No time to read the update? Watch/listen for free:

Edited by Brian Birnbaum.

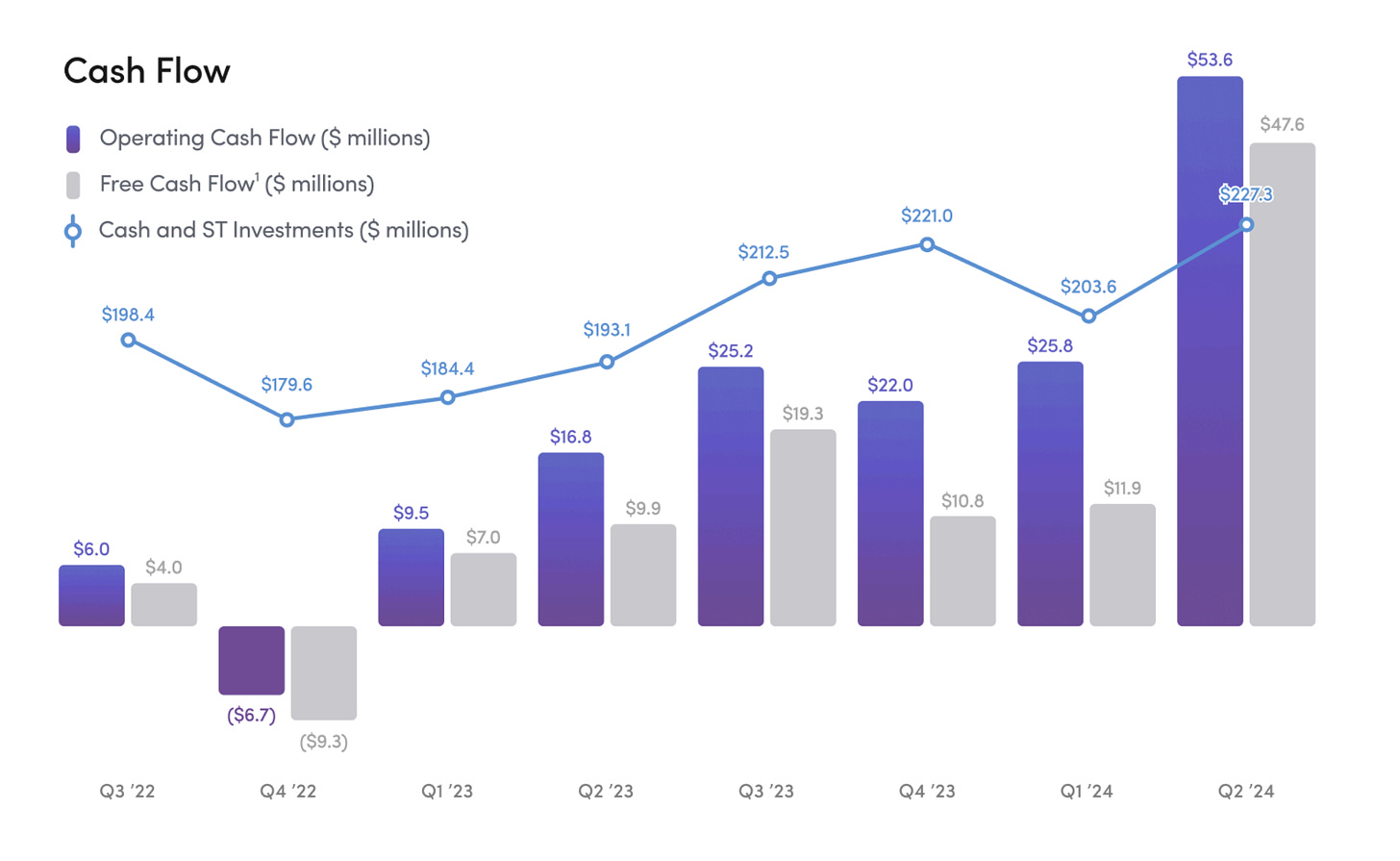

Stock prices track free cash flow per share levels over the long term. As you can see in the graph below (in grey), Hims’ quarterly free cash flow has grown from $9.9M to $47.6M in a year. This is 480% growth year over year, which points to management’s notable ability to deploy capital in the healthcare space. In turn, total shares outstanding have only increased from 211M to 217.1M in the same period.

These dynamics continue driving free cash flow per share. Assuming the company can also continue deploying and converting capital into greater free cash flow, investors will inevitably enjoy a higher stock price over the long term–with or without GLP-1.

The free cash flow growth is indicative either of a defensible and scalable operation or of the fact that the $4T US healthcare industry has little interest in Hims’ operations. Statistically I tend to believe the former is more likely. (For example, Walmart shut down its telehealth operations this past April.) Susceptibility to competition would likely stifle free cash flow growth.

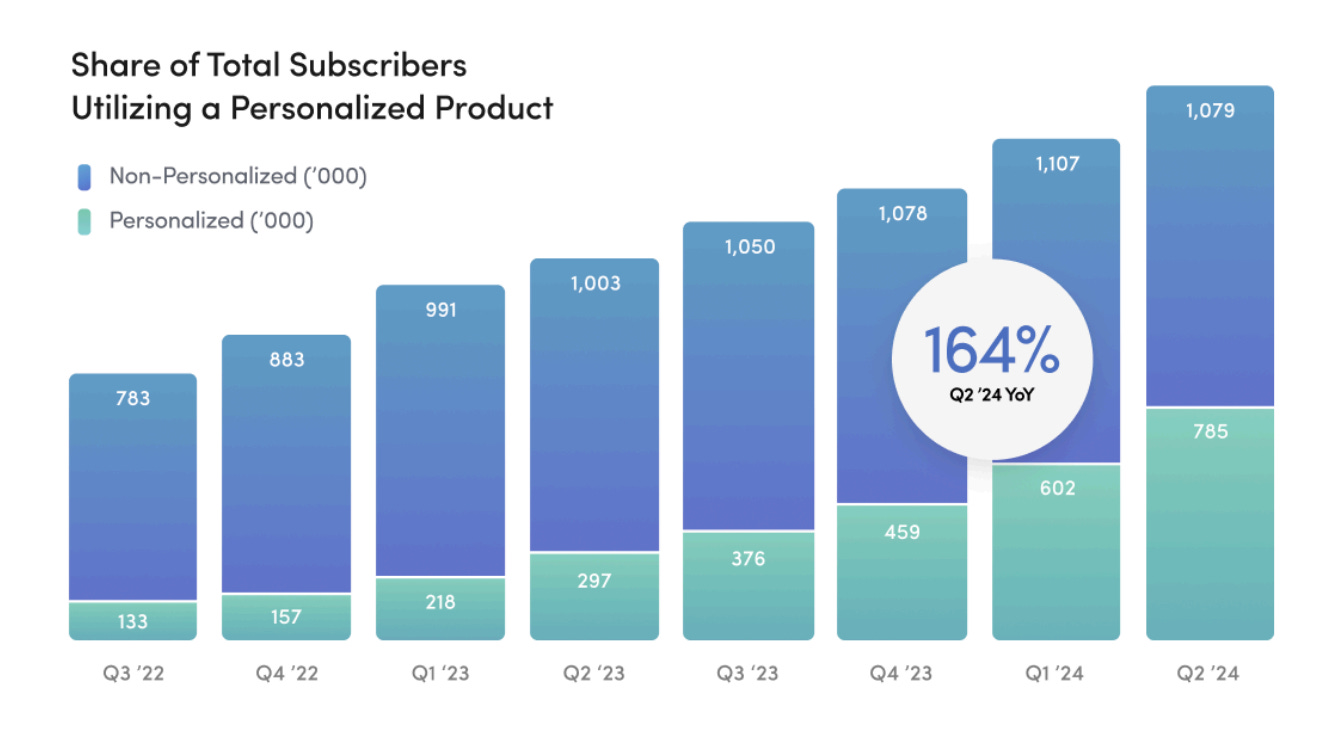

The below graph depicts the percentage of Hims subscribers receiving personalized treatments increasing from 22.8% to 42.1% over the past year. Personalization makes the operation harder to imitate and also makes outcomes better for patients, because dosage is as important as selecting the appropriate medication. The rising personalization thus continues to strengthen the moat and increase the rate at which Hims compounds goodwill with customers.

Meanwhile, the market continues to speculate about the GLP-1 business. The temporary buzz around GLP-1 ignores the company’s true bull case. Beyond personalization, the main driver of the business is the speed with which Hims launches and grows new verticals. By launching verticals more rapidly than the competition could even hope to, Hims increases ARPU (average revenue per user) and, thus, free cash flow levels quicker than otherwise.

Historically, it’s taken the company just under two years to grow a new vertical to meaningful scale. Hims launched its weight management business seven months ago and the operation has scaled to 100,000 customers and a $100M revenue run rate since, thus achieving material scale in approximately one third of the time.

It’s possible Hims rushed to market at a greater pace than usual to beat the temporary protections for compound producers while the drug maintained its legal shortage status. Still, the capability to execute at such speeds implies that the business will accelerate considerably going forward.

As a result, free cash flow per share levels are set to rise faster than we have seen over the past year.

Additionally, the market is thinking about the GLP-1 business as a one-off operation driven by supply shortages. The business is in fact similar to the other verticals, in that it comes down to providing better patient outcomes in an increasingly convenient and affordable way. Hims gives physicians and patients access to the nuance required to minimize side effects and maximize outcomes.

Here’s what Andrew said about this during the Q2 earnings call:

I'd start by saying we're currently still seeing (and wouldn't expect this [to] change) thousands of patients coming to us every day, struggling to get access to these GLP-1s, including tirzepatide.

[…]

I think there's really [an] established precedent with regard to the compounding exception, which allows for this level of personalization that we've spoken about for patients that need it.

And I would expect that the clinical necessity of that will be really clear. With these medications, as people know, there are real side effects. There are really no one size fits all dynamic. But we think there’s a really robust platform that extends well beyond the shortage [dynamic] across a number of these avenues.

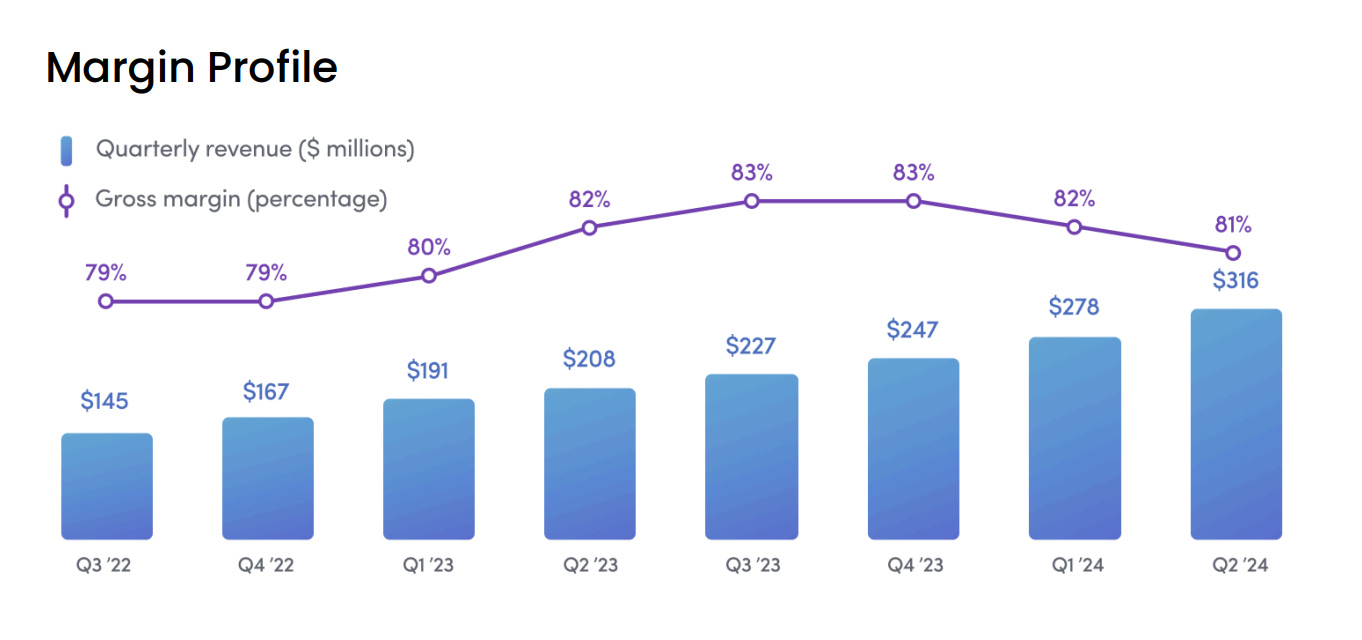

The bad news is that management expects gross margins to continue declining as the weight management vertical continues to scale up. In the graph below you can see how gross margin has been trending down, declining from 83% in Q4 2023 to 81% this quarter. According to management, it usually takes Hims time to optimize the gross margins of a given vertical and the rapid growth of the weight loss vertical is weighing gross margins down.

Here’s what CFO Yemi Okupe said about the matter in the Q&A section of the Q2 earnings call:

And so I think as the cost structure stands today, on a gross margin basis, GLP-1s, you do have a dilutive effect on the gross margins.

I think we're confident that as we continue to make investments in verticalization, optimizing processes, continuing to look for optimization opportunities across the logistics, the economics and what we've observed in other specialties as they started to season the bid will only mature.

And so I think that the price points that we put the GLP-1s at are a reflection of us being able to utilize this muscle historically in the past.

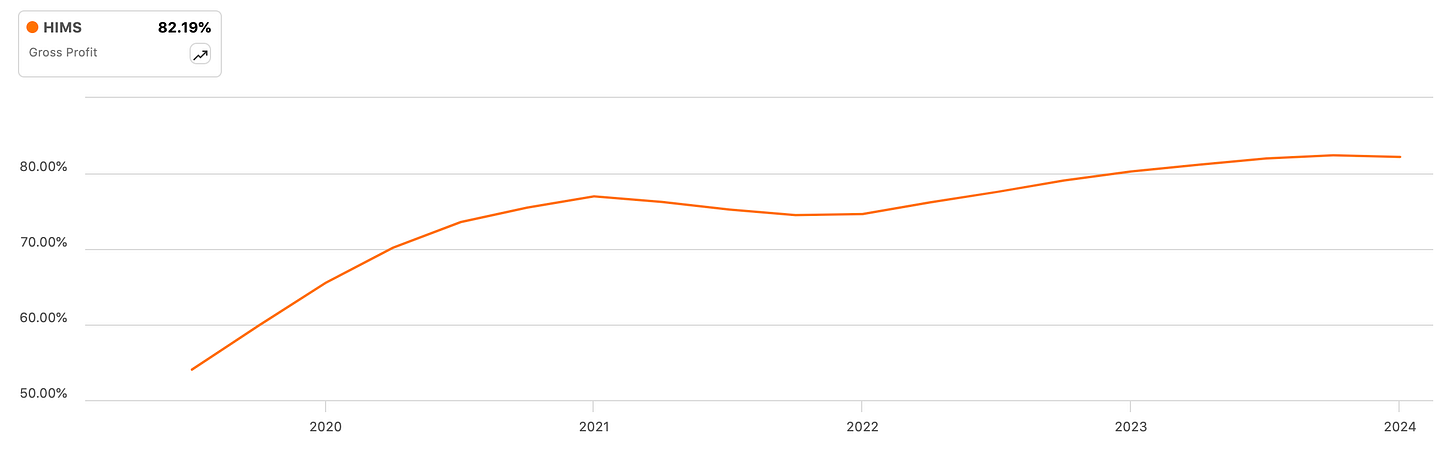

The graph below supports Hims’ noteworthy track record of optimizing margins. As I’ve explained in previous deep dives, Hims has managed to increase margins and eventually print cash while assembling a highly complex, vertically integrated infrastructure. Thus, I am currently comfortable betting on management’s ability to fix the presently dilutive nature of the weight loss business, as the gross margin level.

One last thought experiment: Younger companies prioritize growth over maximizing free cash flow. They choose to invest back into the business rather than retain cash or return it back to shareholders through dividends and buybacks. That’s why it’s critical, when analyzing a company’s financials, to read between the lines and put each item in context.

Hims is spending roughly $300m per year on marketing–and to good use, as it’s translating directly into strong revenue growth. (Many capital-intensive companies would show this sort of investment as CapEx, which would produce higher levels of net income–and thus a higher tax bill–which further lends to many tech companies’ optically higher multiples.) Since marketing is a completely discretionary operating expense, Hims could, if it wanted, instead retain that $300m, which would fall right to the bottom line.

Meaning, Hims has the capacity to trade at a P/FCF multiple roughly 10X. Hims is 100% correct not to do so. The value of the business relies on investing this capital back into operations. But as a thought experiment, we can see that Hims is actually quite cheap when seen under this lens.

To conclude, I remain long Hims because I believe that free cash flow per share levels will continue trending up. The company’s core value drivers are accelerating, and it looks like Hims will be deploying and maturing verticals at a faster rate. As a result, I expect free cash flow per share levels to increase non-linearly over the coming five years.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc