Winston Churchill said, “history is just one damn thing after another”, whilst studying financial history, one can just about hear the SP500 whisper “history is just one damn bounce after another”.

I was looking at some graphs this morning and I was quite entertained to see that the SP500 is up by 60%+ with respect to June 2019. Since, we have lived through an end-of-the-world type scenario (COVID19), a resulting economic and social crisis and a record fiscal deficit in the US. Now, we are entering a period of troubles relating inflation and geopolitics, which the market is getting quite fussy about. Below follows a brief historical frame work that I find quite helpful in putting things into context.

Humanity has had it quite tough since the beginning. Without much prior consent, we have all spawned in a floating rock that hurls through space and it is all very confusing. In fact, we only have to look back at the last 100 years or so to understand what our species is up against. From 1929 to 2022, we have had to deal with countless recessions and financial panics, 2 world wars, 4 major pandemics and a cold war that menaced to destroy the planet.

During this period, however, the SP500 has gone up 264x:

Each one of these major events and even their own small sub-components seemed like the end of the world. The Cuban Missile Crisis (Oct 1962), a key incident of the Cold War, had the world in arms for a few weeks. It had the whole world preparing for nuclear war between the US and the USSR. The SP500 fell 23%+ during the crisis and then bounced back, because nothing happened in the end.

The point is that history is full of incidents which seemed like the end of the world. The Cuban Missile Crisis is just a little blip in history, but even a far more consequential occurrence such as WW2 was not able to throw the market of its feet for too long. Hitler invaded Poland in September 1939, short after the Great Depression. By 1942 (towards the end of WW2), the SP500 had dropped 50%+, going from ~17$ to ~7$. After WW2, in the period from 1942 (1945 being the official end date) to 1952, the SP500 4xed.

Can you imagine a scenario in which we go right from 2008 on to Putin invading Ukraine in its entirety? That would be the modern day equivalent of what happened in 1939. What followed until 1942 was the equivalent of Putin then succesfully invading a series of other countries, killing around 10 times more people than COVID has killed to date. One can only imagine what watching CNBC would feel like.

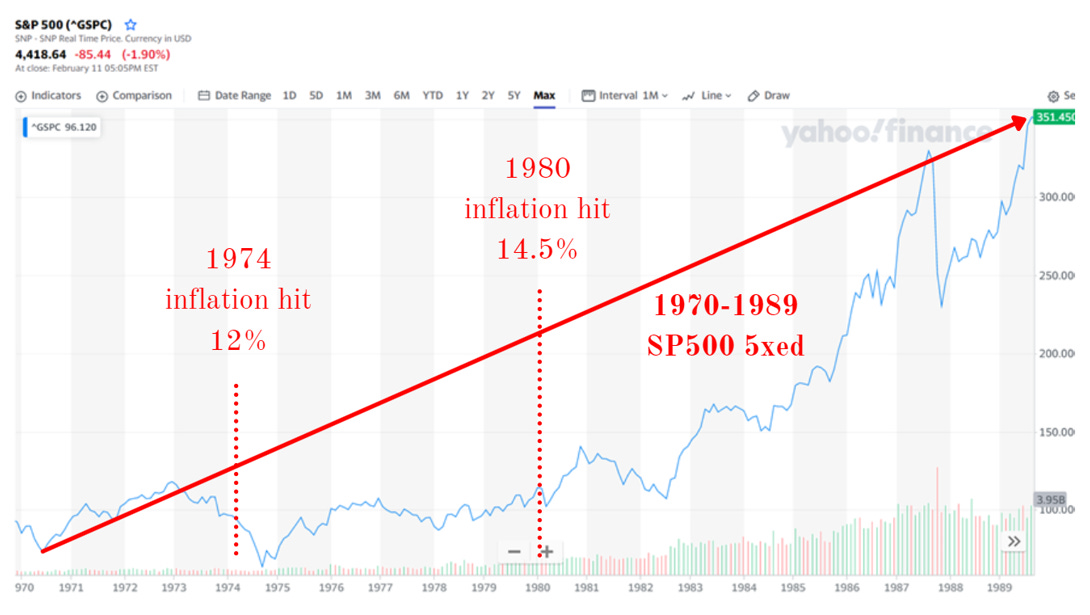

After the world wars, easy money was abundant in the US, much like today after COVID. Credit was ubiquitous, which fostered consumption and in turn propped up the consumer durables sector. In the US, the average citizen went from having few durables to having any and every kind of gadget, from fridges to hair dryers. However, this lead to quite severe inflation. Inflation hit 12% in 1974 and 14.5% in 1980 (sounds familiar?), rates were then hiked to 20% and 4m people lost their jobs during the early 1980s. Inflation did eventually subside (back to 2-3%) and in fact, from 1970 to 1989 the SP500 5xed.

None of these events were trivial to live through at all, but our civilization seems to have prospered time and time again, with the markets reaching new highs successively. Winston Churchill said, “history is just one damn thing after another”, whilst studying financial history, one can just about hear the SP500 whisper “history is just one damn bounce after another”.

History teaches us that the biggest risk is not being invested and that the second biggest risk is thinking short term. If indeed an actual end of the world event comes along, then the markets going down will be the least of our problems. Until then, staying invested with a strong focus on the long term seems to be the best course of action.

⚡ If you enjoyed the post, please feel free to share with friends and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Why have you used 1942 as the end date for World War II? You could argue that the Battle of Stalingrad (1942) was a turning point, the official end of the WWII was in 1945.

Do consider that you're looking at the US.

It was the rising power, the apex power, at the end of the WWII with huge portions of the Global GDP - more than half by some estimates - and immense military power combined with a domestic economy that was merely retooled for war instead of ruined utterly lack a number of other countries.

Using it as the reason to stay invested seems deeply unwise.

I do agree with you that we must stay invested, but I don't quite agree with your reasoning in the article.

Thanks for your work in writing it though.