Welcome to the couple hundred of you that joined Investment Ideas over the past few weeks! I am back from my Easter holidays and am excited to continue this journey with you all.

The Streaming Hamster Wheel

For the last few days, I have inevitably directed some of my attention to the $NFLX situation and as a result, I have stumbled across the $WBD merger. I have spotted some very simple and interesting dynamics going on in the streaming / entertainment industry, which I think are worth noting.

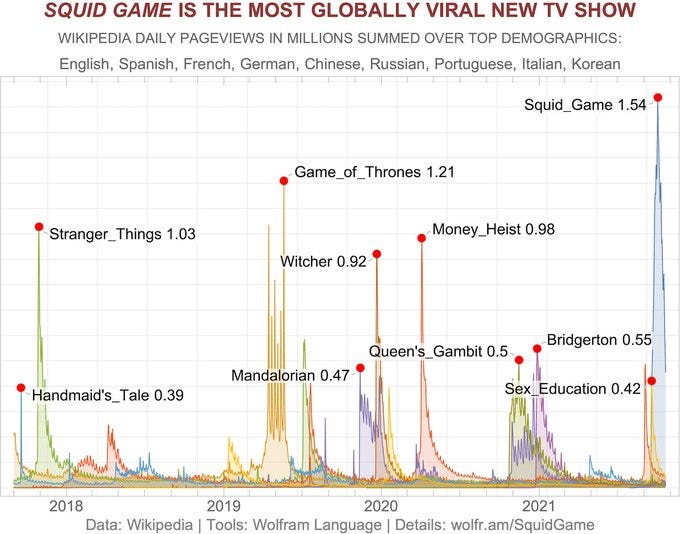

The thing $NFLX and $WBD have in common is that they need to produce one hit after another to stay relevant and make money. As soon as they stop doing so, they lose relevance, which leads to lower revenue and ultimately, less powder to invest in new potential hits.

I term the above the Streaming Hamster Wheel. One can win at this game, but as more and more players enter the arena, the streaming industry (movies, shows specifically) is reverting to the default state of the film industry, which is a hyper competitive red ocean.

Of course, Netflix has been very succesful at playing this game. A decade ago, the company was struggling to out-compete small indie studios and today, it is making the world´s most popular movies and shows.

At its essence, like any other company, Netflix is just a bunch of people doing things together. The above must therefore be a result of:

The individual talent of Netflix employees and Netflix´s ability to lure them in.

The corporate structure and culture than enables the aggregation of individual talent to flourish into world class output.

When I see a company that has evolved in this manner the past decade, I see a a group of people working together optimally to compete in the film industry, streaming or not. Today, Netflix is simply a world class film studio and at its core, that is its source of value.

Studios go through ups and downs because you cannot always be producing more and better hits than your competitors. There will be times when others do better, but so long as the company´s structure and culture persists, eventually it will get its mojo back.

Having said that, the question is, I am excited to invest in a company that tends to emerge victorious from the Streaming Hamster Wheel? The answer is no. Today, I am just starting to see around the (Attention Economy) corner and I believe there are far greater things to be invested in, like synthetic biology or more specifically, Amyris.

As a final note, Netflix´s valuation may come down enough to turn it into a value play, at which point I will not hesitate to leverage the above observations.

Warner Brothers Discovery

Discovery has a lot of unscripted IP, whilst Warner Brothers has plenty of scripted / theatrical IP. In the latter´s case, DC Comics stands out most (Batman, Superman etc). The combination of the two IP portfolios can make for an unstoppable media outlet, that could no doubt rival Disney +, Netflix and others.

This makes $WBD very interesting as a long term play. Non-scripted IP tends to have higher margins, since content is generated in a more casual manner and scripted content, although more capital intensive, tends to drive all the fandom. If well executed, the resulting financials can also be excellent, with plenty of cost synergies available.

For the combination of the two portfolios to be succesful, the two companies (group of people) need to be effectively merged and brought together to collaborate, like they do at Netflix. Else, it will likely end up like the post-Welchian $GE.

However, Warner Brother´s assets have been through 3 different strategic imperatives over the last decade (owned by 3 different companies). One can imagine the effect this has on creatives, which are the core source of value of the company, going back to the above definition of Netflix.

Further, the shutdown of CNN+ weeks after its debut (announced yesterday) is an early sign of dysfunction. In all fairness, there is no such thing as a perfect merger, but an incident of this sort already points to the difficulty (and unpredictability) of the task ahead.

Question: what happens if you merge burned out Buggs Bunny creators with CNN master minds?

Apparently, Zaslav has a very good reputation in the industry and seems to have great skill in managing people and in fact, I believe the $WBD long thesis can be boiled down to just that. Does Zaslav have what it takes to bring together the two companies, invest / divest where appropriate? I cannot tell, as of yet.

$WBD´s market cap today is $52.05b and has a total debt of $58b. In other words, the company´s debt is 111.4% of its market cap. This means that Zaslav not only needs to be a people management master, but also has to be a world class capital allocator. He will have to chose what assets to sell and which to keep / further invest in.

The fact that $WBD operates in the Streaming Hamster Wheel does not make the debt burden any lighter - content production is capital intensive. For instance, $DIS will be spending $33b on content production in 2022.

On the other hand, the projected revenue for the company in 2022 is $49.8b, which means the market is paying us relatively well to take on the risk of the merger going south.

In general, with all the $T shareholders thinking about selling their $WBD shares or not, together with the magnitude of the challenge, the stock is likely to wither for some time. If all goes well, however, perhaps we can expect $WBD to 2x going forward, reaching Netflix´s market cap. Does not sound very exciting as I am writing it.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Thank you for the insights. I was one of the net 200K unsubscribes from Netflix in the past quarter. Before Apple, Disney, Peacock I had no reason to unsubscribe from NFLX. With their recent price increase and current content, it was a question of allocation of discretionary “entertainment” budget. They just didn’t make the cut (in my case). It is interesting as I have been aNetflix fan/ customer since their DVD days. They are definitely on the hamster wheel now…which is very crowded.