minimum viable platform (which involves most of the capex) and then gradually enhance its utility and resulting earning power via the gradual deployment of additional software modules, that incrementally solve problems for platform participants. We have seen this with Amazon, Facebook and more.

This thesis is potentially another instance of the very abstract idea that business problems are becoming networking problems. Increasingly, business is about first laying down an infrastructure that makes electron management possible in the given scope of business (goods, Amazon; social, Facebook) and then get very good at it and expand the scope. As we move forward into the 21st century, this trend will accentuate and Pareto´s law in terms of corporate profits will take on the look and feel of Moore´s.

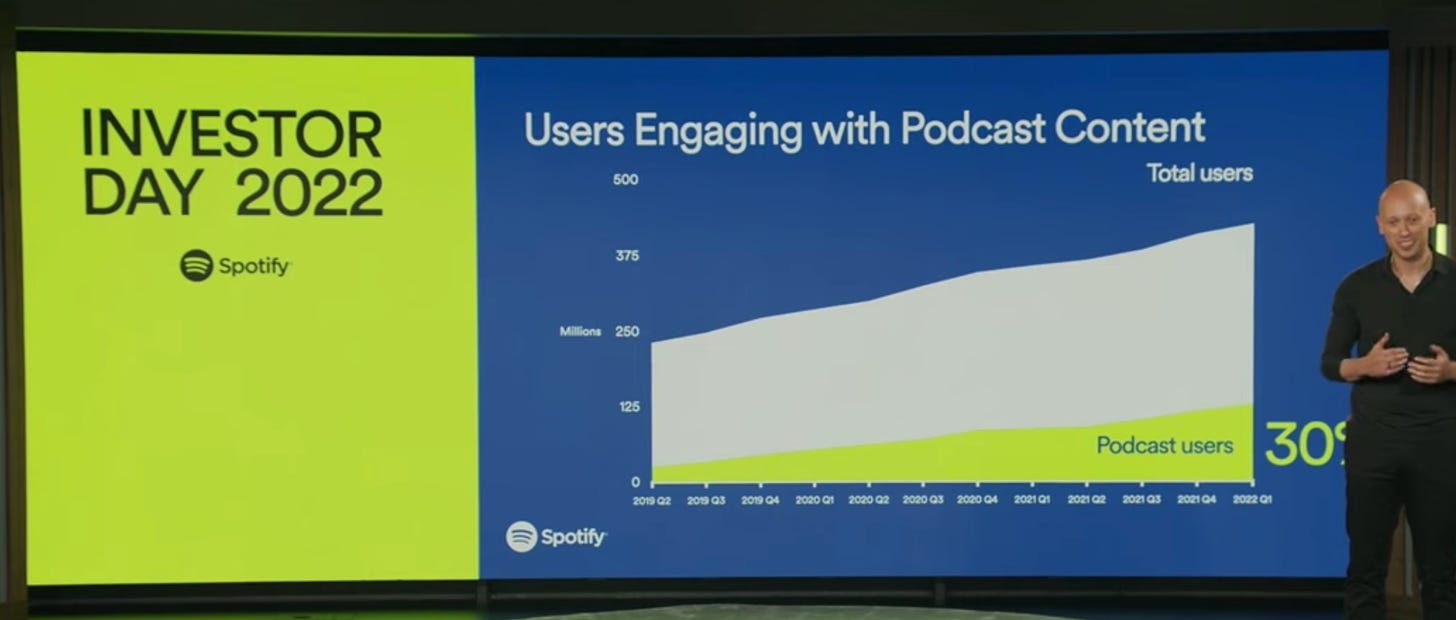

"Users who listen to both podcast and music listen 2x as much as users who only listen to music" - Dawn Ostroff, Chief Content and Advertising Officer

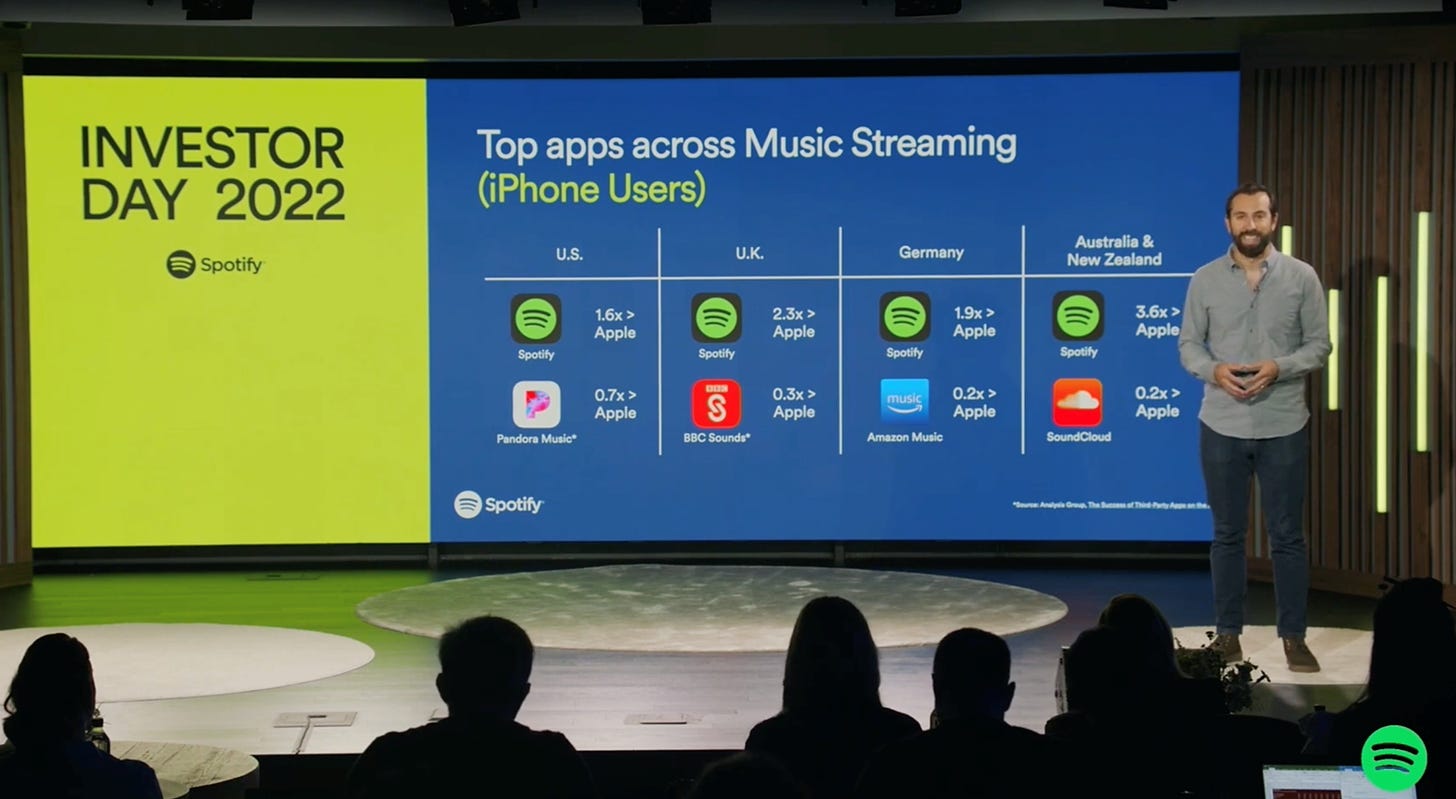

The basis of the long thesis is Spotify´s continued domination of the audio space, as a result of its relentless focus on it. It continues to leave the competition behind including Amazon, Apple and others by in Ek´s words, “running faster and [being] more focused than anyone on audio”. If you look around you will see subtle queues that point to this reality - but not in the financials yet.

8 years is indeed a long time in tech and Spotify´s plans could be disrupted anytime. There is a caveat to this nonetheless, which is that distribution is king. As a creator, the possibility of building and reaching your audience in the first place is a priority. So long as Spotify remains the go-to audio platform for creators to distribute their work, the long thesis will remain viable.

As I have written about previously, web 3 menaces Spotify´s ability to dominate distribution, but as Spotify gets bigger and smarter, its ability to compound its distribution efficiency goes up exponentially through time. Whilst not impossible, both web 2 and web 3 contenders will have a tough time catching up. In the case of web 3 solutions, they are more likely to be accretive than destructive.

2. The Music Industry is Better Off with Spotify

Following the money > following narratives.

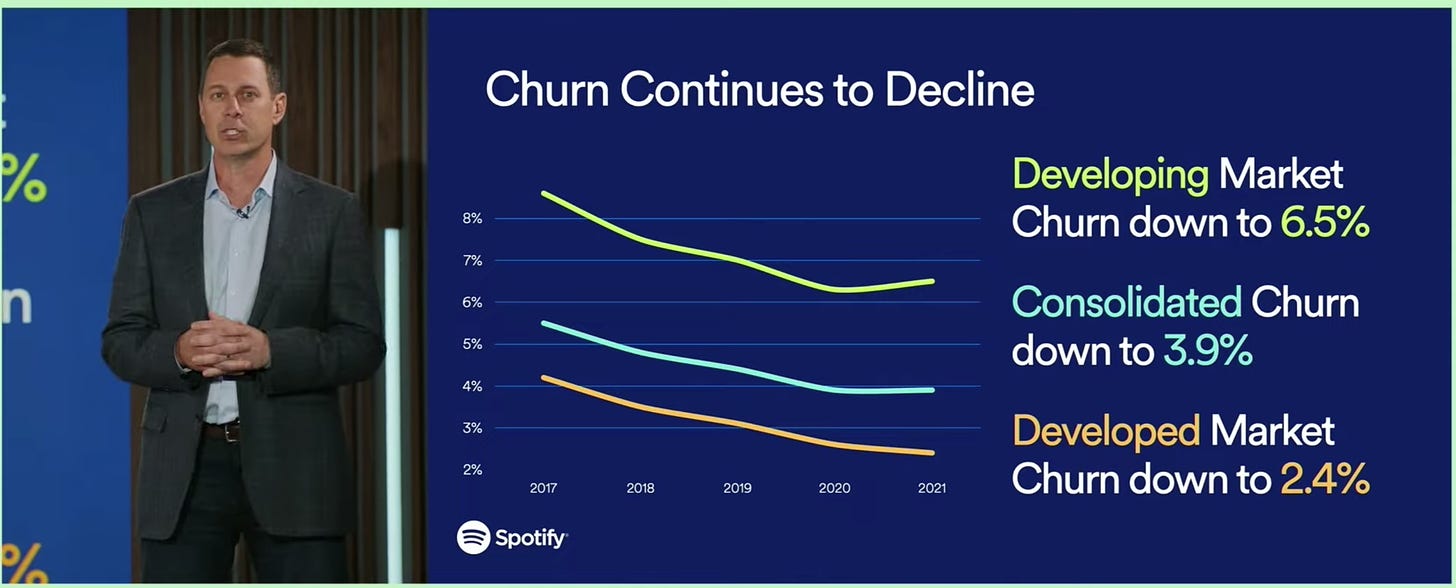

If you look at the churn graph in the previous section, you can see a small uptick in the user churn rate. That coincides in time with the Joe Rogan controversy which, even by investment professionals, was taken very seriously. Essentially, some relatively big artists threatened to pull their music from Spotify unless Joe Rogan was taken down. Some (ex) users joined the quarrel.

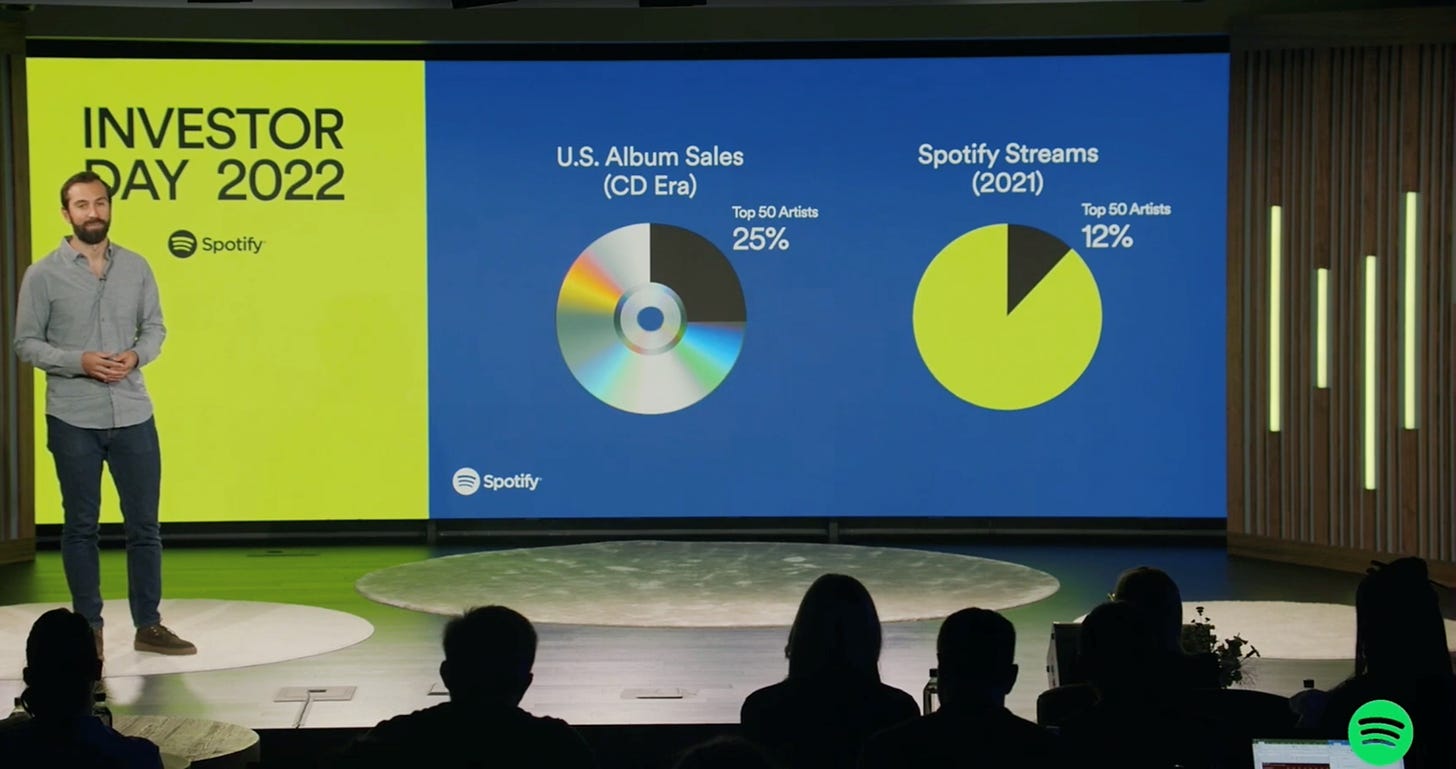

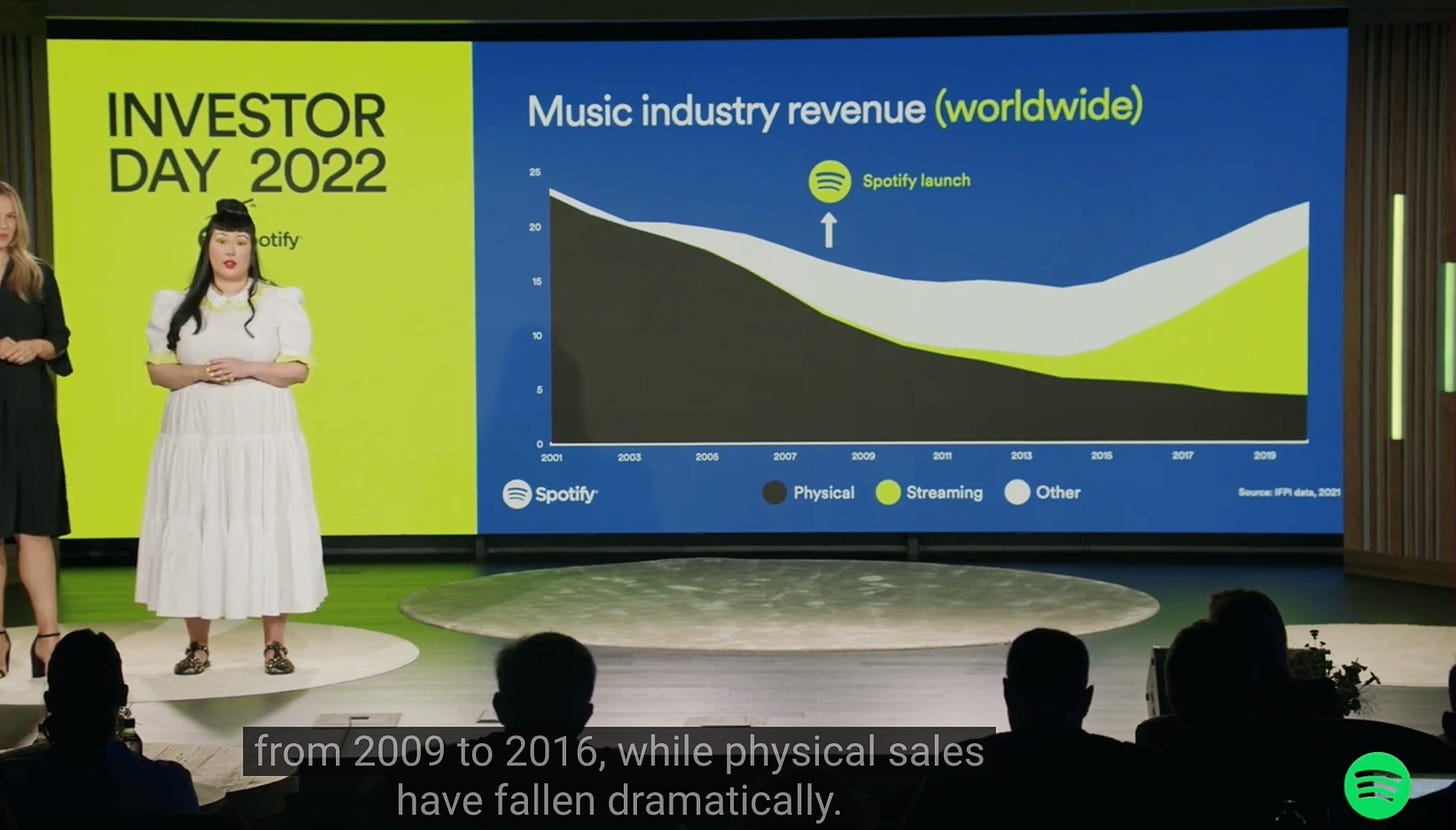

There is, however, a dynamic taking place beyond the superficial level which explains why the churn rate then returned to the trend line. In summary, the music industry is far better off with Spotify than without it. Starting with artists, they now enjoy a far less concentrated industry in terms of revenue:

And in general, all stakeholders enjoy what would otherwise be a far smaller industry, including right´s holders that received a $7b payment from Spotify in FY2021, up from $3b in 2017:

The bottom line is that whilst Spotify is not perfect and has a history of artists rebelling back and forth, it continues to be a net positive to the industry, as it continues to focus on lifetime value, which is my next topic.

"We are proud that we are the biggest contributor to the music recording industry" - Paul Vogel, CFO

3. Lifetime Value: the Secret Sauce

When Spotify talks about hitting $100B in revenue, LTV optimization is what they are actually taking about.

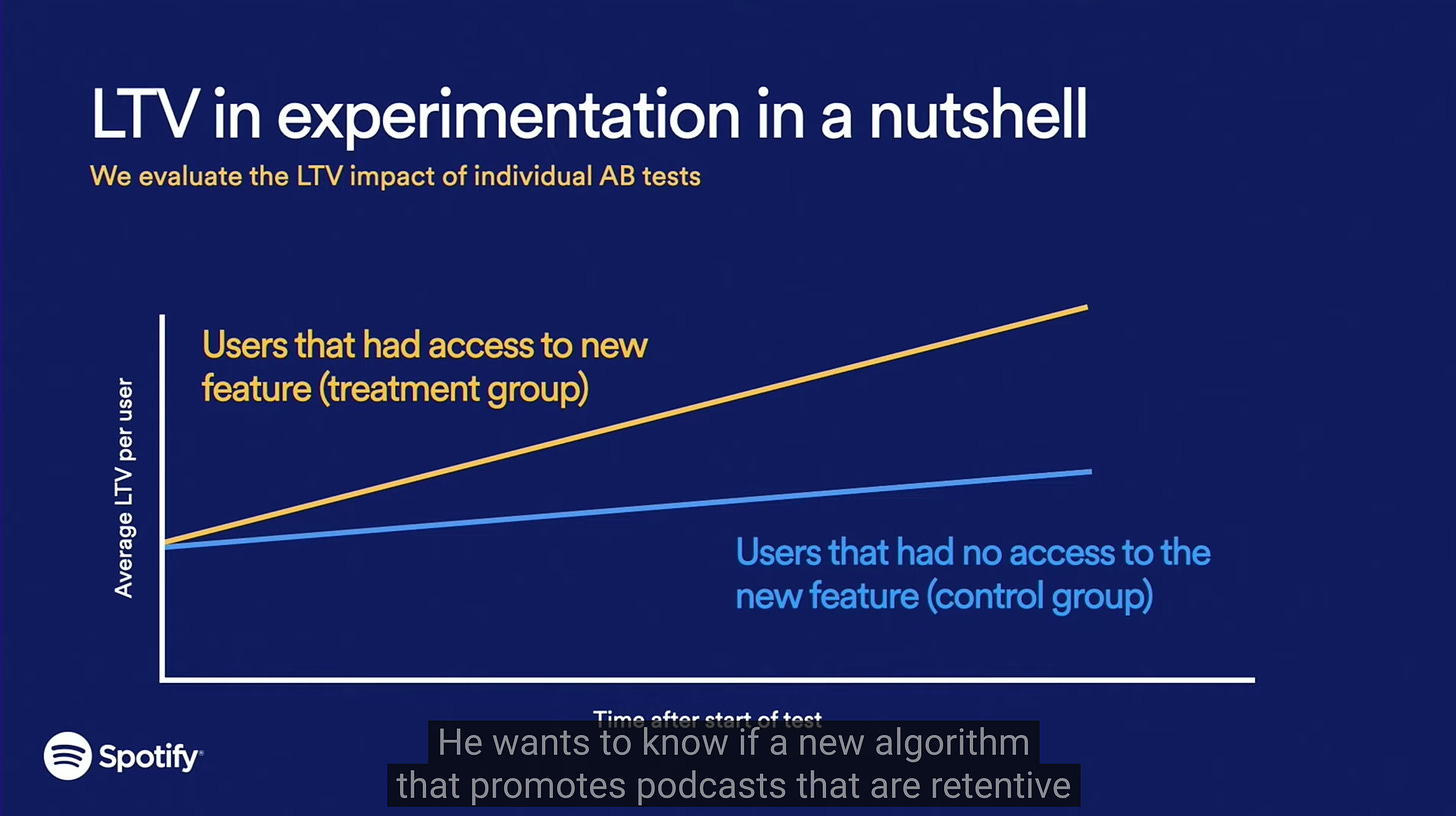

Since I started studying the company a few years ago, something has always felt very thorough about the way the company is managed. Throughout its brief history, the company has never really jolted in any direction, but has rather been an example of incremental improvement. Yesterday, we got to take an insightful peak under the hood with Tony Jebara, Head of ML. It turns out Spotify is all about lifetime value (LTV).

The value of Spotify, for all its stakeholders, is merely a direct function of the LTV of its users. In my Q1 digest, you will see how I made a special mention of the fact that the company ran 2000 tests:

Now we know that all of these tests come down to the maximization of LTV, which is quite appropriate because it filters out decisions that can drive short term results and harm the long term value of the enterprise. Paraphrasing Tony, “We grow lifetime and margin at the same time” and quoting him:

"We are thinking about every decision, a thousand times a second, 24/7, to grow the user and the business together for the long term". "We have integrated these tables across most business units".

If you read about Spotify wide and deep, you will eventually feel this. To further drive my point, all this time that I have been writing about the company´s culture and focus on audio, the link between all that and actual results is this operational dynamic that Tony explained yesterday. Learning this alone gives me a kick. In effect, this makes the company an optimization machine in the literal sense. Everything the company does adds to LTV.

4. The Spotify Machine

You don´t invest in a company for what it is today, but for what it will be.

The market seems to have an obsession with investing in companies as if they were static entities, focusing on its financials and products today. In fact, a company´s output at T=0 is a function of dynamics that have been put in place before that. Someone´s personality determines their fate, as much as these underlying dynamics determine that of a company.

When Spotify outlines their goals for 2030, most are not looking under the hood and are instead focused on the obvious, immediate datapoints. To put it differently, just 4 years ago Spotify had barely any podcasts in their platform. Today, they are a “global leader in the market”. This tells you something.

The underlying properties to achieve this feat are the same required to:

Continue consolidating the podcast vertical.

Add successive audio verticals.

Deploy software that drives incremental value for users and enhances monetization.

Throughout the presentation, the company announced all sorts of capital allocation moves and new features that advance in the direction they laid out, but the point is I inherently trust their execution because I understand how the company works. Every step forward they take compounds the value of the platform.

A very real result of this is how the spend for advertisers that bundle music and podcasts is 4X the ad spend when it is just music. It is also interesting to note that for now only 14% of the podcast listening hours are being monetized.

5. Not the Netflix of Audio

The goal of Spotify Exclusives is to be top of mind for listeners and creators.

Another conclusion the market has reached recently is that Spotify is like Netflix but for audio. It is definitely a step forward but still far removed from reality. Although the company puts a lot of money into Spotify exclusives, the endgame is to lure in listeners and creators. If you do not have the big names, no one cares about you to start with. In Dawn Ostroff´s words, Chief Content and Advertising Officer:

“Hit originals create a cultural halo effect, keeping us front and center with audiences and creators.”

This is a fundamentally different business from Netflix, which operates a highly capital intensive hamster wheel. The issue here is that the operational time horizon to successfully become top of mind in the podcasting space is longer than the average investor nowadays can bear and so the market´s natural response is to put it into a bucket that it can live with.

If you take a step back and go down the qualitative alley, it is quite clear that Spotify is well on its way to achieving this critical mass. Just about anyone who creates a podcast today defaults to posting it on Spotify (as well as on other platforms), but just 4 years ago no one would have thought of that.

6. The Audio Arbitrage

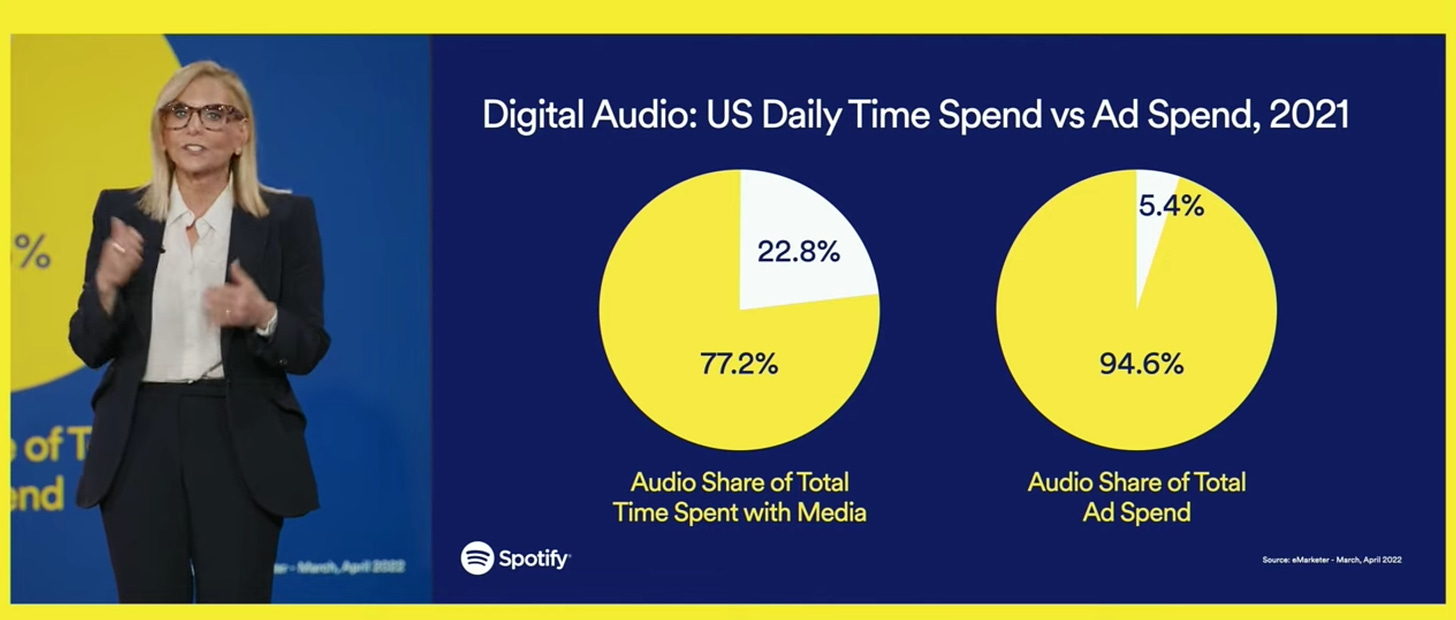

Audio will catch up quickly with other media types, producing fantastic capital returns.

The narrative that en-globes the makes Spotify contrarian case possible is that “audio is not a valid media format for the internet”. Images, text and video have taken off while audio has been left behind. Not everyone wants audio, but as a matter of fact it is the basis of spoken language and so of course, it is destined to be an integral part of internet. Music and podcasts are just the early innings. All sorts of formats will follow and per Spotify´s inner mechanics, the company is very likely to capitalize well on this.

During his part of the presentation, Alex adds that if you sum in a few more verticals like education, sports and news, the size of the whole pie goes up to $350b. This is a number that begins to reflect the fundamental observation I make in the above paragraph. The basis for spoken language will naturally find its place on the Internet.

Per the market´s perception of audio, it also follows that whatever audio there is today on the internet is under-monetized. It just does not exist in people´s mind space:

As Spotify continues to mature, these two forces are going to come together and produce results of an exponential nature. Advertisers will rush to audio as the “new frontier” with better economics (less bidding competition), people will spend exponentially more time on the platform and Spotify will provide a highly satisfactory infrastructure to match the interests of creators, listeners and advertisers profitably.

Spotify has been executing towards this opportunity quite well, with its market place gross revenue growing very fast. The domino pieces are in place.

7. Some Key Metrics and Guidance

Spotify disclosed some datapoints that I found highly insightful and I want to dedicate this section to list and comment them.

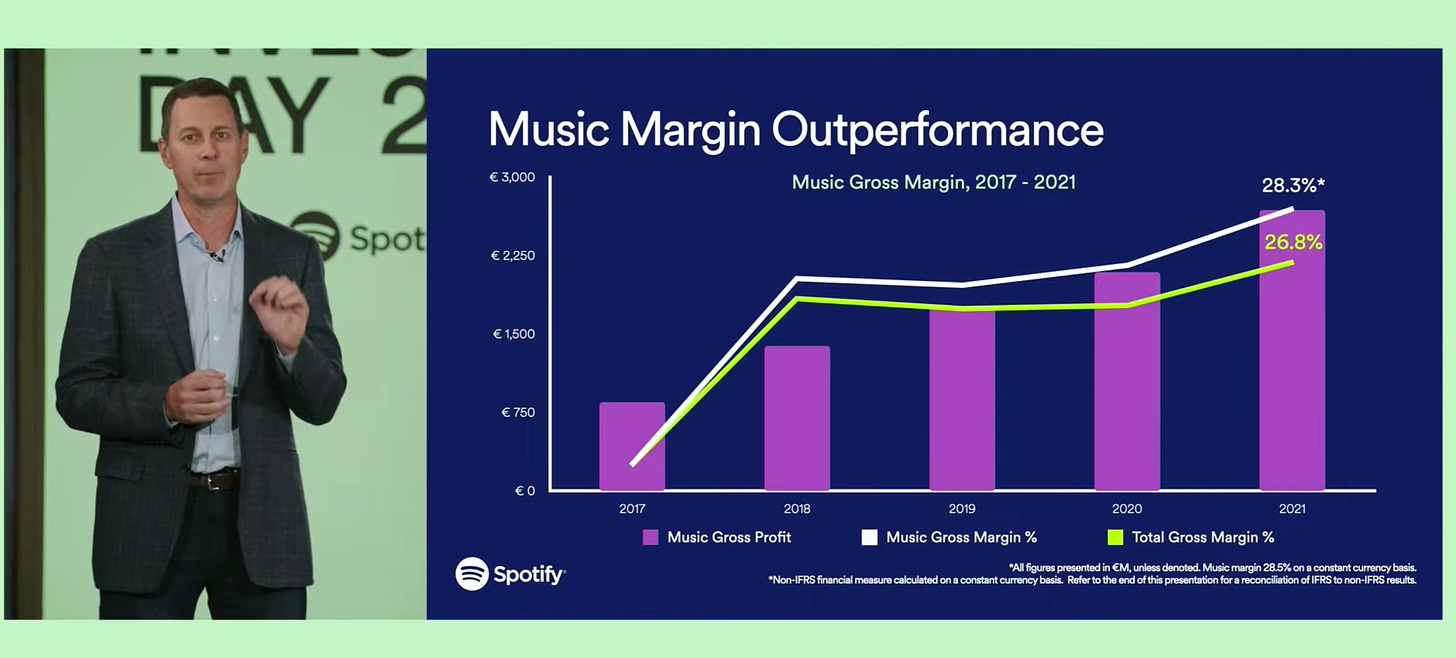

Starting with music, music gross margin has actually been ticking ahead of overall gross margin, as the company has been investing in podcasts. The strategy going forward for Spotify is not renegotiate with labels, but to increasing tap into their S&M dollars. Honestly, I think Spotify can do both in the future and overall, I think the music business will have better unit economics through time than it does today.

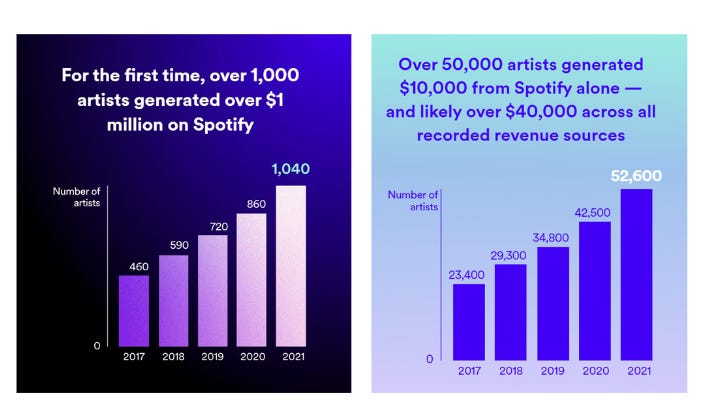

Spotify is also driving discovery, with 10B artist discoveries and a far larger 22B in 2020. This is a big increment and a data-point worthy of attention. Many complain that a lot of artists on Spotify cannot make a living, but the truth is the music industry has always been like that and if anything, Spotify is making the situation better for everyone. Take a look at the graphs below, together with the graph in section 2 about revenue concentration in the industry.

Further, the company has a strong balance sheet with $3.01b in cash and $1.2b in LT debt. Most interestingly, Spotify is FCF positive and expects to remain so.

About the guidance, the company expects music gross margin to trend up to 35% and long term, for podcasts to hit a gross margin of between 40-50%. Podcasts are expected to be accretive to gross margin in the time frame of between 3 to 5 years and the company will be launching 3 new audio verticals over the coming years.

“[we are] focused on growing gross margin faster than revenue and on staying FCF positive” - Paul Vogel

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Great summary. $SPOT is underrated indeed, with investors more focused on past music margins and operating income, than its burgeoning bargaining power with labels and potential value of its podcast business. Audio ads work well with podcasting, and I can attest to subscribing to Tegus after listening to Invest Like The Best. Subscriptions are underpriced - I would pay so much more, especially with increasing value from podcast content. $100bn is shocking - my model has $60bn, but I do not assume additional business lines like audio books