Edited by Brian Birnbaum.

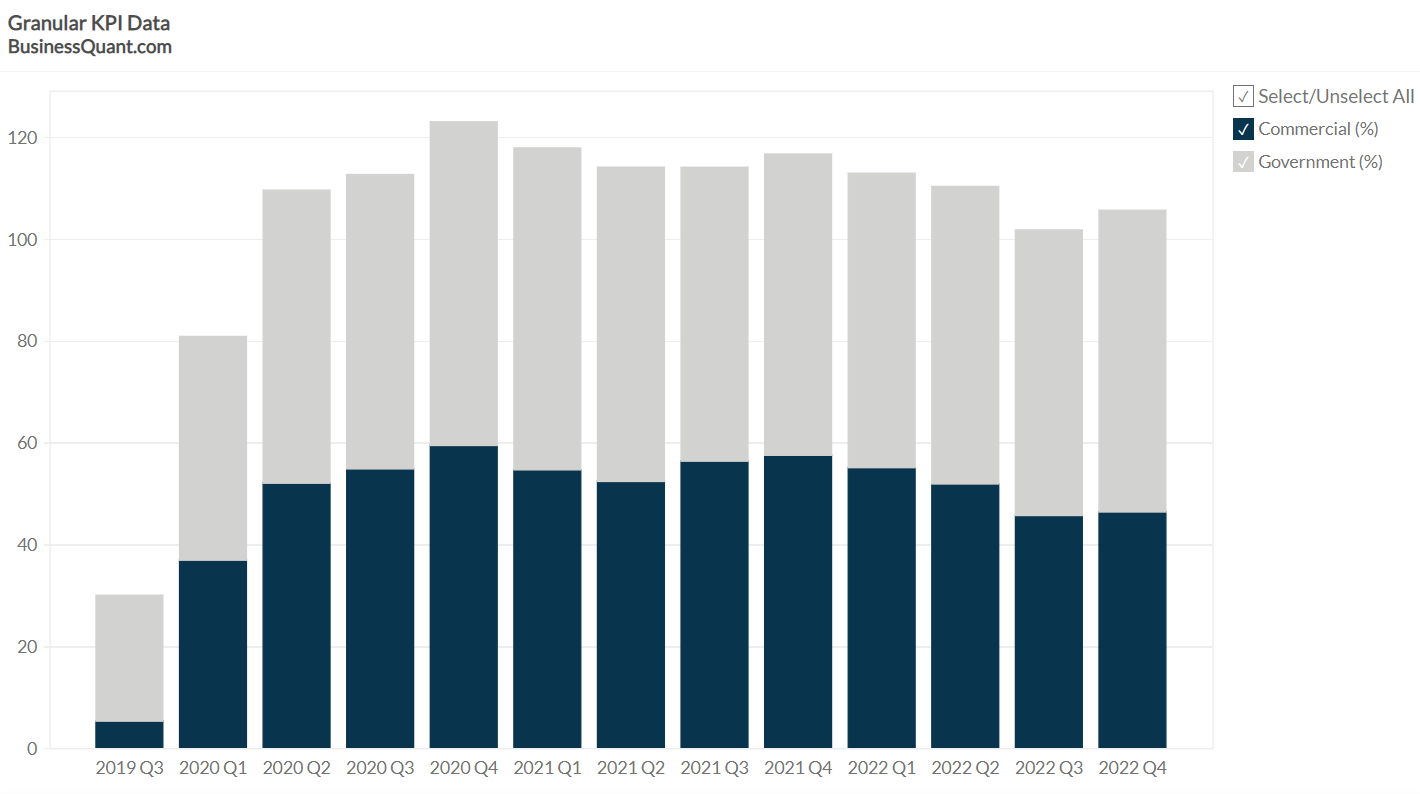

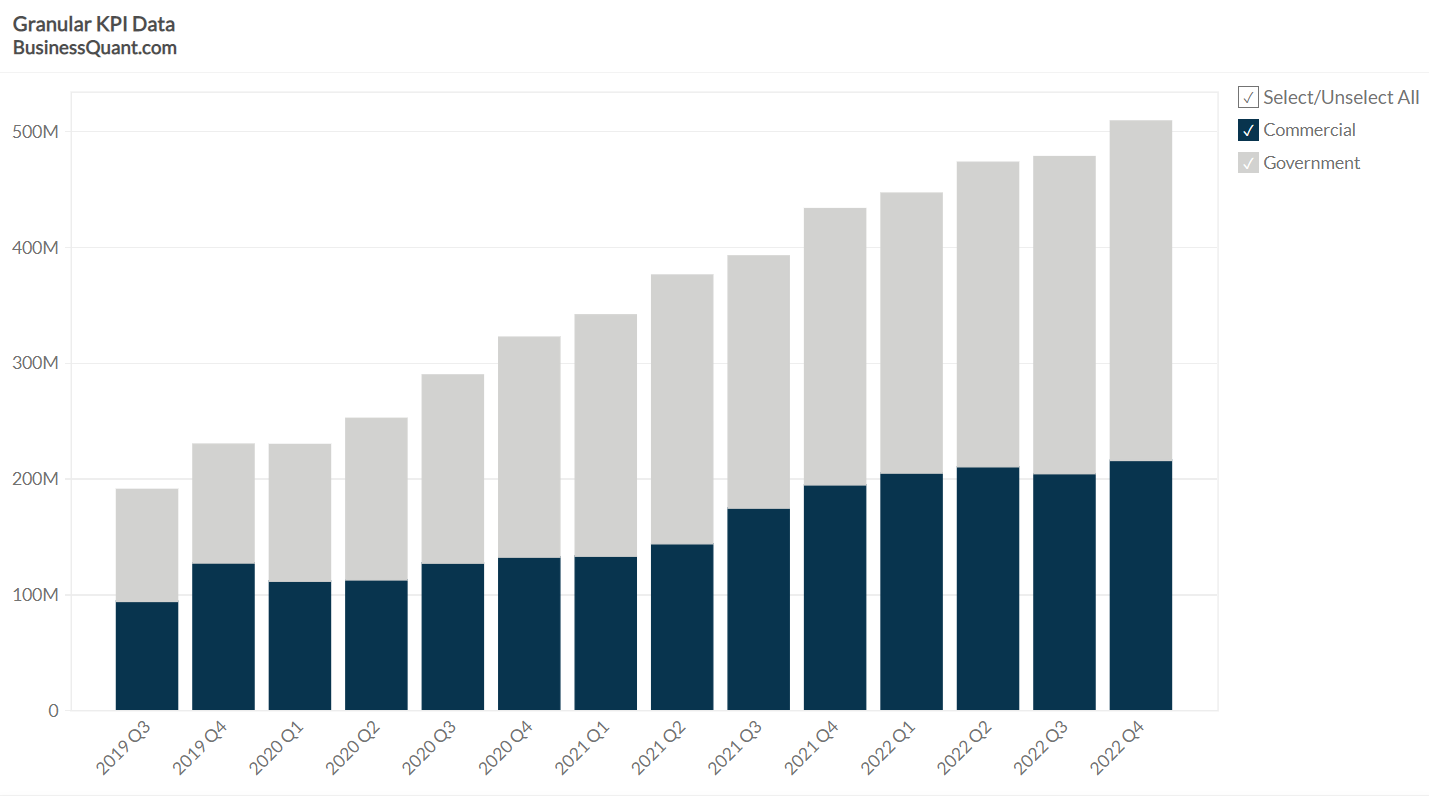

In my original Palantir deep dive, I explained how I believed that the company will eventually become a platform on which companies will be built on first, in order to leverage the power of AI. The ultimate metric to track the progress of thesis is the contribution margin. The lower the cost of deployment, the higher the contribution margin goes and thus, the closer Palantir is to becoming a platform. Since I wrote my thesis, commercial contribution margin has been trending down and perhaps, for good reasons.

“As you see, the average customer size is decreasing, and that's in part because of the volume of customers that we're bringing on to the customers into our space.”

“Most U.S. commercial customers don't buy $50 million contracts. They buy $2 million, $3 million contracts. I think we're going to see a lot more of that.”

- Alex Karp, CEO @ Q4 2022 ER

It seems that as Palantir expands its commercial business, it is on-boarding smaller customers. This has been the result of modularizing its offerings and making them more accessible for smaller organizations. I speculate that this is distorting the contribution margin metric, due to thornier sales processes. For now, we remain in the quantitative dark and have to lean on qualitatives.

“We are deploying increasingly focused go-to-market strategies, including in the healthcare, supply chain, manufacturing, energy, automotive, and utility sectors.” - Ryan Taylor, CRO @ Q4 2022 ER.

On the other hand, healthcare revenue is growing very fast and this has a number of implications. Firstly, healthcare is a highly regulated industry and the growth speaks to Palantir´s ability of developing verticals with highly sensitive data. Secondly, the healthcare sector is particularly allergic to innovation and it thus serves as a thermometer for the world´s current stance towards digital twins. Healthcare is one of the trickier verticals out there and I believe more will follow soon. The key question is, who else can do this?

Palantir´s move to profitability, although somewhat manufactured, sends a great signal. The company is serving increasingly crucial functions and it needs to project financial strength, especially during these times of turmoil. These may seem like vague words, but an in depth study of the history of semiconductors really suggests this move to be pivotal. No one wants to put their eggs in a feeble basket.

Further, amidst the macro headwinds, I believe it is easy to get lost in the numbers. Qualitatively, I see the world continuing to fold to Palantir´s digital twin supremacy and per my studies of the company, I see this as the company´s key driver of financial results historically speaking. Barely anything in the universe ever grows in a straight line and quarterly expectations are a costly distraction, which I will rarely entertain.

On the other hand, the company´s digital twin supremacy can turn out to be redundant for shareholders via excessive stock-based compensation. In the last six quarters, SBC has trended down sequentially and as of Q4 2022, is down 27% YoY, coming from some very high levels. Generally, I believe the market underestimates what Palantir is up to and thus, the lengths it must go to retain its talent. For this reason, I am not immediately deterred.

“Stock-based compensation expense was down 38 million in the fourth quarter compared to the year-ago period and down 213 million compared to the year-ago period.” - Dave Glazer, CFO @ Q4 2022 ER

However, the tech space is littered with companies that are highly reliant on a relatively small number of employees. This has acted as a breeding ground for cultural issues of varying degrees (Netflix, Twitter etc) which have had material impacts on financial performance. I have come to understand that this is the greatest risk in my Palantir thesis, but I see no signs of cultural degradation as of yet.

Palantir ended Q4 2022 with $2.6b in cash and no debt. Incidentally, I am doing a deep dive on Netflix this month and I am fascinated by how, in hindsight, the company´s financial performance and ultimately meteoric stock price increase can be attributed to one single key driver. In the many quarterly earnings calls that I have examined in the period entertained below I have not found one single analyst showing an interest in it.

The morale of the story is to stay focused on what matters, not on what others tell us matters.

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Thank you!

You have the ability to look at companies from your own angle! (I think that you have read a lot about PLTR and at the same time have not lost your system and vigilance / objectivity - a very valuable quality.)

What are the competitors of PLTR in your opinion?