Edited by Brian Birnbaum.

1.0 Thesis Recap 2.0 The Ad Business 3.0 Gross Margins

4.0 Organizational Complexity 5.0 AI

1.0 Thesis Recap

Across the board, I am seeing a weak consumer shaving off the financial performance of my companies at the margin. However, the economy naturally ebbs and flows and what truly matters in the pursuit of long term capital gains is the following:

That the company in question continues to exist and strengthen its market position.

That it continues to focus on long term value creation, while being shareholder friendly.

In a time like this, analyzing companies becomes slightly more complicated because we are left temporarily in the dark, with otherwise primordial KPIs going on a provisional retreat. The only way to keep track of a thesis now is to go deeper, while delaying gratification to the point of almost unreasonable detachment. Same game, higher levels.

Spotify is essentially an audio network that has the potential to exponentiate its operating leverage over the coming decade. Labels keep 75% of the money it makes via music streaming, but this is not the case in its newer audio verticals like podcasts and audiobooks. By deploying new audio verticals and enabling deeper levels of interaction between creators and fans, Spotify can radically transform its income statement at marginal cost.

2.0 The Ad Business

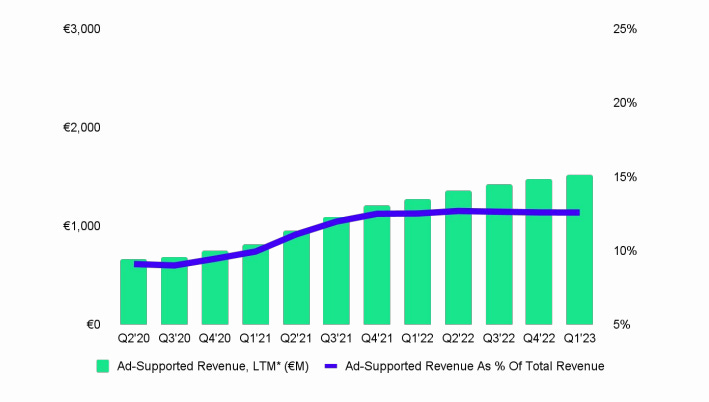

Spotify´s advertising business represents one area of optionality, which until recently has been growing rapidly. Growth is now stagnating and there are two ways to look at it:

Advertisers are not interested in Spotify.

Advertisers are pulling back across the board.

The performance of any given advertising network is a direction function of:

the engagement of the audience;

and the network’s technical capacity to offer better measurement, attribution and targeting.

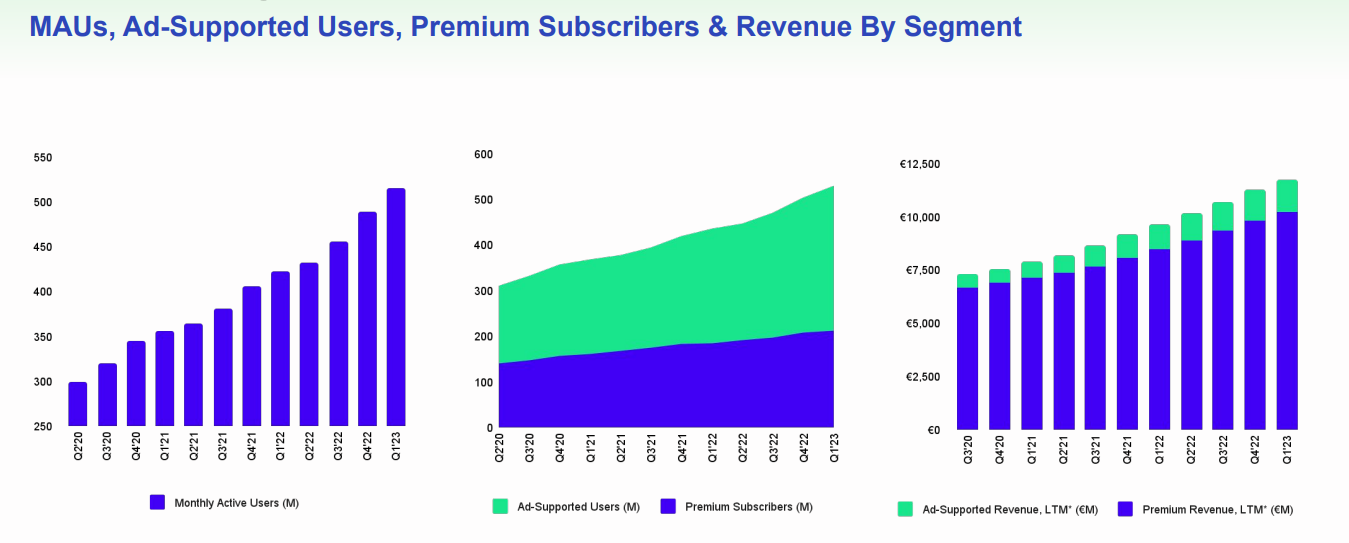

Management claims to be working on the latter, but what we know for sure is that people love Spotify, with the platform now having over 0.5 billion MAUs despite lower marketing spend than planned. Regardless of this metric, if you look around (and depending on where you live), it’s easy to see that Spotify plays a big role in people´s lives, heavily influencing listeners of music and podcasts alike. When the economy is back in shape, this audience will likely remain of interest to advertisers.

“This marks the first Q1 in Spotify's history where we surpassed €300 million in ad revenue”. - Paul Vogel, CFO @ Q1 2023 ER.

Thus, the unknown in the advertising business is whether Spotify can build out a sufficiently performing ad-tech stack. I would argue that the odds are favorable, given the company´s track record of shaking off big competitors (Apple, Amazon) and prospering against all odds. In fact, I have proposed many times that Spotify has the same fundamental organizational traits as Amazon and that this makes it a winning horse.

Reduced to very simple terms, I believe that so long as Spotify continues making a product that people love, it will continue to have the option to then increase its operating leverage. On top of an advertising network, it can build out a whole range of features to bring creators and fans together, like selling concert tickets. The graph below tells a story of incapacity or of delayed gratification, depending on your view of Spotify´s qualitative aspects.

3.0 Gross Margins

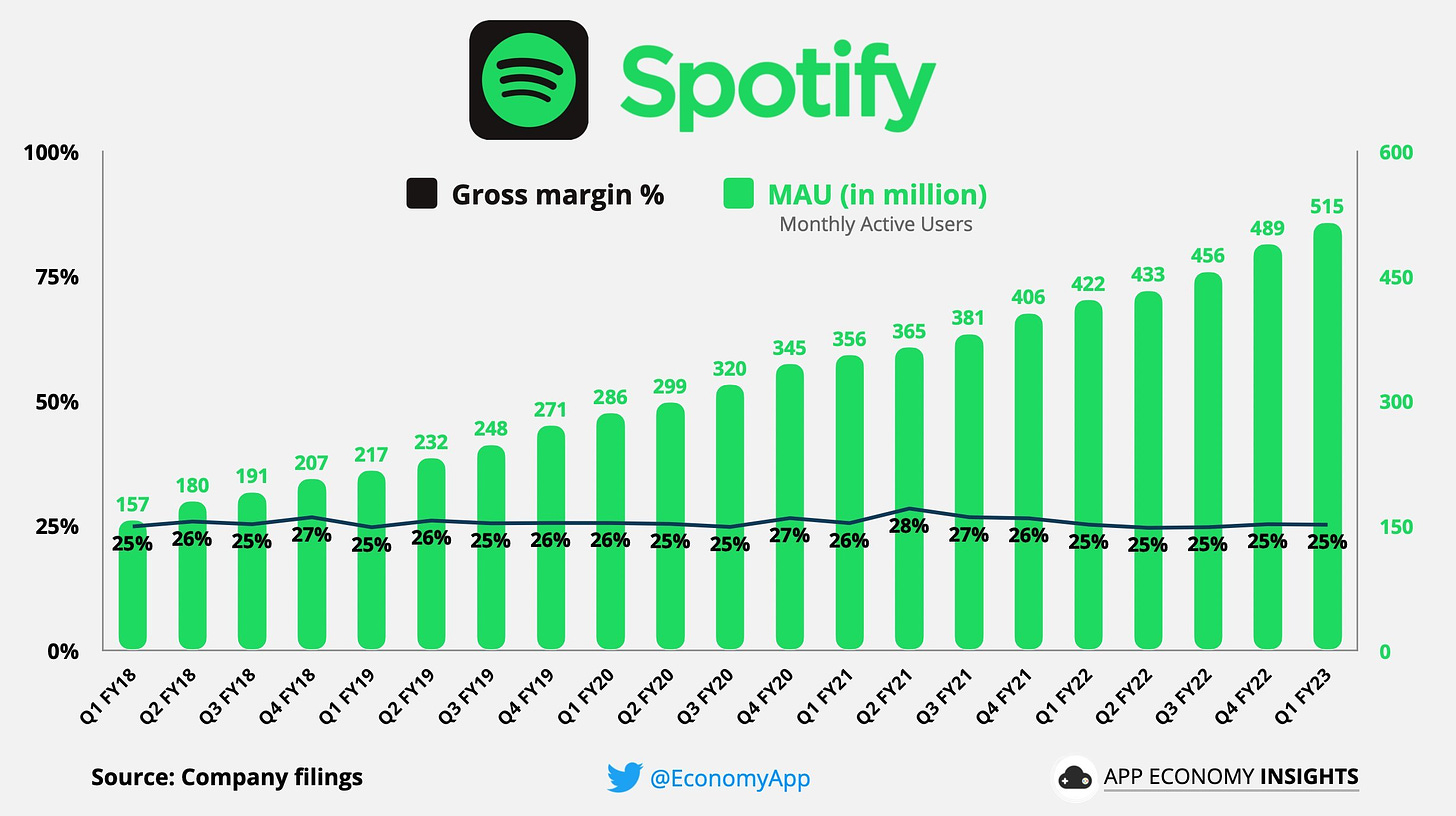

Management is now guiding for a steady progression of gross margin over FY2023 in tandem with a fundamental transformation of the network, catalyzed by its new UX, which implies higher levels of discovery and engagement, enabling fans to jump into worlds, versus just listening to audio files within a relatively flat experience. I believe it represents a quantum leap in the default level of engagement between the two sides of the network, which, I believe, will increase gross margins going forward.

“And just by way of context, we did raise prices in 46 different occasions and markets last year. So it's not like we haven't raised prices. And even in those markets, we were still outperforming.” - Paul Vogel, CFO @ Q1 2023 ER.

When looking at this transformation, it is important to bear Spotify´s nature in mind. It is an optimization machine that excels at processing information from the market. Releasing an entirely new UX is a cumbersome task, and I am relieved that Spotify is approaching it just as it has approached past challenges: by listening to customers and iterating non-stop.

“I've often talked about the fact that our success is not attributable to just one thing, but literally 100s, if not sometimes even 1000s of improvements that we're investing in and working on in parallel. And that's not to say that every one of them ends up producing the outcomes we strive for. But over time, the things that do work, they do add up. And together they have a compounding effect.

[…]

We're rolling it out slowly just to make sure we have performance dialed up and that we can react to the feedback. And we've already made lots of iterations with the user feedback we've gotten”. - Daniel Ek, CEO Q1 @ 2023 ER.

4.0 Organizational Complexity

Per every additional audio vertical that Spotify deploys, the complexity of operating the company rises exponentially. To manage this complexity, it has to evolve into a much more efficient information processing machine. Ek started talking about this a number of quarters ago and it seems that, now, material progress has been made on this front. When asked about efficiency in the Q&A section, Ek said the following:

“And the leading indicators that I look to is really just speed of decision-making. And we've really kind of driven more collaboration and more speed of decisions now than we've had probably at any other time in the Spotify history.

But that obviously will still take some time before that then leads into actual products that then leads to actual business results.

I mean the only thing I'd really add is that we have really become a lot leaner over the last six months, but I think that progress is still early in its reflection on our financials”.

With every new vertical, you have to now manage and populate an entirely new sub-network, together with a separate UX and its effect on the other sub-networks and UXs it coexists with on the platform. This is why it is key for Spotify to evolve its organizational properties as it deploys new verticals. Without doing so, it stands no chance of succeeding and incidentally, if you study great companies like Amazon, Walmart and Costco, they all evolve in this manner whilst mediocre companies do not.

5.0 AI

When I first wrote about Spotify and AI, my remarks may have seemed somewhat remote to many. However, with the advent of LLMs it is now obvious to the world how proprietary datasets can be quickly converted into value, by training an AI that it would otherwise not be possible to train. As Spotify amasses more creators and listeners, it is effectively creating a super intelligence that knows who likes to listen to what, when and how.

In time and with the permission of key stakeholders (like record labels), this will act as an almost irreplaceable form of leverage for creators, that will meaningfully increase their productivity, both in terms of:

Creating new assets (songs, podcasts and other audio content).

Distributing and monetizing them.

It shall happen slowly and then, suddenly.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Thanks for the update! One thing I am wondering. It seems video podcasting is open to all creators but very few have actually turned their audio podcasting to video. Any comments?