Note: this is an update to my deep dive on $GPRO.

Intro

I believe $GPRO is one of the most undervalued companies in the market today. It is currently turning around fast, has a far larger moat / healthier balance sheet than the market believes and is developing a remarkable ability to produce free cashflow. $GPRO is not going to be the next Apple or anything of the sort, but at a 1.36b$ market cap today, it definitely has a good 200-300% upside ahead, if the management continues to execute well.

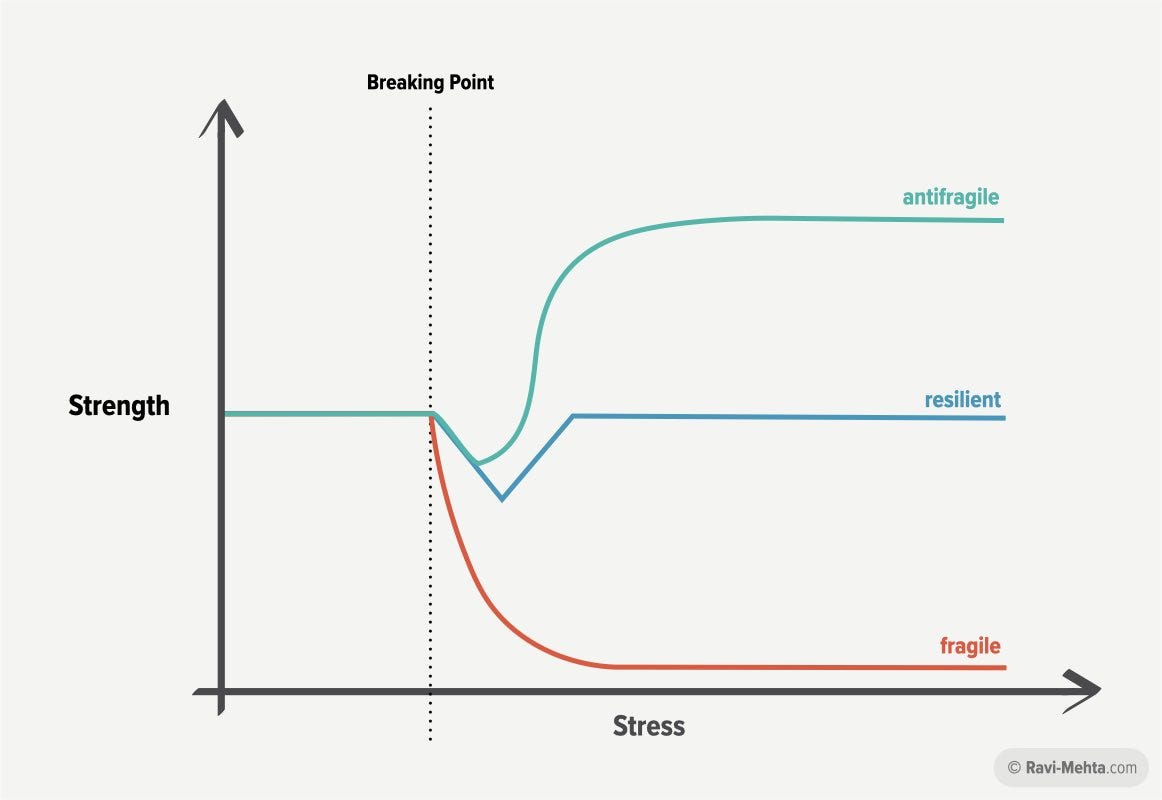

Below, I will address some topics that I continue to hear a lot about and I will try to explain why I believe the company is anti-fragile.

Addressing the Narrative

As the company continues to turn around, the main narrative in the market continues to be that:

Smartphones have killed action cameras.

The management is incompetent.

With earnings coming up on the 4th of November, this is an exciting and unsettling time for $GPRO longs. After having reached multi year highs in the YTD, the stock price has been languishing for months now (albeit on very low volume) and this is conducive to plenty of second guessing. Going into the earnings, I think this is an interesting time to briefly address the two bullet points above.

Action Cams vs Smartphones

As you may know if you read the deep dive, until recently $GPRO´s business model consisted uniquely in selling hardware units (cameras). Being caught up in the action in 2013-2015, I imagine it must have looked like every camera on the planet was going to be a $GPRO camera. Then smartphones really kicked into the space with top quality cameras and what I ultimately believe happened was that the TAM for action cams got reduced.

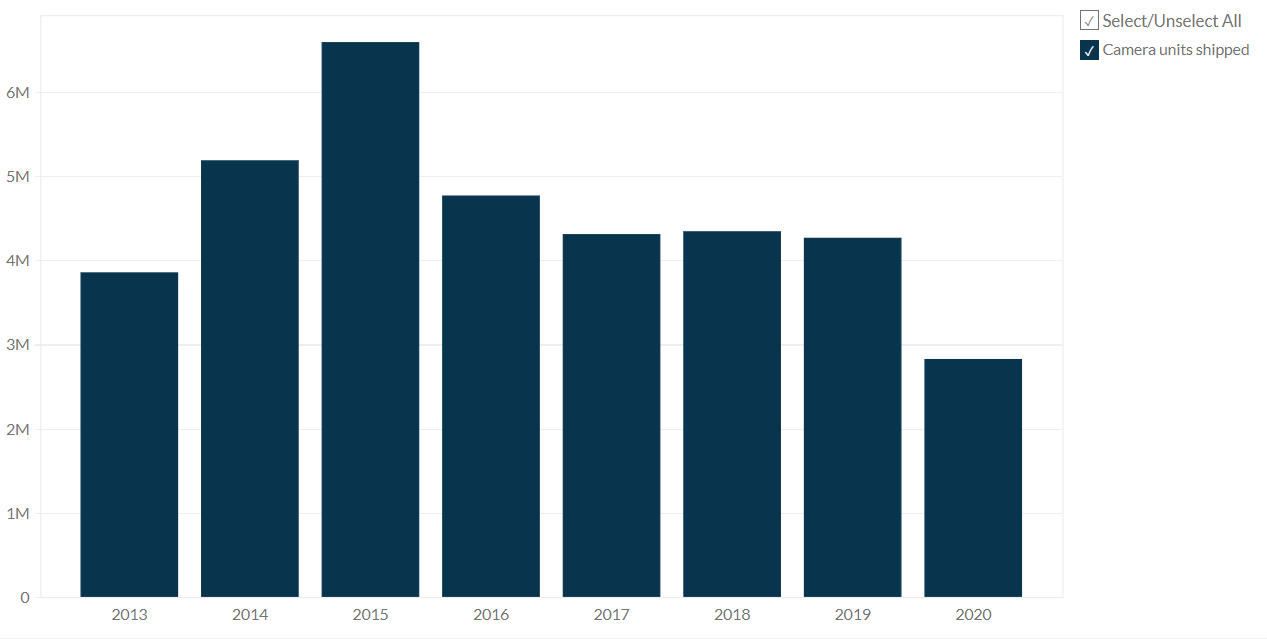

Unit shipments have been quite stable since then, with the exception of FY2020 due to the pandemic. I think the numbers here show that the demand for action cameras continues to exist, despite the vigorous proliferation of smartphones that we have seen over the past half decade or so (with around 7b smartphones in the world today). Qualitatively, since content is now king (or directly equivalent to cash), I think $GPRO cameras have their brightest days ahead of them still. They are after all premium quality content creation devices.

Management

As you can see the graph reflecting the units shipped per full year, 2020 was quite a blow for $GPRO, since its cameras are used for travelling by many. Nonetheless, the company seems healthier than ever. The good health of the company is evident by looking at its balance sheet, with a net debt of (36.2)m$ and 285.8m$ of cash in hand. The company has also produced 163.2m$ of FCF in the TTM, around 10m$ higher than in its former glory days (2015). This means it could pay off all of its debt, buy back a large % of the float some time after and still continue to operate.

How can this be? This is due to the transformation it is currently undergoing, which is yielding:

Higher margins and ARR.

A lower OPEX.

In my opinion, a much higher efficiency as a company, in terms of giving customers what they want cost effectively.

Ultimately, a healthier balance sheet, higher FCF / share and thus, a higher fundamental value per share.

Conclusion

So, even though the company has gone through what is in effect a worst case scenario for it, it has emerged stronger. To make my case, allow me to re introduce the graph I started this post with:

Which line do you think best describes $GPRO? Even though this is a high risk play, I continue to be comfortable holding the stock for the long run. Plenty of things can go wrong, but if this company has made it through such rough seas, I think that as long as the management continues to execute well, the stock price is likely to go up. Feel free to check out the deep dive re: valuation.

If you enjoyed this article, remember to subscribe for free to my newsletter for more!

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc