Note: this is an update to my PLTR 0.00%↑ deep dive. Below, you can find the format of this post and as always, feel free to skip to any section of your interest.

1.0 Market Commentary and Long Thesis Recap

2.0 Why are Metrics Weaker?

2.1 What is Going on in the Government Side?

2.2 The Platform Begins

3.0 Financials

4.0 Framing the Investment Going Forward

1.0 Market Commentary and Long Thesis Recap

The market seems to have little room for moderate views in the technology space nowadays. We have gone from everything is a buy at 50 times sales, to everything is a red flag at far lower multiples. Many are now applying all of their brain power to dig up and hyper-rationalize these red flags, when just months ago raising any kind of concern was an anomalous act.

Despite this, the reason we buy technology companies today is because we believe that in the future, they will have a much larger earning power and that, if well managed, the share price will reflect it. Regardless of the market´s deviations, plenty of technology companies continue to evolve fundamentally, brewing soon to be world class businesses, with earning powers far higher than today. “It´s simple, but it´s not easy”.

Specifically, Palantir is likely to become a trillion $ market cap company if it is able to change the way companies are run. Digital twins, Palantir´s core offering, enable organizations to operate in a much more efficient manner and my thesis is that, in the future, companies will be started digital twin first. This is what management refers to when they say “what AWS has been in the last decade, Foundry will be in the next”.

Today, companies buy raw instances of compute, that they then have to re-purpose to extract some kind of value. By creating a company digital twin first, the time to value is much shorter than otherwise, because the computation you buy is valuable from scratch. As the market fluctuates back and forth, this is the level of abstraction at which I analyze the company.

In order to reach this stage, Palantir has to incrementally modularize and productize its offerings, to increase the speed of distribution enough to become a SaaS. If you break down the product into more digestible bits (modularize) and make it easier for customers to install (productize), then it will be easier to get more customers onboard.

As more customers employ Palantir´s offerings, Palantir will get better at enabling companies across a whole range of industries get more efficient, effectively making its platform a go-to for anyone creating / operating a company in whatever industry Palantir has achieved critical mass. This is the version of the future in which Palantir becomes a key cloud provider and in which an investment in Palantir generates wealth.

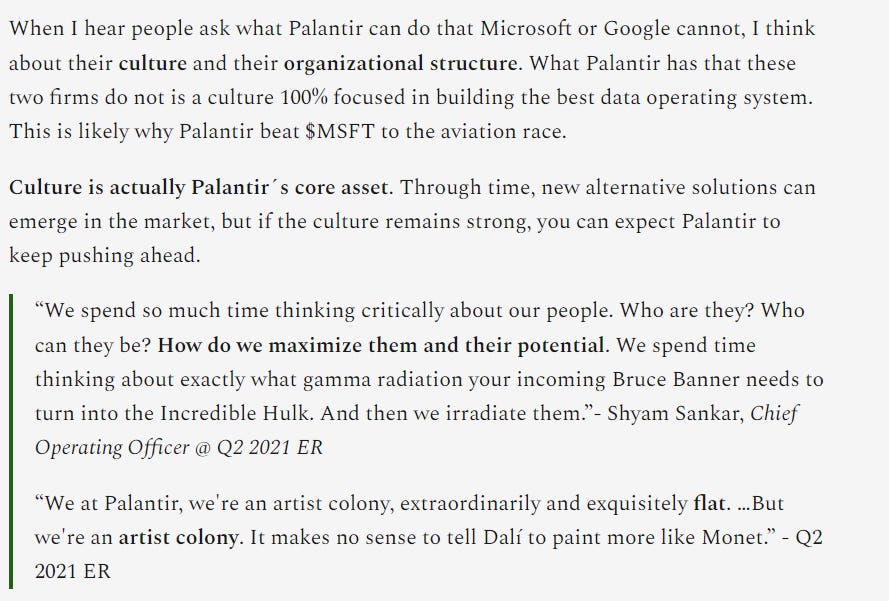

Further, all of Palantir´s competitive advantage in the market comes from its people and the way they work together or in other words, its organizational culture and structure. Palantir is highly unique in this sense and so long as the culture remains as it is, the investment will continue to be a reasonable bet.

If you read Karp´s letter, you may see that his remarks resemble my original thoughts:

It may not surprise you, therefore, that in my quarterly analysis I place great emphasis on metrics that lead to increased product distribution speed / decreased cost. Further, the above is all useless if retention is low. We want Palantir´s customers to stick around for a long time, because this is how the company actually makes money.

Now that you know how I think about Palantir, what follows is my take on the company´s Q1 2022 earnings.

2.0 Why are Metrics Weaker?

There are some reasons to be concerned about the business now.

The following datapoints are concerning:

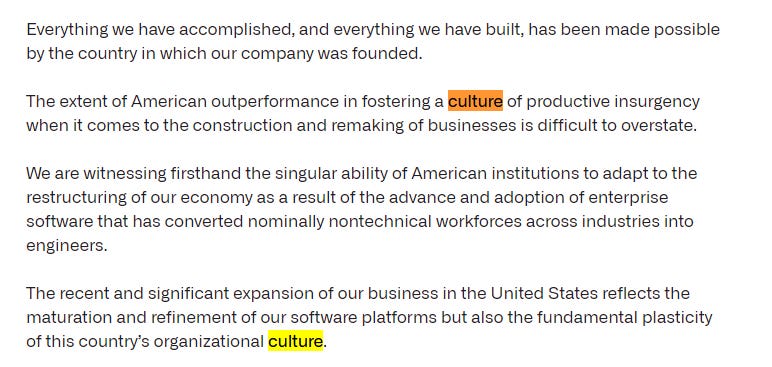

The government business is slowing down.

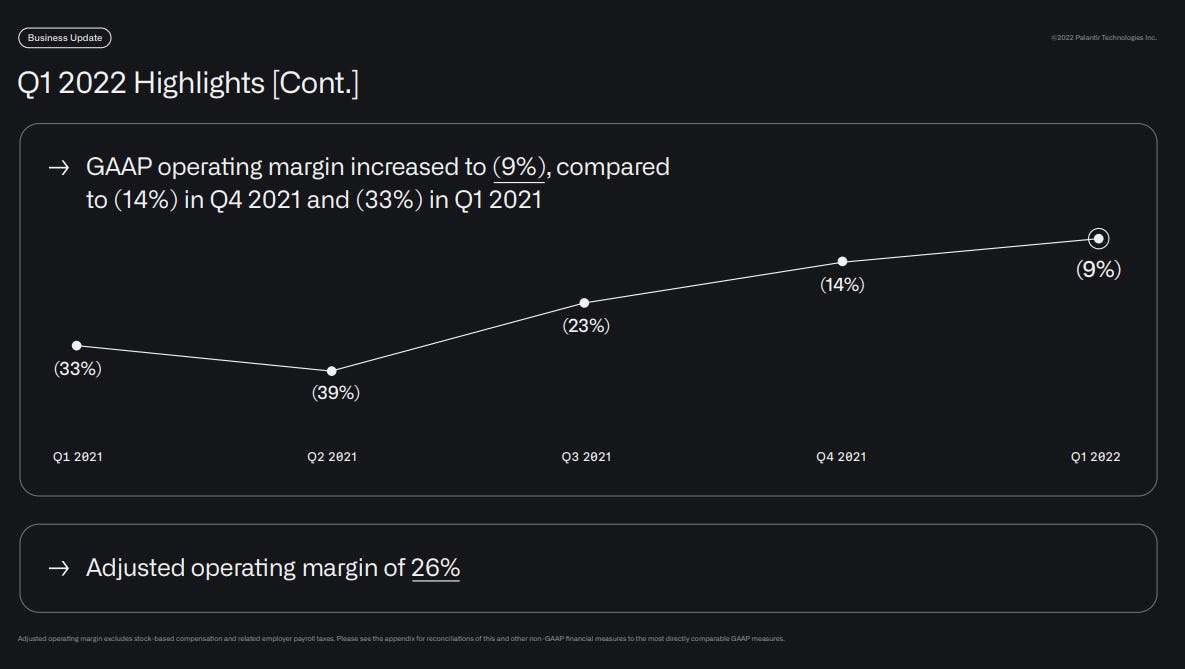

Adjusted operating margin came in at 26% and the guidance for Q2 is 20%.

2.1 What is Going on in the Government Side?

Despite the slowdown, I think the long term trend is likely to continue.

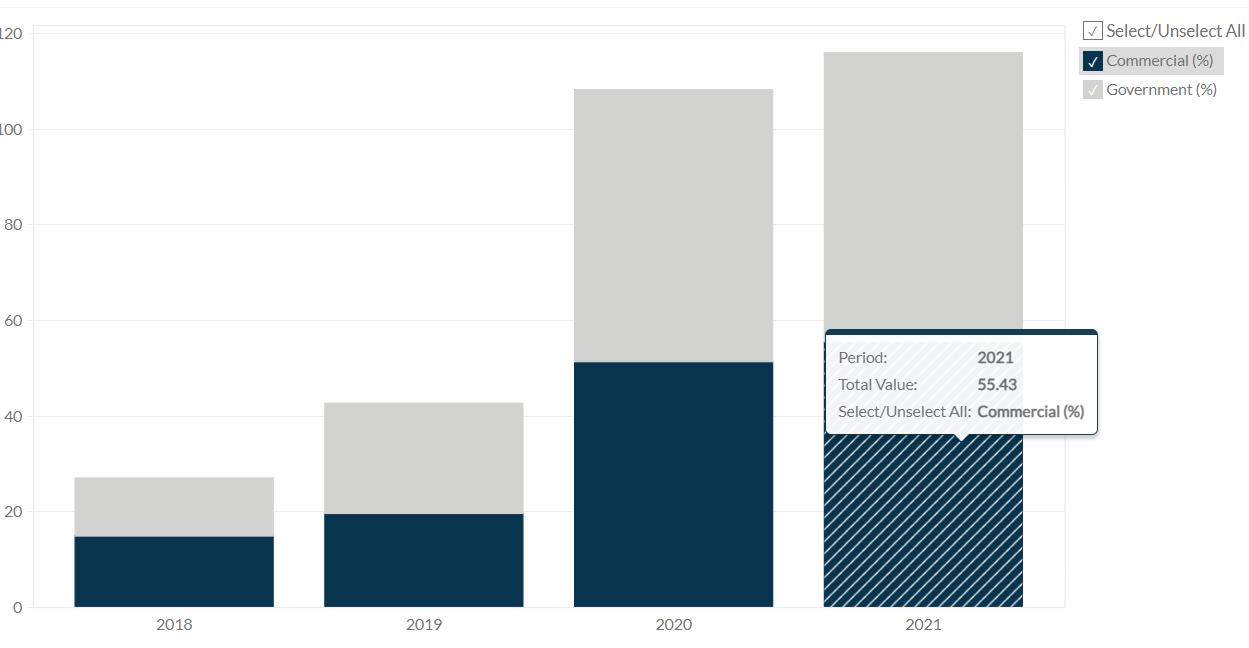

As you can see in the graph below, government revenue growth is decreasing quite considerably. On a positive note, the average revenue per customer is going up. When asked, all the management talked about in the call is nuclear war and how everything is heating up in that sense.

I have some thoughts on the matter, which are fundamentally qualitative. Firstly, there is no way to figure out what is happening other than getting insider information or waiting to see. However, as I noted the last time I wrote about Palantir, the company is currently in charge of operating the US nuclear stockpile. That tells us a number of things:

That Palantir is indeed seeing the conflict with Russia in FPV mode.

That the US government really trusts Palantir.

To add to the above, Palantir has been serving the US government for 15 years now, under 4 different administrations. All this put together makes it hard for me to jump to the conclusion that this part of the business is going to fall off a cliff. With this much geopolitical conflict it would be logical for allies to emulate the US government in this sense.

Nonetheless, the above is all speculation. The truth is, no one has a clue and in fact, I did not buy Palantir for its government business, but for the potential its technology has in the commercial space. So long as the gov business is not pulled from Palantir´s feet, I believe the company continues to have a good shot at fulfilling the potential I describe in section 1.0. During the call, management said:

“The U.S. government's businesses TCV has been impacted by the continuing resolution. But now that a new budget has been passed, we're already seeing Q2 U.S. government revenue re-accelerate.”

I believe the risk of this part of the business going down the drain is low, however, putting together all the little datapoints. The US government accounted for 42% of the company´s revenue in Q1, however, so this dynamic needs to be cleared out as soon as possible.

2.2 The Platform Begins

Weaker metrics may be a result of the company accelerating its execution towards becoming a platform that others build on.

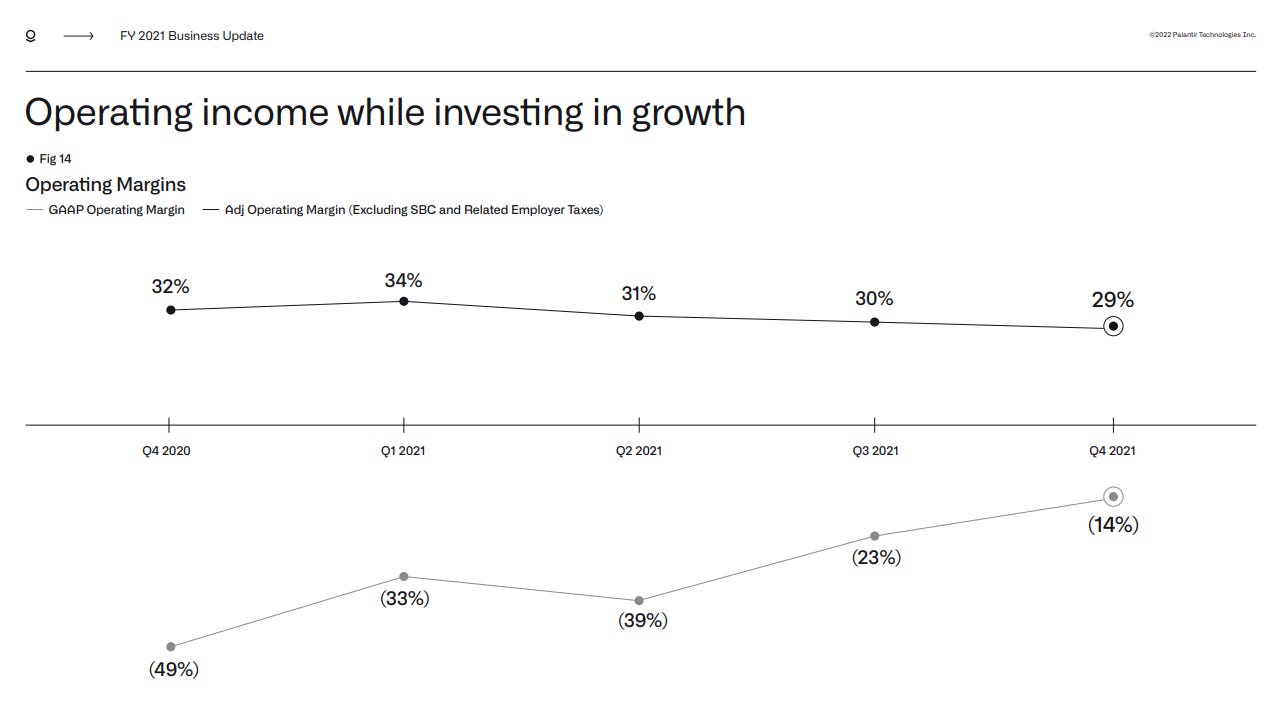

About the commercial space, there is a trend that I find interesting and that management has been disappointingly quiet about, that seems to explain why adjusted operating margins are going down. Firstly, let me outline the facts: adjusted operating margin has fallen to 26%, which is quite a deviation from the tendency you see below. (Adj. operating margin is the line at the top, gaap operating margin is the line at the bottom).

If you were to plot the current quarter´s op margin and the guidance for Q2, which the company did not, the above graph from 2021 would look terrible. To make matters worse, management did not say anything about it in the call and the analysts forgot (?) to ask. This all makes for quite a frustrating analysis experience and it has taken me the larger part of today to figure out what is going on. It makes me question management´s transparency.

The company has added 37 new commercial customers this quarter, which is a big increase however you look at it. Specifically, the number of US commercial customers grew by 136%. Most interestingly, total remaining deal value finished at $3.5b, down from $3.8b last quarter, making it likely that most of their new customers are small. Simultaneously, marketing spend is up considerably YoY and while adjusted operating margin is down, gaap operating margin is going up. So what is going on?

Per all the above datapoints, together with the fact that SBC is seemingly beginning to normalize ($149.323M this quarter versus $193.731M the last), my conclusion is that the company is accelerating its journey towards becoming a platform. It is ramping up marketing to bring in new customers that will grow with the company.

These smaller customers tend to have a higher bankruptcy rate and as a consequence, a higher churn. They also have smaller contracts, which seems to explain the relatively lower outstanding deal value. Incidentally, net retention rate has come in at 124% versus 131% for FY2021.

The above is just me stitching information together, but I could be entirely wrong. It could be that the company´s fundamentals have deteriorated considerably. However, there are additional crumbs the company is giving us. Firstly, as far a I am concerned, this is the first time management expressly states that they are building a platform. See Sankar´s comments during the call:

“…the greatest opportunity for Foundry continues to be the application development infrastructure platform. We believe that Foundry will become the place that you go to build the applications of the future. With AWS or Azure with their highly unopinionated collection of services, most of the work remains in front of you to get to value. And all of that onus is on you, the customer, to get to that value.”

The following comments from Karp´s letter are also quite revealing, about productization and modularization, that seem to reinforce the above hypothesis:

“We have made progress in productizing our existing offerings and developing new ones. As a result, we have begun to turn a corner with regard to customer acquisition.”

“We also see further opportunities to decompose our platforms, so that an increasingly broad and diverse group of customers using our software have access to the specific component products they need from the start.”

“Our three principal platforms (Gotham, Foundry, and Apollo) are composed of hundreds of component parts, any one of which we believe could have a market in the thousands or tens of thousands of large enterprises.”

Commercial revenue growth was 54% YoY, accelerating for the 5th quarter in a row. It would seem that they really have turned a corner in this sense, so all in all, it looks like the business is accelerating its execution towards becoming a platform. Marginally worse metrics result as the average customer quality drops, as scale begins to pick up. This is, however, the path to changing how companies are create and run - by becoming a platform that others build on.

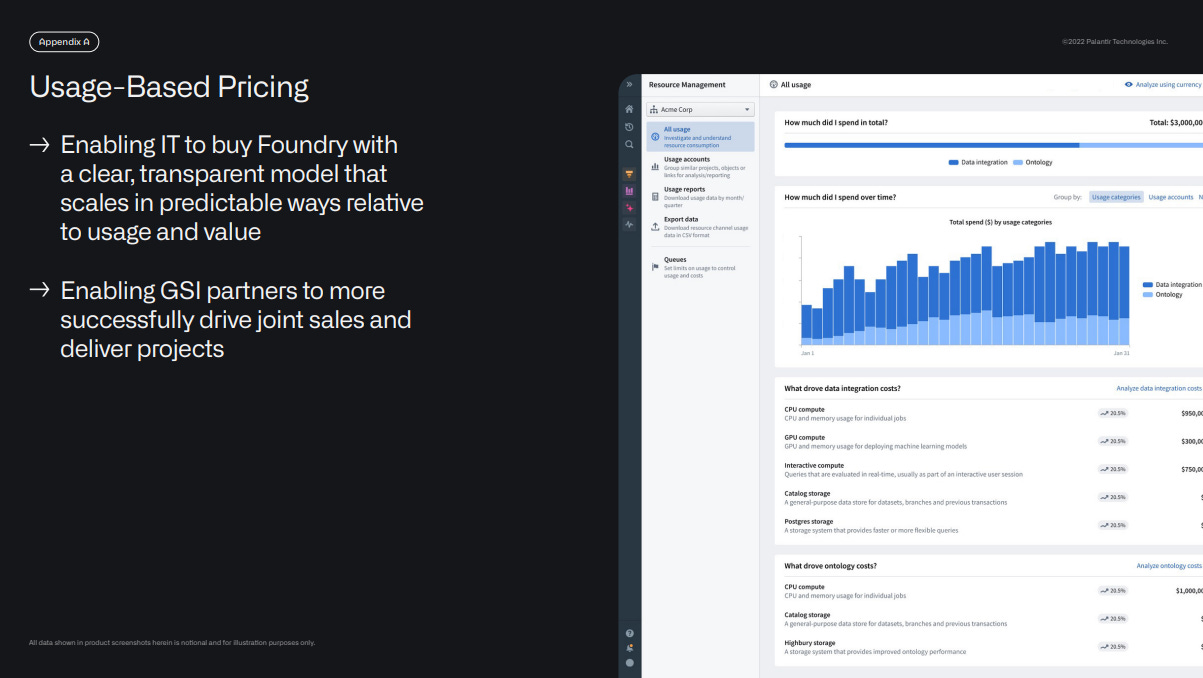

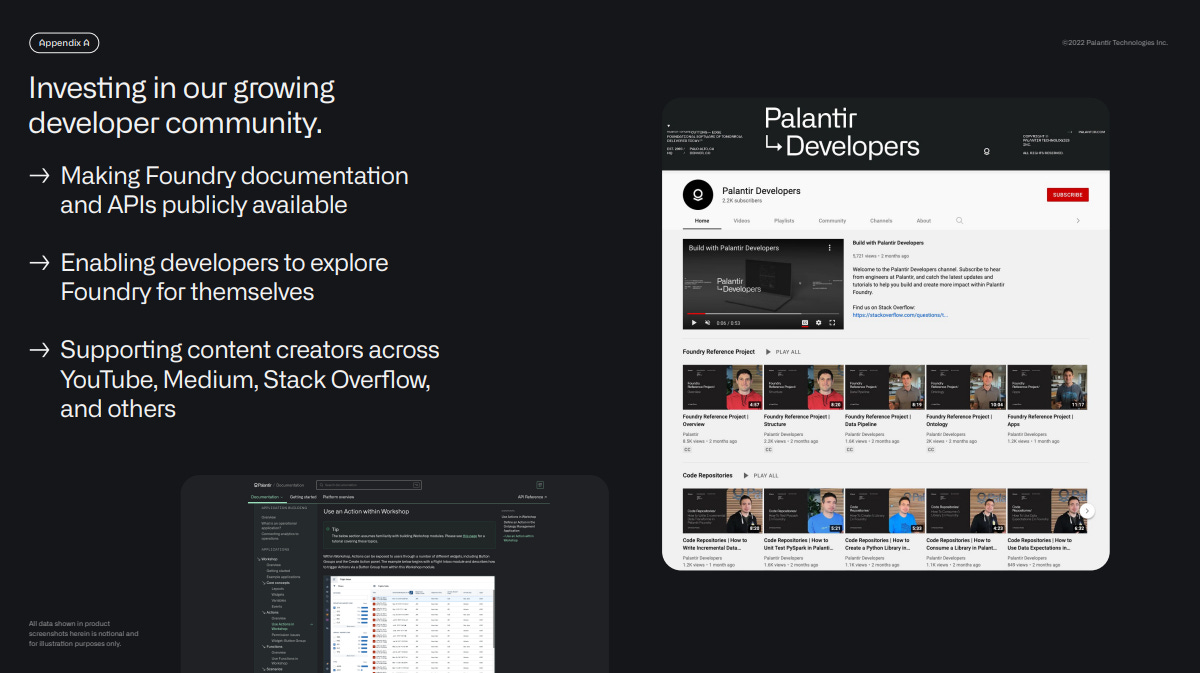

If you look through the ER presentation, there are two slides that management did not comment on in the call which are the following and no one asked:

Again, why did management not comment on these two advances? I cannot shake off the feeling that the company generally under-reported this quarter. Still, both usage based pricing and brewing a developer community are key for Palantir to become a platform.

Palantir´s increased modularization of its products have been showing in its top line. In this sense, usage-based pricing is a quantum leap with respect to the current licensing format - it makes it way easier for IT.

Additionally, it helps to have a developer community that can make it easier for organizations to integrate Palantir´s offerings. We have seen how this play out in Salesforce $CRM for instance, which has magnified the company´s efforts by orders of magnitude. I am looking forward to hearing more about this soon, hopefully.

3.0 Financials

The balance sheet and the overall financial health of the company continues to be excellent.

As we see in the coming quarters how the business deals with the above uncertainties, it has finished Q1 with an outstanding balance sheet. It has $2.3b in cash and no debt. Palantir also has a revolving credit facility of $500m, which remains untapped for now. Regarding cash generation, we continue to see a company that is able to support itself.

Adjusted gross margin was 81% and contribution margin was 57%. On the first, I have no concerns and the latter seems to be within a reasonable range. You may recall that in my deep dive I explained why I thought contribution margin was perhaps the most important metric for the company. Palantir defines it as

“…revenue less our cost of revenue and sales and marketing expenses, excluding stock-based compensation, divided by revenue”,

so the higher it is, the more Palantir has productized its offerings (less sales and marketing expenses per unit of revenue). We do not see a meaningful leap here, but definitely not a concerning drawback either. The company seems to be advancing well here, specially stitching this metric with all the qualitatives mentioned above.

A particularly relevant datapoint regarding modularization is how Palantir´s “hospital operations suite is now used by hospitals covering over 37,000 beds across the U.S., up from just over 1,000 on January 1”, as a result of “continued interest in our modular offerings”.

Another one is how they are making Nexus Peering available as a separate capability. Nexus Peering is a distributed database is what makes Gotham so powerful, making it way easier to safely store and manage data. We should see sales of NP as a standalone unit pickup across the Department of Defense going forward, increasing contribution margin.

Contribution margin for the government and commercial segments in FY2021 were 60.41% and 55.43%, so nothing out of the ordinary going on here yet. I am looking forward to seeing the metric evolve over FY2022.

4.0 Framing the Investment Going Forward

My original observations regarding the valuation have proven relevant, at least for now. The company continues to be very promising and so the current environment may yield an exceptional investment opportunity.

In my deep dive´s conclusion I wrote about how despite the company´s great promise for the future, I felt that the market was not paying me enough to take on the different blind spots I had with the business at the time. As such, I allocated accordingly.

One of these blind spots was just how demand generation in the government side of the business really worked, which I think is knowledge not generally available to the investment public. The uncertainty it has caused has dragged the stock down dramatically, evidently encouraged by the overall macro environment.

The way I am looking at the investment now is, the company continues to hold tremendous potential for the future and it is now way cheaper than when I invested. I think that the carnage is probably far from over, so if and when I see Palantir trading at a ridiculous valuation, I may pull the trigger again.

Before that happens, I think I need to hear more from management about what is going on inside the business and regarding the guidance, I believe that as they continue to increase productization and modularization, sales will continue to pick up across both segments of the business. Through time, we will see a valuable platform emerge.

Until next time and good luck to all!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc