Edited by Brian Birnbaum.

GoPro is well on its way to becoming a content creation ecosystem, with much higher margins and a remarkable ability to produce cash.

GoPro burned many investors but now is becoming a cash machine. Two key strategic moves facilitated GoPro’s turnaround:

The shift towards premium hardware.

The launch and growth of the digital subscription business, with 70-80% gross margins.

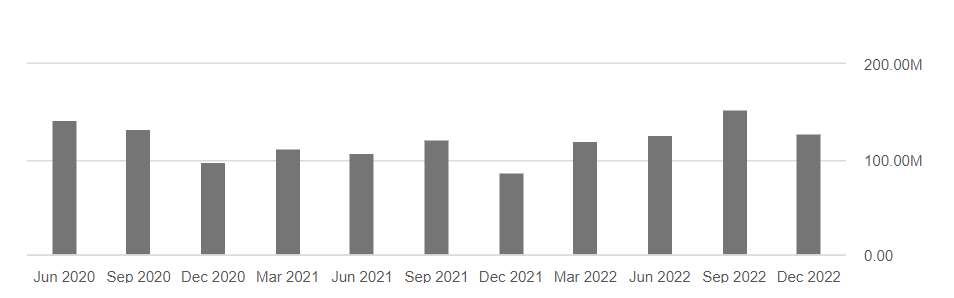

GoPro´s income statement boasts gross margins and net income on the rise in recent years. Over the last year, however, the turnaround seems to have lost steam. Inflationary pressures and less spending is eating into the subscription business. Nevertheless, the business continues to evolve structurally, alluding to a return to growth just around the corner.

In FY2022, revenue would have been $50M higher on a constant currency basis. The subscription business generated $82M in revenue during the same period, with gross profits of $56-65.5M. Inflationary headwinds canceled out a large portion of subscription cash-flow. However, I believe subscription cash-flow will resume growing over the long term because it delivers real value, which this quarter’s numbers reflect.

“[On a constant currency basis] gross margin would have been nearly 41%, versus 38.1% actual results and the EBITDA to revenue approximately 13% versus 9% actual results.” - Brian McGee, COO @ Q4 2022

In my original GoPro thesis, I explained that the subscription business opens an avenue to launching high-margin digital services. I saw the company developing its hardware business as the foundation of a content-creation ecosystem. In Q4, this ecosystem continued to materialize as engagement rocketed across GoPro´s digital real estate:

”58% increase year-over-year in subscribers connecting their HERO11 cameras to our cloud vs. HERO10 subscribers in 2021.”

“Additionally, content uploads to the cloud increased 65% year-over-year for HERO11 subscribers vs. HERO10 subscribers in 2021.”

“In 2022, camera usage increased 15% year-over-year to approximately 15 million unique cameras connecting to our app.”

“We shared that, in 2022, we had approximately 15 million unique GoPro cameras connect to the GoPro Quik app during the year…in 2020, that number was about 12.1 million.”

Management announced during the call that GoPro will soon roll out a “synced mobile, cloud and desktop experience that will target GoPro owners and non-owners alike with a new premium subscription tier.” This tier is expected to yield a higher dollar amount and margin. Qualitatively, I get the impression that the company is beginning to really own the shift towards digital.

Still, elements of the market believe the subscription business is fake. To aid its launch, GoPro funneled gopro.com customers into the service in exchange for a discount on hardware purchases. The discount is nominally equivalent to the cut a retailer would otherwise take. D2C sales have gone from nonexistent during the pandemic to accounting for 38% of all sales for FY2022, versus 34% for FY2021.

In my view, the subscription service is a no-brainer for content creators. The Q4 report served us with a datapoint alluding to such. Retail attach rates have increased from ~20% in FY2021 to ~35% in FY2022. Clearly, consumers aren’t merely being bribed by gopro.com discounts and instead are finding meaningful value in the digital service. Together with the engagement data, I see a compelling quantitative picture taking shape.

Looking toward the long term, I see the subscription business continuing to grow. At 2.25M subscribers at the end of Q4, I think that 10M subs is a reasonable five-year objective. Such a subscriber base would transform the company into a cash machine. Prior to the recent downturn, we saw flashes of the newly cash-rich GoPro. Going forward, the subscription business is likely to grow enough to buffer the company from further shocks in hardware supply.

The turnaround has confounded elements of the market who would otherwise expect the top line to be growing. GoPro’s shift to premium hardware has coincided with shrinking unit sales. For FY2022, street ASP (average selling price) was $389, up 5% year-over-year, or 10% growth in constant currency. This has enabled GoPro to increasingly focus on its real customers: well-off content creators.

I make no exaggeration in stating my belief that GoPro has one of the strongest moats on Earth. Many large companies have tried to take its place. Despite the scores of knock-offs, which people do in fact buy, GoPro continues to dominate the space. The product’s cultural and qualitative strength remind me of Apple. Much in the way that Apple went all in on total integration, GoPro has strengthened its moat by focusing on the premium segment, which, in turn, further solidifies the foundations of the subscription business.

Over the long turn, the subscription business should meaningfully grow the top line and increase profitability. However, the company´s current vulnerability to disruptions in hardware supply stands as its greatest risk. If we see a deep recession, GoPro´s camera business could collapse, bringing its digital potential down with it.

However, my thesis is that GoPro cameras are actually indispensable tools for professional content creators. Every year, content becomes more relevant. I believe over the coming decades that content creation will explode as an industry. So long as Brian McGee (COO) continues managing the company as well as he has, this fundamental trend is likely to nurture GoPro’s prosperous future.

FY2022 has been a tough year, but the company made a clean escape, as it had in 2020:

“[In FY2022] we paid off debt of $125 million and repurchased $40 million in stock and we exited the year with a strong cash balance of $367 million, up 9% sequentially.”

“Fourth quarter collective cash net of debt was $224 million, up 9% sequentially.”

Cash from operations was barely positive in 2022. But the current state of its balance sheet provides the company a long runway. Survival likely depends on their ability to manage inventory through fluctuating environments. So far, management is looking lean and mean in this domain.

For FY2023, the company´s top initiatives are:

Continuing to expand its lineup of hardware (initiated in FY2022 with its derivative cameras).

Continuing to develop the subscription business and launch the premium tier.

My vision remains the same. Management has executed flawlessly since the start of the turnaround. In ~5 years time, a high-margin content creation ecosystem will build a strong moat around the business. Further, the company´s emergence from 2020 gives me confidence in management´s ability to weather upcoming storms. Although the downturn is yielding some unaesthetic numbers, the business continues to improve structurally.

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Hi Antonio, overall good article. However, what i couldnt reconcile is whether a 2.25m to 10m subscriber growth over 5 years is reasonable. This would amount to a nearly 35% compounded growth for 5 years straight to reach 10m. How was fast did subscribers actually grow in for example 2022? and what makes you think they can keep it up for 5 straight years.