Welcome to the 200+ new subscribers that joined Investment Ideas last week! For this month´s deep dive on SHOP 0.00%↑ , I will be trying a new and more digestible format, which you can see below. Please let me know if you like it better than the previous format.

Feel free to skip to whatever section may be of your interest.

1.0 Introduction and History

2.0 Opportunity

3.0 Core Value

4.0 How Shopify makes $$$

4.1. Advancements in Merchant Solutions (Shopify Fulfillment Network)

4.2 Advancements in Merchant Solutions (App Store Revenue Sharing)

5.0 Competition

6.0 Financials

7.0 Key Performance Indicators

8.0 Thesis / Conclusion

Disclaimer: the information contained in this write up is not intended to serve as financial advice. It is just my opinion and remember, there is no substitute to doing your own research. Also note that my minimum investment horizon is 5 years.

Also, if you would like to stay even more up to date with my investing related thoughts, feel free to follow me on Twitter:

1.0 Introduction and History

Shopify was founded in 2006 and in just 9 years, grew to 140,000 merchants and $3.7b in sales. It went public in May 2015.

Shopify is a platform that enables merchants to sell products and services online. Today, the company has a market cap of $85.26b, more than 1.5m merchants worldwide and has grossed in $4,611.9m in the TTM. Below follows a brief recount of its history.

Tobias Lütke (Shopify´s founder, CEO) was born in 1980 in Koblenz, Germany. By age 12, he was already playing around with computer code. In 2002, age 23, he moved to Canada and soon after, started a journey that led to the creation of Shopify.

By 2004, Lütke had been out of his job for a while and decided to start his own snowboard ecommerce company (called Snowdevil) with co-founders Daniel Weinand and Scott Lake. He built the website on Ruby on Rails.

In 2006, age 27, Lütke launched Shopify, having realized that many more merchants would want a website to sell their products on aswell. By 2009, Shopify netted $100m in sales since the launch and just a year later, the company raised $7m in a Series A round from Bessemer Venture Partners, FirstMark Capital and Felicis Ventures

In 2011, the company raised a new $15m Series B round from Bessemer Venture Partners, FirstMark Capital, Felicis Ventures and Georgian Partners. By 2013, Shopify had 40,000 operative stores across 90 countries.

In 2013, Shopify acquired Jet Cooper (a firm specialized in UX [user experience]) and raised a further $100m in a Series C round. By 2014, Shopify hit a total 80,000 merchants that sold $1.6b worth of inventory in 2013. At this stage, Shopify had only 30 employees.

By the end of FY 2014, the company had 140,000 merchants and $3.7b in sales. At this stage, the company began to succesfully transition into the mobile space. In May 2015 Shopify went public and by this stage, the management was already quite vocal about its focus on the long term, which I have come across repeatedly throughout my research.

“We want to build a company for the next 100 years”

- Harley Finkelstein, $SHOP´s Chief Platform Officer

One of the most remarkable details of Shopify´s history is Lütke´s stoicism. He allegedly did not buy a house for himself until recently, despite Shopify´s early success, living at his in-laws´for quite some time. In many podcasts I have heard him say “as long as I have my laptop, I´m good”. Shopify seems to have inherited this trait.

2.0 Opportunity

Shopify is a world class company that has recently been sold off. The company is likely to become a trillion dollar behemoth over the coming decade.

What makes the company interesting now from an investment perspective is that $SHOP is considerably cheaper than it was just a few months ago, having gone from around $1500 to $670 per share.

Shopify trades at a PE ratio of 24.45 and a PS ratio of 18.45. It is not trading for free, but given the quality of the company and the growth runway that lies ahead, it may be a good price to get in at.

The above is a great example of a narrative reversal. Not too long ago, the market found a way to justify very high valuations for anything with the least amount of technological promise. Now it is finding reasons to do just the opposite, turning many bull traps into hybrid value-growth plays.

In its recent Q4 2021 earnings call, the company said a number of things the market did not like:

Going forward, $SHOP will reinvesting all of its gross profits into the business.

They are eliminating revenue share on their app store with 3rd party developers on the 1st million dollars they make.

They are entering a 4 year investment cycle in which they will spend 2 billion dollars to create their own fulfillment infrastructure, with the goal to deliver <2 day delivery to 90% of the US population.

“our financial outlook anticipates revenue growth for the full year 2022 that's lower than 2021's 57% but still rapid and outpacing the growth of e-commerce”.

I believe the above (1-3) will do nothing but strengthen the business in the long run, although there are some nuances to point #3 which I will cover in section 4.1. Further, the above measures will likely keep the company´s bottom line for a while, which together with rising rates may yield a scratch-your-eyes kind of opportunity in the near future.

About growth not being as fast, I do not see anything wrong with it.

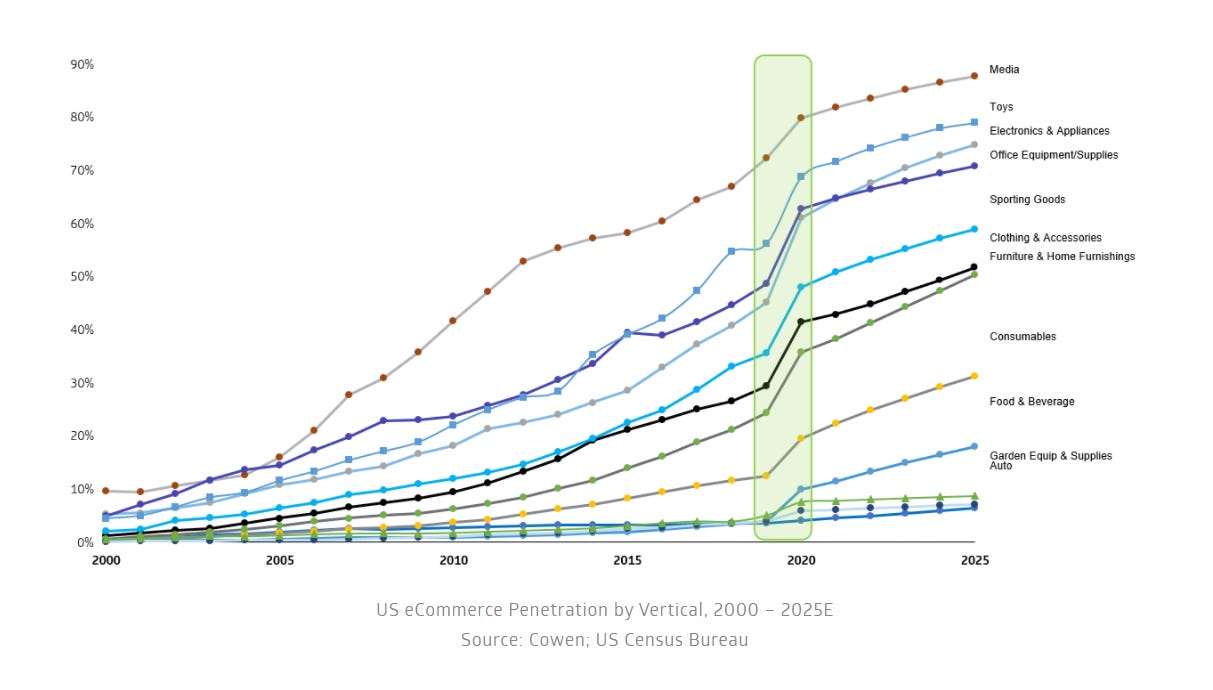

Whilst the market does not believe in technology so much any more (until it swings back), ecommerce´s secular trend continues, as people get increasingly comfortable shopping online. Take the below graph not as a prediction, but rather as a visualization of what common sense suggests.

The above reasoning extends to most technological domains that the market suddenly does not believe in. Just because the narrative has reversed, it does not mean reality has changed. Technology is still the future and in fact, a much better opportunity at today´s prices if you manage to see through / escape the market´s reflexivity.

In 10 years time, Shopify has a good chance of being a trillion dollar company. After all, today it has just over 1.5m merchants and there are no real signs of its growth slowing down meaningfully. Given its current dominance, 10m merchants is probably just around the corner. Skip to section 7 to get a view on how beautifully KPIs have evolved for the company.

Since the pandemic started and as you will see in section 6, Shopify has tightened OPEX. This has produced some fantastic and very aesthetically pleasing financial results. The point is, the company has proven that it can be profitable.

As a result, today we get $SHOP´s existing business at a seemingly fair price, together with its proven ability to grow fast cost-effectively, which is quite a rare occurrence in high growth tech names.

3.0 Value

Shopify makes it easier than anybody for merchants to build and operate their brands. Brands equate to earning power, which translate into better financials than otherwise.

If we agree that ecommerce is here to stay, then it follows that relative to its largest competitor ($AMZN), $SHOP´s core value stems from its ability to enable merchants to build out their own brands. This is very valuable because strong brands command earning power, which tends to equate to better financials than in its absence.

$AMZN is a powerful logistics machine in which merchants can afford to sell products without a brand at all. $AMZN effectively leases out its brand and its logistical prowess to merchants and in return, the merchants effectively subdue to the machinery.

$SHOP has taken a different route, in which it partners with merchants by giving them world class tools to help them build out their brands. Building a brand is a very hard thing to do (although potentially very lucrative long term) and full of little hurdles which amount to huge obstacles. $SHOP is laser focused on removing all of them.

As a result, $SHOP has become a platform on which great brands can flourish with less and less friction through time, relative to other platforms. Since branded products come with wider margins, $SHOP is in essence a value generating machine and is by design optimally positioned to capture much of it, since once you launch an ecommerce store, it is generally quite tricky to switch to another platform.

The above graph demonstrates that the platform is indeed sticky, with revenue expanding yearly for each cohort. Without this metric, the platform would be of little value for shareholders, since for $SHOP to capture any value merchants must stick around for a long time.

Note that whilst Shopify´s value stems from its ability to help merchants exponentiate intangibles and $AMZN´s from its ability to provide an ever green liquidity pool, both are of value to merchants at different points of their business journey.

Just to further comment on the above, $SHOP´s value is not so much about technology but about its ability to solve problems for merchants through technology. Surely, better platforms can come along technologically speaking, with perhaps more efficient programming languages for instance.

However, $SHOP´s organizational focus is its key asset will continue to get stronger as time goes by and with it, its ability to solve problems for merchants and ultimately, its value as a company.

A recent example of the above is Shopify taking strides to help merchants sell on social media or to sell NFTs, but most of it we cannot see as outsiders. In platforms of this sort, it is always the intense cultural focus on serving the end customers that ends up producing many tiny things that amount to a whole lot of value, in this case for merchants. This is the lesson I learnt seeing $SQ defeat $AMZN in 2015.

Today, 7 brands that started out on Shopify trade publicly. These brands are the ultimate expression of what can be built on the platform and they illustrate the above point.

Shopify is the best in the world at enabling others build brands and that´s why they are in the money.

4.0 How Shopify makes $$$

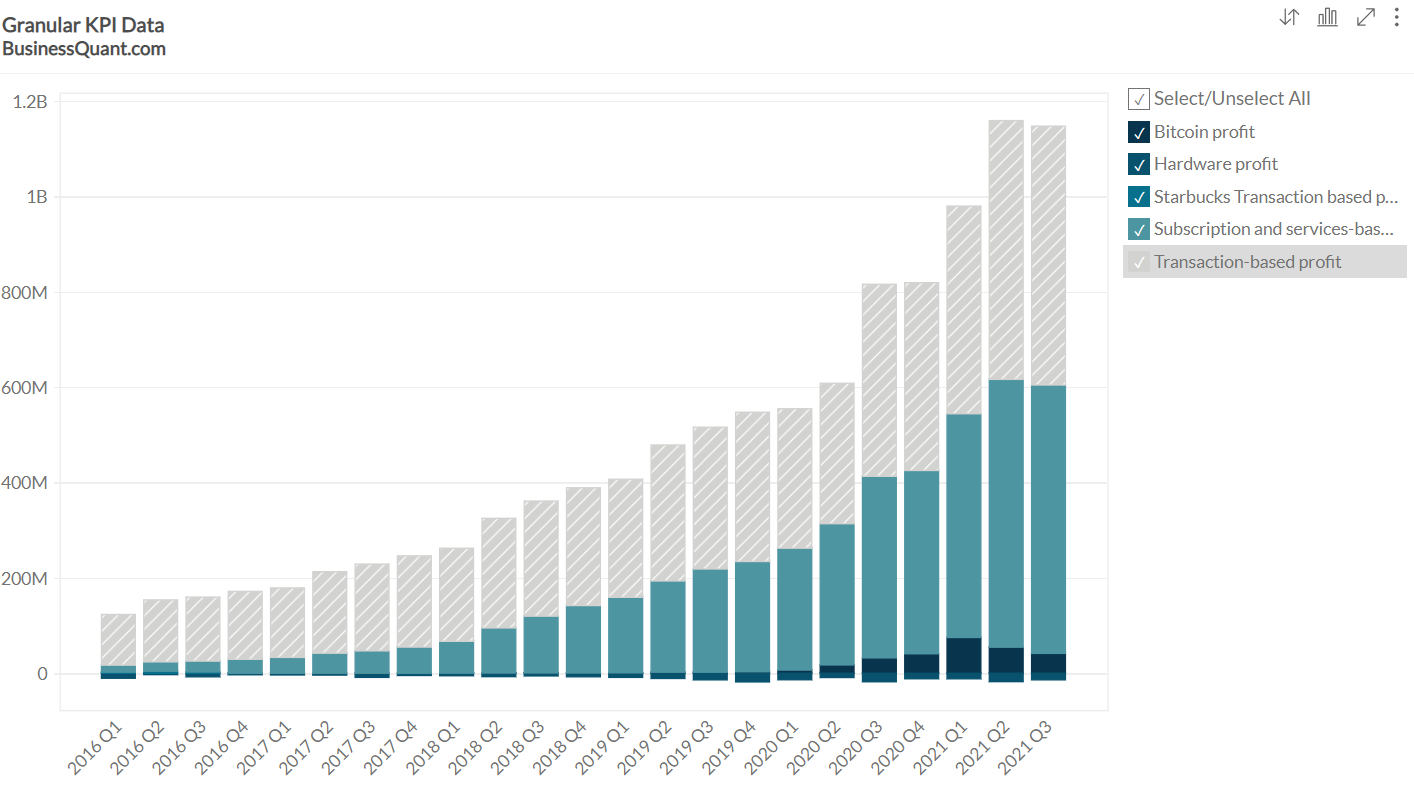

Shopify charges a subscription fee to use its platform and also charges merchants for additional services, mostly processing payments. It makes 70%+ of its revenue through the latter.

Above you can see that Shopify makes most of its money through merchant solutions. In turn, most of the revenue from that segment comes from charging merchants a fee to process payments.

Going back to Shopify´s core value, its merchant solutions seems like an appropriate value capture mechanism. The more brand value that grows on Shopify´s platform, the higher the average transaction value / number of transactions and ultimately, the more money Shopify makes by charging fees to merchants.

Incidentally, the whole payment infrastructure runs on Stripe, which actually results in a much lower gross margin for merchant solutions than for subscriptions. It also results in a single point of failure.

For this reason, the difference in gross profit between the two segments is not as stark.

In its annual letter, Shopify says that most its customers are SMBs and that they “may be quite sensitive to price increases or prices offered by competitors”. On the one hand it is tricky to switch platforms once you start your store, but a fee hike may just trigger you enough to do so as an SMB owner.

For the above reason, I think we can factor in enough pricing power for $SHOP to deal with inflation but not enough to translate into higher margins on demand for the company.

Both revenue segments ramificate into a range of sub-offerings:

Subscription solutions:

“variable platform fees, the sale of subscriptions to our Point of Sales Pro offering, the sale of themes, the sale of apps, and the registration of domain names.”

Merchant solutions:

“other transaction services, referral fees, advertising revenue on the Shopify App Store, Shopify Capital, Shop Pay Installments, Shopify Balance, Shopify Shipping, Shopify Fulfillment Network, collaborative warehouse fulfillment solutions, non-cash consideration obtained for services rendered as part of strategic partnerships, the sale of POS hardware, Shopify Email and Shopify Markets”.

About #1, the company says in its annual letter that most of its GMV comes from customers subscribed to the Shopify Plus plan, which is “offered at a starting rate that is several times that of our Advanced plan”.

Regarding #2, the offerings are about helping merchants out with tasks beyond operating their store front. In general, they all provide $SHOP an opportunity to expand the contribution margin per merchant and in turn, further augment customer retention. After all, merchants increasingly have everything in one place.

I will not enumerate each one of merchant solutions sub-offerings, because that is not the value added of this write up, but I will proceed to explore some noteworthy ones.

4.1 Advancements in Merchant Solutions (Shopify Fulfillment Network)

The SFN will be a tricky task for management, but the rewards could be grand.

Firstly, $SHOP is now on its way to build its proprietary fulfillment network, as outlined in section 3.0. Previously the company was / still is operating a decentralized network of 3rd party fulfillment centers that it unifies via the 6 Rivers Systems software it acquired in 2019.

For one, I am not an expert in fulfillment systems so I cannot go into much depth here, but the challenge looks complex for two reasons:

Shopify cannot force merchants to use their proprietary network, but can only give them a choice. Since optimizing the network requires a consistent stream of demand, this may prove to be more challenging for Shopify than otherwise.

The margins of the fulfillment business are relatively low, which requires a high degree of optimization which further complicates point #1.

In the Q4 call, management said that the “percentage of surveyed merchants who are very satisfied more than tripled by the end of 2021 relative to the end of 2020”. Obviously, the surveyed merchants used the prototype $SHOP has been working on these past few years.

People buy from brands to indulge in the intangibles / qualitatives. Delivery time is often secondary, but quite important. If indeed Shopify builds a network that delivers stuff in <2 days for 90% of the US population, then the rewards could be grand for two reasons:

It would be able to better compete with $AMZN in terms of capturing the mind share of prospective investors (read section 5.0).

It would meaningfully accelerate commerce in its platform, slowly becoming more of an Amazon that lets people build brands. The prospects of value creation here are enormous.

4.2 Advancements in Merchant Solutions (App Store Revenue Sharing)

The App Store is $SHOP´s innovation engine. Giving more incentives for developers to build value on it is “free leverage” for the company´s R&D.

I saw a Tweet yesterday which kind of confirms what I have been suspecting for a while, which is that $SHOP seems to use the App Store as inspiration / an empirical laboratory to figure out what to turn into a core feature of the platform:

In FY2021, app development partners cashed in $411m (up 76% YoY) from the app store. Shopify´s take rate is 20%, which means in FY2021 the company cashed in $82.2m via the app store which is a tenth of its R&D expenditure in the TTM.

Shopify is in a strong position to lure in innovation through its app store and creating incentives for people to build on it effectively adds considerable leverage to its R&D process at a marginal cost, per the numbers above.

Of course, we do not want Shopify getting too predatory here because the reputation could eventually spill over to the merchant side of things and ultimately raises the cost of client acquisition / lower the life time value per customer.

5.0 Competition

Shopify operates in a very contested space, but its ability to make life very easy for merchants is likely to be a durable competitive advantage. I believe its main competitor is actually Block $SQ.

I prefer to invest in companies with no real competition. Shopify is definitely not one of these businesses.

Shopify has competition on three main fronts:

Enabling merchants to set up and operate ecommerce infrastructure.

Main competitors: Wix, Magento, WooCommerce, PrestaShop, Opencart and more. Not necessarily in that order.

Luring people to start commerce companies.

Main competitors: Amazon $AMZN

Enabling merchants to process payments.

Main competitors: Block $SQ, formerly Square (deep dive).

On #1, the competitive landscape is blurry, although my understanding is that Shopify is better than any other solution, in terms of allowing merchants to focus on what really drives value for them.

I believe there are two datapoints that act as evidence for the above statement:

Shopify seems to have gained the most market share in the past decade.

Shopify seems to have the largest market share.

I say it seems because this data is compiled by 3rd parties that I would not trust blindly when it comes to making an investment.

For me at least, getting a read on Shopify´s competitive landscape is hard because I have only used Shopify once in a brief attempt to start a brand, whilst I have not used any of the other solutions. I therefore have no qualitative insights into the different platforms at this stage.

On #2, Shopify competes with Amazon in terms of mindspace. Both depend on people starting companies to sell things. They present two meaningfully distinct ways to go about it, however and I believe Shopify is meaningfully differentiated in this front.

In fact, I believe the two may benefit mutually from their existence since they decrease the overall risk of starting a company, by providing a liquid market ($AMZN) and brand building tools ($SHOP).

To further complicate matters, Shopify´s actual main competitor is Block. Block makes most of its money by charging merchants a subscription for its point of sale solutions and by taking a fee for processing payments - the same as Shopify.

It so happens that $SQ serves merchants operating in the physical space and $SHOP serves merchants operating in the cyber space. Further, the lines between ecommerce and commerce are blurring. They are both increasingly the same thing and thus, $SQ and $SHOP are destined to clash very soon.

Both companies have already taken little steps towards each other. In the height of the pandemic, $SQ launched a solution to help merchants sell online. In 2021, $SHOP launched a card reader which is now integrated in 8 countries. The competitive advantage of both companies is their blatant focus on serving merchants and so I believe the competition between the two will be quite intense and hard to forecast.

6.0 Financials

Shopify has a solid balance sheet and a good ability to generate cash. Its revenue is growing consistently whilst OPEX has been getting leaner, proving the company´s ability to deliver profits.

Shopify´s balance sheet and cashflow exhibit good health. The company has $2,503.0m cash in hand and a moderate $1,169.96m in debt, in the form of a convertible note due 11/01/2025, with a conversion price of $1440.0922 per share.

In the TTM it also produced a healthy $573.5m in free cashflow. Cash from operations has been in the green since it went public and has grown meaningfully over the past 3 years. On the other hand, cash from investing was $(2,347.8m) in the TTM, which the company is mostly investing in marketable and equity securities.

Revenue has exploded from just $205.2m in FY2015 to $4,611.9m in the TTM. That is an impressive 22 fold increase in just under 7 years. Revenue per share has increased 11.11 fold, which is not that terrible a dilution all things considered. Throughout this period, the gross margin has remained stable in the low 50s. In the TTM, gross margin was 53.80%.

Interestingly, the company has been getting leaner recently, with OPEX accounting for a decreasing % of total revenue. This is highly correlated with its recent growth in free cashflow production.

As the company gets into the new investment cycle that it announced during the Q4 2021 call, we are going to see less aesthetic numbers at the bottom line. However, the excellent financial health it is able to showcase as soon as it focuses on profits I think proves the company has the required muscle.

It is also worth noting that most of Shopify´s revenue comes from the US, in terms of merchant location, meaning that there is still a great deal of geographical expansion ahead, which is actually one of the company´s main focus points going forward per their latest earnings call:

“Next, helping merchants go global. Since the dawn of humankind, the greatest hurdles and opportunities for commerce have come down to geography. Digital commerce offers a completely new way to navigate these boundaries, but with different laws, regulations and customs in different countries, selling globally is incredibly challenging.

What Shopify does best is make the complex simple, which is where Shopify Markets comes in, optimizing international selling for merchants to improve sales conversion and create a better customer experience. We began rolling out Shopify Markets in late January and already thousands of merchants are using Shopify Markets, benefiting from features like…”

7.0 Key Performance Indicators

Pretty much any KPI looks great for Shopify. There are no centralized dependencies on any customer, which considerably decreases risk.

A quick glance through the graphs below will reveal that $SHOP has a formidable long term growth story. So long as the company continues to be well managed, I believe the growth will continue. The world is just getting started with ecommerce.

In the 2021 annual letter, the company discloses that by year end they had 2,063,000 merchants on the platform and even more interestingly, that no customer has ever represented more than 5% of total revenues in a single reporting period.

In a platform of this kind, a decentralized customer structure is highly desirable. In the platforms in which this is not the case, you get the disadvantages of a platform model and of a centralized model simultaneously.

8.0 Thesis / Conclusion

Ecommerce will keep growing and Shopify will likely remain a key player.

There is nothing too fancy about this thesis. People are going to buy more things online as time goes by and Shopify is one of the key ecommerce platforms today. I believe this will remain the case for the next few decades.

In the tech space, it is frequent to see companies that grow fast, but dilute shareholders considerably and lose money. It is quite infrequent to see companies that grow fast too, but do not overly dilute shareholders and have a proven ability to generate profits.

Shopify in this case is a rare exception in the market today. In its new investment cycle, the company is putting on its shoulders the hard task of building a fulfillment network. This will not be easy, but I believe management can be trusted to execute well.

Since I run a concentrated portfolio, I chose to add this stock to my watch-list should Mr. Market give it away at bargain prices. The blind spot I have regarding the fulfillment network makes it a pass for me - for now.

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc