1.0 The Platform

My Palantir thesis has one cornerstone: that it is likely that Foundry will eventually become a platform on which companies are built on first and hence the company´s value will rise exponentially. As such, in my original deep dive I singled out the contribution margin as the primary key performance indicator. As Palantir gradually gets better (faster, cheaper) at deploying its products, the contribution margin rises until deployment is seamless and hits an asymptotic maximum and voila, you have a platform. Per Karp´s words, the advancements since I initiated my position seem to be notable:

“We have at this point essentially captured the market of commercial enterprises and industrial leaders that were first to begin leveraging software to reshape their businesses. And the remainder are now following.

The shift has been made possible by a more sophisticated and coherent commercial offering, which can now be deployed to new customers within minutes.

In the past, the time and effort required to build relationships with and deliver our software to customers weighed on our ability to expand at a pace commensurate with demand in the market. We were iterating and experimenting with building a software platform, and our customers were iterating and experimenting with us.

A pure software business has now emerged.” - Alex Karp, Q3 2022 Letter

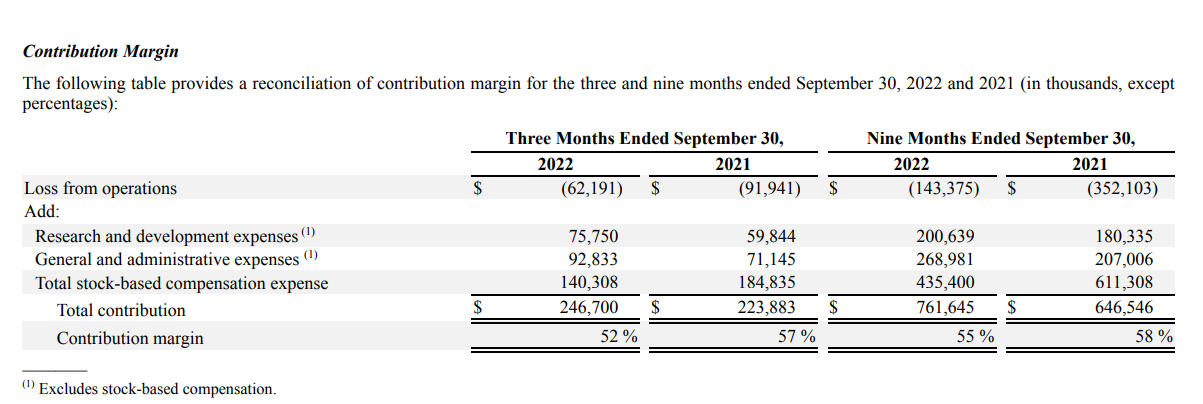

“ We define contribution margin as revenue less our cost of revenue and sales and marketing expenses, excluding stock-based compensation, divided by revenue.” - 10Q, page24

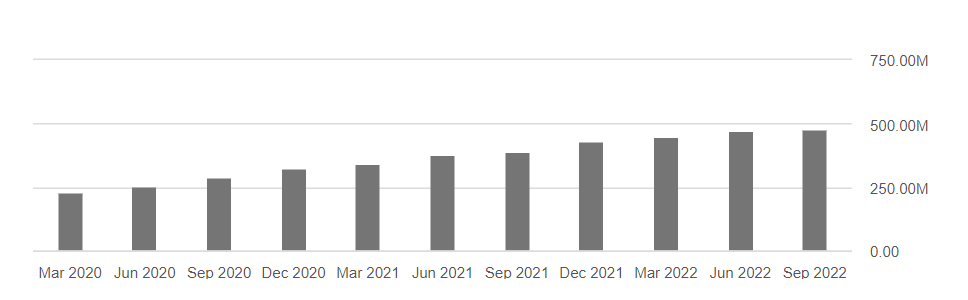

It is curious that despite Karp´s words, contribution margin is actually going down on YoY basis. Whilst G&A has ticked up 30.4%, R&D has only ticked up 26.5%, meaning that most of the decrease in the contribution margin is actually due to increased selling costs. This currently stands in contradiction with Karp´s words, which makes the situation a bit confusing. Given the number of moving parts in the business and the push to grow commercial, this in non-conclusive data but I do believe this must be watched carefully going forward.

In FoundryCon we heard people from companies like Tyson Foods and others illustrate just what Foundry can do to a company. I must admit, my original thesis is also largely based on the self-formulated and non-proven abstraction that companies are optimization functions and that all they do is process information (move electrons back and forth) to figure out what levers to pull, when and how in order to minimize inputs and maximize costs. It turns out however, that the abstraction models fairly well the experiences shared in the conference. Indeed they all boil down to a resource allocation game in which the reward is notable efficiency gains:

“The time to analyze ... we reduced by a factor of 6x. We could fly more o en. We could learn faster.” - Yves Yemsi COO of Lilium

“Executives at Tyson Foods shared how they generated $200 million of annualized savings in 24 months. Jacobs Engineering shared how our software has reduced energy consumption by 1/5 at its first wastewater plant running on foundry. Swiss Re shared that they saved more than $100 million in the first year of use alone.” - Shyam Sankar, COO @ Q3 2022 ER

Data is very much like content, in that it snowballs through time and so do the pertinent benefits. As such, when a company integrates Foundry, it not only is capable of generating impressive results, but it also becomes a part of its DNA. It becomes somewhat impractical to remove or even switch a given data fabric, when it holds the relevant information that enables you to minimize inputs and maximize outputs as an organization and that gradually holds more of the processes and inherent wisdom that makes your organization valuable in the first place. Once deployed, a digital twin is just a few non-linear steps away from becoming the most important asset and the top priority on the OPEX side.

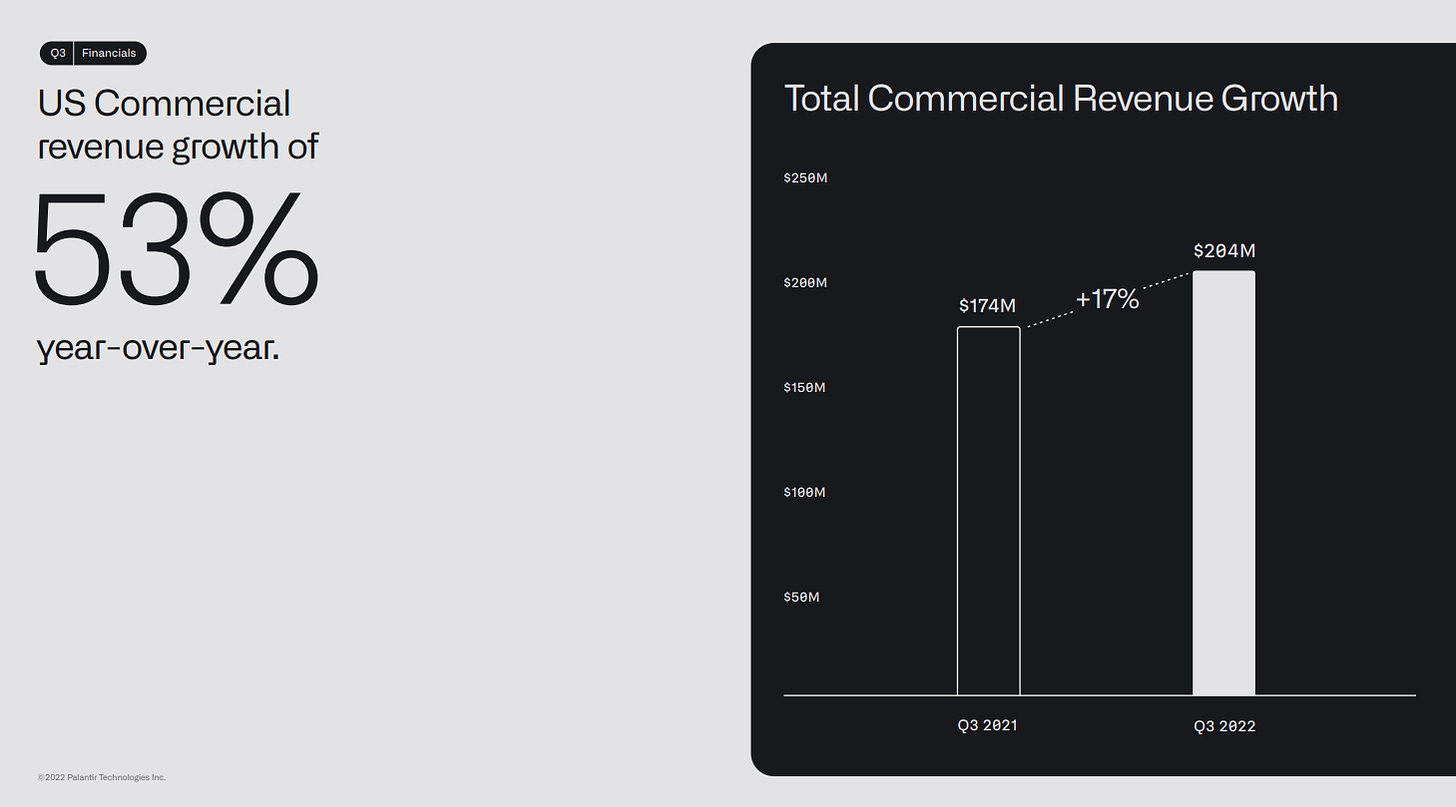

The US commercial business continues to exhibit healthy signs of growth, whilst this is the first quarter that I see management explicitly stating that the company´s offerings are near or at productization. Hereinafter, if Karp´s words are true, we should see a considerable acceleration in the growth of the commercial business and if indeed a digital twins do turn out to be indispensable for a majority of the new clients, excellent financials are likely to accrue.

“… our U.S. commercial business grew for the ninth quarter in a row, rising 53% year-over-year.

We increased our U.S. commercial customer count to 132 at the end of Q3, a 124% increase year-over-year.” - Ryan Taylor, Chief Legal Officer @ Q3 2022 ER

Yesterday, I wrote a post termed “Super Enterprises or Kaizen 2.0” illustrating what I think the Foundry platform can do to the world as it penetrates different value networks, but essentially, so long as Palantir carries on in this direction the odds that the resulting platform will be enormously valuable remain high. I believe that you will enjoy reading it and that it will add to your long term vision of the economy. About kaizen, which you can learn more about in the post, Karp gave us the following insights in his letter:

“The strength of our engineers, those building our software products, often stems from their disinterest in grand unifying theories when it comes to the construction of software and how it should be built.

They see what works and discard what does not.

The rapid cycles of iteration that arise from this way of working are only possible if one remains relatively unbeholden to ideological ways of thinking.” - Alex Karp, Q3 2022 Letter

2.0 The Government Business

Whilst I have always framed the upside on the commercial side as exponential, the government business has been a blind spot for me at the outset, thus impeding me from turning this investment into one of my biggest positions, despite its currently notable size. In effect, it is hard to see what is happening on the B2G side because it is an opaque domain, but the same fundamental principle that has guided my thoughts on the commercial side has done so on the government side: building a leading digital twin solution is very hard to do and the market is gradually compelled to default to the best one via osmosis. It does not happen immediately, but it happens through time and looking back, the trend is clear.

Whilst there where some grave concerns about the government business slowing down over the last year, which I did point out in previous write ups as premature and non conclusive, in Q3 we have seen the US military ramping up the adoption of Palantir offerings as things have been getting serious around the world. I believe this is once again indicative of the superiority of Palantir´s digital twin solutions and how, given the appropriate conditions, which do not appear in the world in a linear and predictable manner but rather quite the opposite, the osmosis happens swiftly. This is largely evidenced by the spike in TCV produced this last quarter:

“We executed contracts in the third quarter of this year worth a total of $1.3 billion over time, with $987 million of the $1.3 billion coming from contracts entered into with the United States government alone.

The significant increase in contract value this quarter was principally driven by the expansion of our work with the United States military to support the deployment of artificial intelligence and machine learning capabilities to soldiers on the front lines.

We furthermore do not view the increase in contract value this quarter as an aberration but rather as a sign of a more fundamental shift in our business, from insurgent outsider to incumbent, particularly in the U.S. market.” - Alex Karp, Q3 2022 Letter

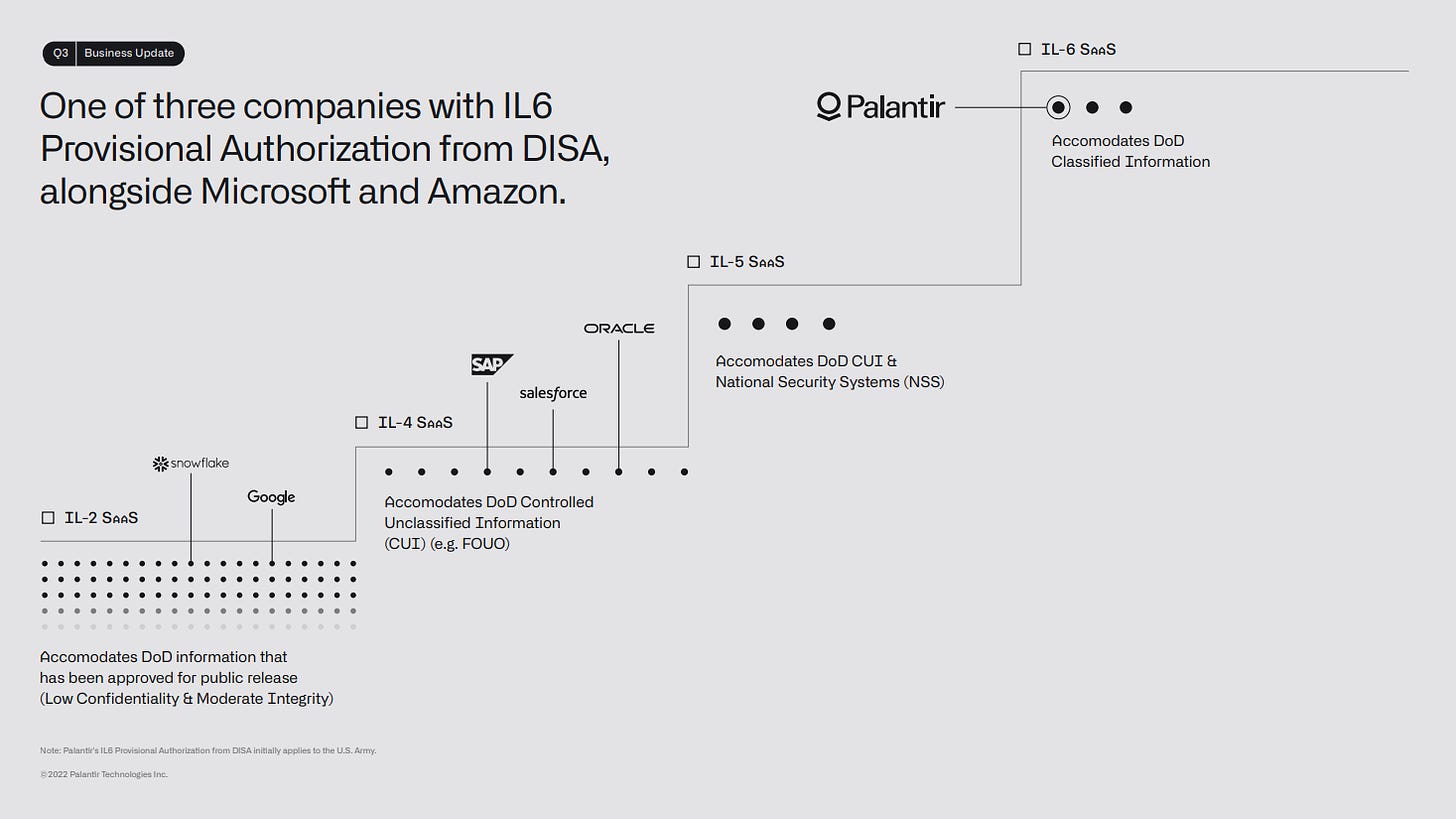

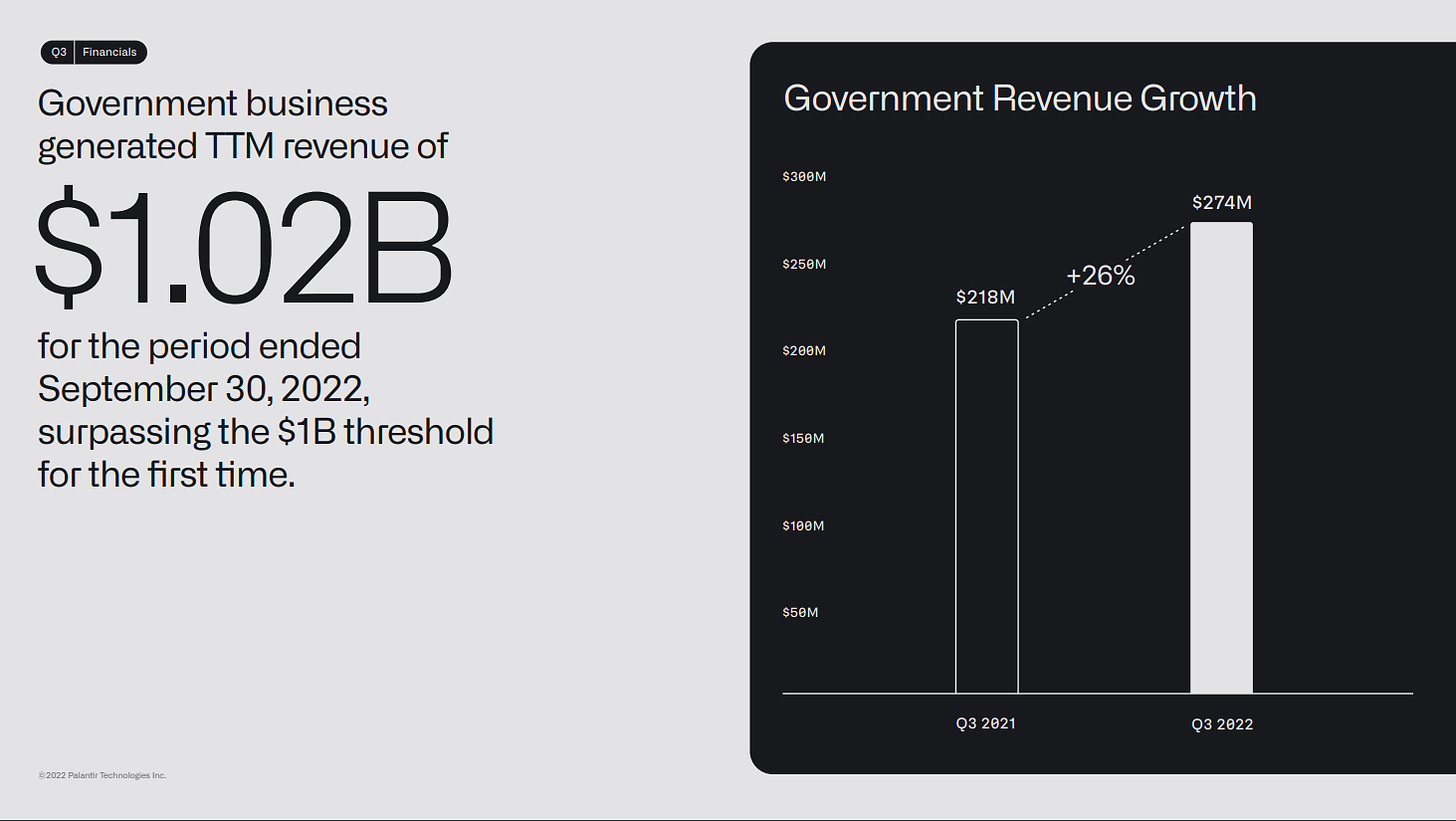

During the quarter, we also saw the company surpass $1B in government revenue in the TTM for the first time and achieve the IL6 provisional authorization, which are excellent signs of progress in the right direction. The government business remains opaque to me, but across the board I see continued signals of the above fundamental principle holding. Thus, whilst I have not invested in the business for the governmental applications, it nonetheless continues to enable the asymmetry of the investment, as the commercial business continues to ramp up.

3.0 Financials

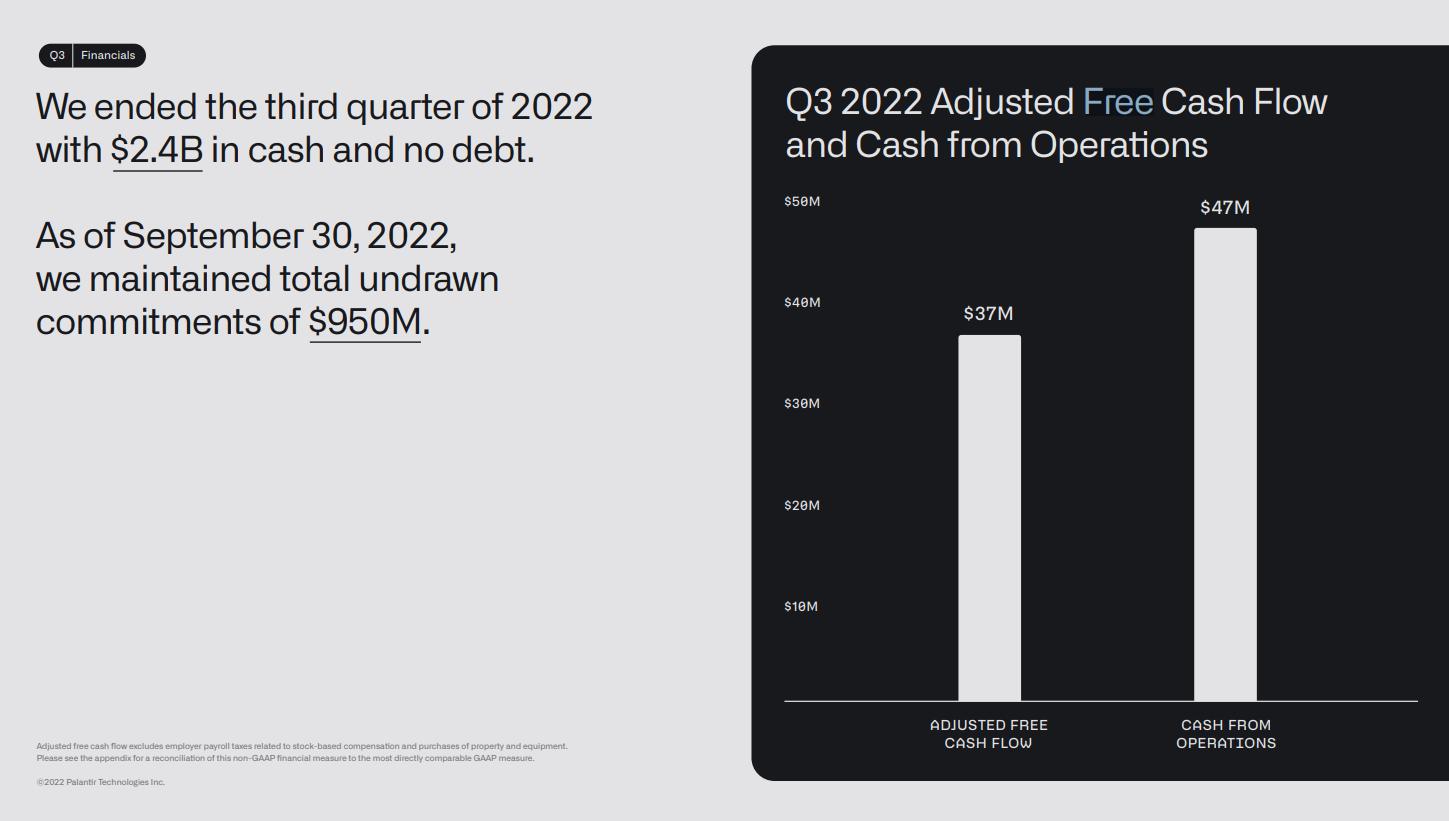

“We generated $478 million in revenue this past quarter and $37 million in adjusted free cash flow, marking our eighth consecutive quarter of positive adjusted free cash flow.” Ryan Taylor, Chief Legal Officer @ Q3 2022 ER

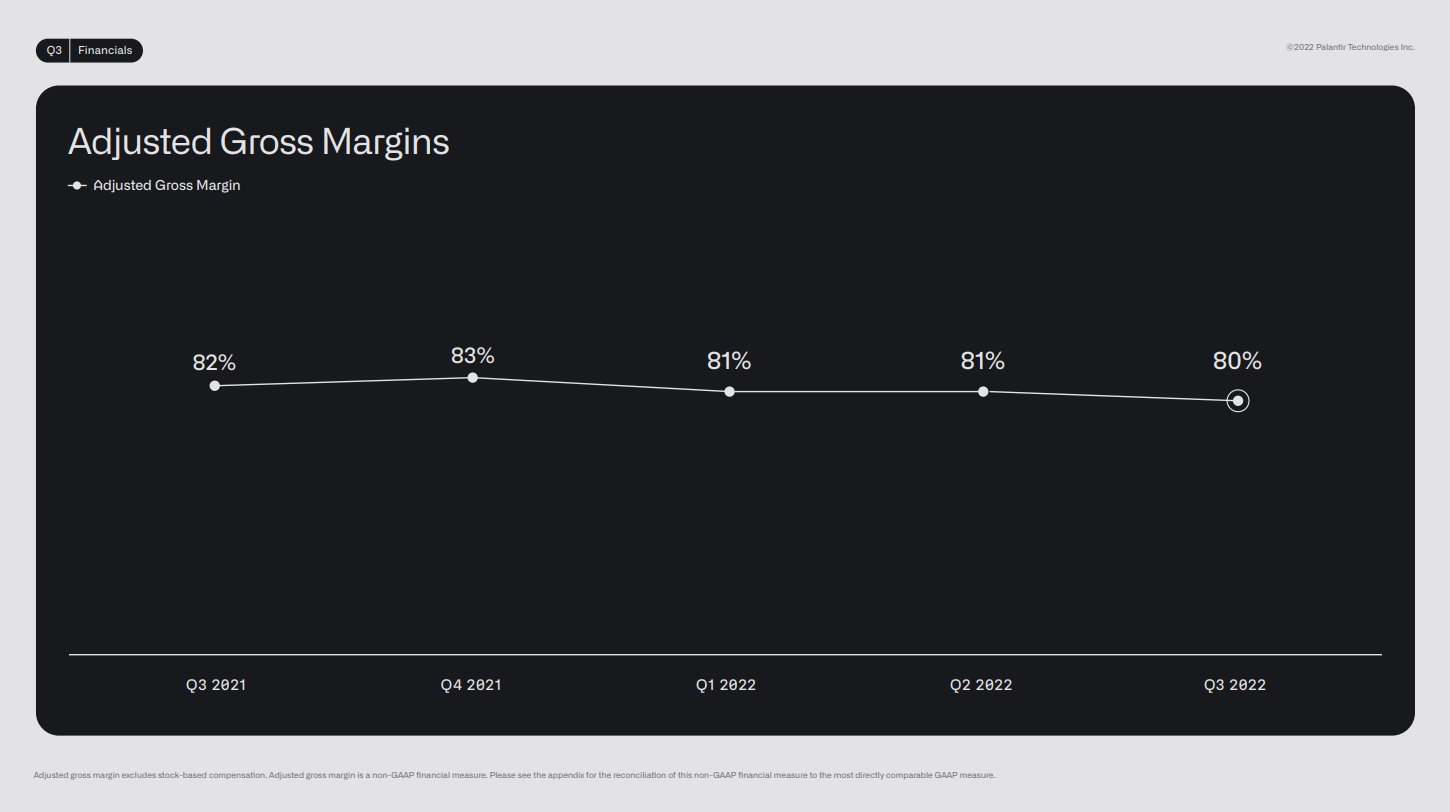

Meanwhile, metrics like the gross margin and the net dollar retention continue to fall, which is not desirable. However, looking into cost of revenues the rise does not seem to stem from some sort of structural degradation of the business and additionally, there are some insights that further enable me to calibrate the contribution margin data. Namely, cost of revenues is up because the company is getting people out there to sell and the platform seems to be taking off, per the increased cloud costs:

Cost of revenue for the three months ended September 30, 2022 increased by $20.8 million, or 24%, compared to the same period in 2021.

The increase was primarily due to increases of $12.6 million in field service representatives and other direct deployment costs mainly related to new projects, $5.3 million in third-party cloud hosting services driven by increased usage from customer growth and expansion, and $4.5 million in payroll and other payroll-related costs as a result of increased headcount attributable to our cost of revenue function. - 10Q, page 29

The company now seems to be initiating a non-linear sales push and this seems to be dampening the financials but only very slightly. The point being, there seems to be nothing wrong with the offerings themselves, but rather, Palantir is now leaning further into sales. The company gives some further color on the matter at the beginning of its 10Q at the bottom of page 22, where it explains that it has

“expanded access to our platforms to early- and growth-stage companies, including startups, as we continue our outreach efforts to an increasingly broad swath of the potential market.

The speed with which our platforms can be deployed has significantly expanded the range of potential customers with which we plan on partnering over the long term. We anticipate that our reach among an increasingly broad set of customers, in both the commercial and government sectors, will accelerate moving forward. We believe that, as these new partners grow, we will grow with them.”

For this reason, it would make sense for much of the new customers to have higher rates of failure and its own, this may take a toll on net dollar retention rate. I covered the metric on my Q2 digest and whilst the same dynamic that I outlined remains in play, as the cloud platform continues to grow I believe this metric will continue to see some downward pressure. Indeed, as outlined at the beginning of this post, if digital twins do turn out to be indispensable for customers in the long term the metric should trend upwards nicely.

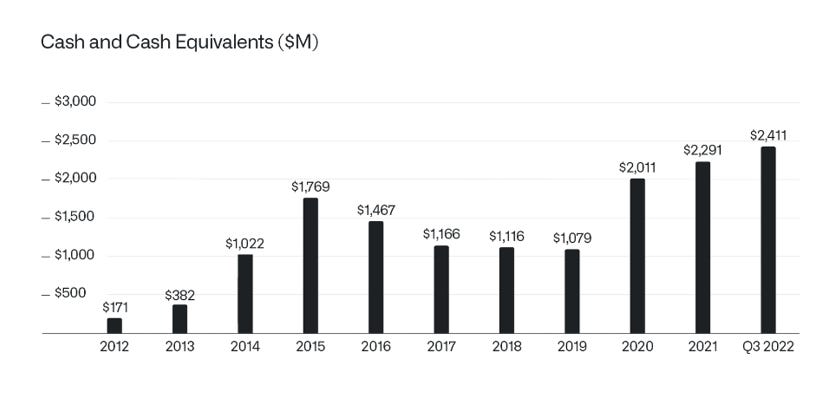

There are infinite angles to look at the financials from, but my main focus apart from the contribution margin is the qualitative signals that Palantir is actually the best in the world at digital twins. Someday this may become apparent or turn out to be erroneous, but to date I still have that perception / gut feeling and per all the empiric data exposed in this write up, I believe there are no reasons to invalidate the perception just yet. Whilst this plays out or not, I do like to see the company´s balance sheet remain healthy:

“We have also now generated $461 million in cash flow from operations over the past two years. Our preparation for the current moment is anything but accidental.” - Alex Karp, Q3 2022 Letter

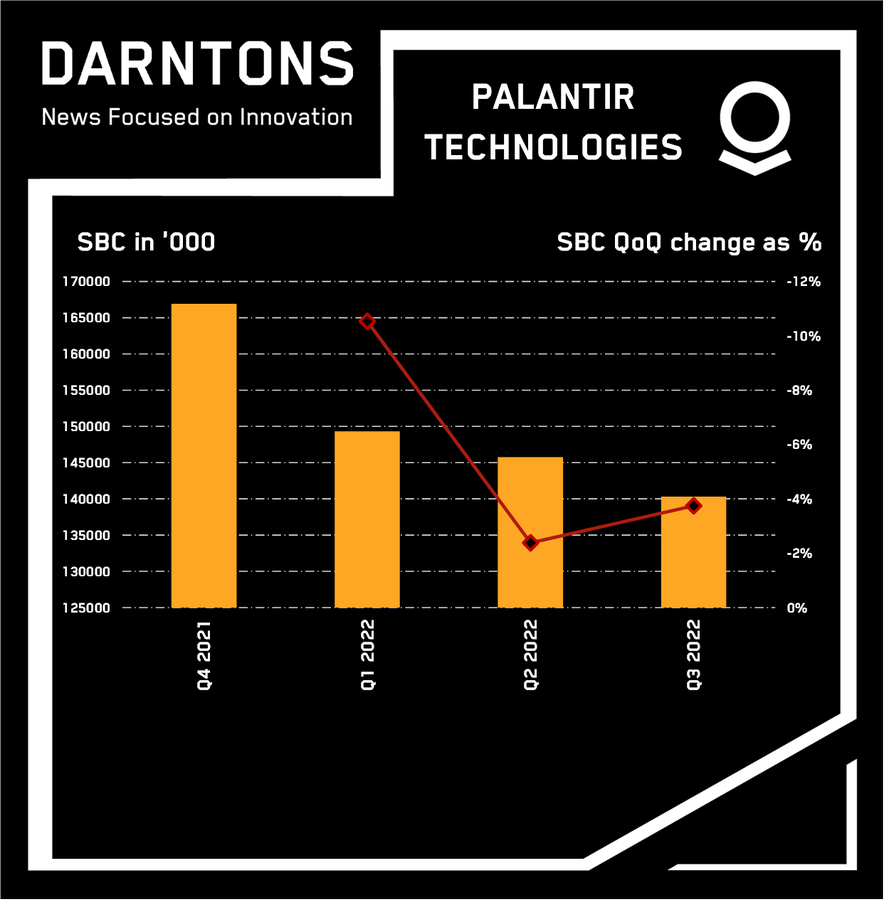

Additionally, SBC continues to normalize as evidenced by the excellent graph below by Darntons Media.

All in all, I believe the company remains on a good path and I remain excited to see the commercial endeavor flourish over the next year or two.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Hi Antonio, Thanks for your brilliant analysis. One comment / concern which you touch on above: I am getting increasingly concerned about stock based compensation. This write up made me think: https://www.epsilontheory.com/stock-buybacks-and-the-monetization-of-stock-based-compensation/

Any more thoughts / numbers on this? You seem hopeful that the very generous compensation schemes might be reduced going forward..? One concern is that the value of previous compensations have dropped with the falling share-price and this might trigger continued generosity..? Thanks again, BR Kjetil

Thanks a lot!)