The market is a narrative producing machine. Participants in the market perform transactions expressing their individual beliefs and in the aggregate, this amounts to the formation of narratives (stories) that move prices back and forth. Every participant wishes to get as close to reality as possible, but individual and mass psychology mechanisms end up producing narrative fluctuations which deviate from the truth, yielding opportunities for cunning investors.

I find that the deviations are best represented by a cosine (or sine) function like the one above. The market spends quite a bit of time either over or undershooting reality, but it does accurately reflect it eventually, whilst not necessarily staying rational after that. Once it manages to depict reality, it will likely soon be on its way to produce the next deviation.

A property of the market which further complicates things is its reflexivity. When narratives materialize into price action or lack of it, the price action further consolidates the narrative that caused it in the first place. This is a very strong force, with plenty of power to disorient market participants. It can make the most irrational of narratives come across as an immutable reality.

The disorientation is further accentuated by duration mismatches. Narratives can persist for a long time, whilst humans are mostly driven by short term impulses. A narrative can go on for years, but individual market participants have needs and wants to cover tomorrow. When narratives swing, the emotional vulnerability of investors is proportional to the magnitude of the duration mismatch. I would argue that exponentially so.

A company can be doing absolutely fine and a narrative can come along to cut its stock price in half. Or conversely, a company can be improving its earning power considerably, with the market ignoring said advances for a long time. Investors that operate in time intervals far shorter than the duration of the narrative fluctuations will carry out operations that will produce bargains for investors that are better mentally equipped.

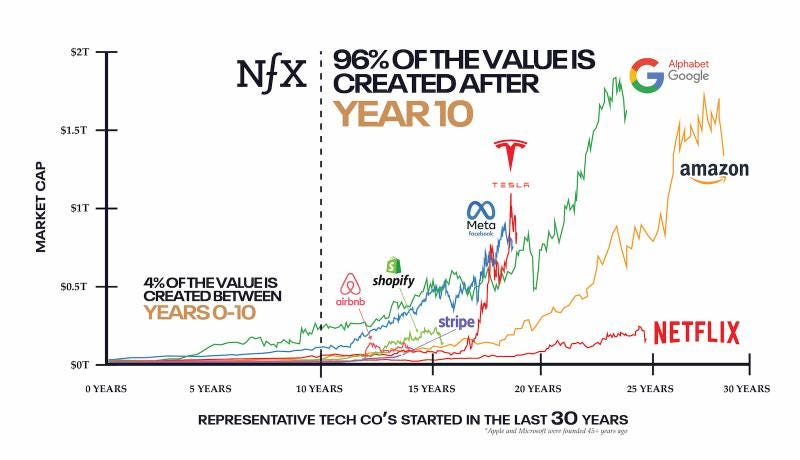

Today, most market participants spend their time in pursuit of short term rewards, whilst value in the economy is generated over decades. For the rare investor that operates in time horizons that reflect this reality, narrative fluctuations are opportunities to generate wealth.

Below, an illustration by @studios to accompany my thoughts on going above and beyond the duration of narratives.

⚡ If you enjoyed the post, please feel free to share with friends and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc