This is an update to my original Spotify deep dive. Below, you can find the format of this post and as always, feel free to skip to any section of your interest.

1.0 I Doubled My SPOT 0.00%↑ Position

2.0 The Attention Economy Recession, Except Spotify

3.0 FC Barcelona and Capital Allocation

4.0 Podcasts, The Creator Economy and Ads

5.0 Organizational Structure and Culture

6.0 Financials and Guidance

1.0 I Doubled My Spotify Position

Thanks, Mr. Market.

Last week, I found Spotify´s earnings to be quite satisfactory and the subsequent sell off yielded an opportunity that I could not ignore. I increased the number of $SPOT shares I own by 125% at $97.50 per share, making it quite a large bet for me now. It was a thrilling purchase.

At a price to sales ratio of 1.8, even if Spotify stays a music streaming app with poor financials, the investment is quite asymmetric. Indeed, I believe that Spotify will become one of the world´s largest online advertising platforms and that it will be worth several times more than today a few years from now.

Through spending a lot of time reading about the company, I have come to greatly trust Spotify´s management. I am able to sleep very well at night knowing that the company is well and honestly managed. In hindsight, Daniel Ek will be compared to Bezos and others.

Before moving on, I know many of you reading this post work at Spotify, so I want to thank you all for the great work that you do. Spotify will do just fine in the coming decade (despite the recent price action in the markets) and by then, you will have made a contribution of historical magnitude to the world.

Now let´s dive into the details.

2.0 The Attention Economy Recession, Except Spotify

Spotify continues to exhibit healthy growth, despite a less favourable macro backdrop.

During the pandemic, life was about online subscriptions and now we are back to life being about living. We have seen this dynamic (plus some extra competition) propel Netflix to new heights and then bring it down a little bit.

I hypothesize that we will see many cycles of this nature and that we are just entering an attention recession, but they key point is that Spotify seems to be relatively unaffected by this trend. Firstly, during the outage experienced in Q1, 3M new accounts were created. Let me just dissect that a bit.

Spotify was down for just over an hour, but 3M people attempted to get back in by creating a new account, instead of just forgetting about the service. Qualitatively, I think this signals a service that people really want in their lives and it seems to match what I hear from many, which is that “I can´t live without Spotify”.

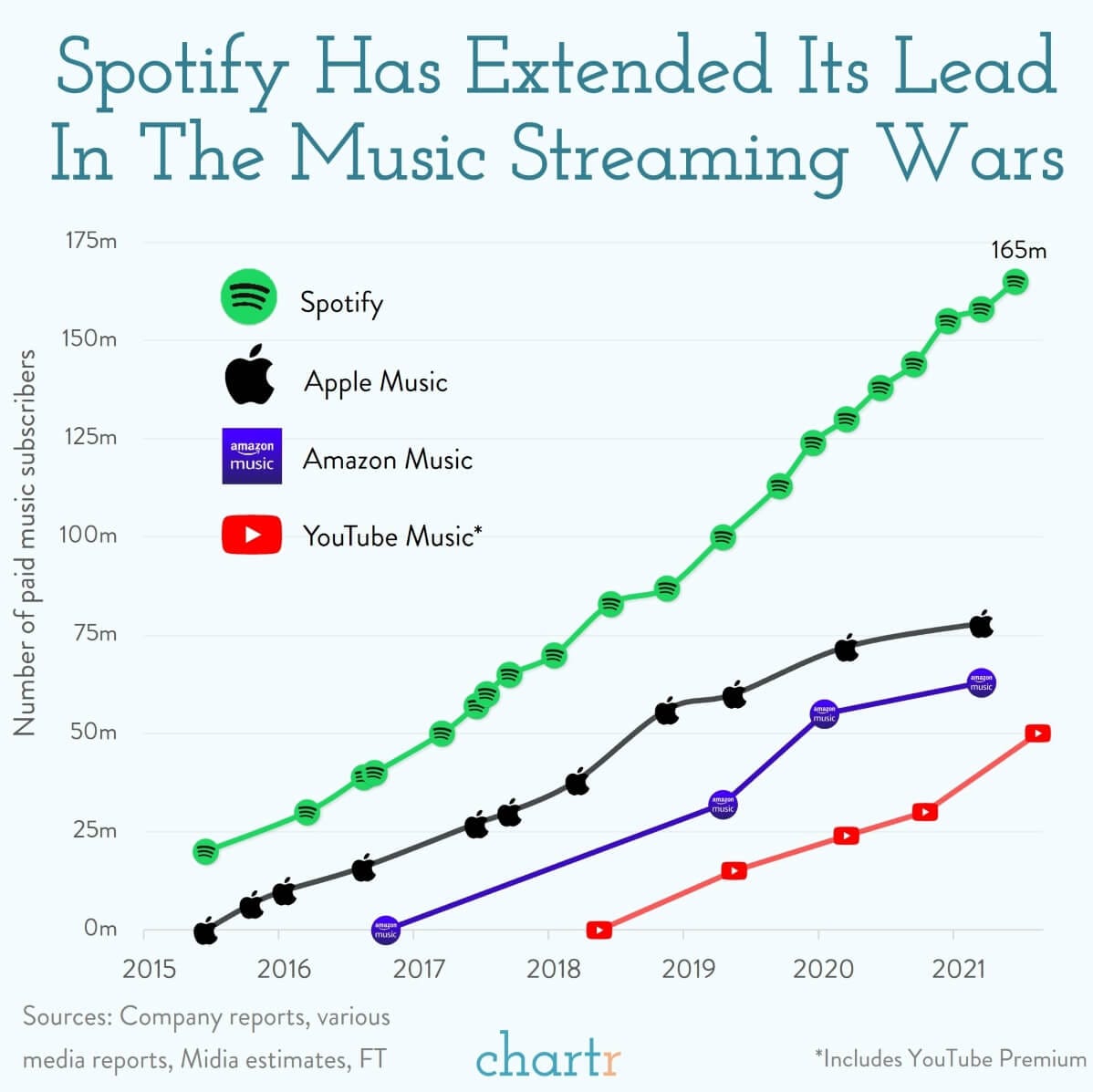

Secondly, the platform continues to grow fantastically despite Spotify pulling out from Russia (which represented 1% of all MAUs and less than 1% of all revenue). We see a continuation of the trend that I outlined in my deep dive - Spotify continues to grow because its 100% focus on audio has no real match.

Should we enter a recession, I expect Spotify´s growth to slow a bit. Long term, however, as long as Spotify maintains its focus, the platform will continue to grow.

3.0 FC Barcelona and Capital Allocation

An additional sign of management´s capital allocation skills.

Spotify has signed a 4 year $310m contract, starting this season, to be Barça´s main partner for the next 4 years. This deal is misunderstood by the market and is likely to be one of the greater capital allocation moves we have seen recently.

According to Spotify´s management, FCB brings in 700m unique viewers every year, making it one of the world´s most supported teams. In turn, the club is in horrible shape lately, both in terms of its performance and its financials, making it all the more likely that Spotify has acquired the FCB platform for cheap, like with Joe Rogan.

At $310m for 4 years, that is $9.03 for a full season´s exposure per unique viewer. Any one viewer can be converted to a creator and / or a listener. It seems like a reasonable price and further, the combination of the two brands will tend to generate a cultural value that is bigger than the sum. In practice, this will make user acquisition more efficient than otherwise.

All in all, the deal seems reasonable to me and looks a lot like a contrarian value play.

“If you look at the landscape of advertising over the past sort of decade, I would say it’s really grown from being offline to more online, dollars has moved online. And it’s gotten harder and harder for advertisers to gain value.” - Daniel Ek

As I have been talking about Spotify being the Google of audio in the making, some have been coming back to me calling it the Netflix of audio. I believe that Netflix is in fact a very good film studio that uses technology to distribute its products and that Spotify is a platform.

I have previously written about how I consider Netflix (and its now analogous competitors) to be participating in “The Streaming Hamster Wheel”. Although Spotify leverages proprietary content, this is not where the company is heading. It is heading towards empowering 50m creators that upload their own content.

4.0 Podcasts, The Creator Economy and Ads

Podcasts will add billions of $ to Spotify´s top line at a marginal cost. Spotify is advancing well in this direction.

In the internet, audio is the forgotten media format. So much so, that most people cannot envision it ever moving beyond music. Spotify´s future plans only begin to make sense when you exit the little “audio is music” matrix. Having said that, podcasts are Spotify´s gateway to becoming a key component of the creator economy.

As a creator, you can build a highly monetizable audience through a podcast. Many doubtful prospective Spotify longs or manifest bears make two very good points:

Spotify does not drive interactions / discovery between creators and listeners.

Spotify does not enable audience monetization.

The two above points are true, but I have been arguing for some time that achieving critical podcast mass comes first, so there are enough podcast creators and listeners for additional features to make any sense at all. I believe that Spotify is now achieving that mass:

Spotify now has 4M podcasts on its network, “up 53% YoY and up from 3.6m last quarter … with podcast share of overall consumption hours reaching another all-time record last quarter”.

Per the management´s comment, driving interactions / discovery and monetization comes next:

“But truthfully, when you look at the sort of consumer and creator journey, it’s still – you publish content to Spotify and people consume it, but there is not a lot of interaction happening between creators and consumers on the platform. You are starting to see some experiments, but no sort of massive rollouts yet. And that’s what we are focused on in ‘22 and ‘23 is to take some of those experiments, double down on them and expand on them so that more and more consumers and creators are using these tools.” - Daniel Ek

Podcasts are moving fast and accordingly, the Spotify Audio Network (which enables advertisers to buy ads in podcasts) is growing just as fast, with advertising revenue hitting a Q1 record of 11% of overall revenue.

The point is, the same way Spotify discretely outpaces its alleged competitors, one day we will wake up and it will have tens of millions of podcasts on the platform, which will add billions of $ to Spotify´s top line at a marginal cost, via ads and interactions between listeners and creators. In terms of the ceiling, management said in the call:

“…and we look at the comparisons like radio, i.e. audio consumption patterns, we still see the sort of ceiling being probably 2x to 3x from where we are today in hours. So plenty of growth left ahead. And this is in some of our more mature markets. So obviously, massive growth opportunities left in that, too. So definitely, no engagement ceiling in sight for us.”

5.0 Organizational Structure and Culture

Spotify is an optimization machine, much like Tesla.

If you have read my deep dive on Tesla, you will know that I believe its organizational structure and culture to explain for much of its success. A person´s fate is often determined by his/her personality and the same happens with companies and their structures and cultures.

By watching Spotify´s UX iterations closely, I have come to perceive the way the company works. As is the case with many other succesful organizations, it combines decentralized operations with centralized capital allocation decisions. I will be dedicating an entire post to this subject down the line, but for today, note the following:

“…we are doing a lot of experiments, over 2,000 in the quarter alike. Some of these are live events, digital and physical ones where we are helping enable those. And of course, merch, NFTs, we are experimenting across a lot of different things to provide more value for creators and consumers alike.”

Over 2,000 experiments in one quarter is a lot and it explains why Spotify is the largest audio network in the planet. It is constantly iterating, creating the best product possible. Dominant network effects follow as a result.

I do not know what features will drive the creator economy funnel and the ad network forward, but I know I can count on Spotify iterating enough times to cost effectively find the solution to whatever problem emerges. I invest in the company´s DNA, rather than on some future prediction.

6.0 Financials and Guidance

Spotify is playing the long game.

The market did not like the gross margin guidance for next quarter (flat), which is what led to the post earnings sell off. About that, management said the following:

“And yes, most of the reason the margins in general haven’t expanded from a consolidated basis is all the incremental investments on top of it”

In other words, the company continues to be in investment mode:

“…we have been hiring aggressively against the investment. So hiring is up pretty significantly in Q1 and it continues to be up in Q2. We’ve talked about that, that’s all about our initiatives on the investment side. We lead with technology and product. And so more than 50% of the people we bring are all R&D. So we continue to really grow and invest in that area. And then we do have some increased sales and marketing based on some of the timing of some stuff. And that will be part of the growth as well. So it’s kind of head count, it’s sales and marketing and then it’s FX. And then the other thing I would say is despite the loss, we are investing because we have $3.5 billion of cash on the balance sheet. We’re a free cash flow positive business we will be free cash flow positive again this year.”

If Spotify stopped investing and focused on profits today, I would have to sell my position. For the investment to bear its fruits, the company must continue investing to stay ahead and transform itself into a high margin audio network. I do like that the company stays cashflow positive however. I think positive FCF + net loss due to reinvestment is the growth stock Goldilocks zone.

Further, the market did not like MAU growth guidance for next quarter, which is perhaps the most ridiculous part of the market´s reaction. The company is guiding for 14m new MAUs, which is 1m more MAUs than the company acquired in the same quarter during the pandemic, when all you could do in life was subscribe to digital services. Not the finest judgement by Mr. Market here, but I am nonetheless grateful.

Finally, I will be dedicating an exclusive post to Spotify´s deal with Google, to explore what new business models it can unlock. Stay tuned for that.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Hi Antonio, great work on the Substack! Would you happen to have any thoughts on the subscriber and FCF pessimism in this post: https://seekingalpha.com/article/4503945-spotify-worrisome-subscriber-numbers-guided-for-q2-what-you-need-to-know