Edited by Brian Birnbaum.

No time to read the update? Watch/listen for free:

Betting My Entire Portfolio on Five ‘Predictions’

My students know better than to try and ‘predict’ the future. However, we can bet on systems that are likely to find profitable and defensible solutions to problems–the essence of multi-bagger investments.

I’m betting my entire portfolio on Hims and four other companies, based on the high odds of the following events unfolding successfully:

$HIMS will become one of America's largest healthcare giants, serving as a deflationary force in the typically inflationary US healthcare sector.

$PLTR will transform into the foundational platform for new enterprises, becoming essential for building businesses from scratch.

$AMD will rival $NVDA's dominance by leveraging its long-standing expertise in chiplet technology, which $NVDA will eventually have to fully embrace.

$SPOT will secure its role as the $GOOG of audio, becoming the go-to platform for music streaming and all things audio. Margins will rise meaningfully as a result.

$TSLA will revolutionize global material production, achieving abundance through ultra-efficient manufacturing, low-cost energy, and large-scale AI deployment.

But before getting deep into why I’ve picked these companies, allow me to explain how I think about the architecture of my portfolio.

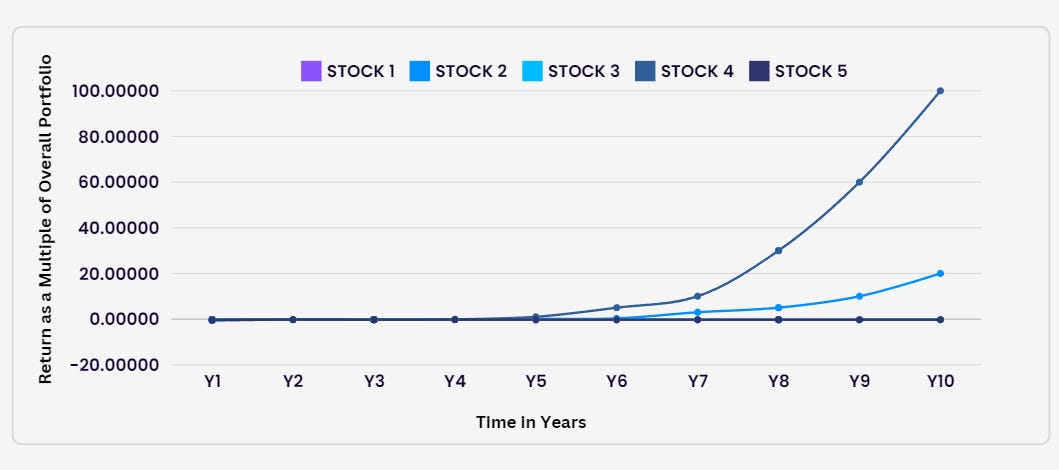

I pick stocks whose potential, I believe, is asymmetric, in that the upside is far larger than the downside. In aggregate I seek to own just a handful of stocks such that any one of them has high odds of returning the entire portfolio many times over. In turn, I also pick these companies such that more than one has a high probability of performing in this manner. The investment horizon is decades, as opposed to the average market participant’s handful of quarters.

Over a decade’s time, success can look like the graph below, with perhaps only two companies living up to multibagger potential and the rest failing along the way. So far this approach has flourished, with AMD andTesla up ~38X and ~10X, respectively, over the last decade. Of my more recent investments,Spotify andPalantir are both up ~3X to date and, I believe, are just getting started.

Recently I sold some losers/mistakes and concentrated the resulting capital into Hims, which is up over 40% since I initiated the position. Hims is a pristine example of the type of company that I teach students to spot in my 2 Hour Deep Diver course. Hims solves a growing volume of acute customer pains at scale, in a way that is increasingly harder to imitate profitably.

Now that you know how I think about my portfolio, I will dive deep into why I’ve picked each of these five companies.

1.0 Hims

100X potential.

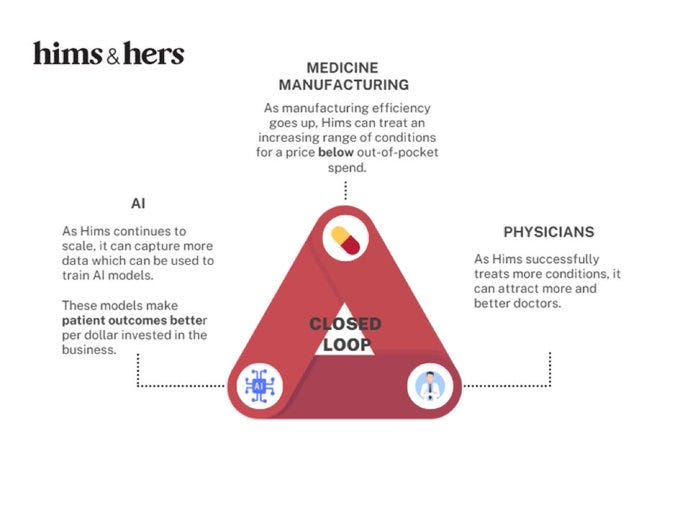

As I’ve said many times already, Hims is a stock with clear 100X potential. Hims is a telehealth company that connects patients with physicians via an app–which in turn fills prescriptions via automated pharmacies. Most importantly, Hims is building the world’s first AI healthcare closed loop, depicted in the graph below.

With nearly 1.5M subscribers–and assuming Hims has been storing the anonymized data–its AI will see in one day more patients than a physician can see in ten lifetimes. As Hims continues to scale, this competitive advantage will continue to compound.

No one else is treating millions of patients while picking up data and immediately applying the resulting insights to iterate an underlying and vertically integrated healthcare infrastructure. All other AI healthcare loops require, like Teladoc, a modification of the sluggish traditional healthcare system.

These are the 6 core value drivers of the company:

A cost advantage: Hims can treat a growing range of conditions at a cost below what patients would pay out-of-pocket via their insurance. This is a strong moat in an industry that is otherwise an inflationary hamster wheel.

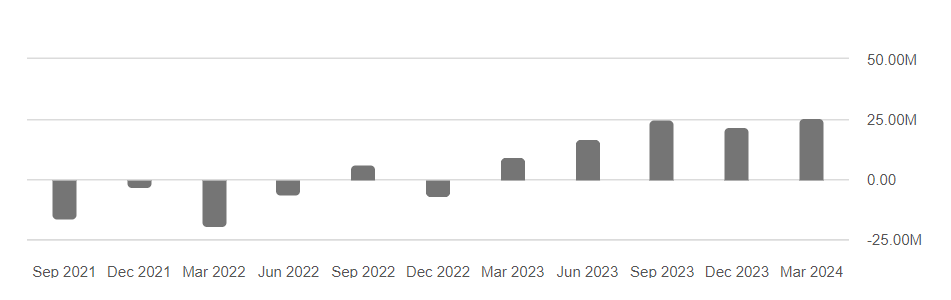

Expanding verticals: Every quarter Hims is treats more and more conditions. Management has demonstrated great discipline in picking new verticals, with the company increasing its cash from operations.

Extraordinary organizational properties: Hims has succeeded in orchestrating from scratch an operation based on software (app), hardware (pharmacies) amidst a hellish landscape (healthcare industry). For instance, the Hims iOS app is ranked #16 in healthcare in the US just 2 years after its launch. Only a great organization can do this.

AI-driven Insights: Hims is the world's first AI closed loop in healthcare, meaning that it is the only company that can directly leverage the insights its data generates to iterate the underlying healthcare infrastructure. This sets Hims up to compound faster than other players over time.

Personalization: The combination of more conditions treated over time will decrease CAC and increase LTV, as users shift towards personalized treatments. This will make Hims more irreplaceable for customers and will make them stick around longer on the platform.

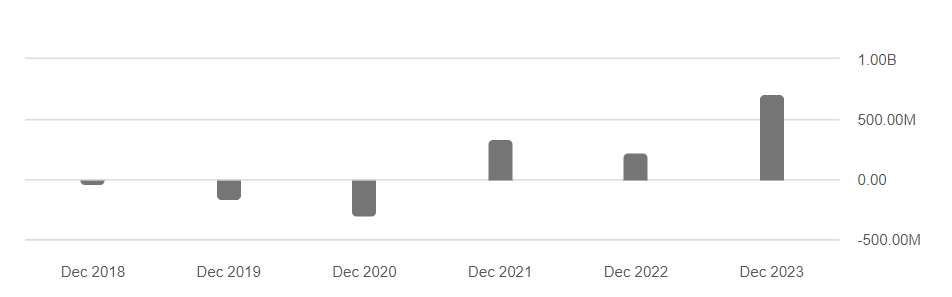

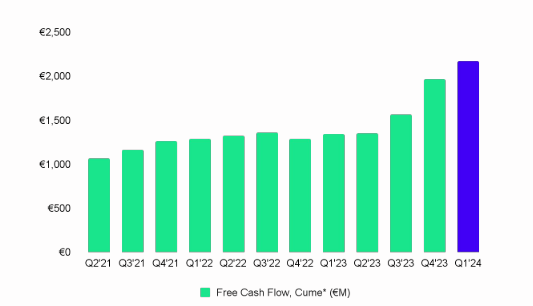

Operating Leverage: As Hims deploys more verticals and fine tunes its automated pharmacies, its level of personalization will become increasingly harder to imitate at scale. This should yield improved unit economics over time, which are thus far translating into an improved cash flow profile, as you can see below:

2.0 AMD

20X potential from here.

I believe AMD is going to again 20X over the next decade, driven by a highly differentiated product roadmap that the market still doesn't understand.

The market is looking at AI as if it were only about selling GPUs. But all of AMD's business segments are effectively distribution channels via which it repackages and sells its core AI tech. I believe this distribution advantage will pay off in the years to come, yielding better unit economics for AMD than otherwise.

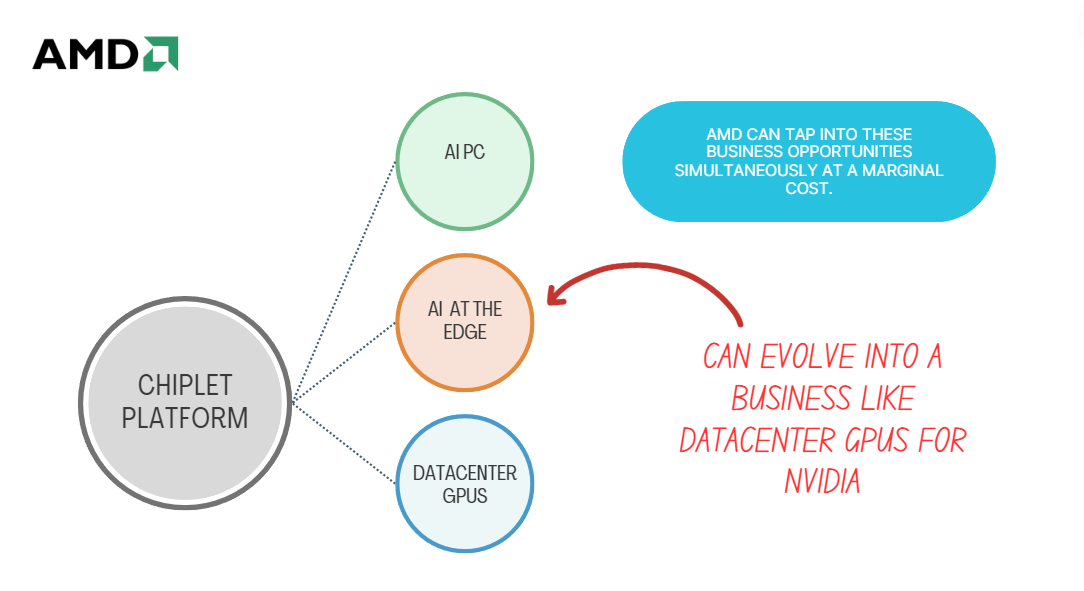

As depicted in the diagram below, AMD’s chiplet platform taps into multiple $100B+ business opportunities at marginal cost. Chiplets enable AMD to connect different computing engines at will, in a way no other company in the semiconductor space can. As I’ll address later, AI at the edge has the potential to evolve into an analog of Nvidia’s datacenter GPUs.

AI won’t be confined to GPUs; it’ll be absorbed into all computation platforms over the next decade–from smartphones to desktop computers and laptops, cars, and fridges. Expertise in chiplets uniquely positions AMD to connect disparate compute engines. By extension, this competence sets AMD up to infuse all of its products with AI capabilities.

Over the long run, this is a much better strategy than only going head to head with NVDA in GPUs–which AMD will also do. Bringing chiplet-based GPUs to the market with a differentiated price/performance ratio and iterating on its ROCm software gives AMD a great chance of taking GPU market share from Nvidia. Further, simultaneously re-purposing that tech across its various business segments increases AMD’s overall odds of success.

The potential upside in taking market share from Nvidia is huge, but so is the upside in becoming–just as one example–the number one provider of AI PCs. Better yet, AMD can take on both endeavors at a marginal cost because the competitive advantage in both cases stems from its chiplet platform, which can generalize across the aforementioned product lineups and beyond.

AMD already has the distribution channel on the PC (CPU) side. This means that even if the company does not succeed in taking market share from Nvidia, it can still obtain a strong return on AI investment via PCs–hence the asymmetry of AMD’s move into the AI space.

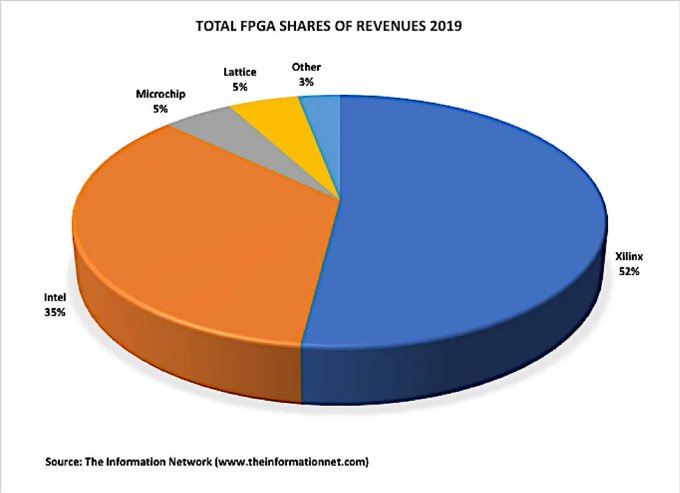

This dynamic is also giving way to AMD’s new $200B AI at the edge business, which promises to evolve into something like datacenter GPUs for Nvidia at present. Since the Xilinx acquisition, AMD has been positioning itself to dominate this emerging space by onboarding Xilinx’s leading FPGA technology.

As you can see in the graph below (although the data is from 2019), Xilinx is the undisputed leader in the FPGA market and, in turn, these kinds of chips perform at the edge like no other. AMD is thus uniquely positioned to capitalize on the AI at the edge opportunity, with fairly insurmountable barriers to entry.

Hypothetical competitors need to not only surpass AMD’s FPGA technology but also its interconnect technology (Infinity Fabric) if they want to seamlessly connect FPGAs with any other compute engine.

3.0 Tesla

20X potential from here.

Despite the pessimistic price action, I see Tesla going up 20X from here. While many associate Tesla primarily with automotive production, it's in fact building a transformative platform akin to the internet in its potential impact. As Tesla continues to compound its manufacturing efficiency, AI, and batteries, it is likely to bring abundance to the world.

As Tesla forges ahead with this platform, it approaches a pivotal moment that dwarfs previous milestones. Despite recent fluctuations in Tesla's stock value, the company has substantially enhanced its manufacturing capabilities over the past year alone.

Enhanced manufacturing prowess is propelling Tesla's bold expansion into AI and renewable energy. Together, these endeavors augur a "second internet of things," where AI-driven robots automate tasks globally, leveraging Tesla's core strength in rapid economic optimization.

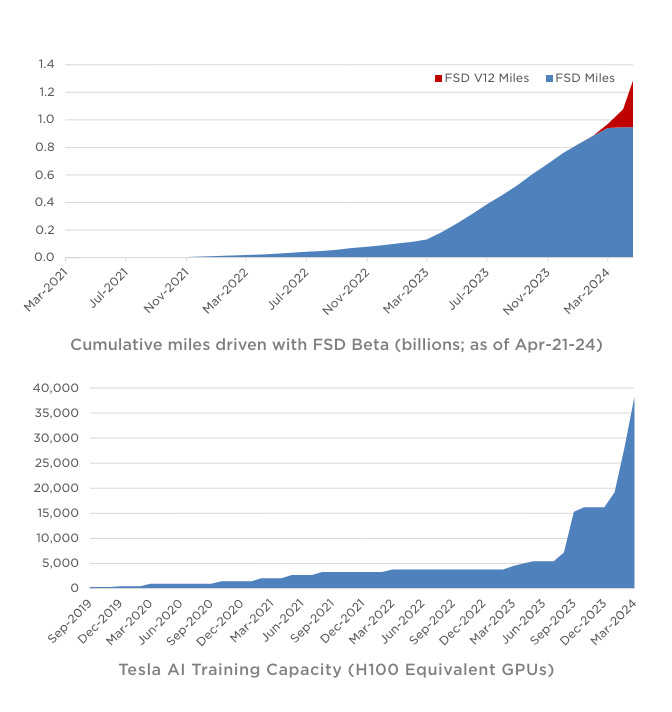

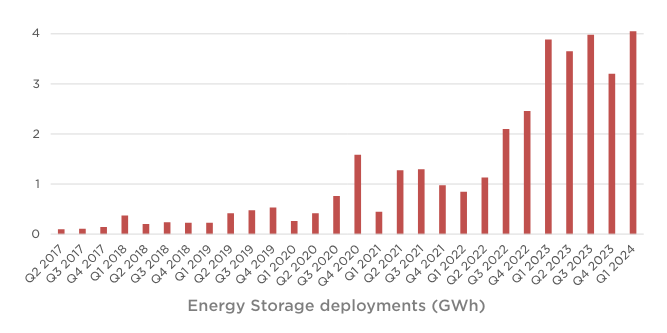

Bolstered by this fundamental capability, Tesla is rapidly advancing its battery, solar, and vehicle technologies, yielding invaluable data for refining full self-driving capabilities. As this data reservoir grows, so does Tesla's AI expertise. Recent milestones underscore this progress. The graphs below depict cumulative miles driven with FSD, with energy storage deployments growing exponentially.

While the automotive market faces uncertainties due to rising interest rates, Tesla's robust manufacturing foundation fuels exponential growth in AI and renewable energy initiatives. This sets the stage for a future where autonomous, self-sustaining robots redefine the global economic landscape.

The company's enduring focus on optimizing unit economics lend a terrific view to its long-term trajectory.

4.0 Palantir

20-100X potential from here.

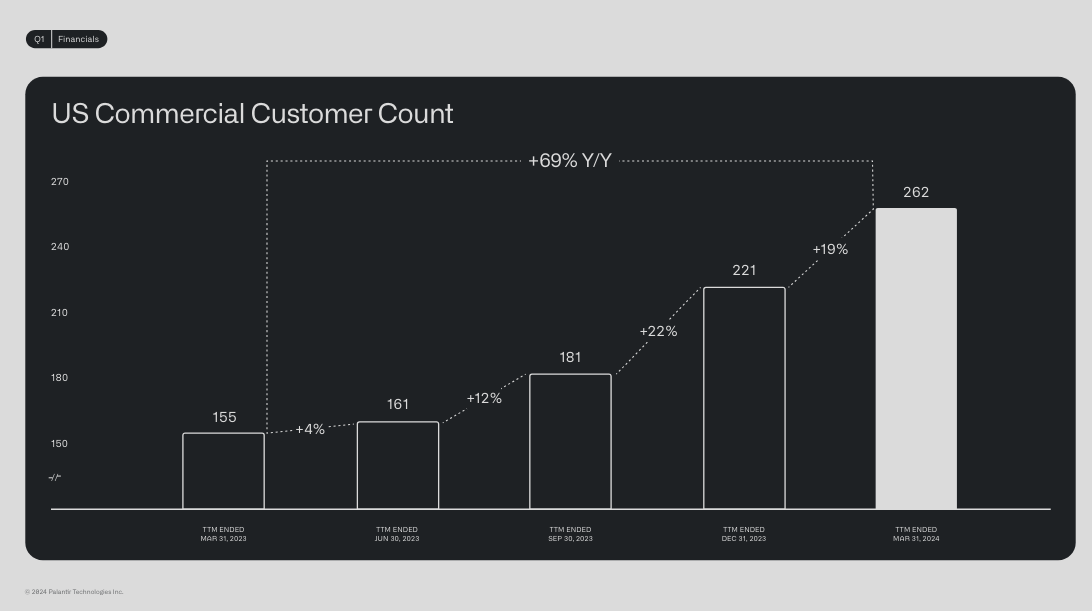

Set to become a multi-trillion-dollar company in the next decade, Palantir is revolutionizing the core process of wealth creation by amplifying it. This breakthrough is currently underappreciated by the market and is best evidenced by the rapid US commercial customer growth, depicted below:

At its heart, wealth creation is about uncovering insights that drive better decisions. Throughout history, wealth has been generated by discovering innovative ways to organize atoms and electrons for beneficial purposes. In essence, we're all participating in the "Information Game."

This abstract idea becomes tangible through historical examples. Innovations like semiconductors, electricity, the internal combustion engine, and the telephone all represent rearranging the universe's building blocks to create wealth. In modern economies, most wealth is produced by private enterprises.

Companies are essentially optimization engines, striving to maximize output while minimizing resource use and time. They are concentrated manifestations of the Information Game. Historically, we've been playing this game on an introductory level, managing companies with subjective observations and a limited grasp of the information flows within and around them.

This is where Palantir comes in. Palantir empowers companies to develop digital twins—comprehensive digital replicas of their organization and operations–unleashing the power of AI and blockchain–technologies that operate entirely in the digital realm–and setting the stage for a radical shift in business operations:

With digital twins, organizations transform into data-generating entities. Every action produces additional data.

This data is analyzed by AI models, extracting valuable insights far faster and at a lower cost than human managers.

These models commoditize predictions, enabling companies to simulate first and then act, as opposed to the traditional approach of acting first and then analyzing results.

As AI models grow more precise, much of the operational complexity can be managed by smart contracts (blockchain), trusted to execute as programmed.

Palantir will drastically cut costs relative to revenue across numerous industries. Envision a company that becomes more intelligent with every operation, liberating humans from mundane, repetitive tasks.

Thanks to Palantir's technology, this vision is no longer science fiction. This evolution leads to a new type of organization, one that excels at uncovering insights and using them to generate wealth.

Palantir drives this transformation through a continually evolving software suite, positioning it to deliver and capture significant value. As industries adapt to this model, Palantir is poised to optimize the operational expenditures (OPEX) of an increasing number of companies worldwide. As a result, Palantir will become an indispensable asset, greatly enhancing its value.

In turn, Palantir is rapidly productizing its offerings, making them easier for customers to integrate. Productization increases Palantir’s contribution margin, the key driver of Palantir’s improved financials at present, as evidenced by the rising cash from operations levels, for example:

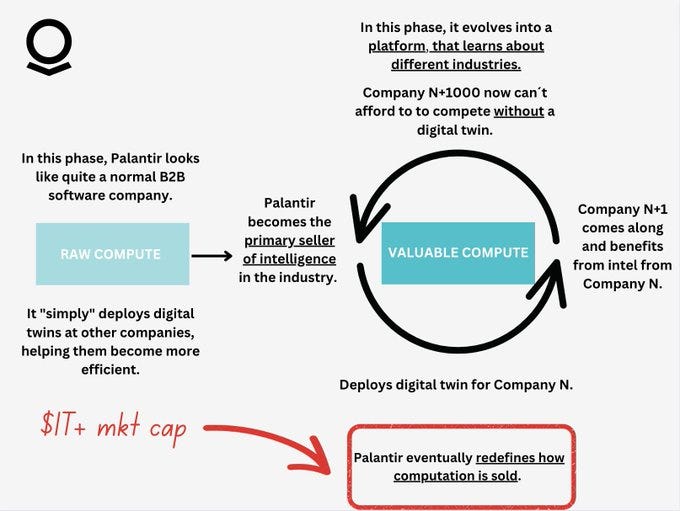

Improving productization draws them toward an inflection point in which it has sufficient customers per vertical/industry to start selling tailored compute at a marginal cost. Customization has the potential to redefine how computation is sold in the marketplace, putting Palantir at the top of the distribution funnel in the cloud industry.

The graph below conveys a flywheel by which competitors find it increasingly more difficult to imitate Palantir, giving way for the company to emerge as a computing titan akin to Microsoft, Apple, and other computing giants of our time.

5.0 Spotify

10-20X potential from here.

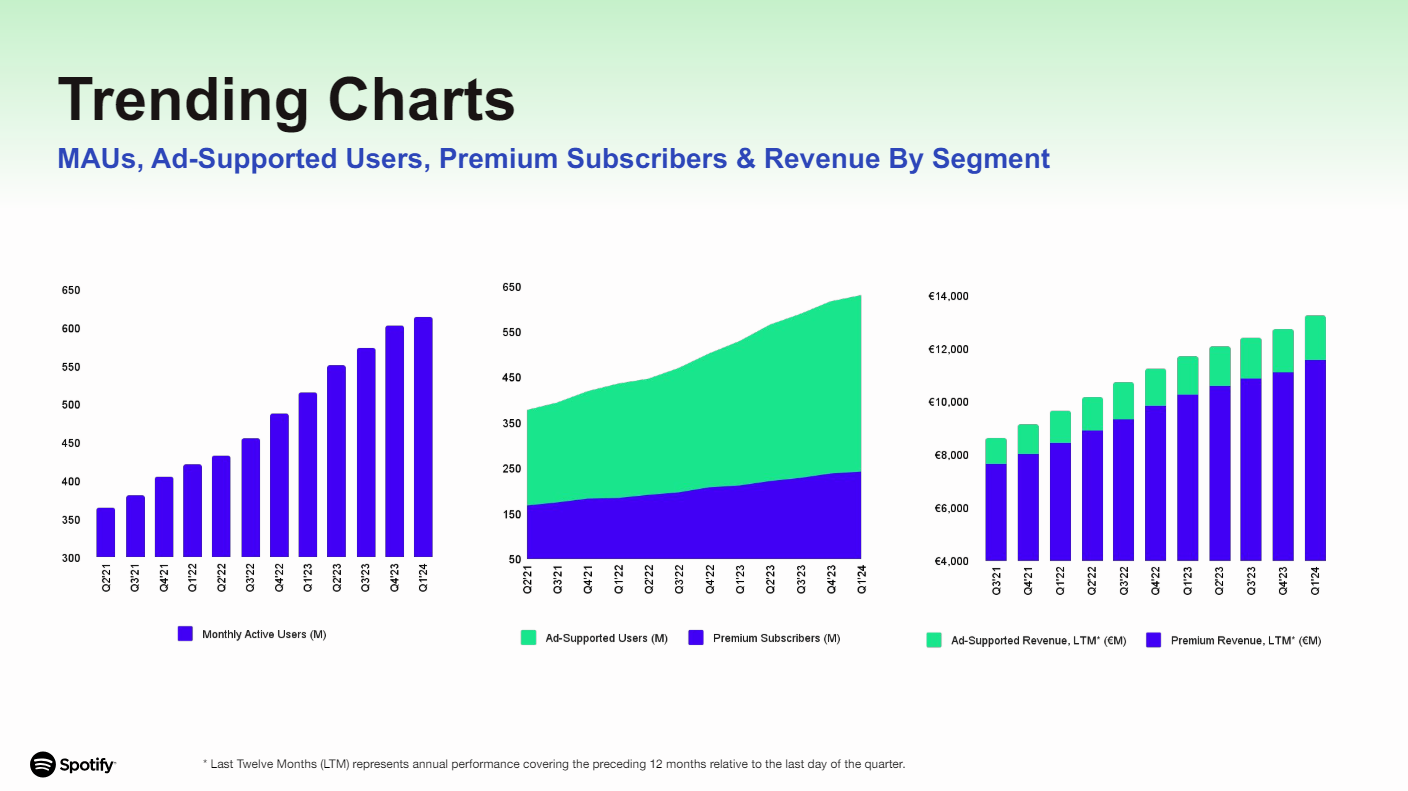

Spotify today is like Amazon in 2001, a misunderstood "goodwill compounding machine" with the potential to solve problems for creators and fans, just as Amazon has done for consumers, merchants, and developers. As you can see in the graph below, MAUs (monthly active users) continue to grow at breakneck pace.

Both Amazon and Spotify share two fundamental principles that have fueled their success:

Cultivating consumer loyalty: Spotify has consistently earned the trust of its users by providing exceptional value, mirroring Amazon's approach to customer satisfaction.

Embracing relentless innovation: Spotify is constantly expanding and experimenting with new audio verticals, such as podcasts, audiobooks, and education, echoing Amazon's expansion from tangible books to tangible and intangible everything.

Spotify's dominance of the podcasting market, outpacing even tech titans like Apple and Amazon, is a testament to its ability to identify and capitalize on emerging opportunities. Spotify's prowess in recognizing and capitalizing on new avenues for growth bolsters future execution.

Similar to Amazon in its formative years, Spotify is disrupting traditional industries. Spotify's ad inventory is thriving due to the lack of gatekeepers in the new audio verticals, while Spotify is well-positioned to connect creators and consumers efficiently, opening up new revenue streams.

Despite competing with Apple and Amazon, Spotify reigns supreme in the audio space, boasting over 615 million monthly active users. Spotify's unwavering focus on audio is unparalleled in the industry.

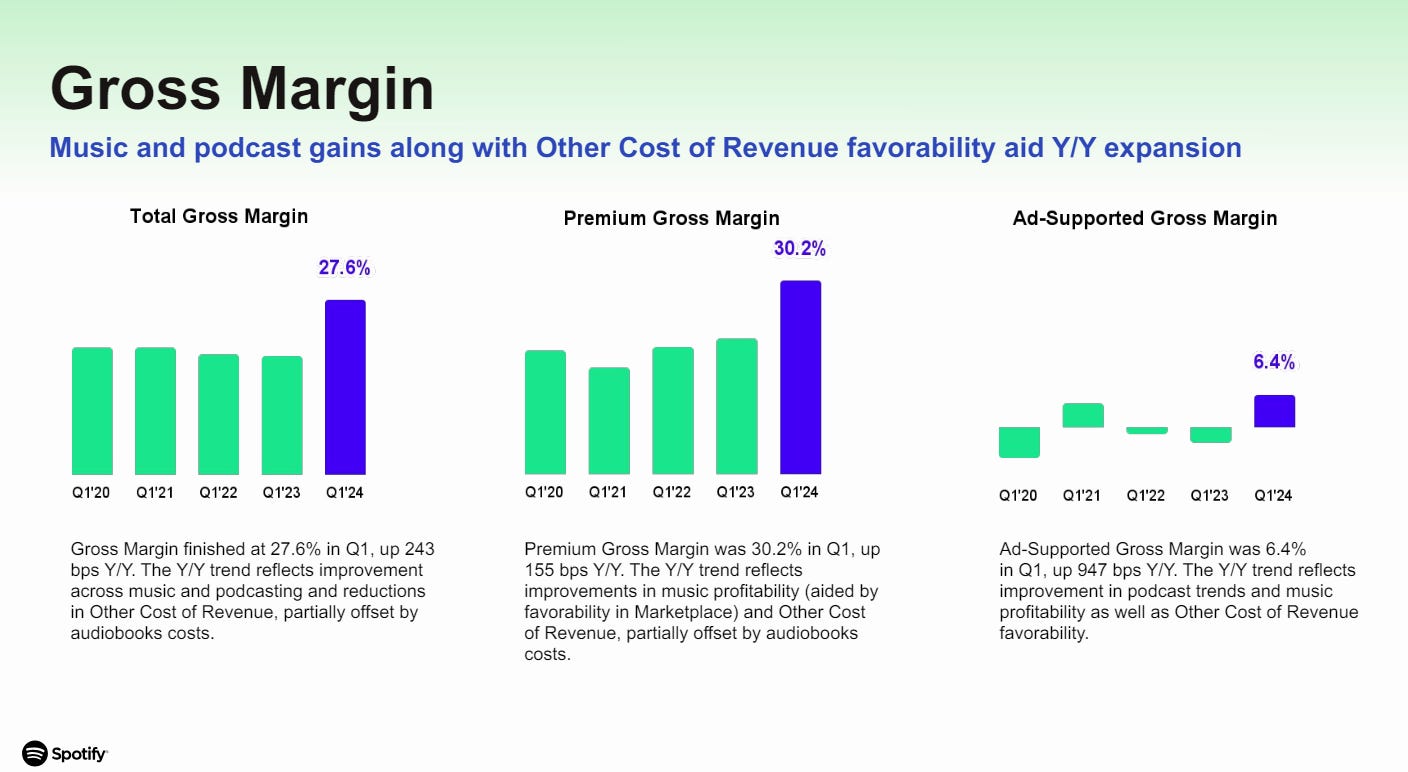

In the years to come, Spotify's financials are poised for transformation as it expands into new audio verticals and margins improve. With its relentless pursuit of optimization and iteration, Spotify could even establish an "AWS equivalent" in the audio realm. While this vision may not materialize, the potential upside is large.

This thesis is already materializing, with Spotify’s margins and free cash flow levels arching up in the past few quarters. I believe that this trend will continue to accelerate in the coming quarters, with the market likely reevaluating Spotify.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc