Edited by Brian Birnbaum.

Spotify is now headed towards its biggest challenge yet.

I have found myself doubting my original Spotify thesis plenty of times over the past few years. However, whenever I catch myself vacillating, I am often listening to something on Spotify, and I often see others doing the same. In those moments I feel dislocated from time, as if I had returned from the future, where Spotify has evolved into the world´s top audio network and, eventually, a search engine. But if you look closely, you can already see the evolution taking place in front of your very eyes.

At this stage, Spotify has left Amazon and Apple in the dust in terms of MAUs. As I exposed in my original deep dive, credit for this is due to Spotify´s organizational culture and its laser focus on audio. It is an optimization machine that iterates solutions, refining itself each day to the delight of listeners across the world. This trait is subtle but is the fundamental driving force behind the world´s top companies.

Just a few years ago, almost no one in my analog environment listened to podcasts and Apple was the “unassailable” leader in the space. Today, the situation has been reversed, with Spotify at the reins of an exploding podcast industry. The idea that podcasts could underpin a mega-cap tech company sounded silly at the start. But incessant iteration has made podcasts mainstream. Ek´s reply when asked about the evolution of audiobooks gives an insight into how the company functions:

“ I mean it’s early days on audio books. That's kind of what I can say. We're seeing some encouraging signs.

[…] There's two types of companies:

There's the company that waits until it gets things perfect the first time and then it tries to launch something that's perfect.

And then there's the company that releases something that it knows needs work and then rapidly improves from there.

We're definitely the latter. It's hard for people to understand when they're looking at us because it looks like it's an inferior product or an inferior strategy.

We have the same notion around podcasting. How is this thing going to win podcasting these many years ago when we announced that and yet now four years later, we're the leader in that space.” - Daniel Ek, CEO @ Q4 2022

The company´s current audiobooks effort looks meek. However, the odds are high that the company´s cultural and structural properties will eventually render success. My thesis remains that, as the company scales audio verticals, an audio network –far more than just a music app– with far better unit economics will prevail. Indeed, a robust network replete with people sharing information (via audio, the basis of spoken language) opens infinite opportunities for monetization.

In Q4, two things stand out for me:

Spotify hit 489M MAUs (6.1% of the world´s population).

The advertising business grew 30% over FY2022.

Spotify has managed to grow at a time when consumers are tightening their belts thanks to its misunderstood value proposition. Furthermore, its ad business is coming along, although from a very small base. The platform will soon have more than half a billion MAUs while the advertising operation will likely continue growing. What will the company look like should this process continue compounding for 5-10 years?

In the digital space, marginal improvements in product/service quality yield exponential improvements in adoption. The former is a result of imperceptible deltas across countless organizational properties, much like the expression of DNA over time. You cannot see the progress in real time, but it defines a company´s fate like personality defines that of a given person. So long as Spotify hews to its principles, it should continue to do fine and, naturally, its advertising business should flourish.

With Musk´s takeover of Twitter, the market´s perception of human capital has changed. Due to personal experience, I believe the decreasing employee count will be temporary. For now, however, Spotify must shed a few pounds as well. Indeed, as the company continues building out its third audio vertical, it faces its biggest challenge to date: recalibrating its organizational structure for the transition from growth at all costs towards leverage.

With each new vertical, Spotify’s complexity increases non-linearly. It has been successful with two verticals, but additional verticals decrease the odds of continued success. To offset this dynamic, Spotify needs an organizational structure that:

Enables for a much more efficient information flow, with a focus on leanness.

Can handle each vertical without losing track of the bigger picture (user lifetime value).

During the call, we got very little information on the matter and I do suspect Spotify will have to iterate its way towards a solution in this domain too. Management was also vocal about being focused on efficiency and creating more leverage going forward.

“Essentially, Spotify is a lot more complex of a business than it was several years ago.

And so, to have both Gustav and Alex help me in the day-to-day in this much more complex business, I think, will materially mean that we'll have more brains thinking about these things.

And then we're going to holistically now look at the business rather than looking at things bit by bit. So, marketing was under Alex’s preview previously, but not advertising and not content. And now we're holistically looking at it as one P&L and focus on driving efficiency across the board by readdressing resources to where it's most needed.”

On the other hand, with each new vertical its competitive position improves non-linearly as well. Users find a growing selection of content and decreasing incentives to consume audio somewhere else. In effect, Spotify is sharing economies of scale with its users by continuously broadening selection and keeping prices low. Still, in FY2022 it has been able to increase prices in “more than 40 markets around the world”.

In retrospect, I have seen the market misunderstand companies that share economies of scale time and time again. The market wants profits now, but compounding goodwill for a very long time is the best way to rake in massive profits down the line. Amazon is a great example, with more consumers every day trusting the company without competitive comparison. Spotify is headed down this road as well, as the value of audio is misunderstood: it allows one to consume information without looking at a screen, opening up an array of simultaneous activities and, therefore, greater efficiency.

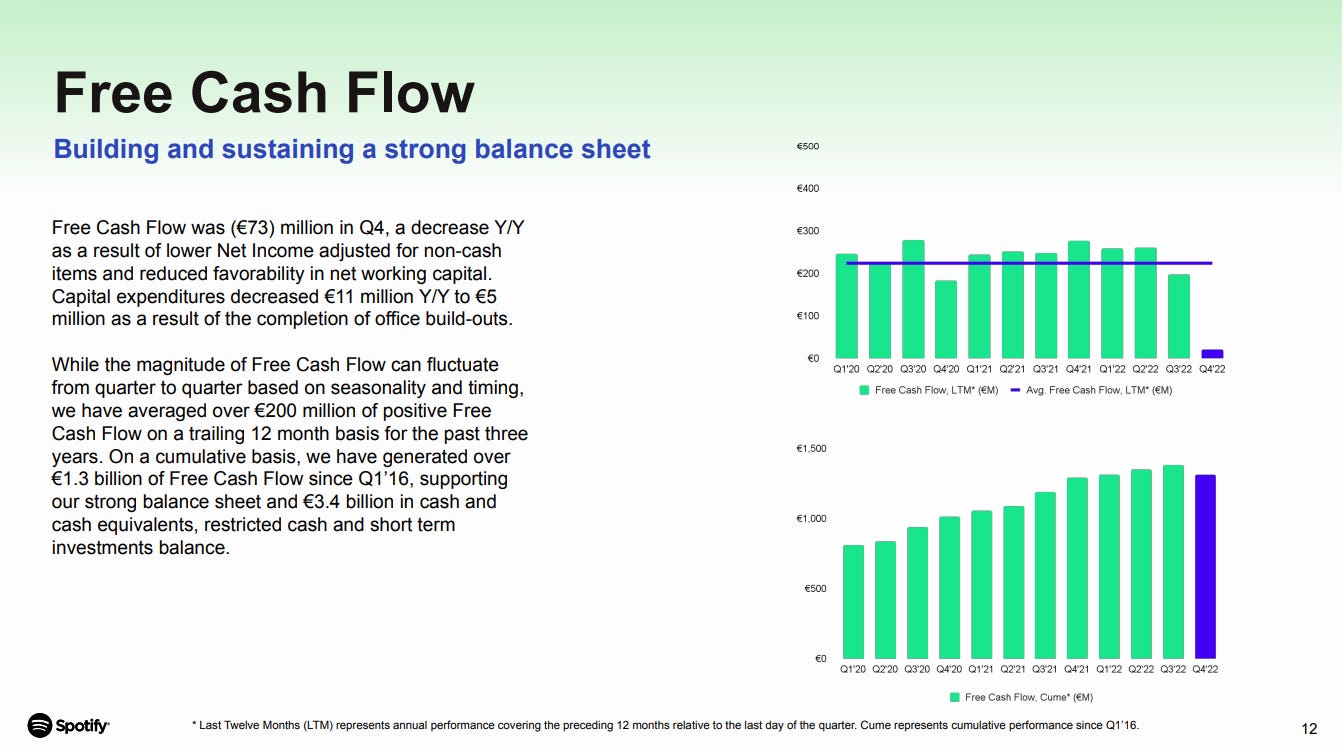

At this stage the financials are mostly noise. Key metrics swing aimlessly quarter over quarter as the company continues investing for the future. Management expects the company to be free cash-flow-positive throughout FY2023. Fundamentally, I do not see any changes in the business that jeopardize this prospect. To get it right from here, Spotify must maximize their runway and keep iterating. For this reason, positive free cash-flow is paramount.

The balance sheet remains strong, with $3.4B in cash and equivalents and $1.2B in long term debt.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Agreed that it’s been impressive so far. Looking far down the road, when energy is abundant and cost of compute is minimal, when information can be accrued and accessed widely, I wonder what value Spotify will provide, or what problems it will solve. Kind of like Netflix, it’s already really good at providing dopamine seamlessly. One possible problem I see Spotify solving is using AI to get the user exactly what audio/ info / ad user wanted that other platform won’t provide as well, based on data on the platform exclusive to Spotify. I could see how this could be profitable. Still, the magnitude of problem seems less exciting than the missions for Tesla, Amyris, or Palantir. But at the same time, ultimately our goal as investor is $.

Well written. They have shown amazing user growth. With a focus on efficency now after laying the foundations for podcasts (and audio book development will cost less CapEx as per their comments), Gross Margins will start to grow again and if revenue can grow faster than Operating Expenses (for a software company, it should be able to), operating income will start to reveal itself. If you deleted all podcasts today, their Gross Margins would be 27%+ and no reason Operating Margins with less spending wouldn't be 10-15% already, if they hadn't focused on maximum growth and new verticals (of which I want a company to do instead)