Summary:

GPRO 0.00%↑ has burnt a lot of investors in the past. For this reason, its current turn around is being mostly overlooked. Action cameras are here to stay, since they enable the creation of top quality content and today, content is king and equivalent to cash.

$GPRO has a very strong moat and is turning around quickly, delivering higher margins, a growing ARR and an increasingly leaner OPEX. Its balance sheet is rock solid and has a strong ability to produce cash.

$GPRO has considerable pricing power and may serve as an inflation hedge.

$GPRO looks very undervalued and has a long growth runway ahead. This is likely to be an asymmetric investment opportunity.

Buying Opportunities Arise in Times of Desperation

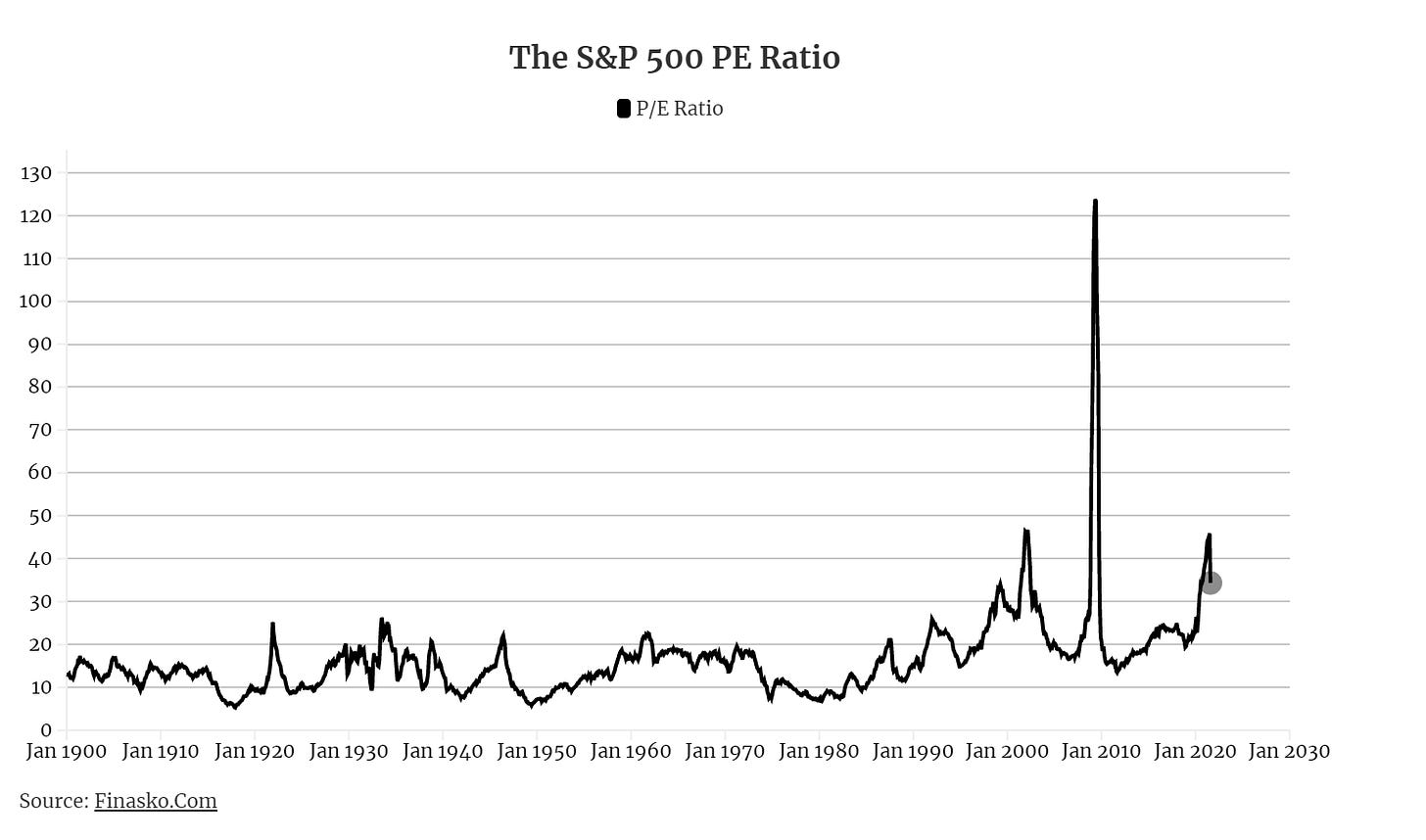

I am a devoted student of Benjamin Graham and as such, I spend a lot of time looking for under priced value. I truly believe that the only way to make money in investing is to buy assets below their fair value, but is that even possible in today´s market? It is charming to read about the man´s adventures back in his day, finding plenty of companies selling for less than their net cash positions and similar bargains. This was due to the dominant pessimism at the time (The Great Depression), which led market participants to overlook value in general. In the last few decades, we have witnessed somewhat of an opposite scenario, judging by the SPX P/E ratio.

GoPro, on the other hand, has induced considerable pessimism amongst its shareholders (and spectators) over the last decade, with its share price dropping around 90% from ATH. Since, the $GPRO story has been:

Smartphones have killed / will kill action cameras.

The company is therefore going to die.

The pessimism that has settled around the company has been sufficient to keep most market participants from looking under the hood and so far, $GPRO´s turn around has gone largely unnoticed. The market´s main existential concern with $GPRO (point 1 above), has been rendered false with the passing of time, as I shall explain below.

The company is also transitioning from purely selling hardware (cameras) to providing an exhaustive content creation ecosystem, with higher margins and recurring revenue. This pivot has been producing amazing results for a number of quarters now and the share price today seems to not reflect these fundamental advances, to our advantage. Let´s look under the hood.

Addressing the Existential Concern: Content is King

In today´s world content is directly equivalent to money. This is because selling anything online requires producing and distributing content of the highest quality possible, in order to captivate the attention of potential buyers. This was previously the case (TV ads, for instance), but is now considerably more so due to the pervasiveness of social media.

If you haven´t tried it for yourself, producing content is actually quite a hard thing to do. For this reason, specialized tools are often preferred by content creators, to make their lives a bit easier. As an analogy, consider running. Whilst it is true that you may go jogging with the same sneakers you wear to the club, for instance, if you go jogging enough times eventually specialized running shoes are preferable and worth paying for. You end up paying considerable premiums to avoid getting blisters on your toes or to avoid damaging those cool sneakers.

Exactly the same thing happens with “action cameras”. I use quotations because in fact they are high performing content creation devices, not just action cameras. If you make content for a living, you want the best content creation tools. You can indeed create content with your smartphone, but you will end up getting mental blisters or damaging your phone. Even worse, you may receive an incoming call when you are producing content. Now, not everyone makes content for a living and for this reason, $GPRO´s TAM is never going back to the TAM the market was thinking about when it was pricing it at around 90$ a share, but it certainly is not 0 (which is what a P/S ratio of 1.40 tentatively points to) because there are plenty of content creators out there and content is king.

Identifying Value: the Un-obvious Moat

If action cameras are here to stay, because they make the creation of valuable content easier, then what makes $GPRO valuable particularly? Because what it does, is in alignment with how it does it and why it does it. This produces gravitas. In such scenarios, this gravitas is capable of producing a moat, because it yields such a powerful brand.

Consider $AAPL. We don´t care if HP launches an amazing smartphone tomorrow, which is twice as good as the iPhone and half the price. If HP launched such a phone, most of us would still prefer to buy the iPhone because it inspires us and has tremendous gravitas. In reality, the iPhone matches this gravitas with an equal or superior product quality and HP does not in fact produce better phones than $AAPL - the why, what and how are in alignment. The iPhone is probably the best phone, but on top of that, we feel the most inspired by it and that is why we pay a growing amount of money for each model.

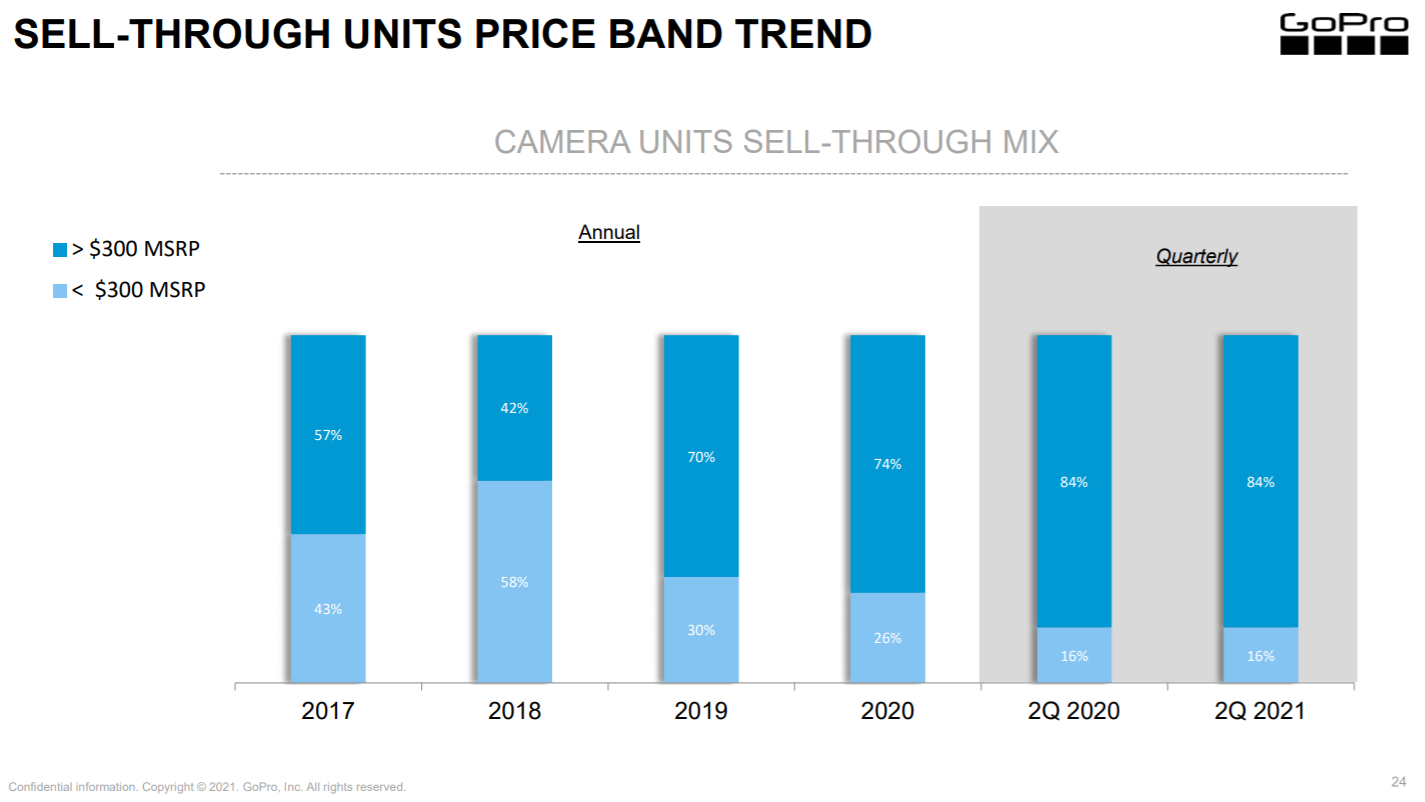

In the TAM-reduced world of “action cameras”, $GPRO cameras actually occupy the same spot as iPhones in the smartphone world. Of course $GPRO has plenty of competition, but its managed to shed off attackers of all sizes all these years. As evidence for the above, consider the rising ASP of their products. A rising ASP reflects many things, but fundamentally it means that $GPRO has pricing power. The pricing power stems from $GPRO consistently minimizing the amount of work content creators have to put in to produce top quality content and equally inspiring them to do their best work. The above may act as a solid inflation hedge going forward as well.

Materializing the Turnaround

Having identified $GPRO´s source of deep value, we can now look at what has changed in terms of execution. The turnaround has 3 main components:

New focus on premium hardware renewal. The company is delivering increasingly premium devices that super serve its core customers.

Pivot to D2C / subscription business model, which is enabling $GPRO to become a content creation ecosystem provider, versus a straightforward hardware provider. This is translating into higher margins.

New management, with Brian McGee effectively running the company (in my opinion). The past couple of years are full of signs of the company being far better managed.

The 3 components above are yielding the following:

Growing margins and decreasing OPEX.

A healthy balance sheet, with signs of improved management.

A growing ability to produce cash.

Ultimately, a growing fundamental value per share.

Before getting into the 3 components of the turnaround in depth, let´s browse through the results obtained so far first.

Growing margins, Lower OPEX

Over the past 5 quarters we have seen $GPRO steadily increasing its gross margin, hitting almost 40% in the last quarter.

Looking at annual figures, we can clearly spot the mismanagement that has brought the company much of its bad reputation. In the past few years, however, we can already see clear signs of better management, with annual gross margins beginning their ascent and OPEX going in the opposite direction.

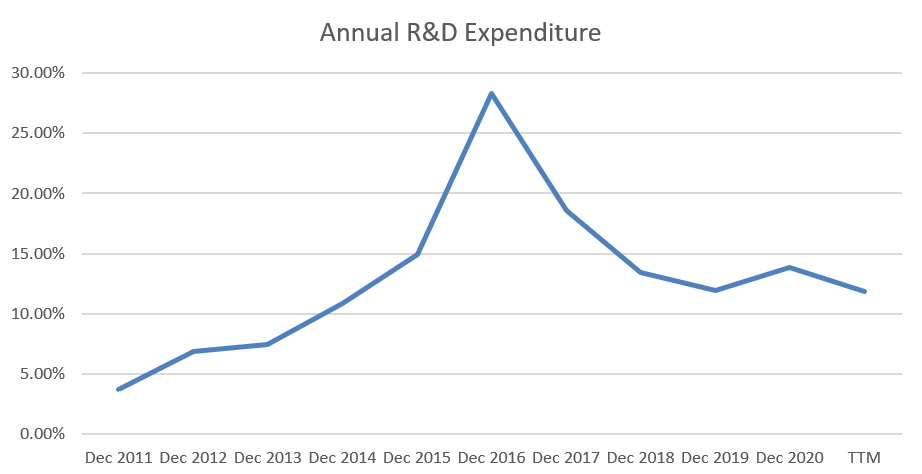

It is also revealing to see the company’s R&D expenditure decreasing, as the ASP of its products reaches ATHs. This indicates a highly optimized R&D department, which in my experience tends to point to a healthy and functional corporate culture.

A healthy balance sheet, with signs of improved management

$GPRO has historically had enough cash to pay the bills and continues to do so. Additionally, with a quick ratio of 1.25, it has sufficient cash to meet its immediate needs.

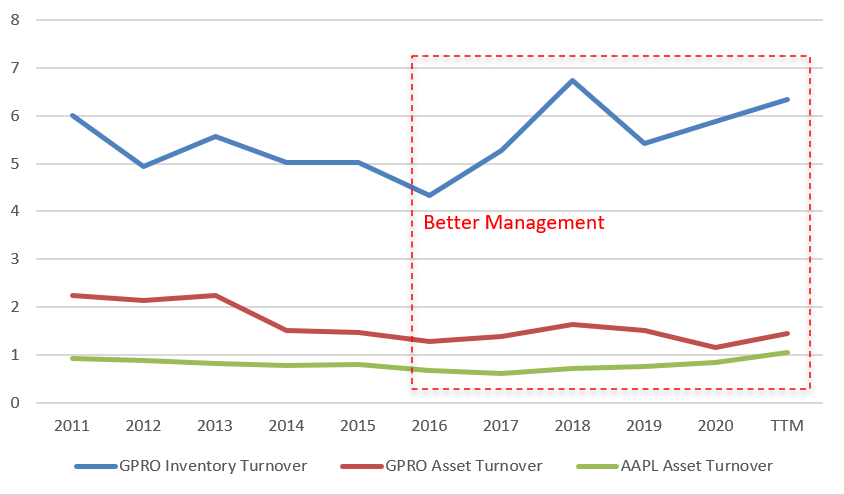

In the TTM, $GPRO exhibits metrics that suggest the balance sheet is being better managed. Inventory turnover is increasing and whilst asset turnover does not show such a favourable trend, it still is somewhat better than $AAPL´s, which is a similar business. I learnt about this in this video, by Robert Reynolds.

A growing ability to produce free cash flow

Past performance does not necessarily reflect future performance. Whilst $GPRO´s cash generation has been weak in the past, it looks like it is now poised to produce cash generously.

Evidently, something is happening inside the company that´s delivering better results. The investment case does not depend on any complicated quantitative reasoning, but rather on a qualitative understanding of what is producing these advancements and why they are going to keep on delivering for the long run. As I have explained previously, the turnaround is based on 3 core components, that capitalize on $GPRO´s deep value. Let´s take a look at them.

New focus on premium hardware renewal

$GPRO is delivering better cameras . For a while, during the company´s mismanagement era, buying another GoPro camera each year did not make much sense for consumers.

This is further differentiating $GPRO from the competition and serves to increase margins and enhance the moat.

Pivot to D2C / subscription business model

$GPRO is now going direct to consumer and has also been operating a subscription business model for a while. Previously, $GPRO was predominantly selling hardware through retail partners. These partners would take a cut of the final sale and would pose a number of inventory management challenges. Consumers would pay for a camera once and not come back for a while.

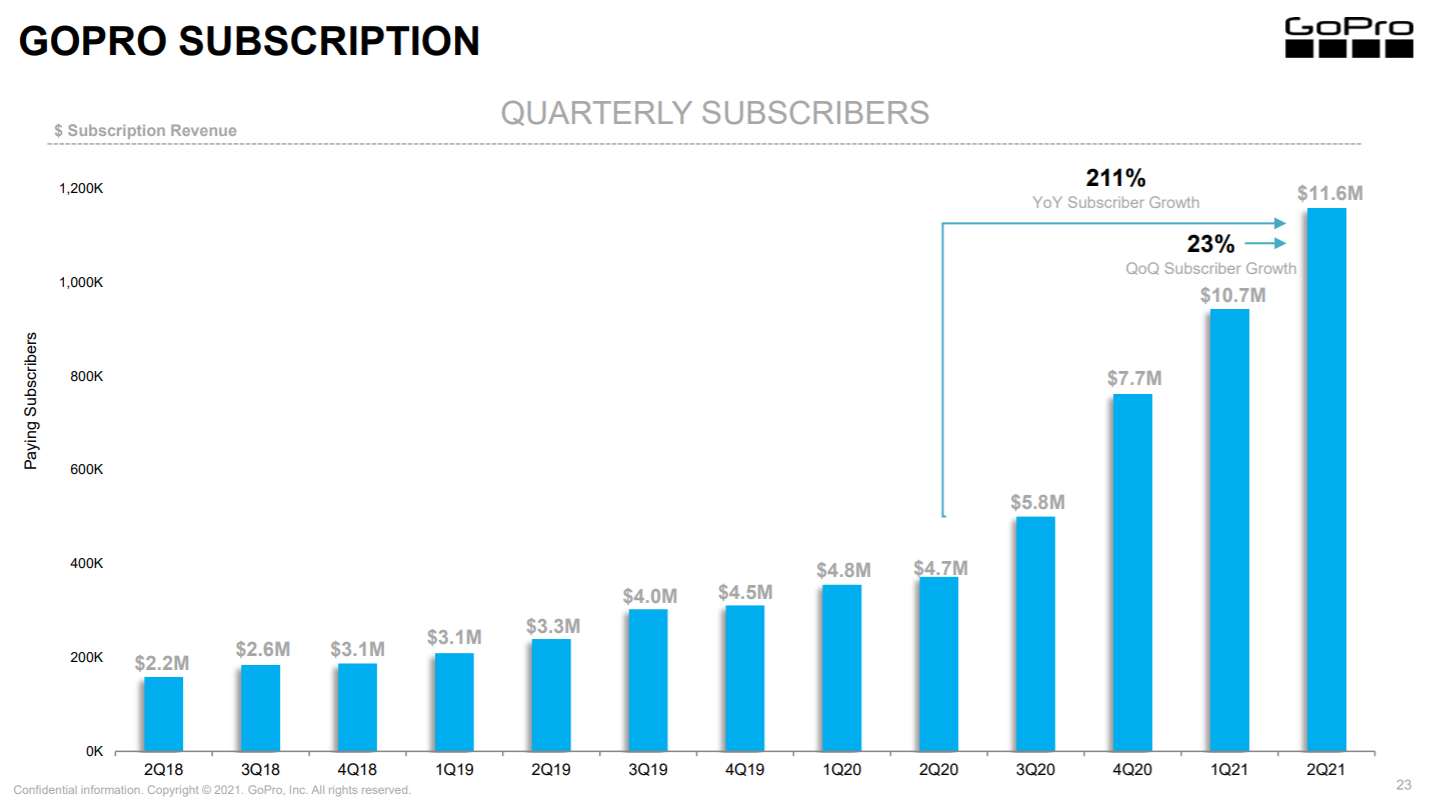

The shift to D2C / subscription is providing $GPRO with a growing ARR and higher margins. Through the D2C model (gopro.com), retailers no longer take a cut of the sale. $GPRO is actually using that cut to funnel customers into a 50$/year subscription service, which in my opinion, provides a great deal of value to customers. The subscription service includes unlimited cloud storage of footage, camera replacement and a 50% discount on gopro.com. The cloud storage alone is worth the annual subscription.

Furthermore, the subscription opens up an avenue in which $GPRO can continue to provide high margin digital services. $GPRO customers want to produce / distribute / monetize top quality content with the least amount of pain. The number of services $GPRO can throw into the subscription deal (and new subscription deals that it may role out) is endless. Per Brian McGee´s comments (COO & CFO), around 80% of the people that buy $GPRO cameras every year are new customers. On top of that, $GPRO has tens of millions of followers on social media. They can all be funnelled into the subscription service through time and for this reason, $GPRO now has a massive growth runway ahead.

New management

Nick Woodman has evidently mismanaged the company over the last decade. The graphs above speak for themselves. However, the man has succeeded at creating a very strong brand and may have also succeeded at appointing a world class operator to undo his mistakes. The more I listen to Brian McGee the more I am convinced that the company is in good hands now, with him at the operational driving wheel and Nick ensuring that $GPRO´s key source of value, its brand and its overall alignment, goes untouched.

When I made my first investment in $GPRO, back in Feb 2020, my impression of McGee was merely intuitive. Today, however, we have plenty of evidence that management is doing a good job. Firstly, the growing margins and increased leanness are evident signs of a good management. Another sign is the previously mentioned inventory and asset turnover metrics, as is the growing cash position.

Discrepancies between the share price and the share value

All the above would not be of immediate interest unless the company was selling at a meaningful discount. There´s plenty of complex calculations that one can perform to see if a security is selling under its fair value. In most cases, however, if one needs to do them then the security is probably not very undervalued.

$GPRO TTM revenue is 1,091.5m USD and it is currently trading at a market cap of 1,527m USD. Need we go deeper? The market is effectively pricing this company as if it were in liquidation phase. If the company is doing around 1b USD of revenue each year, then how much could the brand and the IP alone be worth, if it were liquidated today? Additionally, the brand is arguably far bigger than the business itself. This all equates to what feels like little downside.

Regarding the upside, $GPRO is above all developing a remarkable ability to produce cash. Its current cash position is 285.8m USD, which yields a net debt of -36.2m USD. $GPRO could totally pay off its debt right now and with the free cash flow it is producing yearly, then proceed to purchase around 10% of the stock´s float. For this reason, as the subscription business grows, a lot of the revenues it produces will be converted into free cash flow and this will invariably increase the intrinsic value per share. In the coming years $GPRO could hit a yearly FCF of 250-300m USD, with its subscription service hitting over 10m+ subscribers.

At a P/S ratio of 1.40, EV/FCF ratio of 7.66, $GPRO looks remarkably cheap compared to similar businesses such as $SONO, with a P/S ratio of 3.17, EV/FCF ratio of 15.58. For instance, should $GPRO yield a FCF of 200m in the coming years, with an EV/FCF equivalent to that of $SONO, the market cap of the company would be 3,116.0m USD, or twice the current market cap.

Subscription churn rate

Going forward, much of the bull thesis depends on the subscription’s churn rate, which $GPRO has not disclosed yet. This is data that I am going to be definitely looking out for. Qualitatively, however, I feel the subscription deal is a no-brainer for content creators. The value proposition is straight forward and the price is very competitive.

You can also reach me at:

Twitter: @alc2022

The drop in price could also be the reflection of increased competition from e.g. Apple where your phone camera is essentially everything waterproff and etc because of the technological development. I would rather call their moat narrow.