Hello everyone! This month I bring you what I think is a particularly instructive case, with a vast long term potential- LMND 0.00%↑ . Below, you can find the post´s structure and as always, feel free to skip to any section of your interest.

1.0 The (Insurer´s) Dilemma

2.0 Key Fundamental Drivers

3.0 The Odds and Implications of an Insurance AI

4.0 Operational and Cultural Aspects

5.0 KPIs

6.0 Metromile Acquisition

7.0 Re-Insurance and Financials

8.0 Competitors

9.0 Conclusion

1.0 The (Insurer´s) Dilemma

Lemonade is positioned to give legacy insurance companies a hard time.

There is one pattern that repeatedly occurs in the land of disruptive innovation, which can predictably destroy and create trillions of dollars of value in a short time. I have learned about it over the last month reading the book “The Innovator´s Dilemma” and it is fascinating to me that Lemonade has leveraged it to positioned itself to take over the insurance sector, that accounts for 11% of US GDP or around $2T - so no small deal.

The pattern essentially involves two steps:

Come into the market with an offering that looks like a toy to incumbents, yields lower margins than their existing businesses and can only gain traction in a small part of the market, such that your business is meaningless to them.

Then move this offering up-market, appealing to the broader market.

Although this is very hard to do in practice and involves a great deal of risk, specially in the earlier stages, by doing so you leverage a fundamental principle in business: companies have a really hard time looking down-market. Even if it is clear that your disruptive offering is the future of a given industry, managers and employees of incumbent firms will have a tough time saying:

“OK guys, let´s cannibalize our existing business by shifting to this highly deflationary innovation with lower margins, which will likely render most of us and the people we like obsolete in this company and make us painfully fail to achieve our quarterly goals along the way”.

This is why, as a disruptor, you have a major advantage when moving upwards -even if they see you coming, there is not much they can / are willing to do about it. If your business has a gross margin of 70%, for example, moving to a business with a gross margin of 30% requires shifting towards a radically tighter cost structure. Good luck getting regional manager Jim to be excited about a little, low margin deal in the “new business” that is going to get his friends fired.

Further, in a world obsessed with quarterly performance, companies have tremendous pressure to advance up-market, in order to keep growing. If saving an incumbent company from disruption involves slashing profits in the short term, the market will not have it. Thus, what is widely known as “excellent management” is also often a death sentence when faced with disruptive innovation - quite the dilemma.

Even if managers of an incumbent firm decide to pursue an innovation down-market, in response to a disruptive threat, the company´s culture, processes and values would likely prove incompatible with those required to pursue the new venture. By getting good at the legacy business, people inside the incumbent firm come to develop a series of enabling processes and expectations that also define what the company cannot do.

Lemonade has put traditional insurers into this dilemma by:

Allowing customers to buy insurance and make claims in seconds via an ever more delightful app and harvesting large amounts of data from it.

Keeping only 25% of premiums (thus pegging its gross margin) and paying any surpluses after claims to non-profit organizations chosen by users.

Whether the above can ever be a profitable arrangement remains in question, but it enables Lemonade to do three things:

Operate and scale at a marginal cost relative to incumbents, forgoing the need of hiring many insurance brokers.

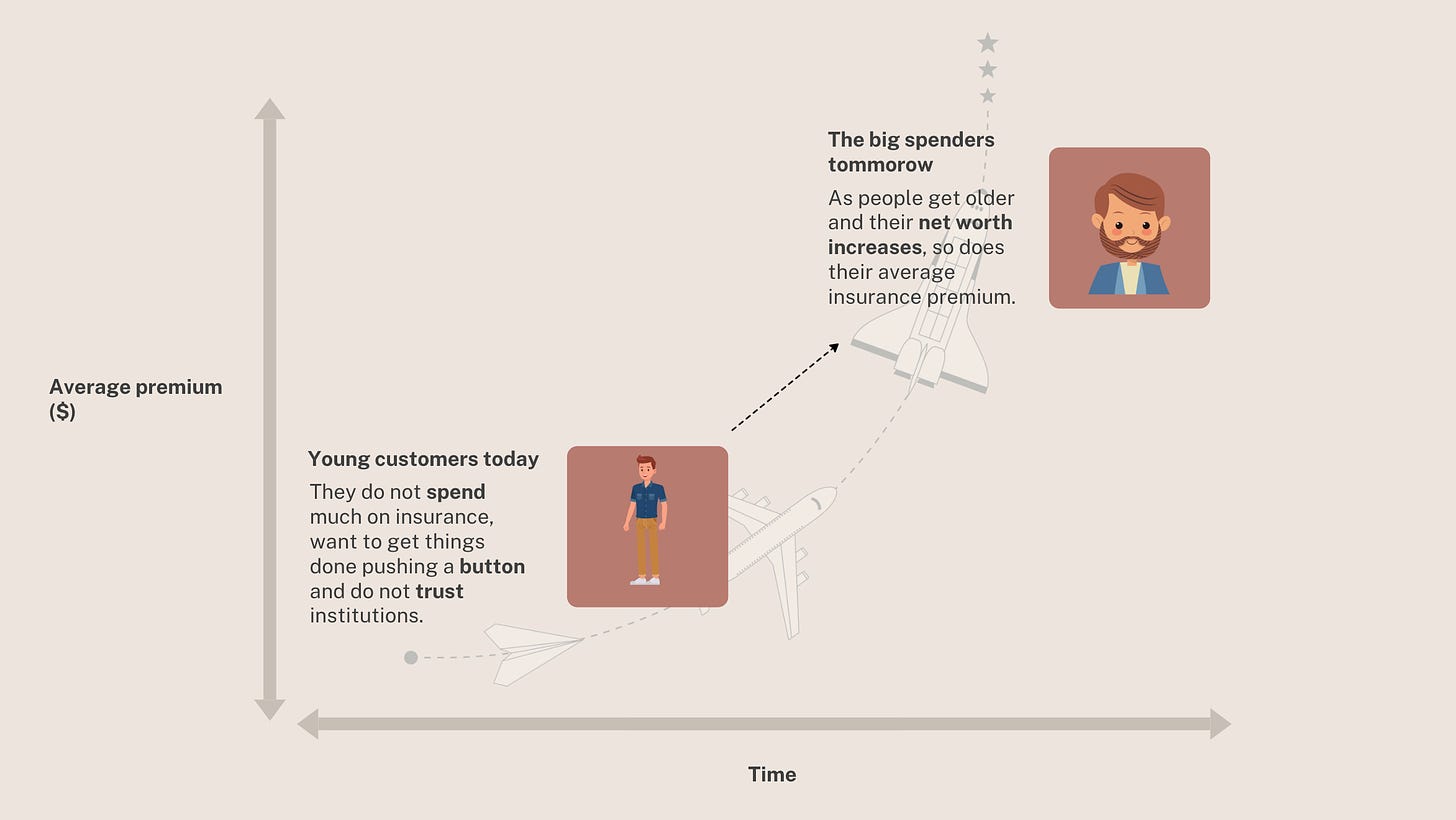

Align itself with the expectations of younger customers, that today do not spend much on insurance (down-market) but will do so much more in the future as they grow up (up-market).

Pick up a lot of data, which it can then train an AI with, to make buying insurance and settling claims easy for customers to an extent that legacy players could not ever dream of. This may eventually yield a winner-takes-most scenario, driven by a data virtuous cycle.

Today this business looks silly, because young customers are not a meaningful business, “anyone” can build an app, the whole non-profit thing is kind of woke and financials look wobbly. However, although the company is not perfect, this is the recipe for a future whatever-you-want-bagger.

There are many aspects to Lemonade, but in the next section I boil the business down to just 4 key fundamental drivers that must keep moving forward for it to meaningfully reward shareholders. At this stage three are looking great, but one of them is very much in question.

2.0 Key Fundamental Drivers

Lemonade is a magnet for young insurees, but its AI capabilities are a question mark (and have tremendous potential).

The insurance business is about, over the very long run:

Maximizing: premiums received from clients.

Minimizing: claims paid to clients and how much you pay to acquire each client.

Lemonade is attempting to optimize this function via 4 key fundamental drivers, that you can see below:

Values: by keeping 25% of premiums and donating the rest to non-profit organizations, it is aligning its values with younger generations, that fundamentally distrust traditional institutions.

UX: by offering a delightful and ever frictionless UX, that makes brokers redundant and accommodates lower margins, it rises to satisfy the expectations of newer generations that are used to just pressing a button.

New Verticals: per every customer it acquires, it makes a lot more money if it can sell multiple insurance products. As it deploys new insurance verticals and performs cross-sells, it can effectively obtain a larger life-time value per customer.

AI: theoretically, by processing vast amounts of data it is able to predict how likely a given customer is to make claim and so can price risk more accurately than legacy counterparts, that do not accumulate so much data and do not process it via AI.

Drivers one and two give Lemonade an advantage by default over incumbents in terms of customer acquisition, retention and their relative proclivity to make claims (Lemonade keeps 25% of premiums regardless: by claiming you are taking money away from your favorite non-profit). As a young person, you just like them better, as evidenced by their world-class customer reviews. Lemonade´s value proposal is very solid in this domain.

Over the long term, the return from enchanting young people can be exponential, with around 65% of Lemonade´s customers currently being under the age of 35 and even more so as it continues to push forward driver number 3 (new insurance verticals):

“…the median net worth of an adult American under the age of 35 is about $11,000. By their 40s and 50s, their net worth has grown by 10 to 15 times, and that growth peaks at 25 times after the age of 75.”

“ As of December 31, 2021, the median age of a Lemonade customer with an entry level $60 a year policy — corresponding to $10,000 of possessions — is about 30 years old. This climbs toward 40 for customers with policies of about $600, and among the handful of customers paying approximately $6,000 a year, the median age is about 50” - 2021, 10-K

About the last driver, AI, it will make or break the thesis by enabling Lemonade to price risk more accurately than incumbents or not . Processing vast amounts of data via AI would enable Lemonade to compound the enchantment by making the overall experience seamless for customers, whilst making sense of numbers. If it manages to train an above-human performing AI, Lemonade will tick all the boxes for insurees of the future.

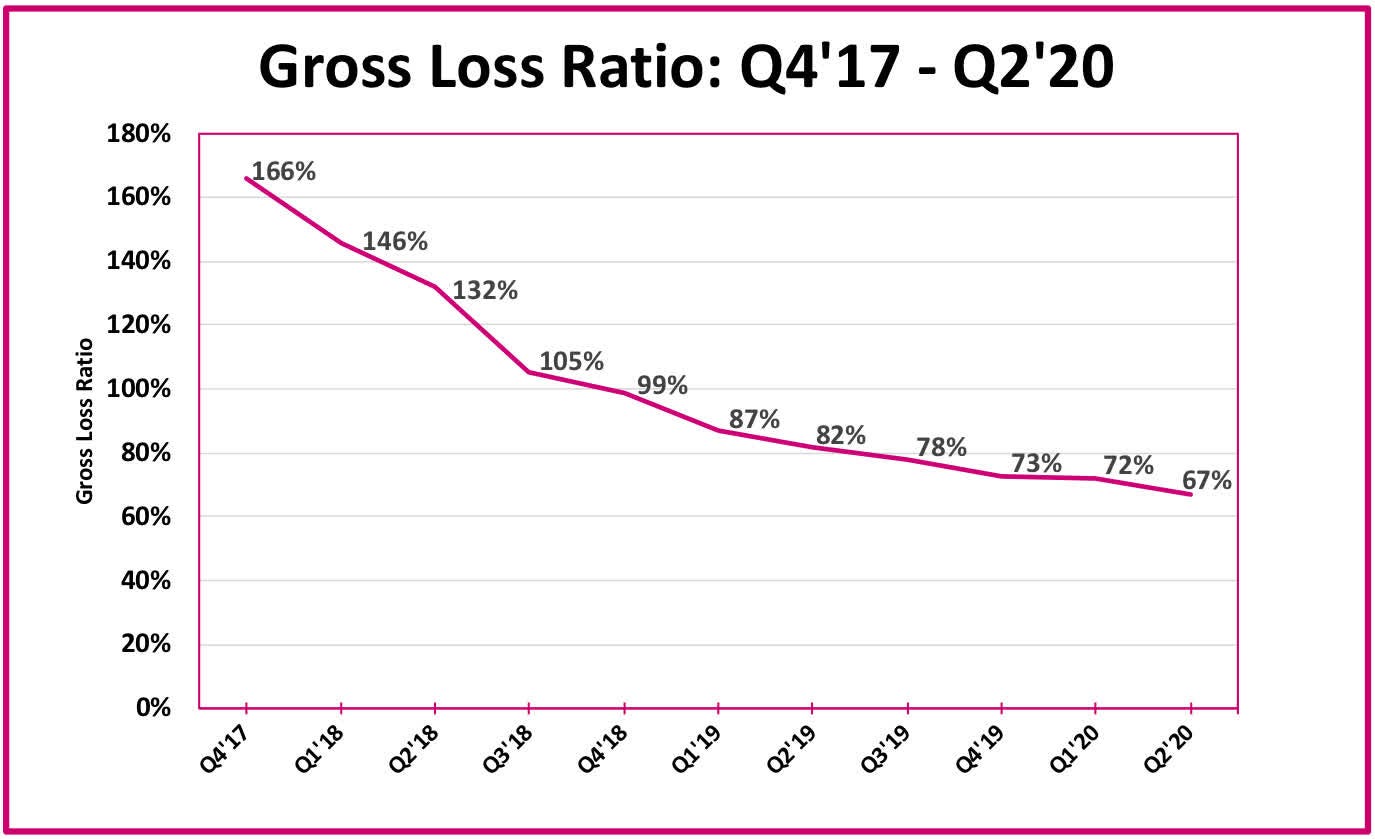

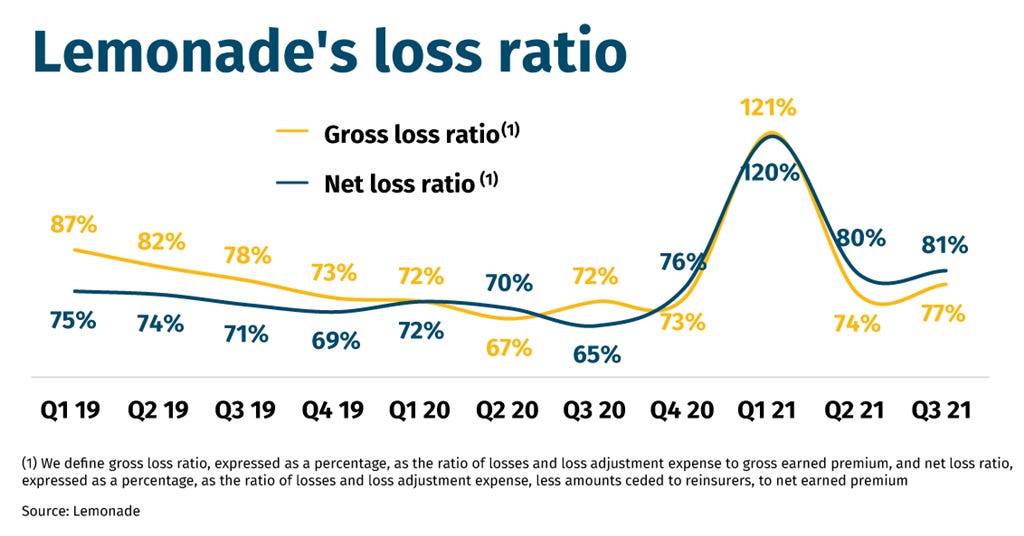

One way to measure how accurately the company is pricing risk is by analyzing its gross loss ratio (the ratio of gross losses and loss adjustment expenses to gross earned premiums). Gross loss ratio has been trending down nicely if you zoom out (and there are some acceptable reasons for the recent uptick, which I will review in depth section 5.0, because there is a lot more to it), but in the Q2 2022 investor letter management stated:

“It was only one year ago, in June 2021, that our AI models were credible enough to be allowed into production. That model - LTV4 - was trained on data from the almost four years we'd been in business at that point.”

The above means that much of the gross loss ratio curve cannot be attributed to the company´s AI models, at least yet. For this reason, the company today seems to have been propelled by a differentiated value proposal (drivers 1 to 3) enabled by organizational aspects (section 4.9), but not by an AI that fundamentally changes the industry. Regardless, Lemonade has laid down the building blocks to achieve such an AI and so it is worth tracking its evolution. I examine this concern in more depth in the next section.

3.0 The Odds and Implications of an Insurance AI

Whether an insurance AI is possible is unknown - but in the affirmative, Lemonade is well positioned to give birth to it. This would decimate legacy competitors.

To train an AI, you must feed it data, so that it learns to associate signals with outcomes. Once it does, it can perform predictions at a marginal cost. In effect, AI commoditizes inferences, much like electricity did so with energy. As such, the quality of an AI depends on that of the data that it is trained with.

Lemonade picks up qualitative datapoints about its customers, by observing the way they interact with the app. For instance, a customer that signs a policy right away without reading it much may denote impulsivity. If in Lemonade´s dataset customers with high impulsivity “points” tend to make more claims, then the AI would learn to price in that risk.

“To date we have collected over 8.2 billion data entries, a trove that grows by the minute.”

“… a typical broker-based insurance company will generate between 20 and 50 data points per policy. […] AI Maya typically asks only 13 questions before giving a bindable quote for home insurance, but the interaction generates close to 1,700 data points.” - 2021, 10-K

There is no question that Lemonade can pick up many datapoints of this sort, thanks to its app and underlying infrastructure. Yet, at this stage, what is in question is the relevance of such data. It comes down to whether you believe the way someone interacts with an app can help you learn about how likely that person is to behave in a riskier or more fraudulent way.

My intuition is that such a data set is actually very signal rich and thus conducive to gradually optimized risk pricing. I think the odds of successfully training a competitive AI with are high. To be clear, however, I do not see any compelling evidence that the AI is a reality yet. For this reason, I am thinking about the problem in a probabilistic sense, as in, where is a functional insurance AI likely to prop up first? Lemonade is undoubtedly a good candidate.

Once an AI of this sort peaks its little head, dollars in the industry will flow disproportionately towards it, as it compounds its growing ability to price risk more accurately. Under this binary light, Lemonade looks more like reasonable call option on AI disrupting the industry. Per the way things are done inside Lemonade, the organization is essentially primed to give birth to this AI (if it is possible at all), which brings me onto the next section.

“Yet, in the 12 months since then [the passing of AI models to production], we have handled twice as many claims as we did in those first 4 years combined. During those same 12 months, we also pushed 12,000 software builds into production.” 2021, 10-K

4.0 Operational and Cultural Aspects

The company has the fundamental operational traits to succeed, but something is up with culture and hence, potentially so with management too.

To bootload an AI, Lemonade needs to acquire a lot of users and pick up lots of data in an orderly fashion. This is a highly iterative process and to succeed, the company needs to iterate and optimize its operations continuously. This is almost a standard organizational property to many young investors, but most companies are not like this. Lemonade is.

I make two fundamental observations about the way Lemonade works:

The company is an optimization machine.

The culture supports the above property, but it also seems to be a bit off.

What makes Lemonade an optimization machine? It is constantly iterating its product and verticalizing its operations such that, for instance, its marketing efforts are allegedly incrementally adjusted real time based on what customers are doing inside its perimeter:

“Incumbents typically release improvements to their system's software a handful of times a year, whereas we averaged 5 code releases per day in 2018, 8 per day in 2019, 21 per day in 2020 and more than 40 per day 2021.”

“Our systems are entirely integrated, so data generated in a customer support interaction can inform the claims process, while claims data routinely impacts marketing campaigns.” 2021, 10-K

This DNA sets Lemonade miles away from legacy players, without a fully functional AI and but to be fair, without it the company is basically an insurance subsidizer. However, at the present time it is able to meaningfully satisfy the expectations of younger customers and this is a very strong foundation going forward.

In an ideal scenario, this iterational DNA is a result of employee autonomy and empowerment, such as Tesla or Spotify, but for now I am picking up the opposite. Perhaps ironically as proof that the company is indeed an optimization machine, I see plenty of complaints on Glassdoor from employees about them being scared to get up from their chair, because then their personal KPIs wither. I do not know to what extent the claims are exaggerated, but there is a lot of them.

Further, I also see complaints about employees being overworked, underpaid, micromanaged and most importantly, about them also being scared to deliver bad news to management. This is particularly concerning, because information must move freely and efficiently across an organization for it to succeed in the long term and specially in this type of organization. If you are very picky, it could also be indicative of sub-optimal management. Something is off about the culture.

There are also undoubtedly positive reviews, but even if the above negative aspects are true to a small degree, in the long term it will be a considerably hindrance to the evolution of the company. A lot of this negativity seems to stem from the lay-off of 50 employees that was seen as unfair by remaining employees, so perhaps it is temporary. I will be keeping a close eye on this.

5.0 KPIs

Δcustomers x Δpremium/customer ; ∇claims

So far so good, but there are blind-spots.

In this business, we want the following to happen, for the longest amount of time possible:

Go up: the number of customers and the premium per customer.

Go down: the amount they claim and how much they spend to support their operations.

If this happens, the company´s earning power will compound through time and it will probably do fine: more and more dollars will accrue to a relatively small cost structure. For each of these KPIs, there are a number of sub-KPIs that support them and I am going to unpack that in the rest of this section.

Δcustomers

The drivers of customer growth look healthy. Capital allocation in marketing is perhaps suboptimal.

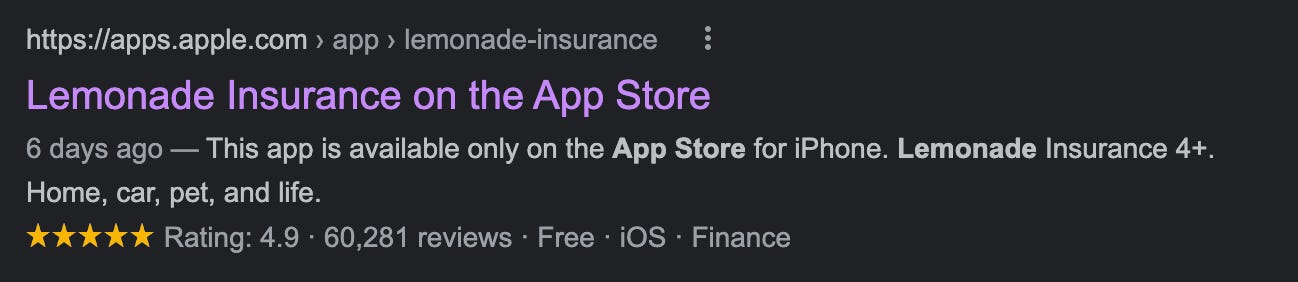

The trajectory thus far is excellent. I have not found any information about to what extent the growth is organic versus paid, although reviews in the app store are formidable - I would be surprise if a lot of the growth was due to word of mouth. According to its 2021 10-K, however, paid user acquisition, to whatever extent it is responsible for the growth, is fairly efficient:

“… for the year ended December 31, 2021, we spent $1 in marketing to generate about $2 of in force premium.”

The company defines in force premium as “the aggregate annualized premium for customers”. Hence, the company seems to be able to translate marketing spend into value in a reasonable manner and together with the perceived quality of the UX, I think we will continue to see healthy growth here.

One particular thing that caught my attention in this sense is that the company ramped up its marketing spend going into Q1 2021 - at the very height of general euphoria. This is perhaps in stark contrast to companies like HIMS 0.00%↑ that do the opposite - they are ramping up their marketing spend now, when ad spend across the board is pulling back. Two different approaches to allocating capital in marketing.

Indeed, as the number of customers and premium per customer (next section) continue to grow, so does IFP:

Δpremium/customer

Premium per customer is growing very well, as the company deploys new verticals - but this is precisely what impedes a deeper analysis at the moment.

To keep increasing this KPI, Lemonade has to do two things:

Increase annual dollar retention (ADR) to keep customers around for the longest time possible, as they age and spend more in insurance.

Sell more insurance products to their customers (deploy new verticals).

The company is succeeding at deploying new verticals, but this is precisely what makes analyzing the evolution of KPIs opaque. Per the way ADR is calculated, when a customer buys an additional insurance product, this bumps up ADR but it does not mean that retention is actually improving. In Q2 2022 36% of all Lemonade sales in Q2 were cross or up sells (which is great), but it is hard to see whether the bucket is leaking and to what extent.

“Non-renters products, including homeowners, pet health, and term life insurance, represented about 1/2 of our new business in Q1 2021, up from about 1/3 in Q1 2020.” - Shareholder letter, Q1 2021

This has some further implications, as it refers to ∇claims, as I will explore in the next section.

∇claims

The deployment of new verticals and the recency of the AI deployment makes it hard to see what is going on in terms of the gross loss ratio.

If risk is inadequately priced, claims can eventually be bigger than the premiums received and so this is a key domain of the business to watch out for. Gross loss ratio expresses what % of premiums received does the company spend in paying claims. The lower it is, whilst fairly treating customers, the better.

The gross loss ratio has been trending down quite attractively, but remember that AI models were only passed into production a year ago, again, meaning that we cannot attribute this progress to the hypothetical AI, from which much of the company´s potential future value will emerge in case of success.

Further, since the AI was passed into production, gross loss ratio is actually trending up: 96% @ Q4 21' , 90% @ Q1 22', 86% @ Q2 2022. According to the company, newer verticals tend to have higher loss gross ratios than more mature ones, which makes sense, but again we cannot see what is going on with the AI and to what extent it is driving value.

“Our business mix has evolved considerably since a year ago, with US-based renters comprising less than half of the book, relative to ~2/3 a year ago. The lines of business that have captured that share (home & pet) demonstrate higher loss ratios than our more mature, stable renters book.” - Shareholder letter, Q4 2021

With the launch of their later verticals behind them and the AI deployed, perhaps we see gross loss ratio quickly come down. If so, it would be very encouraging.

6.0 Metromile Acquisition

The acquisition seems quite prudent and smart. It sets the company on a collision course with Blackberry.

In Q2 2022, Lemonade closed the acquisition of Metromile. I am unaware of in what situation Metromile found itself prior to the acquisition, but getting $155m+ in cash in exchange for $145m in stock is quite a dashing move:

“We spent approximately $145m-worth of stock on this acquisition, and in return we’ve received nearly 100,000 new customers, over $110m of additional IFP, over $155m in cash and cash equivalents, a second insurance entity with 49 state licenses, and precision data from about half a billion road trips.”

Lemonade´s car vertical jumped from 1% to 20% of the book overnight. Metromile enables the average driver to save up around $500/year in insurance by plugging a very simple telematic device into his/her car. This is quite valuable, because most people do not drive much and so the little device delivers a lot of alpha - and is highly deflationary to incumbents.

This sets the company in an interesting collision path. Across the board, cars are becoming software defined. As such, a car´s operating system and the features it enables are slowly but surely becoming the most important factor. Blackberry´s QNX real time operating system powers more than 210m cars on the road (out of ~1 billion in total) versus 100k for Metromile.

Blackberry (deep dive) sits at the lowest point of the software stack and is building an ecosystem, Blackberry IVY, to enable third party developers to create apps on top of it. This is a fundamentally different and more consequential approach to employing ad-hoc hardware and I believe it will prevail through time.

However, if Lemonade can grow this vertical fast enough, perhaps it can consolidate its brand and leverage it to make its way into the software defined landscape. Given then non-net-costly nature of the acquisition, this seems like another call option. It definitely has lots of existing customers to sell this solution to at a marginal cost.

7.0 Re-insurance and Financials

The company is built for massive scale. It will likely achieve it if it breeds a competitive insurance AI and this will yield attractive financials.

Re-insurance

Lemonade´s re-insurance arrangement basically renders it a demand funnel for re-insurers, making a flat fee of 25% per every dollar of businesses it sends to them. With this set up, the game comes down to achieving massive scale with a nimble cost/capital structure. Financials must be analyzed in this light.

“Under the Proportional Reinsurance Contracts, which span all of our products and geographies, we transfer, or "cede," 70% of our premiums to our reinsurers. In exchange, these reinsurers pay us a "ceding commission" of 25% for every dollar ceded, in addition to funding all of the corresponding claims.” - 2021, 10-K

“As of July 1, 2022, we’re ceding 55% of gross premiums to this same program - down from 75% when we instantiated the program. […] A 55% cession is stage-appropriate for us, as our current IFP is more than 4x where it was two years ago, and we’ve diversified in the intervening years, growing from a monoline business to a multi-product, multi-geography business.” - Shareholder letter, Q2 2022

**The above arrangement also has the benefit of capping the company´s downside. In Q1 2021, a large storm in Texas led to an equivalent spike in the gross loss ratio (see end of section 5.0), but EBITDA did not spike.

Income Statement

Effectively, Lemonade sells pre-priced risk to re-insurance companies. The more accurate Lemonade´s pricing is, the more business volume will accrue to it: both in terms of people wanting to buy insurance via Lemonade and in terms of re-insurance companies wanting to buy it off them. Hence, although the company´s financial statement beyond its top line looks like a disaster, it would very quickly fix itself up if the company can breed an AI as explored in section 4.0.

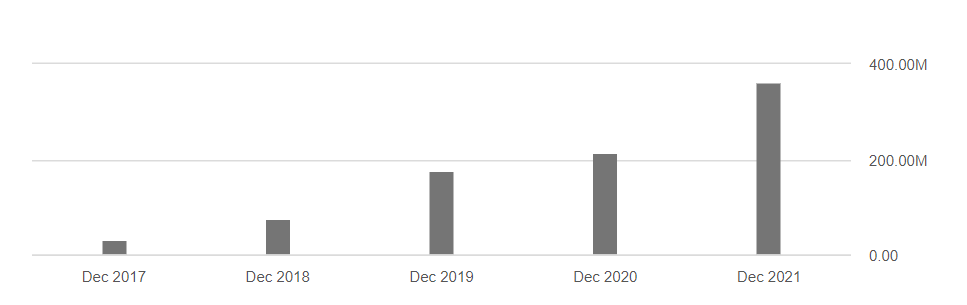

Since FY2017 to the TTM:

The premiums have gone 45.8X

and OPEX has gone just 14.5X

Here we see that revenue can scale meaningfully without the cost structure having to do so much. So what is the Achilles heel here and why does the bottom line look so messy? Claims. They have gone up 55.8X in the same period, faster that premiums:

As you can see, the thesis goes back to AI: now that Lemonade has deployed the new verticals and its models are working, it is primed to get really good at pricing risk and quickly fix its I/S - assuming that the dataset is indeed relevant and all the other concerns explored above.

The truth is that the company has only scratched the surface and it is very early days. With revenue scaling much faster than the cost structure, deep learning can send this youngling to the moon.

Cashflow Statement

The company is currently bleeding cash, with a red cash from operations and increasingly so as it scales. This can be quickly traced back to claims growing faster and exceeding premiums. Free cashflow exhibits the same dynamic.

Balance Sheet

On a very positive note, the company has no debt. (edited) Cash, cash equivalents and investments totaled approximately $1.0B at the end of Q2 2022. Per its cash from operations, this affords the company around 5-6 quarters of operations.

The company only just IPOed in 2020, but it may need another raise soon.

8.0 Competitors

The insurtech space is not that visible yet and incumbents seem to be idle.

Since the company went public just over a year ago, there are plenty of insurtech competitors that we cannot analyze as readily. Lemonade claims they are all mono-line and thus are at a fundamental disadvantage with respect to the company, which is more diversified in terms of its offerings and its geographical scope. At least from my position, more time is needed to fully weed out the competitive dynamics here.

As it refers to incumbents, they generally do not stand a chance unless Lemonade goes bankrupt, fails to create the AI or they instantiate separate, autonomous insurtech organizations that are allowed to do their own thing, without the legacy culture and organizational structure interceding. Unless I am mistaken (and feel free to correct me in the comments), I do not see them doing this.

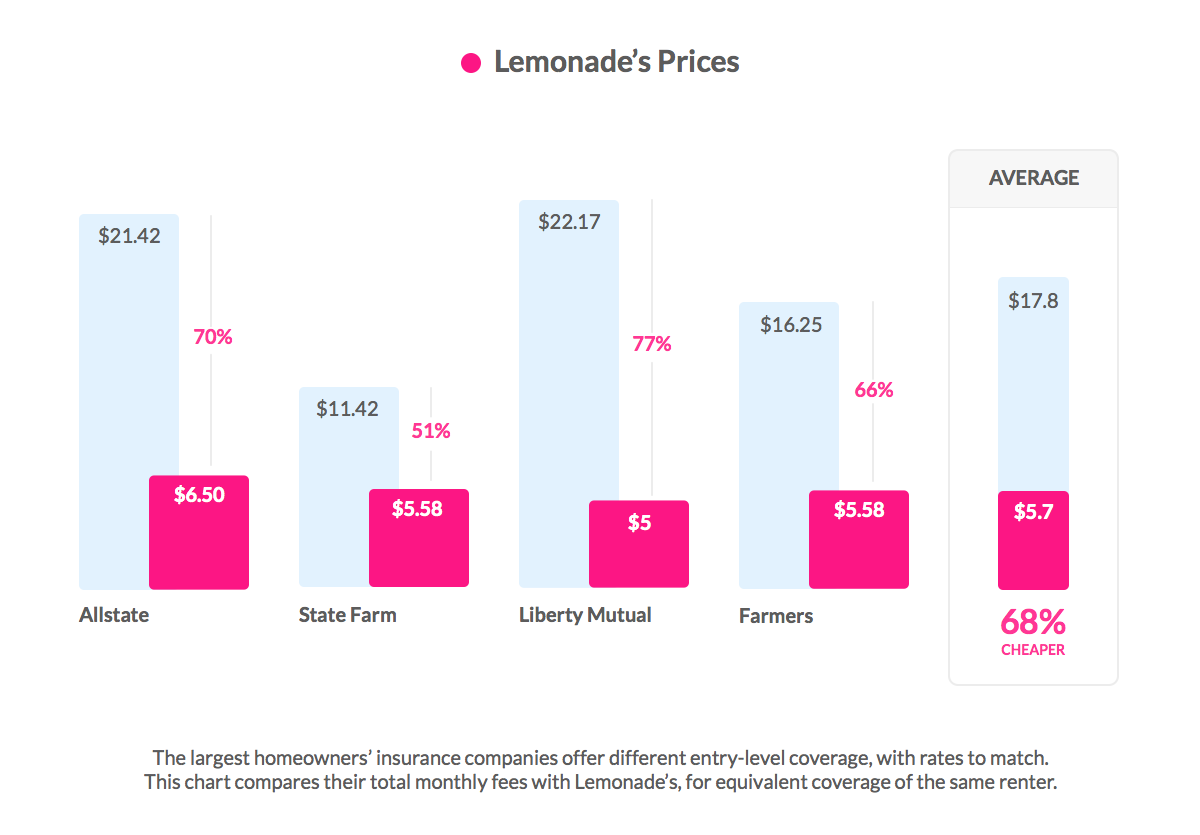

About prices, Lemonade seems to be subsidizing customers to some extent. The price differences below are not yet financially viable, as evidenced by the I/S. However, as reviewed above customer satisfaction is very high and per Lemonade´s set up, this is actually fundamental to give the company a chance at taking over the market. Even if it requires further equity raises, it makes strategic sense for the company to continue doing this for a long time - the goodwill will pay off.

9.0 Conclusion

A potential whatever-you-want-bagger.

Lemonade is in an optimal position to take the insurance industry by storm. This is a trillion dollar opportunity that, as explored, relies on the company´s ability to bootload a competitive insurance AI and stay alive until it does so.

There are some issues with the company, such perhaps a suboptimal culture and financial situation, but as the opacity regarding its KPIs begins to fade going forward, we have a front row seat to a development of a potentially historic magnitude.

At a price to sales ratio of 8 (half that if you account for the re-insured premiums), I would not say the market is unaware of the opportunity. Even at this valuation, if the company pulls off the AI (and perhaps there are some strong signals that I´m missing out - drop them in the comments if so) it will likely be a whatever-you-want-bagger and even more so if the current downturn goes on for much longer.

For now, however, until I see compelling signs of the company´s data science having a clear impact on its gross loss ratio, I remain on the sidelines. In order to build a larger position, I would also need to see the cultural aspect be cleaned up a bit and I would love to see a financial set up similar to that of PLTR 0.00%↑ or SPOT 0.00%↑, with a large war chest and positive FCF.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Antonio, great article, as usual! As a former actuary, I'm particularly interested in these type of new insurance companies and I'm sure they'll take over the old ones in relatively close future. We have a few in France that are already becoming a threat for the older insurance companies.

A few remarks after looking at the numbers, it's funny that their net loss ratios is sometimes higher than their gross loss ratios. If you're losing money with your reinsurance strategy, you better have a good investment policy. But because the business is short-tailed, I don't see how they could get substantial revenues from investing their premium.

Also, it's interesting to see that both the customer count and revenue per customer grew, but the premium revenue and annuity is flat YoY.

Have a great weekend.

PS: Thanks for the book reco in the intro I'll check it out