Edited by Brian Birnbaum and an update of my original Meta deep dive.

1.0 Meta Still has Asymmetric and Exponential Upside Ahead

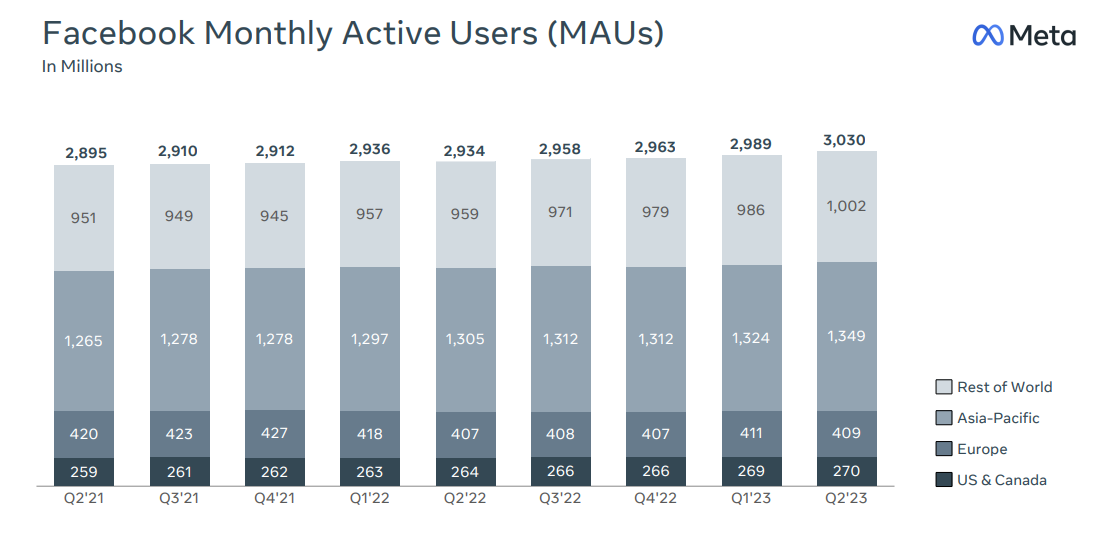

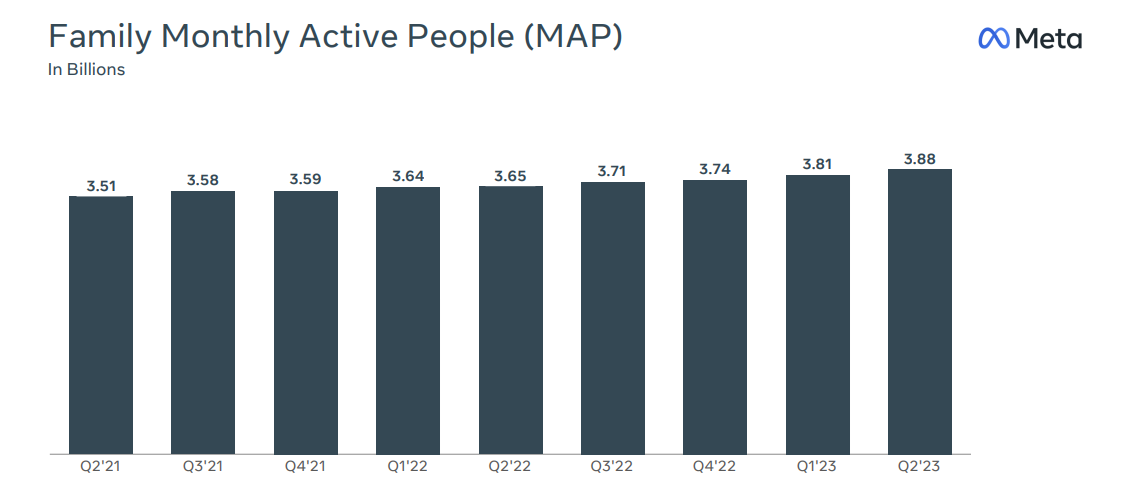

A thus far quiet deployment of AI has made Meta relevant again, with engagement metrics trending in the right direction. As the network evolves to span 50%+ of the world´s population and Meta continues to invest in its AI infrastructure, it is gearing up to command a level of power unseen in human history.

In my Meta deep dive last November, when the pessimism surrounding the stock was inescapable, I pointed out three things in conflict with the narrative:

Meta was not betting the house on the Metaverse. Instead, it was allocating most of its capital towards Family of Apps (Facebook, Instagram, Messenger, Whatsapp).

In turn, far from being thrusted into irrelevance by TikTok, back then it was actually gearing up to give its Family of Apps a second and potentially far more explosive life, by enhancing the applications with AI and thus promoting content discovery. I also pointed out that this, in turn, was enabled by a cultural revamp.

The narrative that Meta was not able to monetize Whatsapp was not true. By Q3 2022 Meta was making $9B annually from its new click-to-messaging platform, which enables merchants to interact with potential customers via Whatsapp after they click on an ad.

Looking back, these observations seem to have accurately reflected reality. Now, Meta has surfaced as an AI powerhouse and its Family of Apps has notably gained in relevance since. Whatsapp/messaging monetization is also advancing well and the company is again mean and lean.

Here is the data regarding how AI has enhanced Family of Apps:

In Q3 2022, 15% of the content displayed on Instagram was AI recommended; according to management, that percentage has risen “significantly” as of Q2 2024.

Since the introduction of AI-recommended content, overall time spent on Family of Apps has risen by 7%.

Reels, which is the primary surface that leverages AI recommendations, has gone from 140B plays daily in Q3 2022 across Family of Apps, to 200B in Q2 2023. That is a 42% increase.

As of Q1 2023, since the launch of Reels overall time spent on Instagram has gone up by 24%. This makes sense because all around me I see people hooked on Reels when, a few years ago, this was not the case.

Being a newer and higher dopamine surface, Meta was finding it challenging to monetize Reels in Q3 2022. At 140B plays daily, Meta calculated that it was yielding $(500)M in revenue, since it was taking traffic away from other surfaces with more mature monetization (pictures, mostly).

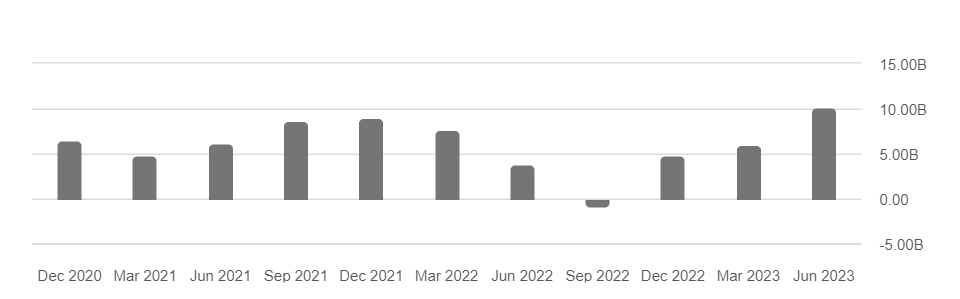

As of Q2 2023, Reels is now at a $10B revenue run rate, compared to $3B “last fall.”

From Q4 2022 to Q1 2023, Reels monetization efficiency is up over 30% on Instagram and over 40% on Facebook.

YoY, ad impressions are up 34%, but the price of ads is down 16%. This is due to lower monetization surfaces like Reels and the fact that the platform is seeing most of its growth come from developing nations.

Here is the data regarding regarding Whatsapp/messaging monetization:

As previously stated, Meta was making $9B annually from its new click-to-messaging platform. In Q4 2022, the run rate was up to $10B. In Q2 2023, management said that click-to-WhatsApp ads revenue continues to grow very quickly at over 80% year-over-year.”

Regarding the capital allocation, total expenses in Q2 2023 were $18.6B and 82% of those expenses were directed towards Family of Apps. Thus, Meta continues to allocate most of its capital towards supercharging Family of Apps, and it is without a doubt succeeding.

Further, reading the quarterly reports since Q3 2022, it is evident that most of the capital directed towards Family of Apps is in turn being directed toward infrastructure capable of operating AI at scale through the Meta network.

When I realized this, it struck me that I had been considerably underestimating the company´s long term potential.

Meta´s monthly active users account for 49.1% of the world´s population. Last fall, when it seemed like Instagram was going to be rendered irrelevant by TikTok, the breadth of the network came across as less meaningful. Today, with everyone hooked on AI-recommended content, which is growing more effective every day, I realize that Meta is gearing up to command a level of power unseen in human history.

By heavily investing in the infrastructure to support AI, Meta is getting ready to gift a network that connects half the world´s population with intelligence, which will not only supercharge Family of Apps, but will multiply the ease and rate at which people connect with each other online by a factor of 10, then 100, then 1,000, and then, essentially, infinitely.

Bottom line: the upside here over the long run is tremendous.

Unless intervened by policy, Meta will over the coming decade(s) yield some form of ultra-valuable superintelligence that will underpin the world´s social fabric. In this regard, analysts during the Q2 2023 call kept asking Zuckerberg why they insisted on open sourcing the LLM model Llama 2. They do not understand that the value is not in the model itself, but rather effectively deploying it within a vast and rich network.

If open source helps Meta iterate faster than otherwise, it’s the right decision. But what they will absolutely not do is open source the network.

[…] cost of revenue increased 15%, driven primarily by infrastructure related costs. - Susan Li, Meta CFO, during the Q2 2023 conference call.

2.0 Meta´s Cultural and Structural Makeover

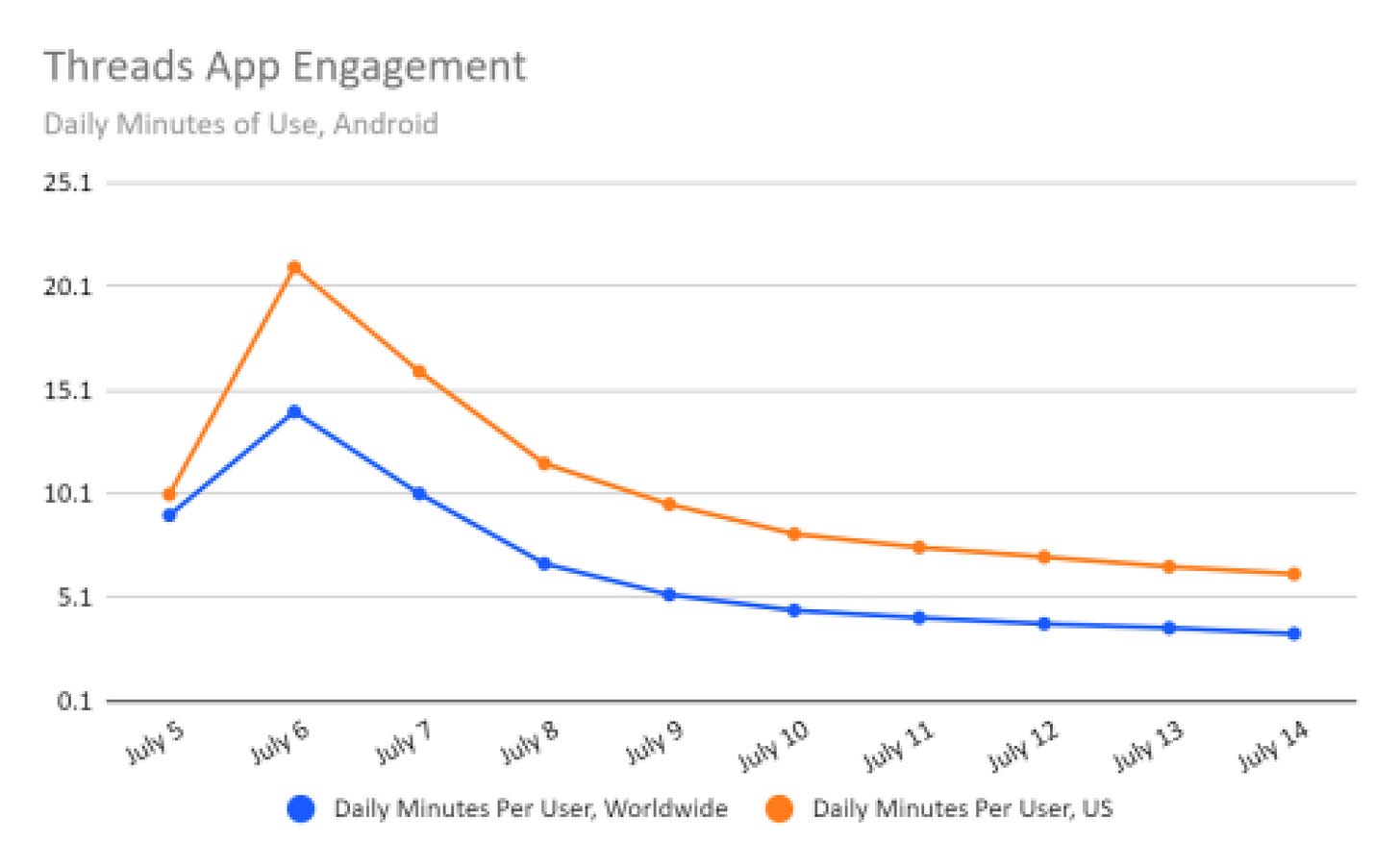

The launch and evolution of Threads is a litmus test of Meta´s cultural and organizational improvements, which underpin the rest of the company´s progress.

During the pandemic, the company got a bit bloated, and Zuckerberg seemed to get a little bit ahead of his skis with the Metaverse vision. While the focus was still very much Family of Apps, the pace of innovation was visibly slowing down.

The results obtained across Family of Apps with the introduction of AI-recommended content is a great sign of renewed innovation. But the pace at which Meta launched Threads (the X competitor) was particularly telling. Zuckerberg´s comments on the matter:

[…] the product was built by a relatively small team on a tight timeline. We've already seen a number of examples of how our leaner organization and some of the cultural changes that we've made can build higher-quality products faster and this is probably the biggest example so far.

According to this report, and as you can see below, after a spectacular start, Threads engagement has been declining. However, as I pointed out in my original deep dive, Meta has a track record of nourishing these networks like no other company on Earth. Zuckerberg said the following during the Q2 2023 conference call:

We saw unprecedented growth out of the gate. And more importantly, we're seeing more people coming back daily than I'd expected.

And now we're focused on retention and improving the basics.

And then after that, we'll focus on growing the community to the scale that we think is going to be possible.

Only after that we are going to focus on monetization.

We've run this playbook many times before with Facebook, Instagram, WhatsApp, Stories, Reels and more.

Going forward, Threads will be a litmus test of the cultural and organizational changes management is talking about.

3.0 Financials

The company is in great financial health.

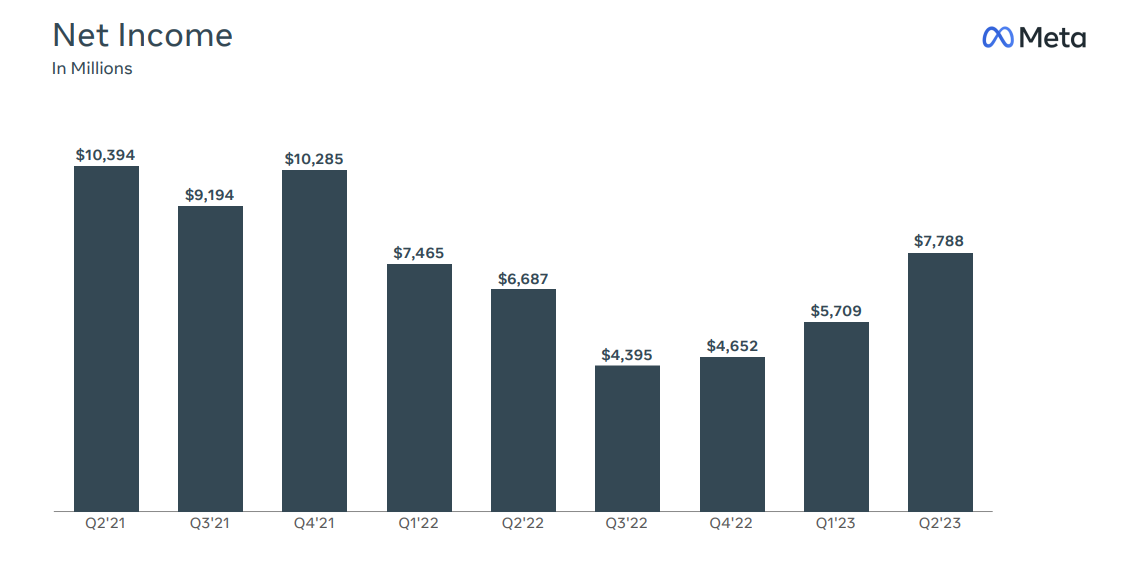

Revenue is now rising faster than expenses. Q2 total revenue was $32 billion, up 11% or 12% on a constant currency basis. Q2 total expenses were $22.6 billion, up 10% compared to last year. The materialization of converging net income helps the market perceive Meta in a different light, with the stock up 177%+ since I wrote the deep dive.

Q2 Family of Apps ad revenue was $31.5 billion, up 12% or 13% on a constant currency basis. Within ad revenue, the online commerce vertical was the largest contributor to year-over-year growth, followed by entertainment, media, and CPG. Here, we begin to see the click-to-ads platform shining through.

The inflection point at the top of the income statement has translated into a seemingly rising free cash flow. However, the former has been aided by deferral of income taxes that are likely to be paid in the fourth quarter of FY2023.

Meta ended Q2 2023 with an enviable $53.4 billion in cash and marketable securities after having repurchased $793 million of Class-A common stock.

The company also persists in its Reality Labs initiative, which in Q2 2023 accounted for 18% of total expenses. Q2 Reality Labs revenue was $276 million, down 39% due to lower Quest 2 sales. Reality Labs expenses were $4 billion, up 23% due to lapping a reduction in Reality Labs loss reserves in Q2 of last year, along with growth in employee-related costs. Reality Labs operating loss was $3.7 billion.

4.0 Conclusion

So long as capital allocation remains predominantly skewed towards Family of Apps, the overall asymmetry of the Meta thesis remains. The company has evolved very favorably since I wrote my deep dive, and I am terribly impressed by the management team.

However, I regret that the core activity of the business is to reprogram the limbic brain of its users, because I believe that, as is the case with tobacco, this may in time evolve into a headwind.

Further, I believe that in my original deep dive I underestimated the company. Firstly, the Family of Apps platform has another 50% of the world´s population to penetrate. Secondly, with the structural capability of deploying AI on this network, and the exponential increase in models’ effectiveness, the company is set up for a future of continued dominance.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Great review and thesis. Agree, the company and especially its investments is misunderstood right now and has been for a while. Digging into the actual reports and call transcript brings out the truth, not headlines, Twitter memes, or CNBC discussion.

Excellent review and eye opening for me