Both Palantir and Spotify are formidable companies and decabagger candidates. They operate in seemingly unrelated industries, but since my capital is limited, they compete in terms of my capital allocation. Below follows my take on how I think about allocating capital to one versus the other and to what degree.

To better enjoy the rest of the post, I suggest you check out my deep dives on Spotify and Palantir.

The AI Business

Palantir and Spotify are AI powerhouses.

Value = f(distribution speed, retention, monetization capacity)

Firstly, at the lowest level both companies are networks made of nodes. In Spotify´s case, each node is a listener and / or creator. In Palantir´s case, each node is an operating unit inside a company - from a computer to a door knob connected to the internet.

At the beginning of this write I say both companies operate in seemingly unrelated spaces, because indeed Spotify operates in the music industry and Palantir operates across industries, enabling their customers to generate digital twins. However, both companies are in the business of unlocking insights.

Networks, coupled with AI, get smarter as they onboard more nodes and as the interactivity between the nodes increases. Increased node activity simply generates more and better data, which can then be processed via AI to extract insights. Ten years on, both Spotify and Palantir will be on demand intelligence machines in their respective industries.

Spotify is continuously learning who likes to listen to what, when and how,. Palantir is continuously learning how to best operate a business within a range of industries. The end game is:

Spotify will yield the world´s largest intelligent information sharing network, after or on par with $GOOG.

Palantir will make raw computation obsolete, by commoditizing valuable compute, resultingly becoming a dominant software player.

The essence of the above is simple. The nature of a business radically transforms once it becomes a network problem. When Palantir serves N customers in the manufacturing industry for instance, the resulting digital twins converge into a kind of blueprint that other companies in the space can leverage, transforming how business is done.

Once connected, for instance, each component in a manufacturing plant becomes a data generating node. In aggregate, the plant then becomes a data churning machine / network. The job now consists in making sense of the data to optimize operations. You are now running a network, more than you are running an industrial facility.

With music it is much the same. Previously, music was about recording a song and broadcasting it unidirectionally. Now, music is just another package of information in a network. Do people like it? What pattern did people like that we can leverage for further songs? Did it vary across geographies? Etc.

It thus follows that, assuming talent / culture / management persists at both companies, the value of each firm will be mostly a direct function of:

The speed with which they add nodes to their respective network (distribution).

The retention rate per node.

The capacity to monetize interactions between nodes.

Ideally, we want a network that nails all 3 parameters above together with the market missing the point. In reality, however, this is hard to find, so the name of the game is striving for optimal odds based on a thorough understanding of qualitatives.

Distribution and Retention

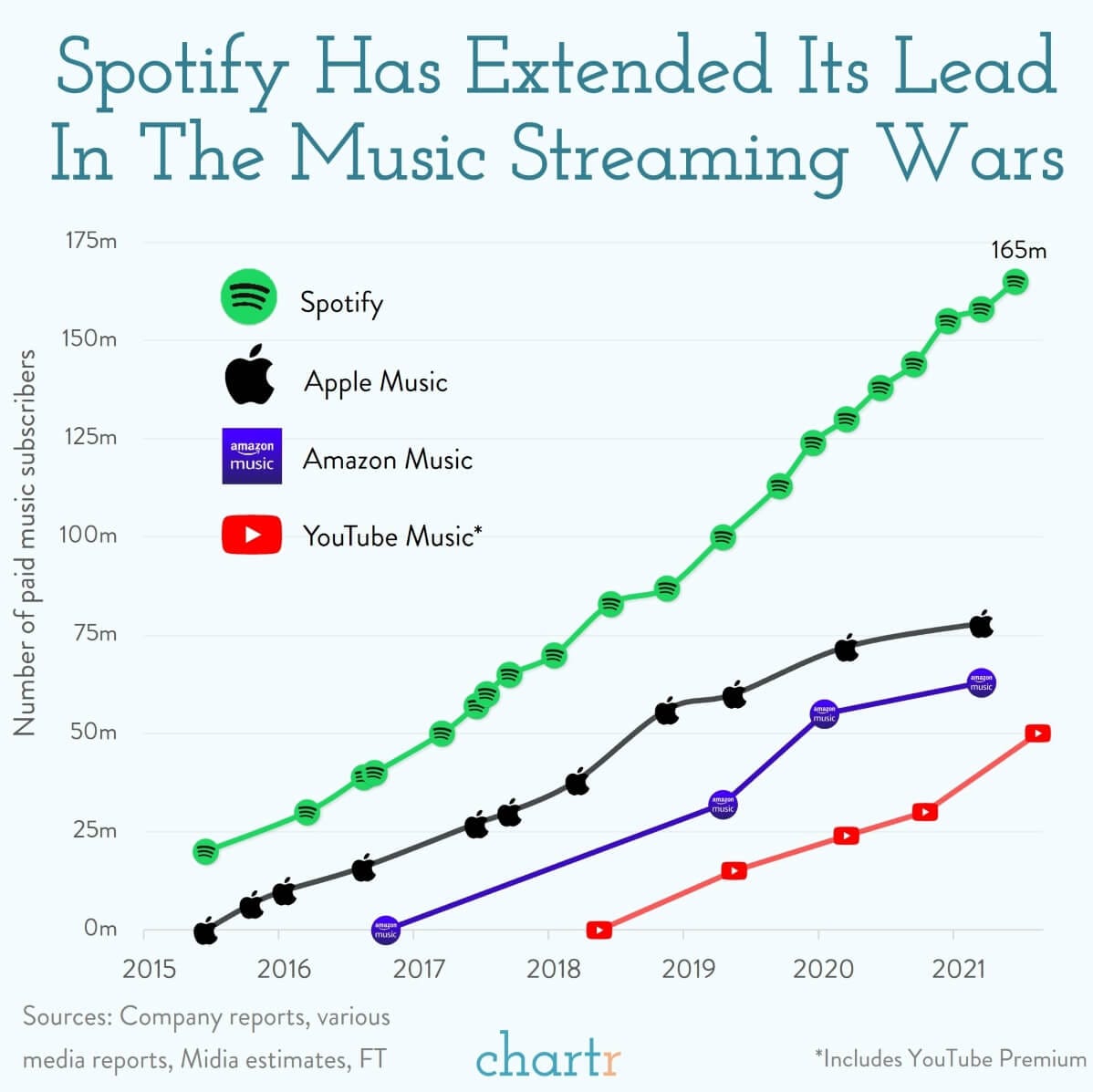

Spotify is ahead of Palantir in terms of distribution.

When the market looks at tech companies, it often forgets that the tech is a result of the people. In this sense, both companies have world class structures and cultures. So long as this persists, the moats (Spotify, Palantir) will remain strong.

It is worth noting that the moats of the two companies are at different stages. Spotify´s moat is mostly the dominance of its network as compared to competitors, which has emerged from its focus on the space. Palantir is on its way to similarly productizing its moat, but it is not quite there yet and so we have to look further into qualitative signals to assess it.

Regardless, both companies exhibit signs of the Innovation Stack at work. Quick reminder: the Innovation Stack is when a company focuses on one thing and by doing so, delivers many thousands of little incremental value additions that creates a very strong moat, “inexplicably” fending off larger competitors. The current state for both companies:

Spotify:

Palantir:

provides “the operating platform to safeguard America's nuclear stockpile”. The $90m 5 year contract was announced in Q1.

“Microsoft and Boeing launched a competitive ecosystem nearly a year before Palantir and Airbus launched Skywise” Now, “65% of the Boeing fleet is managed in Airbus' Skywise ecosystem”. Skywise now connects more than 100 airlines and 9,000 aircraft ).

As it refers to distribution, Palantir has made notable advances by modularizing (cutting into smaller bits) its offerings. This has made selling easier for them, by making their product more digestible to potential customers. Still, the company is a work in progress in this sense, whilst Spotify has almost totally figured out distribution.

Per the progress Palantir is making, I think they will eventually fully productize their offerings and make distribution as seamless as it can be. This is still, however, the big challenge ahead for the Hobbits.

Monetization

Palantir is ahead of Spotify in terms of monetization

Palantir makes a decent amount of money for what it currently offers, whilst Spotify has very weak unit economics. Per every dollar that Spotify makes, labels (that own the rights to most of the music in the platform) take 75 cents.

The relationship between labels and Spotify has become symbiotic, with a large share of the total revenue for labels coming from Spotify and its other non-competitors. In this sense, the existential threat for Spotify is less acute than most people think, but the symbiosis definitely weights on Spotify´s margin.

Going back to the network abstraction, it seems evident to me that Spotify´s network is underutilized. Firstly, Spotify is under monetized in terms of advertising. Secondly, the market has somehow written audio off as a non-valid form of communication versus video, images and text, which has a profound implication.

Audio is the basis for spoken language, which is arguably the basis for our civilization. Whilst the market views Spotify as a music streaming app, I see it as a network that further amplifies this basis and takes it to the next level through podcasts.

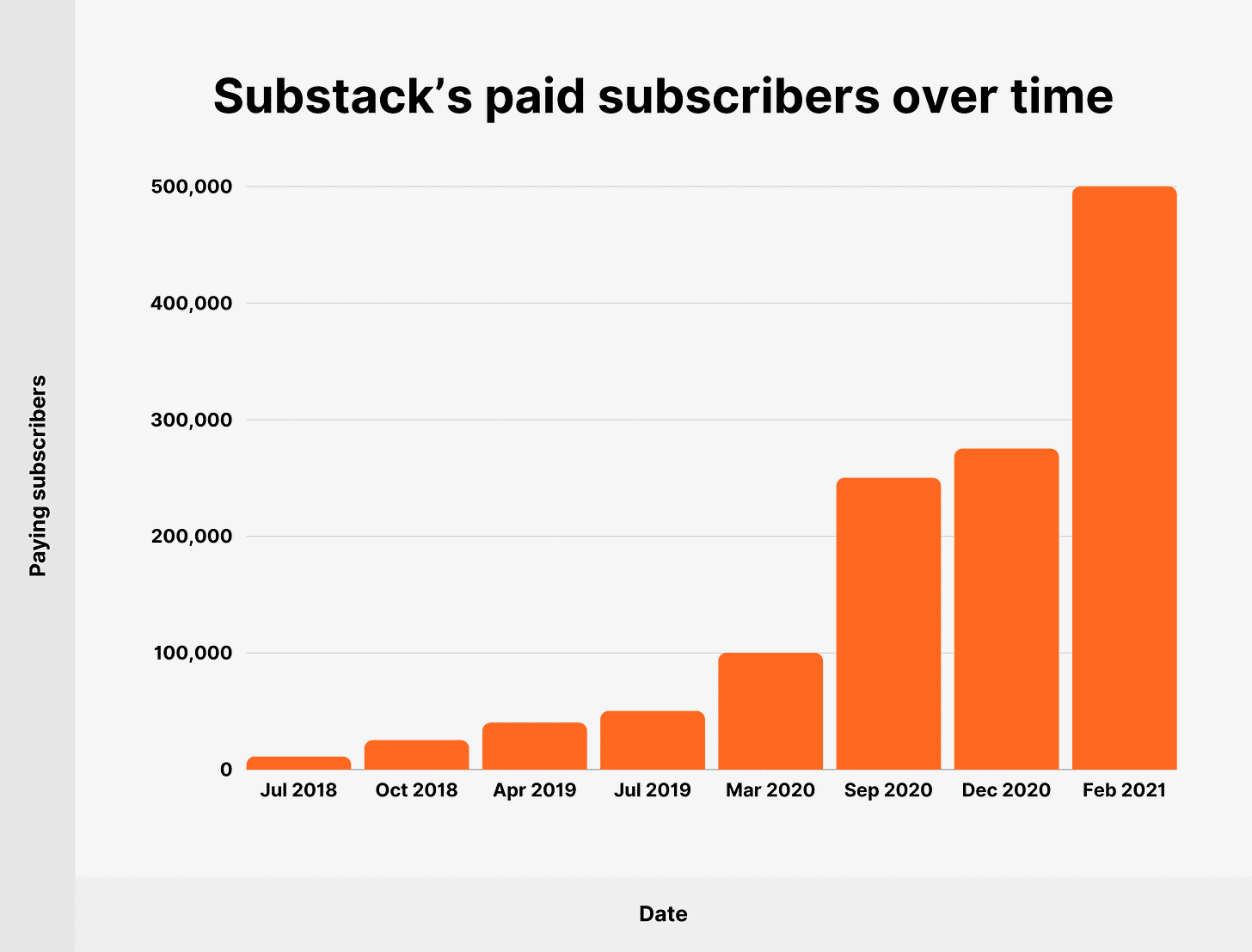

Podcasts have a much more advantageous cost structure for Spotify and give way to the Creator Economy, by which any given person with relative expertise in a topic can start making them and build an audience. A % of the audience will turn into super fans, which will happily say 500$ per year to interact more deeply.

The above is a whole new, far more monetizable use of Spotify´s network, yet it remains the biggest challenge for the firm today and is, seen in the abstract, an equivalent challenge to Palantir fixing its distribution. The question is, what do you prefer, a monetization or a distribution challenge and just how much is the market paying you to take on this risk? Bear this in mind as we proceed.

Perpendicular Risks

You can´t have the cake and eat it too.

Half of Palantir´s revenue comes from government clients and Spotify is prone to clashing with cancel culture.

Palantir´s dependence of government clients is not something bad per se, but I definitely cannot model it or fully understand it the way I can understand a B2C kind of model, where I the consumption dynamics are more transparent and somewhat predictable.

To Palantir´s credit, the firm has operated in this space through 4 different administrations in the US, which suggests that hey do have a way of navigating whatever dynamics unfold in the public space. Still, a big blindspot for me.

Also, I have seen Cathie Wood´s comments about selling Palantir due to the decline in government revenue growth and unless she has some insider information, it does not seem justified to me. The company has growing its government business for decades now and a little blip in the graph is likely not indicative of anything.

Spotify´s equivalent of the above is the way it clashes with the novel interest in censorship. My theory is that it emerges from the way modern states are run, which is by directing the population through high-intensity repetitive messages, which form narratives. This dynamic tends to evolve in a segment of the population reacting violently when someone notably challenges the narrative. I expect this to persist through time.

Unlike with Palantir´s governmental dependence, I actually have plenty of insight into the above dynamic, because I have spent a lot of time reading about mass and individual psychology. My conclusion is that most people will not care about the Joe Rogan´s of the world violating narratives, whilst a small % of the population can make it seem time and time again like there is actually a problem. Conversely, I expect this dynamic to be a great source of publicity Spotify.

Conclusion

Both are notable portfolio additions. The market is paying us more to take on Spotify´s risks, nonetheless, which I have a better understanding of.

Palantir merits some degree of capital allocation on my end. In 10 years time, it will be a software / computing giant. People will buy Palantir´s offerings (valuable compute, rather) before starting a business, like today they set up Gmail. I do not go “all in” on Palantir because I have a blindspot that encompasses 50% of its revenue, although it seems to me like that part of the business will do fine. I may monitor this for some quarters.

Valuation wise, Palantir is not catching the market by surprise. Spotify, on the other hand, will have many scratching their heads just a year or two from now. The market is currently pricing the company as a music streaming app, whilst in a few years it will look like Google´s cousin. Spotify does present a risk in terms of monetization, but the market is paying me generously to take on this risk.

Further, I am quite sure the monetization challenge for Spotify is surmountable, because I am seeing the key dynamics unfold in the marketplace around me. Substack is taking off in terms of paying subscribers. This is because the Creator Economy is real. The question that remains in this sense is, are podcasts a valid medium for this economy? Just look at the number of people that regularly listen to podcasts today and compare that with what you saw 2 to 5 years ago.

In terms of financials, the two balance sheets look healthy and so does free cashflow generation. One major concern for me would be shareholder dilution in Palantir, although I believe this will cease as the stock option program normalizes. On this I do not have much insight on, other than hoping management will treat shareholders well.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

TOP!

Great work! You do your homework!