$OSTK has turned around succesfully. Today it has very strong financials, a solid position in its market and good growth prospects. In turn, the market is pricing in 0 future growth, placing excessive weight on inflation and supply chain disruption concerns, together with post-COVID online penetration slow down.

The Investment Opportunity

Overstock, originally, Discounts Direct, was founded by Robert Brazel in 1997. Two years later, it was bought by Patrick Byrne who changed the name to Overstock. Initially, Overstock focused on liquidating the inventory of companies that went bust in the dot com bubble and then, pivoted to selling furniture. Today, Overstock is essentially a furniture ecommerce company.

In the last decade, the company got into a bit of a swamp, mostly by putting some money to work in funding Medici Ventures, that invests in blockchain projects. The company then began its turnaround in 2019, when Jonathan E. Johnson became CEO. Post 2019, the company has focused on:

Offering competitive price points,

combined with stylish products and an easy shopping experience.

Per the financials, this seems to have worked. Revenue has effectively doubled from 2019 ($1,435m) to the TTM ($2,813.5m). Gross margin has ticked up to 22.44% from 20.08% and free cashflow, operating and net income are in the green starting with FY2020. The balance sheet is quite healthy, with $512.2m in cash and just $38.8m in long term debt.

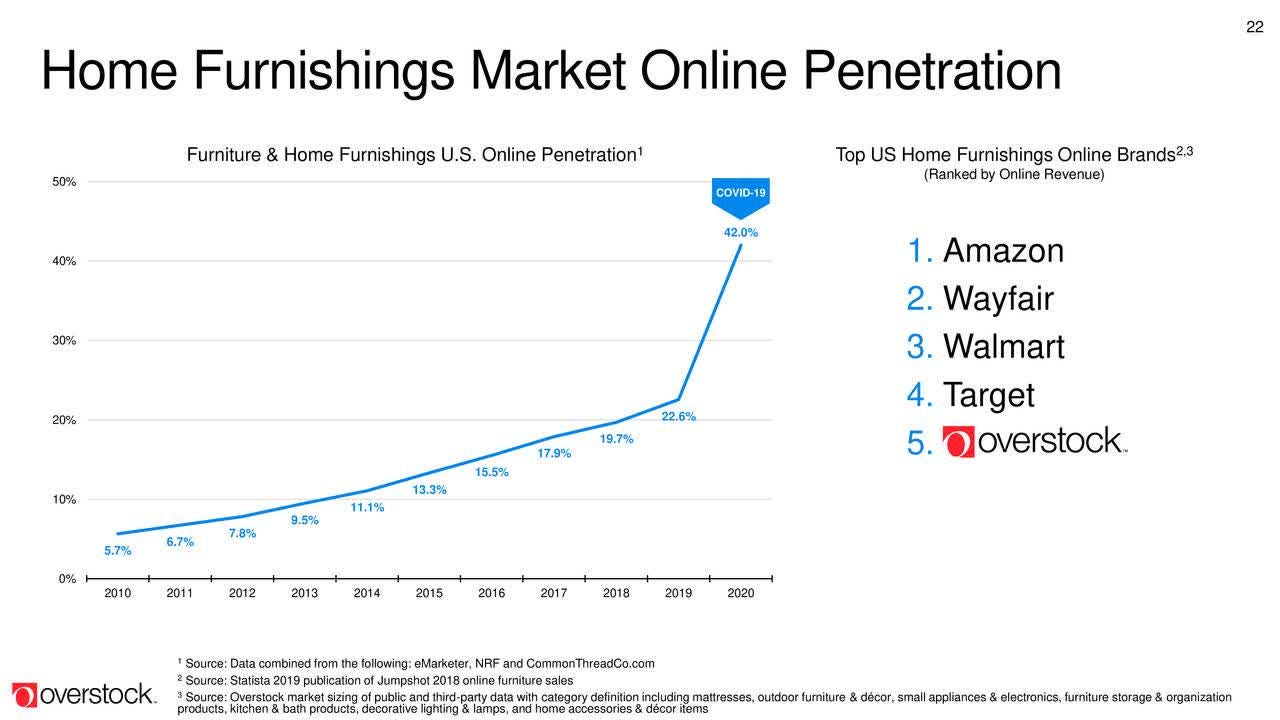

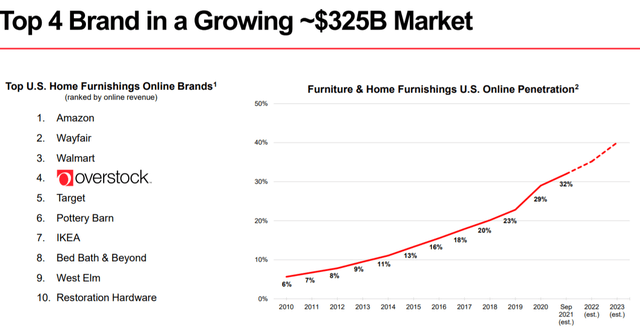

One major factor that has aided $OSTK´s turnaround is the online penetration of furniture sales. The COVID19 pandemic has greatly accelerated it:

$OSTK ´s price action has reflected its turn around over the past two years, specially during Jun 2020 as you can see below. But now, after the recent sell off, the current price per share is factoring in 0 future growth, trading at a P/S ratio of 0.71 and a PE ratio of just 6.18.

At this price, the market is effectively assuming:

Furniture sales online penetration will not continue growing / slow down meaningfully.

Inflation / supply chain disruptions will considerably disrupt the company´s operations.

If you consider that penetration will continue to grow and that the company will make it through the latest perils the market is fixating on, then $OSTK may be an interesting buying opportunity. I would say it has a further 100% upside just to catch up with fair value.

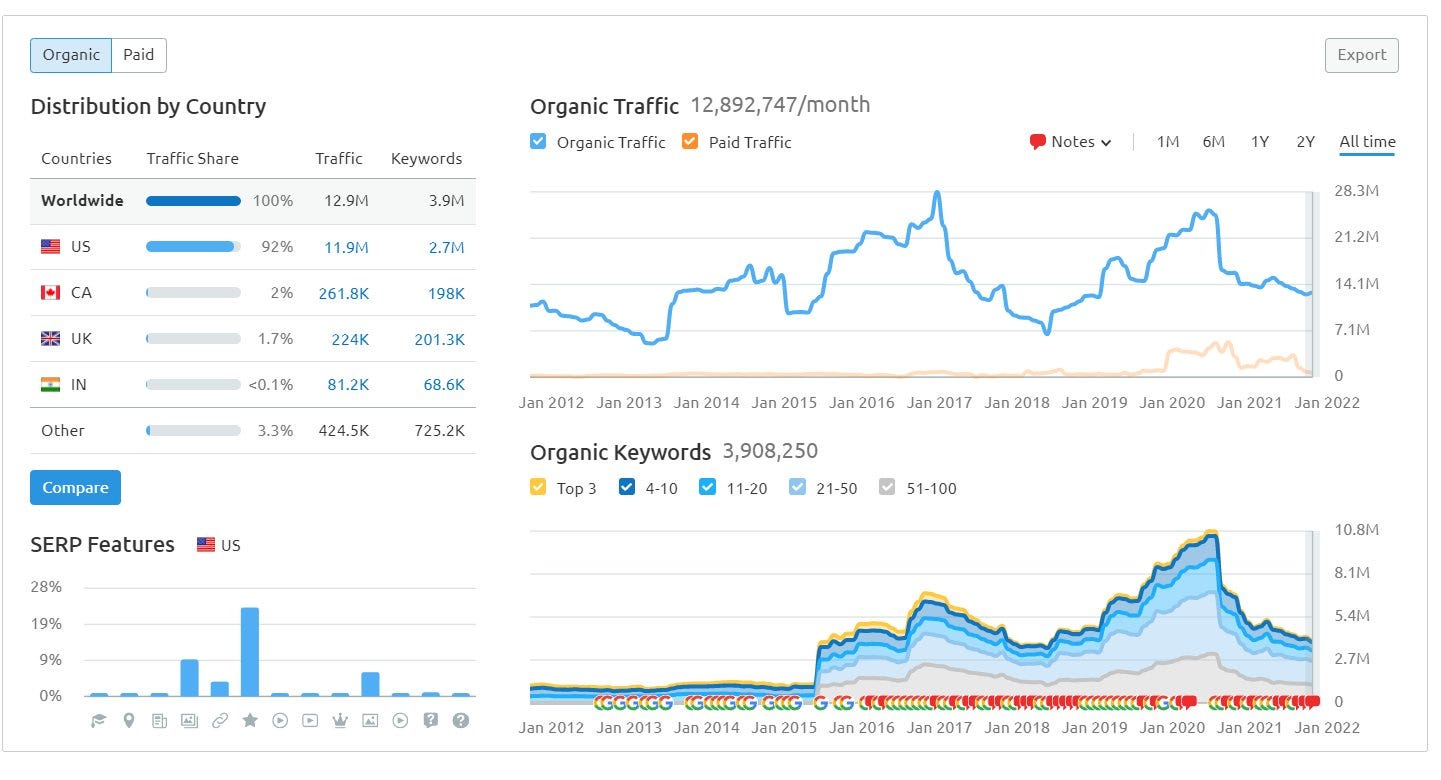

Website Traffic Decline

$OSTK´s business is selling furniture online, which means that if their online traffic goes down, so will their sales. In the image below, you can see a considerable decrease in organic traffic for overstock.com.

*Organic traffic is traffic that has not been paid for and that naturally flows to the website in question.

In their Q3 2021 ER, management said “In fiscal year 2020, we saw a substantial year-over-year increase in our Website traffic, number of new customers, and customer demand, particularly in our home furniture and furnishings categories. While many of our key metrics remain positive, some have receded from the elevated 2020 levels during the third quarter of 2021.”

From 2017 to 2019, I was running my own startup that in turn, relied heavily on traffic coming from Google. For this reason, I spent a lot of time dealing with the search algorithm to position the company´s website. I endured many times the pain of Google suddenly changing their algorithm and the website´s positioning materially declining overnight, losing organic keywords - the search terms that your website shows up for.

Example: type ‘cheap furniture’ in Google: 1st result => overstock.com

In the image above, you can see that this is what has happened to $OSTK. If traffic dropped without a decline in organic keywords, then we could attribute this to an overall decline in furniture sales and / or online penetration. However, the drop in traffic is highly correlated with the decrease in organic keywords associated to the website, meaning that the algorithm may have disrupted traffic / overstock has done something for the algo to punish them.

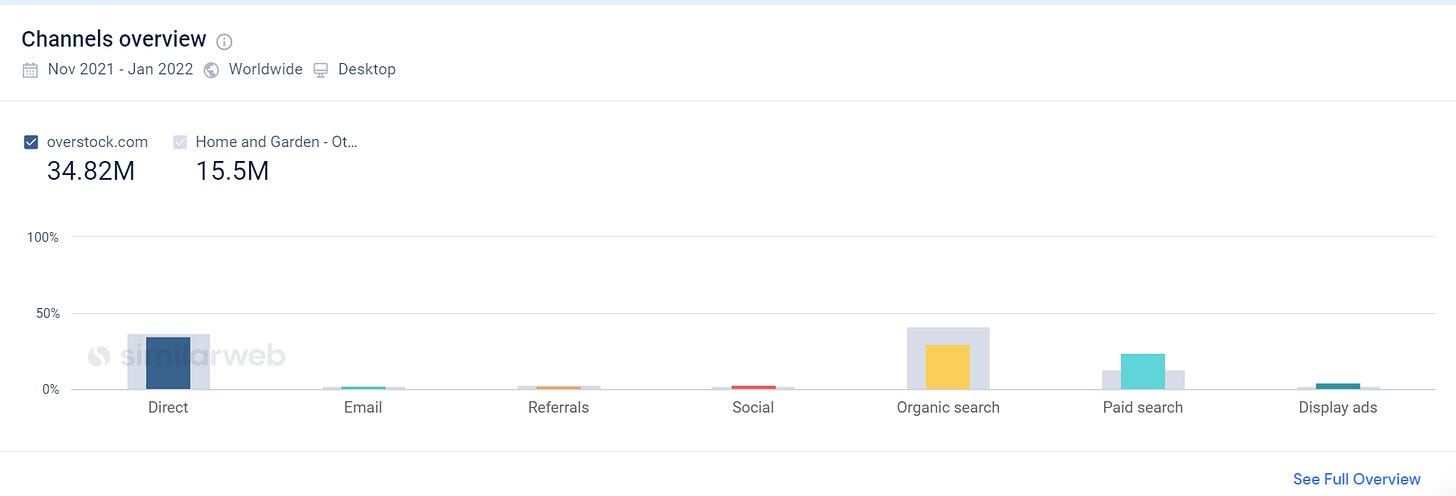

It looks like most of their traffic is either direct (people typing in overstock.com) or organic (through keywords typed into search engines), so this is likely a vulnerability to keep in mind nonetheless:

Moat

$OSTK seems to have found a special position inside their customers´minds. In B2C companies, if this is strong enough it can act as a moat. I am not sure yet, because I have only recently come across $OSTK, but it seem that consumers consider $OSTK to be a unique combination of price and style or “smart value”. Given the size of the brand, I think this is a quite a strong position to be in.

To illustrate the above, last week I read “Positioning: The Battle for Your Mind” by Al Ries and Jack Trout. The book explains how in an over communicated world (one saturated with information), the way to cut through the noise and get into people´s mind is by positioning yourself, so that you can occupy a relatively empty space in the latter.

Business history is full of examples of businesses that managed to do so succesfully, gaining a stronghold in their customers´psyche and effectively gaining a competitive edge over bigger and meaner competitors. I think this is what $OSTK is doing / has done and this will likely translate into healthy growth through time. I do not see a future in which people do not want to furnish their homes, so there is likely quite a runway ahead.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc