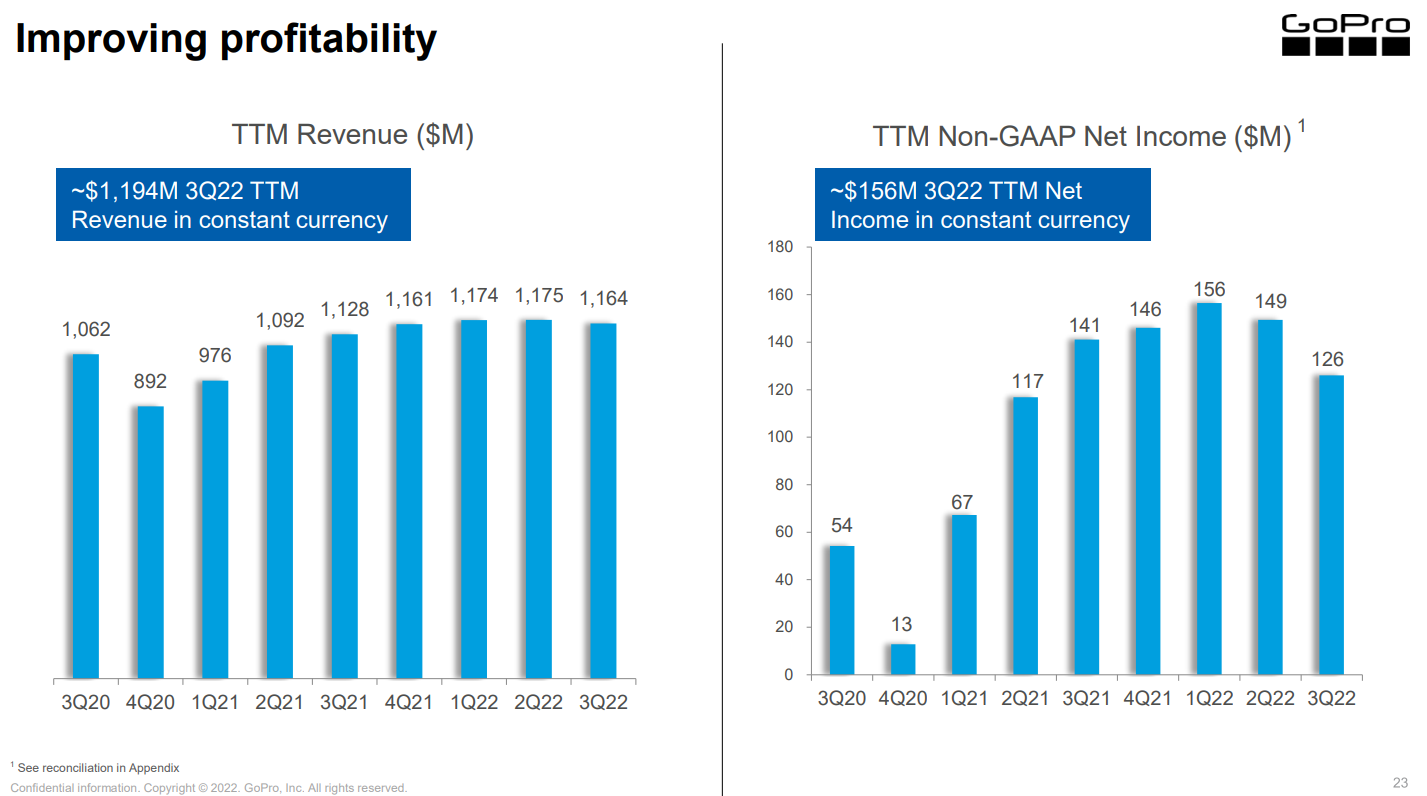

At this stage, GoPro has successfully transformed its business as I hypothesized in my original deep dive and continues to be radically undervalued. Whilst it has morphed into a lean cash machine, the thesis is now about to be stress tested as we fly into some macro dark clouds. Consumers are tightening their belts and the FX headwinds are strong. The latter seems to be compressing GoPro´s margins and is chipping away at the company´s ability to produce cash.

“We expect to exit 2022 with cash of approximately $400 million [~50% of its market cap today], which contemplates continued share repurchases with 68 million remaining under our existing program.” - Bryan McGee, COO @ Q3 2022 ER

The bedrock of this thesis, as well as the strategies outlined in my deep dive, is that GoPro customers are not what the market thinks they are. They are mostly well off content creators that happily invest in premium content creation tools and services come rain come shine, because it empowers them. This is nonetheless a qualitative observation of mine and throughout the next year or two, we likely see the truth.

If we do see a recession and indeed the bedrock is firm, the company will likely emerge just fine on the other side, with its nascent cash generating abilities even strengthened perhaps and in time, the market will weigh the company. Else, GoPro will tend to wither and fail. Additionally, since the turnaround begun, management has displayed excellent capital allocation and execution abilities. I remain confident in their capacity to manage the company going forward.

1.0 The New Business

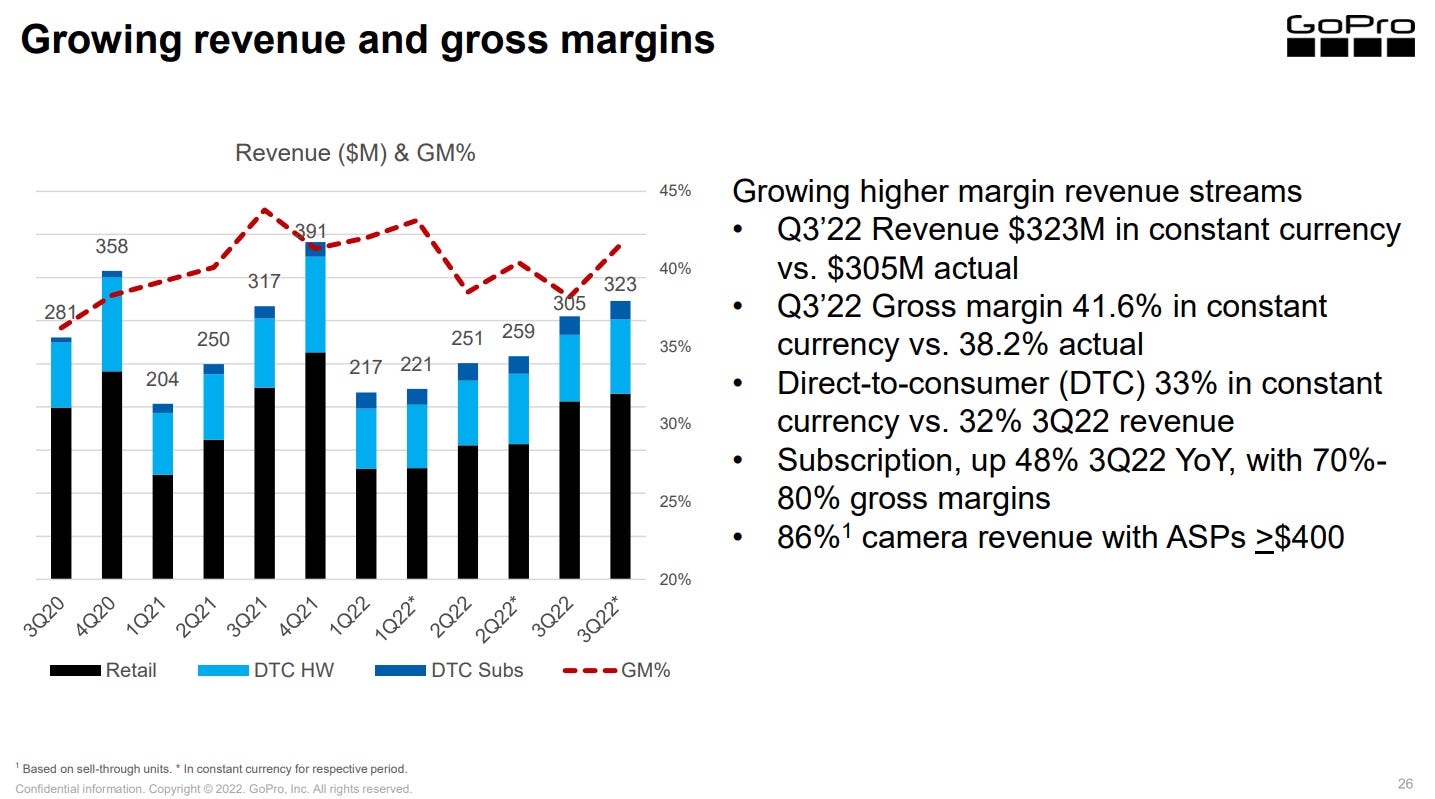

The improving hardware business acts like a funnel to the much more profitable subscription service, which has a very long runway ahead and is growing very well.

GoPro continues its push towards the premium spectrum of “action cameras” (content creation tools), reaching a record ASP camera mix this quarter. This makes the company more robust, as it concentrates its resources on serving higher end and more loyal customers, that its knockoff rivals cannot cater for. It also launched the Hero 11 cam during Q3 - a worthy heir of the Hero 10.

GoPro´s hardware business now acts predominantly as a funnel to its subscription business. The end goal of GoPro customers is not to buy a camera, but to produce engaging content. The company is thus able to funnel its customers into a digital subscription, whereby it offers a range of value added content production services - in exchange for a discount on the hardware purchase at gopro.com. This is now GoPro´s “financial engine”:

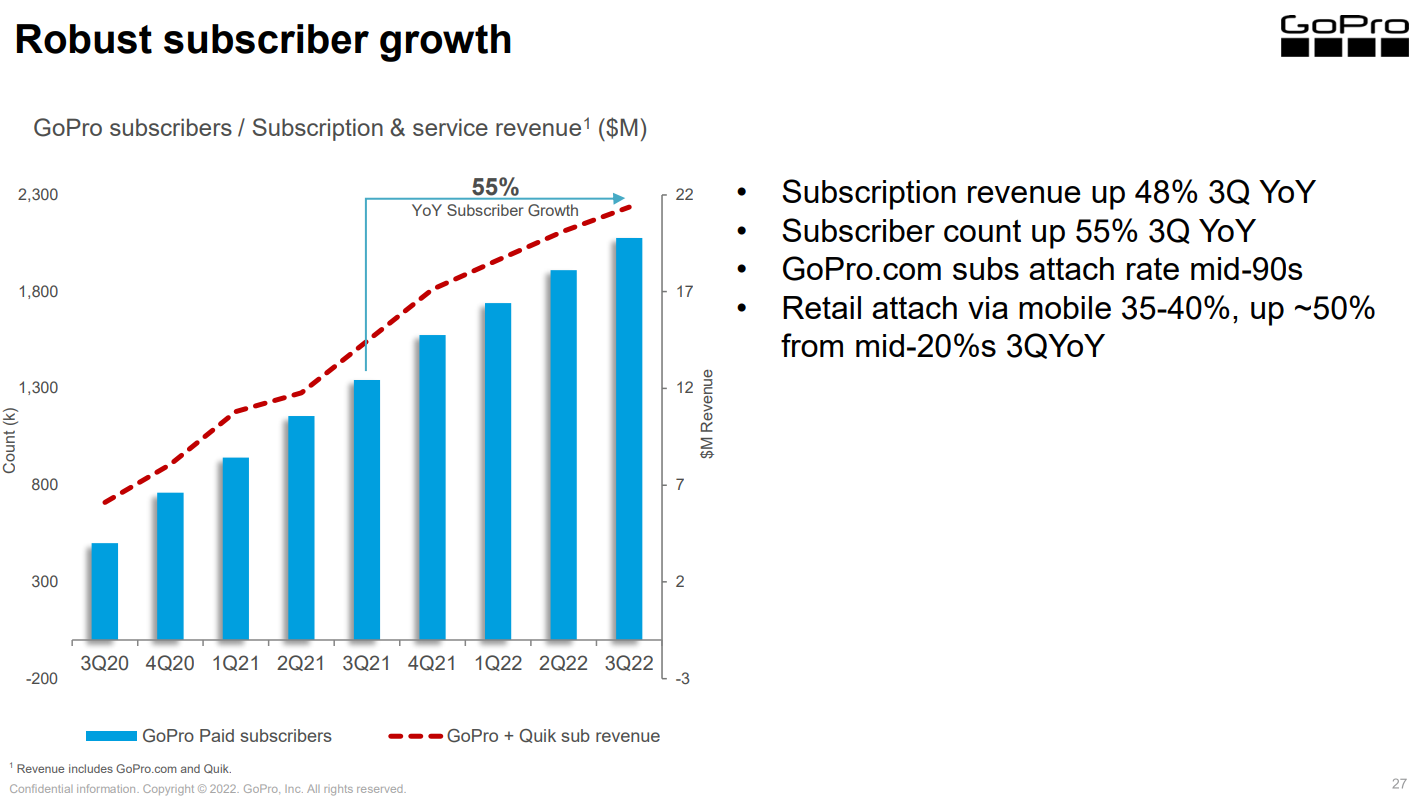

At the end of Q3, GoPro subscribers and subscription and service revenue grew respectively by 55% and 48% year over year to 2.1 million and $21 million, which positively contributes to gross margin and our bottom line. We are on track to achieve 2.2 million subscribers by year-end.”

“So we'll continue to drive more software engineering into 2023 to continue to build out our subscription and service offerings, because it's the most profitable portion of our business, right? As a product, our subscription is 70% to 80% margin and the fastest growing product we've got.”

- Nick Woodman, CEO @ Q3 2022 ER

This discount represents the cut that a retailer would otherwise take if the customer bought a camera at a physical store and thus many sensibly term this a “fake” subscription. However, as in many other occasions, it comes down to qualitatives. The expanding value proposition of the subscription is a no-brainer for content creators and the runway ahead is very long. This becomes apparent try if you give (video) content creation a shot yourself.

“Another thing we pointed out is retention of our annual subscribers who make up 85% of the total subs has improved about 5%, actually better than 5% from this time last year and we're seeing some companies reported their storage business was actually down in storage, we're the opposite. Our storage has doubled year over year for GoPro content. So we're seeing real usage by the consumers.” - Nick Woodman, CEO @ Q3 2022 ER

One very interesting thing is how the retail attach rate for the subscription has been going up very fast, when customers do not get the discount as they do in gopro.com. This quarter, it came in at 35-40%, up 50% from the mid 20s% year over year. Why would consumers opt into the subscription service without the discount? Likely because they dig the value proposition.

Further, the attach rate at gopro.com continues to inch up, coming in at 95%. The company also released a service, included in the subscription, that automatically sends highlight videos to subscribers. The Quik mobile subscription is growing fast too, coming in at 282k paid subscribers, up from 168k YoY (67%+). The point is, the subscription service is not the panacea of content creation, but the company is really iterating its way towards that goal.

GoPro has tens of millions of fans across the globe and ships millions of cameras per year (mostly to new customers), so 2M subscribers is still a very small piece of the pie. As they funnel in more customers and solve incremental problems for them, thus increasing the ARR per customer, it will likely become a big business, or at the very least, a highly accretive one to shareholders relative to the price per share today.

As the macro environment worsens (if it does), the subscription business will be stress tested as well as the hardware one. As I explained above, I believe the business will prevail, since it serves a key function for content creators. The one thing that has enabled the company to do this now is listening to the customer. GoPro is outputting its best products ever with R&D at ATLs.

2.0 Financials

The company is healthy, but FX and a weakening consumer are hurting it.

Income Statement

FX (a stronger dollar) is giving GoPro a bit of a hard time, with around 50% of revenue coming from overseas. Retailers are also decreasing inventory ahead of weak consumer expectations and what this is all doing is shaving off GoPro´s financial performance at the margin. However, structurally the business continues to improve. This is evidenced by the metrics if adjusted for a constant currency.

“Their on hand inventory declined about 25% year over year, so they're definitely bringing them down. And I mentioned that in my opening remarks that the open to buy dollars is definitely down, and we're seeing it. And we're seeing I think they were down to eight weeks of inventory. They're normally around nine, 10, 11 this time of year going into the holidays.” - Bryan McGee, COO @ Q3 2022 ER

For as long as this continues (until it gets offset by subscription growth, GoPro is likely to not exhibit very aesthetic numbers. However, so long as they continue to make the best cameras and refine their subscription service, the business will likely be well positioned to reap the rewards for the next bounty season. Eventually, the subscription is positioned to offset headwinds of this sort.

“And I would just add that we really want to emphasize to investors how laser focused we are on growing our subscription business and investing in it to add ongoing value for our subscribers. It's proving to be very valuable to our subscribers.” - - Nick Woodman, CEO @ Q3 2022 ER

Balance Sheet and Cashflows

The balance sheet remains very strong, ending the quarter with $217M in cash, $131M in marketable securities, $140M in long term debt and no short term debt. With $40M in operating cashflow, the company looks pretty self sustainable.

It is also worth noting that stockholder equity is down from $1.25B to to $1.09B. Excellent to see the buybacks showing up in the numbers. I also like the fact that they are buying back prudently, going into an environment in which cash will be vital, with $68M of the total $100M approved.

3.0 Conclusion

The turnaround is advancing well and management continues to inch its way back towards credibility. The macro situation is unfortunate, but uncontrollable and unpredictable. The company itself, unless the bedrock of the thesis breaks, is well positioned to continue producing cash going forward, at the other end of the ever so pre-announced and hypothetical recession.

Whilst the market did price in the advances when the stock bordered $14, given my average share price, the situation remains more than attractive to me over the next few years. I am happy to wait patiently.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Well written and a good read!

I agree with your assessment about GoPro customers and I've always seen the GoPro as a professional piece of kit offered at a consumer price point. As someone who regularly creates content for a small brand that I own, the GoPro is an invaluable tool for us and we have a few of them floating around with our team.

All of the content we've produced for our insta, tiktok and youtube has been filmed with a GoPro

https://www.instagram.com/ondaskate/