This is an update to my original Palantir deep dive, Q1 2022 ER digest. Below, you can find the format of this post and as always, feel free to skip to any section of your interest.

1.0 Thesis Recap and Digest Summary

2.0 The Commercial Business

3.0 The Government Business

4.0 The Healthcare Business

5.0 Culture and Scalability

6.0 Financials

7.0 Conclusion

1.0 Thesis Recap and Digest Summary

Digital twins will, in hindsight, be seen as one of the main catalyzers of human productivity in history, exponentiating the ability of organizations to harvest and process information. Companies that deploy and operate digital twins have an exponential advantage over those that do not and this dynamic will unfold rather spectacularly over the coming decades. Tesla is an early example, as you will know if you have my read my deep dive on it.

The power of digital twins becomes apparent when you understand what a company is at its core: an optimization function. The best companies in the world process information more efficiently than the rest and are able to excel at minimizing inputs and maximizing outputs through time. The more information a company can process, the better it becomes at optimizing its operations.

PLTR 0.00%↑ has an unrivaled focus on delivering the world´s top digital twins. I have reached this conclusion after picking up many disperse, qualitative data-points which I have shared with you in my previous write ups. At a high level, the irreplicability of its technology, which in turn stems from its unique culture, has set the company up to deliver and capture much of this exponential value.

As I have tweeted about today, I view quarterly reports as predominantly noise and even more so if we layer the market´s reaction on top. I focus most of my energy on tracking the key fundamental drivers of the company in question. I believe Palantir (Foundry, specifically), is a platform on which companies will be built on first and when/if that day arrives, the company´s fair value should be orders of magnitude higher than it is today.

I have framed Palantir as an exponential asymmetric bet, based on two assumptions:

E0(6th Prime): that Palantir is likely to become the 6th (software prime) of the US Government and that the government business is likely to overall continue doing fine.

E1(Platform): that Foundry is likely to become a platform, as described above.

If E1 materializes, the investment´s return will be non linear. Else and if the government business remains strong, then there should not be a permanent loss of capital. If both assumptions fail, the losses will be severe, but the odds are that E0, E1 or a combination of the two will materialize.

Regarding the key drivers, what I look for on a quarterly basis is:

Increased productization of Foundry, yielding increasingly lower times to value for clients. Eventually time to value reaches an asymptotic maximum and Foundry becomes a widely available platform, like AWS.

Note: to this day, I believe I framed this vision before management did so publicly, so not parroting the slides.

Continued absolute growth of both the commercial and government business.

In Q2, I see both key drivers advancing just fine. Regarding the government slow down, the company´s track record and other qualitative datapoints suggest that this is just a little bump in the road. Framed differently, there is still no guarantee of success or failure in this sense and so invalidating the thesis based on the slowdown would be precipitous.

2.0 The Commercial Business

The US commercial business has grown from 10% of TTM revenue in Q2 2021, to 17% of TTM revenue in Q2 2022. Customer count in this segment has grown from 34 to 119 customers year over year and this growth has been driven by just 42 salespeople, which accounts for less than 1.5% of the total workforce. I would say this is at least satisfactory progress on the commercial front.

Management makes continued reference to their focus being on productization (minimizing time to value) and growing the commercial business to eclipse the government segment:

“Our revenue growth in the U.S. commercial market continues to be our focus and is gathering momentum.”

“Our focus in the short term remains on making our 3 principal software platforms, Gotham, Foundry and Apollo, available to broader segments of the market with unbeatable time to value.” - - Shyam Sankar

“Part of our strategy is that we are going to grow commercial to be so big and so linear, and that – especially starting in the U.S. that, in fact, these vicissitudes are just less important. What you're seeing in our business now is the largest part of our business is subject to contracting. That actually is going to shift.” - Karp

On the product side, Palantir has come out with two key innovations that I believe will drive further productization:

Workshop: allows users with little or no coding experience to build operational applications on top of data warehouses within minutes. 10,000 developers are “now building applications within the platform”.

Pipeline Builder: “brings this same no-code approach to authoring data

pipelines”.

In my deep dive I outlined how contribution margin is the metric that depicts productization most. With a growing workforce, for the contribution margin to go up the company must constantly decrease its cost of revenue - meaning, easier and less costly deployments. Down the line, the contribution margin will also reach an asymptotic maximum as the platform emerges. At the moment, it seems to be trending slightly down, but I will evaluate it at the end of the fiscal year:

3.0 The Government Business

Across my research, I am seeing B2B pipelines dwindle, perhaps due to hesitation more than actual economic difficulties. Across the board, it looks like organizations of every type are putting their heads up, meerkat mode and deals are being pushed back. In this sense, I do not think that Palantir´s B2G pipeline is an anomaly:

“The pipeline around the government business continues to be really robust, both domestically and internationally. But we also have more certainty around what is obviously a frustrating contracting experience.” - Karp

“…all purchases are just getting a significantly higher level of scrutiny […] you’ve heard and read in all of the news about companies reducing workforces.” - Teladoc @ Q2 2022

Perhaps an excuse from both companies, but both have particularly excellent track records of B2B sales - perhaps among the best in the world (learn more about Teladoc´s B2B track record).

As I outlined in the introduction, from this quarter it is actually hard to know whether the government business has changed direction, but I doubt that a company that was awarded a contract to take care of the US nuclear stock pile just a few quarters ago (Q1 2021) is now suddenly falling out of favor with governments.

Interestingly, government TTM revenue per customer continues to trend up, suggesting that existing clients are happy to expand on their purchases:

Additionally, you will remember from my deep dive that Palantir´s government business is a bit of a black box to me and I think generally to everyone as well, which is what keeps me from augmenting my position unlike in other picks, in which I have far more visibility.

4.0 The Healthcare Business

Since early July I have been reading up on the (US) healthcare system and thinking about were it might be headed. I have reached the conclusion that it is doing so towards longitudinal medicine, which consists in picking up patient data continuously through time and using it to focus on outcomes. (You can learn more about that in my recent Teladoc and Hims deep dives). This is a trillion $ opportunity in the US alone.

In effect, the healthcare system can be revolutionized by deploying digital twins both for healthcare organizations and patients. It is no surprise to me that Palantir´s healthcare business is growing fast, bringing in a revenue of $263m in Q2 2022: $153m in H1 2022 versus just $42m in H1 2020.

“We see substantial opportunities for Palantir as a health care technology company” - Shyam Sankar

Here we see Palantir carrying over its expertise to a sector that is in dire need of it, but that is actually very reluctant to innovation. The story of Teladoc´s founders is specially informative in this sense. I believe this is another point in favor the quality of Palantir´s offerings and is no doubt also a result of its relationships with governments.

“…hospital operations suite is now used by hospitals covering over 37,000 beds across the U.S., up from just over 1,000 on January 1”, as a result of “continued interest in our modular offerings”. - Palantir Q1 2022 ER

5.0 Culture and Scalability

Culture is Palantir´s key asset and Karp is a good leader. Karp´s tone in the conversation is indicative of two things:

The fact that he is an outsider.

That he may be (and thus Palantir´s culture) slightly too confrontative to scale up successfully.

Early adoption is about working with people that believe in what you believe in. A strong, contrarian culture is often required to get from 0 to 1. When it fades or it is not toned down to a more mild version, the company fails to scale. See Uber.

Palantir, specifically, sells a product that in the commercial space is a double edged sword. On the one hand it makes a company far more efficient, but on the other hand, it absorbs its value. Once a digital twin is fully integrated, it is the business. This is a great source of power for Palantir and to successfully scale, the company must transition to a lighter tone.

6.0 Financials

Income Statement

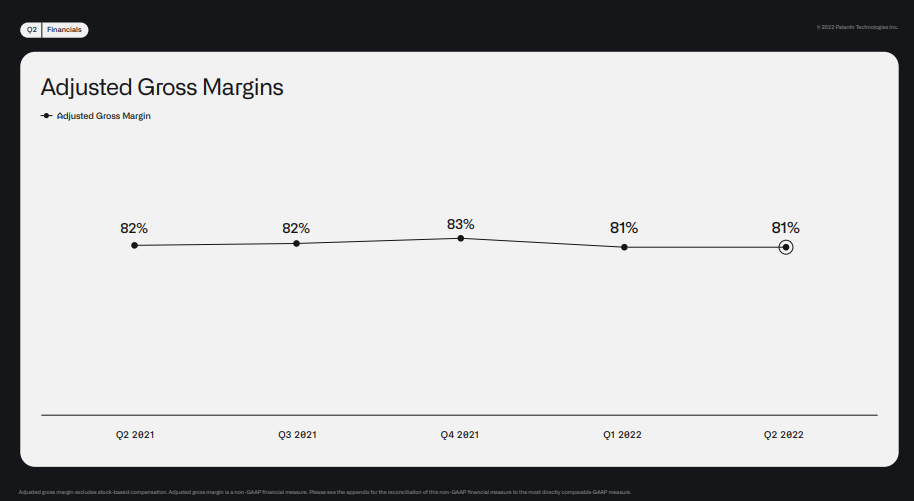

Revenue continues to trend up nicely, with adjusted gross margin coming in at 81%. The initial down turn from 83% to 81% was perhaps surprising, but it seems to now be stabilizing.

On the OPEX side of things, everything is looking stable. No particular anomalies, except for the SG&A expenses, which continue to trend up versus 2019-2020.

On the other hand, if you look at Q1 2022 adjusted operating income was a 26% and now it is at 23% (ahead of their 20% guidance), I understand that as a result of the sales efforts ramping up and SBC normalizing:

Net dollar retention came in at 119%, versus 131% for FY2021 and 124% versus Q1 2021, so not optimal. On the other hand, commercial revenue grew 46% YoY and government revenue grew just 13% YoY. Taking into account the relative proportions of both business segments, this implies that the commercial business is actually quite strong. If the slowdown on the gov side is indeed transitory, we should see shiny numbers again.

Balance Sheet

The balance sheet remains very strong, with $2.4B in cash and no debt. The company has also “closed a $450M delayed draw term loan, for a total undrawn credit facility of $950M, including our revolving credit facility, to add additional dry powder to our war chest”. Notice the belligerence.

Cash flow

Cash from operations and free cash-flow remain in the green, coming in at $62.4m and $65m respectively. This, together with the cash pile, greatly contributes to de-risking the investment, giving the company more time than otherwise to iterate its way towards becoming a platform.

7.0 Conclusion

The commercial business is advancing well and the slowdown of the government business fits into the broader conditions that I am seeing across B2B sales pipelines. Financially, the company remains sound and well equipped to persist in its initiatives.

Of special importance is the NDR metric (section 6.0, income statement), which at first sight suggests the business is tanking but actually indicates that the commercial business is doing better than it seems. It also great to see SBC really trending down.

In all, the thesis remains intact and about the guidance, I am focused on the bigger picture.

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Love how you connect the Digital Twins to the operations.

Without the right level of abstraction it is easy to get lost in quarterly noise.

Amazing article Antonio!