Edited by Brian Birnbaum and an update of my original Rivian deep dive.

With the Volkswagen joint venture, Rivian’s platform is tentatively evolving into an operating system.

In my recent Rivian update I explain that Rivian’s platform is likely set to become a key component of the auto industry. There’s plenty of risk in the thesis, but at a market cap of just $10.41B there’s also commensurate upside if Rivian does become the platform of choice for legacy auto companies to infuse perception into their cars.

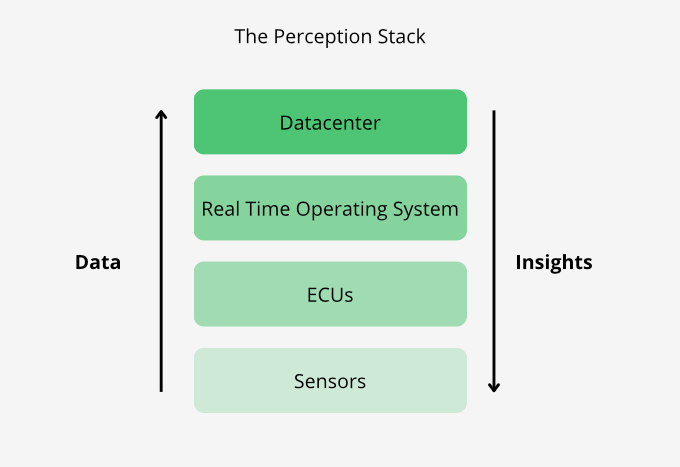

Perception enables cars to pick up information from the real world and ultimately transform it into insights that unlock value for end customers, as depicted in the graph below. Rivian is the only other auto company in the West with a fully productised perception stack that others can leverage, aside from Tesla.

At this stage, Western OEMs (original equipment manufacturers) are faced with two options: delegating perception to Tesla (a direct competitor) or Rivian, a less menacing direct competitor. Traditional car companies are simply incapable of dealing with the complexity involved in equipping cars with all the hardware and software required for perception (and all attendant applications). It gets even harder as network participants (modern vehicles) increase daily, which network effects make perception valuable in the first place.

Indeed, the future of the auto business is connecting cars to a network and teaching each car via data collectively generated by the fleet.

Productization is particularly important because, as Elon Musk says, prototypes are easy, while production is much harder. Rivian is certainly far behind Tesla, but the rest of the auto industry in the West is exponentially further behind Rivian. Per the recent joint venture deal that Rivian signed with Volkswagen, Rivian’s platform seems to be deployable at third party manufacturing sites. And per the remarks of CEO and co-founder RJ Scaringe during the Q3 2024 earnings call, it seems that Rivian’s platform is evolving into an operating system that other OEMs can leverage to accurately scale perception, all the way from the software to the hardware layers. (Note that the joint venture with Volkswagen is expected to close in Q4 2024.)

Here’s what RJ said about the Volkswagen deal in the Q3 2024 earnings call:

As I said, we're excited about our partnership with Volkswagen. And looking forward to being able to support developing really compelling products across a portfolio of brands and markets. As it stands today, we've built a demonstrator essentially that is a driving vehicle that utilises our electrical architecture, our ECU technology, our software stack.

[…]

And in terms of which products our technology is going to go into and what cadence that's not been announced yet, but of course, the nature of the deal and the scale of this partnership in this deal is such that our technology will be seen across many different products and brands within the Volkswagen Group family.

Rivian’s Chief Software Wassym Bensaid also shared some insightful remarks:

Our engineers have been working very closely with the Volkswagen Group and we actually have a driver with demonstrator now that contains the Rivian electronic components, the Rivian software stack and we're moving forward really, really well in understanding how our technology will scale up and down in the entire Volkswagen Group portfolio.

At present, Rivian has not announced the terms of the deal with Volkswagen other than the $5B total (subject to the achievement of undisclosed milestones). What’s important for current and prospective shareholders is that the deal does not impede Rivian from licensing out its platform to other OEMs over the long term. Should this condition be met in the agreement, I believe that Rivian’s process power will make their platform easier to install and operate, opening up a line of business that could be far bigger for Rivian than selling cars alone could ever be.

Although Rivian is making good progress with the car business, the dynamics of the operating system business are more appealing. In the future, the value of a car will be directionally proportional to its ability to convert data from other cars in the network into valuable insights for its owner. This means that the central asset for OEMs will be the infrastructure that powers their network of cars. As such, should Rivian become the operating system of choice, Rivian will become an essential utility for OEMs. Unplugging from its network would be akin to switching off electricity.

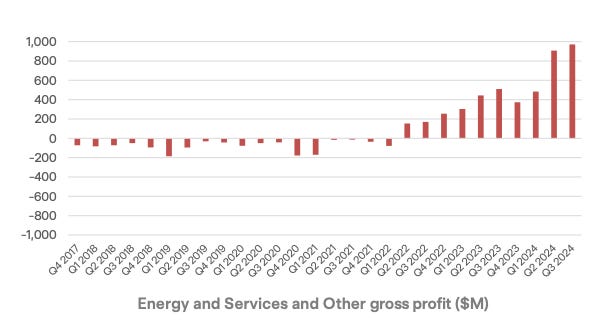

The biggest risk here is the potential for OEMs to license Tesla’soperating system instead. In Q2 2023 we saw OEMs like Ford, GM, Mercedes, and even Riviandefaulting to Tesla’s supercharger network. Tesla’s energy and services gross profit hit an inflection point in Q2 2023 and has continued upwards since, per the graph below. Thus, the possibility that Tesla gobbles up the perception space is quite high. For now, what seems to keep OEMs away is Tesla’s competitive threat in the car business. Rivian poses far less of a threat.

Rivian’s car business is the boot-loader for its operating system business.

The odds of Rivian’s operating system growing far beyond current expectations increases as Rivian improves car production. Q2 and Q3 2024 financials are noisy, but dig deeper and you’ll find that Rivian is making meaningful progress. Management forecasts positive gross profit for Q4 2024. The enhancement of the Normal production plant seems to put Rivian on a clear path towards said goal. And at a price to sales ratio of just over 2.6, achieving a positive gross margin would likely lead to an expanded valuation multiple.

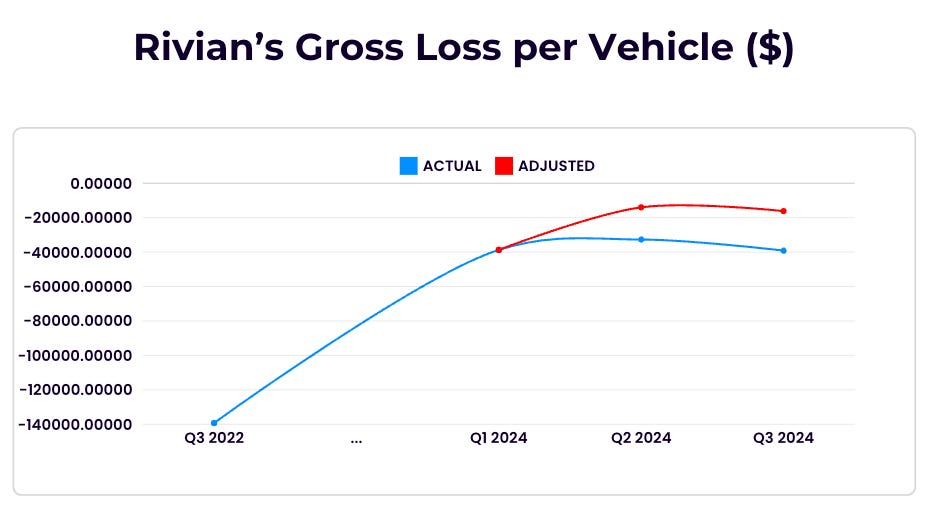

The ultimate measure of the efficiency of Rivian’s car business is the gross profit per car. At first glance, progress doesn’t seem great with gross loss per vehicle coming in at ($37,705) in Q2 2023 and ($39,130) in Q3 2024. Such numbers show little progress made since Q1 2024, in which gross loss per vehicle came in at ($38,705). However, Rivian absorbed considerable expenses in Q2 and Q3 due to the aforementioned re-engineering of its Normal production plant. Thus, adjusting gross profit loss per vehicle for said amortization expenses and associated non-recurring expenses paints a more appealing picture.

The red line in the graph below depicts the evolution of gross loss per vehicle, adjusted for aforementioned expenses. Adjusted gross profit (loss) per vehicle is thus ($14,000) and ($16,200) for Q2 and Q3 2024, respectively. Tracking the evolution since Q3 2022 provides the keenest look at Rivian’s process power and ability to chip away at complex problems over time successfully.

According to management, 50% of the bill of materials for the second generation R1 comes from new suppliers. In Q3 2024, one of these new suppliers “substantially” limited production, which seems to explain the not-so-pleasing progress in gross profit (loss) per vehicle from Q2 to Q3 2024. Assuming this is fixed quickly, efficiency increases resulting from the Normal upgrade should bump Rivian into positive gross profit territory, or at least appealingly close. In combination with the recent conditional approval of a $6.6B loan from the US Department of Energy and the aforementioned funding from the Volkswagen deal, Q4 stands to meaningfully de-risk the thesis.

Rivian upgraded the Normal plant in Q2 2024 to facilitate production of the second generation R1 and the upcoming R2. Allegedly, the new R1 is the result of “hundreds” of design, engineering, and performance upgrades that ultimately reduce the number of joints in the car by 1,500. The factory has been modified to account for these changes and is expected to increase its (R1) production line rate by 30%. In turn, the plant upgrade is expected to yield a 20% reduction in the cost of materials in Q4 2024, with respect to the cost in Q1 2024. The combination of the increased line rate and the cost reductions can be powerful.

Further, Rivian remains focused on enhancing efficiency following successful deployment of the new Normal capabilities. During the Q3 2024 earnings call, COO Javier Varela shared some insightful remarks on how Rivian is working to improve its optimization of processes and systems. When Javier talks about an operating system, he’s not referring to the aforementioned perception stack operating system. Rather, he’s referring to the way people work together at Rivian, which is the ultimate driver of the company’s overall performance:

We are as well robustifying our Rivian industrial operating system, or integrated operating system, all our lean principles and again, accelerating their implementation. And when it comes to the way of working in the teams, enhancing an end-to-end cross-functional view and collaboration.

The big priorities for that performance is improving in the short term that those results. But what's more important is to prepare the plant for landing R2 to appropriately at the right levels of quality, cost and with the right delivery times.

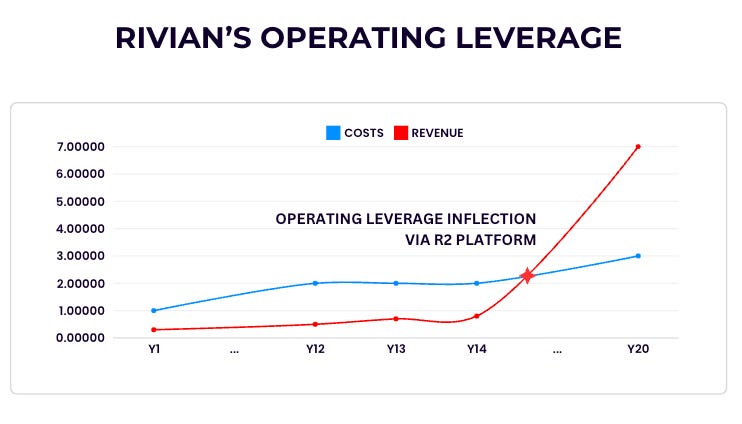

Additionally, the R2 is designed to leverage the existing second generation R1 production capabilities. Therefore the results of the Normal upgrade should compound meaningfully from here. R2 deliveries are expected to start in H2 2026. A starting price tag of $45,000, stands to expand Rivian’s addressable market without equivalent cost increases. It looks like the Normal upgrade, together with the R2 platform, will allow Rivian to substantially increase operating leverage over the coming year or two. In turn, increased scale should feed back into Rivian’s ability to license out its perception stack operating system to other OEMs.

Meanwhile, Rivian is also focused on increasing revenue per vehicle sold. In Q3 2024 Rivian announced the launch of its new Tri-Motor and Quad-Motor. The former puts a single motor in the front and two in the back and the latter is a new version of its previous Quad motor. The Tri-Motor began deliveries in late Q3 and the Quad is expected to ship in 2025. According to management, these two motors deliver “exceptional performance” compared to previous alternatives but at a “much lower cost.” It seems that these two motors will enable Rivian to populate the demand curve more densely and specifically, the Quad motor will enable Rivian to move up-market.

Drivetrain changes now come with accompanying trim packages, which assist in the move up-market. This move is expected to yield higher ASPs (average selling prices), which should help Rivian move towards the positive gross profit domain. Here’s what RJ said about this shift during the Q3 2024 earnings call:

That allows us to not only offer vehicles to folks that are very price-sensitive, but also to give products to customers that want the best of what we can build.

And so those changes happening at the drivetrain level certainly help maintain ASP, but importantly we also have a new trim package that we've just launched which is a more premium trim from what we'd originally had.

We call this the Ascent trim.

According to RJ, Rivian is also focused on enhancing revenue per vehicle on the software side. Improvements on this front should also translate into an increased demand for Rivian’s operating system from other OEMs. However, it doesn’t seem that this will assist at the gross profit level in the short term, with RJ issuing no specific measures being taken at present. Here’s what RJ said about this during the Q3 2024 earnings call:

This is sort of one of the big questions, I think, being asked broadly around the automotive industries to what level the future services show up as recurring revenue? Or do they show up first price on the front end? And in this case, the Connect+, what that's relating to is -- there is a variable cost associated with providing the services.

So the data costs to, let's say, stream music or to have a WiFi hotspot are non-zero.

And so this reflects us capturing that in a bundled package that brings along with it not just the price that covers the cost for us to be providing the connectivity, but also some additional features.

And we're watching this very closely, in particular, thinking about it in the context of the growth of our autonomous platform and what that provides in terms of new features, new capabilities and how to appropriately charge for that.

Reliance on regulatory credits is a considerable risk.

In the Q3 2024 earnings call I learned that mostly leased customers have access to regulatory credits that ultimately make electric vehicles cheaper for the end consumer. In turn, I also learned that the lease penetration of Rivian’s customer base is 42%. Should the new administration reconsider the existence of these credits in any form, Rivian’s path to a profitable gross margin could be severely hindered. This is the issue with investing in businesses that rely on regulatory activity in the first place–you never know when the rug is going to be pulled.

Longer term, I believe that Rivian’s process power could see the company through turbulence on the regulatory side. A $7,500 credit per vehicle is substantial, but Rivian has repeatedly demonstrated the capacity to manifest cost reductions per vehicle of that magnitude and, in many cases, beyond. This is what makes the Rivian case fascinating: it’s yet another test of how process power truly is predictive of financial performance. The journey towards positive gross profit is difficult, and the battle against Tesla at the operating system level will be even more so. But organizationally speaking, I believe Rivian has statistically significant odds of succeeding.

Although I find the case fascinating, I’m not considering an investment at present. I particularly like scenarios in which the path to exponentially higher levels of free cash flow per share is less convoluted, in relative terms, as is the case withHims andPalantir, for example. However, I have only benefitted from closely monitoring companies with extraordinary organizational properties, of which Rivian is definitely one. You never know when the investment thesis will come together into a compelling opportunity.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc