Edited by Brian Birnbaum and an update of my original Hims deep dive.

The 503A exception gives Hims’ GLP-1 business a viable path forward, further augmenting its capacity to offer personalization at scale. Free cash flow per share is up 371% YoY (including a tax benefit this quarter) and, as we know, nothing drives stock prices over the long term more than FCF/share.

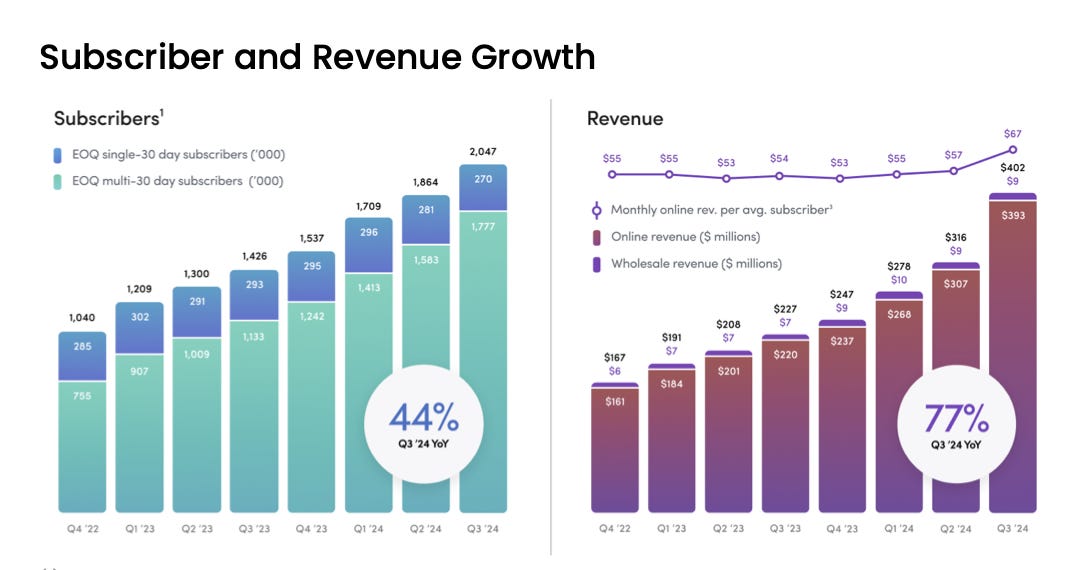

Contrary to current market sentiment, Hims is not a GLP-1 company. Subscribers grew 44% YoY including GLP-1 related offerings and 40% YoY without. The primary driver of Hims’ financial performance continues to be the expansion of its online subscriber base. Further, this base continues to engage with a broadening range of healthcare verticals, far beyond weight loss alone. The market is totally misunderstanding Hims’ approach to the weight loss vertical, addressed herein.

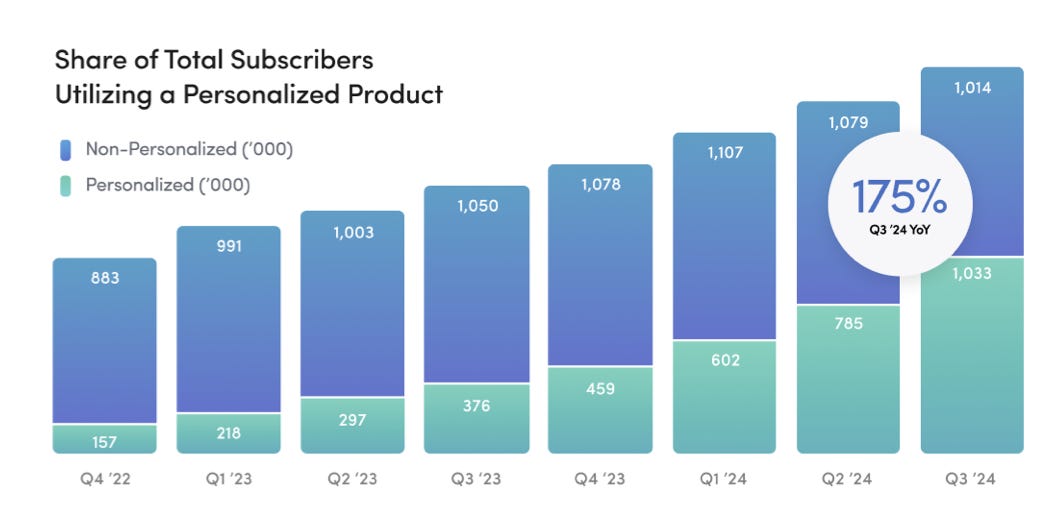

Hims remains focused on increasing personalization and therefore expanding its moat. At the end of Q3, just over 50% of subscribers were utilizing a personalized subscription. This accomplishes two things

Broadens the customer set that Hims can address with each specific offering

Increases retention rates

By personalizing dosages, for example, Hims can both provide cures and preventative methods at marginal cost. This effectively expands the SAM (serviceable addressable market). In turn, personalization drives higher retention by increasing customer satisfaction and customer lifetime value, all of which makes it harder for competitors to replicate the operation. As of Q3 , 65-70% of new customers had chosen personalization.

For example, according to management some Hers dermatology subspecialties have seen annual retention rates expand 20%+ YoY. Meanwhile, the overall percentage of personalized subscriptions increased 40% YoY–to approximately 70% of all subscribers within the specialty. As Hims continues to innovate and increase its efficiency it will deliver personalized services to more and more people. This dynamic is likely to compound across its growing volume of specialties, as more subscribers opt into multi-condition treatments. As of Q3, nearly 300,000 subscribers were being treated for two or more conditions on the platform, including subscribers on a single treatment with multi-condition capabilities - meaning they get one condition treated with a number of active ingredients.

In its myopia, the market fails to see Hims as a machine that delivers better patient outcomes at a lower real price over time. As proof of the first element of the equation (outcomes), consider the retention rates in GLP-1 treatments. On average, less than 70% of Americans continue GLP-1 treatment after four weeks–a number that falls to 42% after 12 weeks. On the other hand, 85% of GLP-1 patients continue with Hims through four weeks and 70% after 12.

With failed adherence to medication being the primary impediment to treatment, it’s quite simple to interpret Hims’ effect on patient outcomes.

Hers offers our first testament to the second element of the equation (prices), having finished Q3 with 400,000 subscribers, with the average household income coming in at $50,000. Hims’ pricing represents the first ring around the castle. Combining rising personalization and better outcomes, Hims is essentially executing the same algorithm as Costco, but for healthcare, making Hims potentially resistant to periods of economic hardship. I believe folks with higher incomes will tend to default to Hims during times of recession, too.

In Q3 average revenue per subscriber ticked up to $67 from $57 in Q2 2024, but to the market’s credit much of that seems to be due to GLP-1. According to management, this increase was driven by a continued shift to more premium personalised offerings, which has offset the longer duration commitments that carry a lower average monthly price. And by the success of the weight loss offering, since the GLP-1 offerings start a higher price point than their other offerings, which have ranged from $35 to $55 per month. On the other hand, the oral weight management offering starts at $79 per month and the GLP-1 offering starts at $199 per month.

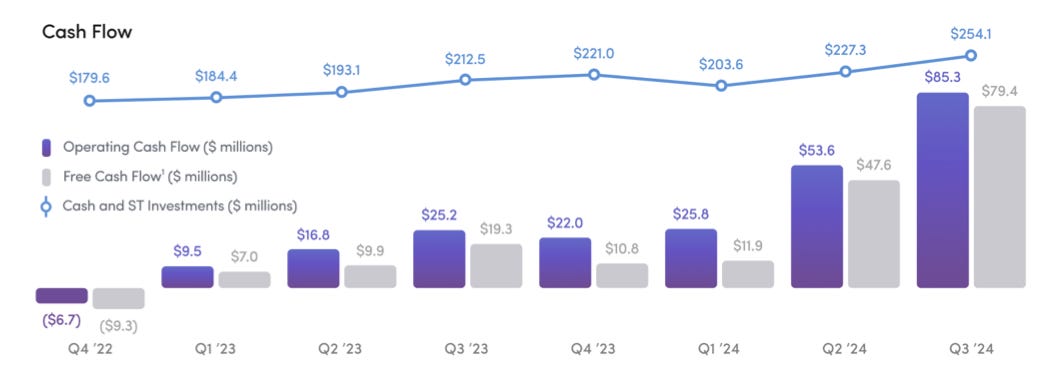

The GLP-1 success thus seems to be driving some of the cash flow production delta QoQ, which you can see in the graph below. In Q3, net cash provided by operating activities was $85.3 million, an increase of 238% year-over-year. Free cash flow in the third quarter was $79.4 million, an increase of 312% year-over-year. Meanwhile, total diluted shares outstanding, which includes SBC (stock-based compensation) have increased from 210.1M to 235.1M YoY, with free cash flow per share thus rising from $0.092 to $0.363 YoY, increasing 371% in a year. In Q3 2024 Hims received a $60.8M tax benefit which has aided the cash flow production, but the trend remains appealing.

The question is, therefore, what is exactly the viability of GLP-1 revenues? At present, Hims has two paths forward to continue growing its GLP-1 business, which are not mutually exclusive:

Semaglutide shortage: Hims & Hers is currently offering compounded versions of semaglutide, the active ingredient in medications like Ozempic and Wegovy. This is permissible because semaglutide remains on the U.S. Food and Drug Administration's (FDA) drug shortage list. Once semaglutide gets removed from the shortage list, Hims can’t continue selling it.

The 503A exception: This allows Hims to create compound weight loss drugs, regardless of whether the active ingredients are in the shortage list or not, so long as:

The medication is compounded for an identified individual patient based on the receipt of a valid prescription order and the formulation or dose is not available commercially.

The compounding must adhere to the United States Pharmacopeia (USP) chapters on pharmacy compounding, ensuring quality and safety standards are met.

The active ingredients used in compounding should comply with USP or National Formulary (NF) monographs, or be components of FDA-approved drugs, unless otherwise specified by the FDA.

The above means that if and when semaglutide gets removed from the FDA shortage list, Hims can continue delivering GLP-1 equivalents to its subscribers, in a personalised manner. Since its platform’s personalisation capabilities are getter better over time, this path is a viable one for Hims to continue growing the GLP-1 business regardless of whether semaglutide remains on the shortage list or not. Thus, the 503A exception allows Hims to perfectly leverage its personalisation at scale capabilities to continue developing its weight loss business over time.

Additionally, Hims management announced in the Q3 earnings call that they will be bringing liraglutide, the first generic GLP-1, to the market in 2025. They allegedly already have a confirmed supplier and expect to finish “complete testing and batch validation” over the next few months. Thus, the 503A exception combined with liraglutide gives Hims a fully viable path forward under normal legal circumstances for its GLP-1 business, regardless of the FDA shortage list. During the Q&A section of the earnings call, CEO and founder Andrew Dudum shared some insightful remarks about this topic:

The compounding exemption, whether or not on shortage or not, has always allowed for the personalisation when clinically necessary and this can be in form factor, it can be in doses, it can be in combination therapies, there's very well-documented and outlined aspects of the compounding exemption for which are allowed and necessary for clinical flexibility.

[…]

And so the ability to really customise that level of care, we think is very well-respected precedent, very much within the bounds of the compounding exemption and we also believe it's very well-respected across all the parties in the industry.

In 2021, Hims & Hers Health, Inc. acquired Apostrophe, an Arizona-based 503A compounding pharmacy. This acquisition provided the company with compounding capabilities and expertise that serve as the foundation for many of its personalised offerings today. In the Q3 earnings call, Andrew stated that Hims is actively investing in this facilities today and that the company expects the facility to enable them to continue offering personalised weight-loss solutions “over the long term.”

I’ve gone deep into the regulatory aspect of the GLP-1 operation out of curiosity, because before investing I made sure that I could totally trust the management team to navigate the regulatory space, together with the other complexities involved in the business. However, I’m fascinated to see how neatly they’ve managed to craft a path forward for the GLP-1 business. This increases my confidence in the management team further, together with the aforementioned rising personalisation levels and overall brilliant execution.

Personalisation is therefore the way forward for Hims in general. In the earnings call I was delighted to see management state that they expect a significant increase in CapEx in Q4 2024 and that it will be directed towards increasing personalisation capabilities and towards increasing automation levels at facilities. An integral part of the Hims thesis is the company reinvesting more capital over time into improving its operations, but CapEx has been relatively low for the past two quarters. Instead, in Q3 Hims has allocated capital towards buying 1.9 million shares at an average price of $15.83 per share, seeing a “meaningful disconnect” between the market and the intrinsic value of the stock.

Lastly, Hims is exhibiting attractive operating leverage, with both GAAP and non-GAAP operating expenses trending down as a % of revenue. G&A costs as a percentage of revenue improved 5 points year-over-year and 2 points QoQ to 11%. Operations and support costs as a percentage of revenue improved 2 points YoY and 1 point QoQ to 12%. Most importantly, marketing expenses as a % of revenue improved 6 points YoY to 45%, achieving a new record in marketing leanness for the second quarter in a row.

According to management, the increased leanness in the marketing budget is due to the following factors:

Personalised solutions increasing retention rates, thus reducing marketing spend as a % of total revenue.

Spending marketing dollars on more “cost-effective channels.”

Customers feeling more “comfortable” discussing their experiences with friends, as Hims moves towards categories will less stigma.

Accordingly, management expects to drive one to three points of marketing leverage per year going forward, achieving an EBITDA margin of 20% by 2023. The first time I studied Hims, the company’s reliance on paid marketing was my primary concern. But having once I saw management’s superior ability to execute on that front (and others that are essential to the operation), I was happy to invest. The rising marketing leverage gives me further confidence that this is an extraordinary management team, as well as the aforementioned execution with the 503A exception.

In all, I see Hims executing the algorithm as Costco, but for healthcare. The number of subscribers on the platform and their average spend continues to trend up. In turn, management continues to exceed my expectations every quarter and my confidence in totally delegating on them continues to rise. Lastly, in general there are many possible ways to look at SBC (share-based compensation). My view is, much like in the case of regulatory complexity, that there’s no substitute to finding a management team that you can trust.

Diluted free cash flow per share is up 371% in a year (including the $60.8M tax benefit in Q3 2024) and there’s a infinite number of new healthcare verticals that Hims can deploy over time, so I’m a happy shareholder.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Can I ask what you mean by the same algorithm as Costco ?

Genial artículo Antonio, como siempre. Sigue así!