Great investments are a natural byproduct of great thinking. Our focus needs to be on the latter.

This week I have been reading “How to Fail at Almost Everything and Still Win Big” by Scott Adams, the creator of Dilbert. The most interesting bit of the book is when he talks about the superiority of focusing on designing and executing systems versus chasing goals, in the pursuit of success and of a good life.

Adams says that if you pursue goals, you find yourself in a state of constant pre-success failure, until you achieve your goal, only to then move onto the next one once you achieve it. This tends to have a great toll on your energy levels, which paradoxically decreases your chances of achieving success and enjoying life at all (guilty).

On the other hand, Adams argues that if you choose to put great systems in place instead, you can feel good every time you execute according to your system. In such a scenario, every little action propels you forward and also increases your energy levels, increasing your odds of success through time.

The most immediate analogy I can find of this in my life is fitness. When I was chasing aesthetic goals, fitness would constantly elude me. Working out and keeping a diet sucked. When I “upgraded” to focusing on living a healthy lifestyle, fitness began to gravitate towards me.

In investing, more so in the case of public companies, we formulate hypotheses and then perform transactions in the market to express them. In this dance, there are two things we cannot control:

How the fundamental value of our investment will evolve through time.

The price the market may choose to assign to it, even regardless of how #1 evolves.

In investing, it follows that the only thing we can control is our thinking and our day to day actions to make it better. If our investment hypothesis is right, through time the fundamentals will improve and the market will tend to price this in. However, in the short term the only feedback we get is noise and as you may recall from the last few weeks, quite a lot of it.

Prices go up and down and we are left wondering, often for years on end, if our thinking is solid or not. If we pursue goals, we effectively leverage the market´s noise against us, using it to debilitate our tenacity, mental agility and energy levels. If we focus on getting smarter, however, we win every day and radically increase our odds of making some great investments down the line.

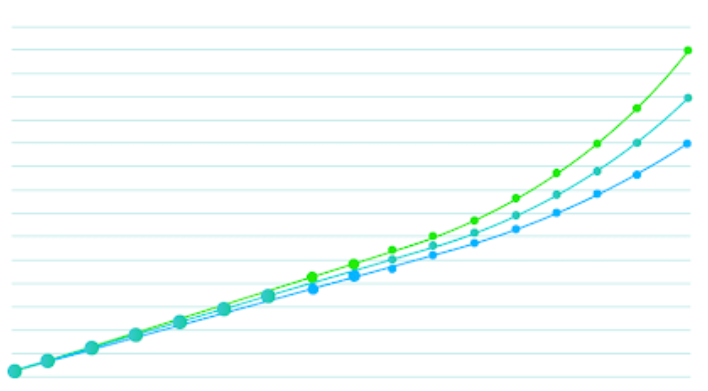

Compound interest applies to all domains of life. We tend to get exponentially smarter by learning new things everyday and parabolic returns are “just” a natural byproduct. If we give to much energy to the market´s “noise machine”, we lose out on an exponential amount of internal progress over the long term, which invariably caps our returns.

The summary of the above mental model is simple. Much like the price of a given stock tends to match the evolution of the underlying company´s fundamentals, our investment success tends to match our mental, emotional and spiritual evolution.

To achieve investment success and live a joyful life, it seems that we are better off placing a focus on our internal development versus worrying about what the market does at all. Easier said than done, however.

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

I really like the way you look at things, Antonio! Keep up the great work and many thanks for sharing your thoughts

Wow, inspiring! Many people think that investors are just people who want to make the most profit quickly. I believe that investors get good at thinking clearly and for that I believe that the focus should be on yourself and others first and then on the market opportunities.